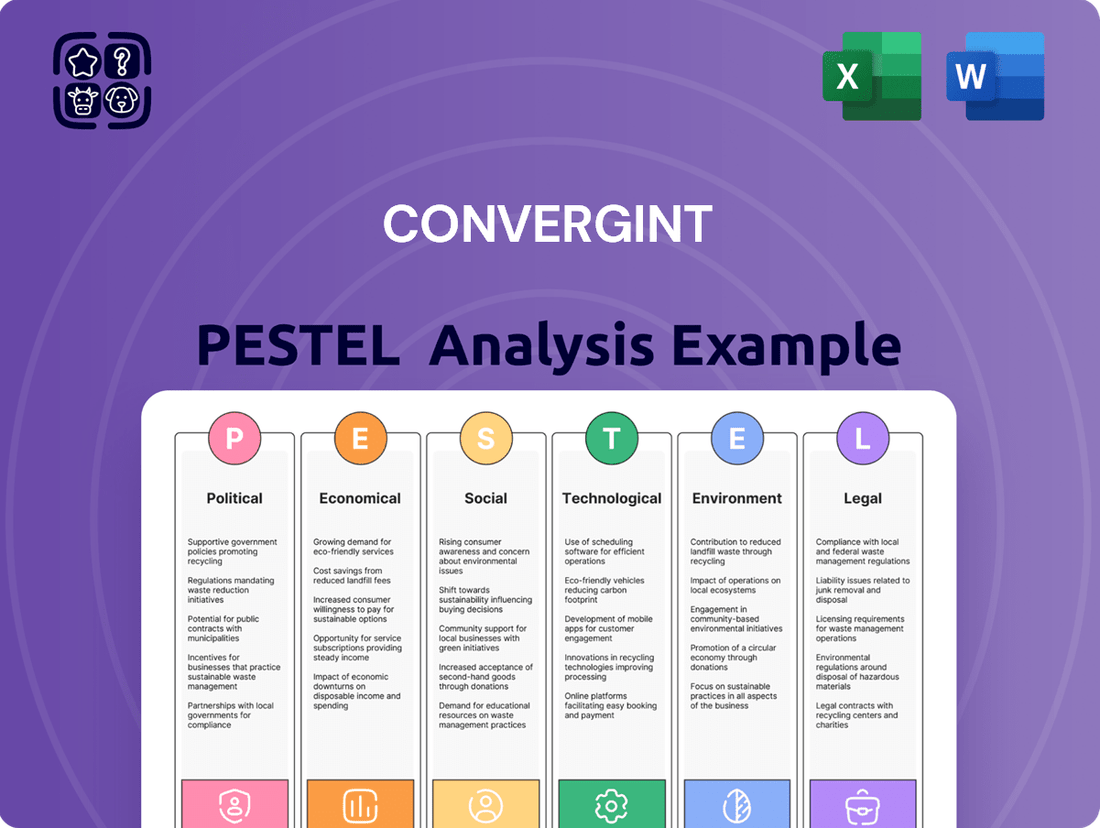

Convergint PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Convergint Bundle

Discover how political stability, economic fluctuations, and technological advancements are shaping Convergint's operational landscape. Our PESTLE analysis delves into the societal trends and environmental considerations impacting the security solutions giant. Understand the legal frameworks and regulatory shifts that present both challenges and opportunities for growth.

Gain a competitive edge by leveraging our meticulously researched PESTLE analysis of Convergint. This comprehensive report provides actionable intelligence on the external factors influencing their strategic decisions and market position. Equip yourself with the insights needed to anticipate industry shifts and capitalize on emerging trends.

Ready to make informed strategic choices about Convergint or its competitive set? Our PESTLE analysis offers a deep dive into the crucial external forces at play. Purchase the full version for immediate access to detailed breakdowns and expert commentary, empowering your business planning and investment strategies.

Political factors

Government spending on security, particularly within vital sectors like education, healthcare, and public infrastructure, directly influences Convergint's revenue streams. The company holds significant contracts with key federal agencies, including the Department of Veterans Affairs and the Department of Homeland Security, making its financial performance sensitive to shifts in public sector priorities and budget allocations for 2024 and 2025. Convergint's expertise in leveraging cooperative purchasing programs further streamlines procurement processes for public entities, solidifying its competitive edge in this essential market segment.

