Convergint Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Convergint Bundle

Convergint operates in a dynamic market, and understanding the forces shaping its competitive landscape is crucial. Our brief analysis highlights key pressures like the threat of new entrants and the bargaining power of buyers, hinting at the strategic considerations Convergint navigates. We've also touched upon the intensity of rivalry and the influence of suppliers, painting a preliminary picture of its industry position.

The complete report reveals the real forces shaping Convergint’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers providing specialized hardware and software for integrated security and building automation systems wield substantial power. Convergint relies heavily on these key technology partners, such as major players in access control and video surveillance, for the core components of its solutions. The unique nature of certain proprietary technologies, like advanced AI-driven analytics or specific IoT sensors, can create significant switching costs for Convergint, particularly given the integration complexities in large-scale projects. This dependence on specialized inputs, often from a limited pool of high-tech vendors, enhances supplier leverage in pricing and terms for 2024 and beyond.

The market for advanced security components, such as high-end surveillance cameras or specialized access control software, often exhibits significant supplier concentration. For example, key players like Axis Communications or HID Global hold substantial market share in their respective niches, giving them considerable leverage over pricing and contract terms. This dynamic can reduce Convergint's negotiating power, potentially impacting its profit margins on integrated security solutions. However, for more commoditized hardware or standard cabling, Convergint can leverage a diverse global network of suppliers to mitigate this concentrated power and secure competitive pricing.

Convergint actively forms strategic partnerships with key technology providers, such as Absen for LED displays and Rhombus for cloud-managed security, as seen in their continued collaboration through 2024. These alliances ensure access to the latest innovations and foster mutual dependency, which helps balance the power dynamic with suppliers. Collaborations, like the ongoing work with Deloitte on cyber-physical solutions, also significantly enhance service offerings, shifting the supplier relationship more towards a true partnership model.

Threat of Forward Integration

A notable threat stems from large technology manufacturers potentially integrating forward by offering installation and integration services directly to end-users, bypassing system integrators like Convergint. This move would transform them into direct competitors, significantly amplifying their market power. However, Convergint's established reputation for robust customer service and deep, long-standing client relationships, evidenced by its broad 2024 global presence across over 150 locations, serves as a substantial barrier against such a threat. Maintaining these strong client bonds and service quality remains crucial.

- Potential for large tech manufacturers to directly offer integration services.

- This direct offering would bypass integrators like Convergint.

- Convergint's strong customer service and client relationships mitigate this threat.

- Global presence in 2024 across 150+ locations fortifies its market position.

Availability of Alternative Inputs

The increasing prevalence of cloud-based solutions and AI-driven systems significantly expands Convergint's supplier choices for critical technologies. The global cloud computing market, valued at over USD 600 billion in 2023, continues to diversify, alongside a rapidly growing AI market projected to exceed USD 200 billion in 2024. This rise of alternative technologies and new entrants in various manufacturing and software sectors intensifies competition among suppliers. Such availability of substitutes for key inputs provides Convergint with greater leverage in negotiations, often leading to more favorable costs and terms. Convergint can strategically pivot to alternative providers, reducing dependency on any single supplier.

- Cloud computing market size exceeded USD 600 billion in 2023.

- AI market projected to surpass USD 200 billion in 2024.

- Increased supplier competition in technology sectors.

- Convergint gains leverage for favorable costs.

