The Container Store Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Container Store Bundle

The Container Store navigates a competitive landscape shaped by moderate buyer power and the persistent threat of substitutes, particularly online retailers offering similar organizational solutions. Understanding these forces is crucial for any business operating in the retail sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore The Container Store’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Container Store's reliance on a limited number of suppliers for its specialized storage and organization products significantly impacts supplier bargaining power. If a particular product line, like custom shelving components, is sourced from only one or two manufacturers, those suppliers gain substantial leverage. For instance, if a key supplier of proprietary modular shelving systems experienced production issues in 2024, it could force The Container Store to accept higher prices or face stockouts, demonstrating the power of concentrated supply.

The Container Store's suppliers hold significant bargaining power if the company faces high costs or disruption when switching. These costs could involve redesigning custom storage solutions, retooling manufacturing, or lengthy contract renegotiations, all of which can impact operational efficiency and profitability.

For instance, if a key supplier of specialized materials for their popular Elfa custom space system were to increase prices or reduce quality, The Container Store might struggle to find an immediate, comparable alternative without incurring substantial expenses and potential delays.

The company's own manufacturing capabilities for its Elfa line, which accounted for a notable portion of its sales historically, could mitigate some supplier power by reducing reliance on external manufacturers for that specific product category, offering a degree of vertical integration.

Suppliers could leverage their position by threatening to integrate forward into the retail market, effectively selling their storage solutions directly to consumers and cutting out The Container Store. This would introduce a new layer of competition, potentially impacting The Container Store's sales channels.

While this threat is generally low for a broad range of storage product suppliers, manufacturers with highly recognizable brands might find it economically viable to bypass retailers. For instance, if a popular brand of modular shelving were to launch its own direct-to-consumer e-commerce platform, it would directly compete with The Container Store's offerings.

This forward integration by suppliers would not only increase competition but could also put pressure on The Container Store's pricing strategies and market share. In 2024, the rise of direct-to-consumer (DTC) models across various retail sectors, including home goods, has made this a more plausible threat than in previous years.

Uniqueness of Supplier Offerings

The Container Store's reliance on suppliers offering unique or proprietary storage and organization solutions significantly influences supplier bargaining power. For instance, if a supplier provides highly specialized custom closet components that are crucial to The Container Store's differentiated market offering and are not easily sourced elsewhere, that supplier gains considerable leverage. This dependence is amplified when these products are difficult for competitors to replicate, forcing The Container Store to meet the supplier's terms.

The Container Store works with a diverse range of partners for its product assortment. While specific supplier revenue concentration data is not publicly disclosed, the company's strategy of offering a curated selection of specialized products means that key suppliers of these unique items hold a stronger position. For example, in 2023, The Container Store reported net sales of $1.14 billion, indicating a substantial volume of goods purchased from its supply chain, making the terms with key differentiated suppliers particularly impactful.

- Supplier Differentiation: The more unique and proprietary a supplier's storage and organization solutions are, the greater their bargaining power.

- Integral Products: Suppliers of components essential to The Container Store's core value proposition, such as custom closet systems, wield more influence.

- Replicability: If a supplier's offerings cannot be easily replicated by other manufacturers, The Container Store's dependence on that supplier increases.

- Strategic Partnerships: The Container Store's collaborative approach with its partners means that the terms negotiated with suppliers of specialized, high-demand items are critical.

Supplier's Importance to The Container Store's Business

The Container Store's reliance on specific suppliers for its custom closet systems and unique organizational products significantly amplifies supplier bargaining power. When a supplier provides a critical component or an innovative product that defines The Container Store's market differentiation, that supplier gains considerable leverage. For example, if a key material for their popular Elfa shelving system comes from a limited number of specialized manufacturers, those suppliers can command better terms.

The company's extensive supply chain, boasting over 298 Tier 1 connections, indicates a broad base of suppliers. However, the bargaining power of individual suppliers hinges on their criticality to The Container Store's operations and product uniqueness. A supplier of a common, easily substitutable item will have less power than one providing a proprietary component essential for a high-margin product line.

- Criticality of Products: Suppliers providing unique or proprietary components for The Container Store's custom closet systems and innovative organizational tools hold higher bargaining power.

