The Container Store PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Container Store Bundle

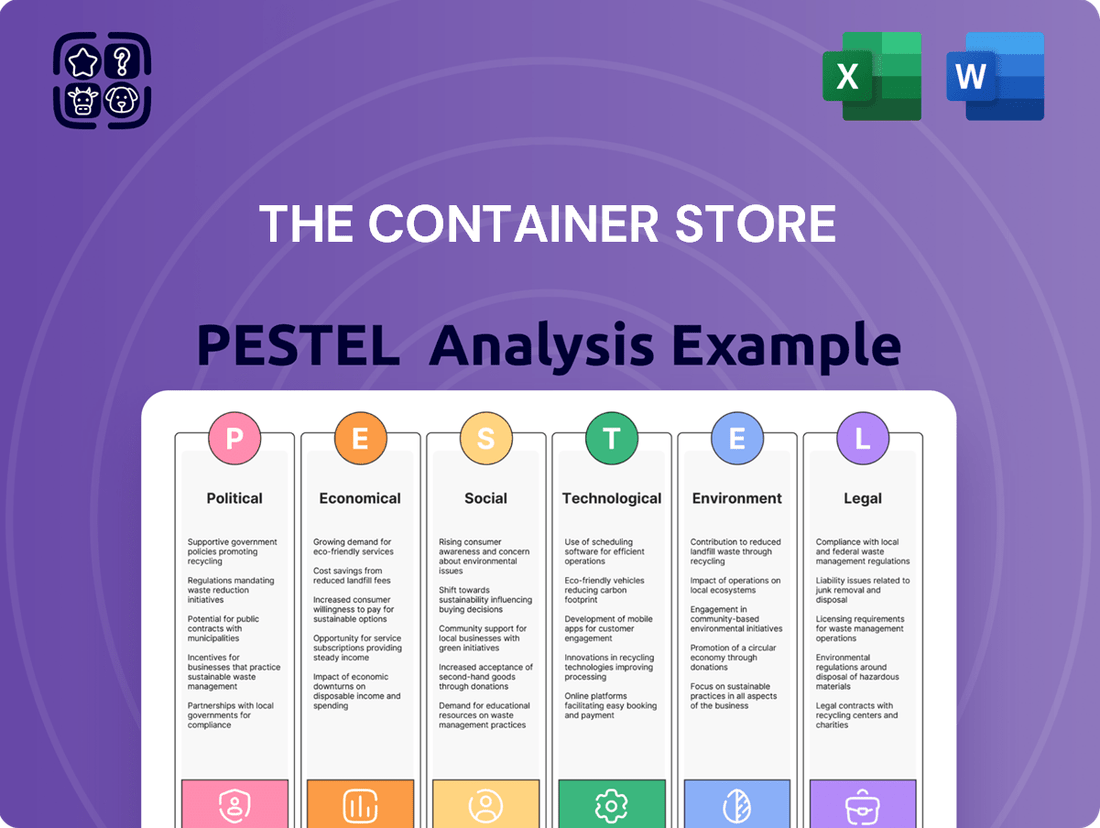

The Container Store operates within a dynamic external environment, influenced by evolving political regulations, economic shifts, and technological advancements. Understanding these forces is crucial for strategic planning and identifying potential opportunities or threats. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights.

Unlock a deeper understanding of how political stability, economic growth, social trends, technological innovation, environmental concerns, and legal frameworks are shaping The Container Store's trajectory. This ready-made analysis is your key to informed decision-making.

Gain a competitive edge by leveraging our expertly crafted PESTLE analysis for The Container Store. Discover how external factors can impact market share and profitability. Download the full version now to access the intelligence you need to thrive.

Political factors

The Container Store navigates a complex web of government regulations impacting its retail footprint. Zoning laws and building codes, which differ significantly across states and even local municipalities, directly influence where and how new stores can be established. For instance, a proposed store location might face hurdles if it doesn't meet specific commercial zoning requirements or if building code updates necessitate costly retrofits.

