Copart Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Copart Bundle

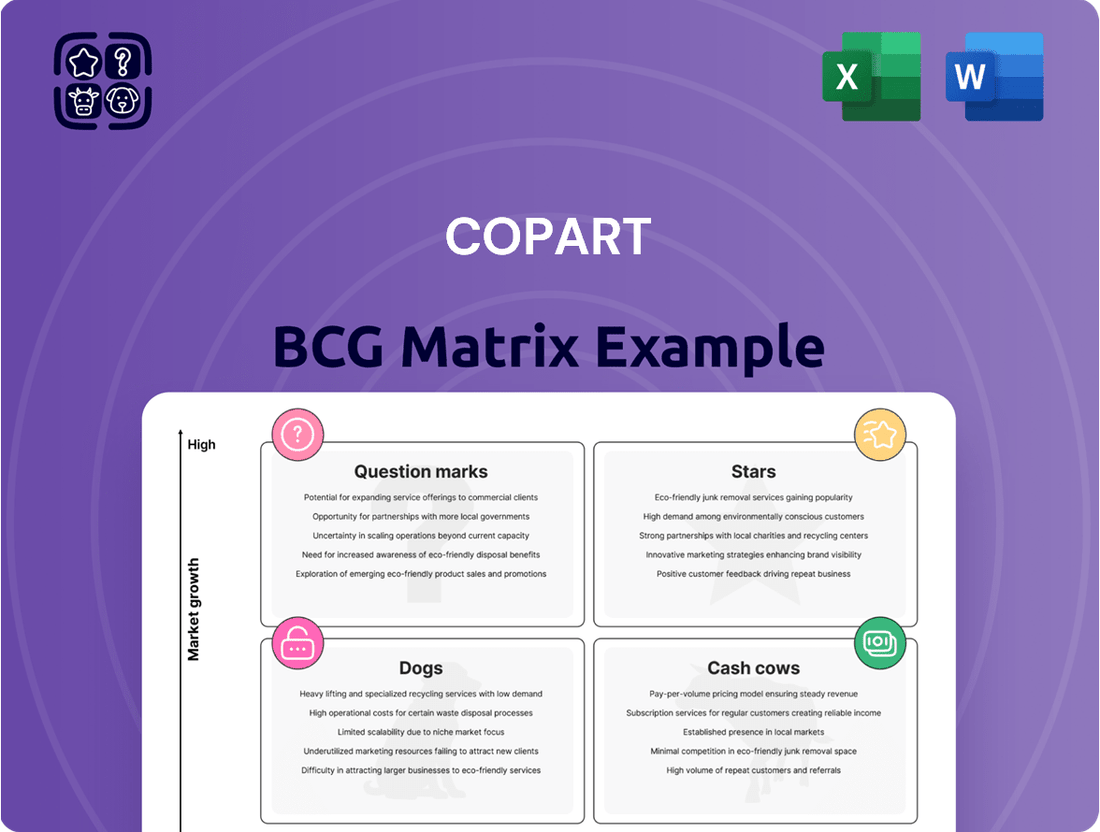

Curious about Copart's strategic product positioning? Our BCG Matrix analysis reveals their Stars, Cash Cows, Dogs, and Question Marks, offering a glimpse into their market performance.

Unlock the full potential of this insight by purchasing the complete BCG Matrix report. It provides a detailed breakdown of each product's quadrant placement, empowering you with data-driven recommendations for optimal resource allocation and future growth strategies.

Don't miss out on the opportunity to gain a competitive edge. Invest in the full Copart BCG Matrix today and equip yourself with the essential tools for informed decision-making and strategic planning.

Stars

Copart stands as the undisputed leader in the global salvage vehicle auction market. In 2024, its market share solidified its dominance, driven by an expansive network of over 250 locations across 11 countries. This vast infrastructure caters to the increasing demand for total loss and damaged vehicles, a segment experiencing consistent growth.

Copart's proprietary Virtual Bidding Third Generation (VB3) technology is a significant competitive advantage, driving its position in the BCG Matrix. This platform facilitates global participation, allowing buyers from over 190 countries to access Copart's inventory, thereby maximizing demand and sale prices.

The VB3 system streamlines the entire auction process, from vehicle listing and condition reporting to bidding, payment, and retrieval. This end-to-end efficiency supports Copart's ability to maintain high per-vehicle margins, a key indicator of its strong market performance and profitability.

