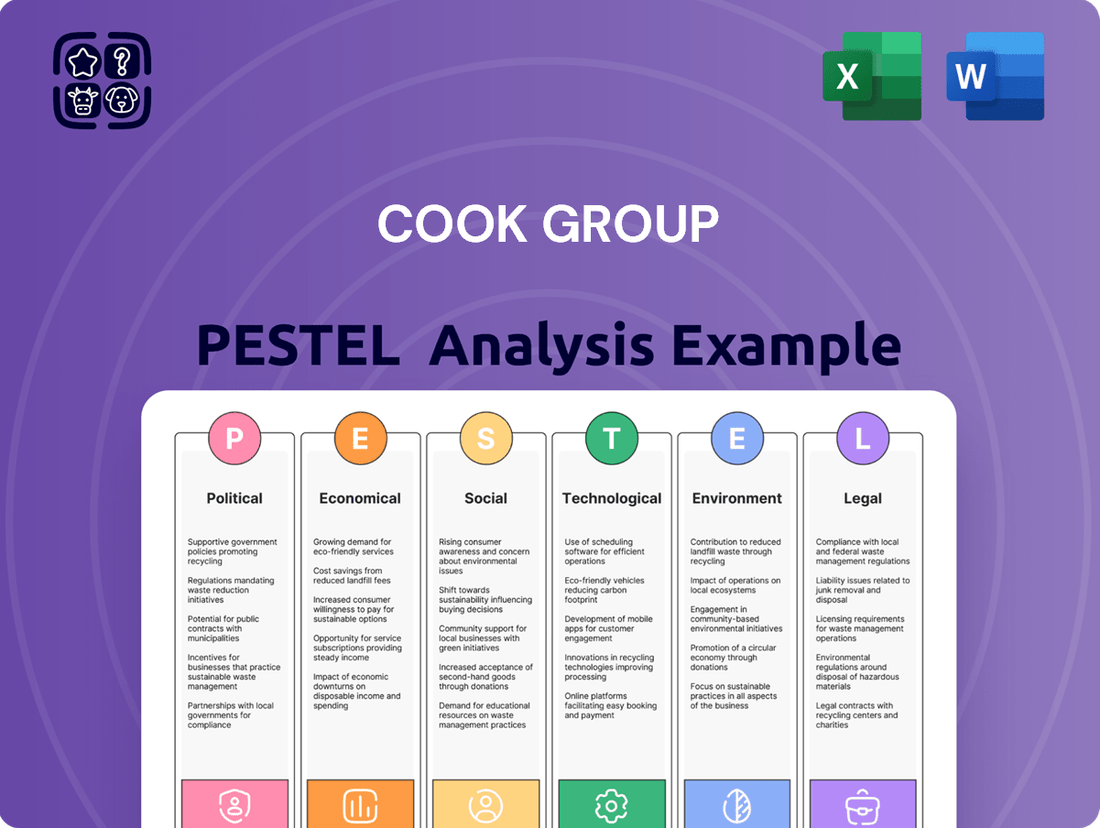

Cook Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cook Group Bundle

Navigate the complex external forces shaping Cook Group's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic decisions. Gain a competitive advantage by leveraging these expert-level insights to inform your own market strategy. Download the full version now for actionable intelligence.

Political factors

Government healthcare policies, such as those influencing Medicare reimbursement rates and Affordable Care Act marketplace premium tax credits, directly shape patient access to medical devices. For instance, the Centers for Medicare & Medicaid Services (CMS) finalized a Medicare Physician Fee Schedule for 2024 that included adjustments impacting device utilization. Cook Group must closely track these policy shifts, as changes in administrative priorities can alter funding allocations and regulatory frameworks, affecting the company's market access and reimbursement strategies.

The regulatory environment for medical devices, overseen by agencies like the US Food and Drug Administration (FDA) and the European Union's Medical Device Regulation (MDR), significantly impacts companies like Cook Group. These regulations are designed to ensure patient safety and product efficacy, demanding rigorous testing and documentation. For instance, the EU MDR, fully implemented in 2021, imposed stricter requirements, with a transition period extending into 2028 for certain legacy devices, requiring substantial investment and adaptation from manufacturers.

Cook Medical, like its peers, is navigating these evolving standards, notably transitioning its product portfolio to comply with the EU MDR. This process involves re-certifying existing devices and ensuring new products meet the heightened demands for clinical evidence, post-market surveillance, and transparency. The cost of compliance for the EU MDR alone is estimated to be billions of euros across the industry, highlighting the financial and operational challenges involved.

