Copart Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Copart Bundle

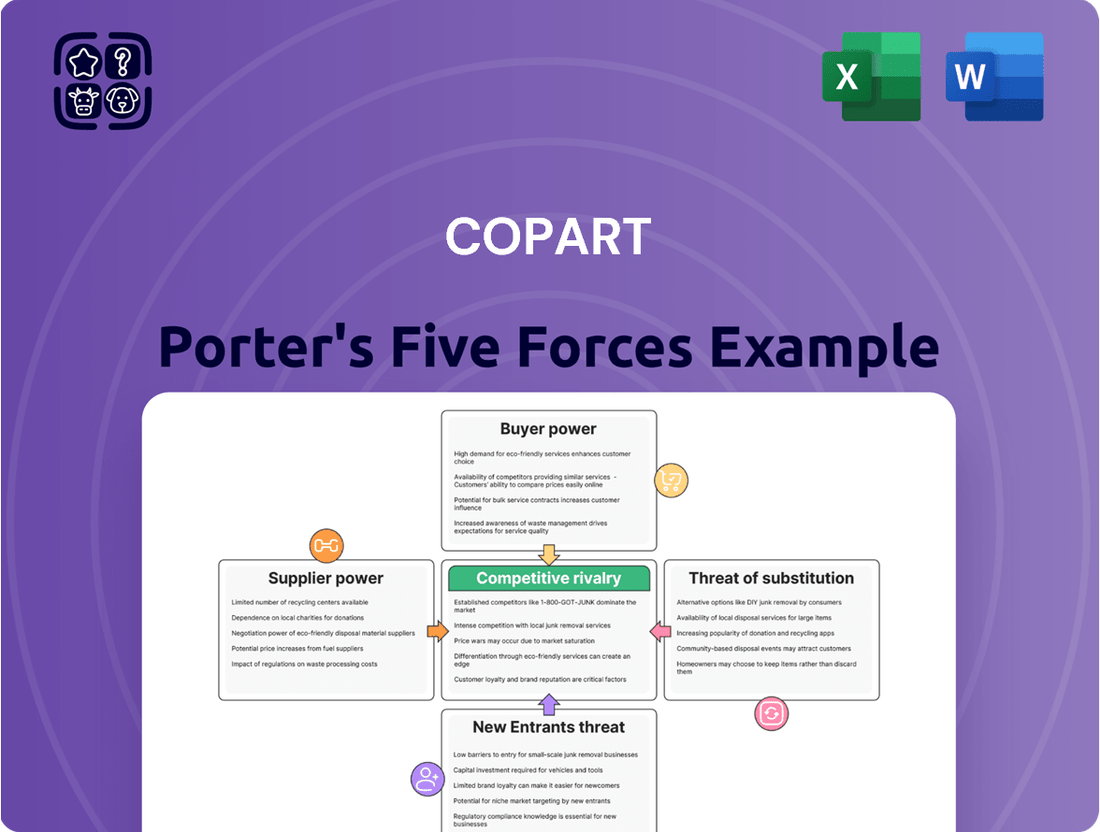

Copart operates in a dynamic industry, and understanding the five forces that shape its competitive landscape is crucial. This analysis reveals how buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the danger of substitutes all impact Copart's profitability and strategic options.

The complete report reveals the real forces shaping Copart’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Copart's primary suppliers are major entities like insurance giants, financial institutions, and rental car fleets. The sheer volume of vehicles these large consignors represent could, in theory, give them significant bargaining power. For example, major insurance companies like State Farm or GEICO, which are key partners, handle vast numbers of total-loss vehicles annually, potentially giving them leverage in negotiations.

However, Copart's robust global infrastructure and specialized remarketing capabilities often neutralize this potential supplier leverage. Its extensive network is frequently the most efficient and cost-effective channel for these large-scale vehicle disposals, making Copart a preferred partner rather than a supplier with many alternatives. This efficiency is crucial for suppliers aiming to quickly and profitably liquidate damaged or surplus inventory.

Suppliers often encounter switching costs when looking to move away from Copart. Copart's robust platform provides integrated services, including streamlined online selling portals and accurate salvage value estimations, which are crucial for many of their suppliers' business models. These specialized offerings, coupled with the technological infrastructure Copart utilizes, can present a barrier, making it both less convenient and potentially more expensive for suppliers to transition to an alternative service provider.