- Supplier Dependence: The more essential a supplier's product or service is to The Container Store's core business and customer offerings, the greater the supplier's leverage.

- Supply Chain Breadth: With over 298 Tier 1 connections, The Container Store manages a wide supplier network, but the power of individual suppliers varies based on product specificity and substitutability.

The Container Store's suppliers of unique or proprietary storage solutions possess significant bargaining power. When these specialized components, like those for custom closet systems, are not easily substituted, suppliers can dictate terms. This leverage is amplified if The Container Store's brand identity is closely tied to these specific offerings, as seen with their historically strong Elfa product line.

The company's reliance on a select few manufacturers for certain high-demand, differentiated products means these suppliers can command higher prices or more favorable contract terms. For instance, if a key supplier for a proprietary shelving material faced production constraints in 2024, it could force The Container Store to accept price increases or risk stockouts, impacting sales and customer satisfaction.

Suppliers of common, easily replaceable items, however, have less influence. The Container Store's broad supplier base, exceeding 298 Tier 1 connections, allows it to diversify for less specialized products, thereby reducing the power of individual suppliers in those categories.

| Factor | Impact on The Container Store | Example/Data Point |

| Supplier Product Uniqueness | High Bargaining Power | Proprietary components for custom closet systems |

| Ease of Substitution | Low Bargaining Power | Commonly available storage bins |

| Supplier Dependence | High Bargaining Power | Key materials for Elfa shelving system |

| Supply Chain Breadth | Reduces individual supplier power | Over 298 Tier 1 supplier connections |

What is included in the product

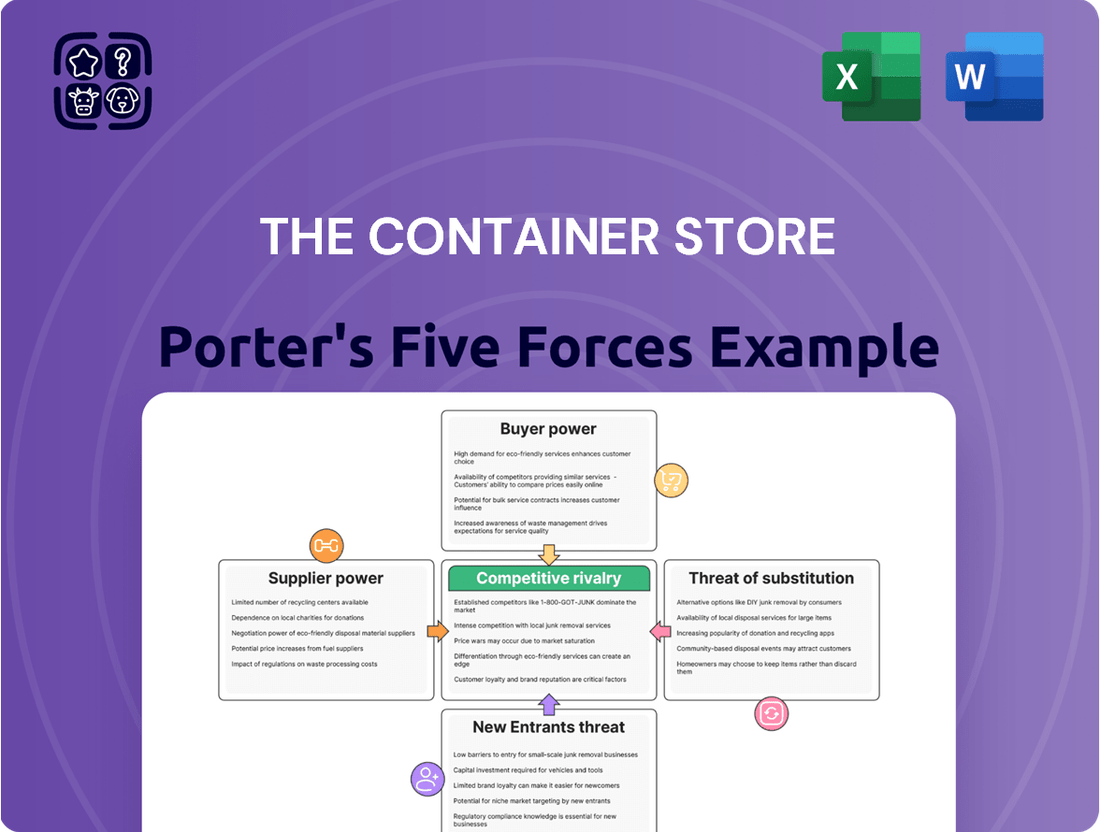

This Porter's Five Forces analysis for The Container Store examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes, providing a strategic overview of its competitive environment.

