The Container Store Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Container Store Bundle

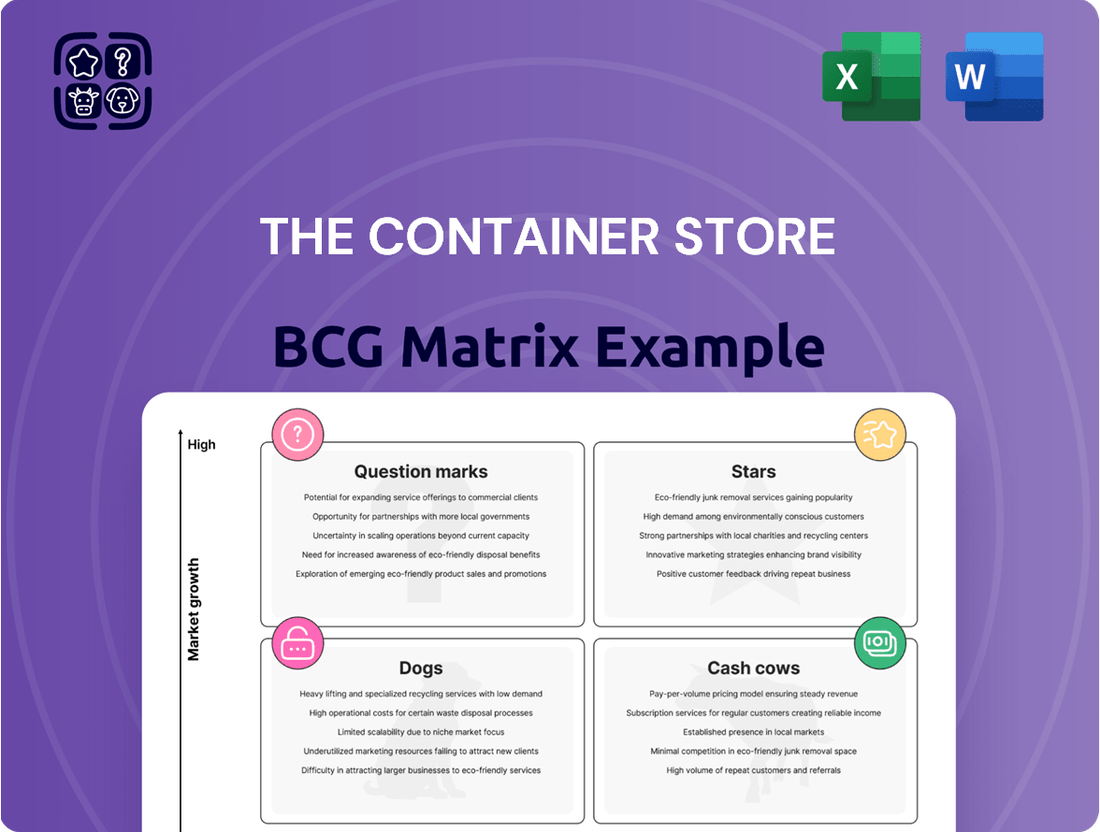

Curious about The Container Store's product portfolio? This snapshot reveals how their offerings might fit into the BCG Matrix, hinting at potential Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock the strategic advantage, dive into the full BCG Matrix. Gain a comprehensive understanding of each product's market share and growth potential, empowering you to make informed decisions about resource allocation and future investments.

Purchase the complete report for actionable insights and a clear roadmap to optimizing The Container Store's product strategy and driving sustainable growth.

Stars

The Container Store's Custom Spaces segment, encompassing its Elfa and Preston custom closet lines, demonstrates robust performance with positive comparable sales growth. This suggests a strong market standing within the expanding custom closets sector.

The global custom closets market is anticipated to experience substantial expansion, with a projected compound annual growth rate of 7.2% between 2025 and 2032. This positions custom closet services as a high-growth, high-market-share offering for the company.

The company's CEO has articulated a strategic objective for Custom Spaces to eventually represent 60% of the business. This ambition underscores the critical role these services play in The Container Store's future growth strategy.

Elfa Shelving and Drawer Systems are a cornerstone of The Container Store's Custom Spaces division, representing a significant portion of the company's proprietary offerings. This vertically integrated product line boasts strong brand recognition and consistent quality, contributing to a solid market share in the custom storage solutions market. The Container Store's ongoing investment in Elfa, including the introduction of new lines like Decor+ by Elfa, underscores its commitment to this high-performing product category.

