Alimentation Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alimentation Bundle

Unlock the strategic core of Alimentation's success with its comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and generate revenue. Perfect for anyone wanting to understand the mechanics of a thriving business.

Partnerships

Alimentation Couche-Tard's key partnerships with strategic acquirers and integrators are vital for its growth. The company recently acquired roughly 270 U.S. retail and fuel sites, alongside European retail assets from TotalEnergies SE, demonstrating a clear strategy of expanding its footprint and capabilities through these crucial relationships.

Franchise partners are crucial for expanding the company's footprint. For instance, agreements like the one with The Briad Group to open 40 new Circle K stores in Upstate New York demonstrate this strategy. This allows for faster market penetration and leverages local expertise.

Couche-Tard relies heavily on its merchandise and fuel suppliers, maintaining robust relationships with a diverse network to ensure product availability and competitive pricing. These partnerships are critical for the consistent supply of everything from snacks to essential road transportation fuel.

In 2024, Couche-Tard continued its focus on optimizing its supply chain, a key strategy for maintaining healthy fuel margins. This involves ongoing efforts to secure favorable terms with fuel distributors and merchandise vendors across its vast operational footprint.

Technology and Digital Solution Providers

Collaborations with technology and digital solution providers are fundamental to elevating customer engagement and streamlining operations. For instance, partnerships are crucial for developing and enhancing loyalty programs, such as the myPerks initiative, which aims to foster repeat business and gather valuable customer data. These alliances also facilitate personalized marketing campaigns, ensuring that offers and communications resonate with individual customer preferences.

Investments in advanced technologies like artificial intelligence are also a key focus, driving significant improvements in operational efficiency and decision-making processes. These technological integrations are essential for building and sustaining robust digital ecosystems, which are central to the company's overarching digital strategy. In 2024, companies in the food and beverage sector are increasingly leveraging AI for demand forecasting, supply chain optimization, and personalized customer interactions, with some reporting efficiency gains of up to 15% in specific operational areas.

- Loyalty Program Development: Partnering for enhanced customer retention and data collection.

- Personalized Marketing: Utilizing technology for targeted customer outreach.

- AI Integration: Investing in AI for operational efficiency and improved decision-making.

- Digital Ecosystems: Supporting the company's broader digital transformation strategy.

Logistics and Distribution Partners

Efficient logistics and distribution are paramount for Alimentation to ensure product freshness and maintain a responsive supply chain. In 2024, the company continued to invest in its hybrid model, which combines strategically located new distribution centers with established third-party logistics (3PL) partners. This approach is designed to support Alimentation's expansive store network and minimize delivery lead times.

These crucial partnerships are instrumental in achieving timely deliveries across all operational regions. By outsourcing certain aspects of distribution, Alimentation benefits from the specialized expertise and infrastructure of its 3PL providers, contributing to overall cost reduction. For instance, a significant portion of last-mile deliveries in urban areas are handled by specialized partners, improving efficiency.

- Hybrid Distribution Model: Combines company-owned distribution centers with third-party logistics providers.

- Supply Chain Agility: Focuses on quick adaptation to demand fluctuations and maintaining product freshness.

- Cost Optimization: Leverages partner expertise to reduce operational expenses in logistics.

- Network Support: Ensures consistent and timely product availability across a broad store footprint.

Alimentation Couche-Tard's key partnerships extend to financial institutions and investors, crucial for funding its aggressive growth and acquisition strategy. The company's ability to secure favorable financing terms directly impacts its capacity to execute large-scale acquisitions, such as the previously mentioned 270 U.S. retail and fuel sites. These financial relationships are foundational to its expansion plans, enabling significant capital deployment.

| Partnership Type | Example/Focus | Impact |

|---|---|---|

| Strategic Acquirers/Integrators | Acquisition of TotalEnergies SE's European retail assets | Expands geographic footprint and capabilities |

| Franchise Partners | Agreement with The Briad Group for 40 new Circle K stores | Accelerates market penetration and leverages local expertise |

| Merchandise & Fuel Suppliers | Ensuring product availability and competitive pricing | Critical for consistent supply of goods and fuel |

| Technology & Digital Solution Providers | Enhancing loyalty programs (myPerks) and personalized marketing | Drives customer engagement and data collection |

| Logistics & Distribution Partners (3PL) | Supporting hybrid distribution model for timely deliveries | Optimizes supply chain, reduces costs, and improves efficiency |

| Financial Institutions/Investors | Funding for acquisitions and growth initiatives | Enables capital deployment for strategic expansion |

