Converge Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Converge Bundle

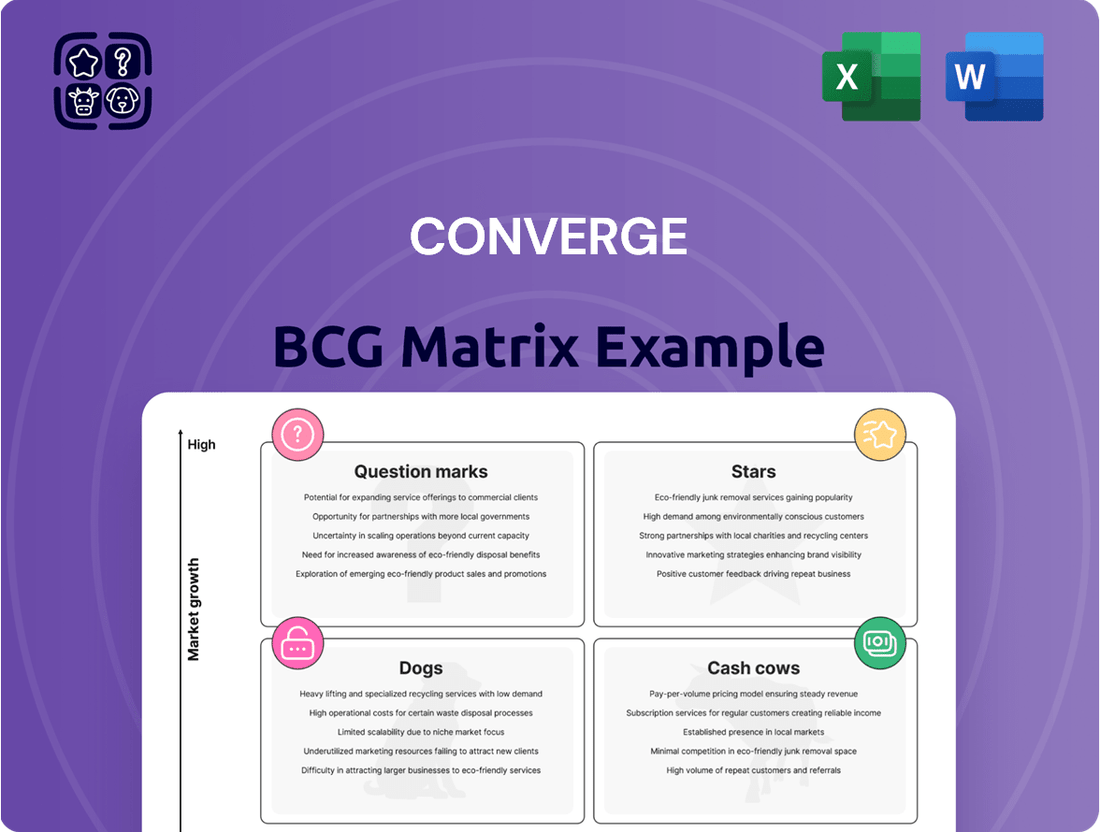

Curious about how this company's products stack up in the market? Our BCG Matrix preview shows you the initial lay of the land, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock strategic growth and make informed decisions about resource allocation and future investments, you need the full picture.

Purchase the complete BCG Matrix report for a detailed breakdown of each product's position, complete with data-driven insights and actionable recommendations. This comprehensive analysis will equip you with a clear roadmap to optimize your portfolio and drive sustainable success.

Stars

Converge's flagship FiberX broadband service is a shining star in its business portfolio, consistently showing robust subscriber growth. In 2024, the company reported a significant increase in residential revenues, a trend that continued into the first quarter of 2025, underscoring its strong market penetration. This expansion isn't limited to urban centers; Converge is actively reaching underserved areas, solidifying FiberX's position as a dominant player.

The demand for high-speed internet in the Philippines remains exceptionally high, fueling FiberX's continued success. This sustained demand, coupled with Converge's strategic market positioning, firmly places FiberX in the high-growth, high-market share quadrant of the BCG matrix. The company's commitment to expanding its fiber network ensures this segment will remain a primary engine for future growth.