The Container Store's introduction of premium wood closet systems, like the Preston line and new DIY wood options, targets the growing demand for upscale, customizable home organization. These products appeal to consumers valuing aesthetics and flexibility, tapping into The Container Store's custom solution expertise.

In-Home Design and Organizing Services

The Container Store's in-home design and organizing services act as a powerful complement to their custom closet and storage solutions. These personalized offerings directly address the growing consumer desire for expertly optimized living spaces, fostering deeper customer relationships and driving sales of higher-margin custom products.

The company's strategic investment in these services positions them to capture a larger share of the home organization market, which saw significant growth. For instance, the professional organizing industry was projected to continue its upward trajectory, with many consumers willing to pay for expert assistance in decluttering and maximizing their homes. This trend was particularly evident in 2024, as homeowners continued to prioritize functional and aesthetically pleasing living environments.

- Enhanced Customer Value: Offering in-home consultations elevates the customer experience beyond product purchase to a comprehensive solution for organized living.

- Increased Custom Solutions Sales: The services directly lead to higher sales of The Container Store's custom closet and storage systems by identifying specific customer needs.

- Market Differentiation: This personalized approach sets The Container Store apart from competitors who primarily focus on product sales alone.

- Growing Demand: Consumer interest in professional home organization and space optimization services has been steadily increasing, creating a favorable market for these offerings.

Strategic Partnerships for Custom Spaces Expansion

The Container Store's strategic partnership with Beyond, Inc. is a key move to grow its Custom Spaces business. This collaboration will see The Container Store's Custom Spaces solutions integrated across Beyond's various e-commerce platforms.

This alliance is designed to tap into Beyond's robust data infrastructure and extensive e-commerce know-how. The goal is to broaden the customer base for Custom Spaces and improve conversion rates. Such partnerships are crucial for gaining traction in rapidly expanding markets.

- Market Expansion: Integrating Custom Spaces into Beyond's e-commerce banners allows The Container Store to reach a wider audience beyond its traditional customer base.

- Leveraging Data and Expertise: Beyond's data platform and e-commerce proficiency are expected to drive more targeted marketing and a smoother online customer journey, boosting traffic and sales for Custom Spaces.

- Growth Opportunity: This partnership is positioned to capitalize on the growing demand for customized home organization solutions, a segment experiencing significant market growth.

The Container Store's Custom Spaces, including Elfa and Preston, are its Stars in the BCG Matrix. These segments exhibit high growth potential and strong market share, driven by increasing consumer demand for organized living. The company's strategic focus on expanding this division, aiming for 60% of the business, highlights its Star status.

The global custom closets market is projected to grow at a 7.2% CAGR from 2025 to 2032, underscoring the high-growth nature of this segment. The Container Store's proprietary Elfa and premium Preston lines, coupled with in-home design services, solidify its strong market position within this expanding industry.

The partnership with Beyond, Inc. further amplifies the growth trajectory of Custom Spaces by leveraging e-commerce platforms and data expertise to reach a broader customer base.

| Segment | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Custom Spaces (Elfa & Preston) | High (7.2% CAGR projected 2025-2032 for custom closets) | Strong (Proprietary lines, in-home services) | Star |

What is included in the product

This BCG Matrix analysis identifies The Container Store's Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment decisions.

The Container Store BCG Matrix provides a clear, one-page overview, instantly relieving the pain of deciphering complex business unit performance.

Cash Cows

Core storage bins and baskets are The Container Store's cash cows. Despite broader challenges in general merchandise, these foundational items continue to be essential for home organization, ensuring steady demand. For example, in fiscal year 2023, The Container Store reported total net sales of $1.02 billion, with core organization products like bins and baskets forming a significant, albeit mature, revenue stream.

This category likely provides consistent cash flow due to its everyday utility and wide customer appeal. While specific sales figures for bins and baskets aren't always broken out, their consistent presence in customer baskets and store layouts highlights their role as reliable performers. Even with a reported 2.6% decrease in comparable store sales for fiscal year 2023, these items remain a substantial part of the company's sales volume and customer engagement.

Kitchen and pantry organization solutions represent a significant segment for The Container Store, tapping into a market driven by a desire for functional and clutter-free living spaces. These established product lines are likely consistent revenue generators, benefiting from sustained consumer interest and requiring minimal marketing spend to maintain their position.