Copart's strategic land ownership is a cornerstone of its business model, positioning it favorably within the Boston Consulting Group (BCG) matrix. By owning the majority of its salvage yard locations, Copart secures long-term cost control and financial resilience, differentiating it from competitors who often rely on leases.

This proactive land acquisition strategy has been a key growth driver. For instance, Copart significantly expanded its physical footprint, tripling its total acreage since 2015. This expansion not only boosts operational capacity but also curtails transportation expenses, a critical factor in the salvage industry.

AI-Powered Solutions and Digital Innovation

Copart is aggressively integrating AI to streamline its business, from vehicle evaluation to customer interactions. This digital innovation is a key driver for its position in the market.

AI-powered tools like Total Loss Express 360 and Rapid Total Loss AI are significantly speeding up claims processing for insurance partners, demonstrating tangible efficiency gains. These advancements highlight Copart's commitment to technological leadership.

- AI-Driven Efficiency: Tools like Total Loss Express 360 reduce processing times for insurance claims.

- Enhanced Customer Experience: AI improves search functionality and listing optimization for buyers and sellers.

- Data-Driven Decisions: Advanced analytics and predictive modeling inform operational strategies.

- Innovation Investment: Copart's ongoing focus on digital solutions positions it for future growth.

Increasing Total Loss Frequency and Non-Insurance Growth

The automotive industry's increasing total loss frequency, fueled by escalating repair expenses and advanced vehicle technology, is a significant tailwind for Copart. This trend means more vehicles are deemed uneconomical to repair, directly feeding Copart's auction inventory. For instance, in 2023, the average repair cost for vehicles involved in accidents continued to climb, making total loss declarations more common.

Copart's strategic expansion into non-insurance sectors highlights robust growth and revenue diversification. Their 'Blue Car' services, catering to financial institutions like banks, rental companies, and fleet operators, are gaining traction. This segment, alongside increased dealer sales volume, demonstrates Copart's ability to leverage its platform beyond its traditional insurance partnerships.

- Rising Repair Costs: Advanced driver-assistance systems (ADAS) and complex electronics contribute to higher repair bills, pushing more vehicles into total loss status.

- Non-Insurance Segment Growth: Copart's 'Blue Car' services and dealer sales are expanding, reducing reliance on insurance companies and broadening market reach.

- Market Share Expansion: In 2023, Copart continued to solidify its market position, with its auction volumes showing consistent year-over-year increases across various segments.

Copart's "Stars" in the BCG matrix are its core salvage auction operations, characterized by high market share and high growth. This segment benefits from increasing total loss frequencies in the automotive industry, driven by rising repair costs. Copart's extensive global auction network and proprietary VB3 technology are key enablers of this strong performance.

The company's strategic land ownership provides a significant competitive advantage, ensuring cost control and operational efficiency for its high-volume salvage operations. Furthermore, Copart's aggressive integration of AI is enhancing its ability to process claims faster and improve customer experiences, solidifying its leading position.

Copart's expansion into non-insurance sectors, such as financial institutions and fleet operators, further fuels the growth of its star performers. This diversification, coupled with consistent increases in auction volumes in 2023, underscores the robust health and upward trajectory of its core business segments.

| Metric | 2023 Data | Significance |

|---|---|---|

| Global Locations | Over 250 | Expansive operational footprint |

| Buyer Participation | Over 190 Countries | Maximizes demand and sale prices |

| Total Loss Frequency | Increasing | Directly feeds inventory |

| AI Integration | Aggressive Adoption | Drives efficiency and innovation |

What is included in the product

The Copart BCG Matrix analyzes its business units as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic guidance on investing in high-growth Stars and Cash Cows, while managing Question Marks and divesting Dogs.

A clear Copart BCG Matrix visualizes each business unit's market share and growth, easing the pain of strategic uncertainty.

Cash Cows

Copart's primary salvage vehicle auction services are the bedrock of its business, acting as its Cash Cows in the BCG Matrix. This core operation, centered on online auctions of vehicles, predominantly from insurance companies, is a mature and exceptionally profitable segment. In fiscal year 2023, Copart reported total revenue of $3.36 billion, with its North American segment, driven by these auction services, showing robust performance.

The strength of this Cash Cow lies in its deep-rooted relationships with major insurance carriers, which are the primary suppliers of vehicles to Copart's auctions. These partnerships ensure a consistent and substantial flow of inventory. Copart's efficiency in maximizing auction prices and expediting vehicle processing further solidifies its market position and revenue generation within this segment.

