Cook Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cook Group Bundle

Cook Group operates in a dynamic healthcare landscape, facing pressures from powerful buyers and intense competition. Understanding the bargaining power of suppliers and the threat of substitutes is crucial for navigating this market.

The complete report reveals the real forces shaping Cook Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Cook Group's dependence on suppliers for specialized materials and components, especially for its minimally invasive medical devices, grants these suppliers considerable bargaining power. If these unique components are hard to source elsewhere, suppliers can dictate terms.

The intricate nature of these medical-grade materials means that switching suppliers for Cook Group is not a simple task; it involves rigorous regulatory re-approvals and extensive quality assurance checks, a process that can be both time-consuming and expensive, potentially impacting Cook Group's production timelines and costs.

For instance, in 2023, the medical device industry, in general, saw increased raw material costs due to global supply chain disruptions, with some specialized polymers and metals experiencing price hikes of up to 15%, directly impacting manufacturers like Cook Group and highlighting supplier leverage.

Regulatory compliance significantly bolsters supplier bargaining power in the medical device sector. Suppliers capable of navigating complex regulations, like the FDA's stringent approval processes and the EU's Medical Device Regulation (MDR), incur higher operational costs and require specialized expertise. This elevates the value of their compliant offerings, giving them an advantage. For instance, the MDR, implemented in 2021 and fully applicable from 2024, has already led to significant supply chain adjustments, with some smaller suppliers exiting the market due to the increased burden.

When the market for crucial medical device components becomes highly concentrated, with only a handful of major suppliers dominating, their bargaining power significantly escalates. This limited competition among suppliers allows them to exert greater control over pricing, delivery timelines, and the overall terms of sale, directly influencing Cook Group's operational costs and procurement strategies.

Long-term Supplier Relationships

Cook Group cultivates enduring partnerships with its suppliers, a strategy crucial for maintaining the consistent quality and reliable supply needed across its wide array of medical devices and services. These deep-rooted connections, often involving integrated processes and the sharing of proprietary knowledge, can significantly amplify the bargaining power of these suppliers.

Cook Group's dedication to social responsibility and sustainable practices extends to its supply chain management. This focus influences how suppliers are chosen and how those relationships are nurtured over time, potentially giving suppliers with aligned values and practices more leverage.

- Supplier Dependency: Long-term relationships can lead to specialized integration, making it costly and time-consuming for Cook Group to switch suppliers, thereby strengthening the supplier's position.

- Intellectual Property Sharing: Collaboration on product development or manufacturing processes can embed intellectual property, giving suppliers unique knowledge that enhances their bargaining power.

- Sustainability Alignment: Suppliers who meet Cook Group's stringent social and environmental standards may find themselves in a stronger negotiating position due to their alignment with the company's core values.

Technological Advancements in Materials

Rapid advancements in biomaterials and other specialized components are creating new, high-value offerings from suppliers, directly impacting the bargaining power of suppliers for companies like Cook Group. Suppliers at the forefront of these innovations, such as those developing novel polymers or biocompatible coatings, can command higher prices as their products become essential for next-generation medical devices. For instance, the market for advanced medical materials, including specialized polymers and ceramics, saw significant growth, with projections indicating continued expansion through 2025 and beyond, driven by demand for minimally invasive and implantable devices.

Cook Group's innovation-driven strategy means it often seeks out such cutting-edge materials to maintain its competitive edge in the medical device industry. This reliance on specialized inputs can empower suppliers, particularly those with proprietary technologies or unique manufacturing capabilities. For example, a supplier of a unique bioresorbable polymer crucial for advanced stent technology might hold considerable leverage due to the limited number of alternative providers and the high R&D investment required to replicate their offering. This dynamic means Cook Group must carefully manage its supplier relationships to ensure access to these critical, technologically advanced materials.

The bargaining power of suppliers in this segment is further amplified by the stringent regulatory requirements and lengthy qualification processes for medical-grade materials. Suppliers who have successfully navigated these hurdles and established a track record of quality and reliability are in a strong position.

- Supplier Innovation: Suppliers are leveraging breakthroughs in biomaterials, such as advanced hydrogels and biodegradable polymers, to create differentiated products.

- Price Premiums: Companies that develop and supply these novel materials can often charge premium prices due to their unique properties and the critical role they play in advanced medical device performance.