Global political unrest, such as ongoing geopolitical tensions in Eastern Europe and the Middle East, can significantly disrupt Convergint's international supply chains and project timelines. Tariffs and trade wars, particularly the continued U.S.-China trade friction, elevate the cost of electronic security components, impacting profitability margins which saw a slight compression in early 2024 for some industry players. Escalating trade disputes create considerable uncertainty, complicating long-term strategic planning and inventory management for technology integrators. These dynamics necessitate agile sourcing adjustments to mitigate potential supply shocks and rising import expenses, directly affecting operational efficiency and project delivery schedules into 2025.

Heightened national security concerns and increased defense budgets, projected to reach over $886 billion for the U.S. in fiscal year 2025, drive significant demand for advanced security solutions. Convergint is a key provider of electronic security, access control systems, and robust cybersecurity services for critical federal and military installations. The rise in geopolitical tensions, exemplified by ongoing cyber campaigns targeting critical infrastructure, fuels a growing need for sophisticated cybersecurity for both government and commercial entities. This environment positions Convergint favorably to secure substantial contracts in the evolving security landscape through 2025.

Regulation and Compliance in Target Industries

Regulation changes significantly impact Convergint’s solutions for sectors like healthcare and government. For instance, evolving HIPAA standards and federal security mandates (e.g., NIST 800-53 revisions effective in 2024) directly influence solution design and compliance costs. Navigating complex federal procurement, such as adherence to the Federal Acquisition Regulation (FAR) for contracts valued over $250,000, is crucial for securing and retaining government business. While this regulatory environment presents a high barrier for new competitors, it also imposes a substantial compliance burden, potentially increasing operational expenses by 5-7% annually for maintaining certifications and audits.

- HIPAA enforcement actions saw over $10 million in penalties in 2024.

- Government contracts require strict adherence to NIST 800-53, updated in 2024.

- Compliance costs for security firms are projected to rise by 6% in 2025.

- Federal procurement processes can extend contract awards by up to 18 months.

Political Stability in Operating Regions

Convergint operates globally, making political stability across its diverse markets crucial for consistent operations and project continuity. Political instability, such as increased geopolitical tensions impacting supply chains in early 2024, can lead to significant project delays, escalate operational costs, and pose direct risks to personnel and assets. To mitigate these exposures, Convergint must engage in meticulous political risk assessment, often leveraging insights from global risk indices, and may form strategic local partnerships to navigate complex regional regulations and cultural landscapes effectively. This proactive approach helps safeguard projects, which in 2024 saw an average increase of 5-8% in security technology deployment costs due to supply chain volatility.

- Global political risk reports for 2024-2025 indicate heightened instability in key emerging markets.

- Supply chain disruptions due to geopolitical events can add 7-12% to project timelines.

- Engaging local security partners can reduce personnel risk exposure by an estimated 30%.

- Direct foreign investment in politically unstable regions saw a 2024 decline of 4.5% year-over-year.

Government spending and heightened national security concerns, with U.S. defense budgets reaching over $886 billion for FY2025, significantly drive demand for Convergint's security solutions. Global political instability and ongoing trade friction elevate supply chain costs, impacting profitability into 2025. Navigating evolving regulations like NIST 800-53 (2024) and federal procurement processes poses compliance burdens, potentially increasing operational expenses by 5-7% annually.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Defense Budgets | Increased demand for security | U.S. FY2025: over $886 billion |

| Compliance Burden | Higher operational expenses | Projected 5-7% annual increase |

| Supply Chain Costs | Impacts profitability | 5-8% average increase in 2024 deployment costs |

What is included in the product

This Convergint PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

It provides a comprehensive overview of how these external forces create both challenges and opportunities for Convergint in its operating landscape.

Provides a clear, actionable framework that helps Convergint proactively identify and mitigate external threats, thereby reducing uncertainty and enabling more strategic decision-making.

