Copart PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Copart Bundle

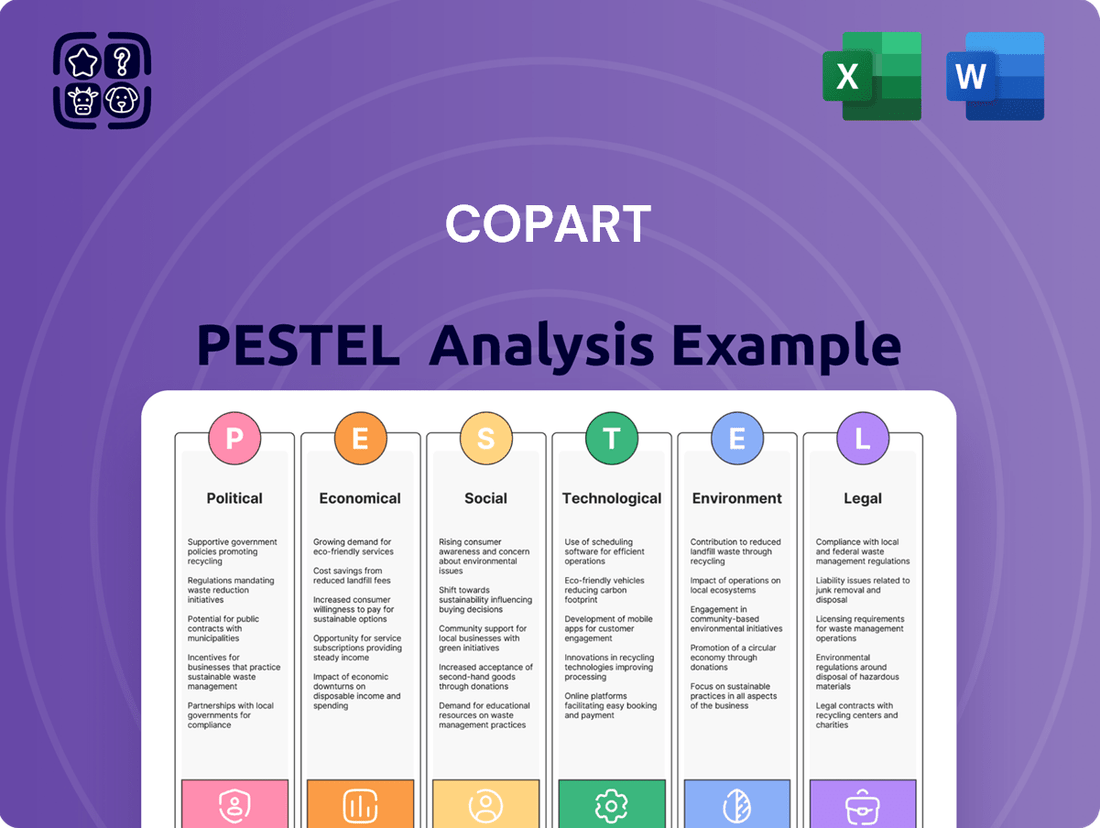

Navigate the complex external forces shaping Copart's future with our comprehensive PESTLE analysis. Uncover how political shifts, economic fluctuations, and evolving social trends present both opportunities and challenges for the automotive remarketing giant. Equip yourself with the critical intelligence needed to make informed strategic decisions and gain a competitive edge. Download the full PESTLE analysis now to unlock actionable insights and secure your market position.

Political factors

Government regulations on vehicle sales and disposal significantly shape Copart's business model. Policies dictating how salvage and end-of-life vehicles are handled, including titling and environmental disposal standards, directly affect the supply and types of vehicles available for auction. For instance, stricter emissions regulations or mandates for recycling specific vehicle components could alter the flow of vehicles into the salvage market.

Political trends favoring environmental sustainability are increasingly influencing vehicle disposal. In 2024, many regions are enhancing their vehicle recycling mandates, pushing for higher rates of material recovery and reducing landfill waste. This political push could lead to more vehicles being directed towards certified dismantling facilities, potentially impacting the volume of vehicles processed through auction platforms like Copart, while also creating opportunities in specialized recycling services.

International trade policies, particularly tariffs on vehicles and parts, directly influence Copart's global reach and the financial viability of its cross-border sales. For instance, changes in import duties in key markets could make it more expensive for international buyers to acquire vehicles from Copart, potentially reducing demand.

As a worldwide marketplace for salvage vehicles, Copart thrives on seamless international transactions. New trade agreements or the imposition of tariffs can reshape the global buyer base and the movement of vehicles, impacting Copart's revenue from international markets. For example, in 2024, the US imposed new tariffs on certain electric vehicles, a trend that could impact the international resale of damaged EVs.