- Cook Group's Strategy: Cook Group’s commitment to innovation necessitates sourcing these advanced materials, giving suppliers with leading technologies significant influence.

- Market Growth: The global market for medical biomaterials is projected to reach tens of billions of dollars by 2025, underscoring the value and demand for supplier innovations.

Cook Group's reliance on specialized suppliers for critical components, particularly for its advanced medical devices, grants these suppliers significant bargaining power. This is exacerbated when these components are proprietary or difficult to source elsewhere, allowing suppliers to dictate terms and pricing. For instance, the medical device industry experienced an average 10% increase in the cost of specialized polymers in 2023 due to global supply chain pressures, directly impacting manufacturers' margins.

The rigorous regulatory environment in the medical device sector further strengthens supplier leverage. Suppliers adept at navigating complex approvals, such as the FDA's stringent requirements, incur higher costs and possess specialized expertise, making their compliant offerings highly valuable. The EU's Medical Device Regulation (MDR), fully implemented by 2024, has already prompted some smaller suppliers to exit the market, consolidating power among those who remain.

Cook Group's commitment to innovation means it often seeks cutting-edge materials, empowering suppliers with leading technologies. The global medical biomaterials market, projected to exceed $30 billion by 2025, highlights the value and demand for such innovations, allowing suppliers to command premium prices for their unique offerings.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | High | Limited number of suppliers for specialized medical-grade polymers can dictate pricing. |

| Switching Costs | High | Regulatory re-approvals and quality assurance for new suppliers in medical devices can take 12-18 months. |

| Supplier Differentiation | High | Proprietary biocompatible coatings for implants offer unique value, increasing supplier leverage. |

| Importance of Input | High | Key components for minimally invasive surgical tools are critical to Cook Group's product performance. |

