Alimentation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alimentation Bundle

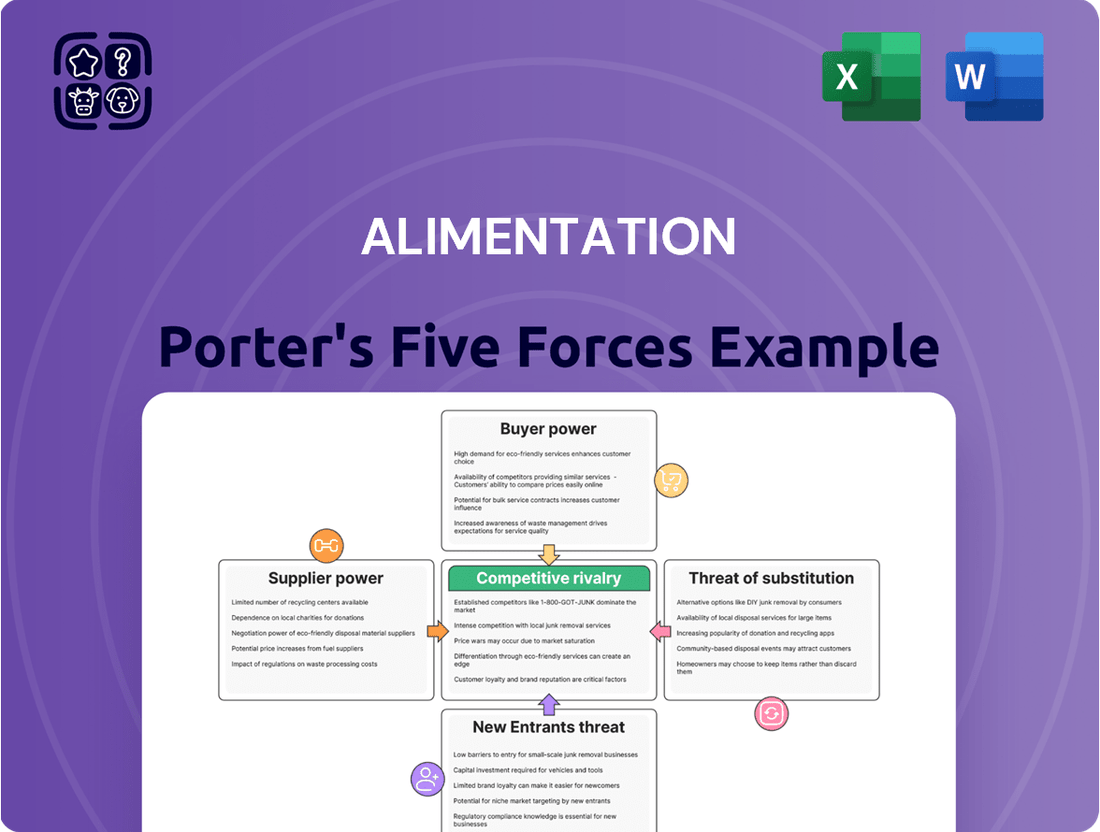

Alimentation's competitive landscape is shaped by the interplay of five key forces, including the bargaining power of its suppliers and buyers, the threat of new entrants, and the intensity of rivalry among existing competitors.

The complete report reveals the real forces shaping Alimentation’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for essential products like fuel can significantly impact Alimentation Couche-Tard's costs. For instance, in 2024, the refining capacity for gasoline in North America, a key market for Couche-Tard, remained relatively concentrated among a few large players, potentially granting them greater pricing power.

While the global fuel market is vast, regional supply can be consolidated. This consolidation gives a few major refiners or distributors more leverage over pricing and terms, directly affecting Couche-Tard's fuel gross margins. In 2023, for example, disruptions at a few key refineries in the US Gulf Coast led to regional price spikes, illustrating this supplier leverage.

Suppliers of well-known, branded products, such as popular beverages and snack items, wield considerable influence. This power stems from strong consumer recognition and established brand loyalty, making these items essential for attracting shoppers.

Alimentation Couche-Tard relies heavily on these recognizable brands to draw customers into its stores. Consequently, the company's leverage in negotiating lower prices or more advantageous contract terms with these suppliers is somewhat constrained, potentially affecting its merchandise gross profit margins.

