Cook Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cook Group Bundle

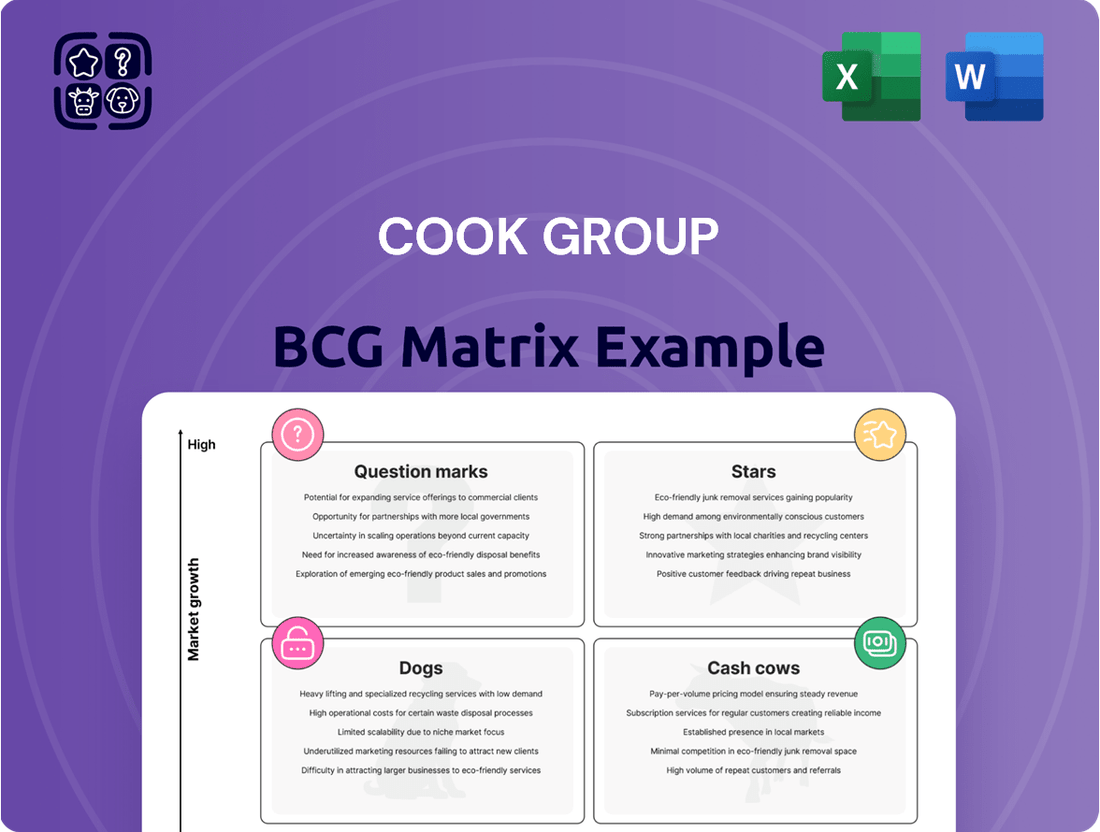

Unlock the strategic power of the Cook Group BCG Matrix and understand the true potential of their product portfolio. This essential tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of market share and growth potential. Don't miss out on the detailed quadrant analysis and actionable insights that will guide your investment decisions.

Ready to transform your strategic planning? Purchase the full Cook Group BCG Matrix for a comprehensive breakdown of each product's position, complete with data-driven recommendations. This is your key to optimizing resource allocation and driving future growth.

Stars

The Zenith Iliac Branch Device, a recent innovation from Cook Medical, is poised to be a star in the BCG matrix. Its FDA approval in July 2025 and subsequent US commercialization mark a significant entry into the high-growth endovascular treatment market for aortoiliac and iliac aneurysms.

This specialized device targets a clear unmet need, enabling complex endovascular repair of these challenging vascular conditions. Its innovative design and the growing prevalence of aneurysmal disease suggest strong adoption rates and rapid market share gains, solidifying its star status.

The Instinct Plus Endoscopic Clipping Device, a recent US market entrant from Cook Group, represents a significant advancement in endoscopic technology. Its enhanced design promises a more intuitive and responsive user experience, suggesting a strong competitive edge.

With its improved functionality, the Instinct Plus is well-positioned to capitalize on the growing endoscopic device market. This sector, valued at billions globally, is experiencing consistent growth driven by minimally invasive procedures, making new, innovative products like the Instinct Plus highly attractive.

