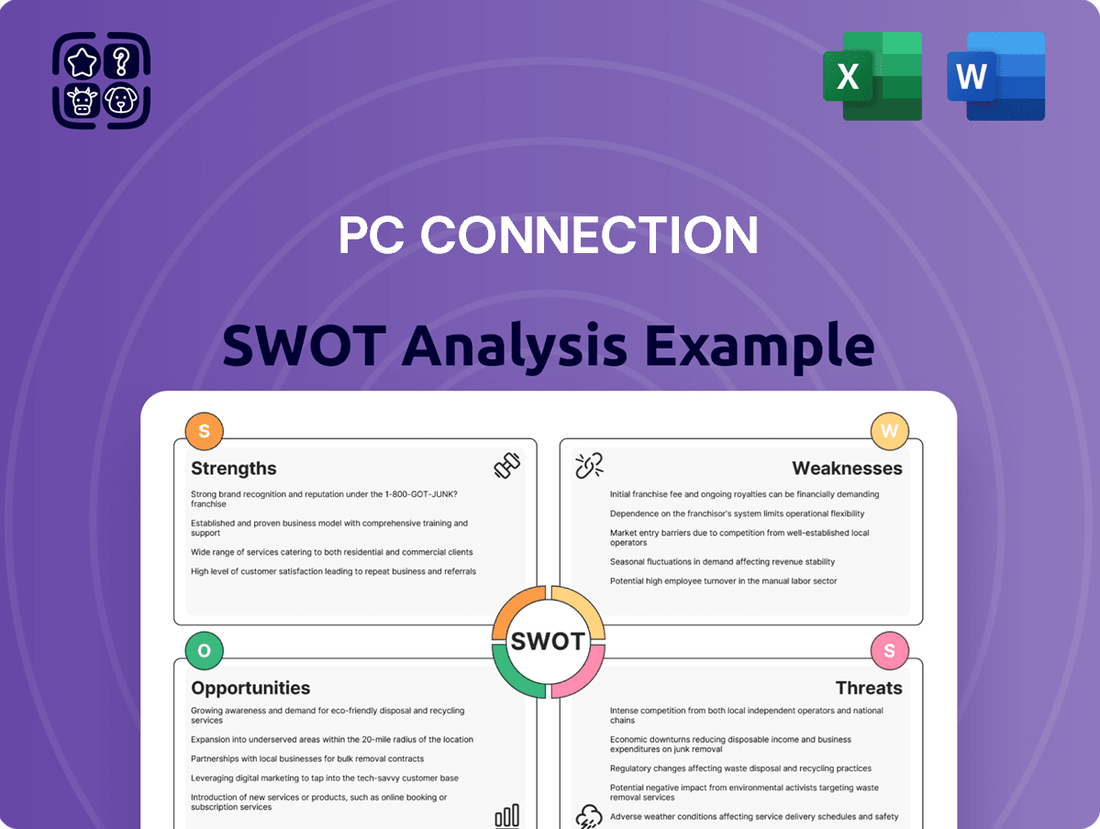

PC Connection SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PC Connection Bundle

PC Connection, a prominent IT solutions provider, demonstrates significant strengths in its established customer base and broad product portfolio. However, potential weaknesses lie in its reliance on key vendors and the competitive landscape of the IT services market. Understanding these dynamics is crucial for any business looking to navigate this sector.

Want the full story behind PC Connection’s market position, its competitive advantages, and the potential threats it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

PC Connection boasts a remarkably comprehensive IT solutions portfolio, encompassing everything from basic hardware and software procurement to sophisticated IT solution design, implementation, and ongoing managed services. This breadth allows them to act as a true one-stop shop for businesses navigating the complexities of technology.

This all-encompassing approach positions PC Connection as a full-service technology partner, capable of addressing a wide spectrum of client needs across diverse industries. For example, in fiscal year 2023, their solutions and services segment saw robust growth, contributing significantly to their overall revenue, demonstrating client trust in their integrated offerings.

Connection has cultivated a significant market presence by diligently serving diverse sectors including businesses, government agencies, healthcare providers, and educational institutions. This broad reach has fostered a deeply loyal customer base, a testament to their consistent service and tailored solutions. For instance, in fiscal year 2023, Connection reported revenue from these key segments, underscoring the stability and breadth of their established customer relationships.

