Converge SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Converge Bundle

Converge boasts significant strengths in its robust technological infrastructure and a loyal customer base, but faces challenges from intense market competition and evolving regulatory landscapes.

Want the full story behind Converge's opportunities for expansion and the threats it must navigate? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Converge ICT's exclusive focus on a pure end-to-end fiber optic network is a major strength, enabling them to offer exceptionally fast and dependable internet. This dedicated infrastructure significantly reduces data degradation and external disruptions, ensuring a consistently better experience for users than older cable or mixed systems.

This commitment to a superior network backbone allows Converge to stand out as a top-tier internet service provider in the Philippines. For instance, by the end of 2024, Converge reported a substantial expansion of its fiber network, reaching over 16.7 million homes passed, a testament to its infrastructure-centric strategy.

Converge ICT's financial performance in 2024 was exceptionally strong, with net income attributable to owners rising by 18.8% to P10.81 billion, up from P9.1 billion in 2023. This robust growth underscores the company's solid financial foundation and effective operational strategies.

The company also experienced a substantial 14.8% increase in consolidated revenues, reaching P40.61 billion in 2024. This revenue expansion highlights the growing demand for its services and its success in capturing market share across its key segments.

Looking ahead, Converge ICT has projected an optimistic consolidated revenue growth rate of 14-16% for 2025. This target is supported by the expectation of continued strong performance in both its residential and enterprise business units, indicating sustained momentum.

Converge ICT's commitment to expanding its subscriber base is a significant strength, evident in its impressive growth figures. By the close of 2024, the company had secured 2,563,458 residential subscribers, encompassing both postpaid and prepaid segments. This expansion is particularly fueled by the success of its accessible prepaid services, such as BIDA Fiber and Surf2Sawa, which experienced an outstanding approximate 150% subscriber growth throughout 2024.

This aggressive subscriber acquisition strategy is vital for Converge ICT's market penetration efforts. By focusing on reaching a broader customer base, especially in areas with limited connectivity, the company is effectively capturing market share. The ambitious target of reaching 4 million subscribers by 2027 underscores the company's confidence in its ability to continue this upward trajectory and solidify its position in the telecommunications industry.

Strategic Investments in Infrastructure and Technology

Converge is strategically investing heavily in its infrastructure and technology to boost its capabilities. This includes significant capital expenditures, with a 2025 CAPEX budget of P20-25 billion earmarked for crucial projects.

These funds are specifically allocated towards enhancing global connectivity through participation in two international subsea cable systems: Bifrost and SEA-H2X. These initiatives are vital for improving the speed and reliability of data transmission across vast distances.

Furthermore, the company is investing in the construction of two new data centers. These facilities will bolster its capacity to store and process data, catering to the growing demand for cloud services and data-intensive applications.

- Subsea Cable Investments: Bifrost and SEA-H2X projects aim to expand global network reach.

- Data Center Expansion: Construction of two new data centers to increase processing and storage capacity.

- 2025 CAPEX: P20-25 billion allocated for these strategic infrastructure upgrades.

- Future-Proofing: Investments designed to support increasing demand for data-intensive services.

Diversified Service Offerings and Enterprise Growth

Converge is strategically broadening its service portfolio beyond residential broadband, with a significant push into the enterprise sector. This diversification is proving fruitful, as evidenced by a robust 21.9% year-on-year revenue increase in its enterprise segment during 2024, highlighting strong market penetration, particularly among small and medium enterprises (SMEs) which represent the fastest-growing sub-segment.

The company is actively enhancing its enterprise and wholesale offerings by introducing innovative solutions and forging strategic alliances. These include the deployment of Fiber-to-the-Room (FTTR) technology, branded as Converge Content+, tailored for the hospitality sector, and a partnership to resell Starlink services, further expanding its reach and value proposition.

- Diversified Revenue Streams: Expansion into enterprise and wholesale services reduces reliance on the residential segment.

- Enterprise Segment Growth: 21.9% year-on-year revenue growth in 2024 for the enterprise sector.

- SME Focus: Small and medium enterprises are the fastest-growing sub-segment within the enterprise division.

- Product Innovation: Introduction of FTTR (Converge Content+) and reselling Starlink services expand market appeal.

