PC Connection Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PC Connection Bundle

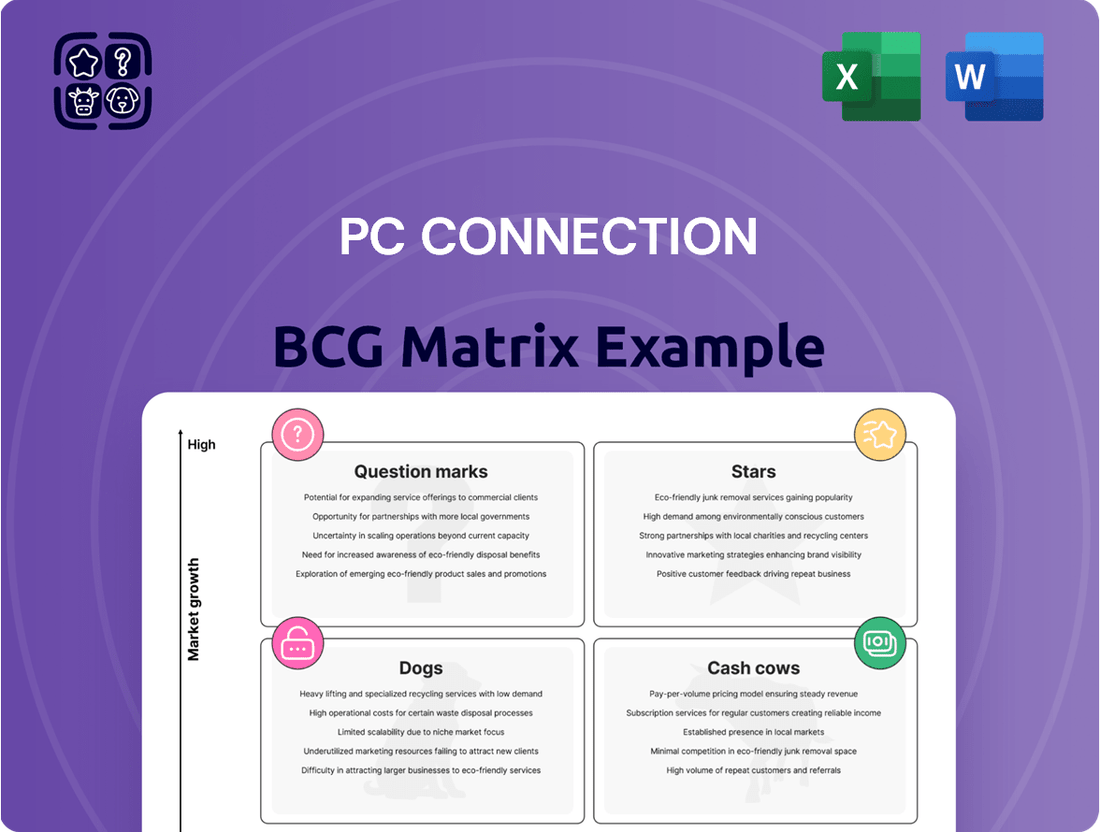

Curious about PC Connection's product portfolio? This glimpse into their BCG Matrix highlights key areas of opportunity and potential challenges. Understand which products are driving growth and which might be underperforming.

To truly unlock the strategic potential of PC Connection's product lineup, dive into the full BCG Matrix. Gain comprehensive insights into Stars, Cash Cows, Dogs, and Question Marks, and equip yourself with actionable strategies for market dominance.

Don't miss out on the complete picture. Purchase the full BCG Matrix report to receive detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing PC Connection's product investments and future growth.

Stars

Cybersecurity Solutions represents a strong contender in PC Connection's BCG Matrix. The company's investment in and attainment of Microsoft Security Specializations highlights its commitment and capability in a high-growth area.

The global cybersecurity services market is experiencing robust expansion. Projections indicate a compound annual growth rate (CAGR) of 6.42% from 2025 to 2034, with some estimates even higher, reaching 14.5% by 2029. This growth is fueled by increasing cyber threats and stringent regulatory compliance needs, positioning cybersecurity as a crucial driver for PC Connection's future success.

The artificial intelligence market is booming, expected to hit $243.7 billion by 2025 with a robust 27.67% annual growth rate. Connection is already making waves, securing a U.S. Department of the Navy Prize Challenge win for its Gen AI Platform. This signifies a strong start in a rapidly expanding sector.

With tech companies increasingly integrating AI for critical functions like cybersecurity and product innovation, Connection's AI and Generative AI solutions are positioned as prime candidates for the Stars quadrant. This means they represent high-growth, high-market share opportunities, reflecting significant current and future potential.