PC Connection's strategic investments in advanced technologies, particularly in AI and modern infrastructure, are a key strength. These investments enhance their integrated solutions capabilities, positioning the company to meet evolving customer demands for cutting-edge IT solutions. For instance, their focus on cloud and cybersecurity solutions, areas experiencing significant growth, demonstrates this commitment. In the fiscal year 2023, PC Connection reported a 3.8% increase in revenue for its Solutions Specialists segment, which heavily features these advanced technology offerings, reaching $1.3 billion.

Strong Financial Foundation and Margin Expansion

Connection has shown a strong ability to grow its gross margins, even with some ups and downs in overall revenue. This is largely thanks to selling more of their advanced tech like cloud services, software, and security products. For instance, in the first quarter of 2024, the company reported a gross profit margin of 16.5%, an increase from 15.8% in the same period of 2023, showing their focus on higher-margin solutions is paying off.

This financial strength is further supported by their commitment to returning value to shareholders through share repurchases. In 2023, Connection repurchased approximately 1.5 million shares of its common stock, demonstrating confidence in its financial health and a strategy to boost shareholder value. These actions highlight a robust operational performance and a solid financial base for future growth.

- Gross Margin Growth: Connection's gross profit margin reached 16.5% in Q1 2024, up from 15.8% in Q1 2023.

- Focus on Advanced Technologies: Sales of cloud, software, and security solutions are key drivers for margin expansion.

- Shareholder Returns: The company actively engages in share repurchase programs, having bought back around 1.5 million shares in 2023.

- Financial Resilience: These factors underscore a stable financial position and effective operational management.

Extensive Technical Certifications and Capabilities

Connection's extensive technical certifications, boasting over 2,500, underscore a profound depth of expertise across a wide array of IT solutions. This commitment to technical mastery is further validated by their ISO 9001:2015 certified technical configuration lab, a testament to their rigorous quality management systems.

These combined capabilities allow Connection to excel in delivering highly customized IT solutions tailored to specific client needs. Their ability to handle complex configurations and troubleshoot intricate IT challenges positions them as a reliable partner for businesses seeking advanced technological support.

- Over 2,500 Technical Certifications: Demonstrates broad and deep IT knowledge.

- ISO 9001:2015 Certified Lab: Guarantees high standards in technical configuration and operations.

- Custom Solution Delivery: Enables tailored IT solutions for diverse client requirements.

- Complex IT Problem Solving: Highlights proficiency in addressing advanced technical challenges.

PC Connection's comprehensive IT solutions portfolio, from hardware to managed services, makes them a valuable one-stop shop for businesses. Their broad market presence across business, government, healthcare, and education sectors has cultivated a loyal customer base, as evidenced by consistent revenue generation from these segments in fiscal year 2023.

Strategic investments in advanced technologies like AI, cloud, and cybersecurity are a significant strength, as shown by the 3.8% revenue increase in their Solutions Specialists segment to $1.3 billion in fiscal year 2023. This focus on higher-margin offerings has boosted their gross profit margin to 16.5% in Q1 2024, up from 15.8% in Q1 2023.

The company's financial health is further bolstered by its commitment to shareholder value, demonstrated by repurchasing approximately 1.5 million shares in 2023. This financial resilience is underpinned by over 2,500 technical certifications and an ISO 9001:2015 certified configuration lab, ensuring high-quality, customized IT solutions and adept problem-solving capabilities.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Gross Profit Margin | 16.5% | 15.8% | +0.7 pp |

| Solutions Specialists Revenue (FY23) | $1.3 billion | N/A | +3.8% growth |

| Shares Repurchased (2023) | ~1.5 million | N/A | N/A |

What is included in the product

Delivers a strategic overview of PC Connection’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address PC Connection's strategic vulnerabilities and leverage its strengths.

Weaknesses

PC Connection's financial health is susceptible to broader economic shifts. For instance, during the first quarter of 2024, the company observed customers holding back on IT capital expenditures due to prevailing macroeconomic uncertainties. This sensitivity means that economic slowdowns or a general hesitancy in business IT spending can directly translate into reduced revenue for Connection.

