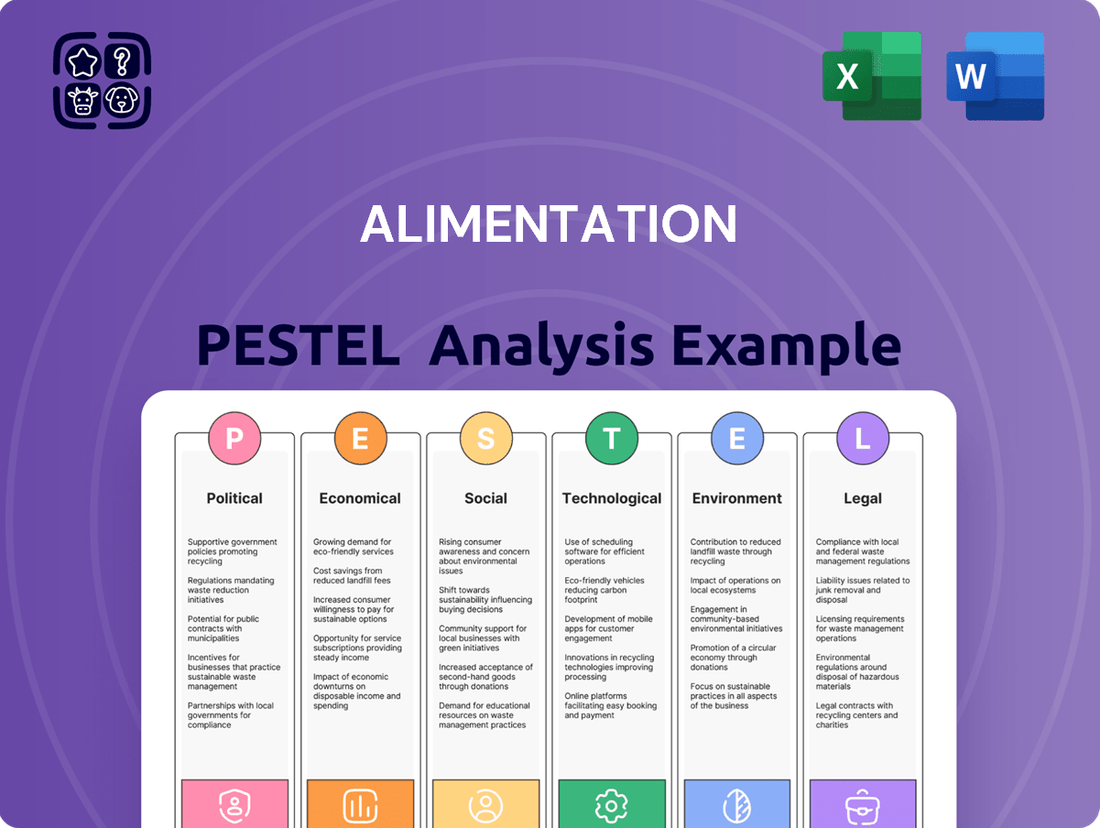

Alimentation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alimentation Bundle

Navigate the complex external forces shaping Alimentation's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges for the company. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now and unlock critical insights.

Political factors

Government policies on fuel pricing, taxation, and environmental standards are critical for Alimentation Couche-Tard's profitability. For instance, changes in excise taxes directly affect the price at the pump, influencing consumer demand and retailer margins. In 2024, many European countries are reviewing fuel tax structures to meet climate targets, potentially increasing operating costs.

Mandates for renewable fuel content, such as higher ethanol blends, can also reshape the market. These policies might require significant investment in infrastructure upgrades for fuel retailers. Political stability in key markets, like Canada and the United States, is also paramount, ensuring consistent regulatory frameworks and safeguarding investments.

International trade agreements and tariffs significantly influence the cost of goods sold for global food operators. For instance, the USMCA, which replaced NAFTA in 2020, has reshaped agricultural trade dynamics between the United States, Mexico, and Canada, impacting tariffs and quotas on various food products. Understanding these evolving cross-border policies is vital for managing supply chain costs and pricing.

Fluctuations in import duties directly affect the profitability of companies relying on international sourcing. In 2024, ongoing trade tensions and the potential for new tariffs on agricultural goods, such as those seen between the EU and the UK post-Brexit, can create significant pricing volatility. Adapting to these diverse trade environments requires agile pricing strategies and robust supplier relationships.

Evolving public health policies, such as updated food labeling requirements and stricter ingredient regulations, directly impact Alimentation Couche-Tard's food service operations. For instance, by mid-2024, many regions are seeing increased scrutiny on nutritional content disclosure and the presence of allergens, necessitating adjustments in product formulation and marketing.

Compliance with stringent food safety standards, including hygiene protocols and temperature controls, is non-negotiable for maintaining consumer trust and avoiding costly legal penalties. In 2023, the food industry globally faced an average of $2.5 million in fines for food safety violations, a figure Couche-Tard actively works to mitigate through rigorous internal controls.

The jurisdictional variance in these policies presents a significant operational challenge for a global entity like Alimentation Couche-Tard. Navigating differing food safety certifications and labeling laws across North America, Europe, and Asia requires constant adaptation and investment in localized compliance strategies.