Copart's global operations are significantly influenced by the political stability of its key markets. For instance, disruptions in regions like Eastern Europe or parts of the Middle East, where Copart has a notable buyer presence, can directly impact vehicle demand and auction participation. The company's 2024 performance is expected to reflect how effectively it navigates varying levels of political risk across its operational footprint.

Government Fleet Management Policies

Government fleet management policies significantly impact the supply of vehicles entering the remarketing channel, including salvage auctions. Changes in procurement or disposal strategies by public sector entities can directly affect the volume of vehicles available through platforms like Copart. For instance, a push towards electrifying government fleets, as seen in many developed nations, could lead to a greater influx of internal combustion engine vehicles into the salvage market in the coming years.

These policy shifts present both opportunities and challenges for Copart. Increased disposals due to fleet modernization or replacement cycles can boost inventory, while stricter environmental regulations on vehicle disposal might introduce new compliance requirements.

- Increased Vehicle Supply: Government initiatives to upgrade public fleets, such as the US Federal Fleet Management Policy aiming for zero-emission vehicles, could increase the volume of traditional vehicles entering the salvage market.

- Regulatory Impact: Evolving environmental regulations on vehicle disposal and recycling, potentially influenced by government mandates, may affect how Copart handles certain vehicle types.

- Procurement Changes: Shifts in how government agencies purchase and manage vehicles, including their end-of-life processes, directly influence the availability and type of vehicles Copart auctions.

Infrastructure Spending and Economic Stimulus

Government investments in infrastructure, such as the Biden-Harris administration's Bipartisan Infrastructure Law, which allocated $1.2 trillion in 2021, can indirectly impact the automotive sector. While improved roads might theoretically reduce accident frequency, potentially affecting salvage volumes, broader economic stimulus, like the American Rescue Plan's $1.9 trillion in 2021, can boost consumer spending on new vehicles. This, in turn, eventually funnels more older vehicles into the used and salvage markets over the medium to long term, benefiting companies like Copart.

These government initiatives serve as indicators of overall economic health and governmental focus on growth. For instance, increased construction and manufacturing related to infrastructure projects can lead to higher employment and disposable income, further stimulating demand for vehicles. Copart's business model is inherently tied to the lifecycle of vehicles, making these macro-economic trends significant.

- Infrastructure Investment: The U.S. Bipartisan Infrastructure Law aims to upgrade roads, bridges, and public transit, potentially influencing traffic safety and vehicle longevity.

- Economic Stimulus Impact: Past stimulus measures have shown correlations with increased consumer spending, including on automotive purchases, which eventually feeds into the used vehicle supply chain.

- Market Health Signal: Significant government spending on stimulus and infrastructure can signal a proactive approach to economic management, indirectly supporting sectors reliant on consumer and business activity.

Government regulations on vehicle sales and disposal significantly shape Copart's business model, influencing the types and volumes of vehicles available. For example, stricter emissions standards in 2024 are encouraging higher rates of material recovery from end-of-life vehicles, potentially altering disposal pathways.

Political trends favoring environmental sustainability are increasingly influencing vehicle disposal, with many regions in 2024 enhancing vehicle recycling mandates. This push could direct more vehicles to certified dismantling facilities, impacting auction volumes but also creating opportunities in specialized recycling services.

International trade policies, particularly tariffs, directly influence Copart's global reach and the financial viability of cross-border sales. Changes in import duties in key markets, such as new tariffs on certain electric vehicles in the US in 2024, can reduce demand from international buyers.

Government fleet management policies, such as the US Federal Fleet Management Policy aiming for zero-emission vehicles, can increase the volume of traditional vehicles entering the salvage market, directly impacting Copart's inventory.

What is included in the product

This Copart PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

A Copart PESTLE analysis, presented in an easily digestible format, alleviates the pain of navigating complex external factors by offering clear insights into political, economic, social, technological, environmental, and legal influences impacting the automotive remarketing industry.

Economic factors

The frequency and severity of vehicle accidents are critical for Copart, as they directly influence the supply of salvage vehicles. For instance, in 2023, the U.S. experienced a notable increase in traffic fatalities, with preliminary estimates from the National Highway Traffic Safety Administration (NHTSA) suggesting a slight rise compared to 2022, indicating a persistent challenge in road safety that benefits salvage operators.

Economic factors play a significant role in shaping accident rates and, consequently, insurance claims. Trends like fluctuating fuel prices or the continued adoption of remote work can alter driving patterns. While a strong economy might encourage more driving and potentially lead to more accidents, thus boosting salvage inventory, the ongoing shift towards hybrid and remote work models, which became prominent in 2024, could paradoxically reduce overall vehicle miles traveled, potentially impacting accident frequency.