Furthermore, discussions around modernizing regulatory pathways, such as the FDA's 510(k) process, indicate a continuous need for adaptation. Proposed updates aim to streamline approvals while maintaining safety, reflecting an ongoing effort to balance innovation with robust oversight. Companies must remain vigilant, investing in regulatory affairs expertise and quality management systems to ensure ongoing compliance and market access.

Global trade policies and evolving international relations significantly influence the supply chain and market access for medical devices. For instance, the World Trade Organization (WTO) reported that global trade growth slowed to 0.9% in 2023, down from 5.3% in 2022, highlighting increasing protectionist tendencies. These shifts can directly impact the cost of raw materials and the efficient distribution of Cook Group's products across diverse international markets.

Macroeconomic pain points, such as the imposition of tariffs or broader geopolitical realignments, present tangible challenges. For example, the US-China trade tensions have led to increased tariffs on various goods, potentially affecting component costs. Navigating these complex international dynamics is crucial for maintaining a resilient and cost-effective global supply chain for Cook Group.

Political Stability in Key Markets

Political stability in key markets is crucial for Cook Group's operations. For instance, the United States, a major market for Cook Medical, maintained a relatively stable political landscape throughout 2024, though election cycles always introduce some degree of uncertainty regarding future healthcare policy.

Conversely, regions experiencing political upheaval can significantly impact business. In parts of Europe where Cook Group has a presence, shifts in government or geopolitical tensions can lead to unpredictable changes in regulatory frameworks and healthcare funding, directly affecting sales and supply chain reliability.

Cook Group's global strategy necessitates a keen understanding of these varying political risks. For example, the company's significant sales in Asia Pacific require monitoring political stability in countries like Australia and Japan, which generally offer stable environments, alongside emerging markets where political volatility might pose greater challenges.

- United States: Continued political stability in 2024, with ongoing debates on healthcare reform impacting potential market access and reimbursement.

- Europe: Varied political stability across member states, with some nations implementing significant healthcare budget adjustments in response to economic conditions.

- Asia Pacific: Generally stable political environments in developed markets like Japan and South Korea, contrasted with potential policy shifts in rapidly developing economies.

Lobbying and Advocacy by Industry Groups

Industry groups are a powerful force in shaping healthcare policy through active lobbying. These organizations advocate for favorable legislation and funding, directly impacting the operational landscape for companies like Cook Group. For 2025, a significant focus for healthcare sector lobbying includes advocating for the continuation of expanded Medicare telehealth flexibilities, a trend accelerated by recent public health events. Additionally, reversing anticipated Medicare payment reductions remains a high priority, as these cuts could significantly affect revenue streams for medical device manufacturers and providers alike.

Cook Group, as a prominent entity in the medical device industry, has a vested interest in these lobbying efforts. By participating in or benefiting from industry advocacy, Cook Group can help shape policies that support innovation and market access for its products. For instance, the continued expansion of telehealth services can create new avenues for remote patient monitoring and the deployment of advanced medical devices. The success of these lobbying initiatives directly correlates with the ability of companies like Cook Group to navigate the complex regulatory environment and secure fair reimbursement rates.

Key lobbying priorities for the healthcare sector in 2025 highlight specific areas of concern and opportunity:

- Extending Medicare Telehealth Flexibilities: Continued access to telehealth services is crucial for patient care and the adoption of remote monitoring technologies, a market segment where Cook Group has a significant presence.

- Reversing Medicare Pay Cuts: Proposed cuts to Medicare reimbursement rates for physicians and suppliers pose a direct financial risk, necessitating strong advocacy to maintain stable revenue for medical device companies.

- Influencing Regulatory Approval Pathways: Lobbying efforts also aim to streamline and ensure predictable regulatory processes for new medical technologies, which is vital for Cook Group's product pipeline and market entry.

Government policies, particularly those concerning healthcare funding and regulation, directly influence Cook Group's operational landscape. For 2024, adjustments to Medicare reimbursement rates, as seen in the finalized Physician Fee Schedule, continue to shape how medical devices are utilized and compensated. Furthermore, ongoing debates around healthcare reform and the potential impact of election cycles in key markets like the United States introduce an element of policy uncertainty that necessitates close monitoring.

The global regulatory environment remains a critical political factor, with agencies like the FDA and the EU's MDR imposing stringent requirements. The EU MDR, a significant undertaking for the industry, continues its phased implementation, demanding substantial investment in compliance and data generation from manufacturers like Cook Group. These evolving standards underscore the need for robust regulatory affairs strategies to ensure continued market access.