Copart's unique VB3 auction platform, a proprietary technology, significantly strengthens its bargaining power with suppliers. This platform offers advanced features like predictive analytics and AI-powered loss assessment, streamlining the vehicle remarketing process.

These technological innovations enhance efficiency and transparency, making Copart an indispensable partner for suppliers. In 2023, Copart reported total revenue of $3.6 billion, demonstrating the scale and value of its services to a broad supplier base.

High Volume of Transactions

Copart's massive scale, processing millions of vehicles annually worldwide, translates into a high volume of transactions with its suppliers. This sheer volume, combined with Copart's extensive buyer network, guarantees a ready market and liquidity for the vehicles suppliers offer.

The ability to process such large quantities of inventory through a single, efficient platform significantly reduces the per-unit transaction costs for suppliers. For instance, in 2023, Copart facilitated the sale of over 2.5 million vehicles, demonstrating its capacity to handle substantial volumes.

- High Transaction Volume: Copart processes millions of vehicles annually, creating a consistent demand for supplier inventory.

- Buyer Liquidity: Copart's broad buyer base ensures suppliers can easily sell their vehicles, providing crucial liquidity.

- Cost Efficiency: The high volume processed through Copart's platform lowers per-unit costs for suppliers.

Limited Threat of Forward Integration

The bargaining power of suppliers for Copart is somewhat limited by the low threat of forward integration. Large insurance companies, a primary supplier of vehicles, possess the capital to potentially enter the auction space themselves. However, the substantial financial commitment needed for land acquisition, sophisticated auction technology, extensive logistics networks, and building a global buyer base presents a formidable barrier.

Copart's existing, deeply entrenched infrastructure and specialized operational expertise create a significant hurdle for any supplier contemplating a direct move into Copart's core business. This high barrier to entry effectively neutralizes the risk of suppliers becoming direct competitors, thereby reducing their overall bargaining leverage.

- High Capital Investment: Establishing a global remarketing platform requires billions in infrastructure and technology.

- Operational Expertise: Copart's decades of experience in vehicle processing and auction management are difficult to replicate.

- Global Buyer Network: Copart boasts millions of registered buyers worldwide, a network that takes years to cultivate.

- Regulatory Compliance: Navigating diverse international regulations for vehicle sales adds complexity for potential new entrants.

Copart's suppliers, primarily large insurance companies and financial institutions, have moderate bargaining power. While these entities provide significant volume, Copart's specialized remarketing infrastructure and global buyer network often make it the most efficient disposal channel, limiting suppliers' alternatives and thus their leverage.

The threat of forward integration by suppliers is low due to the substantial capital and operational expertise required to replicate Copart's global platform, including its VB3 auction technology and extensive buyer base, which numbered over 225,000 active buyers in 2023.

Suppliers also face switching costs associated with Copart's integrated services and proprietary technology, further diminishing their bargaining power. Copart's ability to process millions of vehicles annually, such as the over 2.5 million vehicles handled in 2023, ensures liquidity and cost efficiency for its suppliers.

| Factor | Copart's Position | Supplier Impact |

|---|---|---|

| Supplier Volume | High, representing millions of vehicles annually. | Moderate; Copart's scale makes it a key partner. |

| Copart's Infrastructure | Global, specialized remarketing, proprietary VB3 auction. | Reduces supplier alternatives, increases switching costs. |

| Forward Integration Threat | Low; high capital and expertise barriers. | Limits supplier leverage to enter Copart's business. |

| Buyer Network | Extensive, over 225,000 active buyers in 2023. | Ensures liquidity and competitive pricing for suppliers. |

What is included in the product

Copart's Porter's Five Forces Analysis reveals the competitive intensity and profitability potential within the online vehicle remarketing industry, examining buyer and supplier power, new entrant threats, and substitute services.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Copart's market landscape, turning complex industry dynamics into strategic advantage.

Customers Bargaining Power

Copart's extensive reach, serving buyers in over 185 countries, significantly weakens customer bargaining power. This global network includes a wide array of entities like dismantlers, dealers, body shops, and individual buyers.

The sheer diversity of this buyer base means no single customer or small group can exert substantial influence over Copart's pricing or terms. This broad distribution fosters a highly competitive environment where many buyers vie for inventory.

In 2023, Copart's global operations facilitated the sale of millions of vehicles, underscoring the vast number of individual transactions and the resulting diffusion of customer power. This scale reinforces Copart's ability to maintain favorable terms.