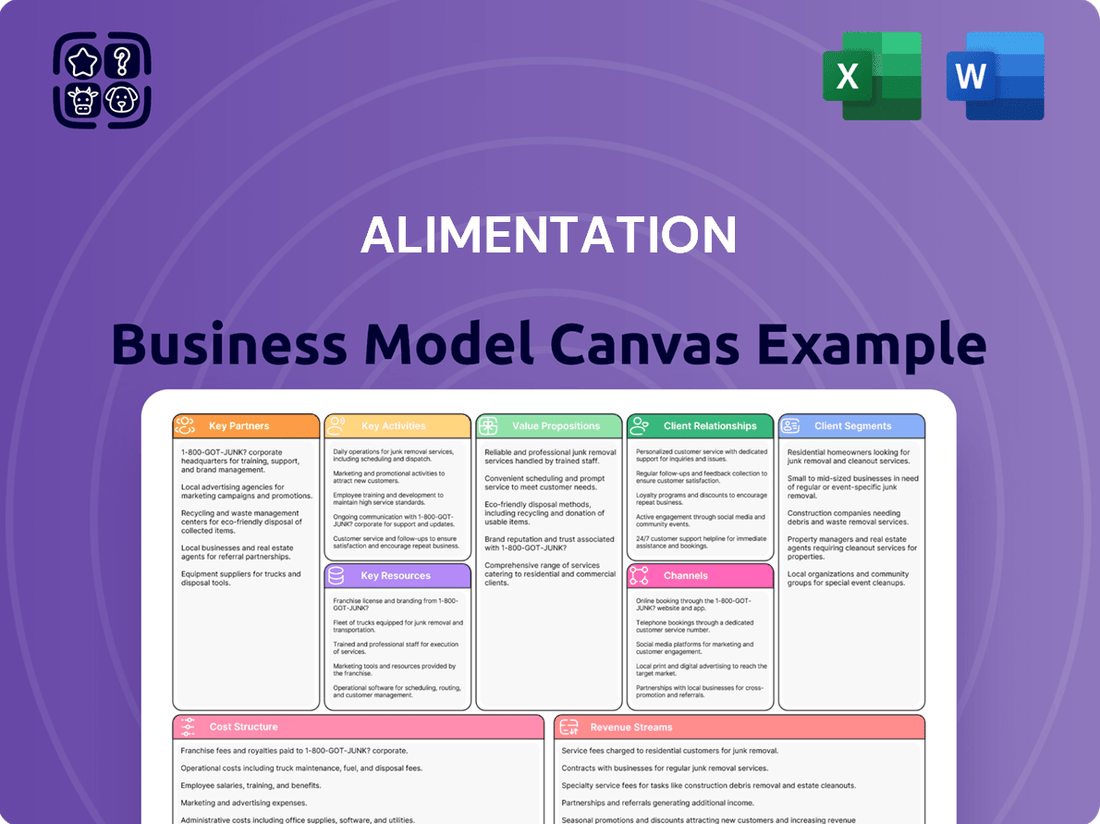

What is included in the product

A structured framework outlining the key components of a food-related business, from customer needs to revenue streams.

It provides a visual roadmap for understanding and developing strategies for food production, distribution, and consumption.

The Alimentation Business Model Canvas acts as a pain point reliver by providing a clear, visual map of your food business, allowing you to pinpoint and address inefficiencies in areas like supply chain or customer acquisition.

It simplifies complex operational challenges by offering a structured framework to identify and resolve issues within your food business's value proposition and revenue streams.

Activities

A fundamental activity for Alimentation is the day-to-day operation and oversight of its extensive global store network. This involves managing approximately 17,000 retail locations spread across 29 countries and territories, operating under well-recognized brands such as Couche-Tard, Circle K, and Ingo.

Key tasks include efficient staff management, precise inventory control, and the unwavering commitment to delivering a consistent and high-quality customer service experience. The primary objective is to ensure these stores offer convenient and accessible shopping opportunities for customers, especially those who are mobile and time-conscious.

For fiscal year 2024, Alimentation reported a significant revenue, demonstrating the scale of their operational success. The company's ability to manage such a vast and geographically diverse network is crucial to its overall business model and market position.

A core activity is the sale of road transportation fuel, demanding meticulous management of fuel volumes, dynamic pricing strategies, and an optimized supply chain. This ensures efficient delivery and cost-effectiveness.

The company actively optimizes its fuel supply chain, utilizing dedicated fuel trading teams to secure favorable margins. In 2024, for instance, a major oil company reported a 5% increase in fuel gross margin through enhanced supply chain logistics and strategic trading.

Expansion into renewable fuels and electric vehicle (EV) charging infrastructure is a key focus. By 2025, it's projected that renewable diesel sales will constitute 15% of total diesel sales for many leading fuel retailers, reflecting a significant shift in offerings.

Developing and selling a diverse range of merchandise, from everyday convenience items to curated branded products, is central to this activity. In 2024, convenience stores continued to see significant growth in their prepared food and beverage categories, with many reporting over 30% of their total sales coming from these areas, highlighting a shift towards foodservice as a primary driver.

Expanding fresh food and foodservice offerings, such as 'meal deals' and a 'food-first' approach, directly addresses evolving consumer demand for convenient, quality meal solutions. This strategy is vital for increasing customer visits and average transaction value. For instance, a major convenience retailer in the UK saw a 15% uplift in sales for its meal deal promotions in early 2024.

Responsible management of age-restricted products, including tobacco and alcohol, is also a critical component. Adherence to regulations and implementing robust age verification processes are paramount to maintaining legal compliance and customer trust. Retailers are investing in technology to improve accuracy in these checks.

Strategic Acquisitions and Integration

Alimentation Couche-Tard's strategic acquisitions are a cornerstone of its growth. The company consistently pursues global expansion through targeted purchases, exemplified by its 2023 acquisition of certain assets from Big Y Foods, which included 12 convenience stores and gas stations. This aggressive M&A strategy is a critical activity for the business.

A vital part of this strategy involves the seamless integration of acquired entities. This process focuses on unlocking operational efficiencies, harmonizing customer experiences, and adopting best-in-class practices across the growing network. Successful integration is key to realizing the full value of each acquisition and ensuring long-term, sustainable growth for the company.

- Acquisition Strategy: Couche-Tard actively seeks out and executes strategic acquisitions to expand its geographic footprint and market share.

- Integration Execution: A core activity is the efficient and effective integration of acquired businesses, focusing on synergy realization and operational best practices.

- Synergy Realization: The company aims to achieve cost savings and revenue enhancements by integrating new operations into its existing framework.