Easily visualize competitive intensity by seeing the impact of each force on The Container Store's profitability.

Customers Bargaining Power

Customers of The Container Store, especially for everyday storage solutions, are showing a growing awareness of price. This is particularly true given the current economic conditions. The company's need to offer more discounts, a trend observed in recent years, directly reflects this heightened price sensitivity among shoppers.

The Container Store's pricing often stands out as higher when compared to many of its competitors. This price difference makes customers more inclined to explore alternatives that offer similar products at a lower cost, thereby strengthening their leverage.

For instance, the increased presence of off-price retailers in the market means customers have readily available, cheaper options for many storage and organization items. This competitive landscape directly impacts The Container Store's ability to maintain premium pricing without losing market share.

The Container Store faces significant customer bargaining power due to the sheer abundance of substitute products available. Retail giants like Walmart and Target, along with online behemoths such as Amazon, offer a vast array of storage and organization solutions, often at lower price points. This accessibility means customers can easily switch if The Container Store's pricing or product offerings are not competitive, directly impacting the company's ability to maintain premium pricing.

Customers today are incredibly well-informed, largely thanks to the internet. They can easily compare prices, read reviews, and research alternatives for storage solutions. This readily available information significantly reduces the knowledge gap between buyers and sellers, giving customers more leverage.

This transparency directly translates to increased bargaining power for customers. Knowing the market value and quality of competing products allows them to negotiate better deals or choose more cost-effective options. In 2024, online channels continued to be a dominant force in the storage product market, further amplifying this customer empowerment.

Switching Costs for Customers

For many of The Container Store's standard storage products, the ability for customers to switch to a competitor is quite high. This means customers have significant bargaining power because they can easily find similar items at other retailers, often at different price points. For instance, a basic plastic bin can be sourced from numerous big-box stores or online marketplaces.

However, the landscape changes considerably with The Container Store's custom closet solutions. Here, switching costs can be a significant factor. Customers investing in a custom design and installation have already committed resources, making a switch to another provider for a similar project more complex and potentially costly. This investment inherently reduces their immediate bargaining power.

The Container Store's strategic focus on its custom spaces business, including offerings like elfa and Contained Living, is a deliberate move to increase these switching costs. By offering integrated design, product, and installation services, they create a more sticky customer relationship, thereby mitigating the bargaining power of customers in these higher-value segments.

- Low Switching Costs for Standard Products: Customers can easily purchase generic storage items from a wide range of retailers, giving them leverage.

- Higher Switching Costs for Custom Solutions: Investments in design and installation for custom closets create barriers to switching for customers.

- Strategic Differentiation: The Container Store leverages its custom closet offerings to build customer loyalty and reduce price sensitivity.

Volume of Purchases by Individual Customers

For The Container Store, the volume of purchases by individual customers generally doesn't grant them significant bargaining power. Most shoppers buy products for personal use, and the quantities are typically modest.

However, there's a potential for increased customer power when considering larger clients. Businesses or individuals undertaking extensive custom closet projects might place substantial orders, which could give them more leverage in negotiations for bulk discounts or customized solutions. This segment, while smaller than the individual consumer base, represents a notable area where bargaining power could manifest.

The overall impact of individual customer volume on The Container Store's bargaining power is likely limited, given that the core business model relies heavily on a broad base of individual consumers rather than a few high-volume corporate clients. For instance, in 2023, The Container Store reported net sales of approximately $974 million, with the vast majority attributed to individual retail transactions.

- Individual Consumer Purchases: Typically low volume, limiting direct bargaining power.

- Business/Project Purchases: Higher volume potential for specific clients, increasing bargaining leverage.

- Overall Impact: Limited due to the dominance of individual retail transactions in total sales.

The bargaining power of customers for The Container Store is moderate, influenced by product type and customer segment. For standard storage items, customers possess significant power due to low switching costs and abundant alternatives, especially from mass retailers and online platforms. This is amplified by increased price transparency in 2024, allowing easy comparison shopping.