For specialized equipment like advanced fuel dispensers or car wash systems, the cost and complexity of switching suppliers can be substantial. These high switching costs, often running into tens of thousands of dollars for installation and integration, give specialized equipment providers significant leverage. For instance, a convenience store chain heavily reliant on a specific brand of fuel dispensers might face considerable downtime and retraining expenses if they decide to change providers, limiting their ability to negotiate better terms.

Availability of Alternative Sourcing and Private Labels

Alimentation Couche-Tard's robust strategy of sourcing from a diverse range of suppliers and actively developing its private label brands significantly diminishes the bargaining power of its suppliers. This dual approach allows the company to spread its purchasing across multiple vendors, thereby reducing dependence on any single source. For instance, in fiscal year 2024, Couche-Tard's extensive network of over 15,000 stores across various geographies provided substantial leverage in negotiations with its vast array of suppliers, from fuel providers to convenience store product manufacturers.

The development and promotion of private label brands further bolster Couche-Tard's position. By offering its own branded products, the company creates internal competition for national brands and captures a larger share of the profit margin. This strategy not only enhances its negotiation leverage with external suppliers but also provides greater control over product quality and pricing. In 2024, private label sales continued to be a key growth driver for the company, contributing to improved profitability and a stronger overall market presence.

- Diversified Sourcing: Couche-Tard's ability to source from numerous suppliers across different categories reduces reliance on any single entity, weakening individual supplier leverage.

- Private Label Strength: The expansion of private label offerings, a key focus in 2024, provides an alternative to national brands, enhancing negotiation power and margin control.

- Negotiation Leverage: With over 15,000 stores globally in 2024, Couche-Tard commands significant purchasing volume, enabling more favorable terms with its supplier base.

Labor Market Dynamics

The labor market, particularly for frontline staff in retail, is a critical supplier of human capital. In 2024, many sectors, including convenience retail, experienced tight labor markets. This scarcity of available workers, coupled with increased demand for competitive compensation and benefits, significantly bolsters the bargaining power of employees. For companies like Couche-Tard, this translates directly into higher operational costs as they must offer more attractive packages to attract and retain staff.

This dynamic can be seen in rising wage pressures. For instance, in the convenience store sector, average hourly wages saw an upward trend throughout 2024, driven by the need to compete for talent. This gives employees a stronger voice in negotiating terms, directly impacting the cost structure for businesses that rely heavily on a large, accessible workforce.

- Labor Scarcity: Tight labor markets in 2024 increased demand for retail workers.

- Wage Inflation: Rising average hourly wages in convenience retail reflect increased employee bargaining power.

- Cost Impact: Higher labor costs directly affect operational expenses for companies like Couche-Tard.

- Benefit Demands: Employees are increasingly negotiating for better benefits alongside wages.

The bargaining power of suppliers is a key factor in Alimentation Couche-Tard's operational costs. Suppliers of essential goods like fuel and branded merchandise can exert significant influence due to market concentration or strong brand loyalty. For instance, in 2024, a concentrated North American gasoline refining market meant fewer suppliers held more pricing power. Similarly, popular branded items are crucial for customer traffic, limiting Couche-Tard's negotiation leverage with those suppliers.

High switching costs for specialized equipment, such as fuel dispensers, also empower their providers. This can involve substantial installation and integration expenses, making it costly for retailers to change suppliers. For example, a reliance on a specific dispenser brand can lead to significant downtime and retraining costs if a switch is considered, weakening a company's ability to negotiate better terms.

However, Couche-Tard actively mitigates supplier power through diversified sourcing and private label development. By spreading purchases across many vendors and promoting its own brands, the company reduces dependence on any single supplier. This strategy, evident in its 2024 fiscal year with over 15,000 stores globally, provides substantial leverage in negotiations and enhances margin control.