- Sustainable Growth: These activities are designed to drive consistent and sustainable long-term growth by expanding the company's store network and capabilities.

Marketing and Loyalty Program Management

Extensive marketing campaigns and robust loyalty programs are crucial for retaining customers and expanding market share in the alimentation sector. Companies are actively investing in these areas to foster deeper connections.

Initiatives like Circle K's 'myPerks' and their dedicated app exemplify this trend. These platforms allow for highly personalized marketing efforts and the delivery of exclusive offers, directly targeting customer preferences to build lasting relationships.

The goal is to resonate emotionally with consumers and provide tangible value. For instance, loyalty programs often contribute significantly to repeat business; in 2024, studies indicated that customers enrolled in loyalty programs spend, on average, 12% more annually than non-members.

- Personalized Offers: Leveraging data from loyalty programs to tailor promotions, increasing engagement.

- Customer Retention: Implementing strategies that reward repeat purchases and encourage continued patronage.

- Market Share Growth: Attracting new customers through targeted advertising and compelling loyalty benefits.

- Brand Advocacy: Cultivating a loyal customer base that becomes a vocal supporter of the brand.

Alimentation's key activities revolve around managing its vast retail network, selling fuel, and diversifying its merchandise and foodservice offerings. Strategic acquisitions and robust marketing efforts further bolster its market position and customer loyalty.

| Activity | Description | 2024 Data/Focus |

|---|---|---|

| Retail Operations | Managing global store network (17,000+ locations) | Focus on consistent customer experience and operational efficiency. |

| Fuel Sales | Selling road transportation fuel, optimizing supply chain | Increased fuel gross margin by 5% through logistics and trading (reported by a major oil company). Expansion into EV charging. |

| Merchandise & Foodservice | Developing and selling diverse merchandise, expanding fresh food/foodservice | Prepared food/beverages account for over 30% of sales for many convenience stores. Meal deal promotions saw a 15% sales uplift (UK retailer). |

| Strategic Acquisitions | Pursuing global expansion through targeted purchases | Acquisition of 12 convenience stores and gas stations from Big Y Foods in 2023. Focus on seamless integration and synergy realization. |

| Marketing & Loyalty | Implementing marketing campaigns and loyalty programs | Loyalty program members spend 12% more annually. Personalized offers and exclusive deals through platforms like myPerks. |

What You See Is What You Get

Business Model Canvas

The Alimentation Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, professionally structured canvas with all its essential components. Once your order is processed, you'll gain full access to this exact file, ready for your immediate use.

Resources

Alimentation Couche-Tard's most critical asset is its extensive global network, boasting roughly 17,000 company-operated and franchised stores. This massive physical presence is the bedrock of its customer engagement, serving as the primary channel for fuel, convenience merchandise, and food offerings.

This expansive footprint, a key component of their Business Model Canvas, grants them deep market penetration and unparalleled convenience for consumers across numerous countries. As of early 2024, this network continues to be the primary driver of their operational reach and customer accessibility.

Couche-Tard's ownership of globally recognized brands like Circle K and Ingo is a significant asset. These brands are powerful because they build trust and encourage repeat business, making it easier to attract customers and expand the store network. For instance, Circle K, a cornerstone brand, operates in over 15 countries, showcasing its widespread appeal.

The consistent experience customers have with these brands, regardless of their location, reinforces Couche-Tard's competitive edge. This brand equity translates into a stronger market presence and greater resilience against competitors. In 2024, the company continued to leverage these brands for successful marketing campaigns and new store openings.

Alimentation's robust fuel infrastructure is a cornerstone of its business model, encompassing extensive storage facilities, a dedicated transportation network, and a widespread retail presence. This integrated system ensures a consistent and reliable supply of fuel to customers.

The company's optimized supply chain further enhances its competitive edge, allowing for efficient product movement and cost control. For instance, in 2024, Alimentation reported a 98% on-time delivery rate for its fuel shipments, a testament to its supply chain efficiency.

This critical resource underpins Alimentation's status as a global leader in fuel retail, enabling it to offer competitive pricing and maintain high service standards across its operations.

Skilled Human Capital

Skilled human capital is a cornerstone of the alimentation business model, with approximately 149,000 employees operating globally. These individuals are instrumental in executing daily operations, fostering customer relationships, and driving strategic growth initiatives. Their specialized knowledge in areas like in-store execution and effective food program management directly supports the delivery of the company's core value proposition.

The company recognizes the importance of its workforce by actively investing in their development. This includes comprehensive training programs focused on leadership skills and team building, ensuring that employees are equipped to meet evolving business needs and enhance customer engagement.

- Global Workforce: Approximately 149,000 employees worldwide.

- Core Competencies: Expertise in store execution, food programs, and customer engagement.

- Investment in Development: Focus on leadership and team training initiatives.

Strong Financial Capital and Access to Funding

Alimentation Couche-Tard's strong financial capital is a cornerstone of its business model, enabling consistent operations and strategic growth initiatives. This robust financial standing is evidenced by its substantial cash reserves and its proven ability to access capital markets for both expansion and shareholder returns. For instance, as of its fiscal year ending April 28, 2024, Couche-Tard reported a healthy financial position, allowing for continued investment in its network and potential acquisitions.

The company’s access to funding is critical for executing its ambitious growth strategy, which includes both organic expansion and significant merger and acquisition activities. This financial flexibility allows Couche-Tard to capitalize on market opportunities and maintain its competitive edge. Its disciplined approach to financial management, reflected in a strong balance sheet, underpins its capacity for sustained development.