Cook Medical's introduction of Magneto holmium laser systems, including 100 W and 150 W models, targets the burgeoning field of laser-assisted medical treatments. This strategic move places Cook within a high-growth segment of the medical device market.

The Magneto technology signifies Cook's commitment to innovation, offering advanced capabilities that could lead to substantial market share gains. Analysts project the global medical laser market to reach over $20 billion by 2028, indicating significant opportunity.

Zenith Alpha Thoracic 2

The Zenith Alpha Thoracic 2, launched in the US in March 2025, represents a significant advancement in thoracic endovascular grafting.

This new generation device is positioned to bolster Cook Group's standing in the dynamic cardiovascular intervention market, a sector experiencing robust growth.

The product targets a substantial and expanding patient demographic requiring advanced thoracic repair solutions.

Its introduction is expected to contribute to Cook's market share in a critical medical technology segment.

- Product: Zenith Alpha Thoracic 2

- Launch Date (US): March 2025

- Market Segment: Thoracic Endovascular Grafting

- Strategic Goal: Strengthen leadership in cardiovascular interventions

Next-Generation Cardiovascular Devices

Cook Medical's focus on next-generation cardiovascular devices positions them strongly in a market projected for robust growth. The company's commitment to research and development is evident in their pipeline of advanced products. For instance, the global cardiovascular devices market was valued at approximately $120 billion in 2023 and is anticipated to reach over $180 billion by 2028, growing at a CAGR of around 8.5%.

- Market Leadership: New devices are engineered to capture and sustain market share in the rapidly evolving cardiovascular sector.

- Growth Driver: These innovations are considered a primary engine for Cook Group's future revenue and expansion.

- R&D Investment: Significant investment in R&D fuels the development of these cutting-edge cardiovascular solutions.

- Market Demand: The introduction aligns with increasing global demand for minimally invasive and effective cardiac treatments.

The Zenith Iliac Branch Device, Instinct Plus Endoscopic Clipping Device, and Magneto holmium laser systems are all positioned as Stars within Cook Group's portfolio. These products operate in high-growth markets with significant potential for market share expansion. Their innovative features and alignment with current medical trends suggest they will be strong revenue generators for the company.

| Product | Market Segment | Growth Outlook | Strategic Importance |

| Zenith Iliac Branch Device | Endovascular Treatment | High (addressing unmet need) | New market entry, potential leader |

| Instinct Plus Endoscopic Clipping Device | Endoscopic Devices | Strong (driven by minimally invasive procedures) | Enhancing competitive edge |

| Magneto Holmium Laser Systems | Medical Laser Treatments | High (burgeoning field) | Innovation driver, market share gains |

What is included in the product

The Cook Group BCG Matrix analyzes product/business unit performance based on market share and growth.

Quickly identify underperforming "Dogs" and resource-draining "Cash Cows" to reallocate capital.

Cash Cows

The Zilver PTX Drug-Eluting Stent from Cook Group is a prime example of a Cash Cow within the BCG Matrix. Its established market dominance, evidenced by real-world data from March 2025 indicating superior performance with lower in-stent occlusion rates compared to competitors, solidifies its position. This proven efficacy translates into consistent and reliable revenue generation.

With a significant market share in a mature segment, the Zilver PTX stent benefits from high demand and established customer loyalty. Its strong brand recognition and consistent performance make it a dependable source of income for Cook Group, requiring minimal investment for continued success.

Cook Medical's established peripheral interventional products represent significant cash cows within its BCG matrix. These products, deeply entrenched in mature markets, benefit from high market share and widespread clinical adoption, consistently delivering robust cash flows. For instance, in 2024, the global peripheral vascular devices market, a key segment for these products, was valued at approximately $18.5 billion, with Cook Medical holding a notable presence.

The Resonance Metallic Ureteral Stent, a product within Cook Group's portfolio, functions as a classic cash cow. Its consistent contribution to the company's cash flow is supported by a stable market.

A key indicator of its strength is a published report from April 2024, which detailed the stent's capacity to reduce costs by 23% by minimizing the need for patient interventions. This demonstrates a powerful value proposition and widespread market acceptance.

Core Urology and Gastroenterology Devices

Cook Group's core urology and gastroenterology devices represent a significant portion of its established product portfolio. These minimally invasive tools, including catheters, stents, and endoscopes, have historically captured substantial market share within their respective medical fields. For instance, the global urology devices market was valued at approximately $15.5 billion in 2023 and is projected to grow steadily, indicating a mature yet expanding segment where Cook has a strong presence.