Connection's continued reliance on hardware and infrastructure sales presents a notable weakness. This segment, which historically formed a core part of their revenue, remains susceptible to fluctuations in IT spending. For instance, during periods of economic uncertainty, Chief Information Officers (CIOs) often delay significant hardware upgrades or infrastructure investments, directly impacting Connection's top-line performance.

PC Connection has faced headwinds in specific areas, with its Business Solutions segment seeing a revenue decline of 2.3% year-over-year in the first quarter of 2024. Similarly, the Enterprise Solutions segment experienced a 1.5% dip in the same period. These contractions suggest potential market saturation or increased competition within these particular business lines.

Intense Competitive Landscape

The IT solutions and services market is incredibly crowded, making it tough for any single company to stand out. Connection operates in this environment, facing pressure from both large, well-known companies and smaller, specialized firms that can be very nimble.

This intense competition means Connection must constantly innovate and find ways to offer unique value. For example, in the cloud services sector alone, the market is projected to reach over $1.3 trillion by 2025, according to some industry estimates, highlighting the sheer number of players vying for a piece of that pie.

- High Rivalry: Connection competes against major IT distributors and solution providers, many with significant resources.

- Differentiation Challenge: Standing out requires continuous investment in specialized services and customer support.

- Market Share Pressure: Rivals actively seek to capture market share across various IT segments, from hardware to cybersecurity.

Potential for Supply Chain Disruptions

Connection, as a significant player in the IT products and solutions market, faces considerable vulnerability to global supply chain disruptions. Events like geopolitical tensions, persistent inflation, and issues with raw material sourcing or freight can directly impact operations. For instance, in early 2024, ongoing shipping container shortages and port congestion continued to affect delivery times and costs for electronic components, a core part of Connection's inventory. This can translate to higher operational expenses and, critically, affect the availability of products for their customers.

These external pressures can manifest in several ways:

- Increased Costs: Rising freight charges and the need to secure components from alternative, potentially more expensive, suppliers directly impact profit margins.

- Delays in Product Availability: Extended lead times for critical hardware and software can frustrate customers and lead to lost sales opportunities.

- Inventory Management Challenges: Predicting demand becomes more difficult when supply is unreliable, potentially leading to either stockouts or excess inventory.

- Impact on Service Delivery: For businesses relying on Connection for IT solutions, delays in hardware deployment can disrupt their own operational continuity.

Connection's reliance on hardware sales remains a significant vulnerability, as seen in the 2.3% revenue decline in its Business Solutions segment and a 1.5% dip in Enterprise Solutions during Q1 2024. This dependence makes the company susceptible to customer delays in IT capital expenditures, a trend observed in early 2024 due to macroeconomic uncertainties.

The company also faces intense competition in a crowded IT solutions market, with pressure from both large and specialized firms. This necessitates continuous investment in differentiation and specialized services to maintain market share against rivals actively vying for customers across various IT segments.

Supply chain disruptions pose another considerable weakness, impacting operations through increased costs and product availability delays. For instance, persistent shipping container shortages and port congestion in early 2024 affected electronic component delivery times and costs, directly influencing Connection's inventory management and customer service.

| Segment | Q1 2024 Revenue Change (YoY) | Key Factor |

|---|---|---|

| Business Solutions | -2.3% | Customer hesitancy in IT capital expenditures |

| Enterprise Solutions | -1.5% | Market saturation and increased competition |

| Overall IT Market | Varies by segment | Supply chain disruptions, macroeconomic uncertainty |

Full Version Awaits

PC Connection SWOT Analysis

This is the actual PC Connection SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the same structured insights that will be yours to download and utilize immediately after completing your order.

Opportunities

The global cloud computing market is on a significant upward trajectory, with projections indicating it will surpass $1 trillion by 2025. This expansion is fueled by widespread digital transformation initiatives and the increasing reliance on Software as a Service (SaaS) and Infrastructure as a Service (IaaS) models across industries.

Connection is well-positioned to leverage this burgeoning market by enhancing its existing cloud service offerings and developing new solutions tailored to evolving business needs. This strategic focus can unlock substantial revenue streams and solidify its competitive standing in the tech solutions sector.