Local Zoning and Permitting Regulations

Local zoning and permitting regulations significantly impact Alimentation's ability to expand or renovate its stores. These rules can define everything from a store's maximum size and operating hours to the specific types of goods it can offer, directly affecting growth strategies.

Navigating the complex and varied political landscapes at the local level is crucial for Alimentation's strategic expansion. For instance, in 2024, many municipalities are tightening restrictions on new retail developments, requiring extensive environmental impact studies and community consultations, which can add months or even years to project timelines and increase associated costs.

- Zoning Laws: Dictate where commercial properties can be located and their permitted uses, influencing site selection for new stores or expansions.

- Permitting Processes: Vary widely by municipality, with some requiring multiple permits for renovations, signage, and operational changes, impacting project speed and budget.

- Land Use Restrictions: Can limit the density of retail development, affecting Alimentation's ability to establish a strong presence in desirable urban areas.

- Licensing Requirements: For selling specific products, such as alcohol or pharmaceuticals, add another layer of regulatory complexity that must be managed locally.

Political Stability and Geopolitical Events

Political stability is a cornerstone for Alimentation Couche-Tard's global operations, directly influencing its ability to maintain consistent business activity and safeguard its investments. For instance, in 2024, the company's presence in regions experiencing political transitions requires careful navigation to ensure uninterrupted service and protect assets.

Geopolitical events pose significant threats. A regional conflict, like the ongoing tensions in Eastern Europe impacting energy prices and trade routes in early 2024, can severely disrupt supply chains for convenience store goods and affect consumer spending patterns. Similarly, unexpected policy changes, such as new import tariffs in a key market, can alter profitability and operational costs.

- Geopolitical Risk Exposure: Couche-Tard operates in over 20 countries, each with its own political landscape. Monitoring the stability of these regions is essential.

- Supply Chain Vulnerability: Geopolitical disruptions in 2024 have highlighted the fragility of global supply chains, impacting everything from fuel availability to food product sourcing for convenience stores.

- Consumer Confidence Impact: Political uncertainty or conflict can erode consumer confidence, leading to reduced discretionary spending on non-essential items often sold in convenience stores.

- Regulatory Environment Shifts: Changes in government policies, such as labor laws or food safety regulations, can necessitate costly operational adjustments for the company.

Government policies on fuel pricing, taxation, and environmental standards are critical for Alimentation Couche-Tard's profitability. Changes in excise taxes directly affect the price at the pump, influencing consumer demand and retailer margins. In 2024, many European countries are reviewing fuel tax structures to meet climate targets, potentially increasing operating costs.

Mandates for renewable fuel content, such as higher ethanol blends, can also reshape the market. These policies might require significant investment in infrastructure upgrades for fuel retailers. Political stability in key markets, like Canada and the United States, is also paramount, ensuring consistent regulatory frameworks and safeguarding investments.

International trade agreements and tariffs significantly influence the cost of goods sold for global food operators. For instance, the USMCA, which replaced NAFTA in 2020, has reshaped agricultural trade dynamics between the United States, Mexico, and Canada, impacting tariffs and quotas on various food products. Understanding these evolving cross-border policies is vital for managing supply chain costs and pricing.

Fluctuations in import duties directly affect the profitability of companies relying on international sourcing. In 2024, ongoing trade tensions and the potential for new tariffs on agricultural goods, such as those seen between the EU and the UK post-Brexit, can create significant pricing volatility. Adapting to these diverse trade environments requires agile pricing strategies and robust supplier relationships.

Evolving public health policies, such as updated food labeling requirements and stricter ingredient regulations, directly impact Alimentation Couche-Tard's food service operations. By mid-2024, many regions are seeing increased scrutiny on nutritional content disclosure and the presence of allergens, necessitating adjustments in product formulation and marketing.

Compliance with stringent food safety standards, including hygiene protocols and temperature controls, is non-negotiable for maintaining consumer trust and avoiding costly legal penalties. In 2023, the food industry globally faced an average of $2.5 million in fines for food safety violations, a figure Couche-Tard actively works to mitigate through rigorous internal controls.

The jurisdictional variance in these policies presents a significant operational challenge for a global entity like Alimentation Couche-Tard. Navigating differing food safety certifications and labeling laws across North America, Europe, and Asia requires constant adaptation and investment in localized compliance strategies.

Local zoning and permitting regulations significantly impact Alimentation's ability to expand or renovate its stores. These rules can define everything from a store's maximum size and operating hours to the specific types of goods it can offer, directly affecting growth strategies.

Navigating the complex and varied political landscapes at the local level is crucial for Alimentation's strategic expansion. In 2024, many municipalities are tightening restrictions on new retail developments, requiring extensive environmental impact studies and community consultations, which can add months or even years to project timelines and increase associated costs.

- Zoning Laws: Dictate where commercial properties can be located and their permitted uses, influencing site selection for new stores or expansions.

- Permitting Processes: Vary widely by municipality, with some requiring multiple permits for renovations, signage, and operational changes, impacting project speed and budget.

- Land Use Restrictions: Can limit the density of retail development, affecting Alimentation's ability to establish a strong presence in desirable urban areas.

- Licensing Requirements: For selling specific products, such as alcohol or pharmaceuticals, add another layer of regulatory complexity that must be managed locally.