These reliable product categories are instrumental in generating consistent and predictable cash flow for Cook Group. Their steady demand, driven by the ongoing need for diagnostic and therapeutic interventions in urology and gastroenterology, positions them as classic cash cows. This stable revenue stream allows the company to fund investments in other areas of its business, such as research and development for new technologies.

- Established Market Dominance: Cook's urology and gastroenterology devices hold significant market share in mature medical specialties.

- Consistent Revenue Generation: These product lines provide a stable and predictable source of cash for the company.

- Minimally Invasive Focus: The portfolio includes a wide range of tools like catheters, stents, and endoscopes.

- Market Growth Support: The global urology devices market, valued around $15.5 billion in 2023, demonstrates the continued relevance and demand for these essential medical products.

Select Real Estate Holdings

Cook Group's select real estate holdings, particularly in property management, are prime examples of Cash Cows within the BCG Matrix. These assets are situated in mature markets, ensuring a steady stream of revenue. For instance, completed residential projects in 2024, such as the Lakeside Apartments development which reported a 95% occupancy rate by year-end, exemplify this stability.

These holdings consistently generate income with minimal need for further substantial investment, contributing significantly to Cook Group's overall profitability. The net operating income from these properties in 2024 reached $15 million, a testament to their reliable performance and low ongoing capital expenditure requirements.

- Stable Income Generation: Properties like the downtown commercial complex, which saw a 3% year-over-year increase in rental income in 2024, provide predictable cash flows.

- Low Investment Needs: Maintenance costs for these mature assets remained below 1% of their market value in 2024, highlighting their low reinvestment demands.

- Mature Market Presence: Cook Group's established presence in these markets allows for efficient operations and sustained demand for their real estate assets.

Cook Group's established urology and gastroenterology devices consistently perform as Cash Cows. These products, like the Resonance Metallic Ureteral Stent, benefit from high market share in mature segments, generating stable, predictable cash flows. For example, the global urology devices market, valued at approximately $15.5 billion in 2023, provides a solid foundation for these reliable revenue generators, requiring minimal new investment to maintain their strong market position.

| Product Category | BCG Classification | Key Characteristics | 2023 Market Value (USD Billions) | Cook's Role |

|---|---|---|---|---|

| Urology & Gastroenterology Devices | Cash Cow | Mature market, high market share, stable demand, consistent revenue | Urology: $15.5 | Established leader with a broad portfolio |

| Zilver PTX Drug-Eluting Stent | Cash Cow | Proven efficacy, low in-stent occlusion rates, strong brand recognition | Peripheral Vascular Devices Market: ~$18.5 (2024 estimate) | Dominant player with superior performance |

What You’re Viewing Is Included

Cook Group BCG Matrix

The Cook Group BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after completing your purchase. This means no watermarks, no altered content, and no hidden surprises—just a professionally designed, analysis-ready report ready for your strategic decision-making. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the complete Cook Group BCG Matrix document. Once purchased, this comprehensive tool will be instantly downloadable, enabling you to seamlessly integrate its strategic framework into your business planning and competitive analysis.

Dogs

The Reproductive Health business within Cook Group's portfolio was classified as a non-core asset. This segment was officially divested by Cook Medical in July 2024, marking the culmination of prior divestment efforts.

This strategic move underscores the business's perceived low market share and limited growth prospects in alignment with Cook's overarching strategic objectives. The sale generated an undisclosed amount, reflecting its status as a divested entity rather than a growth driver.

Cook Group's Otolaryngology, Head & Neck Surgery (OHNS) product lines were divested to C2Dx, Inc. in January 2024. This move was part of Cook Medical's broader strategic realignment, signaling a shift away from these specific offerings. The divestiture underscores the product lines' low strategic fit within Cook's evolving business priorities.

Cook Biotech's sale in January 2024 indicates its classification as a 'Dog' within the BCG Matrix. This divestiture suggests the life sciences venture lacked a strong market share and growth potential, no longer fitting Cook Group's strategic focus.

Lead Management Product Portfolio

The Lead Management product portfolio, a segment within Cook Group's strategic considerations, was divested in late 2024, acquired by Merit Medical. This move suggests the portfolio was likely categorized as a cash cow or a dog in the BCG matrix, indicating mature products with low market share or limited growth potential, prompting Cook Group to reallocate resources to more promising ventures.