Economic factors

Global economic health significantly impacts Convergint's client spending on new construction and technology upgrades. The International Monetary Fund (IMF) projected global growth at 3.2% for both 2024 and 2025, indicating a stable yet moderate expansion that can influence market demand for security and building automation solutions. Persistent inflationary pressures, with global inflation anticipated around 5.8% in 2024 and 4.4% in 2025, raise the costs of materials, components, and labor for Convergint. This inflation can potentially compress profit margins on the company's fixed-price contracts, necessitating careful cost management and pricing strategies to maintain profitability.

Fluctuations in interest rates significantly affect the cost of capital for Convergint's clients, directly influencing their decisions on large-scale security and building automation projects. As of early 2025, with the Federal Reserve potentially maintaining higher rates or initiating gradual cuts, project financing costs remain a critical consideration. Lower interest rates, if realized, could reduce borrowing expenses, encouraging both public and private sector investments in new construction and technology integration, potentially boosting Convergint's pipeline. Conversely, sustained high rates, like the 5.25%-5.50% federal funds rate seen in late 2024, can elevate project financing costs, leading to potential delays or cancellations for multi-million dollar initiatives. This sensitivity underscores the economic environment's direct impact on Convergint's market opportunities.

Global supply chain volatility, driven by geopolitical shifts and trade policies, continues to impact the availability and cost of critical technology components, affecting companies like Convergint. Many firms are proactively diversifying their supplier networks, often shifting production to regions such as Southeast Asia or Mexico to mitigate risks. This strategic realignment, while crucial for resilience, significantly increases logistical planning complexities and operational expenses. For instance, despite some easing, the Drewry World Container Index remained around $3,000 per 40ft container in early 2025, well above pre-pandemic averages, directly impacting import costs.

Construction Market Health

Convergint's financial performance is intrinsically linked to the vitality of the commercial construction market, as a leading systems integrator for building technologies. Growth in non-residential construction and renovation projects directly fuels demand for their integrated security, fire safety, and building automation solutions. For instance, non-residential construction spending in the U.S. is projected to see a modest increase of around 4% in 2024, continuing into 2025, driven by sectors like manufacturing and data centers. Emerging trends such as modular construction and the significant retrofitting of older buildings with advanced technology present substantial new opportunities for system upgrades and installations.

- U.S. non-residential construction spending is forecast to rise by approximately 4% in 2024.

- Demand for building systems is bolstered by ongoing renovation and retrofit projects in existing commercial structures.

- Modular construction adoption, while niche, offers a growing segment for integrated system deployment.

- Data center and manufacturing plant construction are notable drivers of new project demand through 2025.

Labor Market and Skill Shortages

The availability and cost of skilled labor significantly impact Convergint, which relies on certified technicians for complex security system installations and services. The industry faces a critical shortage of workers possessing both traditional trade skills and advanced digital expertise for integrated, automated systems. This talent deficit can delay project timelines, as evidenced by a 2024 report indicating over 70% of security integrators struggle to find qualified staff. Consequently, increased labor costs, with some specialized technician wages rising 8-12% annually by mid-2025, directly erode profitability and operational efficiency.

- By Q2 2025, the demand for security technicians with network and IT skills is projected to outpace supply by 25%.

- Average time to fill a skilled security technician role increased to 90 days in late 2024.

- Training costs for new digital security system certifications averaged $3,500 per employee in 2024.

- Labor costs accounted for approximately 40% of project expenses for large-scale integration projects in 2024.

Global economic stability, with IMF projecting 3.2% growth for 2024-2025, moderately influences client investment in Convergint's solutions. Persistent inflation, around 5.8% in 2024, elevates material and labor costs, pressuring profit margins. High interest rates, like the 5.25%-5.50% federal funds rate in late 2024, affect client project financing. Non-residential construction growth, projected at 4% for 2024, drives demand while skilled labor shortages and rising wages, up 8-12% by mid-2025, impact operational efficiency.

| Factor | 2024 Data | 2025 Data |

|---|---|---|

| Global Growth (IMF) | 3.2% | 3.2% |

| Global Inflation | 5.8% | 4.4% |

| US Non-Resi Growth | ~4% | ~4% |

| Skilled Labor Wage Inc. | 8-12% |

Preview the Actual Deliverable

Convergint PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Convergint delves into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company's operations and strategic direction.