Operational licenses are another critical layer of regulatory compliance. Obtaining and maintaining these licenses, which can range from general business permits to specific health and safety certifications, are ongoing requirements. In 2024, retailers nationwide continued to adapt to evolving compliance standards, with an estimated 10% increase in regulatory reporting burdens for small to medium-sized businesses, a trend that also affects larger entities like The Container Store.

Shifts in these governmental rules pose a direct threat to The Container Store's strategic expansion and operational agility. Increased compliance costs, stemming from new environmental standards or labor laws, could strain profitability. For example, a hypothetical increase in minimum wage mandated by a state government could raise operating expenses by 2-3% for stores in that region, impacting the overall financial viability of those locations.

Retailers like The Container Store must navigate a complex landscape of labor laws and employment policies that are constantly evolving. These regulations cover critical areas such as minimum wage mandates, acceptable working conditions, and ensuring a safe environment for all employees. For example, the New York Retail Worker Safety Act, which takes effect on June 2, 2025, specifically mandates that retailers employing ten or more individuals must implement robust workplace violence prevention policies and provide comprehensive training to their staff.

Compliance with these directives can significantly impact a company's operational expenses, potentially leading to increased costs associated with wages, benefits, and safety protocols. Furthermore, such legal frameworks necessitate ongoing adjustments to human resource strategies and internal policies to ensure adherence and mitigate potential legal risks, affecting overall business planning and financial projections.

The Container Store, as a retailer with a broad product selection, likely sources items globally. Shifts in trade policies, tariffs, or import/export rules can significantly impact the cost of goods, supply chain reliability, and final pricing. For instance, in 2024, the U.S. imposed tariffs on certain goods from China, which could affect the landed cost of products for retailers sourcing from that region.

Consumer Protection Legislation

Governments continually refine consumer protection laws, impacting everything from product safety and advertising to data privacy. The Container Store must ensure its offerings meet stringent safety regulations and that its marketing is fully compliant. For instance, new state-level data privacy laws, like those enacted or taking effect in Florida, Texas, Oregon, and Maryland during 2024-2025, demand meticulous attention to how customer data is collected, used, and protected, along with respecting consumer rights regarding that data.

These evolving regulations necessitate proactive compliance strategies. The Container Store's adherence to these laws directly influences customer trust and brand reputation. Failure to comply with consumer protection mandates can result in significant fines and legal challenges.

- Product Safety: Ensuring all merchandise, from shelving units to storage containers, meets or exceeds safety standards set by agencies like the Consumer Product Safety Commission (CPSC).

- Advertising Standards: Maintaining truthfulness and clarity in all marketing materials, avoiding deceptive practices that could mislead consumers.

- Data Privacy: Complying with new state laws concerning the collection, storage, and use of customer personal information, including consent requirements and data breach notification protocols.

- Consumer Rights: Upholding consumer rights related to access, correction, and deletion of personal data, as mandated by legislation like the California Consumer Privacy Act (CCPA) and its subsequent amendments, and similar laws in other states.

Political Stability and Economic Policies

The Container Store's operations are significantly influenced by political stability in its key markets, as instability can dampen consumer confidence and reduce spending on non-essential items like home organization solutions. For instance, potential political shifts in the United States, a primary market, could lead to changes in consumer sentiment impacting discretionary purchases.

Government economic policies play a crucial role. Fiscal policies, such as tax adjustments or government spending initiatives, directly affect consumers' disposable income. In 2024, the US experienced continued debate around fiscal policy, with potential impacts on consumer spending power for goods like those offered by The Container Store.

Looking ahead to 2025, the global economic outlook suggests easing inflation, which could bolster consumer purchasing power. However, persistent risks include the potential for unsustainable fiscal policies in various nations and an increasing trend of regulatory burdens that could affect business operations and costs.

- Political Stability: Unrest or uncertainty in operating regions can negatively impact consumer spending on discretionary goods.

- Economic Policies: Government decisions on taxation and spending directly influence household disposable income.

- 2025 Outlook: While inflation may ease, risks from fiscal policies and regulatory changes persist, creating an uncertain environment.

The Container Store operates within a framework of evolving governmental regulations that impact its physical presence and operational compliance. Zoning laws and building codes, which vary by locality, dictate where and how stores can be established, potentially leading to costly retrofits or development delays.