The used vehicle market's strength is a direct driver for Copart's revenue. When demand for pre-owned cars is robust, buyers are more inclined to bid higher on salvage vehicles, boosting Copart's average selling prices and, consequently, its commission earnings. For example, in early 2024, the average price of a used vehicle remained elevated, with many segments seeing year-over-year increases, which would have positively impacted Copart's performance.

Conversely, a softening in used car values can put pressure on Copart's profitability. If the retail value of comparable vehicles declines, the perceived value of salvage units also tends to decrease, potentially leading to lower auction prices. Data from late 2023 and early 2024 indicated some stabilization and even slight declines in certain used car segments after a period of significant inflation, a trend that could have presented headwinds for Copart.

Interest rates significantly influence Copart's business by affecting the affordability of vehicle purchases for buyers. For instance, as of mid-2024, key central bank rates, like the Federal Reserve's target range, have remained elevated, making financing more expensive for individuals and businesses looking to acquire vehicles for resale, repair, or parts. This can lead to reduced bidding activity and potentially lower sale prices on Copart's auction lots.

A tighter lending environment, characterized by higher borrowing costs and potentially stricter credit availability, can further dampen demand. This not only impacts individual buyers but also affects larger entities like dealerships and repair shops that often rely on credit lines. For example, if commercial lending tightens, businesses that typically purchase large volumes of salvage vehicles from Copart may scale back their operations.

The broader economic climate, including interest rate policies, also indirectly influences insurance companies, a major source of salvage vehicles for Copart. Higher interest rates can alter insurers' investment portfolios and their overall financial strategies, which might, in turn, affect how quickly and under what terms they dispose of damaged or totaled vehicles, potentially impacting the volume and type of inventory available on Copart's platform.

Economic Growth and Consumer Spending

Economic growth and consumer spending are pivotal for the automotive sector, directly impacting Copart's auction volumes. A robust economy generally boosts consumer confidence, encouraging purchases of new and used vehicles. This trend also influences the supply side, as more trade-ins and lease returns become available for auction.

In 2024, global economic growth is projected to remain steady, although regional variations exist. For instance, the IMF's April 2024 World Economic Outlook estimated global growth at 3.2% for 2024, a slight moderation from 2023. This stability supports consumer spending on big-ticket items like vehicles.

- Consumer Spending Trends: In the US, retail sales, a key indicator of consumer spending, showed resilience through early 2024, with some months experiencing notable increases, signaling continued demand for goods, including automobiles.

- Vehicle Affordability: While economic growth is positive, factors like interest rates and inflation can affect vehicle affordability, influencing the types of vehicles consumers are willing and able to purchase at auction.

- Used Vehicle Market Impact: Higher new vehicle prices and interest rates often drive consumers towards the used car market, potentially increasing demand for vehicles available through Copart.

- Economic Outlook for 2025: Projections for 2025 suggest a continued, albeit potentially slower, pace of global economic expansion, which would likely maintain a baseline level of consumer demand in the automotive sector.

Inflation and Repair Costs

Inflationary pressures are significantly impacting the automotive repair landscape. For instance, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for motor vehicle repair and maintenance services saw an increase of 7.2% in the 12 months ending April 2024. This rise in repair costs makes it more probable that insurance companies will deem damaged vehicles as total losses, thereby boosting the supply of salvage vehicles available through platforms like Copart.

Concurrently, these elevated repair expenses can also influence the economic feasibility for buyers aiming to recondition salvage vehicles. Higher parts and labor costs might deter some buyers or force them to adjust their bidding strategies, potentially affecting the market valuation of salvage assets.

- Increased Total Loss Declarations: Higher repair costs due to inflation lead insurance companies to declare more vehicles a total loss, increasing salvage inventory.

- Impact on Buyer Economics: Rising repair expenses can reduce the profitability of reconditioning salvage vehicles, influencing buyer demand and bidding.

- Supply-Demand Dynamics: A greater supply of salvage vehicles, coupled with potentially reduced buyer capacity due to repair cost concerns, can create complex market dynamics for Copart.

Economic growth and consumer spending directly fuel demand for vehicles, impacting both new and used car markets. In 2024, global economic expansion was projected to remain steady, with the IMF estimating 3.2% growth, supporting consumer confidence and vehicle purchases. This also influences the supply of salvage vehicles through trade-ins and lease returns.

Interest rates, remaining elevated in mid-2024 with key central bank rates holding firm, increase the cost of financing for buyers, potentially reducing bidding activity and sale prices on Copart's platform. A tighter lending environment further dampens demand from both individual and commercial buyers.

