Corsair Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corsair Bundle

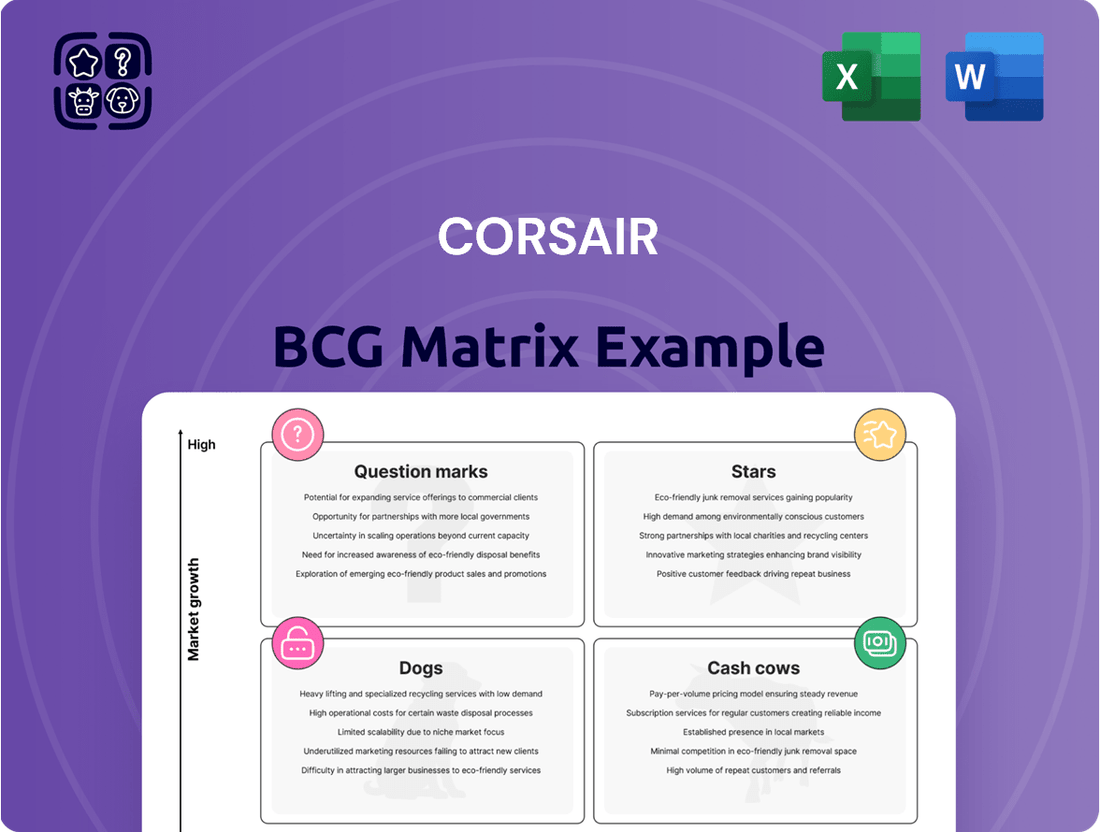

Unlock the strategic potential of Corsair's product portfolio with a glimpse into its BCG Matrix. See how your favorite gaming peripherals and components stack up as Stars, Cash Cows, Dogs, or Question Marks.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Corsair.

Stars

The Gaming Components and Systems segment is Corsair's powerhouse, contributing the most to its revenue. In Q1 2025, this sector saw an impressive 11.9% increase year-over-year, highlighting its significant market presence.

The broader gaming hardware market and the do-it-yourself PC market are both experiencing strong expansion. Projections indicate a compound annual growth rate of almost 9% for gaming hardware through 2030, signaling substantial future opportunities.

Corsair is strategically positioned to benefit from these positive market dynamics. With improving graphics card availability and a continuing upgrade cycle among PC enthusiasts, the company is set to capitalize on this growth trajectory.

