Convergint Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Convergint Bundle

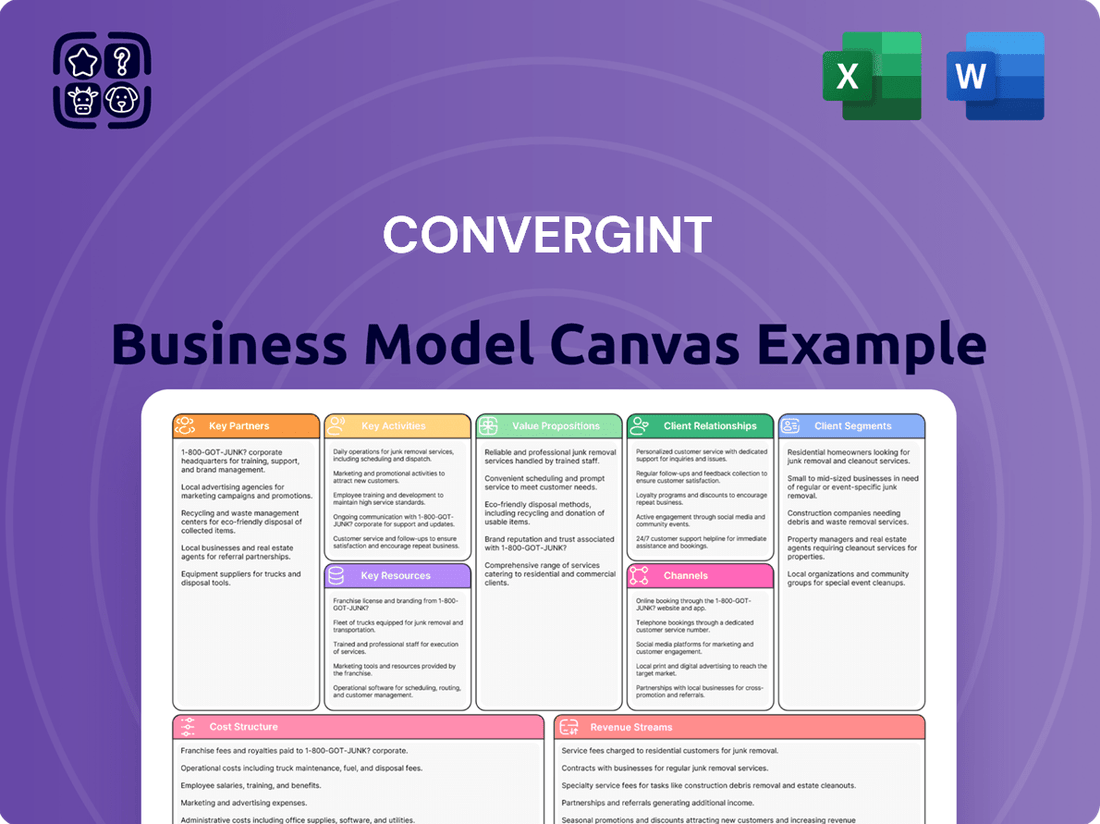

Unlock the full strategic blueprint behind Convergint's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Dive deeper into Convergint’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Convergint operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Convergint’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Convergint’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Convergint strategically partners with top hardware and software manufacturers such as Genetec, Axis Communications, LenelS2, and Honeywell. These alliances, crucial for offering diverse solutions, provide access to cutting-edge technology, specialized training, and robust technical support. This vendor-agnostic strategy ensures Convergint can design optimal, tailored security and building automation solutions for clients, avoiding reliance on a single proprietary system. For 2024, the global physical security market, a key area for these partnerships, is projected to reach approximately $135 billion, highlighting the significance of these comprehensive technology integrations.

Convergint’s strategic partnerships with leading Video Management Software (VMS) and Physical Security Information Management (PSIM) providers are crucial. These collaborations, alongside cloud platform alliances, enable the delivery of advanced solutions like cloud-based video surveillance (VSaaS). In 2024, the global VSaaS market is projected to reach approximately $6.5 billion, highlighting the importance of these integrations. Convergint leverages these partnerships to offer scalable, intelligent security systems with integrated data analytics, ensuring modern enterprise solutions.

Convergint collaborates with vetted specialized subcontractors for complex electrical work, structured cabling, and construction, especially for large-scale projects. This strategic partnership model, crucial for their 2024 operations, ensures greater flexibility and scalability in delivering comprehensive turnkey solutions. It enables efficient management of extensive scopes of work without maintaining all trades in-house. This approach helps optimize operational costs and project timelines, supporting their continued growth in the integrated security market.