The cybersecurity market is experiencing robust growth, projected to reach $345 billion by the end of 2024, driven by escalating cyber threats and stricter data privacy regulations. Connection is well-positioned to capitalize on this trend by expanding its security service portfolio. This includes offering advanced, AI-powered security solutions that address the evolving threat landscape.

Worldwide spending on AI is on a significant upward trajectory, with projections indicating continued robust growth through 2025 and beyond. This surge is particularly evident in the IT sector, where AI is increasingly integrated into service delivery, fueling a demand for specialized consulting and implementation services.

Connection's strategic investments in AI readiness are crucial here. By building its capabilities, the company is well-positioned to assist businesses in adopting AI solutions, offering services that drive operational efficiencies and foster innovation across various industries.

Continued Digital Transformation Initiatives

The ongoing digital transformation across industries presents a significant opportunity for PC Connection. Enterprises are heavily investing in modernizing their IT infrastructures, with a particular focus on hybrid cloud adoption and leveraging AI for automation. This trend is expected to continue driving IT spending throughout 2024 and into 2025.

Connection's ability to offer comprehensive, full-service solutions is a key advantage. By providing integrated support across a wide range of technologies, the company can effectively assist clients in navigating their digital transformation initiatives. This includes everything from cloud migration and cybersecurity to data analytics and managed services.

- Hybrid Cloud Growth: Gartner projected worldwide end-user spending on public cloud services to reach $678.8 billion in 2024, an increase from $611 billion in 2023, highlighting the demand for hybrid solutions.

- AI Integration: IDC forecasts worldwide spending on AI systems to more than double by 2027, reaching $203.3 billion, underscoring the growing need for AI-driven automation tools and services.

- Managed Services Demand: The global managed services market is anticipated to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 13% from 2023 to 2028, indicating a strong demand for outsourced IT expertise.

Leveraging Managed Services and Consulting

The market for managed IT services and consulting is experiencing robust growth, driven by businesses aiming to streamline operations and navigate intricate technology landscapes. Connection is well-positioned to capitalize on this trend.

Connection’s expanded managed services and IT consulting offerings represent a significant opportunity. These services not only generate predictable, recurring revenue but also foster stronger, more integrated relationships with clients.

- Accelerating Demand: The global managed services market was projected to reach $354.8 billion in 2024, with continued expansion expected.

- Recurring Revenue: Managed services provide a stable income stream, enhancing financial predictability for Connection.

- Deeper Client Relationships: Offering comprehensive IT solutions moves Connection beyond transactional sales to become a strategic partner.

- Service Portfolio Expansion: Connection can leverage its existing product and solution capabilities to build out a more robust suite of managed services.

Connection is strategically positioned to capitalize on the expanding cloud computing market, which is projected to exceed $1 trillion by 2025, by enhancing its cloud service offerings and developing new solutions.

The company can also leverage the robust growth in the cybersecurity market, expected to reach $345 billion by the end of 2024, by expanding its security service portfolio with advanced, AI-powered solutions.

Furthermore, Connection's investments in AI readiness enable it to assist businesses in adopting AI solutions, capitalizing on worldwide AI spending growth and the increasing integration of AI into IT services.

The ongoing digital transformation, with a focus on hybrid cloud and AI, presents a significant opportunity for Connection to offer comprehensive, integrated IT solutions.

| Market Opportunity | Projected Growth/Value (2024/2025) | Connection's Strategic Advantage |

|---|---|---|

| Cloud Computing | Exceed $1 trillion by 2025 | Enhance existing and develop new cloud solutions |

| Cybersecurity | $345 billion by end of 2024 | Expand security service portfolio with AI-powered solutions |

| AI Integration | Continued robust growth through 2025 | Assist businesses in AI adoption and implementation |

| Managed Services | Projected to reach $354.8 billion in 2024 | Expand offerings for recurring revenue and deeper client relationships |

Threats

Persistent global economic uncertainties, marked by elevated inflation rates and ongoing geopolitical instability, are likely to compel businesses and governmental bodies to maintain a conservative stance on IT expenditures. This strategic retrenchment in new technology investments, especially concerning hardware procurement, presents a significant impediment to Connection's revenue expansion prospects.