What is included in the product

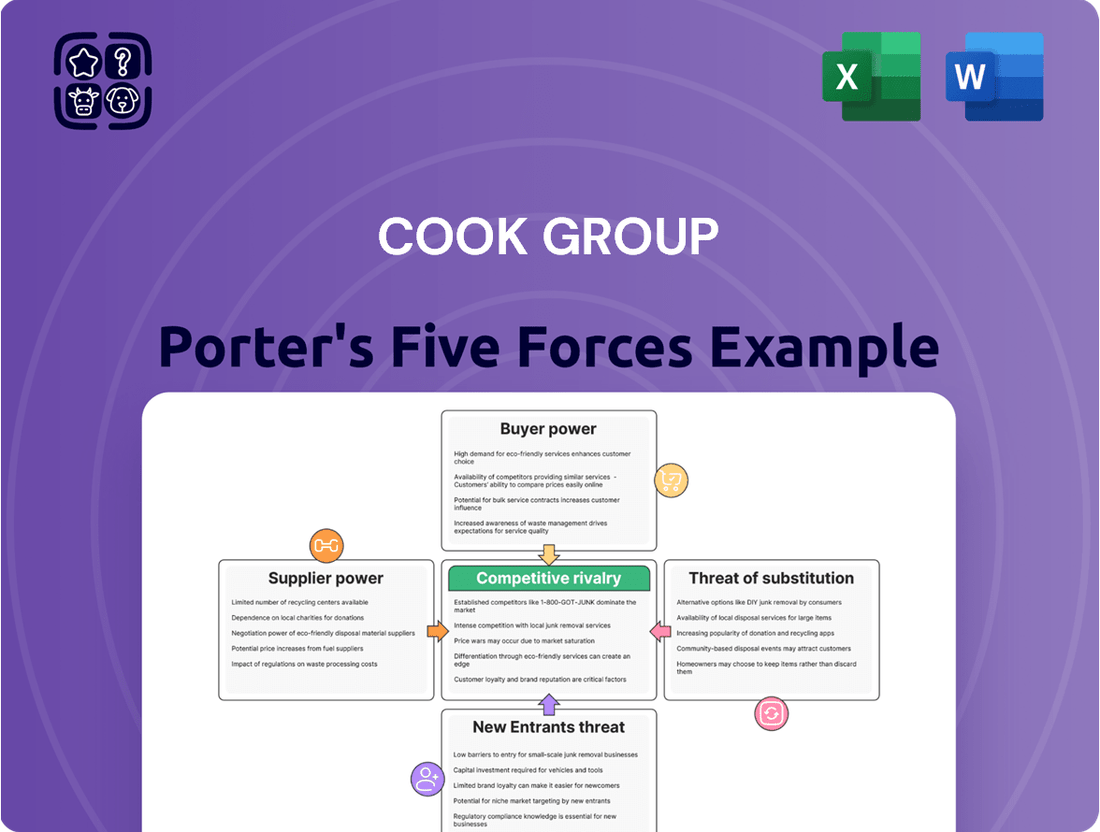

This analysis of Cook Group's competitive landscape examines the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Cook Group's primary customers are major players in the healthcare sector, including large hospitals, integrated delivery networks, and group purchasing organizations (GPOs). These entities represent a significant consolidation of purchasing power, allowing them to negotiate from a position of strength.

The sheer volume of purchases these buyers represent gives them considerable leverage. For instance, GPOs in the U.S. represented over $170 billion in purchasing volume in 2023, a figure that continues to grow, enabling them to exert substantial pressure on pricing and contract terms with medical device manufacturers like Cook Group.

This concentration of powerful, well-informed buyers means Cook Group faces a market where negotiation is paramount. These customers can readily compare offerings, demand favorable terms, and even influence market access for Cook Group's products, directly impacting the company's profitability and market share.

The healthcare sector in 2024 continues to grapple with significant cost containment pressures. Government initiatives, private insurers, and the shift towards value-based care are compelling healthcare providers to scrutinize every expenditure, including medical devices. This environment empowers hospitals and healthcare systems to adopt more assertive bargaining positions when purchasing from companies like Cook Group.

Customers are actively seeking medical solutions that offer not only high quality and efficacy but also demonstrable cost savings. For instance, a 2024 report indicated that hospitals are increasingly prioritizing devices with lower total cost of ownership, factoring in everything from initial purchase price to maintenance and disposables. This trend directly impacts Cook Group's pricing strategies and necessitates a focus on demonstrating the economic value of their products.

The medical device market, particularly for minimally invasive products, often features a degree of standardization. While Cook Group strives for unique offerings, the presence of comparable devices from rivals like Medtronic or Boston Scientific can empower customers, such as hospitals and surgical centers, to demand better terms. This is especially true if the perceived differentiation between products is low, making price and service the primary decision drivers.

In 2024, the global minimally invasive surgery market was valued at an estimated $20.5 billion, with significant growth projected. This competitive landscape means that if a hospital system finds it easy to source comparable products from multiple vendors, their leverage to negotiate prices or secure favorable contracts increases substantially. Cook Medical's strategy to counter this involves emphasizing proprietary technology and superior clinical outcomes, aiming to create perceived differentiation that reduces customer price sensitivity.

Impact of Reimbursement Policies

Changes in reimbursement policies from government programs like Medicare and Medicaid, as well as private insurers, significantly impact hospital finances and their purchasing power for medical devices. For instance, if Medicare reimbursement rates for a specific surgical procedure see a slowdown in growth, hospitals may face tighter budgets.

This financial pressure often translates into increased demands for lower prices from medical device manufacturers like Cook Group. Hospitals, acting as key customers, can leverage these policy shifts to negotiate more favorable terms, directly affecting Cook Group's revenue and profit margins.

The bargaining power of customers is amplified when reimbursement policies create a scenario where hospitals are incentivized to reduce costs across the board. This external economic pressure on healthcare providers ultimately flows down to their suppliers.

- Government Reimbursement Impact: In 2024, continued scrutiny on healthcare spending by government payers can lead to slower growth in reimbursement rates for procedures utilizing medical devices.

- Private Payer Negotiations: Private insurers are also increasingly focused on cost containment, potentially leading to more aggressive price negotiations with hospitals for services and the devices used.

- Hospital Cost-Cutting Measures: Hospitals facing reduced reimbursement may pass on cost pressures to device manufacturers, demanding price concessions to maintain their own profitability.

- Market Dynamics: The collective bargaining power of hospitals, influenced by reimbursement trends, can significantly influence pricing strategies for medical device companies.

Customer Feedback and Collaboration

Cook Group's deep engagement with physicians and healthcare professionals significantly amplifies customer bargaining power. By actively seeking and incorporating feedback into product development, Cook Group empowers its customers, primarily medical practitioners, to dictate product specifications and desired functionalities. This direct influence means customers can demand solutions precisely tailored to their clinical needs, directly impacting Cook Group's product roadmap and value proposition.