The labor market also acts as a supplier of human capital, and in 2024, tight labor conditions significantly strengthened employee bargaining power. Increased demand for competitive wages and benefits in sectors like convenience retail directly translated to higher operational costs for companies needing to attract and retain staff. This was observed in rising average hourly wages within the convenience store sector throughout 2024.

| Supplier Type | Source of Power | Impact on Couche-Tard | 2024 Data/Observation |

|---|---|---|---|

| Fuel Refiners/Distributors | Market Concentration, Regional Supply Consolidation | Potential for higher fuel costs, impacting margins | Concentrated North American refining capacity |

| Branded Merchandise Suppliers | Brand Recognition, Consumer Loyalty | Constrained negotiation leverage, impacting merchandise margins | Essential for customer traffic, limiting price flexibility |

| Specialized Equipment Providers | High Switching Costs (Installation, Integration) | Significant leverage in pricing and terms for equipment | Tens of thousands of dollars for installation/integration |

| Labor Force | Tight Labor Markets, Demand for Compensation | Increased operational costs (wages, benefits) | Rising average hourly wages in convenience retail |

What is included in the product

This analysis dissects the competitive forces impacting Alimentation, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, and ultimately, Alimentation's strategic positioning.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customers for fuel are incredibly sensitive to price, frequently opting for the cheapest available option. This dynamic significantly erodes Couche-Tard's ability to dictate prices for its primary offering, as consumers readily switch between fueling stations based on even minor price differences.

The global fuel market in 2024, influenced by persistent economic headwinds and inflationary pressures, has amplified this customer price sensitivity. For instance, average gasoline prices in the US saw fluctuations throughout 2024, with national averages hovering around $3.50-$3.70 per gallon for much of the year, reinforcing the consumer's focus on cost savings.

For Couche-Tard, customer bargaining power is somewhat limited by a strong preference for convenience and location. Consumers often prioritize the ease of access and speed of service over minor price fluctuations when choosing a convenience store. This means they are less likely to switch providers for a slightly lower price if a competitor is less conveniently situated.

In 2024, the convenience store sector continued to see customers valuing proximity. For instance, studies indicated that over 60% of convenience store purchases are impulse buys, heavily influenced by a store's location along a commuter route or near residential areas. This inherent customer behavior strengthens Couche-Tard's position by making location a key differentiator.

Customers are increasingly seeking fresh, quality, and healthier food options, particularly in the foodservice sector. This trend is evident in convenience stores where consumers now expect made-to-order meals and a wider variety of nutritious choices.

In 2024, the global convenience store market continued to see a rise in demand for fresh and healthy food items, with sales of these categories growing by an estimated 8% year-over-year. This growing preference empowers customers, giving them significant leverage to demand better quality and more diverse product selections from retailers like Couche-Tard.

The ability for customers to choose from an expanding array of healthier and fresher alternatives elsewhere means they can easily switch if their expectations aren't met. This puts pressure on companies to continuously innovate and adapt their offerings to retain customer loyalty and market share.

Impact of Loyalty Programs and Digital Engagement

Loyalty programs and mobile apps significantly bolster customer bargaining power by providing personalized promotions and rewards, essentially giving them access to better deals. This digital engagement allows customers to compare offers more readily and feel more valued, thus increasing their leverage.

Alimentation Couche-Tard, for instance, effectively uses data analytics through its Circle K Easy Rewards program and mobile app to craft tailored offers. This strategy not only boosts customer engagement and loyalty but also strengthens the customer's position by making them more aware of and responsive to value-driven incentives.

- Personalized Offers: Digital platforms enable customized discounts and rewards, directly impacting customer purchasing decisions.

- Enhanced Engagement: Mobile apps foster a direct communication channel, increasing customer interaction and loyalty.

- Data-Driven Strategies: Companies like Couche-Tard utilize analytics to understand customer behavior and offer more compelling value propositions.

- Increased Customer Leverage: Empowered customers with access to better deals and personalized information gain stronger bargaining power.

Switching Costs are Low

Customers face very low switching costs when deciding between convenience stores or fuel stations. This ease of shifting their patronage means they hold significant bargaining power.

The ability for consumers to readily select a competitor based on simple factors like price, proximity, or immediate product availability directly translates to their leverage. If one store doesn't meet their needs, another is just a short distance away.

- Low Switching Costs: For convenience stores and fuel stations, the effort and expense for a customer to switch to a competitor are negligible.