Convergint faces significant supplier power from specialized security technology vendors, especially due to proprietary systems and market concentration from key players like Axis Communications in 2024. However, Convergint actively balances this through strategic partnerships and its ability to leverage the expanding market for cloud-based and AI-driven solutions. The global AI market is projected to exceed USD 200 billion in 2024, offering more supplier choices. This diversification reduces dependency and enhances Convergint's negotiation leverage.

| Supplier Power Factor | Impact on Convergint | 2024 Data/Trend |

|---|---|---|

| Specialized Tech Dependence | High leverage for key vendors | Proprietary systems, high switching costs |

| Supplier Concentration | Reduced negotiation power | Axis, HID Global dominate niches |

| Strategic Partnerships | Mitigates power, fosters mutual dependency | Absen, Rhombus, Deloitte collaborations continue |

| Availability of Substitutes | Increases Convergint's leverage | AI market > $200B, Cloud > $600B in 2024 |

What is included in the product

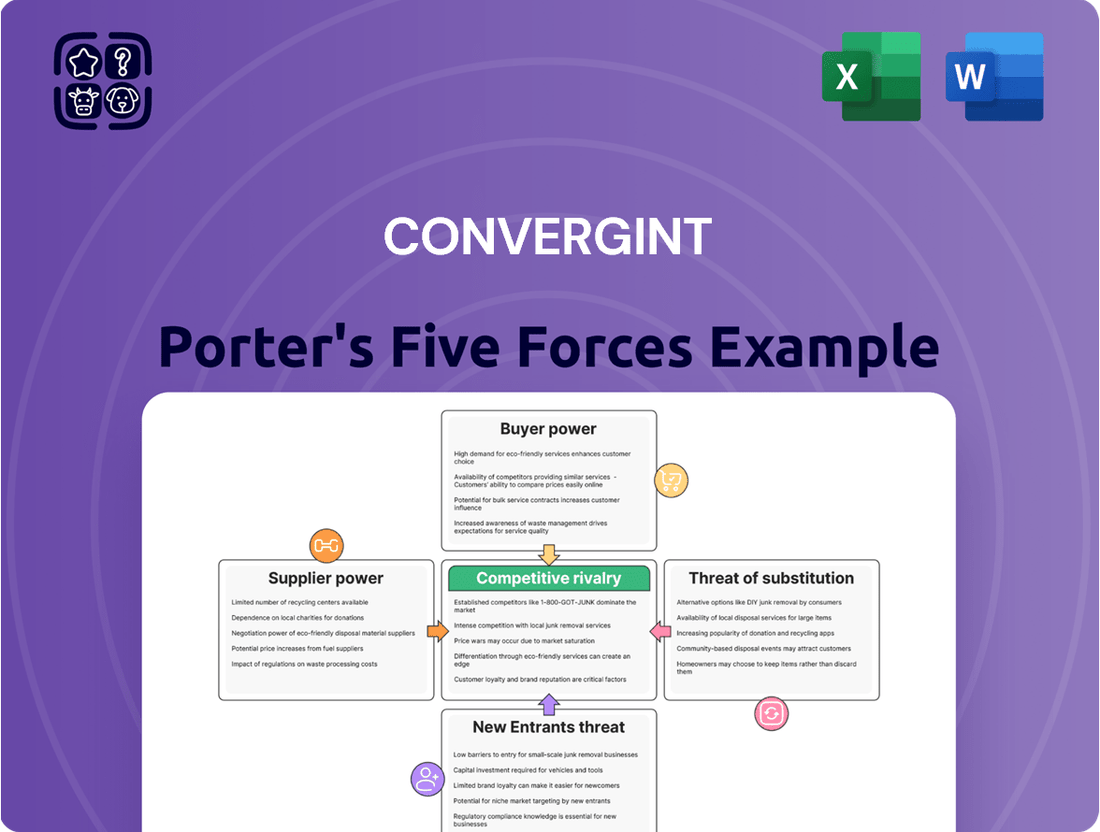

This analysis specifically examines Convergint's competitive environment by evaluating the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the risk of substitute solutions.

Convergint's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces—perfect for quick, informed decision-making.

Customers Bargaining Power

Customers face substantial switching costs when moving from one integrated security and building automation provider to another, significantly reducing their bargaining power. These expenses include not only new hardware and software procurement, which can be millions for large enterprises, but also the costly operational disruption during system changeovers. Furthermore, the need to retrain staff on a new platform adds considerable time and financial burdens. Convergint's deep integration into client operations and its comprehensive service model, highlighted by its 2024 market presence in over 180 locations, further elevates these barriers, making transitions exceptionally complex and expensive for clients.