Private Equity Sponsors

Private equity sponsors, including Ares Management and Leonard Green & Partners, are pivotal key partners for Convergint. This backing provides significant financial capital, enabling strategic acquisitions and global market expansion. Such robust investment, exemplified by ongoing growth initiatives in 2024, fuels their aggressive growth strategy and technology advancements.

- Ares Management and Leonard Green & Partners provide essential financial backing.

- This partnership facilitates strategic acquisitions and global expansion efforts.

- Capital supports investment in new technologies for competitive advantage.

- Their financial commitment is a core driver of Convergint's aggressive growth strategy in 2024.

Industry Associations and Consultants

Engaging with leading security industry associations like ASIS International and SIA is crucial for Convergint. These relationships provide vital market insights and help influence evolving industry standards, which are constantly updated. For instance, ASIS International continued to expand its global reach in 2024, facilitating industry-wide best practices. Partnering with key engineering and consulting firms ensures Convergint is positioned as a preferred integrator from the outset of significant projects.

- ASIS International: Over 34,000 global members in 2024, a key source for industry trends and project leads.

- SIA: Actively shaping security technology standards and advocacy in 2024, providing a strategic advantage.

- Consulting Firms: Early collaboration ensures Convergint's solutions are integrated into project specifications.

Convergint’s key partnerships with leading hardware and software manufacturers, including Genetec and Axis, ensure access to cutting-edge technology and diverse solutions within the global physical security market, projected at $135 billion in 2024. Strategic alliances with specialized subcontractors and cloud providers, vital for the $6.5 billion VSaaS market in 2024, enhance operational flexibility and scalability. Financial backing from private equity sponsors like Ares Management fuels aggressive growth and technology investments. Collaborations with industry associations such as ASIS International, boasting over 34,000 members in 2024, provide crucial market insights and solidify their industry standing.

| Partnership Type | Key Benefit | 2024 Market Data |

|---|---|---|

| Tech Manufacturers | Access to cutting-edge solutions | Physical Security: ~$135B |

| Cloud/VSaaS Providers | Advanced scalable offerings | VSaaS: ~$6.5B |

| Private Equity | Financial capital for growth | N/A |

| Industry Associations | Market insights, standards | ASIS Intl. Members: 34,000+ |

What is included in the product

A strategic overview of Convergint's operations, detailing their customer segments, value propositions, and revenue streams.

This model outlines their partnerships, key activities, and cost structure, reflecting their approach to delivering integrated security solutions.

The Convergint Business Model Canvas serves as a vital pain point reliever by offering a visual, structured framework that simplifies complex strategies.

It efficiently maps out key business elements, enabling teams to quickly identify and address operational challenges and opportunities.

Activities

System design and engineering are pivotal for Convergint, starting with comprehensive needs assessments and site surveys. This activity crafts customized, detailed engineering plans for integrated security, fire, and building automation solutions, directly addressing client operational needs and risk profiles. By translating specific requirements into a technical blueprint, Convergint ensures tailored deployments. In 2024, the demand for integrated smart building solutions continues to drive complex system designs, with the global smart building market projected to reach significant growth, highlighting the criticality of this foundational phase for companies like Convergint.

Installation and Systems Integration involves the physical deployment of security hardware, like cameras and access control panels, into unified platforms. Convergint’s skilled technicians manage the complex task of integrating disparate systems, ensuring seamless communication across all components. This capability, crucial in 2024’s evolving security landscape, differentiates Convergint by expertly merging multi-vendor solutions. Their robust service delivery supports diverse client needs, from corporate campuses to critical infrastructure, reflecting a key operational pillar for their global security enterprise.

Providing ongoing preventative maintenance, emergency service, and remote support for installed security and building automation systems is a critical activity for Convergint. This ensures continuous system uptime, extends asset longevity, and significantly enhances customer satisfaction. This activity is also crucial for generating substantial recurring revenue through long-term service level agreements (SLAs), which often represent a stable and predictable income stream. For instance, the global security services market, a key area for Convergint, is projected to see continued growth into 2024, emphasizing the value of robust post-installation support. This ongoing engagement fosters strong client relationships and drives future business opportunities.

Project Management

Effective project management is central to Convergint's operations, overseeing the entire project lifecycle from initial design to final commissioning. This critical activity ensures projects are completed on time and within budget, involving the precise coordination of internal teams, external subcontractors, and client stakeholders. Robust project management is vital for maintaining profitability and fostering client trust, especially on complex, large-scale security deployments. In 2024, industry data indicates that projects with strong management frameworks are significantly more likely to meet their original goals, with a reported 70% success rate for well-managed projects.