Corsair’s high-performance DRAM products are a significant component of its Gaming Components and Systems segment. In Q1 2025, these memory offerings experienced a notable rise in revenue. This growth is directly linked to the release of new graphics cards from major players like NVIDIA and AMD, which are spurring PC enthusiasts and gamers to upgrade their systems.

The live streaming hardware market is poised for substantial expansion, with projections indicating it will reach $15 billion by 2025 and maintain a robust 15% compound annual growth rate through 2033. Elgato, a key player within Corsair's portfolio, is well-positioned to capitalize on this trend.

Elgato's reputation as an innovator in content creator technology is solidified by its consistent release of cutting-edge products. Recent examples like the Facecam 4K and Game Capture 4K S directly address the burgeoning need for superior video production capabilities among streamers and content creators.

This strong market standing, coupled with the industry's rapid growth trajectory, firmly establishes Elgato's streaming equipment as a Star within Corsair's Business Cash Generation (BCG) Matrix, signifying high market share in a high-growth sector.

Sim Racing Gear (Fanatec Brand)

Fanatec, now part of Corsair following its integration in late 2024, is positioned within the burgeoning sim racing market. This sector is projected to exceed $1 billion globally, with growth rates in the double digits annually, indicating strong demand.

Corsair's strategy includes expanding Fanatec's presence in specialist retail channels by Q2 2025. This move highlights the company's dedication to nurturing this high-potential, in-demand segment.

- Market Growth: The global sim racing market is valued at over $1 billion and is experiencing double-digit annual growth.

- Strategic Expansion: Corsair plans to increase Fanatec's distribution through key specialist retailers in Q2 2025.

- Growth Driver: Fanatec is identified as a significant contributor to Corsair's overall growth trajectory.

High-End Power Supplies and Cooling Solutions

The market for high-end power supplies and advanced cooling solutions is surging. This growth is directly linked to the recent launch of more powerful GPUs from NVIDIA and AMD, which demand more robust system support. For instance, the DIY desktop PC power supply market is expected to see substantial expansion, fueled by the continuous need for high-performance computing setups.

Corsair's products in these segments are critical for the current PC upgrade trend. They represent high-growth opportunities for the company.

- Increased GPU Power Draw: New graphics cards from NVIDIA and AMD are pushing power consumption limits, necessitating higher wattage and more efficient power supplies.

- DIY PC Market Expansion: The do-it-yourself PC building community continues to grow, with enthusiasts prioritizing premium components like advanced power supplies and cooling.

- Corsair's Strategic Position: Corsair's established reputation for quality in these categories positions them well to capture market share in this expanding high-performance segment.

Corsair's Gaming Components and Systems segment, particularly its high-performance DRAM and power supply units, are performing exceptionally well. This is driven by the ongoing PC upgrade cycle, fueled by new, more powerful graphics cards from NVIDIA and AMD. The DIY desktop PC power supply market, a key area for Corsair, is projected for significant expansion, supporting the demand for high-performance computing. These factors solidify Corsair's premium components as Stars in the BCG matrix, indicating high market share in high-growth areas.

| Segment | Market Growth | Corsair's Position | BCG Classification |

|---|---|---|---|

| Gaming Components & Systems (DRAM, PSUs) | Strong, driven by GPU upgrades and DIY PC market expansion | High market share, premium brand reputation | Star |

| Live Streaming Hardware (Elgato) | Very strong (15% CAGR through 2033), reaching $15B by 2025 | Leader, innovator in content creator tech | Star |

| Sim Racing Hardware (Fanatec) | High (double-digit annual growth), exceeding $1B globally | Growing presence, strategic retail expansion planned | Star |

What is included in the product

Corsair's BCG Matrix analysis categorizes its diverse product lines to guide strategic decisions on investment and resource allocation.

Quickly identify underperforming units and strategize for growth.

Cash Cows

Corsair's core gaming peripherals, including keyboards, mice, and headsets, represent a significant cash cow. The company boasts a robust U.S. market share in this segment, with certain products achieving a leading position. This strong standing is built on two decades of brand development and a dedicated customer following.