Convergint serves a diverse range of large clients spanning critical sectors like government, healthcare, and finance. While a substantial portion of revenue from a few large customers could empower those clients to exert considerable pressure on pricing and contract terms, Convergint's broad customer base mitigates this risk. As of 2024, Convergint's extensive global reach across various industries helps to dilute the power of any single client, ensuring no undue influence over its operations or profitability.

Customers hold strong bargaining power because the security systems integration market is very competitive. Major global, national, and regional rivals such as Johnson Controls, Siemens, and ADT offer diverse solutions. This provides clients with a wide array of choices, forcing integrators to maintain competitive pricing and service quality. For instance, the global physical security market, a segment where these firms operate, was valued at over $120 billion in 2023, indicating numerous alternatives available to customers.

Price Sensitivity

For many of Convergint's clients, especially those in highly competitive sectors like retail or manufacturing, the cost of comprehensive security solutions remains a significant factor, making them highly price-sensitive. Customers routinely solicit bids from multiple security integrators, leveraging this ability to compare offerings and exert downward pressure on pricing. This dynamic is particularly evident in 2024, where market data indicates that procurement departments are intensifying cost-efficiency efforts, especially for standardized installations where service differentiation is less pronounced.

- Clients prioritize value, often scrutinizing security solution proposals against budget constraints.

- The competitive landscape for security integration enables customers to easily benchmark pricing across vendors.

- Standardized security projects, such as basic access control or CCTV upgrades, face the most intense price competition.

- Recent market trends show a continued emphasis on cost optimization in B2B service procurement.

Threat of Backward Integration

The threat of backward integration significantly empowers Convergint's large, sophisticated customers. Major corporations and government entities possess the resources and expertise to develop their own in-house security integration capabilities.

This do-it-yourself approach serves as a credible substitute, increasing their bargaining power and pressuring Convergint to continuously demonstrate superior value and expertise in a competitive market. In 2024, an estimated 15% of large enterprises are exploring or have implemented some level of in-house IT and security service management to reduce third-party reliance.

- Large enterprise IT budgets saw a 4.5% increase in 2024, potentially funding in-house solutions.

- Customer bargaining power is heightened by the availability of internal security teams.

- Convergint must differentiate through specialized expertise and cost-effectiveness.

- The global security integration market is projected to reach $180 billion by 2025, intensifying competition.

Convergint's customers face high switching costs due to integrated systems and operational disruption, limiting their immediate bargaining power. However, the highly competitive security integration market, valued over $120 billion in 2023, provides clients with numerous alternatives, fostering significant price sensitivity. This dynamic, coupled with the rising trend of in-house security solutions, where 15% of large enterprises explored or implemented such capabilities in 2024, generally empowers customers to exert strong pressure on pricing and service terms.

| Factor | Impact on Customer Power | 2024 Data Point |

|---|---|---|

| Switching Costs | Lowers | Convergint has 180+ global locations |

| Market Competition | Increases | Physical security market >$120B (2023) |

| Backward Integration | Increases | 15% large enterprises exploring in-house IT/security |

Preview the Actual Deliverable

Convergint Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Convergint's position within the security industry through a comprehensive Porter's Five Forces analysis, examining the intensity of rivalry among existing competitors, the threat of new market entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products or services. This in-depth analysis is crucial for understanding the competitive landscape and strategic positioning of Convergint.

Rivalry Among Competitors

The global security systems integration market, valued at over $100 billion, remains highly fragmented, featuring a mix of large multinational corporations and numerous smaller, specialized regional players. Convergint competes directly with major entities such as Johnson Controls, Siemens, Honeywell, and ADT, alongside thousands of smaller firms. This high number of competitors, with no single entity dominating market share, intensifies rivalry for market share and project bids. The competitive landscape in 2024 continues to be characterized by aggressive pricing and a focus on specialized service offerings to gain an edge.