Global supply chains remain vulnerable due to ongoing international conflicts and persistent labor shortages. These disruptions, compounded by cybersecurity threats targeting logistics, directly hinder PC Connection's capacity to source and deliver goods promptly, impacting both its bottom line and customer loyalty.

The relentless pace of technological change, especially with advancements in AI and quantum computing, poses a significant hurdle for PC Connection. Staying ahead means constantly updating product lines and services to remain competitive.

If Connection doesn't adapt quickly to these new technologies, its market share could shrink. For instance, the demand for AI-powered solutions is projected to grow significantly, and companies that don't integrate these capabilities risk falling behind.

Intensifying Competition from Niche Players and Hyperscalers

PC Connection faces intense rivalry from hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which offer vast, integrated IT solutions. These giants often leverage economies of scale, potentially leading to aggressive pricing that pressures margins for companies like PC Connection. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the sheer scale of these competitors.

Furthermore, specialized niche players are emerging, focusing on specific IT segments such as cybersecurity, data analytics, or managed IT services. These agile competitors can offer tailored solutions and deep expertise, directly challenging PC Connection's broader service offerings. This dual threat from both broad-scale hyperscalers and specialized niche providers necessitates continuous investment in innovation and service differentiation to maintain market share and attract clients.

- Hyperscaler Dominance: Large cloud providers offer comprehensive and often cost-effective solutions, posing a significant competitive threat.

- Niche Player Agility: Specialized firms can outmaneuver larger competitors in specific market segments with tailored expertise.

- Pricing Pressures: Increased competition can force price reductions, impacting profitability.

- Innovation Imperative: Constant development of new services and technologies is crucial to stay competitive.

Cybersecurity and Talent Shortages

The escalating complexity of cyber threats demands constant vigilance and investment in advanced security measures for PC Connection. This includes staying ahead of evolving attack vectors that could compromise data integrity and operational continuity. The company must ensure its own infrastructure and the solutions it offers clients are robust against these sophisticated attacks.

Compounding this is a significant global shortfall in skilled cybersecurity professionals, a challenge that directly impacts PC Connection and its customer base. This talent gap can hinder the implementation and management of necessary security protocols, potentially leading to increased operational risks and affecting the quality of services provided. For instance, a 2024 report indicated a global cybersecurity workforce gap of 3.4 million professionals, highlighting the intensity of this challenge.

- Sophisticated Threats: Cyberattacks are becoming more advanced, requiring continuous updates to security solutions.

- Talent Scarcity: A worldwide shortage of cybersecurity experts affects both PC Connection and its clients.

- Service Impact: The talent shortage could potentially disrupt service delivery and elevate operational risks.

- Increased Costs: Competition for scarce talent may drive up labor costs for specialized cybersecurity roles.

PC Connection operates in a dynamic market susceptible to economic downturns and geopolitical instability, which can curb IT spending. Furthermore, the company faces significant threats from dominant hyperscale cloud providers and agile niche competitors, leading to pricing pressures and the constant need for innovation.

Supply chain vulnerabilities, exacerbated by global conflicts and labor shortages, directly impact PC Connection's ability to deliver products efficiently. The escalating sophistication of cyber threats, coupled with a global shortage of cybersecurity talent, presents a critical challenge for both the company and its clients.

| Threat Category | Specific Threat | Impact on PC Connection |

|---|---|---|

| Economic & Geopolitical | Global economic uncertainty, inflation, geopolitical instability | Reduced IT expenditures by businesses and governments, impacting revenue. |

| Competitive Landscape | Hyperscale cloud providers (AWS, Azure, Google Cloud), niche IT specialists | Pricing pressures, need for continuous innovation, potential market share erosion. |

| Supply Chain & Operations | Global supply chain disruptions, labor shortages, cybersecurity threats to logistics | Delayed deliveries, increased operational costs, potential damage to customer loyalty. |

| Technological Advancement | Rapid pace of technological change (AI, quantum computing) | Risk of obsolescence, need for constant product line updates, potential loss of competitive edge. |

| Cybersecurity | Increasingly sophisticated cyber threats, global cybersecurity talent shortage | Increased investment in security measures, potential service disruptions, higher labor costs for talent. |

SWOT Analysis Data Sources

This analysis draws upon a robust foundation of data, including PC Connection's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-informed strategic overview.