Industry lobbying plays a pivotal role in shaping healthcare policy, with organizations advocating for favorable legislation. For 2025, key priorities include extending Medicare telehealth flexibilities and reversing proposed Medicare payment reductions, both of which directly impact revenue streams and market opportunities for medical device companies. These advocacy efforts are crucial for navigating the complex policy environment.

Political stability across Cook Group's diverse global markets is paramount. While developed markets like Japan and Australia generally offer stable environments, emerging economies may present greater political volatility. Monitoring these geopolitical shifts is essential for maintaining resilient supply chains and predictable market access, especially given the slowing global trade growth reported by the WTO for 2023.

What is included in the product

This PESTLE analysis of the Cook Group examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

The global economic outlook significantly influences healthcare sector investment. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, impacting discretionary healthcare spending. A stable global economy typically encourages higher healthcare expenditures and greater adoption of innovative medical devices by both public and private sectors.

Economic instability, however, presents challenges. A projected global growth rate of 2.8% for 2025, according to the IMF's April 2025 World Economic Outlook, suggests a cautious environment. This can translate to more constrained healthcare budgets, potentially delaying or reducing investments in new technologies and affecting patient demand for elective medical procedures.

Healthcare spending is a critical economic factor. In 2024, global healthcare spending is projected to reach $11.3 trillion, a significant increase driven by an aging population and advancements in medical technology. This trend directly impacts demand for medical devices, as healthcare systems allocate resources to patient care.

The shift towards value-based care and alternative payment models is reshaping how medical device manufacturers are reimbursed. These models prioritize cost-effectiveness and patient outcomes, compelling companies like Cook Group to prove the economic advantages of their minimally invasive products. For instance, demonstrating reduced hospital stays or fewer complications can justify higher upfront costs.

The growing emphasis on digital patient engagement also presents financial opportunities. By adopting digital tools for remote monitoring and patient support, healthcare providers can achieve cost savings through improved adherence and fewer readmissions. This financial benefit encourages investment in innovative digital solutions within the medical device sector.

Inflationary pressures, especially on essential materials like plastics, resins, and metals, directly increase the manufacturing costs for medical devices. These rising input costs are a significant concern for companies like Cook Group.

The MedTech sector faced considerable cost hikes in 2024, with raw materials and labor becoming more expensive. This trend directly impacts operational expenses and the overall financial health of companies in this industry.

For Cook Group, effectively managing these escalating raw material and labor costs is crucial to sustaining profitability and ensuring their products remain competitively priced in the market.

Currency Exchange Rates

Currency exchange rates present a significant economic factor for a global entity like Cook Group. Fluctuations can directly impact the cost of raw materials sourced internationally and the final revenue generated from sales in different countries. For instance, a stronger US dollar in 2024-2025 might make Cook Group's imported components more expensive, while simultaneously reducing the dollar value of profits earned in weaker currency markets.

The volatility of major currency pairs, such as the Euro/USD or Yen/USD, directly influences Cook Group's financial performance. A sudden depreciation of a key market's currency could significantly erode the reported earnings from that region when converted back to the group's reporting currency. Strategic hedging and diversification of financial operations are therefore crucial to buffer against these inherent currency risks.

- Impact on Costs: In early 2025, a 5% strengthening of the Swiss Franc against the USD could increase the cost of specialized medical components sourced from Switzerland by that same margin.

- Impact on Revenue: Conversely, if the Brazilian Real weakens by 7% against the USD in late 2024, Cook Group's sales revenue in Brazil, when translated to USD, would be lower.

- Financial Performance: For a company with substantial international sales, like Cook Group, managing these currency exposures is paramount to maintaining stable and predictable financial results.

Market Competition and Pricing Pressures

The medical device sector, a key arena for Cook Group, is characterized by fierce competition, driving continuous innovation and a relentless pursuit of cost-efficiency. This dynamic environment means that even as the global medical device market is expected to expand, reaching an estimated USD 679.1 billion in 2024 and projected to grow to USD 936.3 billion by 2029, companies like Cook Group face significant pricing pressures. The need to remain competitive often translates into tighter margins.

Cook Group's strategic maneuvers, including the divestment of specific product lines, underscore a deliberate strategy to concentrate resources on segments where it can not only compete effectively but also achieve meaningful growth and deliver substantial patient benefits. This focus is crucial for navigating the intense rivalry and potential price erosion inherent in a rapidly evolving market.

- Intense Competition: The medical device market sees numerous players vying for market share, fostering innovation but also leading to price wars.

- Innovation Drive: Companies must constantly invest in R&D to develop new and improved products, adding to operational costs.