Converge's prepaid fiber services, BIDA Fiber and Surf2Sawa, have seen remarkable expansion in 2024, with subscriber numbers surging by an estimated 150%. This impressive growth highlights their success in reaching new customers who prioritize affordability and flexibility in their internet plans.

This rapid adoption is a strong indicator that Converge's strategy to tap into underserved or budget-conscious markets is paying off handsomely. The significant uptake in these segments validates their position as a key player in providing accessible high-speed internet solutions.

The enterprise segment is a strong performer for Converge, demonstrating impressive growth. In 2024, revenues in this area surged by over 20%, a trend that continued into Q1 2025 with similar robust gains. This expansion was broad-based, with all subsegments, including wholesale and small to medium-sized enterprises (SME), contributing significantly to the overall revenue increase.

Converge's strategic emphasis on offering integrated data, internet, and ICT solutions to businesses is a key driver of this segment's success. This comprehensive approach allows them to meet the diverse and evolving needs of the corporate world, positioning the enterprise division for sustained high growth in the coming periods. The company's commitment to providing end-to-end connectivity and digital solutions is clearly resonating with its business clientele.

Further strengthening Converge's position in the enterprise market are its strategic partnerships and innovative new offerings. The introduction of solutions like Converge Content+ is designed to enhance its value proposition and capture a larger share of the rapidly expanding enterprise connectivity sector. These initiatives underscore Converge's proactive strategy to maintain and grow its market dominance.

International Subsea Cable Systems

Converge's strategic push into international subsea cables, exemplified by the Bifrost and SEA-H2X systems activated in 2025, positions this venture as a significant growth driver. These investments are designed to bolster capacity and network resilience, crucial for attracting and handling increasing international data flows. This move directly addresses the burgeoning demand for robust global connectivity, a key indicator for its potential in the BCG matrix.

The activation of these advanced subsea cable systems is projected to significantly expand Converge's market reach. By enhancing its ability to manage international data traffic, the company aims to secure a more substantial portion of this lucrative market. This infrastructure development is a clear indicator of a high-growth potential area for Converge.

- Bifrost Cable System: Aims to connect Singapore, the Philippines, and the US, with an estimated capacity of over 15 Tbps per fiber pair.

- SEA-H2X Cable System: Aims to connect Singapore, the Philippines, Vietnam, Thailand, and Hong Kong, further strengthening regional connectivity.

- Market Impact: These systems are expected to increase Converge's international bandwidth by over 50% upon full activation.

- Strategic Importance: Positions Converge to capitalize on the growing demand for cloud services and digital content delivery across Asia and North America.

Data Center Services

Data Center Services represent a significant growth opportunity for Converge, positioning them as a potential "Star" in the BCG Matrix. The company's strategic expansion, with two new data centers set to activate in Caloocan and Pampanga in 2025, including a Tier III certified facility, underscores this ambition. These investments are directly addressing the escalating demand for cloud services and enterprise data storage.

Converge's aggressive build-out aims to capture a larger share of this high-growth market. By 2025, the company expects these new facilities to significantly bolster its capacity, enabling it to serve a wider array of clients, from large enterprises to cloud providers. This move is critical for Converge to solidify its competitive position and capitalize on the digital transformation trends driving data center utilization.

- Aggressive Expansion: Two new data centers in Caloocan and Pampanga by 2025.

- Tier III Certification: One of the new facilities will be Tier III certified, ensuring high availability and reliability.

- Market Demand: Directly addresses the surging demand for cloud services and enterprise data.

- Strategic Foothold: Aims to strengthen Converge's position in the lucrative data center market.

Converge's FiberX broadband service is clearly a Star, demonstrating high growth and high market share. The company's consistent subscriber growth and expansion into underserved areas in 2024 and early 2025 solidify this position. This strong performance is driven by the sustained high demand for high-speed internet in the Philippines.

The prepaid fiber services, BIDA Fiber and Surf2Sawa, are also emerging Stars, showing rapid subscriber growth of around 150% in 2024. This indicates successful penetration into budget-conscious markets, aligning with the high-growth, high-market share quadrant.

The enterprise segment, with over 20% revenue growth in 2024 and continued strong gains in Q1 2025, is another key Star. Strategic partnerships and new offerings like Converge Content+ are further bolstering its market dominance.