The commercial security and building automation markets are experiencing robust growth, which naturally helps reduce the intensity of rivalry among competitors. This allows companies to expand their operations without necessarily having to take market share directly from rivals. The global commercial security market, for instance, is projected to grow significantly, reaching over $300 billion in 2024, driven by increasing digitization and heightened security concerns. This attractive growth, however, also invites more aggressive competition from both new entrants and existing players seeking to capitalize on the expanding opportunities.

Convergint significantly differentiates itself through an unwavering commitment to customer service, operational excellence, and its deeply ingrained corporate culture, guided by its Values and Beliefs. This service-centric approach, coupled with technical expertise in complex security and building automation solutions, cultivates a robust brand reputation and fosters enduring customer relationships. By prioritizing client satisfaction and solution efficacy, Convergint effectively mitigates direct price-based competition in the highly competitive security integration market, as evidenced by its consistent growth in 2024.

Strategic Mergers and Acquisitions

Strategic mergers and acquisitions significantly intensify competitive rivalry within the security integration sector. Convergint actively pursues this strategy, acquiring companies like Esscoe in 2021 and Delco Security in 2023 to expand its geographic reach and enhance technical services. This ongoing consolidation, with the industry seeing over 100 M&A transactions annually in recent years, continually reshapes market dynamics. Such activity forces competitors to innovate and consolidate to maintain their market share.

- Convergint's acquisition of Esscoe in 2021 broadened its Midwest presence.

- The Delco Security acquisition in 2023 strengthened its capabilities in the Mid-Atlantic.

- M&A activity drives industry consolidation and competitive pressures.

- This strategy expands service offerings and client bases for market leaders.

Shift to Service-Based Models

The security integration industry is undergoing a significant shift from one-time installation projects to recurring revenue models, notably managed and cloud-based services. This intensifies competitive rivalry, as companies now compete on service quality, reliability, and the ability to deliver long-term value. Firms successfully transitioning to these models, like Convergint, can cultivate more stable business operations and foster stronger client relationships. For instance, the global managed security services market is projected to reach approximately $43.7 billion in 2024, highlighting this growing segment.

- Recurring revenue models enhance client stickiness.

- Focus shifts to continuous service delivery and support.

- Market growth in managed services fosters new competitive battlegrounds.

- Companies offering comprehensive service portfolios gain an edge.

The security integration market is highly fragmented with numerous competitors, intensifying rivalry through aggressive pricing and specialized offerings. While robust market growth, projected over $300 billion in 2024 for commercial security, offers expansion, it also attracts more aggressive competition. Convergint mitigates this via customer service and strategic M&A, yet the shift to recurring revenue models, with managed security services nearing $43.7 billion in 2024, demands continuous innovation in service delivery.

| Rivalry Factor | Impact on Convergint | 2024 Data Point |

|---|---|---|

| Market Fragmentation | High competition for bids | Global security systems >$100B |

| Market Growth | Expansion opportunities, new entrants | Commercial security >$300B |

| M&A Activity | Industry consolidation, increased scale | >100 M&A transactions annually |

| Revenue Model Shift | Competition on service quality | Managed security services ~$43.7B |

SSubstitutes Threaten

Large organizations with substantial resources increasingly consider managing their security and building systems internally, rather than engaging an integrator like Convergint. This involves directly employing security professionals and technicians, a viable substitute especially for entities with consistent, complex needs. For instance, the average salary for a senior in-house security manager in 2024 can exceed $120,000 annually, indicating a significant investment in specialized talent. The feasibility of this in-house approach often hinges on the organization's ability to attract and retain highly specialized security and IT talent, which can be a competitive challenge.