- Price Sensitivity: Consumers can easily compare prices across various locations, forcing businesses to remain competitive.

- Product Availability: If a desired item is out of stock, customers can immediately find it at a nearby alternative.

- Convenience Factor: Proximity and ease of access play a huge role; a slightly more convenient location can easily sway customer loyalty.

Customers wield significant bargaining power when they have numerous alternatives and low switching costs. This allows them to easily shift their business to competitors offering better prices or more favorable terms. For instance, in 2024, the retail fuel market continued to demonstrate this, with consumers frequently choosing the station with the lowest price, often within a few blocks, highlighting the minimal effort required to switch.

The rise of digital comparison tools and loyalty programs further amplifies customer leverage. These platforms provide easy access to pricing information and personalized incentives, making customers more informed and less tied to a single provider. In 2024, the widespread adoption of mobile apps for gas price tracking and rewards programs meant consumers could instantly identify the best deals, increasing pressure on retailers to offer competitive pricing.

The demand for differentiated products, such as healthier food options in convenience stores, also empowers customers. When consumers expect specific quality or variety, they can effectively use their purchasing power to influence product offerings. For example, the growing consumer preference for fresh, ready-to-eat meals in convenience stores in 2024 led to an estimated 8% year-over-year increase in sales for these categories, demonstrating how customer demand for better options directly impacts retailer strategies.

| Factor | Impact on Bargaining Power | Example (2024 Context) |

|---|---|---|

| Availability of Alternatives | High | Numerous fuel stations and convenience stores in close proximity. |

| Switching Costs | Low | Minimal effort or financial penalty to change fuel or convenience store providers. |

| Customer Price Sensitivity | High | Consumers actively seeking the lowest gas prices, with averages around $3.50-$3.70/gallon in the US in 2024. |

| Information Availability | High | Mobile apps and online platforms provide easy price comparisons and deal access. |

| Demand for Differentiation | Moderate to High | Increasing consumer expectation for healthier food options in convenience stores, with related sales growing 8% in 2024. |

Preview Before You Purchase

Alimentation Porter's Five Forces Analysis

This preview showcases the complete Alimentation Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you are viewing is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

Alimentation Couche-Tard operates in a convenience and fuel retail sector characterized by significant fragmentation, featuring a vast array of national brands, regional players, and numerous independent outlets. This crowded landscape means Couche-Tard faces constant pressure from a multitude of competitors vying for market share.

The sheer volume of competitors, from large chains like 7-Eleven and Circle K (which Couche-Tard itself owns many locations of) to smaller, localized businesses, intensifies rivalry. This dynamic compels Couche-Tard to consistently innovate its offerings and maintain aggressive pricing strategies to remain competitive and attract customers.

Major competitors like Casey's and Circle K, a Couche-Tard brand, are aggressively expanding through new store builds and acquisitions. This intensifies the competitive landscape for convenience retailers.

Couche-Tard, for instance, has ambitious plans to open approximately 500 new locations, with a strong focus on North America over the next five years. This significant investment signals a direct challenge to existing market players.

Competitors are moving beyond just selling fuel and convenience items. Many are now focusing on expanded foodservice, offering healthier choices, and even installing electric vehicle (EV) charging stations to capture new revenue streams and customer segments.

This trend means Alimentation Couche-Tard, known for its Circle K brand, must constantly adapt its own product and service offerings. For instance, in 2024, many convenience store chains reported significant growth in their prepared food and beverage categories, often exceeding fuel sales growth, highlighting the importance of this diversification.

Technology Adoption and Customer Experience Focus

Competitive rivalry in the convenience store sector is intensifying due to a strong emphasis on technology adoption and customer experience. Companies are integrating AI for operational efficiency, implementing automated checkout systems, and developing personalized loyalty programs to attract and retain shoppers. For instance, Couche-Tard, a major player, recognizes the necessity of significant investment in these areas to remain competitive and streamline operations.

The drive to enhance customer experience through technology is a key battleground. This includes everything from frictionless payment options to curated product recommendations. Companies that fail to keep pace with these technological advancements risk falling behind in customer satisfaction and market share.

- AI-powered operations are becoming standard for optimizing inventory management and supply chains.

- Automated checkout solutions are reducing wait times, a critical factor for convenience store customers.