Understand the external forces shaping Convergint's industry landscape, from regulatory changes to evolving customer expectations.

This detailed report provides actionable insights for strategic planning and risk mitigation.

Sociological factors

A heightened public perception of threats, ranging from rising global crime rates to persistent terrorism concerns, is significantly driving demand for advanced security and surveillance solutions across public and private sectors. This societal demand elevates security as a top priority for businesses and public entities, leading to increased investment in modernizing aging infrastructure. The global physical security market is projected to reach approximately $150 billion by 2025, reflecting a strong focus on proactive measures and real-time situational awareness. This includes robust growth in video surveillance and access control systems, which are key for comprehensive safety strategies.

There is a growing societal expectation for buildings to be intelligent, responsive, and highly efficient, moving beyond basic safety to enhance occupant well-being. Individuals and facility managers increasingly desire integrated systems that personalize climate control and enable seamless mobile access, boosting comfort and productivity. This trend fuels a strong demand for sophisticated building automation, security, and life safety solutions. The global smart building market, for instance, is projected to exceed $150 billion by 2025, reflecting this significant shift.

The emphasis on health and well-being in corporate environments has significantly increased, driven by post-pandemic awareness. This has fueled demand for Convergint's solutions like touchless access control and advanced air quality monitoring systems. Beyond physical health, there is a growing focus on psychological safety, with 80% of organizations in 2024 prioritizing employee well-being initiatives. This influences the design of secure work environments to foster trust and comfort.

Data Privacy and Ethical Concerns

The increasing use of AI-powered surveillance and biometric data in security systems, like those from Convergint, amplifies public concern over privacy. Building trust is paramount; companies must demonstrate robust ethics policies, particularly regarding data privacy and AI usage, to gain public acceptance. By 2025, global data protection regulations are expected to influence over 75% of the world's population, emphasizing ethical data handling. Clients increasingly prioritize how their data is used and stored.

- Global data protection regulations are projected to cover 75% of the world's population by 2025.

- A 2024 survey indicated 85% of consumers are more likely to trust companies with clear data privacy policies.

Growing Importance of Corporate Social Responsibility (CSR)

Stakeholders, including clients and investors, increasingly expect companies like Convergint to demonstrate a strong commitment to Corporate Social Responsibility (CSR). This encompasses ethical practices, robust community engagement, and a focus on Diversity, Equity, and Inclusion (DEI) initiatives. A company's reputation for social responsibility can be a significant differentiator in today's competitive market, with 2024 reports showing a growing investor preference for ESG-aligned firms. CSR is evolving from an optional activity to a core part of business strategy, reflecting changing societal values and market demands.

- By 2025, over 80% of institutional investors are projected to consider ESG factors in their investment decisions.

- A 2024 study indicated that consumers are 60% more likely to purchase from socially responsible brands.

- Companies with strong DEI programs often report 20% higher innovation rates and better talent retention.

Societal demand for enhanced security and smart, healthy buildings drives significant market growth, with the global physical security market nearing $150 billion by 2025. Growing privacy concerns necessitate robust data protection, as global regulations will influence 75% of the population by 2025. Companies must also prioritize Corporate Social Responsibility and DEI, as over 80% of institutional investors consider ESG factors by 2025.

| Sociological Factor | Market Impact | Key Data Point |

|---|---|---|

| Security Demand | Increased investment | Global physical security market ~$150B by 2025 |

| Smart Building Expectation | Demand for integrated solutions | Global smart building market >$150B by 2025 |

| Data Privacy Concerns | Need for ethical policies | 75% of world influenced by data regulations by 2025 |

Technological factors

Artificial intelligence is transforming security analytics for companies like Convergint, enabling advanced video analytics and predictive threat assessment. AI-powered systems are significantly enhancing operational efficiency by filtering out false alarms and identifying real-time threats, with the global AI in security market projected to reach over 60 billion USD by 2025. This allows for a proactive security stance, moving beyond simple recording to intelligent analysis and automated responses. For instance, AI adoption in physical security is expected to grow by over 25% in 2024, driving demand for solutions that integrate behavioral recognition. Such advancements empower security teams to respond faster and more effectively to evolving threats.