- Project success rates improve with dedicated management.

- Coordination minimizes delays and cost overruns.

- Client satisfaction directly links to project execution.

- Profitability hinges on efficient resource allocation.

Strategic Mergers and Acquisitions (M&A)

A core activity for Convergint involves the continuous identification and acquisition of smaller, regional systems integrators. This M&A strategy serves as their primary method for expanding geographic reach and enhancing technical capabilities. Successful integration of these acquired entities into Convergint's established culture is paramount for sustained growth and market share expansion. For instance, Convergint completed several strategic acquisitions in 2023 and has continued this aggressive M&A pace into 2024 to solidify its market position.

- Convergint completed over 15 acquisitions in 2023, expanding its global footprint.

- The company's M&A strategy targets specialized security, life safety, and building automation firms.

- Integration focuses on cultural alignment and operational synergy post-acquisition.

Convergint's core activities involve designing, engineering, and expertly integrating comprehensive security and building automation systems tailored to client needs. They ensure seamless operational deployment and long-term reliability through meticulous installation, proactive maintenance, and robust project management. Strategic mergers and acquisitions are critical for expanding their global footprint and enhancing specialized service capabilities, solidifying their market position in 2024.

| Activity Area | 2024 Data Point | Impact |

|---|---|---|

| System Design | Smart Building Market Growth | Drives demand for complex solutions |

| Project Management | 70% Project Success Rate | Ensures timely, budget-compliant delivery |

| M&A Strategy | Continued Acquisitions Post-2023 | Expands market share and capabilities |

Delivered as Displayed

Business Model Canvas

The preview you are seeing is a direct snapshot of the actual Convergint Business Model Canvas document you will receive upon purchase. This is not a generic template or a marketing mockup; it represents the complete, professionally structured deliverable. Upon completing your order, you will gain full access to this exact file, retaining all its content and formatting, ready for your immediate use and customization.

Resources

Convergint's core strength lies in its global team of highly trained and certified engineers, project managers, and field technicians. This skilled technical workforce possesses deep expertise in designing, installing, and servicing intricate, multi-vendor security and life safety systems. Their proficiency in managing diverse technological platforms is the company's primary asset, enabling complex integrations. Continuous investment in training and professional certifications remains critical to maintain this high level of technical capability, ensuring the team stays current with evolving industry standards and technologies in 2024 and beyond.

Convergint’s extensive network of physical offices and service centers across North America, Europe, and Asia-Pacific is a critical resource. This global footprint, which in 2024 included over 200 locations worldwide, enables them to provide consistent service and support to large, multinational corporations across all their locations. This network is a major competitive advantage, allowing Convergint to secure enterprise-level contracts by ensuring localized expertise and rapid response times globally.

Official certifications from a wide array of leading technology manufacturers are a crucial resource for Convergint. These certifications, such as those from Axis Communications or Genetec, validate their technical competence and grant access to advanced training and essential support programs. This deep expertise often secures preferential pricing, enhancing their competitive edge. This foundational resource strongly supports Convergint’s vendor-agnostic approach and reinforces their credibility in the integrated security market, where the ability to work with diverse systems is key.

Brand Reputation and Company Culture

Convergint's brand, built on its strong reputation for reliability, exceptional customer service, and its foundational 'Values and Beliefs,' stands as a crucial intangible asset. This robust, positive company culture significantly aids in attracting and retaining top talent, a critical factor for growth, especially given the competitive labor market trends observed in early 2024. It also cultivates deep, trust-based relationships with clients, leading to sustained partnerships and recurring revenue streams.

This distinct cultural foundation and brand recognition serve as a key differentiator within the highly technical and crowded security and life safety integration market, setting Convergint apart from competitors.

- Maintains high employee retention rates, crucial in a competitive 2024 talent market.

- Fosters long-term client relationships, contributing to consistent revenue.

- Supports strategic market positioning through strong trust and reliability.

- Attracts top industry professionals committed to its core values.

Financial Capital and Backing

Convergint's access to substantial financial capital from private equity owners like Ares Management and Leonard Green & Partners is a critical resource. This backing, solidified by Ares Management's majority stake acquired in 2021, directly fuels their aggressive acquisition strategy, as evidenced by multiple strategic purchases in 2024. This financial strength also supports significant investment in internal R&D and employee training initiatives. It provides the stability essential for undertaking large, multi-year security and building automation projects, underpinning their long-term growth ambitions.