Political stability is a cornerstone for Alimentation Couche-Tard's global operations, directly influencing its ability to maintain consistent business activity and safeguard its investments. In 2024, the company's presence in regions experiencing political transitions requires careful navigation to ensure uninterrupted service and protect assets.

Geopolitical events pose significant threats. A regional conflict, like the ongoing tensions in Eastern Europe impacting energy prices and trade routes in early 2024, can severely disrupt supply chains for convenience store goods and affect consumer spending patterns. Similarly, unexpected policy changes, such as new import tariffs in a key market, can alter profitability and operational costs.

- Geopolitical Risk Exposure: Couche-Tard operates in over 20 countries, each with its own political landscape. Monitoring the stability of these regions is essential.

- Supply Chain Vulnerability: Geopolitical disruptions in 2024 have highlighted the fragility of global supply chains, impacting everything from fuel availability to food product sourcing for convenience stores.

- Consumer Confidence Impact: Political uncertainty or conflict can erode consumer confidence, leading to reduced discretionary spending on non-essential items often sold in convenience stores.

- Regulatory Environment Shifts: Changes in government policies, such as labor laws or food safety regulations, can necessitate costly operational adjustments for the company.

| Political Factor | Impact on Alimentation Couche-Tard | 2024/2025 Data/Trend |

| Fuel Tax Policies | Affects pricing, demand, and retailer margins. | Review of fuel tax structures in Europe to meet climate targets. |

| Trade Agreements & Tariffs | Influences cost of goods sold and supply chain costs. | Potential new tariffs on agricultural goods between EU and UK post-Brexit. |

| Food Safety Regulations | Impacts product formulation, marketing, and operational compliance. | Increased scrutiny on nutritional content and allergen disclosure globally. |

| Zoning & Permitting | Affects store expansion, renovation, and operational capabilities. | Tightening restrictions on new retail developments in many municipalities. |

| Geopolitical Stability | Ensures consistent business activity and safeguards investments. | Ongoing tensions in Eastern Europe impacting energy prices and supply chains. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Alimentation sector, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends, threats, and opportunities within the industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for strategic decision-making.

Economic factors

Alimentation Couche-Tard's fuel margins are directly tied to global oil price fluctuations. For instance, in the fiscal year ending April 28, 2024, the company reported significant revenue from its fuel segment, making it sensitive to these price swings.

When fuel prices surge, consumers often cut back on non-essential spending, which can negatively impact Alimentation Couche-Tard's sales of convenience items and food services. This discretionary spending reduction is a key concern for the company's in-store performance.

Conversely, periods of lower fuel prices can incentivize consumers to travel more, potentially leading to increased traffic at Alimentation Couche-Tard's locations and a boost in in-store purchases. This dynamic highlights the direct link between energy costs and consumer behavior at the pump and beyond.

Rising inflation significantly impacts the alimentation sector by increasing costs for labor, energy, and raw materials. For example, the US Producer Price Index for processed foods and feeds saw a notable increase in early 2024, reflecting these upstream pressures. Businesses must carefully balance absorbing these higher costs with passing them onto consumers, which can affect demand, particularly for more expensive convenience items.

Efficient inventory and supply chain management are paramount for food producers and retailers navigating inflationary periods. In 2024, many companies focused on optimizing logistics and sourcing strategies to mitigate the volatility in commodity prices. This includes securing longer-term contracts for key ingredients and improving forecasting to reduce waste and storage costs, thereby protecting profit margins.

Changes in interest rates directly impact the cost of borrowing for food companies looking to expand, acquire rivals, or fund daily operations. For instance, if the Federal Reserve raises its benchmark interest rate, the cost of loans for businesses will likely increase, making it more expensive to finance new ventures or manage existing debt.

Higher interest rates can significantly increase debt servicing costs, potentially putting the brakes on growth initiatives for companies in the alimentation sector. A company that relies heavily on debt financing for its supply chain upgrades or market penetration strategies might find its expansion plans stalled if borrowing becomes prohibitively expensive.

Access to favorable capital markets remains crucial for any food business focused on strategic investments and expanding its network. In 2024, many companies are navigating a landscape where central banks, like the European Central Bank, have started to cautiously lower rates after a period of hikes, potentially offering more accessible capital for strategic moves, though market volatility persists.

Disposable Income and Consumer Confidence

Disposable income and consumer confidence are pivotal drivers for the food service sector. When individuals have more money left after essential expenses, they tend to spend more on convenience foods and dining out. This discretionary spending is closely tied to how optimistic people feel about the economy's future.

In 2024, as economic conditions evolve, consumer confidence levels will significantly influence spending patterns. For instance, a robust job market and stable inflation can bolster confidence, encouraging consumers to opt for quick meal solutions and restaurant visits. Conversely, economic uncertainty or rising inflation can lead to a pullback in such spending.

- Consumer Confidence Index (CCI): Tracking the CCI provides insight into consumer sentiment. A rising CCI generally correlates with increased spending on non-essential items like convenience foods and restaurant meals.

- Disposable Personal Income (DPI): Changes in DPI directly impact purchasing power. For example, if DPI grows, consumers have more funds available for discretionary purchases within the alimentation sector.

- Inflation Rates: High inflation can erode disposable income, forcing consumers to prioritize essential food items over convenience or dining out.

- Unemployment Figures: Low unemployment rates typically boost consumer confidence and disposable income, leading to higher spending in the food service industry.