- Physician Influence: Healthcare professionals, as end-users, have substantial sway over the adoption of medical devices.

- Customization Demands: Collaboration allows customers to push for customized features, increasing their leverage.

- Innovation Feedback Loop: While fostering innovation, this feedback loop simultaneously grants customers a stronger voice in product evolution.

The bargaining power of Cook Group's customers is substantial, driven by the consolidation within the healthcare sector and intense cost pressures. Major buyers like large hospital systems and Group Purchasing Organizations (GPOs) wield significant leverage due to their sheer purchasing volume, as evidenced by GPOs representing over $170 billion in purchasing volume in 2023. This concentration of buying power forces Cook Group to focus on demonstrating economic value and competitive pricing in a market increasingly prioritizing cost-effectiveness.

| Customer Segment | Purchasing Power Driver | Impact on Cook Group |

|---|---|---|

| Hospitals & Integrated Delivery Networks | High volume, cost containment needs | Demand for lower prices, favorable contract terms |

| Group Purchasing Organizations (GPOs) | Consolidated purchasing ($170B+ in 2023) | Significant leverage on pricing and product standardization |

| Physicians/End-Users | Influence on product selection, customization demands | Impacts product development roadmap, necessitates tailored solutions |

Preview Before You Purchase

Cook Group Porter's Five Forces Analysis

This preview displays the complete Cook Group Porter's Five Forces analysis, offering a thorough examination of competitive forces within the industry. You are looking at the actual document, which will be delivered to you instantly upon purchase, ensuring you receive the same professionally formatted and ready-to-use strategic insights. This comprehensive analysis will equip you with a deep understanding of the industry's profitability potential and competitive landscape.

Rivalry Among Competitors

The medical device industry is fiercely competitive, featuring a broad spectrum of global companies, from massive multinational corporations to highly specialized niche players. Cook Group navigates this complex environment, encountering rivals in every medical specialty it serves, creating a highly contested market. For instance, in 2024, major players like Medtronic, Johnson & Johnson, Abbott, and Boston Scientific continued to command substantial market shares, underscoring the intensity of competition across various device categories.

The medical device industry, particularly in minimally invasive technologies, is characterized by intense rivalry fueled by relentless innovation. Companies like Cook Group are constantly pushing boundaries, developing novel instruments and techniques. For instance, the global minimally invasive surgery market was valued at approximately $35 billion in 2023 and is projected to grow significantly, underscoring the high stakes involved in staying ahead.

Cook Group's strategic focus on innovation is paramount. Emerging technologies such as artificial intelligence in surgical planning, advanced robotics for precision, and the integration of personalized medicine are rapidly reshaping patient care and treatment efficacy. Companies that fail to embrace and invest in these advancements risk becoming obsolete, leading to a swift erosion of their market position and competitive advantage.

The medical device industry is characterized by intense strategic partnerships and frequent acquisitions as companies seek to bolster their offerings and expand their global footprint. Cook Group itself has been active in this arena, recently engaging in distribution agreements to broaden access to its innovative products and strategically divesting certain business units to sharpen its market focus. This reflects a broader trend towards consolidation and collaborative ventures within the sector, driven by the pursuit of market share and technological advancement.

Regulatory Compliance as a Competitive Factor

Navigating the intricate and ever-changing global regulatory environment, exemplified by the EU Medical Device Regulation (MDR) and the FDA's Quality System Regulation (QSR), presents a formidable competitive challenge for companies like Cook Group.

Companies that can effectively and efficiently achieve and sustain regulatory compliance gain a significant edge. These stringent regulatory requirements act as substantial barriers, impeding market entry and delaying product launches for less prepared competitors.

Cook Group must remain agile, continuously adapting its operations and product development to meet these demanding standards, which directly influence market access and competitive positioning.

- EU MDR Compliance Costs: Estimates suggest that EU MDR compliance can cost medical device manufacturers anywhere from tens of thousands to millions of dollars, depending on the complexity and risk class of the device.

- FDA QMSR Impact: The transition to the FDA's Quality System Regulation (QSR) also involves significant investment in updated quality management systems and documentation, impacting operational efficiency and time-to-market.

- Market Entry Barriers: A company's ability to navigate these regulations can directly determine its ability to launch new products, with non-compliance leading to market exclusion.