- Private equity capital ensures robust funding for growth.

- Supports an active acquisition pipeline in 2024.

- Enables substantial investment in internal R&D and training.

- Provides stability for undertaking extensive, complex projects.

Convergint's key resources include its global team of highly skilled engineers and technicians, crucial for complex system integration, and its extensive network of over 200 physical offices worldwide in 2024. Official manufacturer certifications validate technical competence and enhance their competitive edge. The strong brand and 'Values and Beliefs' culture attract and retain talent, vital in 2024's competitive labor market. Substantial financial capital from private equity owners fuels an aggressive acquisition strategy and R&D investments, supporting growth.

Value Propositions

Convergint offers a powerful value proposition as a single-source global integrator, simplifying complex security, fire, and building automation systems for multinational clients. This means one point of contact for designing, installing, and servicing these critical infrastructures worldwide, ensuring consistent standards across all operations. For 2024, the global integrated security market is projected to reach approximately $150 billion, highlighting the demand for unified solutions. This approach significantly reduces management complexity and procurement burdens for large enterprises seeking a cohesive security partner, enhancing operational efficiency and compliance.

Convergint's vendor-agnostic approach ensures clients receive the most effective and cost-efficient solutions, rather than a one-size-fits-all product. By not being tied to any single manufacturer, they objectively select and integrate best-in-breed technologies. This commitment builds significant trust and delivers superior technical outcomes across diverse projects. This model contributed to Convergint's strong global presence and projected revenue growth in 2024, emphasizing tailored solutions over proprietary limitations.

Convergint's culture is deeply rooted in being the best service provider, which translates into highly responsive support and proactive communication with clients. This commitment fosters a true partnership approach, extending well beyond initial installation to ensure ongoing success and satisfaction. This focus on service excellence cultivates long-term relationships, contributing to high customer retention rates, reflecting industry benchmarks where top-tier service providers often see retention above 90% in 2024. Their dedication ensures clients receive continuous value and support.

Deep Vertical Market Expertise

Convergint excels by offering solutions precisely tailored to the stringent compliance, operational, and security demands of niche vertical markets, including healthcare, finance, and government. This specialized understanding ensures that implemented systems are not only robust but also rigorously adhere to complex regulatory frameworks, which is crucial given the evolving cybersecurity landscape of 2024. Their deep vertical market expertise is a significant competitive advantage that generalist providers simply cannot replicate, empowering clients with industry-specific insights.

- The global healthcare cybersecurity market is projected to reach $17.5 billion by 2024.

- Financial services firms face an average of 300,000 web attacks per week in 2024.

- Government agencies are prioritizing integrated security systems to combat rising cyber threats in 2024.

- Data center security spending is expected to increase by 15% in 2024.

Reducing Total Cost of Ownership (TCO)

Convergint's value proposition extends beyond initial setup costs, focusing on significantly reducing a client's Total Cost of Ownership (TCO) over time. This is achieved through robust system design, proactive preventative maintenance, and seamless integration of security and building automation systems. By enhancing energy efficiency and providing crucial operational intelligence, they deliver a more efficient and safer environment, moving beyond just selling a product. For instance, integrated solutions in 2024 often show a 10-15% reduction in annual energy consumption for large commercial buildings, directly impacting operational expenses.

- Lowering long-term operational costs beyond upfront installation.

- Achieving savings through robust design and preventative maintenance schedules.

- Improving energy efficiency and operational intelligence via system integration.

- Delivering a more efficient and safer operational environment for clients.

Convergint simplifies global security and building automation as a single-source integrator, offering vendor-agnostic solutions that ensure consistent standards across operations. Their deep vertical market expertise and service-driven culture deliver tailored systems for industries like healthcare and finance, reducing client Total Cost of Ownership. This approach fosters long-term partnerships, enhancing operational efficiency and compliance globally.

| Metric | 2024 Projection | Impact |

|---|---|---|

| Global Integrated Security Market | $150 Billion | Addresses demand for unified solutions |

| Healthcare Cybersecurity Market | $17.5 Billion | Highlights specialized vertical focus |

| Large Building Energy Savings | 10-15% Annually | Demonstrates TCO reduction via integration |

Customer Relationships

Convergint's strategy for key enterprise clients involves assigning a dedicated account manager, serving as a singular point of contact and long-term strategic partner. This fosters a deep understanding of the client's evolving security and facility needs, crucial for proactive service delivery. Such a high-touch model is essential for strong client retention, with industry benchmarks showing that retaining existing customers can be five times more cost-effective than acquiring new ones in 2024. This personalized approach facilitates significant upselling and cross-selling opportunities, contributing to sustained revenue growth and solidifying major account relationships.