Converge ICT's pure fiber optic network is a significant advantage, offering superior speed and reliability compared to competitors. This commitment to infrastructure excellence resulted in a network that passed over 16.7 million homes by the end of 2024. Their financial performance in 2024 was robust, with net income rising 18.8% to P10.81 billion and consolidated revenues increasing by 14.8% to P40.61 billion.

| Metric | 2023 | 2024 | YoY Growth |

|---|---|---|---|

| Net Income (P billion) | 9.1 | 10.81 | 18.8% |

| Consolidated Revenues (P billion) | 35.37 | 40.61 | 14.8% |

| Homes Passed (million) | ~15.0 | 16.7 | ~11.3% |

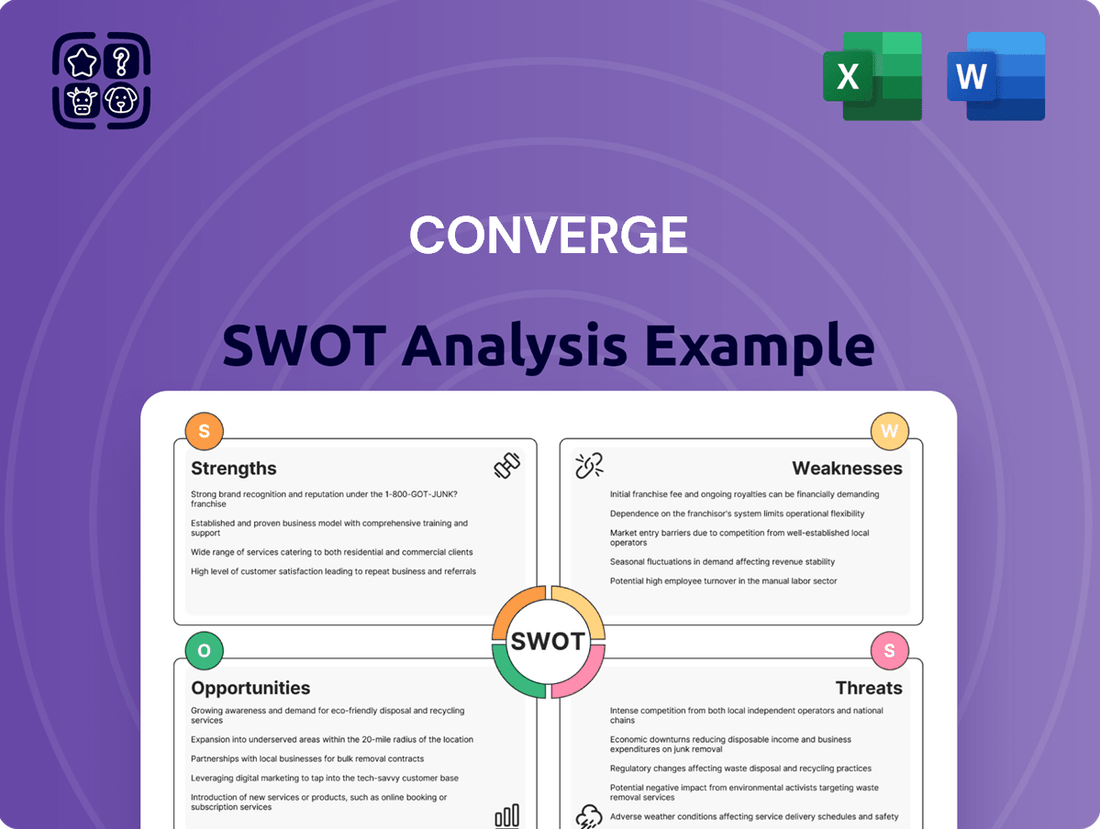

What is included in the product

Analyzes Converge’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights, reducing the burden of extensive analysis.

Weaknesses

Converge ICT Solutions' reliance on extensive infrastructure development, while a core strategy, is a significant weakness. Building out its fiber optic network is a capital-intensive and time-consuming endeavor. This means progress can be hampered by the sheer scale of the undertaking and the need for consistent, heavy investment.

This dependency on physical build-out was evident in 2024, where capital expenditures (CAPEX) came in slightly below target. Such delays in project completion, often referred to as turnkey project turnover, can directly impact the company's ability to expand its reach and meet its ambitious revenue goals. The aggressive target of 11 million fiber ports by 2027 underscores the ongoing need for substantial capital and flawless execution to avoid setbacks.

Converge's rapid subscriber expansion, particularly as they push into new territories, presents a significant hurdle for their customer service and technical support teams. While many users report positive experiences, scaling these operations to match subscriber growth, especially in remote areas where infrastructure might be less developed, is a delicate balancing act.