New labor laws, such as the New York Retail Worker Safety Act effective June 2, 2025, mandate specific workplace violence prevention policies and training for retailers with ten or more employees, increasing operational complexity and costs.

Changes in trade policies and tariffs can directly affect the cost of goods sourced internationally, impacting The Container Store's supply chain and pricing strategies, as seen with U.S. tariffs on certain goods in 2024.

Consumer protection laws, including state-level data privacy legislation enacted in 2024-2025, require meticulous attention to customer data handling and privacy rights, influencing marketing and customer relationship management.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing The Container Store, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both challenges and avenues for growth.

This PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of external factors, making it easy to reference and discuss during meetings, thus streamlining strategic planning.

Economic factors

Consumer spending is a critical driver for The Container Store, as many of its offerings, like storage solutions and organizational accessories, are often viewed as discretionary items. When consumers feel financially secure and have more disposable income, they are more likely to invest in improving their living spaces, directly benefiting The Container Store's revenue streams.

Despite robust economic indicators in 2024, such as a low unemployment rate and steady GDP growth, consumer sentiment has been somewhat cautious. This phenomenon, sometimes dubbed a 'vibecession,' has resulted in consumers feeling less confident about their financial future, leading to more restrained spending habits, even when their actual financial situations are strong.

For instance, while the U.S. unemployment rate remained near historic lows in late 2024, hovering around 3.7%, consumer confidence surveys indicated a degree of hesitancy. This disconnect means that even with available funds, consumers might delay purchases of non-essential goods, impacting sales for retailers like The Container Store.

Inflationary pressures directly impact The Container Store by increasing the cost of essential inputs like raw materials, manufacturing, and transportation for its product lines. This rise in operational expenses can squeeze profitability, as seen when the company's gross margins decreased by 210 basis points in the second quarter of 2024. This margin compression was attributed to a combination of increased promotional activities and an unfavorable product mix during that period.

The housing market is a critical driver for The Container Store, directly impacting demand for its home organization products. For instance, in 2023, the U.S. saw a notable trend of smaller new home constructions, a pattern anticipated to continue into 2024. This shift, largely due to elevated housing costs and changing consumer preferences, is creating a greater need for space-saving and efficient storage solutions.

Furthermore, the health of the housing market, particularly in terms of new construction and home renovation activity, directly correlates with sales potential for The Container Store. A strong market, characterized by increased building and upgrades, typically translates to higher sales for custom closet systems and general storage products as homeowners invest in their living spaces.

Interest Rates and Access to Credit

Interest rates significantly influence consumer spending on big-ticket items like custom closets, as higher rates make financing less attractive. For The Container Store, rising interest rates also mean increased costs for any debt used for business expansion or operational funding.

Fannie Mae's projections indicate a favorable shift, anticipating mortgage rates to decline to approximately 6% by 2025. This potential decrease in borrowing costs could stimulate the housing market, indirectly benefiting The Container Store by encouraging home improvement and renovation projects.

- Impact on Consumer Spending: Higher interest rates can dampen demand for discretionary purchases financed by credit.

- Company Borrowing Costs: Increased rates elevate the expense of debt financing for The Container Store's capital needs.

- Housing Market Outlook: Fannie Mae forecasts mortgage rates around 6% in 2025, suggesting a potentially more robust housing market.

Competitive Landscape and Pricing Pressure

The container store operates in a highly competitive retail environment for home organization solutions. This includes everything from large retailers like Target and Walmart to niche players offering custom closet systems. This intense competition often translates into significant pricing pressure.

To remain competitive, The Container Store frequently engages in promotional activities and strategic pricing. This approach, while driving sales, directly impacts its profitability. For instance, the company noted that its gross margin was affected by increased promotional activities during the second quarter of 2024.

- Market Saturation: The home organization sector is crowded, with numerous brands vying for consumer attention.

- Price Sensitivity: Consumers often seek value, making pricing a critical factor in purchasing decisions.

- Promotional Impact: Increased sales promotions, while boosting volume, can compress profit margins, as seen in Q2 2024.