Advanced Managed Services, particularly in the realm of cybersecurity, represent a significant growth opportunity. The global managed security services market alone is anticipated to surge to USD 731.08 billion by 2030, demonstrating a robust compound annual growth rate of 13.6%.

Connection is strategically bolstering its integrated solutions, which encompass modern infrastructure, to effectively address this escalating market demand. This strategic emphasis on providing all-encompassing, outsourced IT management solutions is designed to capture the growing number of businesses aiming to streamline and safeguard their intricate IT environments.

Public Sector Solutions

PC Connection's Public Sector Solutions segment demonstrated impressive growth, with net sales surging by 42.9% in the fourth quarter of 2024. This robust performance highlights the company's strong position in serving government and education clients. These sectors are actively investing in digital transformation, creating a significant demand for advanced IT solutions.

The substantial sales increase in this segment suggests PC Connection is effectively meeting the evolving needs of public sector organizations. Continued strategic investments in this area are likely to further enhance its market leadership. Capitalizing on ongoing public sector IT spending presents a clear opportunity for sustained growth and profitability.

- 42.9% Net sales increase in Q4 2024 for Public Sector Solutions.

- Government and Education: Key markets driving this segment's performance.

- Digital Transformation: A major catalyst for increased IT spending in the public sector.

- Market Leadership: Potential to be solidified with continued investment.

Cloud Solutions and Integration

Connection's cloud solutions and integration services are a significant growth driver, capitalizing on robust IT spending. The global IT spending is at an all-time high, and the cloud integration software market is expected to expand significantly, with a projected CAGR of 13.6% from 2025 to 2034. This positions Connection favorably in a rapidly evolving market.

In 2024, Connection reported that advanced technologies, including their cloud offerings, software, and security solutions, were instrumental in achieving record gross margins. This demonstrates the profitability and strategic importance of these segments for the company.

Connection's expertise in security solutions, coupled with a strong emphasis on customer success, directly addresses the growing need for secure and seamless integrated cloud environments. This focus on outcomes is crucial for businesses adopting cloud technologies.

- Market Growth: Cloud integration software market projected to grow at a CAGR of 13.6% from 2025 to 2034.

- Financial Impact: Advanced technologies, including cloud, drove record gross margins for Connection in 2024.

- Strategic Alignment: Deep proficiency in security solutions supports increasing demand for integrated cloud environments.

- Customer Focus: Emphasis on customer outcomes enhances the value proposition of cloud integration services.

Connection's Cybersecurity Solutions and Artificial Intelligence offerings are prime examples of Stars in the BCG Matrix, showcasing high growth and strong market share. The company's strategic investments in these areas, evidenced by Microsoft Security Specializations and a U.S. Department of the Navy Prize Challenge win for its Gen AI Platform, underscore their potential.

The robust expansion of the cybersecurity market, projected with a CAGR of 6.42% from 2025 to 2034, and the booming AI market, expected to reach $243.7 billion by 2025 with a 27.67% annual growth rate, highlight the significant opportunities. These segments are critical drivers for PC Connection's future success and profitability.

Connection's Public Sector Solutions also demonstrates Star-like characteristics, with net sales surging 42.9% in Q4 2024, driven by digital transformation initiatives in government and education. Similarly, cloud solutions and integration services are key growth drivers, with the cloud integration software market anticipated to grow at a 13.6% CAGR from 2025 to 2034.

| Segment | Market Growth | PC Connection's Position | Key Data Point |

|---|---|---|---|

| Cybersecurity Solutions | High | Strong Market Share | Microsoft Security Specializations |

| Artificial Intelligence | Very High | Emerging Strong Market Share | Navy Prize Challenge Win (Gen AI) |

| Public Sector Solutions | High | Strong Market Share | 42.9% Net Sales Growth (Q4 2024) |

| Cloud Solutions & Integration | High | Strong Market Share | 13.6% CAGR (Cloud Integration Software Market 2025-2034) |

What is included in the product

The PC Connection BCG Matrix provides a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

Visualize PC Connection's BCG Matrix to identify underperforming "Dogs" and "Cash Cows" needing strategic reallocation.

Cash Cows

Connection's traditional IT hardware procurement, a cornerstone of its business, functions as a classic Cash Cow. Its position as a long-standing leader with a global procurement network has secured a substantial market share in essential IT hardware.

While the broader IT hardware market experiences moderate growth, projected at a 4.2% CAGR for the UK by 2025, this segment delivers dependable revenue. This stability is fueled by regular hardware refresh cycles, ongoing enterprise infrastructure demands, and the enduring nature of hybrid work, all contributing to consistent cash flow.