Basic shelving units and components are the bedrock of The Container Store's offerings. These are the standard, non-customizable items that provide essential organization for homes and offices. Think of the simple, sturdy bookshelves or basic closet shelving systems. These products are not in a high-growth phase, but they are reliable.

Their established market share means they consistently bring in steady cash for the company. This is due to their broad appeal and the fact that people often need to replace or add to these basic units. The market for these items is mature, which generally means lower marketing costs are needed to maintain sales.

In 2023, The Container Store reported net sales of $1.05 billion. While specific segment data isn't publicly broken down, it's reasonable to assume that these foundational shelving products contribute significantly to that revenue stream, acting as consistent cash cows.

Private Label General Merchandise

The Container Store's private label general merchandise represents a substantial part of its business, accounting for roughly 45% of its general merchandise sales. This segment is crucial for profitability, as private label products typically yield higher profit margins compared to national brands. By focusing on these offerings, the company can better manage its costs and build a loyal customer following in a challenging retail environment.

These private label goods act as cash cows for The Container Store due to their strong market share and high profitability. Their consistent sales performance generates significant cash flow, which can then be reinvested into other areas of the business, such as developing new product lines or expanding store locations.

- Private Label Contribution: Approximately 45% of The Container Store's general merchandise sales.

- Profitability Driver: Private label products generally offer superior profit margins, boosting overall company earnings.

- Market Position: Helps maintain an established customer base and provides cost control advantages.

- Cash Flow Generation: Their consistent sales performance fuels the company's cash flow.

Established Home Office Organization Products

Established home office organization products at The Container Store are likely cash cows. The persistent trend of remote and hybrid work continues to fuel demand for dedicated home office solutions. This mature product category, encompassing items like desk organizers, shelving units, and filing systems, probably generates consistent profits with minimal need for further significant investment.

In 2024, the demand for home office furniture and accessories remained robust, reflecting the ongoing shift in work arrangements. For instance, a significant portion of the workforce continues to operate remotely, driving sales in this segment. The Container Store's established presence in this market positions these products as reliable revenue generators.

- Steady Revenue: Home office organization products contribute a stable income stream due to sustained demand.

- Low Investment Needs: Mature product lines typically require less capital for innovation and marketing.

- Market Maturity: The segment is well-established, indicating predictable consumer behavior and sales patterns.

- Profitability: These products likely have healthy profit margins, supporting overall business profitability.

The Container Store's private label offerings, which constitute about 45% of their general merchandise sales, are strong cash cows. These products typically boast higher profit margins than national brands, contributing significantly to the company's overall profitability. Their consistent sales performance generates reliable cash flow, allowing for reinvestment in other business areas.

| Product Category | BCG Matrix Classification | Key Characteristics | Fiscal Year 2023 Data Point |

|---|---|---|---|

| Core Storage Bins & Baskets | Cash Cow | Essential, steady demand, wide appeal | Part of $1.02 billion total net sales |

| Kitchen & Pantry Solutions | Cash Cow | Consistent revenue, sustained consumer interest | Significant revenue stream within overall sales |

| Basic Shelving Units | Cash Cow | Reliable, mature market, low marketing costs | Contributes to $1.05 billion net sales |

| Private Label General Merchandise | Cash Cow | High profit margins, customer loyalty driver | ~45% of general merchandise sales |

What You See Is What You Get

The Container Store BCG Matrix

The BCG Matrix analysis you are previewing is the exact, final document you will receive upon purchase, offering a comprehensive strategic overview of The Container Store's product portfolio. This report has been meticulously crafted to provide actionable insights, ensuring you get a fully formatted and ready-to-use strategic tool without any watermarks or demo content. Once purchased, this BCG Matrix will be instantly downloadable, allowing you to immediately integrate its findings into your business planning or presentations. You are seeing the actual, professionally designed BCG Matrix file that will be yours to edit, print, or present to stakeholders, providing a clear roadmap for strategic decision-making.

Dogs

The general merchandise categories at The Container Store are currently struggling, showing a significant drop in performance. In the first quarter of fiscal year 2024, these categories saw a decline of 21.8%, followed by a further decrease of 18.7% in the second quarter. This underperformance is a major factor in the overall decrease in comparable store sales.

These products are losing ground to larger, generalist retailers such as Target and Walmart. These competitors are able to offer more competitive pricing, making The Container Store's general merchandise less appealing. This dynamic suggests that these categories are not generating sufficient returns and may be considered cash traps.