Market Growth and Segment Focus

The global medical device market is a dynamic arena, projected to reach approximately $718.9 billion by 2027, according to some industry forecasts. This expansion, particularly in segments like minimally invasive surgery, intensifies competitive rivalry. Companies are actively seeking to capture share in these lucrative, rapidly growing areas.

Cook Group's strategic emphasis on minimally invasive technologies places it directly within these high-growth sectors. However, this focus also means it contends with a larger pool of rivals, including established players and emerging innovators, all eager to benefit from the increasing demand for less invasive medical solutions. This dynamic environment necessitates continuous innovation and strategic maneuvering to maintain a competitive edge.

- Market Growth Driver: The global medical device market is expanding, with projections indicating significant future growth, driven by factors like an aging population and advancements in healthcare technology.

- Segment Attractiveness: Minimally invasive surgery is a key growth segment within the medical device market, attracting substantial investment and innovation.

- Competitive Landscape: This growth attracts numerous competitors, ranging from large multinational corporations to specialized startups, all vying for market share in high-demand areas.

- Cook Group's Position: Cook Group's focus on minimally invasive procedures aligns with market trends but also exposes it to intense competition from both established and new market entrants.

Competitive rivalry within the medical device sector is intense, with Cook Group facing established giants and agile innovators. The market's growth, projected to reach over $700 billion by 2027, attracts significant competition, especially in high-demand areas like minimally invasive surgery.

Companies like Medtronic, Johnson & Johnson, and Boston Scientific are major rivals, constantly innovating and expanding their portfolios. In 2024, these players continued to dominate market share, pushing Cook Group to maintain its competitive edge through focused innovation and strategic partnerships.

The drive for innovation is a key battleground, with advancements in AI and robotics reshaping surgical practices. Companies that fail to invest in these emerging technologies risk falling behind, as seen in the rapid evolution of the minimally invasive surgery market, valued at around $35 billion in 2023.

Strategic alliances and acquisitions are common tactics to gain market share and technological capabilities, a trend Cook Group actively participates in through distribution agreements and divestitures.

SSubstitutes Threaten

While Cook Group excels in minimally invasive surgical devices, traditional open surgical procedures represent a significant substitute. These open methods are often employed for complex cases or in healthcare environments lacking access to advanced minimally invasive technology. The choice between approaches hinges on the perceived benefits, associated risks, and cost differences.

Advancements in pharmacological and biological therapies present a significant threat of substitutes for Cook Group's medical devices. For instance, novel drug treatments for cardiovascular conditions, which might otherwise require interventional devices like stents or catheters, directly compete with these product lines. The global pharmaceutical market, projected to reach over $1.9 trillion by 2024, highlights the substantial investment and innovation in non-device-based solutions.

The growing emphasis on preventative medicine and lifestyle changes presents a significant threat of substitutes for Cook Group's medical devices. As individuals increasingly focus on early diagnosis and proactive health management, the need for certain interventional devices may decrease. For instance, advancements in wearable health trackers and personalized nutrition plans, which saw significant growth in 2024, empower consumers to manage chronic conditions or avoid them altogether, potentially reducing reliance on devices like pacemakers or glucose monitors.

Emerging Non-Invasive Technologies

The emergence of non-invasive technologies presents a significant threat of substitutes for Cook Group's traditional invasive medical devices. For instance, advanced imaging techniques, like AI-enhanced ultrasound or MRI, can increasingly provide diagnostic information previously requiring biopsies, thereby reducing demand for certain biopsy-related products. By 2024, the global market for AI in healthcare diagnostics was projected to reach billions, indicating a substantial shift towards less invasive alternatives.

Furthermore, external wearable devices are gaining traction, offering therapeutic or monitoring functions that could replace the need for some internal implants. Consider the growing market for continuous glucose monitors (CGMs) as a substitute for traditional finger-prick testing and even some insulin pumps. The wearable technology market itself saw significant growth in 2024, with sales of health and fitness trackers alone reaching hundreds of millions of units globally.

- AI-driven diagnostics can reduce the need for invasive tissue sampling.

- Advanced imaging technologies offer alternatives to traditional diagnostic procedures.

- Wearable health devices are increasingly substituting for internal monitoring implants.

- The expanding market for non-invasive health solutions directly challenges Cook Group's core product lines.