However, for custom closet solutions like elfa, customer bargaining power is considerably lower. The substantial investment in design and installation creates higher switching costs, fostering customer loyalty and reducing price sensitivity. This strategic focus aims to mitigate customer leverage in these higher-value segments.

While individual customer purchase volumes are generally too small to exert significant bargaining power, larger business clients or those undertaking extensive custom projects can potentially negotiate better terms. The Container Store's sales in fiscal year 2023, totaling approximately $974 million, were primarily driven by individual consumers, underscoring the limited impact of volume on the broader customer base.

| Factor | Impact on Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Availability of Substitutes | High | Abundant alternatives from mass retailers (Walmart, Target) and online (Amazon). |

| Switching Costs (Standard Products) | Low | Easy to find similar items at different price points. |

| Switching Costs (Custom Solutions) | High | Investment in design and installation creates customer stickiness. |

| Price Sensitivity | Increasing | Customers are more aware of price differences and readily compare options. |

| Customer Information | High | Internet facilitates easy price comparison and product research. |

| Purchase Volume (Individual) | Low | Most purchases are for personal use, limiting negotiation leverage. |

| Purchase Volume (Business/Project) | Moderate Potential | Larger orders for custom projects can increase negotiation power. |

| Overall Sales Mix | Limited | Fiscal year 2023 net sales of ~$974M primarily from individual retail transactions. |

What You See Is What You Get

The Container Store Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of The Container Store provides an in-depth examination of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The document you see here is your deliverable; it’s ready for immediate use—no customization or setup required. You're looking at the actual document, and once you complete your purchase, you’ll get instant access to this exact file, offering actionable insights into The Container Store's strategic positioning.

Rivalry Among Competitors

The Container Store operates in a highly competitive environment, facing pressure from a wide array of retailers. This includes massive general merchandise giants such as Walmart, Target, and Amazon, which offer a broad selection of home organization products alongside their core offerings.

Furthermore, home improvement retailers like Home Depot and Lowe's, along with furniture and home goods specialists such as IKEA, also present significant competition. This diverse competitive set means The Container Store must constantly differentiate itself to capture consumer attention and spending in the home organization sector.

The home organization market is poised for expansion, with projections indicating the global market will reach $13.27 billion by 2025. The custom closets segment, specifically, is expected to grow at a compound annual growth rate of 7.2% from 2025 through 2033. This robust growth, however, acts as a magnet for new entrants and encourages existing players to adopt more aggressive tactics to secure market share.

The Container Store itself has seen a downturn in general merchandise sales, a clear signal of the fierce competition it faces. This suggests that while the overall market is expanding, the ability to translate that growth into increased revenue is challenged by the intensity of rivalry.

The Container Store thrives on product differentiation, offering a curated selection of organizing solutions and a premium in-store experience, including personalized closet design services. This focus fosters strong brand loyalty among its customer base. For instance, in fiscal year 2023, the company reported a 3.0% increase in comparable store sales, indicating continued customer engagement with its unique offerings.

However, this differentiation faces pressure. Competitors increasingly offer customizable solutions, and the growth of off-price retailers selling similar items can dilute The Container Store's perceived uniqueness. This competitive landscape challenges the company's ability to maintain its premium positioning and customer loyalty solely on product differentiation, especially given its higher price points compared to many alternatives.

Exit Barriers for Competitors

High exit barriers are a significant factor in the competitive landscape for retailers like The Container Store. These barriers can trap less profitable competitors in the market, intensifying rivalry. Think about the substantial investments required for physical stores, large inventories, and long-term lease agreements; these make it difficult and costly for companies to simply shut down operations.

The Container Store's own recent experience underscores this. In June 2024, the company filed for Chapter 11 bankruptcy protection. Despite this financial restructuring, the plan is to continue operating its stores, demonstrating how these fixed assets and contractual obligations can prevent a clean exit, thereby prolonging competitive pressures.

- Significant Fixed Assets: Retailers often have substantial investments in store locations, fixtures, and distribution networks, making divestiture or closure a complex and expensive undertaking.

- Long-Term Lease Obligations: Leases for retail space can extend for many years, creating ongoing financial commitments that are difficult to escape even in unfavorable market conditions.