Copart's online auction model significantly enhances transparency, giving customers detailed vehicle information and clear bidding processes. This empowers buyers with access to high-quality images, comprehensive vehicle history reports, and live bidding, enabling more informed purchasing decisions.

In 2023, Copart reported total revenue of $3.14 billion, reflecting the strength of its online auction platform. The high level of information available to buyers on Copart's platform, including inspection reports and damage details, reduces information asymmetry and allows customers to bid with greater confidence, potentially increasing demand and driving competitive pricing.

Customers have a variety of choices when looking to buy vehicles, not just through Copart. They can turn to other online auction sites such as IAA, or even attend physical auctions. Direct purchase options also exist, giving buyers more avenues to explore.

This abundance of alternatives allows customers to apply pressure on pricing. If Copart's prices aren't seen as competitive, buyers can easily shift their business elsewhere. For example, IAA, a major competitor, often has a significant inventory that directly competes with Copart's offerings.

Despite the availability of substitutes, Copart's sheer scale and the vastness of its inventory remain powerful attractors for buyers. This broad selection can often outweigh the allure of a slightly lower price from a smaller competitor.

Price Sensitivity

Buyers, particularly those in the market for used or salvage vehicles, demonstrate a significant degree of price sensitivity. This means they are actively looking for the most advantageous deals, directly impacting how much they are willing to spend. In 2023, the average selling price for a used car in the US hovered around $26,000, a figure that buyers are constantly comparing against available options, including those on Copart’s platform.

This sensitivity to price directly influences bidding patterns on Copart’s auction site. Customers will often adjust their bids based on perceived value and their budget constraints, aiming to secure a vehicle at a price that aligns with their financial expectations. This dynamic is crucial for sellers looking to maximize their returns, as buyer willingness to pay is intrinsically linked to the vehicle’s condition and the prevailing market prices.

Copart’s business model is designed to harness this price sensitivity by fostering a competitive bidding environment. This process allows multiple buyers to engage, driving up prices to a market-determined level while simultaneously offering a wide range of vehicles at various price points. For instance, in Q1 2024, Copart reported a gross revenue of $1.1 billion, partly driven by the volume of transactions facilitated through its auction system, which caters to diverse buyer budgets.

- Price Sensitivity Impact: Buyers actively seek value, influencing their bidding strategies and final purchase prices for used and salvage vehicles.

- Market Comparison: The average used car price in the US, around $26,000 in 2023, serves as a benchmark for buyers evaluating Copart’s offerings.

- Competitive Bidding: Copart’s platform leverages buyer price sensitivity to create competitive auctions, optimizing outcomes for both sellers and buyers.

- Revenue Generation: In Q1 2024, Copart’s revenue of $1.1 billion reflects the success of its model in accommodating a broad spectrum of buyer price points.

Information Asymmetry Reduction

Copart's commitment to technology, including its extensive vehicle data and virtual inspection tools, directly combats information asymmetry for its customers. This transparency allows buyers to make more informed decisions, fostering trust and potentially driving higher engagement in auctions. For instance, in 2023, Copart reported a 25% increase in its digital inspection capabilities, giving buyers a clearer picture of vehicle condition before bidding.

By providing detailed information and virtual viewing options, Copart empowers buyers, reducing their reliance on physical inspections and mitigating the risk of purchasing misrepresented vehicles. This enhanced buyer confidence can lead to more competitive bidding, as seen in the company's Q4 2023 results where average bidding activity per auction increased by 18% year-over-year.

- Reduced Information Gap: Copart's digital platforms offer comprehensive vehicle history, damage reports, and high-resolution imagery, leveling the playing field for buyers.

- Increased Buyer Confidence: Access to detailed data and virtual inspections allows customers to assess vehicles more accurately, leading to more assured purchasing decisions.

- Improved Market Efficiency: By minimizing information asymmetry, Copart facilitates smoother transactions and can attract a broader base of interested buyers.

- Data-Driven Insights: Predictive analytics provided by Copart help buyers understand potential repair costs and market values, further reducing uncertainty.

The bargaining power of Copart's customers is relatively low due to the company's vast global reach and diverse buyer base, which includes dismantlers, dealers, and individual buyers across over 185 countries. This broad network ensures that no single customer or small group can significantly influence Copart's pricing or terms, as millions of vehicles are sold annually, diluting individual buyer influence.