Maintaining consistent service quality across a burgeoning customer base is crucial. Inconsistent support experiences, even if the core internet service remains strong, can unfortunately lead to customer dissatisfaction, potentially increasing churn rates and negatively impacting brand perception. For instance, if a customer in a newly connected rural area experiences longer wait times for technical assistance compared to a long-standing urban customer, this disparity can breed discontent.

The Philippine telecommunications sector is intensely competitive, featuring major incumbents like PLDT and Globe, alongside newer entrants such as DITO Telecommunity. This rivalry puts pressure on Converge, even with its strong fiber-only focus, potentially triggering price wars and escalating marketing costs.

Converge's market position faces challenges from competitors who may offer bundled services or aggressive pricing strategies, impacting its ability to maintain profit margins. For instance, in Q1 2024, Converge reported a net income of PHP 6.1 billion, a 10% year-on-year increase, but sustained competitive pressures could affect future growth rates.

To counter these threats, Converge must consistently invest in network upgrades and service innovation to stand out. The ongoing need to differentiate its offerings is paramount for retaining and expanding its customer base amidst aggressive market dynamics.

Cybersecurity Threats and Data Protection

Converge ICT, as an internet service provider, is constantly battling an escalating array of cybersecurity threats. In 2024 alone, the company successfully thwarted an immense 183 billion attempts to access illicit websites, a figure significantly inflated by the rise of AI-powered attacks. While Converge is making substantial investments in AI-driven security, the sheer volume and increasing sophistication of these threats present an ongoing hurdle to maintaining network integrity and safeguarding customer data.

The continuous evolution of cyberattacks means that even with robust defenses, vulnerabilities can emerge. This necessitates perpetual vigilance and adaptation of security protocols to counter new exploit methods. The protection of sensitive customer information is paramount, and any lapse could lead to significant reputational damage and regulatory penalties.

- 183 billion blocked illegal site access attempts in 2024.

- AI-driven attacks are a significant contributor to the increased threat volume.

- Ongoing investment in AI-powered security is crucial but faces the challenge of escalating attack sophistication.

Geographic Coverage Limitations in Remote Areas

Converge's ambition to reach third- and fourth-class municipalities faces significant hurdles in geographically isolated and disadvantaged areas (GIDA). The sheer cost and complexity of deploying fiber infrastructure to these remote locations present a substantial challenge, potentially capping the immediate growth in these underserved regions. Despite government initiatives like the National Broadband Plan, which aims to connect 1.5 million households by 2025, the practicalities of extending high-speed internet to the most remote areas remain a significant obstacle.

The limited reach into truly remote GIDA, despite ongoing expansion efforts, acts as a key weakness. This geographical constraint can impact the speed of market penetration and subscriber acquisition in these challenging terrains. For instance, while the Philippine government targets universal broadband access, the capital expenditure required for fiber deployment in areas with low population density and difficult topography is considerably higher, impacting ROI timelines.

- High Deployment Costs: Extending fiber to remote GIDA significantly increases per-kilometer installation costs compared to urban or peri-urban areas.

- Logistical Challenges: Difficult terrain and lack of existing infrastructure in remote regions complicate deployment, leading to delays and increased operational expenses.

- Limited Addressable Market: The lower population density in many GIDA can result in a smaller immediate customer base, affecting the economic viability of network expansion in the short to medium term.

Converge's heavy reliance on capital-intensive fiber optic network expansion remains a significant weakness. This requires substantial and continuous investment, making project timelines vulnerable to delays. For example, capital expenditures in 2024 slightly missed targets, impacting the pace of expanding their fiber port reach, which aims for 11 million by 2027.

Scaling customer service and technical support to match rapid subscriber growth, especially in new and remote areas, poses a challenge. Inconsistent support experiences can lead to customer dissatisfaction and potentially higher churn rates, impacting brand perception. Maintaining service quality across a diverse and expanding user base requires careful management of support operations.

The intensely competitive Philippine telecommunications market, with players like PLDT, Globe, and DITO, pressures Converge. This competition can lead to price wars and increased marketing expenses, potentially affecting profit margins. While Q1 2024 saw a 10% year-on-year net income increase to PHP 6.1 billion, sustained competition could temper future growth.

Converge faces escalating cybersecurity threats, with 183 billion attempts to access illicit websites thwarted in 2024, many AI-powered. Despite investments in AI-driven security, the increasing sophistication and volume of attacks necessitate constant vigilance and adaptation to protect network integrity and customer data.