Economic factors significantly shape The Container Store's performance, with consumer spending and inflation being key influencers. While 2024 saw low unemployment, consumer sentiment remained cautious, impacting discretionary purchases. Inflationary pressures in 2024, for example, led to a 210 basis point decrease in gross margins for the company in Q2 due to rising operational costs and promotional activities.

The housing market also plays a crucial role, with trends towards smaller homes in 2023 and 2024 increasing the need for efficient storage solutions. Furthermore, interest rate projections, with Fannie Mae anticipating a dip to around 6% by 2025, could stimulate housing activity and, by extension, demand for The Container Store's products.

| Economic Factor | 2024/2025 Trend/Projection | Impact on The Container Store |

|---|---|---|

| Consumer Spending | Cautious sentiment despite low unemployment (3.7% in late 2024) | Potential for restrained spending on discretionary items |

| Inflation | Pressures on raw materials, manufacturing, transportation | Increased operational costs, impacting profitability (e.g., 210 bps gross margin decrease in Q2 2024) |

| Housing Market | Trend towards smaller new constructions; potential for increased renovation | Growing demand for space-saving solutions; potential sales boost from home improvement |

| Interest Rates | Projected to decline to ~6% by 2025 (Fannie Mae) | Lower borrowing costs for consumers and the company; potential housing market stimulus |

What You See Is What You Get

The Container Store PESTLE Analysis

The preview you see here is the exact PESTLE Analysis for The Container Store that you will receive after purchase, fully formatted and ready for your strategic planning needs.

What you’re previewing here is the actual file, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting The Container Store, delivered instantly.

No placeholders, no teasers—this is the real, ready-to-use PESTLE Analysis document you’ll get upon purchase, providing all the insights you need.

Sociological factors

The societal shift towards decluttering and minimalism directly benefits The Container Store. Consumers are actively seeking ways to organize their lives and living spaces, creating a robust demand for storage and organization products. This trend is projected to remain strong through 2025, indicating continued market opportunity.

The increasing movement of people into cities, known as urbanization, is a major sociological trend. This means more individuals and families are living in urban centers, where housing is often at a premium.

As a result, living spaces in these metropolitan areas are becoming smaller. For instance, in 2023, the average size of new single-family homes in the US saw a slight decrease, reflecting this trend in some markets, and this pattern is even more pronounced in dense urban environments.

This societal shift directly benefits companies like The Container Store. Smaller living spaces naturally increase the demand for innovative, space-saving, and multifunctional organization solutions. Consumers are actively seeking ways to maximize the utility of every square foot, making smart storage products a necessity rather than a luxury.

The widespread adoption of remote and hybrid work models, significantly accelerated in recent years, has fundamentally reshaped living spaces. Homes are no longer solely residences but now also serve as primary workspaces, necessitating dedicated home office setups.

This transformation directly fuels demand for organizational and storage solutions. As individuals strive for efficient and clutter-free home offices, the need for products that enhance functionality and productivity within these multi-purpose environments has surged. For instance, a 2024 survey indicated that 60% of remote workers reported needing better organization for their home office spaces.

The Container Store, a leader in organization, is well-positioned to capitalize on this trend. The company's product lines, from shelving and drawer organizers to filing systems, directly address the growing need for effective home office management, a market segment that saw an estimated 15% year-over-year growth in 2024.

Consumer Preferences for Customization

Consumer preferences are leaning heavily towards personalization, with a growing demand for solutions that reflect individual needs and styles. This trend directly impacts The Container Store, signaling a shift away from generic storage options towards bespoke closet systems, adaptable modular units, and personalized organizational accessories.

By 2025, custom-built organizational solutions are anticipated to be a primary choice for consumers aiming for both efficiency and contemporary design. This focus on customization presents a significant opportunity for The Container Store to expand its tailored offerings and meet evolving consumer expectations.

- Demand for Customization: Consumers increasingly seek personalized storage solutions.

- Product Adaptation: This drives demand for custom closets, modular systems, and tailored tools.

- 2025 Trend: Custom-built solutions are expected to be a key trend for streamlined living.

- Market Opportunity: The Container Store can leverage this by enhancing its bespoke product lines.