The shift towards cloud-based security management, specifically Access Control as a Service (ACaaS) and Video Surveillance as a Service (VSaaS), significantly enhances Convergint's offerings. This model provides clients with superior scalability and remote management capabilities, reducing their need for costly on-premise hardware. By adopting these 'as a service' models, Convergint can deliver more flexible and cost-effective solutions, simultaneously establishing valuable recurring revenue streams. The global ACaaS market, for instance, is projected to exceed $1.3 billion by 2025, underscoring the market's robust growth. Cloud platforms are also central to integrating disparate security systems into a unified, efficient interface.

The proliferation of IoT devices is enabling truly integrated smart buildings where Convergint can unify security, fire, HVAC, and lighting systems. This integration supports automated workflows, like automatically adjusting lighting and HVAC based on occupancy or automating emergency lockdowns during a security event. The global smart building market is projected to reach approximately $135 billion by 2025, highlighting this significant opportunity. Convergint's core challenge and competitive advantage lie in seamlessly integrating these disparate systems onto a single, manageable platform for clients seeking advanced operational efficiency.

Mobile-First Access and Biometrics

The security landscape is rapidly shifting towards mobile-first access and biometrics, replacing traditional physical keys and cards with smartphone credentials leveraging NFC or Bluetooth, alongside biometric identifiers like fingerprints and facial recognition. These advancements provide a highly secure and frictionless user experience, enabling seamless entry and movement within facilities. The demand for touchless solutions has significantly accelerated this trend, enhancing both convenience and hygiene protocols. By 2025, the global biometric system market is projected to reach over $50 billion, indicating strong adoption.

- Mobile credentials leveraging NFC and Bluetooth are becoming standard, replacing physical access cards.

- Biometric solutions, including facial recognition and fingerprint scanning, are enhancing security and user convenience.

- The push for touchless access, accelerated by global health concerns, drives demand for these technologies.

- Security integrators like Convergint are capitalizing on this shift, with market projections showing continued growth in biometric and mobile access solutions through 2025.

Cybersecurity of Physical Security Systems

As physical security systems increasingly integrate with IoT networks, their vulnerability to cyber threats escalates significantly. There is a critical imperative for Convergint to implement a Cybersecurity by Design approach, embedding robust defenses from the foundational architecture. This ensures solutions are inherently resilient, safeguarding client data and maintaining the operational integrity of critical infrastructure. The global cybersecurity market for IoT devices is projected to exceed $15 billion by 2025, highlighting the immense demand for secure integrations.

- The average cost of a data breach is estimated to reach $4.5 million in 2024.

- Over 70% of IoT devices are vulnerable to cyberattacks, emphasizing design-level security.

- Security spending on cloud security and data protection is forecast to grow over 12% in 2024.

- Convergint’s focus on secure system integration directly addresses these escalating cyber risks.

Technological advancements, including AI-powered analytics and cloud-based security (ACaaS, VSaaS), are reshaping Convergint's offerings, driving efficiency and scalability. The integration of IoT devices into smart buildings and the shift to mobile-first biometrics offer new revenue streams and enhanced user experiences. Critical cybersecurity by design is essential as IoT expands, with the IoT cybersecurity market projected to exceed $15 billion by 2025.

| Technology Trend | 2024/2025 Market Projection | Impact on Convergint |

|---|---|---|

| AI in Security | >$60 billion by 2025 | Enhances analytics, predictive threat assessment, efficiency |

| ACaaS Market | >$1.3 billion by 2025 | Enables scalable, recurring revenue cloud solutions |

| Smart Building Market | ~$135 billion by 2025 | Integrates systems for operational efficiency |

| Biometric Systems | >$50 billion by 2025 | Provides secure, frictionless access solutions |

| IoT Cybersecurity | >$15 billion by 2025 | Demands robust security-by-design integration |

Legal factors

Data privacy laws such as Europe's GDPR, active since 2018, and evolving U.S. state regulations like the California Privacy Rights Act (CPRA) in effect from 2023, impose strict rules on handling personal data, including biometric and video feeds. Convergint's security solutions must comply with these complex frameworks to avoid substantial penalties, which can reach 4% of global annual turnover under GDPR. The legal landscape continues to rapidly evolve into 2025, necessitating continuous adaptation to new compliance requirements and emerging data protection standards. This ensures operational legality and maintains client trust.