PC Connection’s core software licensing and sales represent a classic Cash Cow. This segment offers a broad range of software solutions, catering to a wide array of business needs. The stability comes from recurring licensing models and the fundamental requirement for businesses to maintain essential software, ensuring a predictable income.

In 2024, the software and cloud services segment for IT solution providers like PC Connection continued to be a significant revenue driver. Many businesses rely on perpetual licenses or subscription-based software for critical operations, from operating systems to productivity suites and specialized business applications. This mature market benefits from established vendor partnerships, allowing PC Connection to secure favorable terms and maintain consistent profit margins with minimal incremental marketing spend.

The sale of essential IT infrastructure, such as servers, storage, and networking gear, is a cornerstone for Connection, firmly placing it in the Cash Cows quadrant of the BCG Matrix. This segment boasts a high market share due to the fundamental nature of these products for nearly every business, ensuring a stable and consistent demand.

These foundational IT products are critical for organizations, driving predictable revenue streams that Connection can efficiently manage. For instance, in 2024, the global IT infrastructure market was valued at over $300 billion, with servers and networking equipment forming a significant portion, demonstrating the enduring demand for these core offerings.

Basic IT Support and Maintenance Contracts

PC Connection's basic IT support and maintenance contracts represent a classic Cash Cow within the BCG Matrix. These services are foundational to their role as a full-service technology partner, providing the bedrock of stable, recurring revenue through long-term agreements.

In the mature market for essential IT upkeep, PC Connection leverages its deep-rooted customer relationships. This allows them to maintain a significant market share in a segment characterized by low growth but high predictability, ensuring consistent cash flow for the company.

- Stable Revenue Stream: Long-term IT support contracts provide predictable income, crucial for financial stability.

- High Market Share in Mature Segment: PC Connection's established presence in basic IT maintenance ensures a dominant position.

- Low Growth, High Profitability: While the market for basic IT support is not rapidly expanding, the services are highly profitable due to established infrastructure and customer loyalty.

- Cash Generation for Investment: The consistent cash generated from these services can be reinvested into higher-growth areas of the business.

Educational and SMB IT Solutions

Connection's focus on educational institutions and small to mid-sized businesses (SMBs) positions these segments as Cash Cows within its portfolio. These markets consistently demand dependable IT solutions and support, areas where Connection, a Fortune 1000 entity, leverages its vast experience for efficient delivery.

The company's ability to cater to this broad customer base translates into a robust market share within a mature industry. This stability is further reinforced by the consistent demand characteristic of these sectors.

- Stable Demand: Educational and SMB IT needs are recurring and less susceptible to rapid market shifts.

- High Market Share: Connection's established presence and tailored offerings secure a dominant position.

- Efficient Operations: Standardized solutions allow for cost-effective service delivery, boosting profitability.

- Fortune 1000 Status: This designation signifies financial strength and operational maturity, supporting sustained cash flow.

PC Connection's core IT hardware procurement, software licensing, and essential IT infrastructure sales are firmly established as Cash Cows. These segments benefit from high market share in mature, stable markets, ensuring consistent and predictable revenue streams. The ongoing demand for foundational IT solutions, coupled with established vendor relationships and operational efficiencies, allows PC Connection to generate substantial cash flow from these offerings.

| Business Segment | BCG Quadrant | Market Characteristics | PC Connection's Position | Cash Flow Contribution |

|---|---|---|---|---|

| IT Hardware Procurement | Cash Cow | Mature, stable demand, moderate growth | High Market Share | Consistent, predictable |

| Software Licensing & Sales | Cash Cow | Recurring revenue models, essential business need | Strong Market Presence | High Profitability |

| Essential IT Infrastructure | Cash Cow | Foundational business requirement, ongoing demand | Dominant Market Share | Significant Cash Generation |

What You’re Viewing Is Included

PC Connection BCG Matrix

The PC Connection BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, ensuring you get a professional, ready-to-use strategic analysis for your business planning. You can trust that the insights and layout presented here are precisely what you'll be working with to make informed decisions.

Dogs

As businesses increasingly migrate to cloud solutions, the market for supporting solely on-premise legacy systems is shrinking. Connection might still cater to a few existing clients in this niche, but it's a low-growth area where further investment offers minimal upside. This segment likely consumes a significant portion of resources for a limited revenue stream.

Commoditized IT peripherals, such as basic keyboards and mice, represent a category with sales characterized by intense price competition and a lack of product differentiation. This often leads to fragmented market share among numerous suppliers.