In response to these challenges, The Container Store is strategically adjusting its store layouts. The company is reallocating space away from some of these underperforming general merchandise areas to better focus on its core product offerings, which are perceived to be more central to its brand identity and customer demand.

Older, large-format stores situated in expensive urban areas are presenting a challenge for The Container Store. The company has been strategically closing some of these underperforming locations, including a recent closure in Los Angeles and a planned exit from a Chicago store, primarily due to escalating rent costs. These closures have resulted in the company recording impairment charges, reflecting the financial impact of these decisions.

These larger stores, often burdened with higher fixed expenses and potentially less efficient sales per square foot, are being re-evaluated. The Container Store's strategy involves minimizing their presence as they pivot towards smaller, more optimized store formats designed for greater efficiency and potentially better profitability. This shift aims to streamline operations and improve overall financial performance.

The Container Store's online sales channel is currently positioned as a Dog in the BCG Matrix. This is due to a significant decline in online sales, dropping 25.6% in Q1 FY2024 and 13.7% in Q2 FY2024. This underperformance occurs within a rapidly expanding e-commerce market for home goods.

The company's e-commerce platform is struggling to gain traction, showing a low market share despite the overall growth in online channels for storage solutions. This suggests the online sales channel is a cash drain, consuming resources without generating proportional returns, a classic characteristic of a Dog in the BCG framework.

Expansions into Non-Core Home Decor Categories

The Container Store's foray into broader home decor categories, beyond its core organization solutions, has been identified as a strategic misstep, aligning with the 'dogs' quadrant of the BCG matrix. CEO Satish Malhotra acknowledged that the company's expansion into general home decor went "a little too far" and is now being scaled back. This suggests these product lines likely suffered from low market share and failed to connect with the brand's primary customer base.

These underperforming categories likely diverted valuable resources and capital from more profitable core offerings. In 2023, The Container Store reported a net sales decrease of 2.7% to $957.7 million. While not directly attributable to the home decor segment alone, this overall trend indicates challenges in expanding product reach without diluting brand focus. Such initiatives, if not carefully managed, can lead to decreased profitability and inefficient resource allocation, characteristic of 'dog' businesses that should be divested.

- Strategic Overreach: The CEO's admission highlights a strategic error in expanding too broadly into general home decor.

- Low Market Share & Resonance: These products likely failed to gain traction and did not appeal to the core customer.

- Resource Drain: The expansion consumed resources without generating commensurate returns, impacting overall financial performance.

- BCG Matrix Alignment: The situation exemplifies 'dogs' in the BCG matrix, businesses with low growth and low market share, necessitating divestment or significant restructuring.

Products with High Price Sensitivity and Mass-Market Competition

Many of The Container Store's general merchandise items fall into this category. These are products where price is a major deciding factor for consumers. When The Container Store prices these items higher than mass-market retailers, it’s a problem.

For instance, in 2024, competitors like Target and Walmart continued to aggressively price similar organizational products. This intense price competition means The Container Store's higher-priced items struggle to gain or maintain market share. This segment is characterized by low growth and low market share, making it difficult to achieve profitability.

- Price Sensitivity: Consumers actively seek lower prices for these everyday organizational items.

- Mass-Market Competition: Retailers like Target, Walmart, and Amazon offer comparable products at significantly lower price points.

- Market Share Erosion: The price gap leads to a loss of customers to these competitors.

- Profitability Challenges: The combination of high prices and intense competition makes breaking even difficult.

The Container Store's general merchandise and online sales channels are identified as Dogs in the BCG Matrix. These segments exhibit low market share and low growth, struggling against larger competitors like Target and Walmart, particularly on price. The company is actively reducing space allocated to these underperforming areas and scaling back its expansion into broader home decor categories, which CEO Satish Malhotra admitted went too far.

These "dog" categories are characterized by declining sales, with general merchandise down 21.8% in Q1 FY2024 and 13.7% in Q2 FY2024, and online sales dropping 25.6% and 13.7% in the same periods. This strategic refocus aims to improve overall financial performance by concentrating on core, more profitable offerings.

The company's strategy involves divesting from or significantly restructuring these low-performing assets. For example, The Container Store reported a net sales decrease of 2.7% to $957.7 million in 2023, reflecting broader challenges in expanding product reach without diluting brand focus.