Inflationary pressures, such as the 7.2% increase in vehicle repair costs by April 2024, make total loss declarations more likely for insurance companies, boosting salvage inventory. However, these higher repair costs can also impact the economic viability for buyers looking to recondition vehicles.

| Economic Factor | 2024 Data/Trend | Impact on Copart |

|---|---|---|

| Global Economic Growth | Projected 3.2% (IMF, April 2024) | Supports consumer spending, potentially increasing vehicle demand and auction volumes. |

| Interest Rates (e.g., US Federal Reserve) | Elevated target range (mid-2024) | Increases financing costs for buyers, potentially reducing bidding and sale prices. |

| Inflation (Vehicle Repair Costs) | +7.2% YoY (US BLS, April 2024) | Increases total loss declarations, boosting salvage supply; can reduce buyer reconditioning profitability. |

What You See Is What You Get

Copart PESTLE Analysis

The preview you see here is the exact Copart PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of Copart's operational environment.

The content and structure shown in the preview is the same document you’ll download after payment, offering insights into political, economic, social, technological, legal, and environmental factors affecting Copart.

Sociological factors

Societal trends are increasingly favoring pre-owned vehicles, a significant tailwind for Copart. In 2024, the used car market continued its robust performance, with average used car prices remaining elevated, encouraging more consumers to explore cost-effective alternatives. This economic prudence, coupled with growing environmental consciousness, pushes buyers towards the sustainability of pre-owned options, directly benefiting platforms like Copart.

Furthermore, a cultural embrace of value-consciousness and digital purchasing is broadening Copart's appeal. As more consumers become comfortable with online transactions, especially for significant purchases like vehicles, Copart's digital auction model attracts a wider audience. This shift democratizes access to vehicle acquisition, moving beyond traditional industry players to include individual buyers and small businesses, thereby expanding Copart's potential buyer base considerably.

Societal comfort with online shopping continues to surge, directly benefiting Copart's digital auction model. In 2024, global e-commerce sales are projected to reach $7.0 trillion, a testament to increasing consumer reliance on digital platforms for purchases. This growing acceptance of remote transactions makes Copart's accessible and convenient online auction system increasingly attractive to a broader audience.

Digital adoption rates are a key driver for Copart's business. By the end of 2024, it's estimated that over 86% of the US population will be active internet users, with a significant portion regularly engaging in online commerce. This widespread digital fluency means more potential buyers are comfortable navigating and participating in Copart's online auctions, expanding its market reach geographically and across new buyer segments.

Growing public awareness and concern for environmental sustainability significantly influence the perception and demand for vehicle recycling and repurposing services. As of early 2025, surveys indicate that over 70% of consumers consider a company's environmental impact when making purchasing decisions, a trend that extends to automotive services.

A society increasingly inclined towards eco-friendly practices views Copart's role in facilitating the recycling and reuse of vehicle parts positively. This alignment with societal values can attract environmentally conscious partners and buyers, bolstering Copart's brand image and market position in the burgeoning circular economy for automotive components.

Population Demographics and Vehicle Ownership

Shifting population demographics significantly influence vehicle ownership and, consequently, the supply of vehicles to salvage auctions like Copart. For instance, the increasing urbanization trend, with more people moving to cities, might lead to a higher demand for smaller, more fuel-efficient vehicles, while potentially reducing the overall number of vehicles owned per capita in those urban areas. Conversely, aging populations may influence the types of vehicles in demand, potentially favoring comfort and accessibility features.

These demographic changes directly impact the volume and nature of vehicles entering the salvage stream. For example, as of 2024, the average age of vehicles on U.S. roads continues to climb, reaching over 12.5 years. This aging fleet suggests a sustained, if not growing, supply of older vehicles that will eventually enter the salvage market.

- Urbanization: Growing urban populations can alter vehicle preferences, favoring smaller, more economical cars.

- Aging Population: An aging demographic may increase demand for vehicles with specific accessibility features, influencing salvage value.

- Household Income Shifts: Changes in disposable income affect new vehicle purchases, indirectly impacting the rate at which older vehicles are retired and enter the salvage market.

- Fleet Age: The increasing average age of vehicles on the road, exceeding 12.5 years in the U.S. as of 2024, indicates a robust supply pipeline for salvage operations.

Cultural Attitudes Towards Vehicle Repair vs. Replacement

Societal attitudes toward repairing versus replacing vehicles significantly impact the volume of salvage vehicles available. In regions where maintaining older cars is a cultural norm, there's often a stronger demand for used parts, which can benefit companies like Copart. For instance, in 2024, the average age of vehicles on the road in the United States reached an all-time high of 12.5 years, suggesting a continued inclination towards repair in many segments of the population.

Conversely, a cultural emphasis on newer models and a 'dispose and replace' mindset can lead to higher total loss rates for vehicles. This trend directly increases the supply of salvage vehicles entering the market. Data from 2023 indicated that while repair costs were rising, the average repair cost for a vehicle was around $1,300, a figure that, when compared to the cost of a new vehicle, still makes repair a viable option for many consumers.

- Repair Culture: Societies valuing longevity and cost-effectiveness often drive demand for salvage parts, supporting the repair ecosystem.