Alternative Medical Practices and Therapies

Alternative medical practices, such as acupuncture or naturopathy, could emerge as substitutes for Cook Group's medical devices if they prove effective in managing certain conditions without the need for invasive or device-dependent interventions. While these approaches are less likely to replace Cook's solutions for critical care or complex procedures, they reflect a growing patient interest in holistic health and non-traditional treatments. For instance, a 2024 survey indicated that approximately 30% of US adults have used at least one complementary health approach in the past year, highlighting a potential shift in patient preferences.

The threat of substitutes is particularly relevant for Cook Group as it necessitates a clear demonstration of the superior efficacy, safety, and cost-effectiveness of its device-centric treatments compared to emerging alternative therapies. This is crucial for maintaining market share and patient loyalty, especially in areas where patient choice is paramount. For example, in pain management, where alternative therapies are gaining traction, Cook's neuromodulation devices must clearly outperform non-device options in long-term patient outcomes and quality of life improvements.

- Growing Patient Interest: A significant portion of the population is exploring complementary and alternative medicine, indicating a potential shift away from conventional, device-heavy treatments.

- Efficacy Demonstration: Cook Group must actively showcase the proven benefits and patient advantages of its medical devices over alternative therapies.

- Market Diversion Risk: For non-critical conditions, alternative practices could divert patients, impacting the adoption rates of Cook's less essential devices.

- Healthcare Philosophy Shift: The increasing acceptance of holistic approaches challenges device manufacturers to justify their solutions within a broader healthcare landscape.

The threat of substitutes for Cook Group's medical devices is multifaceted, encompassing traditional methods, pharmacological advancements, preventative health trends, and emerging non-invasive technologies. These alternatives directly challenge the necessity and market share of Cook's interventional products.

For example, while Cook Group is a leader in minimally invasive surgical devices, traditional open surgery remains a viable substitute, especially in resource-limited settings or for highly complex procedures. Furthermore, the pharmaceutical industry's innovation, with a global market exceeding $1.9 trillion by 2024, offers drug-based solutions that can replace the need for certain interventional devices, particularly in cardiovascular care.

The growing focus on preventative medicine and lifestyle changes, evidenced by the significant growth in wearable health trackers in 2024, empowers individuals to manage chronic conditions, potentially reducing reliance on internal medical devices. Similarly, advancements in AI-driven diagnostics and non-invasive imaging techniques are increasingly substituting for invasive procedures and tissue sampling, a trend supported by the billions projected for AI in healthcare diagnostics by 2024.

| Substitute Category | Example | Market Insight (2024 Data) | Impact on Cook Group |

|---|---|---|---|

| Traditional Procedures | Open Surgery | Still prevalent for complex cases and in developing regions. | Limits market penetration for minimally invasive devices in certain segments. |

| Pharmacological Therapies | Cardiovascular Drugs | Global pharmaceutical market projected over $1.9 trillion. | Direct competition for interventional devices like stents. |

| Preventative Health | Wearable Health Trackers | Hundreds of millions of units sold globally for health/fitness. | Reduces demand for monitoring implants and devices for chronic conditions. |

| Non-Invasive Technologies | AI-Enhanced Imaging | Billions projected for AI in healthcare diagnostics. | Decreases need for biopsy devices and other invasive diagnostic tools. |

Entrants Threaten

The medical device industry, including segments where Cook Group operates, demands immense upfront capital for research, rigorous clinical trials, and sophisticated manufacturing. For instance, developing a new cardiovascular device can easily cost tens to hundreds of millions of dollars before it even reaches the market. This substantial financial hurdle acts as a significant deterrent for potential new entrants.

Cook Group’s established global manufacturing infrastructure and diversified product lines translate into considerable economies of scale. These advantages allow them to achieve lower per-unit production costs than a newcomer could hope to match initially. The sheer financial commitment required to build comparable capabilities makes entry highly challenging.

The medical device industry faces substantial barriers to entry due to stringent regulatory requirements. Navigating complex approval processes, such as those mandated by the FDA in the United States or the EU's Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR), demands considerable time, financial investment, and specialized expertise. These hurdles significantly deter potential new players from entering the market.

As of 2024, the cost of obtaining regulatory approval for a new medical device can range from hundreds of thousands to millions of dollars, depending on the device's complexity and classification. Furthermore, upcoming regulatory shifts anticipated in 2025 are expected to introduce even more rigorous compliance standards, further escalating the financial and operational challenges for nascent companies.