Influence of Social Media and Home Organization Content

Social media platforms, particularly TikTok and Instagram, are powerful drivers of home organization trends. Content focused on decluttering and creating tidy spaces, often termed 'clean-tok', directly influences consumer purchasing decisions. This trend is a significant factor for The Container Store, as it taps into a growing consumer desire for organized living.

The impact of social media on consumer behavior is substantial. For instance, over 80% of consumers report researching brands on social media before making a purchase. This highlights the critical need for The Container Store to maintain an active and engaging presence on these platforms to capture potential customers inspired by organization content.

- Social Media Influence: Platforms like TikTok and Instagram are key in popularizing home organization trends.

- 'Clean-Tok' Phenomenon: The rise of decluttering content directly drives interest in organizational products.

- Pre-Purchase Research: A significant majority of consumers (over 80%) use social media to vet brands before buying.

Societal trends like the increasing emphasis on minimalism and decluttering continue to fuel demand for The Container Store's core offerings. This movement, amplified by social media, encourages consumers to seek organized living solutions, a desire projected to remain strong through 2025.

The ongoing trend of urbanization, leading to smaller living spaces, directly benefits The Container Store by increasing the need for efficient organization. For instance, while national averages fluctuate, urban dwellers often contend with significantly less square footage, making smart storage a necessity.

The widespread adoption of remote and hybrid work models has transformed homes into dual-purpose living and working spaces. This shift necessitates dedicated, organized home office areas, a market segment that saw an estimated 15% year-over-year growth in 2024, with 60% of remote workers reporting a need for better home office organization in 2024.

Consumers are increasingly seeking personalized solutions, driving demand for custom closets and modular systems. By 2025, custom-built organizational solutions are expected to be a primary choice, presenting a significant opportunity for The Container Store to expand its tailored offerings.

| Sociological Factor | Impact on The Container Store | Relevant Data/Trend |

|---|---|---|

| Minimalism & Decluttering | Increased demand for organization products | Trend expected to remain strong through 2025 |

| Urbanization & Smaller Living Spaces | Higher need for space-saving solutions | Urban environments often feature reduced square footage |

| Remote/Hybrid Work | Demand for home office organization | 15% YoY growth in home office organization market (2024); 60% of remote workers need better organization (2024) |

| Personalization Trend | Growth in custom and modular solutions | Custom solutions anticipated as a key consumer choice by 2025 |

Technological factors

The Container Store's success hinges on robust e-commerce and omnichannel strategies. Consumers now expect a fluid transition between online browsing and in-store purchasing, demanding efficient fulfillment and integrated experiences.

This focus is critical as omnichannel shoppers demonstrate significantly higher spending habits, reportedly spending 1.5 times more monthly than those who shop through a single channel. Retailers, including The Container Store, are prioritizing digital acceleration, with this transformation being a key objective for 2025.

The Container Store's operations are significantly impacted by advancements in supply chain technology. AI-enabled demand forecasting is becoming critical for optimizing inventory levels and reducing holding costs, a key challenge in retail. Automation in warehouses, from robotic picking to automated guided vehicles, promises to increase efficiency and speed up order fulfillment.

Efficient logistics are paramount for meeting customer expectations for timely delivery, especially with the growing e-commerce segment. In 2025, we anticipate a continued surge in supply chain innovations driven by AI, with projections indicating that AI adoption in logistics could boost global GDP by $1.5 trillion by 2030, according to Accenture. Automation and the use of drones for last-mile delivery are also expected to play a more prominent role, further streamlining operations and potentially reducing delivery times and costs.

The Container Store is leveraging technology to elevate the in-store customer experience. Interactive displays and virtual design tools for custom closets are becoming increasingly important, allowing customers to visualize solutions before purchasing. This focus on enhancing the physical retail environment aims to attract and retain shoppers by offering a more engaging and personalized journey.

By 2025, advancements in AI are expected to drive personalized recommendations and further enhance the utility of interactive displays. This technological integration is crucial for bridging the gap between online convenience and the tactile, experiential nature of brick-and-mortar shopping, ultimately fostering customer loyalty.