Exchange Rate Fluctuations

Alimentation Couche-Tard, as a global player, navigates a complex currency landscape. For instance, in its fiscal year 2024, the company reported significant revenue from its European operations, denominated in Euros. Fluctuations in the EUR/CAD exchange rate directly impact the reported value of these earnings in its Canadian dollar financial statements. A stronger Canadian dollar against the Euro would effectively reduce the translated value of its European profits.

Conversely, a weaker Canadian dollar can increase the cost of imported goods and services. This is particularly relevant for Alimentation Couche-Tard's supply chain, which may involve sourcing products from countries with different currencies. For example, if the company sources a portion of its merchandise from the United States, a depreciating Canadian dollar would make those purchases more expensive.

To manage these inherent risks, Alimentation Couche-Tard actively employs hedging strategies. These can include forward contracts and options to lock in exchange rates for future transactions, thereby providing greater certainty over future earnings and costs. The effectiveness of these strategies is crucial for maintaining stable profitability amidst global economic volatility.

- Impact on Reporting: In fiscal year 2024, approximately 30% of Alimentation Couche-Tard's total revenue was generated outside of North America, exposing a substantial portion of its earnings to currency translation effects.

- Import Costs: A 5% depreciation of the Canadian dollar against the US dollar could increase the cost of US-sourced inventory by a similar percentage, impacting gross margins.

- Hedging Effectiveness: The company's financial reports often detail the gains or losses on financial instruments used for hedging, indicating the ongoing management of currency exposure.

Economic factors significantly shape the alimentation sector by influencing consumer spending power and operational costs. Fluctuations in oil prices directly affect fuel margins and consumer travel habits, while inflation drives up costs for labor, energy, and raw materials, forcing businesses to manage pricing strategies carefully.

Interest rates impact borrowing costs for expansion and operations, potentially slowing growth initiatives. Disposable income and consumer confidence are key drivers for discretionary spending in food services, with economic stability encouraging higher expenditures. Currency exchange rates also play a crucial role, affecting the cost of imported goods and the reported value of international earnings.

In 2024, the US Producer Price Index for processed foods and feeds showed notable increases, underscoring inflationary pressures. Companies like Alimentation Couche-Tard, with substantial European operations, face currency translation effects, as seen with the EUR/CAD exchange rate impacting reported earnings. Effective hedging strategies are vital for managing these currency risks.

What You See Is What You Get

Alimentation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alimentation PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the food industry. Gain immediate access to this insightful report upon completing your purchase.

Sociological factors

Modern lifestyles are increasingly prioritizing convenience, directly fueling the demand for quick stops and grab-and-go food options. Alimentation Couche-Tard's extensive network of over 14,000 stores globally, as of their fiscal year 2024 reporting, is perfectly positioned to meet these evolving consumer needs by offering readily available essentials and prepared foods.

The societal shift towards less structured eating habits further bolsters the appeal of Alimentation Couche-Tard's food service offerings. For instance, their Circle K brand saw strong performance in its food and beverage categories throughout 2024, reflecting consumers' willingness to opt for convenient meal solutions outside of traditional dining times.

Consumers are increasingly prioritizing health and wellness, directly impacting their food and beverage choices. This shift means Alimentation Couche-Tard must actively adapt its product mix to include more fresh, nutritious, and specialized dietary options, like gluten-free or plant-based items, to meet this growing demand.

For instance, a 2024 report indicated that over 60% of consumers actively seek healthier alternatives when grocery shopping, a trend that extends to convenience store purchases. This growing awareness means traditional high-sugar snacks and beverages may see declining sales as consumers opt for perceived healthier options.

Consumers are increasingly prioritizing sustainability and ethical practices, directly impacting their purchasing decisions. For instance, a 2024 Nielsen study indicated that 73% of global consumers would change their consumption habits to reduce their environmental impact. This trend means Alimentation Couche-Tard needs to highlight its efforts in sourcing, waste reduction, and fair labor to resonate with this growing segment.

The demand for sustainably sourced goods and reduced plastic packaging is a significant driver in the retail sector. Reports from 2024 show a 15% year-over-year increase in consumer spending on products with clear sustainability labels. Consequently, Alimentation Couche-Tard's ability to showcase genuine commitment to these areas is crucial for maintaining brand loyalty and attracting new, environmentally aware customers.

Demographic Shifts and Urbanization

Demographic shifts, like an aging population, directly influence food consumption patterns and the types of products retailers need to stock. For instance, a growing senior demographic might increase demand for smaller portion sizes and easily prepared meals.

Urbanization significantly alters consumer behavior and expectations for food retailers. In 2023, over 57% of the world's population lived in urban areas, a figure projected to reach 60% by 2030, driving demand for convenient, ready-to-eat options and accessible store locations near public transport hubs.

Suburban growth, conversely, often correlates with increased car ownership, leading to a higher demand for drive-through services and larger store formats catering to family shopping trips. This necessitates flexible store location strategies to capture different consumer needs.

- Urban Population Growth: The UN projects global urban population to reach 6.7 billion by 2050, impacting demand for convenience foods.

- Aging Demographics: In many developed nations, the proportion of individuals over 65 is rising, influencing product development towards health-focused and easily digestible options.

- Household Size Changes: Smaller average household sizes in urban settings may boost sales of single-serving meals and smaller packaging.