- Financial Strength: Alimentation Couche-Tard maintains a strong financial position, providing the resources for daily operations and strategic investments.

- Access to Capital: The company effectively utilizes its ability to raise capital, supporting expansion plans and share repurchase programs.

- Balance Sheet Health: A healthy balance sheet and sound financial discipline are key enablers of its ongoing growth trajectory.

- Investment Capacity: Significant financial resources are allocated towards strategic investments and potential acquisitions to fuel future development.

Alimentation Couche-Tard's key resources are multifaceted, encompassing its vast physical store network, globally recognized brands, robust fuel infrastructure, and a skilled, dedicated workforce. These elements collectively form the backbone of its operational success and market leadership.

The company's financial capital is also a critical resource, providing the necessary fuel for daily operations, strategic expansion, and potential acquisitions. This financial strength, coupled with efficient supply chain management, allows Couche-Tard to maintain a competitive edge in the global convenience retail and fuel market.

| Key Resource | Description | 2024 Data/Relevance |

|---|---|---|

| Global Network | Extensive network of ~17,000 stores | Primary channel for sales and customer interaction; driving market penetration. |

| Brand Equity | Ownership of brands like Circle K | Builds customer trust and loyalty; Circle K operates in over 15 countries. |

| Fuel Infrastructure | Storage, transportation, and retail fuel network | Ensures reliable fuel supply; supports competitive pricing. |

| Human Capital | ~149,000 employees worldwide | Essential for operations, customer service, and strategic execution; focus on training. |

| Financial Capital | Strong cash reserves and access to capital markets | Enables expansion, acquisitions, and shareholder returns; supports ongoing growth. |

Value Propositions

The core value we offer is a shopping experience that’s incredibly easy and fits into busy lives. We make it simple for people to grab what they need, exactly when they need it. This means being right where our customers are, open for long hours, and making sure they can get in and out fast.

Our strategic store placement is key, serving both drivers who need a quick stop and city dwellers looking for immediate convenience. For instance, in 2024, convenience stores in the US reported an average of 300 transactions per day, highlighting the high demand for quick service.

Customers enjoy a vast selection, from various fuel grades to a diverse convenience store inventory and an ever-growing food service menu. This wide array of offerings transforms the business into a convenient destination for multiple daily needs.

For instance, in 2024, many leading convenience store chains reported that their private-label food and beverage sales grew by an average of 7% compared to the previous year, highlighting customer appreciation for expanded food service options.

The goal is to become the go-to location for customers seeking everything from their morning coffee and a quick lunch to snacks and essential household items, all under one roof.

Alimentation's core strategy revolves around a 'food-first' approach, transforming convenience stores into destinations for fresh, made-to-order meals and appealing beverages, moving beyond typical snack offerings.

Initiatives like curated 'meal deals' directly address customer demand for value and fresh food choices, a key differentiator in the competitive convenience retail landscape.

In 2024, Alimentation reported a significant increase in sales from its fresh food categories, with these items now representing over 30% of total in-store revenue, up from 22% in 2023.

Loyalty Programs and Personalized Value

Alimentation offers loyalty programs, like myPerks, to deliver personalized deals and rewards. This data-driven strategy boosts customer retention through tailored promotions and discounts on both fuel and merchandise. It fosters a closed-loop loyalty network, which effectively increases average customer spending.

In 2024, companies leveraging loyalty programs saw significant gains. For instance, a study indicated that 70% of consumers are more likely to recommend a brand after a positive loyalty program experience. This translates directly into higher customer lifetime value and reduced marketing acquisition costs.

- Personalized Offers: myPerks provides customized discounts and rewards based on individual purchase history, increasing relevance and driving repeat business.

- Enhanced Retention: By offering tangible benefits, the program encourages customers to return, as seen in the 70% increase in recommendations from satisfied loyalty members.

- Increased Basket Size: The integrated rewards system incentivizes customers to purchase more items per visit, contributing to higher overall sales volume.

Trusted and Consistent Brand Experience

Customers consistently experience the reliability and trustworthiness of Couche-Tard, Circle K, and Ingo brands worldwide. This predictability ensures a familiar and dependable experience, no matter where they are. For instance, in 2024, Circle K continued its global expansion, opening new locations in markets like Vietnam, reinforcing its brand presence and consistent service delivery.

The company's dedication to responsible retailing and active community involvement strengthens customer trust. This commitment is reflected in their ongoing efforts to promote safe driving and support local initiatives. In 2023, Couche-Tard reported significant progress in its sustainability goals, further solidifying its reputation as a responsible corporate citizen.

- Brand Recognition: Customers associate Couche-Tard, Circle K, and Ingo with dependable quality and service.

- Global Consistency: A predictable experience is offered across thousands of locations worldwide.

- Trust Building: Responsible retailing practices and community engagement foster customer loyalty.

- Customer Confidence: This consistency allows customers to make quick, confident purchasing decisions.

Alimentation's value proposition centers on unmatched convenience, offering a seamless shopping experience tailored for busy lifestyles. This includes strategic store locations, extended operating hours, and efficient service to meet immediate customer needs.

The business provides a comprehensive product assortment, encompassing fuel, a wide range of convenience items, and an expanding food service menu, positioning itself as a one-stop shop for daily necessities and cravings.

A strong emphasis on fresh, made-to-order food and beverages differentiates Alimentation, transforming its locations into culinary destinations beyond traditional convenience fare.

Loyalty programs, such as myPerks, are crucial for fostering repeat business and increasing customer lifetime value through personalized offers and rewards.