Despite the moderate growth of the overall core gaming gear market, these established product lines continue to be reliable revenue generators. Their high market penetration and established brand loyalty mean they require less aggressive marketing spend to maintain their sales, thus contributing significantly to consistent cash flow for Corsair.

Corsair's established PC cases represent a classic Cash Cow in their BCG matrix. Their long-standing presence and strong brand recognition in the DIY PC market ensure consistent sales. For instance, in 2024, Corsair continued to see robust demand for their popular 4000D Airflow and 5000D Airflow models, which are known for their quality and airflow capabilities.

These mature products generate steady revenue and profit margins, requiring minimal investment in new development. This reliability makes them crucial for funding growth in other areas of Corsair's business. The PC case segment, while competitive, remains a core strength, contributing significantly to overall profitability.

ORIGIN PC, a Corsair subsidiary, focuses on custom gaming PCs, with its more mainstream pre-built configurations acting as dependable cash cows. These systems benefit from Corsair's established component supply chain and brand recognition, tapping into a wider consumer base for consistent sales. The gaming PC market in 2024 continues to show robust demand, with custom and pre-built systems contributing significantly to the overall PC hardware sector.

Standard Power Supply Units (PSUs)

Corsair's standard power supply units (PSUs) represent a stable segment within their product portfolio, serving a wide array of PC builders beyond the enthusiast market. These units benefit from an established market presence, fulfilling a fundamental need in every computer build and guaranteeing consistent demand. Their mature technology and dependable performance solidify their role as reliable cash flow generators, necessitating minimal investment in research and development when contrasted with their more innovative counterparts.

These standard PSUs are crucial for maintaining Corsair's financial stability, acting as dependable income streams. For instance, in 2024, the mid-range PSU market segment, which these standard units primarily occupy, saw continued robust demand, driven by a steady volume of new PC builds and upgrades. While specific Corsair PSU sales figures for 2024 aren't publicly detailed, the overall PC hardware market experienced growth, with PSUs being a necessary component for any system. This indicates a strong, consistent revenue contribution from this product category.

- Established Market Presence: Standard PSUs are essential components for a vast majority of PC builds, ensuring a consistent customer base.

- Steady Demand: The fundamental nature of PSUs means they are always in demand, regardless of technological shifts in other PC components.

- Mature Technology: Less R&D investment is required compared to cutting-edge products, leading to higher profit margins.

- Reliable Cash Flow: These units contribute significantly to Corsair's financial stability through predictable sales and earnings.

Standard Liquid Cooling Solutions

Corsair's standard liquid cooling solutions, particularly their all-in-one (AIO) units, represent a significant Cash Cow for the company. These established product lines enjoy widespread adoption among PC enthusiasts, a testament to their reliable performance and user-friendly installation process. Despite the emergence of newer cooling technologies, the enduring popularity of these AIOs ensures a consistent revenue stream.

These products command a substantial market share, and their strong brand recognition means they require less intensive marketing efforts to maintain sales. This allows Corsair to allocate resources more strategically. In 2024, the PC cooling market, including AIOs, saw continued growth, with reports indicating a compound annual growth rate of over 10% for the liquid cooling segment specifically. Corsair's established presence in this segment positions their standard AIOs as a dependable source of profit.

- Dominant Market Share: Corsair's AIOs are a go-to choice for many builders.

- Consistent Revenue: Proven performance drives steady sales.

- Low Marketing Overhead: Strong brand loyalty reduces promotional costs.

- Proven Technology: Ease of installation remains a key selling point.

Corsair's established gaming keyboards, mice, and headsets are prime examples of Cash Cows. Their significant market share, built over two decades, ensures consistent revenue with minimal new investment. These products continue to be reliable profit generators, funding other ventures.

