PC Connection Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PC Connection Bundle

PC Connection faces moderate bargaining power from buyers due to the availability of alternative IT solutions and a fragmented customer base. While the threat of new entrants is somewhat mitigated by established distribution channels and brand loyalty, it remains a factor to monitor.

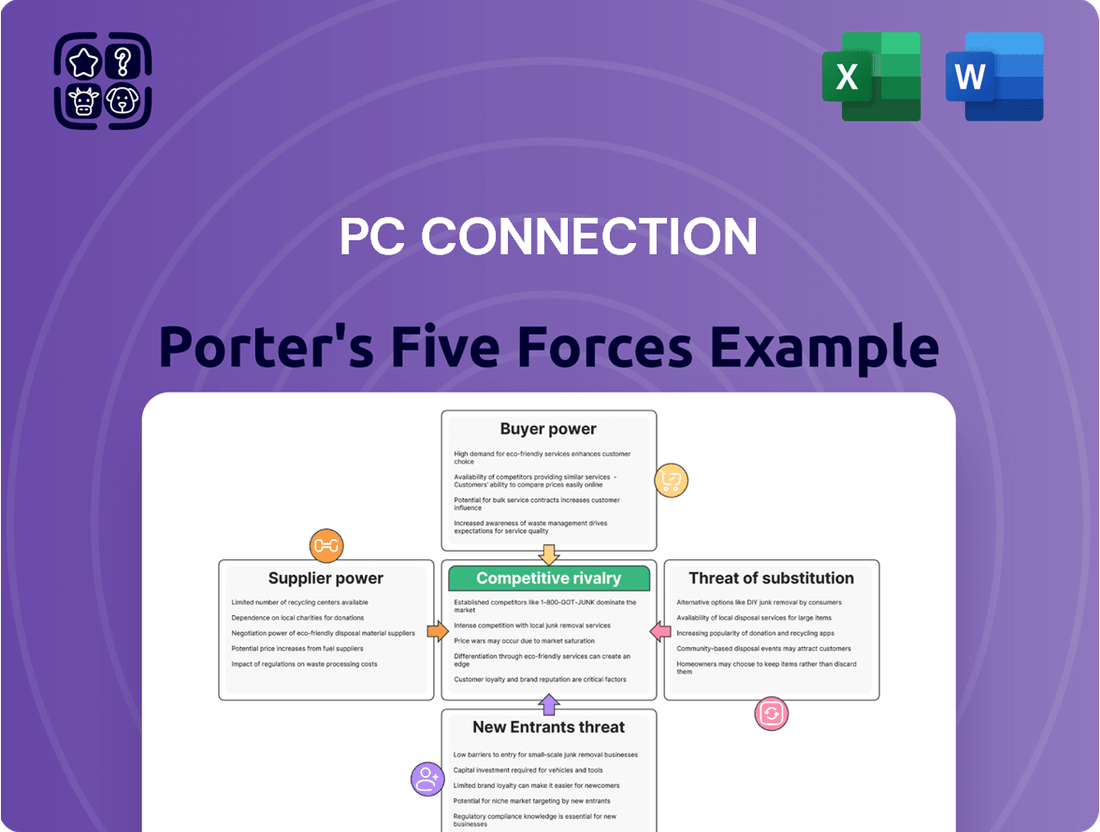

The full Porter's Five Forces Analysis reveals the real forces shaping PC Connection’s industry—from supplier influence to the threat of substitutes. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The IT solutions sector is notably concentrated, with a handful of dominant hardware manufacturers and software developers holding sway. For instance, in 2024, companies like Microsoft and Intel continued to command significant market share in their respective segments, meaning PC Connection, as a reseller, faces suppliers with substantial leverage.

When these key suppliers are few and possess exclusive rights to essential technologies or highly sought-after brands, their bargaining power intensifies. This concentration allows them to dictate terms, impacting pricing structures, product allocation, and overall trading conditions for businesses like Connection, which depend on their offerings.

Suppliers offering highly differentiated or patented components, crucial for PC Connection's integrated solutions, wield significant influence. This is particularly true when alternative sources for these essential technologies are scarce, increasing Connection's reliance on specific vendors.

The costs and complexities Connection faces when switching major suppliers are significant, impacting supplier power. For instance, re-certifying IT staff on new hardware or software, integrating disparate systems, or the potential loss of volume discounts on bulk purchases can create substantial financial and operational hurdles. These high switching costs effectively lock Connection into existing vendor relationships, making it more difficult and expensive to explore alternative suppliers.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to PC Connection. If key hardware or software manufacturers, such as Microsoft or Intel, decide to sell their products and services directly to businesses and individual consumers, they could bypass intermediaries like Connection. This disintermediation would directly increase their bargaining power, allowing them to dictate terms more forcefully.