Copart's extensive global network, boasting over 250 physical locations in 11 countries, coupled with its robust online platform, is a cornerstone of its Cash Cow status. This vast infrastructure facilitates the efficient processing and sale of millions of vehicles annually, with the company managing over 4 million units in 2023 alone.

The company's owned storage yards and operational efficiency create a substantial competitive moat, making it difficult for rivals to replicate. This global reach attracts buyers from more than 190 countries, underscoring its market dominance and consistent revenue generation.

Copart's established customer relationships, especially with insurance companies, are a significant strength. These long-standing partnerships ensure a consistent and substantial supply of vehicles for auction. This reliability is a cornerstone of their operational model.

The company's extensive buyer network, boasting around 1 million members, generates powerful network effects. This means the more buyers participate, the more attractive the platform becomes for sellers, and vice versa, leading to increased liquidity and competitive bidding.

In 2023, Copart's revenue reached $3.7 billion, a testament to the effectiveness of its business model, which is heavily reliant on these strong relationships and network effects to drive sales volume and pricing power.

Title Express Service

Copart's Title Express service is a prime example of a cash cow within its business model. This integrated solution simplifies title procurement and loan payoff processes for insurance companies, significantly boosting their operational efficiency.

The service's success is evident in its rapid growth, with Copart approaching a run rate of one million titles obtained annually through Title Express. This substantial volume underscores its established market position and consistent revenue generation.

- Title Express offers integrated title procurement and loan payoff services.

- The service streamlines complex title processing for insurance companies.

- Copart is nearing a run rate of 1 million titles obtained annually via this service.

- This demonstrates strong, consistent revenue generation and market penetration.

Consistent Profitability and Cash Flow Generation

Copart stands out as a prime example of a Cash Cow within the BCG Matrix, consistently delivering exceptional profitability and predictable cash flow. Its business model, focused on the remarketing of used vehicles, has proven remarkably resilient and lucrative.

The company's financial performance underscores this strength. For instance, Copart reported a revenue of $1.15 billion and a net income of $362.1 million in its first quarter of fiscal year 2025, showcasing impressive operational efficiency and margin strength. This consistent financial health is a hallmark of a mature and dominant business.

Furthermore, Copart maintains a robust financial foundation, evidenced by its substantial liquidity. As of the third quarter of fiscal year 2025, the company held over $5.6 billion in liquidity. This financial flexibility enables Copart to comfortably fund its ongoing operations, pursue strategic investments, and effectively return capital to its shareholders, reinforcing its Cash Cow status.

- Consistent Revenue: Copart's Q1 fiscal 2025 revenue reached $1.15 billion.

- High Profitability: The company achieved a net income of $362.1 million in Q1 fiscal 2025.

- Strong Liquidity: Over $5.6 billion in liquidity was reported as of Q3 fiscal 2025.

- Shareholder Value: Financial strength supports investments and shareholder returns.

Copart's core salvage vehicle auction business is its undisputed Cash Cow, consistently generating substantial profits and cash flow. This mature segment benefits from strong relationships with insurance companies, ensuring a steady supply of vehicles. The company's efficient processing and global reach further solidify its dominance.

The Title Express service also functions as a significant Cash Cow, streamlining title procurement and loan payoffs for insurance partners. Approaching a run rate of one million titles annually, this service demonstrates strong market penetration and reliable revenue streams.

Copart's financial performance highlights its Cash Cow status, with Q1 fiscal 2025 revenue reaching $1.15 billion and a net income of $362.1 million. The company's robust liquidity, exceeding $5.6 billion as of Q3 fiscal 2025, allows for operational funding, strategic investments, and shareholder returns.

| Segment | BCG Classification | Key Strengths | Financial Snapshot (Q1 FY25) |

|---|---|---|---|

| Salvage Vehicle Auctions | Cash Cow | Insurance partnerships, global network, operational efficiency | Revenue: $1.15 billion (overall) |

| Title Express | Cash Cow | Streamlined processes, high volume (approaching 1M titles/year) | Consistent revenue generation |

| Overall Business | Cash Cow | Market leadership, strong buyer network, financial stability | Net Income: $362.1 million, Liquidity: >$5.6 billion (Q3 FY25) |

What You’re Viewing Is Included

Copart BCG Matrix

The Copart BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis is ready for immediate use, offering a clear strategic overview of Copart's business units without any demo content or hidden surprises.

Dogs

Low-value wholesale units, such as those sourced from charities or municipalities, represent a segment of Copart's inventory that typically generates narrower profit margins. These vehicles, while processed, contribute less substantially to the company's overall revenue stream when contrasted with higher-value salvage or clean title vehicles.