Corsair's PC cases, like the popular 4000D Airflow and 5000D Airflow, are also Cash Cows. They maintain strong sales due to brand recognition and quality, requiring little in the way of new development. This segment provides stable income for the company.

The company's standard power supply units (PSUs) are dependable Cash Cows. They serve a broad market, benefiting from consistent demand and mature technology, which leads to healthy profit margins and stable cash flow. In 2024, the mid-range PSU market, where these units compete, saw continued robust demand.

Corsair's standard all-in-one (AIO) liquid cooling solutions are also identified as Cash Cows. Their widespread adoption and proven performance ensure consistent sales, with the liquid cooling segment projected for over 10% growth annually. This makes them a reliable source of profit.

| Product Category | BCG Status | Key Strengths | 2024 Market Context |

|---|---|---|---|

| Gaming Keyboards, Mice, Headsets | Cash Cow | High market share, brand loyalty, mature technology | Steady demand in a moderately growing market |

| PC Cases (e.g., 4000D/5000D Airflow) | Cash Cow | Strong brand recognition, consistent sales, quality reputation | Continued robust demand in DIY PC market |

| Standard Power Supply Units (PSUs) | Cash Cow | Essential component, broad market appeal, mature technology | Robust demand in mid-range PSU segment |

| Standard All-in-One (AIO) Liquid Coolers | Cash Cow | Dominant market share, proven performance, user-friendly | Strong growth in liquid cooling segment |

Preview = Final Product

Corsair BCG Matrix

The Corsair BCG Matrix preview you are currently viewing is the exact, final document you will receive upon purchase. This means no watermarks, no demo content, and no alterations—just the complete, professionally formatted strategic tool ready for immediate implementation. You can be confident that the insights and structure presented here are precisely what you'll be working with to guide your business decisions.

Dogs

Certain older PC component models, like legacy memory modules or power supplies that newer, more efficient versions have replaced, can be considered outdated. These products often see declining sales and struggle against current offerings, leading to a small market share and limited growth potential.

For instance, DDR3 RAM modules, while still functional, have largely been phased out by DDR4 and DDR5 in the new PC market, with sales volumes significantly lower in 2024 compared to previous years. Similarly, power supply units with older efficiency ratings (like 80 Plus Bronze) are increasingly being overshadowed by higher-rated models (Gold, Platinum, Titanium) that offer better energy savings and performance, impacting their market relevance.

Niche, low-volume accessories within Corsair's broad product range might be categorized as Dogs. These are items catering to a very specific, often small, customer base, or those facing intense competition from less specialized alternatives. For instance, certain highly specialized PC modding components or unique gaming peripherals with limited appeal could fall into this group.

These products likely generate minimal revenue for Corsair and demand a significant investment in marketing, inventory management, and customer support for each sale. In 2024, while Corsair's overall revenue grew, these niche items may have contributed less than 1% to the company's total sales, requiring careful evaluation of their continued viability.

Corsair's peripheral lineup may include discontinued items that haven't seen a direct successor. These products, often found being cleared from inventory, represent a "Dog" in the BCG matrix. For instance, if a specific model of a gaming mouse or keyboard was phased out in 2023 without a direct replacement, it would fit this category. Such items offer no future growth potential.

Entry-Level Peripherals with High Competition

Entry-level gaming peripherals like keyboards, mice, and headsets represent a segment where Corsair faces considerable competition. If Corsair offers products in this space that primarily compete on price, they are likely positioned as Dogs in the BCG Matrix.

These products operate in a market flooded with budget-friendly options from numerous brands, making it difficult to capture significant market share or achieve healthy profit margins. For instance, the global gaming peripherals market, while growing, sees intense price wars at the entry-level. In 2024, the average selling price for an entry-level gaming keyboard was often below $50, with many competitors offering similar specifications at this price point.

- High Saturation: The entry-level market is crowded with brands, limiting Corsair's ability to differentiate purely on price.

- Low Margins: Intense competition drives down profit margins, making these products less financially attractive.