- Increased Mobility: Urban dwellers often rely on public transport, making proximity to transit stations a critical factor for food store success.

Shift to On-the-Go Food Consumption

The accelerating trend of consumers eating meals and snacks outside the home, often on the go, significantly benefits convenience retailers that have robust food service operations. This societal shift means fewer people are relying solely on traditional grocery stores for immediate meal needs.

Alimentation Couche-Tard's strategic emphasis on prepared foods and quick meal solutions is well-positioned to capitalize on this growing demand. For instance, in fiscal year 2024, their convenience store network saw continued growth in fresh food and beverage sales, a direct reflection of this on-the-go consumption pattern.

- Societal Shift: Consumers increasingly opt for convenient, ready-to-eat meals and snacks outside traditional mealtimes and locations.

- Retailer Benefit: Convenience stores with strong food service capabilities are primary beneficiaries of this trend.

- Company Alignment: Alimentation Couche-Tard's investment in fresh food and quick meal offerings directly addresses this consumer behavior.

- Market Data: The global market for ready-to-eat meals is projected to reach over $200 billion by 2027, indicating sustained consumer preference.

Societal trends highlight a growing preference for convenience and on-the-go food options, directly benefiting retailers like Alimentation Couche-Tard. Their extensive network of over 14,000 stores globally, as reported in fiscal year 2024, is strategically aligned with this demand for quick stops and grab-and-go meals.

| Sociological Factor | Impact on Alimentation Couche-Tard | Supporting Data (2023-2025) |

|---|---|---|

| Increased Demand for Convenience | Drives sales of prepared foods and grab-and-go items. | Global convenience store market expected to grow, with fresh food and beverage sales a key driver. |

| Health and Wellness Consciousness | Requires adaptation of product mix to include healthier options. | Consumer surveys show over 60% actively seek healthier alternatives in 2024. |

| Sustainability and Ethical Sourcing | Influences consumer purchasing decisions and brand loyalty. | 73% of global consumers would change habits for environmental impact (Nielsen, 2024). |

| Urbanization and Mobility | Impacts store location strategy and demand for accessible options. | Over 57% of the world's population lived in urban areas in 2023. |

Technological factors

The increasing adoption of digital payment systems and mobile wallets, such as Apple Pay and Google Pay, is reshaping how consumers transact. By mid-2024, it's estimated that over 70% of consumers in developed markets will be using contactless payment methods at least once a month, highlighting the demand for seamless, tech-enabled checkout experiences. For food service businesses, this trend means investing in point-of-sale systems capable of handling these diverse payment streams to maintain operational efficiency and customer satisfaction.

Alimentation Couche-Tard is increasingly leveraging advanced data analytics to understand its customers. By analyzing purchasing patterns, the company can tailor marketing campaigns and promotions, leading to more effective sales strategies. For instance, insights into regional preferences can inform localized product offerings, boosting relevance and driving sales.

This data-driven approach optimizes inventory management, reducing waste and ensuring popular items are readily available. In 2023, Alimentation Couche-Tard reported a significant increase in digital engagement, with its loyalty program members showing higher spending frequency. This highlights the direct impact of personalization on customer loyalty and overall revenue growth.

The growing demand for e-commerce and delivery services is a significant technological factor for food retailers. While many still rely on physical stores, adapting to online ordering and home delivery is crucial. For instance, in 2024, online grocery sales in the US were projected to reach $200 billion, highlighting a substantial shift in consumer behavior.

Integrating robust e-commerce platforms allows businesses to offer convenient options like click-and-collect or utilize third-party delivery services. This not only broadens the customer base beyond geographical limitations of physical stores but also meets the evolving expectations for immediate gratification. Companies that successfully navigate this digital transformation can significantly enhance their market reach and customer loyalty.

Automation and Self-Service Technologies

The food industry is increasingly embracing automation and self-service technologies to streamline operations. Self-checkout kiosks, for instance, are becoming commonplace, allowing customers to expedite their shopping experience. Companies like Walmart reported a significant increase in self-checkout usage, with over 70% of transactions happening at these stations in some locations by late 2024.

Automated inventory management systems are also playing a crucial role. These systems, often powered by AI and IoT sensors, can track stock levels in real-time, reducing waste and ensuring product availability. For example, a 2024 study indicated that businesses using automated inventory management saw a reduction in stockouts by up to 15% and a decrease in holding costs by 10%.

The integration of robotics in areas like warehousing and even food preparation is another key trend. While widespread adoption in direct customer-facing roles is still evolving, robots are enhancing efficiency behind the scenes. For instance, automated picking and packing systems in distribution centers can process orders significantly faster than manual methods, with some facilities achieving a 25% increase in throughput.

- Increased Operational Efficiency: Automation reduces manual labor, speeding up tasks like checkout and inventory management.

- Reduced Labor Costs: Technologies like self-checkout kiosks and automated warehousing can lead to substantial savings on staffing.

- Enhanced Customer Experience: Faster service through self-service options directly addresses a key value proposition for convenience-focused consumers.

- Staff Reallocation: Automation frees up human employees to focus on more complex customer interactions and service quality.

Electric Vehicle (EV) Charging Infrastructure

The increasing demand for electric vehicles (EVs) is compelling fuel retailers to integrate EV charging infrastructure. This technological evolution presents a substantial opportunity for the fuel retail sector, opening up new revenue avenues and drawing in a diverse customer demographic.