International subsea cables, such as Bifrost and SEA-H2X activated in 2025, represent a high-growth potential area, positioning this venture as a Star. These systems are expected to increase international bandwidth by over 50%, capturing growing global data traffic.

Data Center Services are poised to become a Star, with two new facilities activating in 2025, including a Tier III certified site. This expansion directly addresses the escalating demand for cloud services and enterprise data storage, aiming to capture a larger market share.

| Business Segment | BCG Matrix Category | Key Growth Drivers (2024-2025) | Market Share | Growth Rate |

|---|---|---|---|---|

| FiberX Broadband | Star | High demand for high-speed internet, network expansion | High | High |

| Prepaid Fiber (BIDA, Surf2Sawa) | Star | Affordability, flexibility, market penetration | Growing | Very High (150% subscriber growth in 2024) |

| Enterprise Solutions | Star | Integrated ICT solutions, strategic partnerships | High | High (20%+ revenue growth in 2024) |

| International Subsea Cables | Star | Increased capacity, network resilience, global data traffic | Emerging | High Potential |

| Data Center Services | Star (Potential) | Cloud service demand, enterprise data storage, new facilities | Emerging | High Potential |

What is included in the product

The Converge BCG Matrix offers a strategic overview of a company's portfolio, categorizing products into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Eliminate strategic guesswork by visualizing your portfolio's strengths and weaknesses.

Cash Cows

Converge's extensive pure end-to-end fiber optic network infrastructure across the Philippines is a prime example of a Cash Cow. This mature and widely deployed asset generates consistent cash flow with relatively lower capital expenditure for maintenance compared to its initial build-out.

As of the first quarter of 2024, Converge reported a subscriber base of over 2.2 million, with its fiber network reaching more than 17.5 million homes passed. This vast reach solidifies its position as a stable revenue source, underpinning all its service offerings.

Converge's established residential postpaid subscriber base, exceeding 2.5 million customers, forms a significant Cash Cow. This large, loyal customer segment generates consistent, predictable recurring revenue, underpinning the company's financial stability.

The substantial market share within this mature segment ensures a reliable cash flow stream. This predictable income is crucial for funding other business ventures and investments, a hallmark of a Cash Cow in the BCG matrix.

Converge's wholesale business segment is a prime example of a cash cow. In the first quarter of 2025, this segment experienced an impressive 54% growth, highlighting its robust profitability and significant cash-generating capabilities.

This segment effectively utilizes Converge's established network infrastructure to offer services to other telecommunication companies and major partners. Its operational efficiency and minimal need for additional investment solidify its position as a substantial cash contributor to the company.

FiberX Flagship Postpaid Plans

Converge's FiberX Flagship Postpaid Plans represent a classic cash cow within their product portfolio. These plans have secured a significant market share and strong brand loyalty, translating into predictable and high-margin revenue streams. The operational costs associated with maintaining this established base are relatively stable, further solidifying its position as a consistent profit generator.

The widespread adoption of FiberX is a testament to its reliability and market appeal. This sustained demand ensures that these flagship plans continue to be a primary source of dependable income for Converge. For instance, as of Q1 2024, Converge ICT Solutions reported a 15% year-on-year increase in its subscriber base, with a significant portion attributed to its broadband services, including FiberX.

- Market Dominance: FiberX commands a substantial portion of the Philippine fixed broadband market.

- High Profitability: The mature nature of these plans allows for optimized operational costs and robust profit margins.

- Consistent Revenue: A large and stable customer base ensures a predictable and ongoing revenue flow.

- Brand Equity: Strong brand recognition built over time contributes to customer retention and continued demand.

Existing Enterprise & Corporate Client Contracts

Converge's existing enterprise and corporate client contracts are classic cash cows. These long-term agreements provide a steady stream of income because these large clients typically need high-capacity, dedicated solutions that, once set up, are very stable. This means less money is spent on marketing and sales compared to winning new business.

In 2024, Converge reported that its enterprise segment, driven by these established relationships, contributed significantly to its overall revenue. For instance, the company highlighted that a substantial portion of its recurring revenue comes from these multi-year contracts, underscoring their cash-generating power.

- Predictable Revenue: Long-term contracts with major corporations ensure a consistent and reliable income flow for Converge.