- Personalized loyalty programs leverage data to offer targeted promotions and rewards, fostering customer retention.

- In 2023, the global retail technology market was valued at over $50 billion, with a significant portion dedicated to in-store technologies aimed at improving customer experience.

Price Competition in Fuel and Merchandise

Despite various efforts to stand out, price remains a crucial battleground, particularly for fuel and everyday convenience items. This intense price pressure can significantly squeeze profit margins, necessitating continuous optimization of Alimentation Couche-Tard's supply chain and operational processes to safeguard profitability.

- Fuel Price Sensitivity: Consumers are highly sensitive to fuel prices, making it a primary driver of store visits and a key area of price competition.

- Merchandise Margin Pressure: Staple merchandise, while driving traffic, often operates on thinner margins, intensifying the need for volume and efficient inventory management.

- Competitive Benchmarking: Companies like 7-Eleven and Circle K are constant benchmarks, forcing Alimentation Couche-Tard to monitor and react to their pricing strategies to remain competitive.

- Impact on Profitability: In 2024, a 1% decrease in average fuel margin could translate to a significant impact on overall earnings, underscoring the importance of strategic pricing and cost control.

Competitive rivalry is fierce in the convenience and fuel retail sector, with numerous players like 7-Eleven, Casey's, and regional chains actively expanding. This intense competition forces companies like Alimentation Couche-Tard to innovate, focusing on enhanced foodservice, healthier options, and EV charging to capture market share. The battleground extends to technology, with AI, automated checkouts, and personalized loyalty programs becoming crucial for customer retention and operational efficiency.

| Competitor Type | Key Strategies | 2024 Focus Areas |

|---|---|---|

| Large Chains | Expansion (new builds/acquisitions), Diversified Offerings | Foodservice Growth, EV Charging Integration |

| Regional Players | Localized Offerings, Community Engagement | Technology Adoption, Customer Experience |

| Independent Stores | Niche Products, Personalized Service | Price Competitiveness, Digital Loyalty |

SSubstitutes Threaten

The growing popularity of public transit and ride-sharing platforms like Uber and Lyft presents a significant threat to fuel demand. In 2024, cities are seeing increased ridership, with some reporting double-digit percentage increases year-over-year in public transport usage, directly impacting the number of cars on the road and, by extension, fuel sales at convenience stores such as those operated by Alimentation Couche-Tard.

The accelerating adoption of electric vehicles (EVs) presents a significant threat of substitution for traditional fuel retailers like Couche-Tard. As more consumers switch to EVs, demand for gasoline and diesel, the company's core products, is expected to decline. For instance, in 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, indicating a growing segment of the automotive market that bypasses conventional fuel altogether.

While Couche-Tard is investing in EV charging infrastructure, the pace of this transition and the associated investment required could strain resources. The rapid shift away from internal combustion engines means that existing fuel-centric business models face obsolescence. This necessitates a strategic pivot, potentially impacting profitability if the transition to alternative revenue streams, like EV charging services, does not offset declining fuel sales quickly enough.

Traditional grocery stores and supermarkets present a significant threat of substitution for convenience stores. They typically offer a broader selection of food, beverages, and household essentials, often at more competitive price points, making them a more attractive option for consumers stocking up on a variety of items. For instance, in 2024, the average grocery basket cost at a major supermarket chain remained considerably lower than accumulating the same items at a convenience store.

Online Retail and Food Delivery Services

The proliferation of online retail and food delivery services presents a significant threat of substitutes for Alimentation Couche-Tard. Consumers increasingly opt for the convenience of purchasing groceries, convenience items, and prepared meals online, bypassing traditional brick-and-mortar stores. This shift directly impacts foot traffic and in-store sales, as demonstrated by the continued growth in e-commerce. For instance, global e-commerce sales were projected to reach approximately $6.3 trillion in 2024, highlighting the substantial consumer migration to online channels.

Food delivery platforms, in particular, offer a direct substitute for Alimentation Couche-Tard's ready-to-eat food offerings. Services like DoorDash, Uber Eats, and Deliveroo provide consumers with a vast array of meal options delivered directly to their homes, often with significant speed and variety. This accessibility can diminish the need for impulse purchases or planned stops at convenience stores for quick meals. The food delivery market itself is substantial, with global revenues estimated to be in the hundreds of billions of dollars annually, underscoring the competitive pressure from these digital alternatives.