The growing availability of simpler, more affordable do-it-yourself security systems and direct-to-consumer sales models presents a notable substitute, especially for smaller commercial clients. These solutions, while lacking the depth and customization of systems Convergint installs, offer a lower-cost alternative for less demanding security applications. The global DIY home security market, for instance, continues to expand, with projections showing significant growth into 2024, driven by accessibility and cost-effectiveness. This trend empowers small businesses to manage basic security needs without full-scale professional integration, diverting potential revenue from traditional providers. Such alternatives appeal to clients prioritizing budget over comprehensive, bespoke solutions.

Customers often consider standalone security products like separate video surveillance or access control systems instead of fully integrated solutions. While these individual purchases may offer a lower initial cost, they lack the operational efficiency and advanced capabilities of a unified platform. However, the market trend strongly favors integration; reports indicate the global physical security market, driven by integrated solutions, is projected to reach nearly $160 billion by 2025, up from an estimated $130 billion in 2024. This growing demand for comprehensive, end-to-end solutions significantly mitigates the threat posed by non-integrated substitutes for Convergint.

IT Service Providers

As security systems increasingly leverage network infrastructure, traditional IT service providers are expanding their offerings to include physical security integration. The convergence of IT and operational technology (OT) means companies with deep IT expertise could represent a substitute for traditional security integrators. For instance, the global IT services market was valued at over $1.3 trillion in 2024, indicating substantial resources for expansion into new areas. Convergint has proactively addressed this by forming strategic alliances with IT firms like Deloitte, bridging this potential gap and maintaining its competitive edge.

- IT service providers are expanding into physical security as systems become network-based.

- The convergence of IT and OT makes IT expertise a strong substitute.

- Convergint forms alliances with IT firms like Deloitte to mitigate this threat.

Low Customer Willingness to Switch for Critical Applications

For Convergint, serving high-stakes sectors like healthcare and government means clients exhibit low willingness to switch to substitute providers. The severe consequences of system failure or security breaches, potentially costing millions in downtime or fines, far outweigh any perceived savings from alternative solutions. Clients prioritize Convergint's proven expertise and integrated service over less specialized options.

- In 2024, the average cost of a data breach in critical infrastructure sectors exceeded $5 million globally, underscoring risk aversion.

- Healthcare organizations face an average breach cost of $10.93 million, making reliability paramount.

- Government agencies often have stringent compliance mandates, further reducing the appeal of unproven substitutes.

- Specialized integrators like Convergint offer comprehensive solutions that substitutes typically cannot replicate.

Convergint faces substitutes from large organizations building in-house security teams and from cost-effective DIY systems for smaller clients. Traditional IT service providers also emerge as alternatives as security converges with IT. However, the market’s strong preference for integrated solutions and clients’ low willingness to switch in high-stakes sectors like healthcare mitigate these threats. Convergint’s strategic alliances with IT firms like Deloitte further strengthen its position against emerging substitutes.

| Substitute Type | 2024 Market Impact | Convergint Mitigation |

|---|---|---|

| In-house Teams | Senior in-house security manager salaries exceed $120,000 annually. | Focus on complex, integrated solutions beyond typical in-house scope. |

| DIY Systems | Global DIY home security market shows significant growth. | Emphasize comprehensive, customized systems for enterprise clients. |

| IT Service Providers | Global IT services market valued over $1.3 trillion. | Strategic alliances with IT firms like Deloitte. |

| Client Risk Aversion | Healthcare data breach cost $10.93 million; critical infrastructure >$5 million. | Proven expertise and integrated services for high-stakes sectors. |

Entrants Threaten

Entering the complex systems integration market, particularly for large-scale enterprise solutions, demands substantial initial capital investment. New entrants face significant financial hurdles for acquiring specialized tools, advanced software licenses, and maintaining a diverse inventory of components. For instance, establishing a comprehensive service infrastructure across multiple regions, similar to Convergint's global presence in 2024, requires immense investment in facilities, personnel, and logistics. These high upfront costs, crucial for delivering integrated security and building automation solutions, act as a formidable barrier, effectively limiting the pool of potential new competitors.