The shift away from these "dogs" is crucial for reallocating resources to more promising areas of the business, ensuring a more efficient use of capital and a stronger market position in its core competencies.

Question Marks

The Container Store's new premium wood closet system, launched in October 2024, enters the market as a potential star. This DIY solution targets a wider audience looking for an easy-to-install, high-end closet upgrade. The custom closet market is experiencing robust growth, with projections indicating continued expansion through 2025.

While the specific market share for this 'in a box' concept is still developing, its introduction addresses a growing consumer demand for accessible custom storage. Significant marketing investment and consumer adoption will be key to solidifying its position. Industry analysts anticipate the premium closet market to reach over $2.5 billion globally by 2026, showcasing substantial opportunity.

The Container Store's Garage+ and Decor+ by Elfa product lines are positioned as Stars or Question Marks in its BCG Matrix. These extensions leverage the established Elfa system's reputation to enter the burgeoning garage organization and decorative home solutions markets. Initial market reception and revenue generation for these new lines are still being assessed, requiring ongoing investment for growth and market establishment.

The Everything Organizer™ Drop-Front Shoe Box, launched in December 2024, represents a new entrant in The Container Store's product lineup. This specialized item aims to capture a segment of the closet organization market, a sector that saw continued growth throughout 2024, with many consumers investing in home organization solutions.

As a recent addition, this shoe box likely falls into the question mark category of the BCG matrix. Its market share is expected to be low initially, but its potential for growth depends on consumer acceptance and The Container Store's marketing efforts. The company's overall revenue for fiscal year 2024 was reported at $976 million, providing a financial backdrop for evaluating new product contributions.

Business-to-Business (B2B) and To-the-Trade Efforts

The Container Store is making a concerted push into business-to-business (B2B) and to-the-trade channels. While this segment is recognized for its growth trajectory, it currently constitutes a minor portion of the company's total revenue. For instance, in fiscal year 2023, the company reported total net sales of $906.1 million, with B2B contributing a smaller, though expanding, piece.

This strategic focus targets commercial clients and design professionals, areas with significant untapped potential. However, The Container Store currently holds a low market share within this segment, necessitating strategic investments to effectively scale operations and capture a larger portion of this lucrative market.

- B2B Growth Potential: High, targeting commercial clients and design professionals.

- Current Market Share: Low, indicating room for expansion.

- Strategic Imperative: Requires investment to scale effectively.

- Fiscal Year 2023 Performance: Total net sales were $906.1 million, highlighting the B2B segment's current small contribution relative to overall business.

Smaller Store Format Expansion (future potential)

The Container Store is exploring smaller store formats as a potential avenue for future growth, with plans to open 70 additional locations. However, new store openings are currently paused beyond fiscal year 2024 due to financial limitations.

These more efficient, smaller stores could unlock access to new markets, but their ability to significantly boost overall sales as a primary expansion strategy still needs to be fully demonstrated. For instance, in fiscal year 2023, The Container Store reported net sales of $1.04 billion, and the impact of these smaller formats on future revenue streams is a key area to monitor.

- Future Expansion Target: 70 identified locations for smaller format stores.

- Current Status: New store openings on hold beyond FY2024 due to financial constraints.

- Potential Benefit: Access to new markets through more efficient store designs.

- Uncertainty: The ultimate impact on overall sales growth as a primary strategy is yet to be proven.

The Container Store's B2B and to-the-trade channels are prime examples of Question Marks within its BCG Matrix. These segments represent high growth potential, targeting commercial clients and design professionals, but currently hold a low market share. Significant strategic investment is required to scale operations and capture a larger portion of this lucrative market, especially considering the company's fiscal year 2023 net sales of $906.1 million, where B2B was a smaller, though growing, contributor.

| Product/Segment | Market Growth Rate | Relative Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| B2B & To-the-Trade | High | Low | Question Mark | Invest to gain share or divest if potential is not realized. |

| Garage+ / Decor+ by Elfa | High | Low to Medium | Question Mark / Star | Requires continued investment to build share. |

| Everything Organizer™ Drop-Front Shoe Box | Medium | Low | Question Mark | Monitor consumer adoption and marketing effectiveness. |

| Premium Wood Closet System | High | Low | Question Mark | Needs significant marketing and consumer adoption to become a Star. |

BCG Matrix Data Sources

Our Container Store BCG Matrix leverages financial reports, market share data, and industry growth projections to accurately position each product category.