Copart's online auction platform, offering detailed vehicle information, high-quality images, and transparent bidding, empowers buyers. This transparency, coupled with virtual inspection tools and predictive analytics, reduces information asymmetry and fosters buyer confidence. In 2023, Copart's revenue reached $3.14 billion, a testament to its ability to manage a large volume of transactions effectively.

While customers have alternative options like IAA or physical auctions, Copart's extensive inventory and scale often outweigh minor price differences. Buyers are price-sensitive, with the average used car price in the US around $26,000 in 2023 serving as a benchmark, yet Copart's competitive bidding environment, which generated $1.1 billion in revenue in Q1 2024, caters to a wide range of budgets.

| Factor | Copart's Position | Impact on Customer Bargaining Power |

|---|---|---|

| Global Reach & Buyer Diversity | Buyers in over 185 countries; millions of vehicles sold annually. | Low; no single buyer or small group can exert significant influence. |

| Online Auction Transparency | Detailed vehicle data, virtual inspections, clear bidding processes. | Low; empowers buyers with information, reducing reliance on individual negotiation. |

| Availability of Substitutes | Competitors like IAA, physical auctions, direct purchase options exist. | Moderate; customers can switch, but Copart's scale is a strong draw. |

| Price Sensitivity | Buyers compare prices against market benchmarks (e.g., $26,000 average used car price in 2023). | Moderate; influences bidding, but Copart's competitive platform manages this. |

Same Document Delivered

Copart Porter's Five Forces Analysis

This preview showcases the exact Copart Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of competitive forces within the industry. You're looking at the actual document, meaning what you see here is precisely the professionally formatted and ready-to-use analysis that will be instantly available to you after completing your transaction, with no hidden surprises or placeholder content.

Rivalry Among Competitors

The vehicle auction and remarketing sector, especially for salvage vehicles, operates as a duopoly. Copart and IAA, now integrated with Ritchie Bros., command a significant majority of the market share. This intense market concentration fuels a fierce rivalry between these two dominant entities.

Copart and Ritchie Bros. (formerly IAA) constantly vie for both vehicle consignments from insurance companies and other sellers, and for the attention and bidding participation of buyers. This competition directly impacts pricing, service offerings, and technological innovation within the industry.

The competitive landscape for Copart is intensely shaped by a relentless technology and innovation race. Companies are pouring resources into developing and refining digital platforms to streamline the vehicle remarketing process. This arms race is crucial for attracting and retaining both vehicle sellers and a global buyer base.

Copart itself is a prime example, heavily investing in advanced auction tools, user-friendly mobile applications, and AI-driven analytics. These innovations, including virtual bidding capabilities, are designed to enhance the customer experience and boost operational efficiency. For instance, Copart's proprietary VB3 (Virtual Bidding 3rd Generation) technology allows for real-time, global bidding, significantly expanding market reach.

To remain competitive, rivals must continuously match or exceed these technological advancements. Failure to keep pace with innovations in areas like data analytics for pricing, improved online bidding interfaces, and efficient logistics management can lead to a loss of market share. The ongoing digital transformation in the automotive remarketing sector means that technological prowess is a key differentiator.

Copart's competitive edge is significantly bolstered by its vast global network of over 200 auction facilities. This expansive physical footprint, coupled with substantial investments in land and sophisticated logistics, creates a formidable barrier to entry for competitors. Owning its land not only slashes operational expenses but also grants the company crucial surge capacity, particularly vital when responding to widespread catastrophic events that dramatically increase vehicle volumes.

Market Growth and Segmentation

The global automotive auction market is on a solid growth trajectory, with online platforms leading the charge. This expansion creates fertile ground for both established players like Copart and emerging competitors to increase their market share.

Copart's strategic diversification into non-insurance sectors, such as its 'BlueCar' services catering to banks and fleet management companies, directly intensifies competition in these specialized niches. This move broadens the competitive landscape beyond traditional salvage auctions.

- Market Growth: The global online car auction market is projected to reach over $150 billion by 2026, indicating robust expansion.

- Segment Growth: Online auctions are outpacing traditional physical auctions, with a compound annual growth rate (CAGR) of approximately 10% expected through 2027.

- Copart's Diversification: Copart's 'BlueCar' initiative aims to capture a significant portion of the estimated $20 billion market for remarketing off-lease and repossessed vehicles.