A new entrant faces a substantial barrier in building a team with the deep technical expertise and numerous certifications required for integrating complex security and building automation systems, ranging from HVAC to access control. Obtaining manufacturer-specific product certifications and adhering to strict safety standards is a time-consuming and costly endeavor. The current shortage of skilled professionals in the security technology sector, evidenced by a reported 60% of security companies struggling to find qualified staff in 2024, makes it difficult for new players to acquire the highly trained workforce necessary to compete effectively with established firms like Convergint.

In the security industry, trust and reputation are paramount, acting as significant barriers for new entrants. Convergint and other established players have cultivated their brands over many years, demonstrating reliability and excellent service. A new entrant would face immense difficulty and time to build this necessary level of trust, especially for winning large, mission-critical projects. Gaining client confidence to handle sensitive security infrastructure, a market valued at over $150 billion in 2024, requires a proven track record. This strong brand equity makes it challenging for newcomers to compete effectively.

Supplier and Distribution Relationships

New entrants face a significant barrier in establishing supplier and distribution relationships within the security and building automation integration market. Established players like Convergint, which reported over $2 billion in revenue in 2023, have cultivated extensive, long-standing partnerships with leading technology suppliers such as Axis Communications and Genetec. These deep relationships ensure not only reliable access to essential products but also preferential pricing and critical technical support.

A new firm would need to build these connections from the ground up, a time-consuming and capital-intensive endeavor that puts them at a competitive disadvantage in terms of cost and product availability in 2024.

- Convergint's extensive network includes over 300 global locations by 2024, facilitating robust supply chain integration.

- Favorable pricing agreements with major vendors are often volume-based, a hurdle for new, smaller entrants.

- Access to specialized technical support and training from manufacturers is crucial for complex system integration, a benefit new companies lack initially.

- Building trust and reliability with suppliers can take years, delaying a new entrant's market penetration.

Economies of Scale

Large, established integrators like Convergint benefit significantly from economies of scale in purchasing, operations, and service delivery. Their global presence, exemplified by their 2024 ranking as a top systems integrator, enables them to serve multinational clients with consistent standards. This scale allows for competitive pricing and efficient project execution. New, smaller entrants struggle to replicate such cost and service advantages, making it difficult for them to compete effectively on large-scale security and life safety projects.

- Convergint’s extensive network allows for bulk purchasing discounts on security technology.

- Operational efficiencies gained from managing numerous global projects reduce per-unit costs.

- New entrants face higher initial costs for infrastructure and talent, hindering competitive pricing.

- The ability to provide consistent global service, a key Convergint offering in 2024, is a significant barrier.

New entrants face substantial barriers due to the high capital investment required for specialized tools and global infrastructure, alongside the difficulty of acquiring certified talent in the 2024 security market. Establishing deep trust and extensive supplier relationships, cultivated over years by firms like Convergint, presents a significant hurdle. Furthermore, established players benefit from economies of scale, making it challenging for newcomers to compete on cost and service delivery in the over $150 billion security market.

| Barrier Type | Impact on New Entrants | Convergint's Advantage |

|---|---|---|

| Capital Investment | High upfront costs for tools, infrastructure | Global presence, over $2B revenue in 2023 |

| Expertise & Trust | Difficulty acquiring certified staff, building reputation | Proven track record, 60% skilled labor shortage for new firms in 2024 |

| Economies of Scale | Higher per-unit costs, limited pricing power | Bulk purchasing, 300+ global locations by 2024 |

Porter's Five Forces Analysis Data Sources

Our Convergint Porter's Five Forces analysis leverages data from Convergint's investor relations, annual reports, and public filings, complemented by industry research reports and market share data to assess competitive dynamics.