Data Analytics and Personalization

The Container Store is increasingly leveraging data analytics to understand its customers. By analyzing purchasing behaviors and preferences, the company can offer highly personalized marketing campaigns and product recommendations. This focus on hyper-personalization is crucial for boosting customer satisfaction and fostering loyalty in the competitive retail landscape.

Retailers are rapidly adopting AI to enhance customer experiences. By the end of 2024, it's anticipated that a significant majority of retailers will have AI capabilities to deliver personalized interactions. This trend directly impacts The Container Store's ability to meet evolving customer expectations for tailored services and product discovery.

- Customer Data Analysis: The Container Store can analyze purchase history, online browsing, and loyalty program data to segment customers.

- Personalized Recommendations: AI-driven algorithms can suggest specific products, organizational solutions, and storage ideas based on individual needs.

- Targeted Marketing: Data insights enable more effective email campaigns, social media ads, and in-app promotions tailored to customer segments.

- Improved Customer Satisfaction: Personalized experiences lead to higher engagement and a greater likelihood of repeat purchases.

Emerging Technologies: AI and AR/VR

The Container Store can leverage Artificial Intelligence (AI) to significantly enhance customer experiences and streamline operations. AI-powered chatbots can provide instant customer support, while AI analytics can personalize product recommendations, leading to increased sales. By 2024, AI adoption in retail saw substantial growth, with projections indicating continued expansion into 2025, as 92% of consumers expressed interest in or were already using AI-driven features.

Augmented Reality (AR) and Virtual Reality (VR) present unique opportunities for The Container Store to differentiate its offerings and improve the online shopping journey. Imagine customers using AR to visualize how custom closet designs would look in their own homes before making a purchase. This immersive technology can reduce purchase hesitation and boost conversion rates.

The integration of these technologies offers tangible benefits:

- AI-driven personalization: Tailoring product suggestions and marketing messages based on individual customer behavior.

- Enhanced customer service: AI chatbots providing 24/7 support and resolving common queries efficiently.

- Immersive product visualization: AR/VR tools allowing customers to virtually place and customize products in their spaces.

- Operational efficiency: AI optimizing inventory management, supply chain logistics, and in-store operations.

Technological advancements are reshaping retail, and The Container Store is actively integrating these innovations. The company's focus on digital acceleration and omnichannel strategies is paramount, as consumers increasingly expect seamless online-to-offline experiences. By 2025, AI adoption in retail is projected to continue its upward trajectory, with a significant majority of consumers showing interest in or already utilizing AI-driven features, indicating a strong market demand for personalized and efficient interactions.

Legal factors

The Container Store, like all retailers, faces a growing web of consumer data privacy laws. With many states implementing new, comprehensive privacy legislation in 2024 and 2025, such as those in Florida, Texas, and Oregon, the company must adapt its data handling practices. Navigating these diverse regulations, which include requirements for data access, deletion, and opt-out options, is crucial for maintaining customer trust and avoiding significant penalties.

The Container Store must meticulously adhere to product safety and liability regulations, ensuring all organizational products meet stringent safety standards. This compliance is crucial for preventing costly legal entanglements and safeguarding consumer trust. For instance, in 2023, product liability claims in the retail sector saw a notable increase, underscoring the importance of robust safety protocols.

This involves strict adherence to laws governing materials used, manufacturing processes, and accurate product labeling. Failing to meet these requirements, such as those outlined by the Consumer Product Safety Commission (CPSC) in the US, can lead to recalls, fines, and significant reputational damage. The company's commitment to quality control directly impacts its legal standing and market reputation.

Beyond minimum wage, The Container Store navigates a complex web of employment laws. These include regulations on fair scheduling practices, overtime pay, ensuring worker safety, and strict adherence to anti-discrimination statutes. These legal requirements impact operational costs and workforce management significantly.

The upcoming New York Retail Worker Safety Act, set to take effect in 2025, presents a notable legal factor. This legislation specifically targets retailers with at least 10 employees, mandating the implementation of workplace violence prevention policies and comprehensive training programs. This will necessitate new investments in compliance and employee education for stores operating within New York.