- Brand and Reputation Costs: A poorly managed exit can damage a company's brand and reputation, impacting future business ventures and potentially incurring severance or closure-related costs.

- Inventory Write-downs: Liquidating large amounts of inventory at a loss can significantly impact a company's financial performance, acting as a deterrent to exiting the market quickly.

Cost Structure of Competitors

Competitors with lower cost structures, particularly large-scale retailers boasting efficient supply chains and extensive product assortments, can significantly pressure The Container Store on pricing. This dynamic is particularly impactful given the company's reported sales challenges. For instance, The Container Store's net sales for the fiscal year ending March 30, 2024, were $1.02 billion, a decrease from $1.05 billion in the prior year, reflecting these macro-related headwinds and soft consumer demand.

The company's inability to compete solely on price, a consequence of its specialized product focus and associated cost base, intensifies the rivalry. This makes it difficult for The Container Store to match the price points offered by more diversified retailers. The ongoing economic climate further exacerbates this, as consumers become more price-sensitive, favoring value propositions that competitors with leaner cost structures are better positioned to deliver.

- Price Pressure: Competitors with lower cost structures can undercut The Container Store's pricing.

- Sales Impact: Macroeconomic challenges and weak consumer demand directly affect The Container Store's sales performance.

- Competitive Disadvantage: The Container Store faces difficulty competing on price due to its cost structure and specialized offerings.

- Market Sensitivity: Increased consumer price sensitivity amplifies the competitive disadvantage for The Container Store.

The Container Store faces intense competition from a broad spectrum of retailers, including large general merchandise stores, home improvement chains, and furniture specialists, all vying for consumer dollars in the home organization market.

This rivalry is amplified by high exit barriers, such as significant fixed assets and long-term lease obligations, which keep less profitable competitors in the market, thus intensifying competitive pressures.

The company's specialized product focus and associated cost structure limit its ability to compete on price with leaner, more diversified retailers, a disadvantage exacerbated by current economic conditions and increased consumer price sensitivity.

The Container Store's net sales for the fiscal year ending March 30, 2024, were $1.02 billion, a decrease from $1.05 billion the previous year, underscoring the impact of these competitive pressures and broader market headwinds.

| Competitor Type | Examples | Impact on The Container Store |

|---|---|---|

| General Merchandise Retailers | Walmart, Target, Amazon | Broad product selection, often at lower price points |

| Home Improvement Retailers | Home Depot, Lowe's | Offer complementary organization products |

| Furniture & Home Goods Specialists | IKEA | Offer stylish and affordable organization solutions |

| Off-Price Retailers | TJ Maxx, Marshalls | Sell similar items at discounted prices, diluting perceived uniqueness |

SSubstitutes Threaten

A significant threat of substitution for The Container Store comes from consumers choosing do-it-yourself (DIY) storage solutions or repurposing general-purpose furniture and containers. These alternatives, often found at lower price points from mass-market retailers, can fulfill similar organizational needs, especially for those in smaller living spaces where versatile storage is key. For instance, many consumers opt for readily available plastic bins or basic shelving units to manage clutter.

Consumers increasingly opt for multi-functional furniture, such as beds with integrated storage or adaptable cabinets, as a direct substitute for dedicated storage solutions. This shift is fueled by a growing demand for space efficiency and seamless aesthetic integration, especially prevalent in urban environments and smaller homes.

Furthermore, the rise of custom built-in solutions, crafted by contractors or carpenters, presents another significant substitute. These bespoke installations offer tailored storage that perfectly fits a home's architecture, often surpassing the flexibility of off-the-shelf products. For instance, a 2024 survey indicated that 35% of homeowners undertaking renovations considered built-in storage as a primary design element, directly impacting the market for traditional storage units.

The proliferation of online marketplaces like Amazon and Wayfair, along with direct-to-consumer (DTC) brands, presents a significant threat of substitutes for The Container Store. These platforms offer an overwhelming variety of storage and organization solutions, often at lower price points and with faster shipping than traditional brick-and-mortar retailers. For instance, Amazon's vast selection of home organization products saw its revenue increase by 11% in 2023, highlighting its growing dominance and appeal to consumers seeking convenience and value.