- Convenience Factor: Online platforms offer 24/7 accessibility and home delivery, a stark contrast to the limited hours and physical presence required for traditional retail.

- Product Variety: E-commerce sites and delivery apps often provide a wider selection of goods and prepared foods than a single convenience store can stock.

- Price Competition: While not always the case, online retailers and delivery services can sometimes offer competitive pricing or attractive promotions that draw consumers away from physical stores.

- Changing Consumer Habits: The pandemic accelerated the adoption of online shopping and food delivery, creating lasting behavioral shifts that favor these substitutes.

Quick-Service Restaurants (QSRs) for Prepared Food

Quick-service restaurants (QSRs) pose a significant threat to Alimentation Couche-Tard's prepared food segment. As convenience stores like Couche-Tard expand their foodservice capabilities, they find themselves in direct competition with established QSR giants. This is particularly true for grab-and-go meals and coffee, areas where both sectors are heavily invested.

The convenience factor that Couche-Tard leverages is also a core strength of QSRs. For instance, in 2024, the global QSR market was valued at over $300 billion, demonstrating the sheer scale of this competitive landscape. Consumers often have ingrained habits and preferences for brands like McDonald's, Starbucks, and Subway when seeking quick, affordable meals.

- Increased Competition: QSRs offer a wide variety of prepared food options, directly challenging Couche-Tard's growing foodservice initiatives.

- Consumer Habits: Established QSR brands benefit from strong brand loyalty and consumer routines that may favor them over convenience stores for meal purchases.

- Market Size: The substantial size of the QSR market, estimated to be hundreds of billions globally in 2024, highlights the intensity of this competitive threat.

- Product Overlap: The convergence of offerings, especially in prepared meals and coffee, means consumers can easily substitute between convenience store food and QSR options.

The increasing availability of private label brands from major grocery chains offers a compelling substitute for national brands often sold at convenience stores. These store-brand products typically provide a more budget-friendly option, directly impacting the perceived value of higher-priced convenience store offerings. In 2024, private label sales continued to capture market share, with some grocery segments seeing over 20% of sales come from these lower-cost alternatives.

| Substitute Category | Key Characteristics | Impact on Convenience Stores | 2024 Data Point |

|---|---|---|---|

| Private Label Brands | Lower price point, comparable quality | Reduces appeal of national brands, price sensitivity | Private label market share grew by 1.5% in 2023, projected continued growth in 2024 |

| Discount Retailers | Bulk purchasing, lower overhead | Attracts price-conscious consumers for staple goods | Discount retailers saw a 7% increase in customer traffic in early 2024 |

| Specialty Food Stores | Niche products, premium quality | Appeals to consumers seeking specific or higher-end items | The specialty food market is expected to grow by 8% annually through 2025 |

Entrants Threaten

The sheer scale of investment needed to build a competitive presence in the convenience store and fuel station sector presents a formidable barrier. Think about acquiring prime real estate, constructing modern facilities, and outfitting them with necessary equipment like fuel pumps and point-of-sale systems. This initial outlay can easily run into millions, if not tens of millions, of dollars, making it a significant hurdle for aspiring new players.

Established brand recognition and customer loyalty present a significant barrier to new entrants in the convenience store sector. Alimentation Couche-Tard, for instance, operates under well-known banners like Circle K, which have cultivated deep customer loyalty over years of operation. This loyalty is often reinforced through effective loyalty programs, making it difficult for newcomers to attract and retain customers without substantial investment in marketing and brand building. For example, in 2024, Circle K's extensive network and established customer base represent a formidable challenge for any new player attempting to gain market share.

Developing efficient and extensive supply chain and distribution networks for fuel, merchandise, and fresh food is a complex undertaking. It demands significant operational expertise and substantial capital investment, creating a formidable barrier for potential new entrants aiming to compete with established players like Couche-Tard.