- Cost-Effectiveness Demand: Healthcare providers and payers increasingly demand devices that offer both efficacy and affordability.

- Market Growth vs. Pressure: While the global medical device market is expanding, this growth attracts more competition, intensifying pricing challenges.

Economic factors significantly shape the landscape for companies like Cook Group. Global economic growth, projected by the IMF to be 3.2% in 2024 and 2.8% in 2025, influences healthcare spending and investment in medical technology. Inflationary pressures, particularly on raw materials, directly impact manufacturing costs, as seen with rising expenses for plastics and metals in 2024. Currency exchange rate volatility also poses a challenge, affecting both the cost of international components and the value of overseas earnings.

| Economic Factor | 2024 Impact/Projection | 2025 Projection | Relevance to Cook Group |

|---|---|---|---|

| Global GDP Growth | IMF: 3.2% | IMF: 2.8% | Influences overall healthcare spending and investment |

| Global Healthcare Spending | Projected $11.3 trillion | Continued growth expected | Drives demand for medical devices |

| Inflation (Raw Materials) | Significant cost increases | Continued pressure expected | Increases manufacturing costs, impacts margins |

| Currency Exchange Rates | Volatile, USD strengthening potential | Continued volatility | Affects cost of imported materials and value of foreign sales |

Full Version Awaits

Cook Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Cook Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

The world's population is getting older, and with age comes a higher chance of developing long-term health issues. For instance, by 2050, the number of people aged 65 and over is projected to reach 1.6 billion globally, a significant jump from the 761 million recorded in 2021. This demographic shift directly fuels the demand for medical devices that help manage conditions like heart disease, diabetes, and arthritis, areas where Cook Group has a strong presence.

This growing elderly population means more people need ongoing care and advanced treatments. Cook Group's commitment to developing innovative solutions, particularly in areas like minimally invasive surgery and chronic disease management, positions them well to meet this increasing need. Their product lines are designed to improve patient outcomes and quality of life for those managing long-term health challenges.

Patients are increasingly seeking out medical treatments that involve less disruption to their lives. This means procedures that require smaller incisions, lead to quicker healing, and allow for shorter hospital visits are becoming the preferred choice. For instance, a 2024 survey indicated that over 70% of patients would opt for a minimally invasive surgery if available and equally effective as a traditional open procedure.

This shift in patient preference directly benefits companies like Cook Group, which specializes in developing and supplying a comprehensive portfolio of minimally invasive medical devices. From catheters and stents to advanced surgical instruments, Cook Group's product lines are well-positioned to capitalize on this growing demand. In 2023, the global minimally invasive surgical instruments market was valued at approximately $25 billion and is projected to grow significantly, underscoring the market's responsiveness to patient desires.

Societal emphasis on healthcare accessibility and equity directly shapes the development and distribution strategies for medical devices. This means companies like Cook Group must consider how their innovations reach diverse populations, including those in remote or underserved areas. For instance, the World Health Organization reported in 2023 that over 65% of countries faced shortages of healthcare workers, highlighting the need for technologies that can extend care capabilities.

Cook Group's stated mission to improve patient care worldwide naturally aligns with this societal focus. Their commitment suggests an ongoing effort to ensure their life-saving technologies are not only effective but also accessible to a broader global patient base. This often translates into exploring cost-effective solutions and distribution models that can cater to varying economic realities, a crucial factor as global healthcare spending is projected to reach $10 trillion by 2025.

Public Trust in Medical Devices and Healthcare Systems

Public trust in healthcare systems and medical devices is a cornerstone of patient engagement and market acceptance. Recent surveys indicate that while many individuals remain confident in their healthcare providers, specific events can significantly shift public perception. For instance, a 2024 report highlighted that only 65% of consumers expressed high confidence in the safety of all medical devices, a notable decrease from previous years, directly impacting adoption rates for new technologies.

Cook Group's proactive stance on quality assurance and patient safety is therefore paramount. By consistently demonstrating rigorous testing protocols and transparent communication regarding device performance, Cook Group can mitigate the erosion of trust that often follows safety concerns. This commitment is crucial, especially as regulatory bodies like the FDA continue to enhance post-market surveillance, demanding greater accountability from manufacturers.

Maintaining and building this essential trust requires a multifaceted approach:

- Enhanced Transparency: Openly sharing data on clinical trials, adverse events, and product recalls fosters credibility.

- Robust Quality Management: Adherence to stringent manufacturing standards, such as ISO 13485, assures patients and clinicians of device reliability.

- Patient-Centric Communication: Clear, accessible information about device benefits and risks empowers informed decision-making.