These products typically yield low profit margins, contributing minimally to the overall strategic growth of a solutions provider like Connection. In 2024, the market for these basic peripherals remained highly competitive, with average margins often hovering in the single digits, tying up valuable capital without generating substantial returns.

Non-strategic, niche hardware sales in the PC Connection BCG Matrix often represent products in declining markets or those being superseded by integrated solutions. These might include legacy components or specialized peripherals with shrinking demand, resulting in low market share and growth. For instance, sales of certain types of external CD/DVD drives, a category facing obsolescence due to cloud storage and USB drives, would likely fall into this dog quadrant.

Generic Break-Fix IT Services

Generic break-fix IT services, characterized by their purely reactive nature without any managed or proactive elements, occupy a low-growth, low-margin position within the IT services landscape. This segment is becoming increasingly less attractive for substantial investment as businesses increasingly prioritize strategic and preventative IT partnerships. The demand for isolated, reactive services is shrinking.

The market for traditional break-fix IT support is experiencing a decline. In 2024, the global IT services market, while robust overall, saw a shift away from purely reactive models. Companies are actively seeking value-added services that offer greater predictability and efficiency. For instance, managed IT services, which encompass proactive monitoring and maintenance, are projected to grow significantly faster than traditional break-fix models.

- Low Growth Potential: The market for reactive IT support is stagnant as businesses mature in their IT strategies.

- Shrinking Margins: Increased competition and the commoditization of basic repair services compress profit margins.

- Decreasing Demand: Companies are moving towards proactive and managed IT solutions, reducing reliance on ad-hoc break-fix services.

- Limited Strategic Value: These services offer little long-term strategic advantage for clients, making them less appealing for sustained IT partnerships.

Reselling Products with Limited Value-Add

If PC Connection focuses on reselling products with minimal value-added services, customization, or integration, these offerings would likely be categorized in the Cash Cow or Dog quadrant of the BCG Matrix, depending on their market share and growth prospects. Merely acting as a distributor in a crowded market often leads to low profit margins and a lack of distinct competitive advantage.

For instance, in 2024, the IT hardware resale market, particularly for commoditized items like standard laptops or basic networking equipment, is characterized by intense price competition. Companies that do not differentiate through services like managed IT, cloud integration, or specialized technical support struggle to command premium pricing.

- Low Margins: Reselling basic hardware without added services typically yields gross margins in the low single digits, often below 5%.

- Intense Competition: The market for unbundled hardware is highly saturated, with numerous players, including direct manufacturers and large online retailers, driving down prices.

- Limited Differentiation: Without unique offerings, customers choose based solely on price, making it difficult to build brand loyalty or capture significant market share.

- Stagnant Growth: Products in this category often experience slow or flat growth, as they are tied to broader market trends rather than specific innovation or service-driven demand.

Products in the Dog quadrant, like commoditized IT peripherals or legacy hardware, offer minimal growth and often low profitability for PC Connection. These segments require resources but yield limited returns, making them unattractive for strategic investment. Their low market share and lack of differentiation mean they don't contribute significantly to the company's overall growth or competitive advantage.

In 2024, the market for basic IT peripherals such as mice and keyboards remained highly competitive, with profit margins often in the single digits. Similarly, sales of obsolete hardware like external CD/DVD drives saw declining demand, reflecting a shift towards integrated solutions and cloud-based alternatives.

| Product Category | Market Growth (2024 Est.) | Typical Profit Margin | Strategic Fit |

|---|---|---|---|

| Commoditized Peripherals (e.g., basic mice) | 1-3% | 3-7% | Low |

| Legacy Hardware (e.g., external CD drives) | -5% to -10% | 2-5% | Very Low |

| Generic Break-Fix IT Services | 2-4% | 5-10% | Low |

Question Marks

Edge computing, a rapidly expanding field, presents a compelling opportunity as businesses increasingly decentralize data processing. PC Connection's involvement in this area likely places it in the "Question Mark" category of the BCG Matrix.

This classification stems from edge computing's high market growth potential coupled with PC Connection's potentially nascent position, indicating a low current market share. For instance, the global edge computing market was projected to reach over $250 billion by 2024, highlighting the significant growth trajectory.

To capitalize on these prospects, substantial investment in research, development, and specialized solutions will be crucial for PC Connection to gain traction and establish a stronger market presence in this dynamic sector.

Quantum computing, while still in its infancy, holds the promise of revolutionizing various industries. PC Connection, recognizing this potential, might be developing or offering advisory services to help businesses prepare for this future. These services could focus on areas like quantum-resistant cryptography, ensuring data security against future quantum threats, or guiding companies on adopting quantum infrastructure.