The operational effort involved in handling these lower-tier units can be comparable to that of more profitable vehicles, yet the financial returns are diminished. This disparity in profitability can influence strategic decisions regarding resource allocation, as companies often prioritize assets that offer a more significant return on investment.

In emerging international markets, Copart's operations might initially fall into the 'dogs' category of the BCG Matrix. These regions often have less developed vehicle remarketing infrastructure and a smaller, less established buyer base, leading to lower market share and slower growth for Copart's services.

As Copart expands globally, new territories can exhibit 'dog' characteristics until the necessary groundwork is laid. This includes building robust infrastructure, cultivating a strong network of buyers, and forging solid relationships with sellers to generate the volume needed for profitable operations. For instance, in 2024, Copart continued its strategic international expansion, with some newer markets still in the early stages of development and buyer acquisition.

Any remaining legacy manual processes within Copart's operations, if not fully digitized, represent potential 'dogs' in a BCG matrix. These inefficiencies would likely consume resources without driving significant growth or market share. For instance, if any vehicle intake or title processing still requires substantial manual data entry, it would fall into this category.

Underperforming Acquired Entities

Acquired entities that don't integrate smoothly or meet projected synergies can become dogs in Copart's portfolio. These might represent niche businesses with limited growth prospects and low market share, draining resources without substantial returns.

For instance, if Copart acquired a regional auto repair chain in 2023 that struggled to adopt its national bidding platform, it could be classified as a dog. Such an entity might have seen only a 2% increase in its customer base in 2024, significantly below Copart's overall growth targets.

- Low Market Share: The acquired entity operates in a segment where it holds a minimal percentage of the total available market.

- Struggling Growth: Despite integration efforts, the acquired business shows negligible or negative revenue growth year-over-year.

- Capital Tie-up: Resources, including capital and management attention, are allocated to this underperforming asset, hindering investment in more promising areas.

- Potential Divestment: Copart might consider divesting such an entity if turnaround efforts prove unsuccessful, to reallocate capital more effectively.

Highly Specialized, Niche Vehicle Segments with Limited Volume

While Copart's strength lies in its broad inventory, certain hyper-specialized vehicle segments with consistently low transaction volumes can be categorized as 'dogs' within its business model. These might include extremely rare, custom-built vehicles or highly specific industrial machinery that appeal to a very small buyer pool.

These niche areas, despite potentially high individual sale prices, lack the consistent demand necessary to drive significant revenue or operational efficiency for Copart. For instance, a segment like specialized agricultural equipment requiring unique repair knowledge might see only a handful of sales annually across the entire platform.

Consider the market for vintage, one-off concept cars. While a single sale could be substantial, the infrequent and unpredictable nature of these listings means they don't contribute reliably to Copart's overall performance metrics. In 2023, Copart's total revenue reached $4.1 billion, demonstrating the scale of their operation where such low-volume niches represent a minimal fraction of overall transactions.

- Niche Segments: Highly specialized industrial equipment, rare vintage models.

- Low Volume: Inconsistent and limited demand restricts transaction frequency.

- Operational Focus: Insufficient volume may not warrant dedicated marketing or resources.

- Financial Impact: Minimal contribution to overall revenue compared to core segments.

Dogs in Copart's BCG Matrix represent business units or inventory segments with low market share and low growth potential. These are often characterized by low profitability and can consume resources without generating significant returns.

Examples include newer international markets still establishing infrastructure and buyer bases, or niche vehicle segments with consistently low transaction volumes. Copart's continued international expansion in 2024 means some of these newer territories are still developing their market share and growth trajectory.

Any remaining manual processes or poorly integrated acquisitions can also fall into the 'dog' category, draining resources. For instance, an acquired business showing only a 2% customer base increase in 2024 would be a prime example of a dog.

While these units don't contribute significantly to growth, Copart's strategy often involves managing them efficiently or considering divestment to reallocate capital to more promising areas, ensuring overall operational health.

Question Marks

Copart's strategic push into emerging European markets like Germany and Spain signifies a calculated move towards high-growth potential regions where its market share is still developing. These territories demand substantial capital for new facilities, forging local alliances, and robust brand development to effectively tap into the burgeoning salvage market. For instance, in 2024, Copart continued its European expansion, with significant investment earmarked for infrastructure in key markets, aiming to solidify its presence and capture a larger slice of the increasing demand for vehicle salvage services.