- Cash Trap Potential: Products that don't offer unique value or brand loyalty in this segment risk becoming cash traps, consuming resources without generating substantial returns.

- Market Share Challenges: Gaining and maintaining significant market share is difficult when competing against numerous low-cost alternatives.

Older, Less Optimized Pre-built PC Configurations

Older, less optimized pre-built PC configurations represent a segment of the market where specific legacy builds struggle to compete. These systems often feature components with a less favorable performance-to-price ratio or have been surpassed by newer, more efficient architectures. For instance, PCs built with last-generation CPUs or GPUs might be available, but their overall value proposition diminishes as newer technology emerges.

These configurations typically experience low sales volumes. This sluggish demand can lead to higher inventory holding costs for retailers and manufacturers. To stimulate sales, significant discounts are often necessary, which in turn compresses profit margins and results in low returns on investment. In 2024, the rapid pace of technological advancement in PC hardware means that even systems released just a year or two prior can fall into this category if not strategically managed.

- Low Market Share: Older pre-built PCs often capture a shrinking portion of the overall PC market as consumers gravitate towards newer, more powerful, and often more cost-effective configurations.

- Inventory Challenges: Holding onto older inventory can tie up capital and incur storage costs. For example, a pre-built PC with a mid-range GPU from 2022 might be difficult to sell at a profit in 2024 without substantial markdowns.

- Reduced Profitability: The need for heavy discounting to move these units directly impacts profitability, making them a less attractive product category for manufacturers and retailers focused on maximizing margins.

- Technological Obsolescence: The rapid evolution of CPU and GPU technology means that older architectures quickly become less competitive, impacting both performance and perceived value.

Corsair's "Dogs" represent products with low market share and low growth potential. These are often legacy components, niche accessories, or entry-level peripherals facing intense competition. For example, DDR3 RAM sales in 2024 were a fraction of DDR5, and older pre-built PCs require significant discounts to sell.

These products typically generate minimal revenue and can become cash traps, consuming resources without substantial returns. Corsair's strategy often involves phasing out or minimizing investment in these "Dog" products to focus on more promising segments.

The entry-level gaming peripheral market, for instance, saw average selling prices below $50 for keyboards in 2024, with low margins due to price wars.

Discontinued items without direct successors, like specific older mouse models, also fall into this category, offering no future growth and often being cleared from inventory.

| Product Category | Market Share (Estimated) | Growth Potential (Estimated) | Example |

|---|---|---|---|

| Legacy PC Components | Low | Low | DDR3 RAM Modules |

| Niche Accessories | Very Low | Very Low | Specialized PC Modding Components |

| Entry-Level Peripherals | Low to Moderate | Low | Budget Gaming Keyboards |

| Discontinued Products | Negligible | None | Older Gaming Mouse Models |

Question Marks

The Corsair AI Workstation 300, launched in July 2025, is positioned within the emerging AI PC market. This segment is experiencing rapid growth due to the increasing integration of artificial intelligence into computing tasks.

Despite the significant future potential of AI-powered computing, Corsair currently holds a small market share in this specialized, high-performance niche. This is primarily because the AI Workstation 300 represents a new entry for the company in this particular market segment.

To elevate the AI Workstation 300 from a potential Question Mark to a Star within Corsair's product portfolio, substantial investments in research and development, aggressive marketing campaigns, and robust ecosystem development are essential. Failure to achieve strong market adoption could relegate it to the status of a Dog.

Products like the Elgato Facecam 4K, launched in July 2025, are prime examples of question marks in Corsair's portfolio. They target the rapidly expanding content creation sector, a market projected to reach $100 billion by 2027, offering advanced features for a discerning user base.

Despite their innovative nature and high growth potential, these high-end peripherals currently hold a small market share due to their recent market entry. Significant investment in marketing and driving user adoption will be crucial for them to evolve from question marks into stars within Corsair's product lineup.