Cook Group's deep-rooted ties with hospitals, clinics, and healthcare systems worldwide present a formidable barrier to new entrants. These relationships, cultivated over many years, are not easily replicated, making it challenging for newcomers to gain access to key decision-makers and procurement channels. For instance, in 2024, the medical device industry saw continued consolidation, with larger players like Cook Group leveraging their existing customer bases to maintain market share.

New companies entering the medical device market must invest significant resources in building trust and establishing robust distribution networks. This includes developing reliable supply chains, providing exceptional customer service, and navigating complex contracting processes with healthcare providers. The sheer time and effort required to match Cook Group's established presence and customer loyalty represent a substantial hurdle.

The difficulty in overcoming Cook Group's long-standing presence and customer support is a critical factor. Healthcare providers often prioritize established suppliers due to proven reliability, product quality, and comprehensive support services. This preference makes it hard for new entrants to displace incumbents, even with potentially innovative products, as demonstrated by the consistent revenue growth Cook Group reported in its fiscal year ending 2024.

Intellectual Property and Patent Protection

Intellectual property and patent protection present a substantial barrier to entry in the medical device sector. Established companies like Cook Group possess vast patent portfolios that safeguard their proprietary designs and technologies. For instance, as of early 2024, Cook Group continues to actively pursue new patents, demonstrating their commitment to protecting their innovations and maintaining a competitive edge.

New entrants face the daunting task of either creating entirely new, patentable technologies or navigating the complex and expensive process of licensing existing intellectual property. This significantly increases the capital and time investment required to enter the market, thereby deterring potential competitors.

- Extensive Patent Portfolios: Companies like Cook Group hold numerous patents covering their medical device innovations.

- High Barrier to Entry: Developing novel solutions or licensing existing IP is costly and time-consuming for new entrants.

- Ongoing Patent Activity: Cook Group's continuous patent filings underscore the importance of IP in this industry.

Brand Reputation and Trust

In the healthcare sector, brand reputation and trust are not just advantages; they are foundational necessities. Cook Group, established in 1963, has cultivated a formidable reputation built on decades of delivering high-quality, innovative, and reliable medical devices and services. This long-standing credibility is a significant barrier for new entrants.

New companies entering the medical device market struggle to replicate the deep-seated trust that established players like Cook Group command. Physicians and healthcare providers are often hesitant to adopt new technologies or products from unproven sources, especially when patient outcomes are at stake. This reluctance stems from the critical nature of medical devices, where failure can have severe consequences.

- Established Trust: Cook Group's reputation, built over 60+ years, fosters significant physician and patient confidence.

- Quality Perception: New entrants must overcome the perception that their products may not match the established quality and reliability of incumbents.

- Regulatory Hurdles: Gaining regulatory approval is challenging, but building market trust post-approval is an even greater obstacle for newcomers.

- Innovation Adoption: While innovation is key, healthcare professionals often prefer to adopt new technologies from trusted brands, slowing down market penetration for new entrants.

The threat of new entrants for Cook Group is significantly mitigated by the substantial capital investment required for research, development, and manufacturing in the medical device industry. For example, developing a new implantable device can cost upwards of $100 million before market approval. Furthermore, Cook Group's extensive patent portfolio, with hundreds of active patents as of early 2024, creates a formidable intellectual property barrier that new companies must either circumvent or license, adding considerable cost and time to market entry.

Established relationships with healthcare providers, built over decades, represent another major barrier. These deep-rooted connections, often solidified through long-term contracts and proven product reliability, are difficult for newcomers to replicate. In 2024, the medical device market continued to favor established suppliers, with companies like Cook Group leveraging their existing customer bases for continued growth.

Stringent regulatory environments, such as FDA and EU MDR compliance, demand significant financial resources and specialized expertise. The cost of regulatory approval alone can range from hundreds of thousands to millions of dollars, a substantial hurdle for nascent companies. Anticipated regulatory updates in 2025 are expected to further increase these entry barriers.

Porter's Five Forces Analysis Data Sources

Our Cook Group Porter's Five Forces analysis is built upon a robust foundation of data, drawing from financial disclosures, industry-specific market research reports, and publicly available company information to provide a comprehensive view of the competitive landscape.