Customer relationships at Convergint are solidified through multi-year service and maintenance agreements, ensuring sustained engagement. These Long-Term Service Agreements (SLAs) precisely outline response times, preventative maintenance schedules, and support levels, establishing a clear contractual foundation. This approach transforms the dynamic from a singular project vendor to a continuous, reliable service partner, fostering long-term value. For example, recurring revenue from service contracts is a critical component of security integrators' business models, often representing a significant portion of their overall revenue in 2024.

Convergint actively involves clients in the solution design and engineering process, fostering deep collaboration. Through dedicated workshops and collaborative reviews, they co-create security and building automation systems precisely tailored to the customer's unique needs and operational environment. This direct engagement builds strong client buy-in, leading to solutions that are highly valued and effectively adopted. In 2024, companies employing co-creation strategies reported up to a 20% increase in customer satisfaction.

Proactive System Monitoring and Reporting

Convergint fosters strong customer relationships through proactive system monitoring and reporting, a key component of their managed services. By remotely tracking system health and providing performance reports, they often identify and resolve potential security or operational issues before clients are even aware. This approach demonstrates continuous value, reinforcing their role as an indispensable partner in maintaining client security and efficiency. In 2024, such proactive engagement is crucial, with industry reports indicating that businesses prioritize partners who can reduce downtime and optimize system performance.

- Managed services include remote health monitoring.

- Issues are often resolved proactively, before client awareness.

- This strategy builds trust and strengthens client relationships.

- It positions Convergint as an indispensable operational partner.

Customer Training and Empowerment

Convergint prioritizes customer training and empowerment, ensuring clients' staff effectively operate and manage their new security and building automation systems post-installation. This comprehensive training reduces user frustration and minimizes simple support requests, reinforcing Convergint's role as an expert partner. It is a critical component of their customer success process, leading to enhanced client self-sufficiency. Industry data from 2024 indicates that effective customer education can reduce support inquiries by up to 20%, significantly improving operational efficiency.

- Post-installation training ensures client operational proficiency.

- Empowerment reduces common support requests by up to 20% by 2024 industry averages.

- Reinforces Convergint's position as a knowledgeable, helpful partner.

- Key driver for sustained customer success and satisfaction.

Convergint builds robust customer relationships via dedicated account management and multi-year service agreements, fostering long-term partnerships and recurring revenue. Proactive monitoring and client co-creation ensure tailored solutions and pre-emptive issue resolution, enhancing satisfaction by up to 20% in 2024. This high-touch model, including training, is 5x more cost-effective for retention.

| Relationship Tactic | 2024 Impact Metric | Benefit |

|---|---|---|

| Client Retention | 5x more cost-effective than acquisition | Sustained revenue growth |

| Co-creation | Up to 20% increase in satisfaction | Tailored, adopted solutions |

| Customer Training | Up to 20% reduction in support inquiries | Enhanced client self-sufficiency |

Channels

The primary channel for Convergint involves a highly skilled direct enterprise sales force, comprising dedicated account executives and solution architects. This team directly engages C-level executives, facility managers, and IT directors within target organizations, particularly for large-scale security and building automation projects. In 2024, enterprise sales growth in the physical security market continues its upward trend, with projections indicating a significant increase in demand for integrated solutions. This direct approach remains most effective for acquiring complex, high-value projects that demand a deep consultative sales process and customized system designs.

Convergint significantly leverages its vast existing customer base, a highly efficient channel for growth. Account managers actively engage clients to sell system upgrades and expand services to new locations, driving substantial recurring revenue. This channel also facilitates cross-selling additional integrated solutions, such as advanced fire systems or comprehensive building automation. For 2024, industry data indicates that retaining and expanding existing customer relationships can be five to seven times more cost-effective than acquiring new ones, underscoring its strategic importance.

Convergint maintains a strong presence at major industry events like ISC West 2024 and GSX 2024 (Global Security Exchange). These platforms are crucial for lead generation, brand building, and networking with potential clients and partners in the security and building automation sectors. Exhibiting at such events, which attract tens of thousands of attendees annually, allows Convergint to showcase their broad expertise and global reach. For instance, ISC West 2024 saw significant participation from key industry players, reinforcing its importance for market visibility and client engagement.