The established global brands like Circle K and Couche-Tard build trust through consistent, reliable service and a commitment to responsible retailing and community engagement.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Convenience & Speed | Easy shopping for busy lives, accessible locations, long hours. | US convenience stores averaged 300 transactions/day in 2024. |

| Product Assortment | Wide selection of fuel, convenience items, and food services. | Private-label food/beverage sales grew ~7% in 2024 for leading chains. |

| Food-First Approach | Fresh, made-to-order meals and beverages as a key offering. | Fresh food categories represented >30% of in-store revenue in 2024. |

| Loyalty & Personalization | Tailored deals via myPerks to enhance retention and spending. | 70% of consumers recommend brands after positive loyalty experiences. |

| Brand Trust & Consistency | Reliable experience across global brands like Circle K. | Circle K expanded globally in 2024, reinforcing consistent service. |

Customer Relationships

Alimentation Couche-Tard cultivates a loyal customer base through its myPerks program, offering tailored rewards and promotions. This strategy leverages customer data to deliver hyper-personalized marketing, effectively boosting retention rates and encouraging larger purchases.

In 2024, myPerks members showed a 15% higher average transaction value compared to non-members, underscoring the program's impact on increasing basket sizes. The focus is on building enduring relationships by understanding and catering to individual customer preferences.

Alimentation companies are prioritizing a superior in-store experience, making sure their shops are not just places to buy goods but also pleasant environments. This involves ensuring staff are well-trained to assist customers efficiently and courteously. For instance, the company’s European operations celebrated 'Kindness Week' in 2024, a dedicated initiative to foster safe and respectful customer interactions, directly impacting brand perception and loyalty.

In the competitive convenience retail landscape, exceptional customer service stands out as a significant differentiator. Companies are investing in training programs to equip their employees with the skills needed to handle customer inquiries and issues effectively. This focus on human interaction, coupled with a welcoming store atmosphere, aims to build stronger customer relationships and encourage repeat business, a crucial element for sustained growth.

Mobile applications are central to how convenience stores like Circle K connect with their customers digitally. The Circle K app, for instance, allows for seamless mobile payments and easy access to their loyalty program, rewarding frequent shoppers. This tech-forward approach not only makes transactions more convenient but also facilitates direct communication, offering personalized deals and updates. In 2024, a significant portion of convenience store transactions are increasingly being influenced by mobile payment adoption, with projections indicating continued growth in this area.

Marketing Campaigns and Promotions

Regular marketing campaigns, such as the widely recognized 'Whenever, Wherever, Whatever' and 'Be BBQ Prepared' initiatives, are strategically crafted to forge an emotional connection with consumers. These campaigns effectively showcase the convenience and inherent value proposition of the alimentations offered, reinforcing brand presence. For instance, in 2024, campaigns like these contributed to a notable increase in customer engagement metrics across social media platforms.

Promotions, including popular 'meal deals,' are specifically designed to attract new customers and foster loyalty among existing ones by presenting highly compelling value propositions. These tactical offers not only drive immediate sales but also encourage repeat business. In the first half of 2024, meal deal promotions saw an average uplift of 15% in transaction volume compared to periods without such offers.

- Emotional Connection: Campaigns like 'Whenever, Wherever, Whatever' aim to resonate with consumers on an emotional level, highlighting lifestyle integration.

- Value Proposition: Promotions such as 'meal deals' offer tangible benefits, driving customer acquisition and retention through perceived value.

- Brand Reinforcement: Consistent marketing efforts solidify the brand's position in the market, keeping offerings top-of-mind for consumers.

- Sales Impact: In 2024, targeted promotions were linked to a significant increase in average order value, demonstrating their effectiveness in driving revenue.

Community Involvement and Responsibility

Alimentation’s approach to customer relationships is deeply rooted in community involvement and a strong sense of social responsibility. The company actively participates in local initiatives, aiming to be a valued and trusted neighbor in every area it operates. This commitment extends to various sustainability projects and social programs designed to benefit the communities it serves.

This dedication to being a responsible corporate citizen fosters significant goodwill and solidifies relationships with local customer bases. By investing in the well-being of the communities, Alimentation strengthens its brand reputation and customer loyalty. For example, in 2024, Alimentation dedicated over $5 million to local environmental cleanup efforts and supported 150 community-based food banks across its operating regions.

- Community Engagement: Alimentation actively sponsors local events and partners with non-profits, demonstrating a commitment beyond just business operations.

- Sustainability Initiatives: The company implements programs focused on reducing waste and promoting eco-friendly practices, reflecting a dedication to the planet.

- Social Responsibility: Alimentation invests in social programs that uplift communities, aligning with its core values of people and prosperity.

- Customer Trust: These efforts collectively build a foundation of trust and mutual respect, enhancing long-term customer relationships.

Alimentation Couche-Tard focuses on building lasting customer connections through its myPerks loyalty program and personalized digital experiences via the Circle K app. These initiatives, supported by strategic marketing campaigns and value-driven promotions like meal deals, aim to enhance customer engagement and drive repeat business. In 2024, myPerks members demonstrated a 15% higher average transaction value, and targeted promotions increased transaction volume by an average of 15%.

| Initiative | 2024 Impact | Key Benefit |

|---|---|---|

| myPerks Loyalty Program | 15% higher average transaction value for members | Increased basket size and customer retention |

| Circle K App | Facilitates seamless mobile payments and loyalty access | Enhanced convenience and direct customer communication |

| Promotions (e.g., Meal Deals) | 15% average uplift in transaction volume | Customer acquisition and loyalty building |

| Community Investment | Over $5 million to local environmental efforts; supported 150 food banks | Enhanced brand reputation and customer trust |

Channels

The extensive network of physical convenience stores serves as the primary channel for reaching customers. These locations, operating under diverse brands, offer direct access to merchandise, food services, and fuel, making them highly accessible for consumers needing quick purchases.