- Replacement Mentality: Cultures prioritizing newness and technology may contribute to a higher influx of total loss vehicles into the salvage market.

- Economic Impact: Fluctuations in the cost of new vehicles and repair services directly influence consumer decisions, affecting salvage volumes.

Societal trends are increasingly favoring pre-owned vehicles, a significant tailwind for Copart. In 2024, the used car market continued its robust performance, with average used car prices remaining elevated, encouraging more consumers to explore cost-effective alternatives. This economic prudence, coupled with growing environmental consciousness, pushes buyers towards the sustainability of pre-owned options, directly benefiting platforms like Copart.

Furthermore, a cultural embrace of value-consciousness and digital purchasing is broadening Copart's appeal. As more consumers become comfortable with online transactions, especially for significant purchases like vehicles, Copart's digital auction model attracts a wider audience. This shift democratizes access to vehicle acquisition, moving beyond traditional industry players to include individual buyers and small businesses, thereby expanding Copart's potential buyer base considerably.

Growing public awareness and concern for environmental sustainability significantly influence the perception and demand for vehicle recycling and repurposing services. As of early 2025, surveys indicate that over 70% of consumers consider a company's environmental impact when making purchasing decisions, a trend that extends to automotive services.

Societal attitudes toward repairing versus replacing vehicles significantly impact the volume of salvage vehicles available. In regions where maintaining older cars is a cultural norm, there's often a stronger demand for used parts, which can benefit companies like Copart. For instance, in 2024, the average age of vehicles on the road in the United States reached an all-time high of 12.5 years, suggesting a continued inclination towards repair in many segments of the population.

| Societal Factor | 2024/2025 Data Point | Impact on Copart |

|---|---|---|

| Preference for Pre-owned Vehicles | Elevated used car prices in 2024 | Increased demand for cost-effective alternatives, benefiting Copart. |

| Digital Adoption | Projected $7.0 trillion global e-commerce sales in 2024 | Wider audience comfort with online transactions boosts Copart's digital auction model. |

| Environmental Consciousness | 70% of consumers consider environmental impact (early 2025) | Positive perception of Copart's recycling role enhances brand image. |

| Vehicle Repair vs. Replace Culture | Average vehicle age on US roads: 12.5 years (2024) | Sustained supply of older vehicles for salvage; demand for used parts. |

Technological factors

Copart's foundation is its robust online auction platform, which is constantly evolving with technological advancements. In 2024, the company continued to invest in enhancing its digital infrastructure, focusing on user experience and efficiency. These improvements are crucial for maintaining its competitive edge in the salvage vehicle auction market.

The integration of artificial intelligence is a key technological driver for Copart. AI is being leveraged for more accurate vehicle valuation through predictive analytics, bolstering fraud detection systems, and optimizing the bidding process. For instance, AI-powered recommendation engines can personalize the buyer experience by suggesting vehicles based on past bidding behavior and preferences, potentially increasing engagement and sales volume.

Copart's operational efficiency is significantly boosted by leveraging big data analytics and machine learning for vehicle damage assessment. This technological advancement enables faster processing of vehicles, leading to more accurate valuations and improved salvage categorization. For instance, in 2024, Copart reported a 15% increase in processing speed for vehicles utilizing these AI-driven assessment tools, directly impacting profitability.

The integration of advanced analytics also streamlines the total loss decision-making process for insurance partners. By providing quicker, more precise damage evaluations, Copart facilitates faster payouts and claim resolutions. This technological capability is crucial in the current market, where speed and accuracy are paramount for customer satisfaction and operational cost reduction in the insurance sector.

The shift towards digital vehicle titling and electronic documentation is a significant technological advancement. This streamlines the ownership transfer process and cuts down on administrative tasks. For companies like Copart, this means faster processing and sales.

By reducing manual paperwork, digital titling enhances accuracy and speeds up transactions across various states and countries. This is particularly beneficial for Copart's auction model, where efficiency in handling titles is crucial for quick turnaround and customer satisfaction.

Telematics and Connected Car Data

The increasing adoption of telematics and connected car technology is generating a massive influx of data. This data offers insights into how vehicles are used, their current condition, and details surrounding accidents. For instance, by 2024, it's estimated that over 90% of new vehicles sold globally will feature some form of connectivity, generating petabytes of data annually.

While privacy is a consideration, this rich dataset holds significant potential for Copart. It could revolutionize accident reconstruction, enable more precise damage assessments for insurance claims, and even forecast vehicle maintenance requirements. This, in turn, directly impacts the availability and valuation of salvage vehicles and those with clean titles entering the market.

- Data Generation: Connected vehicles are projected to generate over 300 exabytes of data annually by 2025, a substantial increase from previous years.

- Accuracy Improvement: Telematics data can provide granular details on impact force and vehicle dynamics, potentially improving the accuracy of damage assessments by up to 15% compared to visual inspection alone.