Expanding into geographically isolated and disadvantaged areas (GIDA) presents high deployment costs and logistical challenges. The lower population density in these regions also means a smaller immediate customer base, impacting the economic viability of network expansion, despite government efforts for universal broadband access.

Preview the Actual Deliverable

Converge SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The Philippines is witnessing a surge in demand for faster and more reliable internet, fueled by the rise of remote work, online learning, and the booming e-commerce sector. This trend creates a significant opening for companies like Converge to capture a larger market share and boost revenue.

The fiber optic cable market in the Philippines is on an upward trajectory, with projections indicating a compound annual growth rate of 7.1% through the forecast period. This expansion is directly linked to the increasing consumer appetite for ultra-fast broadband services, presenting a prime opportunity for Converge to broaden its customer base.

Government initiatives like the National Broadband Plan are actively funding infrastructure to connect less-served regions. This presents a significant chance for Converge to broaden its service footprint.

Converge's plan to deploy more fiber in smaller municipalities over the next couple of years directly taps into this opportunity. By focusing on areas with limited broadband, they can attract new customers.

For instance, the Philippine government allocated PHP 1.14 billion for the National Broadband Program in 2024, aiming to reach unserved and underserved areas. Converge's expansion into these third- and fourth-class municipalities is strategically positioned to benefit from this push.

Converge's enterprise revenue has shown impressive growth, especially within the small and medium-sized enterprise (SME) sector. This trend presents a significant chance to expand and diversify its offerings for businesses, moving beyond basic connectivity.

The company is strategically expanding its Enterprise and Wholesale product portfolio. Initiatives like Fiber-to-the-Room (FTTR) tailored for medical facilities and Content+ for the hospitality sector are set to unlock new revenue streams and solidify Converge's standing in the business-to-business market.

Leveraging Data Centers and Subsea Cable Systems

Converge's investment in new data centers and subsea cables presents a significant opportunity. The planned completion of two new data centers and two international subsea cable systems, Bifrost and SEA-H2X, in 2025 will dramatically boost its infrastructure. This expansion is crucial for meeting the escalating demand for cloud services and content delivery.

These enhanced capabilities will allow Converge to offer more robust and faster connectivity, directly supporting the growth of emerging technologies. The ability to handle increased data traffic positions Converge to capitalize on the burgeoning markets for the Internet of Things (IoT) and Artificial Intelligence (AI).

- Enhanced Capacity: The addition of two new data centers in 2025 will significantly increase Converge's storage and processing capabilities.

- Global Connectivity: The completion of the Bifrost and SEA-H2X subsea cable systems will bolster international network reach and resilience.

- New Service Avenues: Converge can leverage this infrastructure to offer specialized services for IoT and AI applications, tapping into high-growth sectors.

- Improved Performance: The combined infrastructure upgrades are expected to reduce latency and improve data transfer speeds, a key differentiator in the market.

Partnerships and Value-Added Services

Converge can strengthen its market position by forging new strategic alliances, building upon its existing partnerships like the one with Starlink for satellite broadband resale and the asset-sharing agreement with Sky Cable Corp. aimed at optimizing fiber network usage. These collaborations are crucial for expanding reach and operational efficiency.

Expanding its suite of value-added services presents a significant opportunity. Beyond core internet, the planned introduction of Smart Home solutions and bundled entertainment packages, such as Converge Netflix Bundles and the Converge Xperience Hub + Sky TV offering, are designed to increase customer loyalty and create new revenue streams. For instance, the company has been actively promoting bundled services to enhance customer value and retention.

- Strategic Partnerships: Building on the Starlink and Sky Cable Corp. collaborations, Converge can seek further partnerships to enhance service offerings and network reach.

- Value-Added Services Expansion: Introducing Smart Home solutions and entertainment bundles like Converge Netflix Bundles aims to increase customer stickiness and revenue.

- Revenue Diversification: These bundled offerings and new service categories provide avenues for revenue generation beyond basic internet subscriptions.

- Customer Retention: Enhanced service packages and integrated solutions are key to improving customer loyalty and reducing churn.

The increasing demand for high-speed internet in the Philippines, driven by remote work and online activities, presents a substantial opportunity for Converge to expand its subscriber base. Furthermore, government backing through initiatives like the National Broadband Plan, which allocated PHP 1.14 billion in 2024 for infrastructure development, directly supports Converge's expansion into underserved areas. The company's strategic focus on smaller municipalities is well-aligned to capitalize on this push for wider connectivity.