Digital Organization Tools and Services

Digital organization tools and professional organizing services present a potential threat of substitutes for The Container Store's physical products. These digital solutions, such as inventory management apps or cloud storage, address the core need for organization, even if they don't directly replace physical bins or shelves. This is particularly relevant for managing information or smaller, less tangible items.

The demand for home organization products is projected to grow, with estimates suggesting an increase through 2028. This growth is fueled by factors like rising housing costs, which encourage more efficient use of existing space, and changing lifestyle preferences that prioritize tidiness and order. For instance, the global smart home market, which often incorporates organizational aspects, was valued at approximately $80 billion in 2023 and is expected to see significant expansion.

- Digital Alternatives: Apps for digital decluttering and cloud-based document management offer ways to organize information, indirectly substituting the need for physical storage for certain items.

- Service-Based Solutions: Professional organizing services can help individuals declutter and manage their spaces, reducing reliance on purchasing new storage products.

- Market Trends: The increasing value placed on efficient living spaces, driven by factors like higher housing costs, is expected to bolster demand for organization solutions overall, but also highlights the appeal of non-physical alternatives.

- Consumer Behavior: As consumers become more tech-savvy, they may increasingly opt for digital organization methods for aspects of their lives that were previously managed with physical products.

Used and Repurposed Items

The availability of used and repurposed items poses a significant threat to The Container Store. Consumers seeking more economical solutions or prioritizing sustainability may turn to second-hand furniture or creatively reuse existing household goods for storage needs. This is particularly relevant for budget-conscious shoppers.

This trend is amplified by shifting consumer behaviors, with a growing segment of the population actively seeking pre-owned goods. For instance, the resale market for home goods has seen substantial growth, with platforms like ThredUp and Poshmark expanding their offerings beyond apparel. In 2023, the global secondhand market was valued at over $130 billion, with projections suggesting it could reach $350 billion by 2027, indicating a strong consumer preference for cost-effective and environmentally friendly alternatives.

- Budget-Conscious Consumers: Individuals prioritizing cost savings are drawn to the lower price points of used storage solutions.

- Sustainability Focus: Environmentally aware consumers may prefer repurposing items or buying used to reduce waste and their carbon footprint.

- DIY and Upcycling Trends: The rise of DIY culture encourages consumers to find creative ways to use existing materials, bypassing the need for new storage products.

- Market Growth: The expanding resale market demonstrates a clear consumer willingness to engage with alternatives to new retail purchases.

The threat of substitutes for The Container Store is significant, encompassing everything from DIY solutions and repurposed furniture to multi-functional items and custom built-ins. Consumers are increasingly looking for cost-effective and space-saving alternatives. For instance, the resale market for home goods saw substantial growth, exceeding $130 billion in 2023, reflecting a strong consumer preference for pre-owned and budget-friendly options.

Digital organization tools and professional organizing services also present indirect substitutes by addressing the core need for order without requiring physical products. Furthermore, the proliferation of online marketplaces and direct-to-consumer brands offers a vast array of storage solutions, often at lower price points and with greater convenience than traditional retailers. Amazon's revenue from home organization products increased by 11% in 2023, underscoring this competitive pressure.

| Substitute Category | Key Characteristics | Consumer Driver | Market Data/Example |

|---|---|---|---|

| DIY & Repurposed Items | Low cost, creative use of existing materials | Budget-consciousness, sustainability | Resale market valued over $130B in 2023 |

| Multi-functional Furniture | Space-saving, integrated design | Urban living, aesthetic integration | Growing demand in smaller living spaces |

| Custom Built-ins | Tailored fit, high customization | Renovations, specific architectural needs | 35% of homeowners consider built-ins in 2024 renovations |

| Online Retailers & DTC Brands | Wide variety, competitive pricing, convenience | Value, speed, accessibility | Amazon home organization revenue up 11% in 2023 |

| Digital & Service Solutions | Information management, professional guidance | Tech-savviness, efficiency | Global smart home market ~$80B in 2023 |

Entrants Threaten

Entering the specialty retail storage market, especially with a physical store presence and custom installation services like The Container Store, demands significant capital. This includes substantial investments in prime real estate, extensive inventory, and specialized equipment for crafting bespoke storage solutions, all of which act as considerable barriers for potential new competitors.