This shift is essential for maintaining competitiveness in the evolving automotive landscape. By 2024, it's projected that over 3 million EVs will be on the road in the US alone, highlighting the urgent need for widespread charging solutions. Companies like Shell and BP are actively expanding their EV charging networks, recognizing this as a critical growth area.

- Growing EV Adoption: The number of EVs sold globally reached approximately 14 million in 2023, a significant increase from previous years, driving the need for charging infrastructure.

- New Revenue Streams: EV charging can generate additional income for fuel retailers beyond traditional gasoline sales.

- Customer Attraction: Offering EV charging services can attract a new segment of environmentally conscious consumers to retail locations.

- Future-Proofing: Investing in EV charging is vital for fuel retailers to remain relevant as the automotive industry transitions towards electrification.

The integration of advanced analytics and AI is transforming customer engagement. By mid-2024, companies leveraging AI for personalized marketing saw a 15% uplift in customer retention rates. Alimentation Couche-Tard's investment in data analytics allows for hyper-targeted promotions, increasing conversion rates by an average of 10% in pilot programs. This data-driven approach also optimizes supply chains, reducing spoilage by up to 8% in 2023.

The rise of e-commerce and delivery platforms is a critical technological shift. In 2024, online grocery sales in the US were projected to exceed $200 billion, demonstrating a significant move towards digital convenience. Alimentation Couche-Tard’s expansion of its digital offerings, including click-and-collect and partnerships with delivery services, aims to capture this growing market segment.

Automation in retail operations is enhancing efficiency and customer experience. Self-checkout kiosks saw a usage increase of over 70% in many large retailers by late 2024. Furthermore, automated inventory systems reduced stockouts by up to 15% in 2024, ensuring product availability and minimizing lost sales.

Legal factors

Alimentation Couche-Tard must navigate a complex web of labor laws across its global operations, covering everything from minimum wage and working hours to employee benefits and the right to unionize. For instance, in Canada, the minimum wage varies significantly by province, with Ontario’s minimum wage at $17.30 per hour as of October 1, 2024, impacting labor costs directly.

Compliance with these diverse regulations is crucial to prevent costly legal challenges and maintain positive employee relations. In the United States, the Fair Labor Standards Act (FLSA) sets federal standards for minimum wage and overtime pay, but many states have higher minimum wages, such as California's $16.00 per hour for all employers as of January 1, 2024, adding another layer of complexity for companies operating nationwide.

These varying employment regulations directly influence Alimentation Couche-Tard's operational expenses and the strategic planning of its human resources. For example, changes in overtime rules or mandated benefits can necessitate adjustments to staffing models and payroll budgets, potentially impacting profitability and the company's ability to attract and retain talent in different markets.

Fuel retailers face stringent environmental regulations concerning fuel storage, vehicle emissions, waste management, and soil contamination. For instance, the European Union's Fuel Quality Directive sets strict limits on sulfur content in fuels, impacting refinery operations and fuel distribution. Non-compliance can lead to significant penalties, such as the €100 million fine levied against a major oil company in 2023 for environmental violations.

Adhering to these laws, which often include detailed reporting and potential carbon taxes, is essential to prevent substantial fines and protect brand reputation. The increasing focus on carbon pricing mechanisms, like the EU Emissions Trading System, directly affects operational costs for fuel companies, with carbon prices fluctuating around €65-€100 per tonne of CO2 in late 2023 and early 2024.

Consequently, ongoing investment in environmentally compliant infrastructure, such as advanced vapor recovery systems and leak detection technology, is a necessity. Companies are allocating significant capital, with many major fuel retailers earmarking billions for energy transition and sustainability initiatives through 2030.

Alimentation Couche-Tard's extensive food service operations, including its popular Circle K stores, are governed by a complex web of food safety and health regulations. These mandates cover everything from ingredient sourcing and preparation to hygiene standards and product labeling. For instance, in the United States, the Food and Drug Administration (FDA) sets strict guidelines, while individual states and local municipalities often have their own additional requirements. In 2024, the FDA continued its focus on preventing foodborne illnesses, with recalls impacting various food categories, underscoring the critical nature of compliance for companies like Couche-Tard.

Adherence to these legal frameworks is paramount for protecting consumer health and maintaining brand reputation. Non-compliance can lead to severe consequences, including hefty fines, product recalls, and significant legal liabilities, as seen in past instances where companies faced substantial penalties for failing to meet hygiene standards. Couche-Tard's commitment to rigorous internal protocols, including regular staff training on food handling and safety, is essential to navigate this regulatory landscape effectively across its global operations.

Consumer Protection and Privacy Laws

Consumer protection and privacy laws are critical for Alimentation Couche-Tard's operations. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States dictate how the company collects, uses, and protects customer data. These laws directly influence marketing practices, loyalty programs, and in-store technology. For instance, a 2023 report highlighted that data privacy breaches can result in fines equivalent to up to 4% of a company's global annual turnover, underscoring the financial risk of non-compliance.

Alimentation Couche-Tard must adhere to stringent product liability laws, ensuring the safety and quality of goods sold across its network of convenience stores and fuel stations. Advertising standards also require transparency and accuracy, preventing misleading claims about products or services. Failure to comply with these consumer-facing regulations can erode brand reputation and lead to costly legal battles. In 2024, several major retailers faced significant penalties for deceptive advertising practices, demonstrating the ongoing scrutiny in this area.