- Lower Acquisition Costs: Retaining existing large clients is more cost-effective than acquiring new ones, boosting profitability.

- Stable Cash Flows: The high-capacity solutions these clients require create a stable base of recurring revenue.

- Market Dominance: Strong relationships with enterprise clients often indicate a dominant position in specific market segments.

Converge's established fiber network infrastructure serves as a significant Cash Cow, generating consistent cash flow with minimal need for further extensive investment. This mature asset benefits from economies of scale, allowing for efficient service delivery and stable profit margins.

As of the first quarter of 2024, Converge reported a substantial subscriber base, underscoring the widespread adoption and revenue-generating capacity of its core fiber services. This broad reach translates into predictable and reliable income streams, a key characteristic of a Cash Cow.

The company's wholesale business segment, which leverages its existing network to serve other telecommunication providers, is another prime Cash Cow. This segment demonstrated impressive growth in the first quarter of 2025, achieving a 54% increase, which highlights its profitability and efficient utilization of assets.

| Business Segment | Status | Key Metric (Q1 2024/2025) | Cash Flow Contribution |

|---|---|---|---|

| Fiber Optic Network Infrastructure | Cash Cow | 2.2M+ Subscribers (Q1 2024) | High, Stable |

| Residential Postpaid (FiberX) | Cash Cow | 2.5M+ Customers | Consistent, Predictable Recurring |

| Wholesale Business | Cash Cow | 54% Growth (Q1 2025) | Substantial, Growing |

| Enterprise & Corporate Contracts | Cash Cow | Significant Revenue Contribution (2024) | Steady, Reliable |

Full Transparency, Always

Converge BCG Matrix

The preview you see is the actual, fully formatted Converge BCG Matrix document you will receive immediately after purchase. This means no watermarks or demo content, just the complete, analysis-ready report ready for your strategic planning. You are previewing the exact file that will be delivered, ensuring you know precisely what you're acquiring for your business's growth and competitive advantage.

Dogs

As of March 2024, Converge ICT Solutions Inc. reported a considerable number of unutilized fiber ports, indicating a significant portion of their deployed network capacity was not yet generating revenue. This situation places these ports in the 'Underutilized Fiber Ports' category within a hypothetical Converge BCG Matrix, reflecting low market share of active connections relative to their substantial infrastructure investment.

These dormant ports represent capital tied up in assets that are not currently contributing to the company's top line. While they offer substantial future growth potential as demand increases, their current state of non-revenue generation positions them as a strategic challenge that needs active management to convert potential into performance.

Legacy broadband technologies, if Converge were to maintain any non-fiber assets, would likely fall into the Dogs category of the BCG Matrix. These technologies typically experience declining demand and market share as the industry rapidly shifts towards fiber optics. For instance, in 2024, the global broadband market saw continued strong growth in fiber deployments, with an estimated 50% of new broadband connections being fiber-based in many developed regions, further marginalizing older copper or coaxial technologies.

Such legacy systems would require continued investment in maintenance and upgrades without offering significant growth potential or competitive advantage. This would tie up capital and resources that could be better allocated to expanding Converge's pure fiber network, which is the clear market leader and growth driver. The strategic imperative would be to phase out these legacy technologies to streamline operations and focus on high-growth, high-margin fiber services.

In highly saturated, stagnant micro-markets where fiber penetration is already extremely high, Converge's infrastructure could be categorized as dogs. These are areas where market growth has plateaued, offering little room for new subscriber acquisition without significant investment in competitive strategies. For instance, if a specific barangay in Metro Manila already boasts over 90% fiber penetration, and Converge's market share there is less than 5%, it would represent a dog asset.

Small, Non-Strategic IT Integration Services

Small, non-strategic IT integration services within Converge's portfolio, if they exist and aren't aligned with their core fiber or digital infrastructure ambitions, would likely be classified as Dogs in the BCG matrix. These offerings might experience sluggish demand and possess a minimal slice of the overall IT services market. For instance, if Converge offered basic network setup for small businesses not seeking broader connectivity solutions, this could fall into the Dog category, especially if the IT services market grew by an estimated 5% in 2024, with many specialized segments seeing much higher growth.