Referrals from Partners and Clients

Word-of-mouth and direct referrals from satisfied clients, along with architectural, engineering, and construction partners, form a powerful channel for Convergint. A track record of successful project execution, exemplified by the completion of over 15,000 security and life safety projects globally by 2024, consistently leads to new recommendations. This trust-based channel generates high-quality, pre-qualified leads, significantly reducing sales cycle times. Industry data from 2024 indicates that referred customers often have a 37% higher retention rate.

- Referrals contribute to an estimated 80% of new B2B sales leads.

- Customer lifetime value for referred clients is typically 16% higher.

- Over 90% of B2B buyers in 2024 rely on peer recommendations.

- This channel supports Convergint's consistent double-digit growth.

Digital Marketing and Web Presence

Convergint's digital marketing and web presence serve as a crucial inbound channel, attracting and educating prospects actively researching security and building solutions. Their corporate website acts as a comprehensive digital storefront and a valuable resource hub, showcasing their expansive service portfolio and expertise. Through targeted digital advertising campaigns, Convergint reaches specific industry segments, enhancing brand visibility and lead generation. Content marketing, including detailed case studies and insightful white papers, further establishes their authority and addresses client pain points, driving engagement and inquiries in 2024.

- In 2024, corporate websites remain a primary touchpoint for B2B research, with over 70% of buyers beginning their journey online.

- Digital advertising spending in the B2B sector continues to grow, projected to exceed $15 billion in 2024 in the U.S., emphasizing its importance for lead generation.

- Content marketing, particularly case studies, boasts an average conversion rate significantly higher than other digital channels for B2B companies.

- A well-optimized digital presence can reduce customer acquisition costs by up to 30% compared to traditional outbound methods.

Convergint employs a multi-faceted channel strategy, primarily relying on its expert direct enterprise sales force for complex, high-value projects. Significant growth also stems from nurturing existing client relationships, which industry data shows are five to seven times more cost-effective for expansion in 2024. Complementing these are strategic engagements at major industry events like ISC West 2024, robust digital marketing efforts, and a powerful network of client and partner referrals, driving over 80% of new B2B sales leads.

| Channel | 2024 Impact | Key Metric |

|---|---|---|

| Existing Clients | 5-7x more cost-effective | Customer Retention |

| Referrals | 80% of new B2B leads | Lead Generation |

| Digital Presence | 70% of B2B buyers start online | Online Research |

Customer Segments

This segment targets Fortune 500 companies with extensive global operations, often spanning over 50 countries, requiring a unified and centrally managed security program. They highly value Convergint's expansive global footprint, which in 2024 includes over 200 locations worldwide, ensuring consistent service delivery across diverse regions. These clients demand complex security system integration, from access control to video surveillance, with a focus on scalable solutions. Their needs often involve intricate compliance requirements and continuous service support for their vast, interconnected facilities.

The Government and Public Sector segment for Convergint includes federal, state, and local agencies, alongside K-12 school districts and higher education institutions. These entities often navigate stringent procurement processes and compliance mandates, such as FedRAMP, particularly for cloud services, a key focus in 2024. Their primary concern is life safety and security, driving demand for integrated systems. Contracts in this sector are typically large-scale and long-term, reflecting a stable and significant revenue stream, with public sector spending on IT security projected to increase to over $15 billion by 2025.

Healthcare systems and hospitals form a critical segment, requiring integrated security solutions for patient safety, infant protection, and comprehensive facility security. These large networks operate 24/7, facing unique demands for access management and visitor control. Regulatory compliance, particularly HIPAA, is paramount, with potential breaches leading to significant penalties; for instance, HHS reported over 700 large healthcare breaches in 2023 affecting millions. The focus in 2024 remains on robust systems that ensure data privacy and a secure environment for patients and staff.

Financial Services and Banking

Convergint serves the Financial Services and Banking sector, encompassing retail banks, corporate headquarters, and data centers. These clients demand high-security solutions for asset protection, robust fraud prevention, and strict adherence to evolving industry regulations. In 2024, global financial institutions increased security spending, with cybersecurity alone projected to reach over $180 billion by 2025. The focus is on implementing advanced video surveillance, sophisticated access control systems, and integrated intrusion detection to mitigate risks.

- Retail banks prioritize protecting physical branches and customer data.

- Corporate headquarters require secure environments for sensitive operations.

- Data centers need unparalleled security to safeguard critical financial infrastructure.

- Regulatory compliance, like GLBA and PCI DSS, drives solution demands.