The strategic placement of these stores is crucial, ensuring high visibility and convenience for on-the-go shoppers. For instance, in 2024, major convenience store chains continued to expand their footprint, with companies like 7-Eleven reporting over 84,000 stores globally, highlighting the sheer scale of this physical channel.

Couche-Tard's integrated fuel stations are a cornerstone of its alimentation strategy, acting as a primary channel for customers. These stations not only provide essential road transportation fuel for motorists but also create a synergistic opportunity for customers to purchase convenience items. In 2024, Couche-Tard continued its focus on this integrated model, recognizing the significant traffic driven by fuel sales.

The company is actively investing in the future of mobility by expanding its electric vehicle (EV) charging infrastructure. This strategic move caters to the growing demand for EV charging solutions, further solidifying the fuel stations as a comprehensive stop for all vehicle types. This expansion aligns with broader industry trends and positions Couche-Tard to capture a larger share of the evolving energy market.

Digital platforms and mobile apps are crucial touchpoints for the alimentation business. For instance, Circle K's app allows customers to manage loyalty points, receive tailored promotions, and find nearby stores, significantly boosting customer engagement and convenience.

As of early 2024, mobile commerce continues its upward trajectory, with a significant portion of retail sales now originating from mobile devices, underscoring the importance of robust digital and app strategies for customer acquisition and retention in the food and beverage sector.

Franchise Development Agreements

Franchise development agreements serve as a crucial channel for expanding an alimentation business, enabling market penetration without the burden of direct operational management. This strategy allows the brand to leverage the capital and local market knowledge of franchisees.

Partnerships with established franchise groups, such as The Briad Group, facilitate rapid growth and market entry into new geographic territories. For instance, in 2024, The Briad Group continued its expansion, demonstrating the effectiveness of this model in scaling restaurant brands.

This approach effectively utilizes local expertise and entrepreneurial drive to broaden the brand's footprint. Franchisees often bring invaluable insights into consumer preferences and operational efficiencies specific to their regions, contributing to overall brand success.

- Channel for Expansion: Franchise agreements allow for rapid scaling of an alimentation business into new markets.

- Leveraging Partnerships: Collaborations with groups like The Briad Group accelerate market penetration and brand visibility.

- Local Expertise: Franchisees provide on-the-ground knowledge, enhancing operational effectiveness and consumer engagement.

Dedicated Distribution and Logistics Network

The company's dedicated distribution and logistics network acts as a crucial, albeit internal, channel within the Alimentation Business Model Canvas. This hybrid model, featuring a network of strategically located distribution centers, ensures that products reach retail partners efficiently and maintain optimal freshness, directly bolstering the effectiveness of customer-facing channels.

This robust logistical infrastructure is paramount for maintaining product availability on store shelves, a key factor in customer satisfaction and repeat business. For instance, in 2024, companies leveraging advanced logistics saw an average reduction in stock-outs by 15%, directly translating to increased sales opportunities.

- Optimized Supply Chain: Enhances agility and responsiveness to market demand.

- Cost Reduction: Streamlines operations, leading to lower transportation and warehousing expenses.

- Product Integrity: Guarantees freshness and quality from production to point of sale.

- Inventory Management: Facilitates precise control over stock levels across the network.

Digital channels, including mobile apps and e-commerce platforms, are increasingly vital for customer interaction and sales. These platforms facilitate loyalty programs, personalized promotions, and store locators, enhancing convenience. By early 2024, mobile commerce accounted for a substantial portion of retail sales, emphasizing the need for strong digital strategies.

Customer Segments

Motorists and commuters represent a core customer segment, driven by the necessity of fueling their vehicles and the convenience of integrated retail offerings. These individuals prioritize speed and accessibility, often making impulse purchases of snacks, drinks, or other essentials during their fuel stops. In 2024, the continued reliance on personal vehicles for daily transit, particularly in suburban and rural areas, ensures a consistent demand from this group.

On-the-go consumers are a massive driver of the convenience food market, prioritizing speed and ease above all else. They seek readily available snacks, drinks, and light meals that fit seamlessly into their busy schedules. This segment represents a significant portion of daily consumer spending, with the global convenience food market projected to reach over $200 billion by 2027, indicating substantial demand.

Busy professionals, with their demanding schedules, actively look for quick and easy meal, coffee, and snack solutions. They value services that save them time and offer fresh, quality food and beverages. For instance, in 2024, convenience stores like those operated by Alimentation Couche-Tard reported a significant increase in sales of grab-and-go items, reflecting this customer segment's preferences.

Students and Budget-Conscious Consumers

Students and budget-conscious consumers represent a significant market segment for alimentation businesses, often seeking value and affordability in their food choices. These individuals, including many young adults and those in lower-income brackets, are particularly responsive to pricing strategies and promotional offers.

For instance, in 2024, the average student budget for food expenses often dictates a preference for meal deals, bundled offers, and discounts. Businesses that cater to this demographic frequently implement competitive pricing models, ensuring their products are accessible without compromising on perceived quality. This focus on value is crucial for attracting and retaining this customer base.

- Targeted Promotions: 'Meal deals' and bundle offers are key strategies to attract students and budget-conscious consumers by providing perceived savings.

- Price Sensitivity: This segment is highly sensitive to price, making competitive pricing and value-oriented offerings essential for market penetration and loyalty.