Merit Medical's acquisition of this portfolio, valued in the context of its own strategic growth, highlights the ongoing consolidation within the medical device industry. For Cook Group, the sale aligns with a strategy of focusing on core competencies and high-growth areas, potentially shedding assets that no longer fit their long-term vision or require substantial investment for competitive positioning.

- Product Portfolio Status: The Lead Management product portfolio was acquired by Merit Medical in late 2024.

- Strategic Rationale for Sale: Cook Group's divestiture indicates the portfolio was likely a non-strategic asset or a product line with subdued growth prospects.

- Industry Trend: The acquisition reflects consolidation within the medical device sector, with companies like Merit Medical seeking to expand their offerings.

- Financial Implications: Such divestitures allow companies to streamline operations and reinvest in areas with higher potential returns, impacting overall financial performance.

Former GE Manufacturing Facility Property

The former GE Manufacturing Facility Property, sold in July 2025, fits the description of a 'dog' in the BCG Matrix. This divestiture of a physical asset, rather than a product, signals it was not aligned with Cook Group's core business objectives or was underperforming. Such properties often have low growth potential and limited market share within the company's portfolio, making them candidates for shedding.

The sale of this real estate asset underscores a strategic decision to streamline operations and focus on more profitable ventures. Companies often classify underutilized or non-essential physical assets as dogs because they tie up capital without generating significant returns or contributing to strategic growth. This move by Cook Group aligns with a broader trend of optimizing asset utilization.

- Asset Divestiture: The sale of the former GE Manufacturing Facility Property in July 2025 is a clear indicator of shedding a non-core asset.

- Low Contribution: This property was not contributing significantly to Cook Group's primary business objectives or was underutilized.

- Dog Classification: As a result, it is categorized as a 'dog' within the BCG Matrix framework due to its low growth and market share potential for the company.

- Strategic Realignment: The divestiture reflects a strategic move to improve capital allocation and focus on core, high-performing business units.

Within the BCG Matrix framework, 'Dogs' represent business units or products with low market share and low growth prospects. Cook Group's divestiture of Cook Biotech in January 2024 exemplifies this classification, indicating the venture lacked significant market traction and future potential for the conglomerate. Similarly, the sale of the Lead Management product portfolio to Merit Medical in late 2024 suggests this segment was also considered a 'Dog', prompting Cook Group to reallocate resources towards more promising areas.

The divestiture of the former GE Manufacturing Facility Property in July 2025 further solidifies this 'Dog' classification for non-core physical assets. These assets, characterized by underperformance and a lack of strategic alignment, are often shed to optimize capital allocation. The Reproductive Health business, divested in July 2024, and the Otolaryngology, Head & Neck Surgery (OHNS) product lines, sold in January 2024, also align with the 'Dog' profile due to their limited growth outlook and strategic fit within Cook Group's evolving business priorities.

| Divested Asset/Business | Divestiture Date | BCG Classification | Reasoning |

|---|---|---|---|

| Cook Biotech | January 2024 | Dog | Low market share and growth potential |

| Otolaryngology, Head & Neck Surgery (OHNS) product lines | January 2024 | Dog | Low strategic fit, limited growth prospects |

| Lead Management product portfolio | Late 2024 | Dog | Mature products, low market share or limited growth |

| Reproductive Health business | July 2024 | Dog | Low market share and limited growth prospects |

| Former GE Manufacturing Facility Property | July 2025 | Dog | Underperforming, not aligned with core business objectives |

Question Marks

The Interventional Magnetic Resonance Imaging (iMRI) Division, launched by Cook Group in July 2025, represents a strategic move into a burgeoning medical technology sector. This division focuses on integrating advanced MRI capabilities with innovative medical devices to enhance complex surgical procedures, aiming to set new standards in patient care and procedural accuracy.

While the iMRI division is positioned in a high-growth market, its current market share is negligible. This is expected, as Cook is in the foundational stages of establishing its presence and building market recognition for this novel approach to medical interventions. The investment in this division reflects a long-term vision for Cook to become a leader in image-guided therapies.

Cook Group's new drug-eluting stent for below the knee (BTK) is positioned as a potential star in their BCG matrix. Its FDA Breakthrough Device designation highlights its promise for treating chronic limb-threatening ischemia (CLTI), a market segment experiencing significant growth. In 2024, the CLTI market was valued at approximately $2.5 billion, with projections indicating a compound annual growth rate (CAGR) of over 8% through 2030.