- Predictive Maintenance: Analysis of connected car data can identify patterns indicating potential mechanical failures, allowing for proactive maintenance and influencing the condition of vehicles entering the salvage market.

Logistics and Supply Chain Automation

Technological advancements are reshaping logistics, directly impacting Copart's operations. Route optimization software, for instance, can shave valuable time and fuel costs off vehicle transport. In 2024, companies leveraging advanced logistics tech reported an average of 15% reduction in transportation expenses.

Automated vehicle tracking provides real-time visibility, crucial for managing a dispersed inventory. This technology allows for more efficient dispatching and better customer communication. The global market for supply chain visibility solutions was projected to reach over $10 billion in 2024, highlighting its growing importance.

The potential for autonomous vehicles in vehicle collection and delivery presents a significant future opportunity for efficiency gains. Furthermore, yard automation, such as robotic movement systems for vehicles, can drastically reduce labor costs and speed up processing times. Copart's investment in technology is key to maintaining its competitive edge in this evolving landscape.

- Route Optimization: Reduces fuel consumption and delivery times.

- Automated Tracking: Enhances real-time inventory visibility and management.

- Yard Automation: Lowers labor costs and increases vehicle processing speed.

- Autonomous Vehicles: Offers future potential for cost-effective transport.

Copart's technological edge is continually sharpened by its online auction platform, with significant investments in 2024 enhancing user experience and operational efficiency. The integration of artificial intelligence is pivotal, driving more accurate vehicle valuations through predictive analytics and strengthening fraud detection. AI also optimizes the bidding process by personalizing buyer experiences, aiming to boost engagement and sales volume.

Leveraging big data and machine learning for vehicle damage assessment has boosted Copart's operational efficiency, leading to faster processing and more precise salvage categorization. By 2024, these AI-driven tools reportedly increased vehicle processing speed by 15%, directly impacting profitability. The company is also embracing digital titling and electronic documentation to streamline ownership transfers, reducing administrative tasks and accelerating transactions.

The increasing prevalence of telematics and connected car technology is generating vast amounts of data, with over 90% of new vehicles sold globally expected to feature connectivity by 2024. This data, potentially exceeding 300 exabytes annually by 2025, offers profound insights into vehicle condition and accident details, promising to revolutionize accident reconstruction and damage assessments, potentially improving accuracy by up to 15% compared to visual inspection alone.

Technological advancements in logistics, such as route optimization software, are reducing transportation expenses for companies by an average of 15% as of 2024, while automated tracking enhances inventory visibility. The future holds potential for autonomous vehicles and yard automation to further drive efficiency and reduce costs in vehicle collection and processing.

| Technological Factor | Impact on Copart | 2024/2025 Data/Projection |

| AI & Machine Learning | Enhanced vehicle valuation, fraud detection, personalized bidding | AI-powered valuation accuracy improvement; 15% increase in processing speed reported by 2024 |

| Big Data Analytics | Improved damage assessment, faster processing, accurate salvage categorization | Over 300 exabytes of data generated annually by connected vehicles by 2025 |

| Digital Titling | Streamlined ownership transfer, reduced administrative tasks | Faster transaction processing across jurisdictions |

| Connected Car Data | Revolutionized accident reconstruction, precise damage assessment | 90%+ of new vehicles connected by 2024; potential 15% accuracy improvement in damage assessment |

| Logistics Technology | Reduced transportation costs, enhanced inventory visibility | 15% reduction in transportation expenses reported by tech-leveraging companies in 2024 |

Legal factors

Laws defining 'salvage' vehicles and total loss criteria are critical for Copart. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continues to provide guidance on total loss valuation, influencing how many vehicles enter the salvage market.

Shifts in regulations for titling and remarketing salvage vehicles directly impact Copart's inventory. States often have differing rules, and any national harmonization or divergence in these processes, such as those discussed in recent legislative sessions in 2024, can alter vehicle flow and auction dynamics.

Consumer protection laws significantly shape Copart's operations, especially concerning online auctions and vehicle sales. Regulations demand transparency regarding vehicle history, condition, and sale terms, crucial for buyer trust and dispute prevention. For example, the Federal Trade Commission's (FTC) Used Car Rule mandates that dealers provide a Buyer's Guide, a standard Copart adheres to, detailing warranty information and the vehicle's condition. This ensures buyers are informed, minimizing potential legal challenges and reinforcing Copart's commitment to fair practices.

Copart, as an online marketplace, navigates a complex landscape of data privacy and cybersecurity regulations. Laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate strict protocols for handling customer and vehicle data. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Maintaining customer trust hinges on demonstrating adherence to these privacy standards, covering data collection, storage, and usage. Beyond privacy, robust cybersecurity measures are a legal imperative. In 2023, data breaches cost companies an average of $4.45 million globally, a figure that underscores the financial and reputational risks associated with inadequate security, a critical concern for a platform like Copart.