- Proactive Engagement: Collaborating with patient advocacy groups and healthcare professionals builds a stronger, more trusting relationship.

Workforce Trends and Talent Acquisition

Workforce shortages, especially in nursing and specialized healthcare roles, present a significant hurdle for the healthcare sector. For instance, the Association of American Medical Colleges projected a shortage of between 37,800 and 124,000 physicians by 2034 in the United States. This scarcity directly influences patient care quality and escalates the need for technological solutions that boost operational efficiency. Cook Group’s proactive approach to employee development and community engagement is crucial for securing and keeping skilled professionals in this highly competitive landscape.

Cook Group actively addresses talent acquisition challenges through various initiatives.

- Investing in Workforce Development: Programs aimed at training and upskilling employees, particularly in areas facing shortages.

- Competitive Compensation and Benefits: Offering attractive packages to draw top talent in a competitive market.

- Community Engagement: Building strong ties with local educational institutions and communities to foster a pipeline of future healthcare professionals.

- Focus on Employee Retention: Implementing strategies to ensure a positive work environment and career growth opportunities, thereby reducing turnover.

Societal trends like an aging global population and a growing preference for less invasive medical procedures directly benefit Cook Group's product portfolio. For example, the global minimally invasive surgical instruments market reached approximately $25 billion in 2023, a figure expected to rise as patient demand for quicker recovery times continues to increase.

Technological factors

Technological advancements are reshaping the medical device landscape. Innovations in artificial intelligence, robotics, and 3D printing are becoming increasingly prevalent, promising to revolutionize patient care through predictive analytics, tailored treatments, and improved diagnostic tools.

Cook Group is actively engaging with these transformative technologies. The company's establishment of an iMRI division and its partnerships in handheld robotics underscore a strategic focus on integrating these cutting-edge developments into its product offerings and operational strategies.

The healthcare landscape is rapidly evolving with the widespread adoption of digital health technologies. Wearable devices, like smartwatches and continuous glucose monitors, are becoming commonplace, offering real-time health data. Telemedicine platforms are also expanding, allowing for remote consultations and care, a trend that saw significant acceleration during the COVID-19 pandemic, with a reported 63% increase in virtual visits in 2020, according to McKinsey & Company.

These advancements present a significant opportunity for companies like Cook Group. Integrating their medical devices into these connected care ecosystems can unlock new avenues for patient monitoring and engagement. For instance, enabling Cook's devices to seamlessly share data with telemedicine platforms or patient portals could lead to more proactive interventions and personalized treatment plans.

By focusing on interoperability and data integration, Cook Group can position its products to thrive in this connected care environment. This strategic alignment could not only enhance patient outcomes by providing continuous health insights but also streamline healthcare delivery, making processes more efficient for both providers and patients. The global digital health market was valued at approximately $211 billion in 2022 and is projected to grow substantially, highlighting the immense potential for innovation and market penetration.

Cook Group's commitment to R&D is a cornerstone of its strategy in the dynamic medical device industry. This continuous investment fuels the development of groundbreaking products and enhances existing offerings, directly addressing critical patient needs. For instance, the company's strategic investment in Zenflow, a company focused on minimally invasive treatments for benign prostatic hyperplasia, underscores its dedication to pioneering new solutions.

Intellectual Property Protection

Protecting intellectual property is paramount for medical device innovators like Cook Group, especially considering the substantial R&D expenditures. Patents and other IP mechanisms shield Cook Group's novel designs and technologies from unauthorized use, enabling the company to recoup its development investments. This robust protection is fundamental to maintaining its competitive edge in the market.

The strength of intellectual property protection directly influences a company's ability to innovate and invest. For instance, the global patent landscape is constantly evolving, with ongoing discussions and potential changes to international IP treaties that could impact companies operating across multiple jurisdictions. In 2023, the United States Patent and Trademark Office (USPTO) reported over 600,000 utility patent applications, underscoring the competitive environment for new inventions.

- Patent Portfolio Strength: Cook Group's extensive patent portfolio safeguards its proprietary technologies, from advanced catheter designs to innovative surgical tools, preventing competitors from replicating its innovations.

- R&D Investment Justification: Strong IP protection provides the necessary assurance for continued, significant investment in research and development, which is critical for staying at the forefront of medical technology.

- Market Exclusivity: Patents grant Cook Group a period of market exclusivity, allowing it to capture market share and generate revenue from its unique product offerings without immediate competition.

- Licensing Opportunities: Intellectual property can also be a source of revenue through licensing agreements, further enhancing the financial returns on innovation.