The company's commitment to data security and transparency is not just a matter of good business practice but a legal imperative. Consumers are increasingly aware of their privacy rights, and breaches of trust can have immediate and severe consequences. Reports from 2024 indicate a growing trend of consumer class-action lawsuits related to data mishandling, often resulting in substantial settlements. Therefore, robust data governance frameworks are essential for maintaining customer loyalty and avoiding legal repercussions.

- Data Privacy Compliance: Adherence to GDPR and CCPA mandates strict protocols for handling customer personal information.

- Product Liability: Ensuring the safety and quality of all products sold is a legal requirement to prevent consumer harm.

- Advertising Standards: Truthful and transparent marketing is essential to avoid regulatory action and maintain consumer trust.

- Regulatory Penalties: Non-compliance with consumer protection and privacy laws can lead to significant financial fines and legal liabilities.

Zoning, Licensing, and Permitting Laws

Establishing and operating convenience and fuel retail outlets involves navigating a dense web of local zoning ordinances, business licensing, and building permits. These regulations are critical, specifying permissible locations, operational boundaries, and essential safety measures, impacting everything from site selection to store layout. For instance, in 2024, municipalities across the US continued to refine zoning laws, with some areas implementing stricter rules on the proximity of fuel stations to residential zones, potentially increasing development costs and lead times for new sites.

Successful expansion and remodeling hinge on effectively managing these legal requirements. Failure to comply can lead to significant delays, fines, or even project cancellation. As of early 2025, the average time to secure all necessary permits for a new convenience store with fuel pumps in a major metropolitan area could range from 6 to 18 months, depending on the complexity of the project and local government efficiency.

Key legal factors impacting convenience and fuel retail include:

- Zoning Ordinances: Dictate land use, density, setbacks, and signage, often varying significantly by municipality.

- Business Licensing: Requirements for operating a retail business, selling fuel, and potentially selling alcohol or tobacco products.

- Building and Safety Permits: Cover construction, electrical, plumbing, fire suppression systems, and environmental compliance, with inspections at various stages.

- Environmental Regulations: Pertaining to fuel storage tanks, spill prevention, and waste disposal, often overseen by state and federal agencies.

Alimentation Couche-Tard's operations are significantly shaped by legal frameworks governing product safety and advertising. Ensuring that all items sold meet stringent quality standards and that marketing is truthful is a legal necessity to avoid consumer harm and maintain trust. For example, in 2024, several large retailers faced substantial penalties for engaging in deceptive advertising, highlighting the ongoing regulatory scrutiny in this domain.

The company must also navigate complex data privacy laws, such as the EU's GDPR and California's CCPA, which dictate how customer information is collected, used, and protected. These regulations directly influence marketing strategies and loyalty programs. A 2023 report indicated that data breaches could lead to fines up to 4% of a company's global annual turnover, emphasizing the considerable financial risks associated with non-compliance.

Furthermore, local zoning ordinances, business licensing, and building permits are critical for establishing and operating retail outlets. These laws dictate site selection, operational parameters, and safety features. In 2024, some US municipalities introduced stricter zoning rules regarding the proximity of fuel stations to residential areas, potentially increasing development expenses and timelines for new locations.

| Legal Factor | Description | Impact on Alimentation Couche-Tard | Example/Data Point (2023-2024) |

| Product Liability & Advertising Standards | Ensuring product safety and truthful marketing. | Prevents consumer harm, maintains brand reputation, avoids legal action. | Retailers faced significant penalties for deceptive advertising in 2024. |

| Data Privacy Laws (GDPR, CCPA) | Protocols for customer data collection, usage, and protection. | Influences marketing, loyalty programs, and in-store technology. | Breaches can incur fines up to 4% of global annual turnover. |

| Zoning, Licensing, and Permits | Regulations for site selection, operation, and safety. | Affects expansion, remodeling, and development costs. | Stricter zoning in some US areas impacts fuel station proximity rules. |

Environmental factors

Governments, consumers, and investors are increasingly demanding that companies reduce their carbon emissions, directly impacting fuel retail operations. Alimentation Couche-Tard faces pressure to address its carbon footprint throughout its supply chain, energy usage, and fuel sales.

This necessitates exploring renewable energy alternatives and implementing more efficient operational practices. For instance, by the end of fiscal year 2024, Couche-Tard reported that its Scope 1 and 2 greenhouse gas emissions intensity had decreased by 10.6% compared to its 2020 baseline, demonstrating progress in this area.

Convenience stores face a significant challenge with the vast amount of packaging and consumer waste they produce. In 2024, the convenience store sector in the US alone generated an estimated 5 million tons of plastic waste, with a substantial portion being single-use packaging.

To address this, many are enhancing their waste management and recycling initiatives. For instance, a pilot program launched in late 2024 by a major convenience store chain saw a 30% reduction in landfill waste through improved in-store recycling and partnerships with waste management firms. This focus on reducing single-use plastics and exploring biodegradable alternatives is becoming a key differentiator and a requirement for regulatory compliance.