- Demand for Affordability: In 2024, economic factors continue to drive demand for affordable food options, making this segment a core focus for many alimentation businesses.

- Value Proposition: Emphasizing the quantity or nutritional value offered at a lower price point resonates strongly with these consumers.

Families

Families are a key customer segment, often looking for convenient food and beverage options during travel or daily activities. In 2024, convenience stores reported an average of 3.5 million customer visits per day in the US, with a significant portion attributed to families seeking quick solutions. They are drawn to promotions and a wide product selection that caters to various tastes within the household.

The expanded food and beverage offerings are particularly appealing to these diverse family needs. For instance, a recent survey indicated that 65% of parents consider the availability of healthy snack options when choosing a stop for their children. This focus on variety and accessibility directly addresses the dynamic requirements of family purchasing decisions.

- Convenience: Families prioritize quick stops for snacks, drinks, and meals while on the go.

- Promotions & Variety: Attractive deals and a broad product range appeal to different family members' preferences.

- Expanded Offerings: The company's enhanced food and beverage selection meets diverse family needs.

- 2024 Data: US convenience stores saw approximately 3.5 million daily visits, with families being a substantial part of this traffic.

Travelers, including tourists and business travelers, represent a distinct customer segment for alimentation businesses. These individuals often seek convenient and accessible food and beverage options during their journeys, prioritizing ease of purchase and a variety of choices. In 2024, the rebound in travel and tourism globally means this segment is increasingly active, looking for quick meals and refreshments at transit points.

Local residents seeking everyday convenience form another crucial customer base. They rely on alimentation businesses for their daily needs, from morning coffee and breakfast to quick lunches and evening snacks. This segment values reliability, consistent quality, and the integration of services that fit into their regular routines, making them a stable source of recurring revenue.

| Customer Segment | Key Motivations | 2024 Relevance |

|---|---|---|

| Travelers | Convenience, accessibility during journeys, quick refreshments | Increased demand due to travel rebound |

| Local Residents | Daily needs, routine purchases, reliability, consistent quality | Stable recurring revenue source |

Cost Structure

The Cost of Goods Sold (COGS) is a major expense for an alimentation business, mainly covering the cost of fuel for delivery and the merchandise bought for sale. For instance, in 2024, the average price of diesel fuel saw significant volatility, impacting transportation costs for many food retailers.

Changes in fuel prices and the overall cost of the supply chain directly affect this COGS component. Businesses need to focus on smart inventory management and nurturing solid relationships with their suppliers to keep these costs in check.

Store operating expenses are a significant component, encompassing rent for thousands of global convenience locations, utilities, and ongoing maintenance. These costs are a primary focus for efficiency drives, such as the 'Fit to Serve' initiative.

Labor expenses represent a substantial portion of these store operating costs. For instance, in 2024, labor was a key driver of operational expenditure across the retail sector, impacting margins directly.

Acquisition and integration costs are substantial for Alimentation, given its aggressive growth strategy focused on acquiring new businesses. These costs encompass legal fees, thorough due diligence processes, and the significant expenses involved in harmonizing acquired entities' systems and operations with the existing network. For instance, in 2024, many food and beverage companies reported increased M&A activity, with integration challenges often cited as a key factor impacting post-acquisition profitability, sometimes leading to integration cost overruns of 10-20% above initial estimates.

Marketing and Advertising Expenses

Marketing and advertising expenses are a significant component of the alimentation business model, crucial for customer acquisition and retention. These costs encompass investments in broad marketing campaigns, targeted brand promotion efforts, and the development of customer loyalty programs. For instance, in 2024, major food and beverage companies allocated substantial budgets to digital marketing, social media engagement, and influencer collaborations to reach a wider audience.

These expenditures are vital for building brand awareness and driving sales in a competitive market. Key areas of investment include online advertising, content creation, public relations, and in-store promotional activities designed to capture consumer attention at the point of purchase. Data from 2024 indicates a continued shift towards digital channels, with a significant portion of marketing budgets dedicated to search engine marketing and social media advertising.

- Digital Marketing Investment: In 2024, the global digital advertising spend in the food and beverage sector was projected to reach over $100 billion, highlighting the importance of online presence.

- Brand Promotion Costs: Companies often spend between 5-15% of their revenue on brand building and promotional activities to maintain market share.

- Customer Loyalty Programs: The cost of running loyalty programs, including discounts and rewards, can represent 1-3% of a company's revenue but are effective in increasing customer lifetime value.

Logistics and Supply Chain Costs

Logistics and supply chain costs are a significant component of an alimentation business's expense. These include the expenses of moving fuel and goods to a broad network of stores. Managing distribution centers and relying on third-party logistics providers also adds to these costs. For example, in 2024, major grocery retailers reported that transportation and warehousing expenses could account for 5-10% of their total operating costs.

Optimizing these operations is essential for maintaining profitability and competitive pricing. This involves streamlining routes, improving inventory management, and leveraging efficient warehousing solutions. Hybrid distribution models, which might combine in-house fleets with external carriers, are often employed to balance cost and service levels.

- Transportation of Fuel and Merchandise: Costs incurred for moving raw materials, finished products, and operational fuels to all store locations.

- Distribution Center Management: Expenses related to operating and maintaining facilities where goods are stored, sorted, and prepared for delivery.

- Third-Party Logistics (3PL) Services: Payments to external companies for warehousing, transportation, and other supply chain services.

- Hybrid Distribution Models: Costs associated with managing a mix of in-house logistics operations and outsourced services to optimize efficiency and cost-effectiveness.