Newcomers would find it exceptionally difficult to replicate Couche-Tard's deeply entrenched logistical capabilities, built over years of strategic investment and operational refinement. For instance, in 2024, Couche-Tard operated over 14,000 convenience stores globally, each relying on a sophisticated network for timely product replenishment, a feat that requires immense scale and proven efficiency to match.

Regulatory Hurdles and Licensing Requirements

The convenience and fuel retail sector faces substantial barriers to entry due to a complex web of regulations. These include environmental standards for fuel storage and dispensing, stringent zoning laws that dictate where new outlets can operate, and specific licensing requirements for both fuel sales and food service operations. For instance, in 2024, obtaining a new fuel retail license in many jurisdictions can take upwards of six months and involve multiple agency approvals, significantly increasing the time and cost for potential new competitors.

Navigating this intricate regulatory landscape presents a formidable challenge for new entrants. The need to comply with diverse federal, state, and local rules, coupled with the potential for costly fines or operational shutdowns for non-compliance, acts as a powerful deterrent. This complexity effectively raises the cost of entry and the ongoing operational burden, making it harder for new players to establish a foothold against established businesses already familiar with these requirements.

Key regulatory and licensing hurdles include:

- Environmental Permits: Compliance with regulations like the Clean Air Act and various state-level environmental protection mandates for underground storage tanks and emissions control.

- Zoning and Land Use: Adherence to local zoning ordinances that can restrict the location, size, and operational hours of fuel and convenience stores.

- Alcohol and Tobacco Sales Licenses: Obtaining specific licenses for selling age-restricted products, which often involve background checks and fees.

- Food Service Health Permits: Securing health department approvals for any food preparation or service areas, ensuring compliance with food safety standards.

Economies of Scale in Purchasing and Operations

Economies of scale significantly erect a barrier to entry for new players in the convenience store sector. Established giants like Alimentation Couche-Tard leverage their immense purchasing power to secure highly favorable pricing from suppliers, a significant cost advantage that newcomers cannot easily replicate. For instance, in 2024, major convenience store chains continue to negotiate bulk discounts on everything from fuel and tobacco to snacks and beverages, driving down their per-unit costs considerably.

This disparity in purchasing power means that new entrants would struggle to match the cost structure of incumbents. Operating at a much smaller scale, they would face higher per-unit costs for inventory, making it challenging to offer competitive pricing to consumers. This cost disadvantage can be a critical hurdle, deterring potential entrepreneurs from entering the market when faced with the prospect of being unable to compete on price.

- Purchasing Power Disparity: Established firms secure lower prices from suppliers due to high-volume orders.

- Cost Disadvantage for New Entrants: Smaller scale operations lead to higher per-unit costs for inventory.

- Price Competition Barrier: New entrants find it difficult to match the competitive pricing of larger players.

The threat of new entrants in the convenience store and fuel retail sector is significantly mitigated by substantial capital requirements and the need for extensive, established networks. High initial investments in real estate, infrastructure, and inventory, coupled with the difficulty in replicating existing brand loyalty and supply chain efficiencies, create formidable barriers. Furthermore, complex regulatory landscapes and the advantages of economies of scale enjoyed by incumbents like Alimentation Couche-Tard make market entry exceptionally challenging.

In 2024, the sheer scale of operations for major players like Couche-Tard, with over 14,000 global locations, underscores the difficulty for newcomers to achieve comparable purchasing power and logistical efficiency. This scale allows them to negotiate significantly lower supplier costs, a crucial advantage in a price-sensitive market.

| Barrier Type | Description | 2024 Impact Example |

|---|---|---|

| Capital Requirements | High initial investment for real estate, construction, and inventory. | Millions of dollars needed for a single new store. |

| Brand Loyalty & Networks | Established customer relationships and extensive store presence. | Circle K's strong brand recognition makes it hard for new players to attract customers. |

| Supply Chain & Logistics | Complex, efficient networks for product replenishment. | Replicating Couche-Tard's global distribution is a major hurdle. |

| Regulatory Hurdles | Environmental, zoning, and licensing compliance. | Fuel retail licenses can take over six months to obtain in many regions. |

| Economies of Scale | Lower per-unit costs due to high-volume purchasing. | Major chains secure bulk discounts on fuel, snacks, and beverages. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive understanding of competitive dynamics.