Such services typically have low profitability and limited potential for expansion, potentially draining valuable resources that could be better allocated to high-growth areas like 5G infrastructure or cloud integration. Without a clear strategic advantage or a significant market presence, these niche IT services could represent a drag on overall company performance, particularly when compared to the robust growth seen in areas like cybersecurity integration, which analysts projected to grow at a compound annual growth rate of over 13% through 2027.

- Low Market Share: These services likely hold a small percentage of the broader IT integration market.

- Limited Growth Potential: The demand for these niche services may be stagnant or declining.

- Resource Drain: They could consume resources without generating substantial returns.

- Strategic Misalignment: Such services might not contribute to Converge's core fiber and digital infrastructure strategy.

Initial Pilot Projects with Low Adoption

Initial pilot projects for new services or technologies that struggle to gain traction can be categorized as Dogs in the Converge BCG Matrix. These represent investments that haven't achieved their anticipated market share or growth targets. For instance, a tech company might launch a pilot for a new AI-powered customer service chatbot in a limited region. If user adoption rates remain below 15% after six months, and customer feedback indicates significant usability issues or a lack of perceived value, this pilot would likely be classified as a Dog.

Such scenarios demand a critical decision: either divest from the project entirely or undertake a substantial re-evaluation of its strategy and execution. Consider a hypothetical scenario where a retail chain piloted a new in-store augmented reality shopping experience. Despite an initial investment of $500,000, the pilot only saw a 5% engagement rate among shoppers, failing to translate into increased sales or customer loyalty. This outcome necessitates a strategic review.

- Low Adoption Rates: Pilot projects with user engagement below 10% are often flagged as potential Dogs.

- Insufficient Market Share Growth: Failure to capture even 2-3% of the target market within the pilot phase is a strong indicator.

- Negative ROI: When the costs of a pilot significantly outweigh any generated revenue or demonstrable future value, it leans towards Dog status.

- Lack of Strategic Fit: If the pilot's outcomes reveal it doesn't align with the company's core competencies or long-term vision, it may be deemed a Dog.

In the context of the Converge BCG Matrix, 'Dogs' represent business units or offerings that have both low market share and operate in low-growth markets. These are typically characterized by underperformance and a lack of competitive advantage. For Converge ICT Solutions Inc., this could translate to specific legacy services or niche markets where their presence is minimal and the overall demand is stagnant or declining.

For example, if Converge were to offer legacy copper-based internet services in a highly developed urban area where fiber penetration is already near saturation, these services would likely be classified as Dogs. The market for copper is shrinking, and Converge's share within that shrinking segment might also be small. In 2024, the global shift towards fiber optics continued, with many regions reporting over 50% of new broadband connections being fiber-based, further diminishing the prospects for older technologies.

These 'Dog' assets require careful management. They may still consume resources for maintenance without generating significant returns, potentially hindering investment in more promising growth areas. The strategic approach often involves divesting from these units or phasing them out to reallocate capital and focus on core, high-growth segments like their fiber broadband expansion.

Consider a scenario where Converge has a small portfolio of managed IT services for very small businesses that do not require high-speed connectivity. If this segment of the IT services market is growing at only 2-3% annually, and Converge's market share is less than 1%, these services would fit the 'Dog' profile. This is especially true when compared to specialized segments like cloud security integration, which saw projected growth rates exceeding 13% through 2027.

| BCG Category | Market Growth | Market Share | Converge Example | Strategic Implication |

| Dogs | Low | Low | Legacy copper internet services in saturated markets; Non-strategic, low-demand IT services. | Divest, phase out, or minimize investment to reallocate resources to Stars and Cash Cows. |

Question Marks

Converge's Smart Home Solutions, slated for a 2025 launch, represent a classic "Question Mark" in the BCG matrix. This means it's a new product in a growing market, but currently has no established market share. Think of it as a promising startup needing significant capital to even get off the ground.

The smart home market itself is expanding rapidly; by 2028, it's projected to reach over $100 billion globally, showing the potential for growth. However, Converge's offering is brand new, meaning it faces intense competition from established players and will require substantial marketing and development investment to gain any traction. This high investment need for uncertain future returns is the hallmark of a Question Mark.

Converge Content+ is positioned as a Question Mark in the BCG matrix. Launched in late 2024, this internet-based TV solution for the hospitality industry is a new entrant in a rapidly expanding market, giving it a low current market share.