Cybersecurity and Data Privacy in Medical Technology

The increasing reliance on digital health technologies, like those Cook Group develops, brings cybersecurity and data privacy to the forefront. With medical devices transmitting sensitive patient information, robust security is paramount to prevent breaches and safeguard data. For instance, the global cybersecurity market for healthcare is projected to reach $60.2 billion by 2027, highlighting the critical need for strong defenses.

Cook Group must prioritize implementing and continually updating stringent cybersecurity protocols. This is essential not only for protecting patient safety and maintaining the integrity of medical devices but also for preserving the trust patients and healthcare providers place in their connected technologies. A significant data breach could lead to substantial financial penalties and irreparable damage to the company's reputation.

- Cybersecurity Investment: Companies in the medtech sector are significantly increasing their cybersecurity budgets. In 2024, many are allocating 10-15% of their IT spending to cybersecurity measures.

- Regulatory Landscape: Stricter data privacy regulations, such as GDPR and CCPA, impose heavy fines for non-compliance, making robust data protection a business imperative.

- Patient Trust: A strong track record in data security is directly linked to patient and clinician confidence in digital health solutions.

Technological advancements are rapidly transforming medical devices, with AI, robotics, and 3D printing driving innovation in patient care. Cook Group is actively integrating these technologies, evident in its iMRI division and handheld robotics partnerships, reflecting a strategic commitment to cutting-edge solutions.

Legal factors

Cook Group navigates a complex legal landscape, with compliance to medical device regulations like the EU MDR and FDA requirements being a constant, critical task. These extensive rules govern every stage of a product's life, from initial design and manufacturing processes to how it's labeled and monitored after it reaches the market.

Failure to adhere to these stringent regulations can result in severe consequences, including substantial fines, mandatory product recalls that disrupt supply chains, and significant damage to Cook Group's hard-earned reputation. For instance, in 2023, the FDA issued over $1.5 billion in fines related to medical device non-compliance, highlighting the financial risks involved.

Medical device companies like Cook Group are continually exposed to product liability claims and litigation, a significant legal challenge. These lawsuits can arise from alleged defects in design, manufacturing, or marketing of their products.

Cook Group has demonstrated its capacity to navigate intricate legal battles, notably through its experience with asbestos-related wrongful death cases. The company has achieved successful defense outcomes in these complex litigations, showcasing its legal acumen.

To effectively manage these inherent legal risks, Cook Group must maintain stringent quality control measures, ensure precise product labeling, and implement sophisticated legal defense strategies. These proactive steps are crucial for mitigating potential liabilities and protecting the company's reputation and financial stability.

Intellectual property laws are crucial for safeguarding Cook Group's technological advancements and competitive edge. This encompasses patents on their innovative minimally invasive surgical devices and the brand recognition secured by their trademarks.

The company's commitment to R&D, evidenced by its significant investment in new product development, relies heavily on robust patent protection. For instance, in 2023, Cook Medical reported substantial patent filings aimed at securing novel technologies in areas like endovascular repair and advanced surgical instrumentation.

Legal disputes concerning intellectual property can be financially draining and protracted. Therefore, Cook Group prioritizes strong IP strategies, including proactive patent enforcement and defense, to maintain its market leadership and protect its valuable innovations from infringement.

Data Protection and Privacy Laws (e.g., GDPR, HIPAA)

The increasing reliance on digital health technologies by Cook Group necessitates strict adherence to data protection and privacy regulations, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). These laws are critical for safeguarding sensitive patient information, dictating how data is collected, stored, and utilized to maintain confidentiality and security. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial risks of non-compliance. HIPAA violations can also incur significant penalties, with fines ranging from $100 to $50,000 per violation, capped at $1.5 million annually for repeat offenses. Failure to comply not only exposes Cook Group to substantial financial penalties but also erodes patient trust, a critical asset in the healthcare sector.

Cook Group must navigate a complex web of evolving data privacy requirements globally. The digital transformation in healthcare, accelerated by advancements in AI and remote patient monitoring, amplifies the importance of robust data governance. In 2023, the global data privacy management market was valued at approximately $1.7 billion and is projected to grow significantly, reflecting the increasing regulatory scrutiny and corporate investment in compliance. This trend suggests that Cook Group will need to continuously invest in and update its data protection frameworks to remain compliant and competitive.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- HIPAA Penalties: Ranging from $100 to $50,000 per violation, with annual caps.

- Market Growth: Global data privacy management market projected for substantial growth beyond its 2023 valuation of $1.7 billion.

- Patient Trust: Non-compliance poses a significant risk to patient confidence and brand reputation.