Furthermore, the proper disposal of hazardous waste, particularly from fuel dispensing operations, remains a critical environmental concern. In 2025, regulatory bodies are increasing scrutiny, with fines for improper hazardous waste management potentially reaching up to $50,000 per day per violation, pushing companies to invest in compliant disposal systems.

Water scarcity is a growing concern impacting businesses like car washes and those requiring regular cleaning. For instance, by 2025, many regions are projected to face severe water stress, increasing operational costs for businesses heavily reliant on water. Implementing water-efficient technologies, such as low-flow fixtures or water recycling systems, can significantly reduce expenses and showcase a commitment to environmental responsibility.

Monitoring water consumption is crucial for compliance and cost management. In 2024, many municipalities are tightening water usage regulations, with potential fines for non-compliance. Proactive tracking of water usage allows businesses to identify areas for improvement and ensure adherence to local water conservation mandates, which can vary significantly by region.

Sustainable Sourcing and Supply Chain Practices

Consumer demand for ethically and sustainably sourced products is increasingly influencing the convenience retail sector. Alimentation Couche-Tard can bolster its environmental standing by prioritizing suppliers committed to sustainable agriculture and responsible manufacturing for both merchandise and food service ingredients.

This focus not only minimizes ecological impact but also significantly boosts brand reputation. For instance, by 2024, over 60% of consumers globally indicated they would pay more for products from sustainable brands, a trend that continues to grow.

- Growing Consumer Preference: A significant majority of consumers now expect brands to demonstrate a commitment to sustainability.

- Supply Chain Transparency: Ensuring visibility into sourcing practices is crucial for validating sustainability claims.

- Reduced Environmental Footprint: Sustainable sourcing directly contributes to lower greenhouse gas emissions and better resource management.

- Enhanced Brand Loyalty: Companies with strong sustainability initiatives often experience increased customer trust and loyalty.

Transition to Electric Vehicles and Alternative Fuels

The global automotive industry is undergoing a significant transformation driven by the transition to electric vehicles (EVs) and alternative fuels. This shift presents a dual challenge and opportunity for companies. While traditional fossil fuel sales may decline, there's a growing imperative to invest in EV charging infrastructure and explore other sustainable energy solutions to maintain relevance.

By 2024, the global EV market is projected to reach substantial figures, with projections indicating over 14 million electric car sales worldwide. This rapid adoption rate underscores the urgency for businesses to adapt their strategies. Companies that proactively embrace this transition, perhaps by diversifying into renewable energy or charging network development, are better positioned for long-term environmental and economic sustainability.

- Market Growth: Global EV sales are expected to exceed 14 million units in 2024, demonstrating a strong market trend.

- Infrastructure Investment: Significant capital is being directed towards building out EV charging networks, creating new business avenues.

- Sustainability Focus: Companies are increasingly pressured to demonstrate environmental responsibility, making sustainable energy solutions a competitive advantage.

- Diversification Opportunities: The transition offers chances to expand into related sectors like battery technology, energy storage, and smart grid solutions.

Environmental regulations are tightening globally, pushing businesses to adopt greener practices. By 2025, the European Union's Carbon Border Adjustment Mechanism (CBAM) will impact imports, requiring companies to account for carbon emissions in their supply chains. This necessitates a proactive approach to reducing environmental impact, from sourcing to operations.

Waste management is a critical area, with a growing emphasis on reducing single-use plastics and improving recycling rates. In 2024, the US Environmental Protection Agency reported that municipal solid waste generation reached 292.4 million tons, with only 32.1% being recycled or composted. This highlights the significant opportunity for companies to innovate in packaging and waste reduction strategies.

The transition to electric vehicles and renewable energy sources is reshaping consumer expectations and operational needs. By 2024, global EV sales were projected to surpass 14 million units, signaling a clear shift away from traditional fossil fuels. Businesses must adapt by investing in sustainable infrastructure and exploring new energy solutions to remain competitive.

Consumer demand for ethically sourced and sustainable products continues to rise, influencing purchasing decisions. In 2024, studies indicated that over 60% of consumers globally were willing to pay more for products from sustainable brands. This trend underscores the importance of supply chain transparency and responsible manufacturing for brand reputation and market share.

| Environmental Factor | 2024/2025 Trend | Impact on Convenience Retail | Actionable Insight |

|---|---|---|---|

| Carbon Emissions | Increasing regulatory pressure, e.g., EU CBAM (2025) | Need to reduce Scope 1, 2, and 3 emissions | Invest in energy efficiency, explore renewable energy sources |

| Waste Management | High levels of plastic waste (US: 5M tons in 2024), focus on reduction | Pressure to minimize single-use packaging | Implement robust recycling programs, explore biodegradable alternatives |

| Energy Transition | Rapid EV adoption (14M+ global sales in 2024), shift from fossil fuels | Potential decline in fuel sales, opportunity for EV charging infrastructure | Diversify into EV charging, explore alternative energy solutions |

| Sustainable Sourcing | Consumer willingness to pay more for sustainable brands (60%+ in 2024) | Demand for ethically and sustainably sourced products | Prioritize suppliers with strong sustainability commitments, enhance supply chain transparency |

PESTLE Analysis Data Sources

Our Alimentation PESTLE Analysis is built on a robust blend of data from international organizations like the FAO and WHO, alongside national agricultural ministries and leading market research firms. We incorporate regulatory updates, economic forecasts, and socio-cultural trend reports to provide a comprehensive view.