Fire safety regulations are tightening globally, with the UK's updated Building Safety Act 2022 and various U.S. state and local codes, like NFPA 72 and NFPA 13, pushing for more robust safety measures. New mandates for 2025 emphasize advanced fire alarm systems, expanded sprinkler requirements for diverse building types, and comprehensive evacuation planning. This includes stricter maintenance schedules and better integration of smart detection technologies. For Convergint, compliance with these evolving legal standards is non-negotiable and central to their fire and life safety business segment, driving demand for their integrated solutions. These regulations directly impact project specifications and technology adoption across commercial and public sectors.

Convergint navigates a complex legal landscape due to industry-specific compliance mandates in its core sectors. Healthcare clients, for example, require strict adherence to HIPAA regulations concerning data privacy and security, with the average healthcare data breach costing $11.6 million in 2024. For financial institutions, compliance with GLBA and evolving data protection laws is paramount to secure sensitive financial information. Furthermore, serving government agencies necessitates deep expertise in protocols like CMMC 2.0, which is becoming a contractual requirement for Department of Defense contractors in 2025, ensuring robust cybersecurity standards. This specialized knowledge is critical for Convergint to deliver compliant and effective security solutions across these highly regulated markets.

Cybersecurity and Critical Infrastructure Laws

Governments are enacting stricter cybersecurity regulations, especially for critical infrastructure sectors like energy, transportation, and healthcare. Convergint's systems, often integral to these facilities, must meet high standards for cyber resilience. For instance, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) has intensified its focus on industrial control systems, with 2024 initiatives targeting operational technology security. These regulations aim to protect essential services from disruption by sophisticated cyberattacks, pushing for compliance and robust incident response plans.

- The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025.

- The EU's NIS2 Directive, effective October 2024, mandates enhanced cybersecurity measures for critical entities.

- In 2024, the U.S. government allocated significant funding, over $2.5 billion, to CISA for cybersecurity enhancements.

Labor and Employment Laws

As a global systems integrator with thousands of employees, Convergint faces diverse labor and employment laws across its operations in over 200 locations worldwide, including significant presence in North America, Europe, and Asia. Compliance with regulations governing worker safety, fair wages, and specialized training/certification for its technical workforce, which grew substantially in 2024, is paramount. Ensuring adherence to local labor codes, such as minimum wage increases seen in many US states for 2025, and evolving EU directives on working conditions, is crucial for operational stability and maintaining a strong employer brand. Failure to comply could result in substantial fines or reputational damage.

- Global Workforce: Convergint employs over 10,000 colleagues across 200+ global locations as of early 2025.

- Regulatory Complexity: Navigating varying labor laws, including wage standards and health and safety protocols, across countries like the US, Canada, UK, and Germany.

- Training & Certification: Ensuring technical staff meet specific industry and national certification requirements, vital for fire, security, and building automation projects.

- Compliance Impact: Non-compliance can lead to significant financial penalties, with labor law violations potentially costing companies millions annually, alongside reputational damage.

Convergint faces evolving legal risks from global data privacy laws like GDPR and tightening cybersecurity mandates, such as the EU's NIS2 Directive effective October 2024. Compliance with industry-specific regulations, including CMMC 2.0 for defense clients in 2025, is critical. Additionally, navigating diverse labor laws across 200+ global locations impacts operational stability. These legal shifts necessitate continuous adaptation to avoid penalties and maintain market position.

| Legal Factor | Key Regulation (2024/2025) | Impact for Convergint |

|---|---|---|

| Data Privacy | EU GDPR, US CPRA | Strict data handling, avoid 4% turnover fines. |

| Cybersecurity | EU NIS2 (Oct 2024), CMMC 2.0 (2025) | Mandatory enhanced security, critical infrastructure. |

| Labor Laws | Global wage/safety laws | Operational stability, workforce compliance. |

Environmental factors

The increasing global emphasis on sustainable construction and green building certifications like LEED and BREEAM significantly drives demand for advanced building automation systems. Convergint’s solutions are instrumental in helping clients achieve these standards, optimizing energy consumption by up to 30% and enhancing overall building performance. With over 110,000 LEED-certified commercial projects globally by early 2024, these certifications are rapidly becoming integral to government regulations and corporate sustainability policies. This trend reinforces the necessity for smart building technologies that facilitate compliance and improve environmental footprints.