Data Centers and Critical Infrastructure

Data centers, encompassing hyperscale, colocation, and enterprise facilities, represent a vital customer segment requiring robust physical security for their critical IT assets. These operations prioritize sophisticated perimeter security, advanced biometric access control, and intelligent video analytics to ensure continuous protection. Uptime and reliability are paramount, with the global data center security market projected to reach over 13 billion USD in 2024, highlighting significant investment in these areas.

- Hyperscale data centers are expanding, with global capacity expected to grow by 20% in 2024.

- Colocation facilities are investing heavily in advanced biometrics, seeing a 15% increase in adoption in 2024.

- Enterprise data centers face an average of 3-5 security incidents annually requiring physical intervention.

- The cost of data center downtime can exceed 500,000 USD per hour for critical systems.

Convergint serves large-scale clients across diverse sectors, including global Fortune 500 companies, government agencies, healthcare systems, financial institutions, and data centers. These segments require complex, integrated security solutions, prioritizing physical security, regulatory compliance, and continuous operational support. Each sector demonstrates significant investment in security, with the global data center security market alone projected to reach over 13 billion USD in 2024.

| Segment | Key Need | 2024 Data Point |

|---|---|---|

| Fortune 500 Global | Unified Security | 200+ global locations for service consistency |

| Government/Public Sector | Life Safety & Compliance | IT security spending projected over $15B by 2025 |

| Financial Services | Asset Protection | Cybersecurity spending projected over $180B by 2025 |

| Data Centers | Physical Security & Uptime | Global market projected over $13B in 2024 |

Cost Structure

As a leading global systems integrator, Convergint’s labor costs represent the most significant component of its cost structure, encompassing employee compensation for its vast workforce.

This includes salaries, comprehensive benefits, and continuous training for highly skilled engineers, technicians, project managers, and sales staff across their global operations.

In 2024, with a global team exceeding 10,000 colleagues, talent acquisition and retention are major cost drivers, reflecting the investment in specialized expertise required for complex security and building automation projects.

Maintaining a competitive compensation package is crucial for attracting top industry talent and supporting their extensive service offerings.

The Cost of Goods Sold for Convergint primarily encompasses the direct expenses for acquiring essential hardware like cameras, sensors, and access control panels, alongside software licenses from their technology partners for security and building automation installations. Efficient procurement through strategic partner agreements is crucial for managing these significant costs. For instance, in 2024, optimizing supply chain logistics and leveraging volume discounts from key suppliers remains vital. Effective inventory management directly impacts project profitability, as these components represent a substantial portion of each project's total cost.

A significant cost for Convergint stems from its core 'acquire and integrate' growth strategy, aiming to expand its global footprint and service offerings. This includes the substantial purchase price of acquired companies, a major capital allocation. Beyond the acquisition cost, considerable expenses arise from legal fees, thorough due diligence, and the complex integration of new firms into Convergint's operational framework. For instance, Convergint continued its strategic acquisitions in 2024, such as the announced acquisition of Prosys in March, demonstrating ongoing significant M&A expenditure.

Sales and Marketing Expenses

Convergint's sales and marketing expenses are crucial for its global reach and continued expansion, funding efforts like their extensive sales force and significant travel for client engagement. These investments are essential for generating new leads and securing new business, directly fueling organic growth across their security and life safety integration services. While specific 2024 figures for private companies like Convergint are not publicly disclosed, industry benchmarks often show sales and marketing as a substantial portion of revenue for growing service firms. These costs are vital for maintaining market presence and competitive advantage in a dynamic industry.

- Global sales force and commissions drive client acquisition.

- Trade show participation and digital campaigns enhance lead generation.

- Investments in marketing are critical for organic growth.

- These expenses are a significant operational cost for Convergint.

Facilities and Operational Overhead

Convergint's facilities and operational overhead represent a significant cost, essential for its extensive global presence. This includes maintaining a vast network of offices and warehouses worldwide, alongside a substantial fleet of service vehicles, critical for onsite client support in 2024. Significant investments in IT infrastructure are ongoing, ensuring seamless operations across diverse locations.

Furthermore, expenses for comprehensive insurance coverage and continuous professional training programs for over 10,000 colleagues are necessary. These costs underpin their geographically dispersed service delivery model, vital for their integrated security and building automation solutions.

- Global network of over 100 offices supports broad service delivery.

- Maintenance of a large vehicle fleet ensures rapid response times.

- Ongoing IT infrastructure upgrades are crucial for digital security and efficiency.

- Investment in colleague training programs enhances service quality and expertise.

Convergint’s cost structure is heavily driven by its extensive global workforce, with significant labor expenses for over 10,000 colleagues in 2024, alongside substantial hardware and software procurement for security and building automation projects.