Copart's foray into clean title vehicle remarketing marks a strategic pivot beyond its traditional salvage operations. This expanding segment, serving dealerships, rental agencies, and private sellers, is poised for significant growth, mirroring the dynamic shifts in the overall used car market. For instance, the U.S. used car market saw robust activity in 2023, with millions of vehicles changing hands, presenting a substantial opportunity for clean title remarketing services.

While the clean title segment offers high growth potential, Copart's market share here may still be developing compared to its established dominance in salvage. This presents a classic "question mark" scenario within the BCG matrix, where significant investment is needed to capture a larger piece of this expanding pie. By doubling down on infrastructure and marketing for clean title sales, Copart can aim to solidify its position and drive future revenue streams.

Copart's acquisition of Purple Wave in 2018 for $270 million marked a strategic move into the heavy and farm equipment auction sector. This segment, while showing promise, is still being integrated into Copart's established online auction model, suggesting it's currently a Question Mark. Copart's ability to scale Purple Wave's operations using its advanced technology and extensive buyer network will be crucial for its future success.

New Technology-Driven Service Offerings (e.g., advanced AI features)

Copart's commitment to new technology, particularly advanced AI features, positions its service offerings as potential stars in the BCG matrix. These initiatives, like their AI-driven valuation tools and enhanced customer engagement platforms, represent high-growth areas for the company. For instance, in 2024, Copart continued to refine its proprietary bidding technology, which leverages AI to optimize auction dynamics and pricing, aiming to increase both seller realization and buyer satisfaction.

The impact of these AI-driven services on market share is still unfolding, making them a critical area for continued investment. Copart's focus on improving operational efficiency and the overall customer journey through these advanced features is designed to capture a larger portion of the evolving digital automotive remarketing market. The company's ongoing development in this space is key to transitioning these offerings from question marks to market leaders.

- AI-Powered Valuation: Enhancing accuracy and speed in vehicle appraisal.

- Predictive Analytics: Forecasting market trends and demand for specific vehicle types.

- Customer Engagement Tools: Utilizing AI to personalize buyer and seller interactions.

- Operational Efficiency: Streamlining auction processes and backend operations through AI.

Response to EV Remarketing Challenges and Opportunities

The increasing number of electric vehicles (EVs) entering the used car market creates a complex situation for remarketing firms like Copart. While this segment is expanding rapidly, concerns about battery degradation, swift technological upgrades, and unpredictable resale values position Copart's EV remarketing strategy as a 'Question Mark' in the BCG matrix.

Copart must adapt its services and leverage its expertise to navigate this dynamic EV landscape. This adaptation is crucial for sustained growth and capitalizing on the opportunities presented by the EV revolution.

- Battery Health Assessment: Developing robust methods to accurately assess and certify EV battery health is paramount. This will build buyer confidence and stabilize residual values.

- Technological Adaptation: Investing in training and equipment for handling and remarketing newer EV technologies, including advanced charging systems and software updates, is essential.

- Market Data Analysis: Continuously monitoring and analyzing EV residual value trends, demand patterns, and buyer preferences will inform pricing and marketing strategies.

- Partnerships: Collaborating with EV manufacturers, battery recyclers, and charging infrastructure providers can create integrated remarketing solutions and address potential buyer concerns.

Question Marks represent business areas with low market share in high-growth industries. Copart's expansion into new geographic regions and its growing clean title remarketing segment exemplify this category. These ventures require significant investment to build market presence and capitalize on future growth potential.

The company's strategic acquisitions, like Purple Wave, also fall into this quadrant as they are integrated into Copart's broader operational framework. Similarly, navigating the nascent electric vehicle remarketing market presents a classic Question Mark scenario due to its rapid evolution and uncertain long-term value.

Copart's investment in AI-driven technologies, while holding star potential, currently operates as a Question Mark as their market impact is still being established. The success of these Question Marks hinges on strategic capital allocation and effective execution to convert them into market leaders.

| Business Area | Industry Growth | Market Share | BCG Quadrant | Strategic Focus |

| European Expansion | High | Low | Question Mark | Investment in infrastructure, brand building |

| Clean Title Remarketing | High | Developing | Question Mark | Strengthening operations, marketing |

| Purple Wave Acquisition | Medium | Developing | Question Mark | Integration, scaling operations |

| EV Remarketing | High | Low | Question Mark | Developing assessment tools, market analysis |

| AI-Driven Services | High | Developing | Question Mark | Continued R&D, market penetration |

BCG Matrix Data Sources

Our Copart BCG Matrix leverages comprehensive data from internal sales figures, auction performance metrics, and vehicle acquisition costs to accurately represent market position and potential.