Drop, with its community-driven mechanical keyboard approach, fits into the Stars category within Corsair's BCG Matrix. The enthusiast mechanical keyboard market is experiencing robust growth, with projections indicating continued expansion through 2024 and beyond, fueled by demand for customization and premium build quality.

While Drop's market share within Corsair's overall business might be modest, its position in a high-growth, high-potential niche warrants significant investment. This strategic focus aims to solidify Drop's leadership and capitalize on the increasing demand for specialized peripherals.

SCUF Gaming (Custom Controllers)

SCUF Gaming, a key player in custom controllers, operates in a rapidly expanding segment of the gaming peripherals market. While it caters to a passionate, premium-paying customer base, its presence in the overall controller market is still relatively small, suggesting it might be a question mark or a potential star in Corsair's portfolio. Corsair's strategic focus should be on boosting SCUF's brand visibility, innovating its product line, and broadening its sales channels to capture a larger share and improve financial performance.

The esports and competitive gaming market, which SCUF directly targets, saw significant growth, with global esports revenues projected to reach over $2.2 billion in 2024. This robust market expansion provides a fertile ground for SCUF's specialized offerings, positioning it favorably for future development.

- Market Niche: SCUF Gaming focuses on the high-value, performance-driven segment of the gaming controller market.

- Growth Potential: The expanding esports and competitive gaming scene directly fuels demand for SCUF's specialized products.

- Strategic Imperative: Corsair must invest in brand building, product innovation, and distribution to capitalize on SCUF's potential.

New Geographic Market Expansions

Corsair's push into new geographic markets, especially in the Asia-Pacific region, is a prime example of a Question Mark in their BCG Matrix. This area is seeing a boom in gaming and content creation, offering substantial growth potential.

However, Corsair's presence in these emerging territories is likely nascent, meaning their initial market share could be small. This necessitates significant investment in tailored marketing, robust distribution networks, and essential infrastructure to build a solid foundation.

- Asia-Pacific Gaming Market Growth: The global gaming market, with Asia-Pacific as a key driver, was projected to reach over $200 billion in 2024.

- Content Creator Surge: The number of professional content creators globally has been steadily increasing, with a significant portion residing in Asia.

- Investment Requirement: Successfully entering these markets requires substantial upfront capital for brand building and market penetration.

- Potential for High Returns: If these expansions are managed effectively, they could transition into Stars, generating significant future revenue.

Question Marks in Corsair's product portfolio represent new ventures or products in high-growth markets where the company currently has a low market share. These are often innovative offerings that require significant investment to gain traction and potentially become future Stars.

The success of these Question Marks hinges on strategic investment in marketing, research and development, and market penetration efforts. Without sufficient support, they risk declining into Dogs, consuming resources without generating adequate returns.

Corsair's AI Workstation 300 and Elgato Facecam 4K are prime examples of such ventures, aiming to capture emerging market segments with high future potential but currently limited market presence.

The Elgato Facecam 4K, launched in July 2025, is a prime example of a question mark in Corsair's portfolio. It targets the rapidly expanding content creation sector, a market projected to reach $100 billion by 2027, offering advanced features for a discerning user base.

Despite their innovative nature and high growth potential, these high-end peripherals currently hold a small market share due to their recent market entry. Significant investment in marketing and driving user adoption will be crucial for them to evolve from question marks into stars within Corsair's lineup.

| Product/Venture | Market Growth | Current Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| AI Workstation 300 | High (Emerging AI PC Market) | Low (New Entry) | High (R&D, Marketing) | Star or Dog |

| Elgato Facecam 4K | High (Content Creation) | Low (New Entry) | High (Marketing, Adoption) | Star or Dog |

| SCUF Gaming | High (Esports Peripherals) | Moderate (Niche Dominance) | Moderate (Brand, Innovation) | Star |

| Asia-Pacific Expansion | High (Global Gaming Market) | Low (Nascent Presence) | High (Infrastructure, Marketing) | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position Corsair's product portfolio.