For instance, if a major cloud service provider, a key supplier for many IT solutions, were to launch a direct sales initiative targeting enterprise clients, it would directly compete with Connection's existing service offerings. This would put pressure on Connection to maintain competitive pricing and service levels, potentially impacting its profit margins. In 2024, the trend towards direct-to-consumer sales models across various tech sectors underscores this risk.

- Suppliers' Direct Sales Capability: Major IT hardware and software vendors possess the infrastructure and brand recognition to reach end-users directly.

- Incentive for Disintermediation: Suppliers may seek to capture a larger share of the profit margin currently earned by resellers like Connection.

- Impact on PC Connection: Increased supplier bargaining power can lead to less favorable purchasing terms, reduced margins, and a diminished role in the value chain.

- Market Trends: The ongoing digital transformation and the growth of e-commerce platforms provide suppliers with viable channels for direct customer engagement.

Supplier's Dependence on Connection

Connection's bargaining power with its suppliers is largely influenced by how critical Connection is to a supplier's overall business. If Connection is a significant customer, a supplier might be more accommodating on pricing and terms. For instance, in 2024, PC Connection reported annual revenue of approximately $1.7 billion.

Conversely, for major technology manufacturers, PC Connection might represent a relatively small percentage of their total sales. In such scenarios, these dominant suppliers possess considerable leverage, potentially dictating terms and pricing due to their scale and the essential nature of their products in the IT ecosystem. This dynamic can limit Connection's ability to negotiate favorable conditions.

- Supplier Dependence: The degree to which a supplier relies on PC Connection for revenue directly impacts their bargaining power.

- Market Access: If PC Connection provides unique access to specific customer segments or markets, this can enhance Connection's negotiating position.

- Supplier Dominance: Large, established technology companies often hold more power due to their market share and the essential nature of their offerings.

The bargaining power of suppliers significantly impacts PC Connection's profitability and operational flexibility. When suppliers are concentrated, offer differentiated products, or face low switching costs for PC Connection, their leverage increases. This can lead to less favorable purchasing terms and squeezed margins.

In 2024, the IT solutions market continued to see dominant players like Microsoft and Intel, whose essential technologies grant them considerable power. PC Connection, with revenues around $1.7 billion in 2024, often faces suppliers who represent a small fraction of their own sales, amplifying supplier leverage.

| Factor | Impact on PC Connection | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Increased leverage for dominant suppliers | Few key hardware/software vendors |

| Product Differentiation | Higher reliance on specific vendors | Patented or unique components |

| Switching Costs | Difficulty in changing suppliers | Staff re-training, system integration |

| Forward Integration Threat | Potential for disintermediation | Suppliers selling direct to consumers |

| PC Connection's Size vs. Supplier | Limited negotiation power for smaller customers | $1.7B revenue vs. large tech giants |

What is included in the product

This analysis of PC Connection's competitive landscape reveals the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize competitive intensity across all five forces, eliminating the guesswork in strategic planning.

Customers Bargaining Power

PC Connection serves a broad customer base, but a significant portion of its revenue is derived from large enterprise, government, and educational clients. These substantial purchasers, due to their volume, wield considerable bargaining power. For instance, in fiscal year 2023, Connection's top 100 customers accounted for approximately 35% of its total revenue, highlighting the concentration of purchasing power among its larger accounts. This allows these entities to negotiate for lower prices and tailored service agreements, directly influencing PC Connection's profitability on those sales.

The IT solutions and services market is highly competitive, offering customers a wide array of value-added resellers, system integrators, and direct sales channels. This sheer volume of options significantly enhances a customer's ability to compare prices and negotiate favorable terms, thereby increasing their bargaining power.

For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, indicating a robust and fragmented landscape where customers can readily find alternatives. This competitive environment means that PC Connection must continually offer competitive pricing and superior service to retain its clientele, as switching costs for many IT services are relatively low.

Customers, particularly those operating under tight budgets or experiencing economic downturns, exhibit significant price sensitivity when acquiring IT solutions. This pressure forces companies like PC Connection to engage in competitive pricing strategies, which can impact profit margins if not carefully managed alongside the delivery of value-added services.