A core element is the cost of strategic acquisitions, exemplified by the Prosys acquisition in March 2024, coupled with ongoing sales, marketing, and operational overhead for its global network of offices and vehicle fleet.

These investments in talent, technology, and strategic growth define Convergint’s significant operational expenditures.

| Cost Category | Primary Driver | 2024 Relevance |

|---|---|---|

| Labor Costs | Compensation for 10,000+ colleagues | Talent acquisition and retention |

| Cost of Goods Sold | Hardware and software procurement | Supply chain optimization |

| Acquisition Costs | M&A strategy | Prosys acquisition (March 2024) |

Revenue Streams

Convergint's primary revenue stream is derived from one-time fees associated with project-based system installations. This encompasses the meticulous design, procurement, and seamless installation of integrated security and building automation systems. These projects, often the largest single source of income, are fueled by new commercial construction, significant facility upgrades, and evolving security enhancement demands. For example, the North American non-residential construction market, a key driver, is projected to see continued activity in 2024, directly impacting the volume of such large-scale security integration projects.

A significant and growing revenue stream for Convergint stems from recurring fees through long-term service level agreements.

These contracts, often spanning multiple years, cover crucial services like preventative maintenance, software updates, and dedicated on-call support for complex security and building automation systems.

This consistent income stream provides a high degree of revenue predictability and stability, which is vital for long-term financial health.

For instance, the global security services market, a key area for Convergint, continued its robust growth in 2024, emphasizing the increasing demand for such recurring maintenance and support solutions.

Convergint generates substantial revenue from its existing customer base through essential technology refresh cycles and system expansions. This leverages established relationships and a large installed base, which for a company like Convergint, with over 150 global locations by early 2024, translates into significant recurring opportunities. Upgrades to existing security, life safety, and building automation systems, or their expansion into new areas, represent a lower cost of sale compared to acquiring entirely new clients. This strategy is crucial as the global physical security market is projected to reach approximately $150 billion in 2024, with a significant portion driven by ongoing service and upgrade needs.

Managed and Hosted Services (RMR)

Managed and Hosted Services represent a crucial recurring monthly revenue (RMR) stream for Convergint, stemming from ongoing provisions like remote video monitoring and cloud-based access control (ACaaS).

This SaaS-like model is a significant growth driver, offering higher profit margins and fostering deeper customer integration, effectively transitioning Convergint from a traditional vendor to a vital operational partner.

In 2024, the security industry continues its shift towards RMR models, with many integrators aiming for 30-50% of their revenue from recurring services, mirroring Convergint's strategic focus on this high-value segment.

- Remote video monitoring and cloud-based access control (ACaaS) are core offerings.

- This recurring monthly revenue (RMR) model enhances customer loyalty and predictable income.

- Convergint’s strategic shift to RMR aligns with industry trends towards services over one-time installations.

- The SaaS-like approach helps secure long-term contracts and deeper operational partnerships.

Consulting and Professional Services

Convergint generates revenue from distinct consulting engagements, leveraging its profound expertise in security systems. These services encompass critical security risk assessments, comprehensive compliance audits, and strategic master planning for complex enterprise security programs. This specialized consulting arm, which saw a projected market growth of over 10% in 2024 for security consulting, often serves as a crucial entry point, frequently leading to larger, integrated installation and ongoing service contracts.

- Standalone security risk assessments are a key offering.

- Compliance audits ensure adherence to evolving 2024 industry standards.

- Master planning services guide large-scale security initiatives.

- Consulting often prefaces larger installation and service projects.

Convergint diversifies revenue through project-based system installations, driven by 2024 construction activity, and expanding recurring income from long-term service agreements and technology refresh cycles.

A significant focus is on high-margin Managed and Hosted Services, including ACaaS, aligning with the 2024 industry shift towards 30-50% recurring monthly revenue (RMR) for integrators.

Specialized consulting engagements, which saw over 10% market growth in 2024, also contribute, often leading to larger installation and service contracts.

| Revenue Stream | Key Contribution | 2024 Market Impact |

|---|---|---|

| Project Installations | One-time fees | Driven by non-residential construction |

| Recurring Services | Predictable RMR | Global security services growth |

| Managed Services | High-margin ACaaS | Industry shift to RMR models |

Business Model Canvas Data Sources

The Convergint Business Model Canvas is constructed using a blend of internal financial data, extensive market research, and expert strategic insights. These sources are crucial for accurately populating each segment of the canvas, ensuring a robust strategic framework.