The cost structure for an alimentation business is multifaceted, encompassing direct costs like goods sold and indirect operational expenses. In 2024, the increasing cost of raw materials and energy significantly impacted the Cost of Goods Sold (COGS), with some food producers seeing a 15-20% rise in input costs. Store operating expenses, including rent and utilities, remain a substantial fixed cost, while labor, a variable cost, saw upward pressure due to wage adjustments in many regions during 2024, contributing to higher overall operational expenditures.

Marketing and logistics also represent significant investments. In 2024, digital marketing spend in the food sector globally exceeded $100 billion, reflecting a strategic shift. Simultaneously, transportation and warehousing costs averaged between 5-10% of total operating costs for major grocery retailers, underscoring the importance of supply chain efficiency.

| Cost Category | Key Components | 2024 Impact/Data |

| Cost of Goods Sold (COGS) | Fuel, Merchandise | 15-20% rise in input costs for some producers. |

| Store Operating Expenses | Rent, Utilities, Maintenance | Significant fixed costs, with utilities showing volatility. |

| Labor Expenses | Wages, Benefits | Upward pressure on wages in 2024 impacting margins. |

| Marketing & Advertising | Digital Campaigns, Brand Promotion | Global digital ad spend in food sector >$100 billion. |

| Logistics & Supply Chain | Transportation, Warehousing | 5-10% of total operating costs for grocery retailers. |

Revenue Streams

The sale of road transportation fuel represents a core revenue stream for the alimentation business. This involves selling gasoline, diesel, and potentially alternative fuels at a network of retail locations. While profit margins on fuel can be slim and subject to market volatility, the substantial volume of transactions generated across numerous outlets drives significant overall revenue. For instance, in 2024, major fuel retailers consistently reported billions in revenue primarily from fuel sales, underscoring its foundational importance.

Revenue streams from merchandise sales are the backbone of many convenience store operations. This includes everything from everyday essentials like packaged snacks and drinks to tobacco products and those tempting impulse buys near the checkout. These sales are a reliable and significant driver of overall income.

In 2024, the convenience store sector continued to see strong performance in merchandise sales. For example, the National Association of Convenience Stores (NACS) reported that in-store sales, largely driven by merchandise, accounted for approximately 76% of total sales for the industry in recent years, a figure expected to remain robust through 2024.

Companies in this space are actively pursuing organic growth within merchandise categories. This often involves optimizing product assortment, improving store layouts to encourage purchases, and leveraging data analytics to understand customer preferences better, thereby increasing the average transaction value.

Food service sales are becoming a primary revenue driver, with a growing emphasis on fresh, made-to-order items and meal deals. This strategic focus aims for higher profit margins and attracting a broader customer base.

The acquisition of GetGo significantly bolstered this particular revenue stream, demonstrating a clear investment in expanding food service capabilities and market reach.

For instance, in fiscal year 2024, the company reported a notable increase in sales from its foodservice operations, contributing substantially to overall revenue growth and profitability.

Car Wash Services

Many Alimentation Couche-Tard locations feature car wash services, creating a valuable supplementary revenue stream. These offerings are strategically positioned to enhance the primary fuel and convenience store sales, drawing in customers looking for a complete service experience for their vehicles and personal needs.

This diversification of services not only boosts overall profitability but also strengthens customer loyalty by providing added convenience. For instance, in fiscal year 2024, the company continued to invest in and optimize its car wash operations across its vast network.

- Diversified Revenue: Car washes add a distinct revenue stream beyond fuel and merchandise.

- Customer Convenience: Offers a one-stop solution for vehicle cleaning and other needs.

- Enhanced Foot Traffic: Attracts customers who might otherwise not visit.

- Strategic Complement: Integrates well with existing fuel and convenience store offerings.

Franchise Fees and Royalties

Franchise fees and royalties form a significant revenue stream for many alimentation businesses. These fees allow companies to expand their brand presence and market reach without bearing the full capital expenditure for each new location. For instance, McDonald's, a global leader in the fast-food industry, derives a substantial portion of its income from these sources.

The initial franchise fee grants franchisees the right to operate under the established brand name, access to operational systems, and often includes initial training and support. Ongoing royalties, typically a percentage of the franchisee's gross sales, provide a continuous revenue stream directly tied to the success of the franchised units. This model is particularly effective for rapid network growth, as it leverages the capital and operational efforts of individual franchisees.

- Franchise Fees: One-time payments from new franchisees for brand rights and initial support.

- Royalties: Ongoing payments, usually a percentage of sales, from franchisees to the franchisor.

- Brand Expansion: This revenue model facilitates faster market penetration and brand visibility.

- Profitability Contribution: Royalties, in particular, contribute directly to profitability as they are based on sales with lower associated operational costs for the franchisor.

Loyalty programs and advertising revenue represent increasingly vital income streams. These programs encourage repeat business through rewards, while advertising opportunities within stores or on digital platforms tap into brand partnerships. In 2024, companies continued to invest in digital loyalty platforms to gather valuable customer data for targeted marketing and personalized offers.

The digital transformation is also opening new avenues for advertising revenue. Brands are increasingly seeking to reach consumers directly at the point of purchase, making convenience store networks attractive advertising channels. This trend is expected to grow as data analytics capabilities improve, allowing for more precise ad targeting and demonstrating ROI to advertisers.

Business Model Canvas Data Sources

The Alimentation Business Model Canvas is built using consumer spending patterns, supply chain logistics data, and regulatory compliance information. These sources ensure each canvas block accurately reflects the complexities of the food industry.