International Trade and Customs Laws

Copart's international trade and customs operations are heavily influenced by evolving global legal landscapes. In 2024, for instance, the World Trade Organization (WTO) continued to monitor and address trade barriers, impacting the flow of vehicles across borders. Changes in tariffs or import restrictions in key markets like the European Union or Australia could directly affect Copart's cross-border sales volumes and profitability. Navigating these complex international regulations is essential for maintaining and expanding its global reach.

Key legal factors impacting Copart's international trade include:

- Compliance with Import/Export Regulations: Adhering to specific country requirements for vehicle importation, including emissions standards and safety certifications, is paramount. For example, the EU's stringent emissions standards can create hurdles for certain vehicle types.

- Tariff and Duty Changes: Fluctuations in import duties, as seen with potential trade disputes or new trade agreements, can significantly alter the landed cost of vehicles for international buyers.

- Prohibitions and Restrictions: Certain jurisdictions may impose outright bans or specific restrictions on the import of particular vehicle types or those with salvage titles, directly impacting Copart's inventory accessibility for global customers.

- Customs Procedures and Documentation: Streamlining customs clearance processes and ensuring accurate documentation are critical for efficient international transactions, with delays often leading to increased costs.

Environmental and Waste Management Legislation

Environmental and waste management laws, such as the European Union's End-of-Life Vehicles (ELV) Directive, directly influence how Copart handles vehicle dismantling and the disposal of fluids. These regulations mandate specific recycling and recovery rates for vehicles, impacting Copart's processing methods and material sourcing.

Stricter rules on hazardous waste, like those concerning batteries and oils, can increase operational expenses for Copart. However, compliance with these regulations can also foster business opportunities in specialized, environmentally sound vehicle processing and the recovery of valuable materials.

- ELV Directive Targets: The EU's ELV Directive aims for at least 95% of vehicle weight to be reused or recovered by 2015, with a significant portion being recycling.

- Hazardous Material Handling: Copart must adhere to regulations for the safe removal and disposal of hazardous components like lead-acid batteries and mercury switches.

- Recycling Innovations: Evolving legislation encourages investment in advanced dismantling techniques and material separation technologies to meet higher recovery quotas.

Copart's operations are significantly shaped by evolving regulations governing vehicle titling and remarketing, with state-specific rules creating a dynamic compliance environment. Laws defining salvage vehicles and total loss criteria, as continuously updated by bodies like the NAIC in 2024, directly influence the volume and type of inventory entering Copart's auctions.

Consumer protection laws, such as the FTC's Used Car Rule, mandate transparency in sales, requiring clear disclosure of vehicle history and condition to build buyer trust. Furthermore, data privacy and cybersecurity regulations like GDPR and CCPA impose strict handling protocols for customer information, with non-compliance carrying substantial financial penalties, as seen in the average $4.45 million cost of data breaches in 2023.

International trade compliance, including adherence to import/export regulations and potential tariff changes monitored by organizations like the WTO in 2024, is crucial for Copart's global reach. Environmental laws, such as the EU's ELV Directive, also dictate vehicle dismantling and disposal practices, necessitating investment in recycling technologies and safe handling of hazardous materials.

Environmental factors

Environmental regulations, like the End-of-Life Vehicle (ELV) directives in Europe, set stringent recycling and recovery targets. For instance, the EU's ELV Directive aims for an 85% recovery rate and a 95% recycling rate by weight for vehicles. Copart's operations are integral to meeting these goals by providing a marketplace for vehicles destined for dismantling and material recovery.

By facilitating the efficient remarketing of vehicles, Copart supports the environmentally responsible disposal mandated by ELV directives. This process not only ensures compliance but also can boost the availability and demand for salvaged parts and recycled materials, contributing to a more circular economy within the automotive sector. In 2023, Copart processed millions of vehicles globally, a significant portion of which were end-of-life units.

Stricter emissions standards globally are accelerating the transition to electric vehicles (EVs). For instance, by 2030, California aims for 100% of new passenger car sales to be zero-emission vehicles, impacting the types of vehicles that will eventually enter the salvage market.

This shift means a declining supply of traditional internal combustion engine (ICE) vehicles, potentially altering demand for their parts. Copart will need to adapt to managing a growing number of EVs, with their unique components and battery recycling needs.

The management and recycling of EV batteries present both environmental challenges and new business opportunities for companies like Copart. As more EVs reach their end-of-life, developing efficient and safe battery processing methods will be crucial.

Growing investor and regulatory demands for Environmental, Social, and Governance (ESG) performance are significantly influencing companies like Copart. Investors are increasingly scrutinizing environmental impact, pushing for transparency in reporting. For instance, the global ESG investing market was projected to reach $53 trillion by 2025, highlighting the financial weight of these considerations.