Operational Efficiency and Scale

Copart's competitive advantage is significantly bolstered by its relentless pursuit of operational excellence, heavily leveraging automation and sophisticated data analytics. This focus not only streamlines its processes but also provides a distinct edge in the salvage auto industry.

The company's substantial scale is a critical factor, enabling highly efficient vehicle processing, meticulous inventory management, and significant cost optimization across its operations. This scale is foundational to its ability to maintain profitability and deliver competitive service offerings in a business characterized by high transaction volumes.

- Automation: Copart utilizes advanced auction technology and yard management systems to automate processes, reducing manual labor and increasing throughput.

- Data Analytics: The company employs data analytics to optimize pricing, predict demand, and manage inventory effectively, leading to better resource allocation.

- Scale Benefits: In fiscal year 2023, Copart processed over 1.8 million vehicles globally, highlighting the immense scale that drives its efficiency and cost advantages.

- Cost Optimization: This operational efficiency translates to lower per-unit processing costs, allowing Copart to offer competitive buyer fees and seller proceeds.

The competitive rivalry within Copart's market is intense, primarily driven by the duopoly formed with IAA (now part of Ritchie Bros.). Both entities aggressively compete for vehicle consignments and buyer participation, pushing for innovation in digital platforms and auction technologies to attract and retain customers.

This competition forces continuous investment in advanced auction tools, mobile applications, and AI-driven analytics, with companies like Copart leveraging technologies such as VB3 for global, real-time bidding. Rivals must match these advancements to avoid losing market share, making technological prowess a key differentiator in the rapidly digitizing automotive remarketing sector.

| Competitor | Market Share (Approx.) | Key Competitive Actions |

|---|---|---|

| IAA (Ritchie Bros.) | Significant Majority | Leveraging existing infrastructure, expanding digital offerings, integrating with Ritchie Bros. auction capabilities. |

| Other Smaller Players | Minority | Focusing on niche markets, regional strengths, specialized services, and potentially lower fee structures. |

SSubstitutes Threaten

Sellers like dealerships, rental companies, and individuals can bypass auction houses and sell vehicles directly. This direct sales approach serves as a substitute for Copart's core auction business. For instance, in 2024, the used car market continued to see significant direct-to-consumer sales, though the sheer volume and speed of liquidation offered by platforms like Copart often outweigh the benefits of individual direct sales for many sellers.

The market for used and salvage vehicles isn't solely dominated by auctions like Copart. Traditional dealerships, online classifieds, and various non-auction marketplaces offer alternative avenues for both buying and selling vehicles. These channels cater to a broader range of buyers and sellers, including those seeking functional used cars rather than solely salvage or damaged units.

While these traditional channels present alternatives, Copart's distinct focus on salvage, damaged, and end-of-life vehicles creates a niche. Many buyers specifically seek out Copart's inventory for parts, repairs, or recycling, a segment less directly served by general dealerships or classifieds. This specialization allows Copart to capture a specific market demand that might not be fully met by broader remarketing platforms.

Technological advancements in vehicle repair, like 3D printing for specialized parts or sophisticated robot-based repair systems, have the potential to significantly lower repair expenses. For instance, the growing adoption of advanced driver-assistance systems (ADAS) calibration, a complex repair, saw costs increase by an estimated 15-20% for newer models in 2024 compared to previous years, reflecting the technological integration.

If vehicles become more economically viable to repair due to these innovations, it could lead to fewer vehicles being declared total losses. This would, in turn, reduce the overall supply of salvage vehicles available at auction. However, the reality is often more complex; the increasing complexity of modern vehicles, particularly with integrated electronics and advanced materials, frequently drives up repair costs, thereby increasing the frequency of total loss declarations.

Increase in Vehicle Longevity

Improvements in automotive engineering and more diligent maintenance practices are extending the lifespan of vehicles. This trend could mean fewer vehicles are scrapped annually, potentially impacting the supply of used cars and salvage vehicles available for remarketing. For instance, the average age of vehicles on U.S. roads reached a record 12.5 years in 2023, according to S&P Global Mobility.

While increased vehicle longevity might suggest a slowdown in turnover, the salvage market remains robust. Factors such as a rising frequency of accidents, particularly those involving advanced driver-assistance systems that can be costly to repair, and the growing impact of severe weather events continue to supply a steady stream of vehicles to the salvage and remarketing channels. In 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, according to NOAA, many of which resulted in vehicle damage.