Despite these high capital requirements, The Container Store itself has faced financial headwinds, filing for Chapter 11 bankruptcy protection in early 2024. This development underscores that even established players can struggle, potentially making the market seem less daunting to new entrants if they perceive a path to more efficient operations or a differentiated offering.

The Container Store benefits from strong brand loyalty, cultivated through its specialized focus on organization and a premium in-store experience. This makes it challenging for new entrants to gain traction. For instance, in fiscal year 2023, The Container Store reported net sales of $934.4 million, indicating a substantial existing customer base.

Newcomers would face significant hurdles in replicating this brand recognition and customer devotion. They would need substantial investment in marketing and product differentiation to even approach The Container Store's established market position. This is particularly true given that The Container Store's pricing is generally higher than many general retailers, suggesting customers are willing to pay a premium for its specialized offerings.

Newcomers face significant hurdles in securing reliable suppliers and establishing efficient distribution networks for storage and organization items. The Container Store benefits from established supplier relationships and a sophisticated inventory system, giving it an edge over potential entrants who must build these from the ground up.

Economies of Scale

The threat of new entrants for The Container Store is significantly impacted by economies of scale enjoyed by existing large retailers. Companies like Target and Walmart, operating in the broader home goods and general merchandise space, leverage massive purchasing power, sophisticated distribution networks, and extensive marketing budgets. This allows them to negotiate lower prices from suppliers and spread fixed costs over a larger sales volume, creating a substantial cost advantage.

New entrants would find it challenging to match these cost efficiencies from the outset. Without the established scale, they would likely face higher per-unit costs for inventory, marketing campaigns, and logistics. For instance, in 2024, major retailers often secured discounts of 10-15% or more on bulk purchases compared to smaller operations, a gap that is difficult for a new player to overcome quickly. This cost disadvantage makes it harder for new entrants to compete on price, a critical factor in the retail sector.

- Existing players benefit from significant purchasing power, leading to lower per-unit costs.

- Established distribution networks reduce logistical expenses for large retailers.

- High marketing spend by incumbents creates brand awareness that new entrants must overcome.

- New entrants face a considerable hurdle in achieving comparable cost structures to compete on price.

Regulatory Hurdles and Knowledge Base

New entrants face regulatory complexities, including retail compliance, zoning for physical locations, and potential certifications for specialized services like custom installations. For instance, in 2024, navigating local business permits and adhering to consumer protection laws remained a significant initial step for any new retail operation.

Building a robust knowledge base among staff is crucial, a process that demands considerable time and financial investment. The Container Store, for example, emphasizes extensive product knowledge and consultative selling, a capability that new competitors must replicate to be effective.

- Regulatory Compliance: New entrants must understand and adhere to a range of retail laws, zoning ordinances, and safety standards.

- Staff Training Investment: Developing a skilled sales force, a core asset for established players like The Container Store, requires significant upfront training expenditure.

- Certification Requirements: Certain services, such as custom design or installation, may necessitate specific industry certifications or licenses.

The threat of new entrants into the specialized storage and organization retail market, particularly for a player like The Container Store, is moderately high. While significant capital investment is required for physical retail and custom services, the market's established profitability and the potential for online-only models can attract new competitors. For example, in 2024, the growth of e-commerce platforms has lowered some of the traditional barriers to entry for retail businesses.

The Container Store's 2023 net sales of $934.4 million highlight its established market presence, which acts as a deterrent. However, its Chapter 11 filing in early 2024 signals potential vulnerabilities that could be exploited by agile new entrants. This event might encourage competitors who believe they can operate more efficiently or offer a distinct value proposition, perhaps through a more focused product line or a stronger digital-native approach.

New entrants would face challenges in matching The Container Store's brand loyalty and its premium pricing strategy, which is supported by its specialized focus and in-store experience. However, the increasing consumer demand for home organization solutions, a trend that saw continued growth through 2024, presents an ongoing opportunity for new businesses to carve out a niche, especially if they can offer competitive pricing or unique product innovations.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Container Store is built upon a foundation of data from industry-specific market research reports, company annual filings, and publicly available financial statements. This blend of sources provides a comprehensive view of competitive dynamics, supplier and buyer power, and the threat of new entrants and substitutes.