Governments worldwide are implementing stringent energy efficiency regulations to significantly reduce carbon emissions from buildings. For example, the EU's Energy Performance of Buildings Directive mandates the installation of advanced Building Automation and Control Systems (BACS) in larger commercial buildings by 2025. This regulatory push directly expands the market for Convergint's building automation services. The global building automation market is projected to exceed 100 billion USD by 2025, driven by such compliance requirements and a global focus on sustainability.

Growing investor, customer, and employee pressure demands corporate adoption and transparent reporting on Environmental, Social, and Governance (ESG) criteria. In 2024, over 85% of institutional investors consider ESG factors in their decisions. Clients increasingly integrate sustainability requirements into procurement, favoring partners like Convergint that help meet environmental goals. Convergint can effectively market its advanced energy-saving solutions as a crucial tool for clients to significantly improve their ESG performance and reduce operational emissions by up to 20% by 2025.

Climate Change and Extreme Weather Preparedness

The escalating frequency and severity of extreme weather events, amplified by climate change, significantly increase the demand for resilient facilities. Businesses and public safety agencies are now prioritizing robust infrastructure, ensuring life safety and security systems maintain operations with reliable backup power during emergencies. Global economic losses from natural catastrophes are projected to reach over $200 billion annually by 2025, driving substantial investment in preparedness technologies. Convergint's services in integrated security and building automation directly address this critical need for enhanced resilience.

- By 2025, over 60% of new commercial construction projects in high-risk areas are expected to incorporate advanced climate-resilient designs.

- Investment in climate adaptation solutions, including resilient infrastructure, is forecast to exceed $100 billion globally in 2024.

- The market for backup power solutions for critical infrastructure is projected to grow by 8% annually through 2025, reaching $15 billion.

- Insurance payouts for weather-related damage in North America alone surpassed $70 billion in 2023, spurring proactive mitigation efforts.

Waste Reduction and Circular Economy Principles

The security and technology sectors face increasing scrutiny over electronic waste (e-waste), which is projected to reach 74.7 million metric tons globally by 2030.

There is a significant trend towards designing products for longevity and embracing circular economy principles, aiming to reduce this impact. Convergint's clients are increasingly prioritizing sustainable solutions that cover the entire product lifecycle, from utilizing recycled materials in manufacturing to ensuring responsible end-of-life disposal by 2025. This shift means a focus on reducing waste and improving resource efficiency in all security system deployments.

- Global e-waste is expected to grow by 2 million metric tons annually by 2025.

- Over 80% of e-waste is not formally recycled, presenting a major environmental challenge.

- The circular economy model aims to retain product value, reducing resource consumption by up to 99% for some materials.

The increasing emphasis on sustainable construction and stringent energy efficiency regulations, like the EU's 2025 BACS mandate, significantly drives demand for Convergint’s solutions. Growing climate change impacts, with global economic losses projected to exceed $200 billion annually by 2025, necessitate robust infrastructure and advanced resilience technologies. Moreover, rising ESG pressures and concerns over e-waste, expected to grow by 2 million metric tons annually by 2025, push clients towards sustainable, circular economy solutions.

| Environmental Factor | Key Trend/Impact | 2024/2025 Data Point |

|---|---|---|

| Green Building Demand | LEED/BREEAM certifications | Over 110,000 LEED-certified projects by early 2024 |

| Energy Efficiency Regulations | Building Automation (BACS) market growth | Global building automation market to exceed $100 Billion by 2025 |

| Climate Resilience | Extreme weather economic losses | Projected $200 Billion annual global losses by 2025 |

| E-waste Concerns | Annual e-waste growth | Expected 2 million metric tons annual increase by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using data from reputable sources including global economic databases, official government publications, and leading industry research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.