In the current market landscape of 2024, the market share for quantum computing readiness services is negligible. However, the long-term outlook is exceptionally bright. Analysts project the quantum computing market to reach tens of billions of dollars by the early 2030s, with readiness and consulting services forming a significant portion of that growth.

Highly specialized vertical AI implementations, while part of the broader AI Star category for PC Connection, could be considered Question Marks. These require significant investment in research and development to cater to niche industry needs, demanding substantial market development to gain traction and market share in emerging sub-segments.

For instance, AI solutions for highly specific sectors like precision agriculture or advanced medical diagnostics represent areas where Connection might be building expertise. These often involve complex algorithms and extensive data training, necessitating a focused approach to capture nascent market opportunities. In 2024, the global AI market was projected to reach $200 billion, with vertical AI solutions expected to see substantial growth as companies seek tailored applications.

Advanced IoT Solution Integration

The Internet of Things (IoT) market is experiencing robust expansion, creating a demand for sophisticated integration of devices, data streams, and diverse platforms. PC Connection's involvement in advanced IoT solution integration, moving beyond simple hardware sales, represents a strategic pivot in this high-growth, complex sector where its market share is likely still maturing.

This advanced integration capability positions PC Connection to address the increasing complexity of IoT deployments. For instance, the global IoT market was projected to reach over $1.6 trillion in 2025, with a significant portion of that value derived from services and integration rather than just devices.

- Market Growth: The IoT market is a rapidly expanding sector, indicating substantial opportunities for integrated solutions.

- Complexity: Advanced IoT solutions require intricate integration of hardware, software, and data analytics, a space where PC Connection is developing its expertise.

- Strategic Shift: PC Connection's move into advanced integration suggests a strategy to capture higher-value segments within the IoT ecosystem.

- Competitive Landscape: While the market is growing, PC Connection's share in this specific advanced integration niche is likely still in its early stages of development compared to established players.

Blockchain-based Enterprise IT Solutions

Blockchain-based enterprise IT solutions represent a nascent but rapidly evolving segment. While currently holding a small market share, the future growth potential is substantial, positioning it as a potential star in the BCG matrix for companies like PC Connection. The market for enterprise blockchain solutions was projected to reach $16.6 billion by 2026, indicating significant expansion.

Connection's potential foray into this area would likely see these solutions categorized as question marks. This is due to the early stage of adoption and the need for further development and market penetration. However, the underlying technology's promise in enhancing security, streamlining supply chains, and ensuring data integrity makes it an area ripe for investment and strategic focus.

- Emerging Technology: Blockchain offers enhanced security, transparency, and immutability for enterprise data.

- Low Market Share, High Growth Potential: Early adoption means limited current market share but significant future growth prospects.

- Strategic Investment Area: Companies are exploring blockchain for supply chain management, secure data sharing, and digital identity solutions.

- Market Growth Projections: The global enterprise blockchain market is expected to see substantial growth, with some forecasts predicting it to reach over $30 billion by 2027.

Question Marks represent business units or product lines with low market share in high-growth industries. These require careful consideration as they consume significant cash but generate little return currently. PC Connection's potential ventures into areas like quantum computing readiness or specialized vertical AI solutions likely fall into this category, demanding strategic investment to either grow their market share or divest if prospects dim.

The key challenge for Question Marks is their uncertain future. While they operate in expanding markets, their ability to capture that growth is unproven. For example, while the global AI market was projected to reach $200 billion in 2024, PC Connection's share in niche AI applications might be minimal, making it a classic Question Mark.

Successful management of Question Marks involves strategic decisions: either invest heavily to turn them into Stars or acknowledge their limitations and potentially exit the market. This balancing act is crucial for optimizing resource allocation and future profitability.

Consider PC Connection's potential in advanced IoT integration. The IoT market is booming, projected to exceed $1.6 trillion by 2025, but PC Connection's share in complex integration services is likely still developing, placing it firmly in the Question Mark quadrant.

| BCG Category | Market Growth | Market Share | Cash Flow | Strategic Focus |

|---|---|---|---|---|

| Question Mark | High | Low | Negative | Invest or Divest |

| Example: Quantum Computing Readiness | Very High | Negligible (as of 2024) | Consumes Cash | Develop expertise, build partnerships |

| Example: Advanced IoT Integration | High (Market > $1.6T by 2025) | Emerging | Consumes Cash | Build capabilities, secure early clients |

BCG Matrix Data Sources

Our PC Connection BCG Matrix is built on comprehensive data, including sales figures, market share reports, and industry growth trends, to accurately position products.