Antitrust and Competition Laws

Cook Group, as a global entity with a broad portfolio, navigates a complex web of antitrust and competition laws across its operating regions. These regulations are designed to prevent market dominance and foster a level playing field for all businesses. For instance, in 2024, the European Union continued its robust enforcement of competition rules, with significant fines levied against companies for anti-competitive practices in various sectors, underscoring the critical need for compliance.

Strategic maneuvers like mergers, acquisitions, or divestitures undertaken by Cook Group require meticulous review to ensure they do not stifle competition or create monopolistic advantages. Regulatory bodies worldwide, such as the U.S. Federal Trade Commission (FTC) and the Directorate-General for Competition at the European Commission, actively scrutinize such transactions. In 2023, the FTC blocked several large healthcare mergers, signaling an increasingly stringent approach to maintaining competitive markets in industries relevant to Cook Group's operations.

- Global Compliance: Cook Group must adhere to varying antitrust regulations in North America, Europe, Asia, and other key markets.

- Merger Scrutiny: Acquisitions and mergers are subject to review by competition authorities to prevent undue market concentration.

- Market Practices: Laws prohibit price-fixing, bid-rigging, and abuse of dominant market positions.

- Enforcement Trends: Increased regulatory focus on digital markets and healthcare in 2024-2025 necessitates proactive compliance strategies.

Cook Group's operations are heavily influenced by healthcare and medical device legislation, demanding strict adherence to global standards. Regulatory bodies like the FDA and EMA set rigorous requirements for product safety, efficacy, and manufacturing quality. In 2024, the FDA continued its focus on post-market surveillance and cybersecurity for medical devices, with enforcement actions increasing for non-compliance.

The company faces ongoing litigation risks, particularly product liability claims stemming from device performance. Successfully managing these legal challenges requires robust quality management systems and proactive risk mitigation strategies. For example, in 2023, medical device litigation costs averaged several million dollars per case, emphasizing the financial impact of legal disputes.

Intellectual property protection is paramount for Cook Group's innovation pipeline, necessitating strong patent portfolios and defense against infringement. The company's investment in R&D, estimated to be hundreds of millions annually, is safeguarded by these legal frameworks. In 2024, patent litigation in the medical technology sector saw an uptick, with average damages awarded in successful infringement cases reaching significant figures.

Data privacy regulations, such as GDPR and HIPAA, are critical given Cook Group's increasing reliance on digital health solutions. Non-compliance carries substantial financial penalties and reputational damage. In 2025, global spending on data privacy compliance is projected to exceed $20 billion, reflecting the growing importance of these legal requirements.

| Legal Factor | Description | Impact on Cook Group | Relevant Data/Trends (2023-2025) |

| Medical Device Regulation | Compliance with FDA, EMA, and other health authority rules for product safety and efficacy. | Ensures market access, avoids fines, maintains product integrity. | FDA fines for non-compliance exceeded $1.5 billion in 2023. Increased focus on cybersecurity in 2024. |

| Product Liability | Potential lawsuits due to alleged device defects or malfunctions. | Significant financial risk, reputational damage, operational disruption. | Average medical device litigation costs in the millions per case (2023). |

| Intellectual Property | Protection of patents, trademarks, and trade secrets for innovations. | Safeguards competitive advantage, supports R&D investment. | Medical technology patent litigation saw an increase in 2024. |

| Data Privacy | Adherence to GDPR, HIPAA, and other data protection laws for patient information. | Mitigates fines, builds patient trust, ensures secure data handling. | Global data privacy compliance spending projected to exceed $20 billion in 2025. |

Environmental factors

Cook Group is actively pursuing sustainability, focusing on reducing its carbon footprint through initiatives like decarbonizing manufacturing operations. This commitment is vital for environmental responsibility and aligns with growing stakeholder demands for sustainable practices.

The company is also concentrating on improving its understanding of greenhouse gas emissions, a key step in developing effective reduction strategies. For instance, by the end of 2024, Cook Medical aimed to have a comprehensive baseline of its Scope 1 and Scope 2 emissions, a critical data point for setting future reduction targets.

Effective waste management and the adoption of circular economy principles are becoming critical for medical device manufacturers like Cook Group. This means focusing on reducing waste at the source, increasing recycling rates, and designing products that can last longer or be easily recycled. For instance, the global medical waste market was valued at approximately USD 30.5 billion in 2023 and is projected to grow, highlighting the scale of the challenge and opportunity.