Its future success hinges on gaining significant market traction and strategic investments to build a competitive advantage. The hospitality tech market is projected for substantial growth, with estimates suggesting it will reach over $15 billion globally by 2027, indicating a strong potential upside for Content+ if it can capture even a small portion of this market.

Converge's venture into reselling Starlink satellite internet to remote enterprises and government entities positions them within a promising, yet nascent, market segment. This strategic move targets areas with limited terrestrial connectivity, a demographic that represents a significant growth opportunity. As of early 2024, the demand for reliable internet in these underserved regions is escalating, driven by the need for operational continuity and digital inclusion.

Within the Converge BCG Matrix framework, this Starlink reselling initiative would likely be categorized as a Question Mark. The market for satellite broadband in remote enterprise and government sectors is experiencing rapid expansion, with global satellite internet market size projected to reach USD 10.7 billion by 2028, growing at a CAGR of 16.2%. However, Converge is still in the initial phases of establishing its presence and market share in this specialized niche. This means the business has high growth potential but currently holds a low market share, requiring careful investment and strategic development to determine its future success.

Cloud Market Entry via Partnerships (e.g., NAVER Cloud)

Converge's strategic alliance with NAVER Cloud positions it to leverage the burgeoning cloud market, a sector projected for significant expansion. This partnership signifies a move into a high-growth area, aiming to capture a share of the global cloud computing market, which was valued at approximately $590 billion in 2023 and is expected to reach over $1.5 trillion by 2030.

- Strategic Alignment: Partnering with established players like NAVER Cloud allows Converge to accelerate its market entry by utilizing existing infrastructure and expertise, bypassing lengthy development cycles for core cloud technologies.

- Market Potential: The global cloud infrastructure services market alone saw a 20% year-over-year growth in the first quarter of 2024, reaching $66.4 billion, underscoring the immense opportunity for new entrants with strong partnerships.

- Nascent Stage: Despite the partnership, Converge's direct contribution and market penetration within the cloud services ecosystem are likely in their initial phases, necessitating focused investment in service development and customer acquisition to solidify its position.

Advanced IoT Applications and AI-Enabled Network Services

Converge's investment in advanced IoT applications and AI-enabled network services, exemplified by its use of platforms like Ribbon's Muse, positions it in the question mark category of the BCG matrix. These technologies are high-growth but currently represent a developing market share for the company.

The integration of AI for data transmission and IoT management signifies a strategic pivot towards more sophisticated, value-added services. This move aims to capture emerging revenue streams in sectors increasingly reliant on connected devices and intelligent network operations.

- IoT Market Growth: The global IoT market is projected to reach $1.1 trillion by 2027, indicating substantial growth potential for companies offering related services.

- AI in Networking: AI in networking services is expected to grow significantly, with AI-driven network management solutions becoming crucial for efficiency and security.

- Converge's Position: While Converge is investing in these advanced capabilities, their specific market penetration and revenue contribution from these new applications are still being established, aligning with the question mark quadrant's characteristics.

Question Marks in Converge's portfolio represent new ventures in high-growth markets where the company currently holds a low market share. These initiatives demand significant investment to build market presence and fend off competitors. Their future success is uncertain, but they offer substantial potential for future growth if they can gain traction.

Converge's Smart Home Solutions, Content+, Starlink reselling, cloud services partnership, and IoT/AI network services all fall under this category. These are all in rapidly expanding sectors, with significant projected market growth, but Converge is still in the early stages of establishing its footprint in each.

The key characteristic of these Question Marks is the need for substantial capital to fuel growth and development, with the outcome being either a future Star or a Dog. The company must carefully select which of these to invest in heavily, anticipating the potential for high returns.

| Business Unit | Market Growth Rate | Converge's Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Smart Home Solutions | High | Low | High | Star or Dog |

| Content+ (Hospitality TV) | High (projected $15B by 2027) | Low | High | Star or Dog |

| Starlink Reselling | High (global satellite internet market projected $10.7B by 2028) | Low | High | Star or Dog |

| Cloud Services Partnership | Very High (global cloud market ~$590B in 2023) | Low (initial stages) | High | Star or Dog |

| IoT & AI Network Services | High (IoT market projected $1.1T by 2027) | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitor analysis, to accurately position business units.