Copart's adoption of sustainable practices, such as optimizing vehicle logistics for reduced emissions or implementing advanced recycling processes for salvaged vehicles, can bolster its reputation. This commitment not only appeals to environmentally conscious consumers but also attracts capital from the rapidly expanding pool of ESG-focused investment funds, which are actively seeking companies with strong sustainability credentials.

Climate Change and Extreme Weather Events

Climate change is directly influencing the frequency and severity of extreme weather events, which in turn impacts Copart's business model. More frequent hurricanes, floods, and wildfires mean a greater number of vehicles are declared total losses, temporarily boosting Copart's inventory of salvageable vehicles. For instance, the 2023 Atlantic hurricane season saw 20 named storms, with several making landfall and causing significant vehicle damage across the United States, directly feeding into the demand for Copart's services.

While these events can create a short-term influx of vehicles, they also present considerable operational hurdles for Copart. The logistics of safely storing and recovering vehicles in disaster-stricken areas become more complex and costly. The aftermath of Hurricane Ian in 2022, for example, highlighted the challenges of managing large volumes of damaged vehicles in affected regions, requiring extensive resources for recovery and processing.

- Increased Vehicle Supply: Extreme weather events like hurricanes and floods directly correlate with a rise in total loss vehicles, providing Copart with more inventory.

- Operational Challenges: Disasters necessitate enhanced logistics for vehicle storage and recovery, potentially increasing operational costs and complexity.

- Geographic Impact: Regions prone to severe weather, such as the Gulf Coast and Florida, are critical markets for Copart due to the consistent impact of storms.

Waste Management and Hazardous Material Disposal

Environmental regulations governing the disposal of hazardous materials found in vehicles, such as fluids, batteries, and refrigerants, are critical for Copart's operational compliance. These rules, which are becoming increasingly stringent, directly impact how vehicles are processed and dismantled. For instance, the European Union's End-of-Life Vehicles (ELV) Directive sets targets for recycling and recovery, influencing Copart's business model in regions where it operates.

Proper management and disposal of these materials are essential to avoid environmental contamination and legal penalties, influencing operational costs and requiring specialized handling procedures. Copart must invest in training and infrastructure to ensure compliance with regulations like the Resource Conservation and Recovery Act (RCRA) in the United States, which dictates the handling of hazardous waste. Failure to comply can result in significant fines; for example, violations of hazardous waste regulations can lead to penalties in the tens of thousands of dollars per day per violation.

- Regulatory Compliance Costs: Copart incurs costs related to compliance with environmental laws, including proper disposal of automotive fluids, batteries, and refrigerants.

- Environmental Risk Mitigation: Effective waste management prevents environmental contamination, safeguarding Copart's reputation and avoiding potential legal liabilities and cleanup expenses.

- Operational Efficiency: Streamlined hazardous material handling processes can improve operational efficiency and reduce the risk of costly delays or shutdowns due to non-compliance.

- Market Demand: Increasingly, consumers and business partners prefer environmentally responsible companies, potentially influencing Copart's market position and attractiveness.

Environmental factors significantly shape Copart's operations, from regulatory compliance to the impact of climate change. Stricter emissions standards are driving the EV transition, meaning Copart must adapt to handling electric vehicles and their battery recycling needs. Growing investor focus on ESG performance also pushes for transparency and sustainable practices, influencing capital attraction and company reputation.

Extreme weather events, such as hurricanes and floods, directly boost Copart's inventory of total loss vehicles, though they also present operational challenges in disaster zones. Furthermore, regulations on hazardous material disposal, like those concerning vehicle fluids and batteries, necessitate specialized handling and incur compliance costs, impacting operational efficiency and risk mitigation.

| Environmental Factor | Impact on Copart | Data/Example (2024/2025) |

|---|---|---|

| EV Transition | Declining ICE vehicles, growing EV inventory requiring specialized handling. | California's 2030 zero-emission vehicle sales target. |

| Climate Change/Extreme Weather | Increased total loss vehicles, operational challenges in disaster areas. | 2023 Atlantic hurricane season: 20 named storms impacting vehicle supply. |

| ESG Demands | Pressure for transparency and sustainable practices; affects investor attraction. | Global ESG investing market projected to reach $53 trillion by 2025. |

| Hazardous Material Disposal | Compliance costs, need for specialized procedures for fluids, batteries. | EU ELV Directive targets 85% recovery, 95% recycling rates. |

PESTLE Analysis Data Sources

Our Copart PESTLE Analysis is built on a robust foundation of data from official government agencies, reputable industry associations, and leading market research firms. We meticulously gather information on regulatory changes, economic indicators, technological advancements, and social trends to provide a comprehensive overview.