Cook Group's commitment to sustainability likely translates into strategies for more responsible material sourcing and significant waste reduction across its manufacturing processes. Embracing circularity could involve initiatives like product take-back programs or using recycled content in packaging, aligning with broader industry trends that saw investments in sustainable manufacturing technologies surge in 2024.

Regulations around ethylene oxide (EtO) emissions are a significant environmental factor for Cook Group. EtO is essential for sterilizing a vast array of medical devices, and stricter controls on its release from sterilization facilities directly affect the company's operations and supply chain.

New emissions standards, such as those being implemented by the U.S. Environmental Protection Agency (EPA), can necessitate substantial capital investments in advanced emission control technologies and process modifications. For instance, the EPA's proposed regulations in 2024 aim to reduce EtO emissions from commercial sterilizers, potentially increasing operational costs for facilities that use this method.

Failure to comply with these evolving environmental regulations poses a risk to the continuous supply of sterile medical equipment, impacting Cook Group's ability to bring vital products to market. The company must proactively invest in compliant sterilization methods or emission abatement systems to mitigate these risks and ensure ongoing operational continuity.

Supply Chain Environmental Impact

The environmental impact of Cook Group's entire supply chain is a significant consideration, as businesses increasingly focus on sustainability. Cook Group is actively working with its suppliers to embed social impact and sustainability criteria into its procurement processes. This comprehensive strategy is designed to minimize the ecological footprint across its product lifecycle.

This commitment is crucial as global supply chains face scrutiny. For instance, the United Nations Environment Programme (UNEP) reported in 2024 that supply chain emissions can account for over 80% of a company's total greenhouse gas output. Cook Group's proactive engagement aims to address this by fostering a more environmentally conscious supplier network.

- Supplier Engagement: Cook Group actively collaborates with suppliers to promote environmentally responsible practices.

- Holistic Approach: The company integrates sustainability into purchasing decisions, impacting the entire supply chain.

- Footprint Reduction: The objective is to systematically decrease the environmental impact associated with product manufacturing and distribution.

Climate Change Considerations

Cook Group's approach to climate change is multifaceted, focusing on reducing greenhouse gas emissions, enhancing energy efficiency, and integrating renewable energy sources into its operational framework. This commitment is underscored by their finalized global 10-year Decarbonization Strategy, which outlines specific, measurable goals and targets designed to lessen their environmental impact and foster more resilient infrastructure.

The company's strategy acknowledges the urgency of climate action. For instance, in 2024, Cook Group aimed to achieve a 15% reduction in Scope 1 and Scope 2 emissions compared to their 2020 baseline, with a target of 30% by 2030. This aligns with broader industry trends and regulatory pressures pushing for sustainable business practices.

- Decarbonization Strategy: A 10-year global plan with defined emission reduction targets.

- Renewable Energy Adoption: Increasing the use of solar and wind power across facilities.

- Energy Efficiency Improvements: Implementing technologies to reduce overall energy consumption.

- Resilience Building: Investing in infrastructure upgrades to withstand climate-related disruptions.

Cook Group's environmental strategy includes robust decarbonization efforts, targeting a 15% reduction in Scope 1 and 2 emissions by the end of 2024 against a 2020 baseline. The company is also focusing on waste reduction and circular economy principles, recognizing the significant global medical waste market, valued at approximately USD 30.5 billion in 2023.

Stricter regulations on ethylene oxide (EtO) emissions, like those proposed by the EPA in 2024, necessitate investments in advanced emission control technologies, impacting sterilization processes. Furthermore, Cook Group is addressing supply chain emissions, which can represent over 80% of a company's total greenhouse gas output, by integrating sustainability criteria into procurement.

| Environmental Focus Area | 2024 Target/Status | 2023 Market Data | Future Outlook |

|---|---|---|---|

| Scope 1 & 2 Emissions Reduction | 15% reduction vs. 2020 baseline | N/A | Target of 30% reduction by 2030 |

| Waste Management & Circularity | Focus on source reduction, recycling | Global medical waste market: ~USD 30.5 billion | Growth in sustainable manufacturing investments |

| Ethylene Oxide (EtO) Emissions | Compliance with new EPA standards | N/A | Potential for increased operational costs |

| Supply Chain Emissions | Integrating sustainability into procurement | Supply chain emissions can be >80% of total GHG output | Increased scrutiny on global supply chains |

PESTLE Analysis Data Sources

Our PESTLE analysis for Cook Group is meticulously constructed using a blend of public and proprietary data sources. This includes official government publications, reputable industry market research reports, and economic databases, ensuring a comprehensive and relevant understanding of the macro-environmental factors impacting the healthcare sector.