Advertising and Marketing Regulations

The Container Store must adhere to truth in advertising laws, ensuring all promotional content is factual and avoids misleading consumers. This is vital for maintaining customer trust and avoiding potential legal repercussions. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on deceptive advertising practices across various sectors, underscoring the importance of accurate product claims and pricing transparency.

Compliance with these advertising regulations is critical for The Container Store to prevent legal penalties and safeguard its brand reputation. Failure to comply can result in significant fines and damage to consumer perception. The company's marketing strategies, from online ads to in-store promotions, must be meticulously reviewed to ensure they meet these legal standards.

- Truthful Claims: Marketing materials must accurately represent product features, benefits, and pricing.

- No Deception: Avoid any language or imagery that could mislead customers about the nature or quality of goods.

- Regulatory Scrutiny: Stay updated on evolving advertising standards and enforcement actions from bodies like the FTC.

- Brand Integrity: Upholding advertising integrity is paramount for long-term brand loyalty and trust.

Intellectual Property Laws

Intellectual property laws are crucial for The Container Store. Protecting its unique product designs, branding, and proprietary systems through patents, trademarks, and copyrights is essential for maintaining a competitive edge. For instance, in 2023, companies across the retail sector saw increased scrutiny on design patents, with infringement cases impacting product launches and market share.

Simultaneously, The Container Store must navigate the complex landscape of intellectual property to avoid infringing on the rights of competitors or other entities. This involves careful due diligence on product sourcing and marketing materials. A 2024 report indicated that intellectual property disputes cost businesses an average of $1.2 million in legal fees and lost revenue, highlighting the financial implications of non-compliance.

- Patent Protection: Securing patents for innovative storage solutions and organizational systems safeguards The Container Store's unique offerings.

- Trademark Enforcement: Maintaining and defending its brand name, logo, and slogans is vital for customer recognition and loyalty.

- Copyright Compliance: Ensuring all marketing content, website text, and product descriptions are original or properly licensed prevents copyright infringement.

- Infringement Risk Mitigation: Proactive legal review of new products and marketing campaigns minimizes the risk of legal challenges from third parties.

The Container Store faces significant legal obligations regarding consumer data privacy, with new state laws in 2024 and 2025, such as those in Florida and Texas, requiring robust data protection measures. Adherence to product safety regulations, like those from the CPSC, is critical to avoid recalls and fines, especially given the rising trend in product liability claims observed in 2023. Furthermore, evolving employment laws, including the upcoming New York Retail Worker Safety Act in 2025, necessitate investments in compliance and training to ensure fair labor practices and workplace safety.

| Legal Area | Key Compliance Aspects | Potential Impact of Non-Compliance | 2024/2025 Considerations |

|---|---|---|---|

| Data Privacy | Handling customer data, opt-out options, data deletion rights | Fines, loss of customer trust | New state laws (e.g., Florida, Texas) |

| Product Safety & Liability | Material sourcing, manufacturing standards, accurate labeling | Recalls, fines, reputational damage | Increased product liability claims in 2023 |

| Employment Law | Fair scheduling, overtime, worker safety, anti-discrimination | Lawsuits, increased labor costs | New York Retail Worker Safety Act (2025) |

Environmental factors

Consumers are increasingly drawn to businesses that demonstrate a commitment to sustainability, directly impacting purchasing decisions. This trend means The Container Store has an opportunity to align with eco-conscious values by expanding its range of products crafted from recycled or sustainably sourced materials.

Reducing packaging waste and championing responsible sourcing are also key strategies to meet this growing consumer demand. For instance, a significant 36% of Gen Z consumers prioritize sustainability when engaging in second-hand shopping, highlighting a powerful shift in consumer priorities that retailers must acknowledge.

The Container Store, like many retailers, faces the environmental challenge of managing waste from packaging and products reaching their end-of-life. Effective waste management is crucial for its sustainability efforts.

Implementing robust recycling programs and exploring circular economy principles, such as take-back initiatives for old containers or promoting reusable packaging, can significantly improve The Container Store's environmental footprint. For instance, in 2023, the retail sector's overall recycling rate saw a slight increase, highlighting the growing importance of these practices.