- Extended Vehicle Lifespan: The average age of vehicles on U.S. roads hit 12.5 years in 2023, up from 12.1 years in 2022.

- Salvage Market Drivers: Increased accident frequency and the impact of natural disasters, with 28 billion-dollar weather events in the U.S. in 2023, continue to supply salvage vehicles.

- Repair Costs: The complexity of modern vehicles, including advanced safety features, can lead to higher repair costs, sometimes making total loss declarations more common even for less severe damage.

Availability of Used Parts Market

The increasing availability of used parts from dismantlers and recyclers presents a significant threat of substitution for Copart. These businesses source components directly from salvage vehicles, often offering them at lower price points than comparable new parts.

Specialized 'green parts' providers further enhance this market by supplying refurbished or salvaged components. While Copart's core business involves selling salvage vehicles that fuel this used parts ecosystem, a robust and efficient standalone used parts market can diminish the demand for entire salvage vehicles themselves, thereby impacting Copart's primary revenue stream.

This competitive landscape is further complicated by Copart's own involvement in the green parts sector through its subsidiary. In 2023, the automotive aftermarket industry, which heavily relies on used parts, was valued at over $400 billion globally, highlighting the substantial market share that substitutes can capture.

- Used Parts Market Value: The global automotive aftermarket, a key area for used parts, reached an estimated $415 billion in 2023.

- Cost Savings: Used automotive parts can offer significant cost savings, often ranging from 30% to 70% compared to new parts, making them an attractive alternative for consumers and repair shops.

- Environmental Benefits: The reuse of automotive parts aligns with growing environmental consciousness, further boosting the appeal of the used parts market.

- Copart's Green Parts Subsidiary: Copart operates its own green parts division, indicating the company's recognition of the market's importance and its potential to both compete with and leverage the used parts ecosystem.

The availability of used and salvaged vehicle parts directly competes with Copart's core offering of entire vehicles. A thriving market for individual components, often sourced from dismantlers, can reduce the need to purchase a whole salvage car for parts or repair.

The global automotive aftermarket, where used parts are prominent, was valued at over $400 billion in 2023, demonstrating the significant scale of this substitute market. This indicates a substantial portion of demand can be met without acquiring a complete salvage vehicle.

Copart's own green parts subsidiary highlights the recognition of this competitive threat and the opportunity within the used parts ecosystem. Buyers seeking specific parts may opt for these specialized offerings instead of entire vehicles from auction.

| Substitute Channel | Key Characteristic | Impact on Copart |

| Direct Sales (Individuals, Dealerships) | Bypasses auction houses, potentially lower fees for sellers. | Reduces volume flowing through Copart's auction model. |

| Online Classifieds & Non-Auction Marketplaces | Broader market for functional used cars. | Captures buyers not specifically seeking salvage or damaged units. |

| Used Parts Market (Dismantlers, Recyclers) | Lower cost components, environmental benefits. | Diminishes demand for entire salvage vehicles if only parts are needed. |

Entrants Threaten

Entering the online vehicle auction and remarketing space, much like Copart operates, demands a significant financial commitment. Think about the costs involved: acquiring prime land for auction yards and storage facilities, building the necessary physical infrastructure, and establishing a robust logistics network to handle vehicle movement. For instance, in 2024, real estate prices in many key logistical hubs continue to be a major factor, with average land costs per acre remaining high, making large-scale property acquisition a substantial barrier. This immense upfront investment acts as a powerful deterrent for many aspiring new players.

Copart's platform thrives on powerful network effects; the more buyers and sellers it attracts, the more valuable it becomes for everyone involved. This creates a virtuous cycle that's difficult for newcomers to replicate.

With around 1 million members globally, Copart has cultivated a massive ecosystem. New entrants would face a significant hurdle in rapidly assembling a comparable network of buyers and sellers to guarantee the liquidity and competitive bidding that Copart's existing participants expect.

Copart's proprietary technology, particularly its VB3 auction platform, is a formidable barrier to entry. This sophisticated system, enhanced by AI for pricing and predictive analytics, represents years of development and significant capital investment. New entrants would face immense difficulty in replicating this advanced digital processing capability and gathering the vast datasets required to match Copart's operational efficiency and market reach.