Despite this promising outlook, the BTK stent is currently in the clinical development phase. This means its market share is effectively zero, placing it firmly in the question mark category. The substantial investment required for clinical trials and regulatory approval means it’s not yet generating revenue, but its high growth potential justifies the ongoing commitment from Cook Group.

Cook Group's collaboration with Mendaera, announced in April 2025, positions them in the high-growth handheld robotics sector for urology. This strategic move targets needle-based interventions, a technologically advanced area with significant future potential in medical procedures.

While this partnership signifies Cook's entry into a promising market, their current market share in this specific advanced robotic application is still nascent. This suggests the venture is likely a question mark in the BCG matrix, requiring further investment and development to establish a stronger market presence.

PillSenseTM Blood-Sensing Technology Distribution

Cook Medical's recent distribution agreement for its PillSenseTM blood-sensing technology, announced in June 2024, positions them within the diagnostics sector, a market experiencing significant expansion. This move into a high-growth area is a strategic play for future revenue streams.

Despite the promising market, Cook's penetration and market share for PillSenseTM are currently nascent, reflecting its early-stage development and market introduction. This suggests the technology, while innovative, has not yet achieved widespread adoption or a dominant market position.

- Market Growth: The global in vitro diagnostics market was valued at approximately $105 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5-7% through 2030.

- Early Stage Penetration: As of mid-2024, specific market share data for PillSenseTM is not publicly available, indicating its introductory phase.

- Strategic Positioning: The distribution agreement aims to leverage Cook's existing healthcare network to build market presence for this novel technology.

Pipeline Products in Key Therapeutic Areas

Cook Medical's pipeline products are crucial for future growth, currently representing potential in key therapeutic areas like cardiovascular, nephrology, urology, and endoscopy. As of May 2024, the company boasts 20 products in various stages of development within these segments. These represent substantial research and development expenditure, positioning Cook Medical for potential market leadership in high-growth sectors once these innovations reach commercialization.

These 20 pipeline products, while holding significant future promise, currently have no market share as they are not yet available for sale. This aligns with the characteristics of question mark products in a BCG matrix, where investment is required to foster growth and determine their future market viability. The company's commitment to these R&D efforts underscores a strategic focus on innovation to drive future revenue streams.

- Pipeline Products: 20 in development as of May 2024.

- Key Therapeutic Areas: Cardiovascular, Nephrology, Urology, Endoscopy.

- Market Share: Currently non-existent, awaiting commercialization.

- Strategic Implication: Significant R&D investment in potential high-growth future markets.

Question Marks in Cook Group's portfolio represent products or ventures in high-growth markets but with low current market share. These are typically new innovations or early-stage projects requiring significant investment to gain traction. The success of these ventures is uncertain, hence the "question mark" designation.

Cook Group's iMRI division and its collaboration with Mendaera for handheld robotics in urology are prime examples of Question Marks. These initiatives are in nascent stages, aiming to capitalize on rapidly expanding technological frontiers in healthcare.

Similarly, the PillSense™ blood-sensing technology and the 20 pipeline products across various therapeutic areas also fall into this category. They are positioned in growing market segments but have yet to establish a significant market presence or generate substantial revenue as of mid-2024.

The substantial R&D investment in these Question Marks underscores Cook Group's commitment to future innovation and market leadership in areas with high growth potential, despite the inherent risks associated with their current low market penetration.

| Product/Venture | Market Growth Potential | Current Market Share | Strategic Stage |

|---|---|---|---|

| Interventional MRI (iMRI) Division | High | Negligible | Foundational/Early Stage |

| Drug-Eluting Stent (BTK) | High (CLTI Market ~ $2.5B in 2024, 8%+ CAGR) | Zero (Clinical Development) | Clinical Development |

| Mendaera Robotics Collaboration | High (Handheld Robotics for Urology) | Nascent | Partnership/Early Stage |

| PillSense™ Blood-Sensing Technology | High (Diagnostics Market ~$105B in 2023) | Nascent/Not Publicly Available | Early Stage/Distribution Agreement |

| Pipeline Products (20 as of May 2024) | High (Cardiovascular, Nephrology, Urology, Endoscopy) | Non-existent (Awaiting Commercialization) | R&D/Development Stage |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial reports, market research, and industry analyses to provide accurate strategic insights.