Threats

Converge faces significant threats from intense competition and market saturation in urban areas of the Philippines. Established players like PLDT and Globe are aggressively expanding their fiber networks, leading to a crowded market. This saturation pressures pricing, potentially squeezing profit margins for all providers, including Converge.

In 2023, the Philippine telecommunications sector saw continued investment in fiber infrastructure, with major players reporting substantial subscriber growth. However, this growth often concentrated in urban centers, exacerbating saturation. For instance, while the overall fiber market expanded, the rate of new subscriber acquisition in densely populated cities may have slowed due to the presence of multiple providers vying for the same customer base.

The telecommunications sector moves at lightning speed, and Converge's significant investments in fiber optics, while a strong current strategy, face the threat of future technological disruption. Emerging technologies like advanced satellite internet or novel wireless solutions could challenge the dominance of traditional fiber networks, necessitating ongoing research and substantial capital for adaptation.

Changes in Philippine telecommunications regulations, such as new data privacy laws or shifts in spectrum allocation policies, could significantly affect Converge's ability to operate and grow. For instance, unexpected increases in regulatory compliance costs or limitations on spectrum access could hinder network expansion and service delivery.

While the Philippine government has been supportive of broadband development, a reversal of these policies or increased regulatory oversight could introduce considerable risk. Converge's profitability might be impacted by new taxes or fees imposed by regulators, potentially affecting its competitive pricing strategy.

Economic Downturns and Consumer Spending Habits

Economic downturns, characterized by rising inflation and potential interest rate hikes, pose a significant threat to Converge's growth. A contraction in consumer disposable income could force customers to re-evaluate discretionary spending, potentially leading to downgrades from premium internet packages or a slowdown in new subscriber acquisition. This sensitivity to economic fluctuations could directly impact Converge's subscriber numbers and average revenue per user (ARPU), particularly affecting its higher-margin service tiers.

For instance, the Philippines' inflation rate averaged 5.8% in 2023 and remained elevated in early 2024, impacting household budgets. Should economic conditions worsen, leading to a significant drop in consumer spending power, Converge might experience:

- Reduced demand for higher-speed, premium internet plans.

- Increased customer churn as individuals seek more budget-friendly options.

- Pressure to offer more aggressive pricing or promotions, potentially lowering ARPU.

Infrastructure Vulnerabilities and External Disruptions

Converge's extensive fiber optic network, a key asset, still faces threats from physical damage. Natural disasters like typhoons and earthquakes, prevalent in the Philippines, can sever these lines. For instance, Typhoon Odette in December 2021 caused widespread damage to telecommunications infrastructure across several regions, highlighting this vulnerability.

Beyond natural events, vandalism and accidental cuts during ongoing construction projects pose ongoing risks. These disruptions can result in significant service outages for customers, leading to dissatisfaction and potential churn. The cost of repairs can also be substantial, impacting operational efficiency and the company's bottom line. In 2023, the National Telecommunications Commission reported an increase in fiber cuts due to various construction activities, underscoring the persistent nature of this threat.

- Physical Damage: Susceptibility of fiber optic networks to damage from natural disasters (typhoons, earthquakes), vandalism, and accidental construction cuts.

- Operational Impact: Service outages leading to customer dissatisfaction and potential loss of subscribers.

- Financial Strain: Significant repair costs impacting operational efficiency and profitability.

- Reputational Risk: Negative customer experiences due to service disruptions can damage brand reputation.

Converge's growth is threatened by increasing competition and market saturation, particularly in urban areas. Established players are aggressively expanding their fiber networks, leading to intensified price competition and potentially reduced profit margins.

Technological disruption remains a concern, as emerging technologies could challenge fiber optics' dominance, requiring continuous investment in adaptation. Regulatory changes, such as new data privacy laws or shifts in spectrum allocation, could also impact operations and growth, potentially increasing compliance costs or limiting expansion.

Economic downturns, marked by inflation and potential interest rate hikes, could reduce consumer spending on premium internet services, impacting subscriber acquisition and average revenue per user. For instance, the Philippines' inflation averaged 5.8% in 2023, impacting household budgets.

Converge's fiber optic network is also vulnerable to physical damage from natural disasters, vandalism, and construction accidents, leading to service outages and repair costs. The National Telecommunications Commission reported an increase in fiber cuts due to construction in 2023.

SWOT Analysis Data Sources

This Converge SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research, and expert industry analyses to ensure a thorough and accurate assessment.