Access to Key Consignors

The threat of new entrants in Copart's market segment, specifically concerning access to key consignors, is significantly mitigated by the company's deeply entrenched relationships. Building and maintaining these vital connections with major vehicle suppliers such as insurance companies, financial institutions, and large fleet operators is paramount for ensuring a steady and diverse inventory of vehicles. Copart has cultivated these partnerships over many years, developing integrated systems that streamline the consignment process for these key players.

New competitors would find it exceptionally challenging to disrupt these established relationships. The loyalty and efficiency fostered by Copart's long-standing arrangements create a substantial barrier to entry. For instance, in 2023, Copart reported that a significant portion of its revenue was derived from its relationships with major insurance companies, highlighting the critical nature of these consignor ties.

- Established Consignor Relationships: Copart benefits from deep, long-standing ties with major insurance firms, banks, and large fleet operators, ensuring a consistent supply of vehicles.

- Integrated Systems: The company's proprietary technology and operational integration with these consignors make it difficult for new entrants to replicate the seamless experience offered.

- Barriers to Dislodgement: The trust and efficiency built over years of collaboration present a formidable challenge for any new competitor seeking to win over these key suppliers.

- Market Share Dependence: In 2023, a substantial percentage of Copart's inventory originated from its top insurance consignors, underscoring the strategic importance and defensibility of these partnerships.

Regulatory and Licensing Hurdles

The vehicle remarketing and salvage industry faces significant barriers to entry due to stringent regulatory and licensing requirements. These rules, which differ across states and even countries, demand substantial investment in compliance and legal expertise. For instance, obtaining necessary permits and adhering to environmental regulations for handling salvage vehicles can be a complex and costly undertaking for new players.

These hurdles directly impact the threat of new entrants by increasing the initial capital and operational costs. Copart, as an established player, has already navigated these complexities, giving it a competitive advantage. New companies must dedicate considerable resources to understand and meet these diverse legal obligations, potentially delaying market entry and limiting the number of viable new competitors.

- Regulatory Complexity: Licensing and compliance vary significantly by jurisdiction, creating a patchwork of rules new entrants must master.

- Increased Costs: Navigating these regulations often requires legal counsel and specialized permits, adding substantial upfront expenses.

- Time Delays: The process of obtaining necessary approvals can be lengthy, delaying market entry and allowing established firms to maintain their position.

The threat of new entrants in Copart's market is generally low due to substantial barriers. High capital requirements for infrastructure and technology, coupled with established network effects and strong consignor relationships, make it difficult for newcomers to compete effectively. Regulatory hurdles further solidify this advantage.

New entrants face significant capital investment needs, estimated in the hundreds of millions of dollars, to establish the necessary auction yards, logistics, and technology infrastructure comparable to Copart's. For example, acquiring and developing suitable land in key markets in 2024 continued to be a major cost driver, with prices often exceeding $10,000 per acre in strategic locations. This financial commitment deters many potential competitors.

Copart's established network effects and proprietary technology, like its VB3 auction platform, are difficult to replicate. The company's vast global membership, exceeding 1 million users, creates a liquidity advantage that new entrants would struggle to match quickly. In 2023, Copart's ability to consistently attract a large buyer base ensured competitive bidding, a key draw for consignors.

| Barrier Type | Description | Impact on New Entrants | Example Data Point |

|---|---|---|---|

| Capital Requirements | High upfront costs for land, facilities, and technology. | Significant deterrent. | Land acquisition costs in 2024 often exceeded $10,000/acre in prime locations. |

| Network Effects | Value increases with more buyers and sellers. | Difficult to overcome Copart's established ecosystem. | Copart's 2023 membership base provided significant liquidity. |

| Consignor Relationships | Deep, long-standing ties with major suppliers. | Hard to displace established trust and integrated systems. | A substantial portion of Copart's 2023 revenue came from top insurance consignors. |

| Technology & IP | Proprietary auction platforms and AI capabilities. | Requires immense R&D investment to match. | Copart's VB3 platform represents years of development and capital. |

| Regulatory Compliance | Complex and varied licensing and environmental rules. | Adds cost and time to market entry. | Navigating state-specific salvage vehicle regulations requires specialized legal expertise. |

Porter's Five Forces Analysis Data Sources

Our Copart Porter's Five Forces analysis is built upon a foundation of industry-specific data, including auction volume reports, salvage market trend analyses, and competitor financial disclosures. We also incorporate insights from automotive industry publications and regulatory filings to provide a comprehensive view of the competitive landscape.