Furthermore, there's a clear market trend showing increased consumer demand for sustainable and eco-friendly solutions for home organization and decluttering, directly aligning with The Container Store's core product offerings and presenting an opportunity to gain competitive advantage through green initiatives.

The Container Store's operations, from retail stores and warehouses to its supply chain transportation, directly impact its carbon footprint through energy consumption. In 2023, the retail sector's energy use remained a significant environmental concern, with many companies setting ambitious targets for reduction. The Container Store has an opportunity to lower its environmental impact by focusing on energy efficiency measures and investigating renewable energy solutions.

Supply Chain Environmental Standards

The Container Store must ensure its suppliers meet stringent environmental standards in manufacturing, resource consumption, and waste management to uphold its commitment to sustainability. This focus is increasingly critical as regulatory landscapes evolve.

New regulations, such as the European Union's Corporate Sustainability Due Diligence Directive (CSDDD), set to take effect in 2025, will mandate that companies actively identify and mitigate adverse environmental impacts throughout their supply chains. This means The Container Store will need robust systems to monitor supplier practices.

- Supplier Audits: Implementing regular environmental audits for key suppliers to verify compliance with established standards.

- Resource Efficiency: Encouraging suppliers to adopt practices that minimize water usage, energy consumption, and raw material waste.

- Waste Management: Requiring suppliers to have responsible waste disposal and recycling programs in place.

- Regulatory Alignment: Proactively adapting supply chain policies to meet or exceed requirements like the CSDDD by 2025.

Consumer Demand for Sustainable Products

Consumer demand for sustainable products is a significant environmental factor influencing The Container Store. A growing segment of consumers is increasingly willing to pay a premium for items that align with eco-friendly principles. This trend presents a clear opportunity for The Container Store to enhance its appeal.

The company can effectively tap into this market by prominently labeling its sustainable product offerings. Furthermore, transparently communicating its environmental initiatives, such as waste reduction programs or the use of recycled materials, will resonate with environmentally conscious shoppers. For instance, data from 2024 indicates that approximately 30% of consumers aged 35-44 are prepared to pay more for eco-friendly brands, highlighting the financial incentive for The Container Store to prioritize sustainability in its messaging and product selection.

- Growing Consumer Preference: An increasing number of consumers prioritize environmentally friendly products.

- Willingness to Pay Premium: A notable portion of consumers will pay more for sustainable goods.

- Targeted Marketing Opportunity: The Container Store can attract environmentally conscious customers by highlighting sustainable options and initiatives.

- Demographic Insights: Around 30% of consumers aged 35-44 are willing to pay a premium for eco-friendly brands, as observed in 2024 data.

Environmental factors significantly influence The Container Store's operations and market positioning. Growing consumer demand for sustainable products, with around 30% of consumers aged 35-44 willing to pay more for eco-friendly brands in 2024, presents a key opportunity. The company must also manage its operational footprint, particularly energy consumption in retail and warehousing, as the retail sector continues to focus on reduction targets established in 2023. Furthermore, upcoming regulations like the EU's CSDDD by 2025 will necessitate robust supplier environmental standards, impacting supply chain management.

| Environmental Factor | Impact on The Container Store | Opportunity/Challenge | Relevant Data/Trend |

|---|---|---|---|

| Consumer Demand for Sustainability | Drives purchasing decisions; influences product selection. | Opportunity to attract eco-conscious consumers and gain market share. | 30% of consumers aged 35-44 willing to pay more for eco-friendly brands (2024). |

| Operational Energy Consumption | Contributes to carbon footprint; impacts operating costs. | Challenge to reduce energy use; opportunity to invest in efficiency and renewables. | Retail sector energy use remains a significant concern (2023). |

| Supply Chain Environmental Standards | Ensures ethical sourcing and production; impacts brand reputation. | Challenge to monitor and enforce supplier compliance; opportunity to build a resilient and responsible supply chain. | EU's Corporate Sustainability Due Diligence Directive (CSDDD) effective 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for The Container Store is built on a foundation of comprehensive data from government agencies, reputable market research firms, and industry publications. We analyze economic indicators, consumer spending trends, and regulatory updates to ensure a thorough understanding of the external environment impacting the company.