In 2024, the average IT budget for small and medium-sized businesses in the US saw a modest increase, but a significant portion of this budget was allocated towards essential maintenance and security rather than new hardware or software, indicating a continued focus on cost-effectiveness and value for money.

Low Switching Costs for Customers

Customers of PC Connection possess significant bargaining power due to low switching costs. If clients can readily move their IT procurement and service needs to another vendor without facing substantial disruption, expense, or the need for retraining, their leverage increases considerably. This ease of transition makes retaining customers an ongoing challenge for PC Connection.

The ability for customers to switch providers easily means they can readily compare prices and terms. For instance, in 2024, the IT solutions market saw continued competition, with many providers offering comparable product lines and services. This environment allows customers to negotiate more favorable terms or seek out lower prices elsewhere, directly impacting PC Connection's pricing strategies and profit margins.

- Low Switching Costs: Customers can easily move IT procurement and services to competitors.

- Price Sensitivity: Ease of switching encourages customers to seek the best prices.

- Customer Retention Challenge: PC Connection must continuously work to keep its clients satisfied and loyal.

Customer Knowledge and Information Access

Customer knowledge regarding IT products, pricing, and available alternatives has significantly increased, largely due to readily accessible online resources and industry comparisons. This heightened awareness empowers customers to negotiate more effectively, compelling PC Connection to clearly articulate its pricing strategies and demonstrate the unique value it offers.

- Informed Negotiations: Customers can leverage online price comparison tools and product reviews to secure better deals.

- Demand for Transparency: Buyers expect clear breakdowns of costs and justifications for pricing.

- Alternative Solutions: Easy access to information about competitors' offerings intensifies pressure on PC Connection to differentiate itself.

PC Connection's customers, particularly larger enterprise and government entities, possess significant bargaining power due to their substantial purchase volumes. For example, in fiscal year 2023, the top 100 customers represented about 35% of PC Connection's revenue, demonstrating their ability to negotiate favorable pricing and terms, directly impacting profit margins.

The highly competitive IT solutions market, with numerous alternative vendors, further amplifies customer leverage. In 2024, the global IT services market exceeding $1.3 trillion highlights the ease with which customers can find comparable offerings, forcing PC Connection to remain price-competitive and service-oriented, as switching costs are often minimal.

Customers' increased knowledge, fueled by accessible online resources and price comparison tools, empowers them to negotiate more effectively. This demand for transparency and value necessitates that PC Connection clearly articulates its pricing and unique value proposition to retain its client base.

| Customer Segment | Revenue Contribution (FY2023) | Bargaining Power Factor |

| Top 100 Customers | ~35% | High (Volume purchasing, negotiation) |

| General Market | ~65% | Moderate (Price sensitivity, low switching costs) |

Full Version Awaits

PC Connection Porter's Five Forces Analysis

This preview showcases the exact PC Connection Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive intensity and industry attractiveness. You're looking at the actual, professionally formatted document, ensuring no surprises or placeholders when you gain instant access. This detailed analysis will equip you with a clear understanding of the forces shaping PC Connection's market landscape, ready for your immediate use.

Rivalry Among Competitors

The IT solutions and services market is a crowded space, featuring a vast array of companies. These range from massive global IT corporations and major system integrators to smaller, specialized firms and local resellers who add value to existing offerings. This wide spectrum of players, each with different strengths and market focuses, significantly heats up the competition for customers and market share.

While the broader IT market shows resilience, specific segments where PC Connection (now branded as PC Connection, Inc.) operates, particularly in hardware and certain software solutions, are experiencing a more mature growth phase. This maturity intensifies competition among established players as they vie for market share.

In 2024, IT spending is projected to grow, but this growth is uneven across categories. For instance, while cloud services and cybersecurity continue to see robust expansion, the PC hardware market, a significant area for PC Connection, Inc., faces slower growth. This dynamic can lead to heightened price competition and increased marketing spend as companies fight for a limited customer base.

While many IT hardware and software products Connection offers can be seen as commodities, making pure product differentiation difficult, the company actively competes on service quality and technical expertise. Competitors are constantly working to match or surpass these offerings, intensifying the rivalry.

In 2024, the IT reseller market continues to see intense competition where differentiation often hinges on factors beyond just the product itself. For instance, PC Connection's ability to provide robust solution integration and reliable customer support becomes a key battleground against rivals like CDW and SHI, who also heavily invest in these service-oriented aspects.

High Exit Barriers

PC Connection, operating in the IT solutions and services sector, likely encounters high exit barriers. These can stem from substantial investments in specialized IT infrastructure and the intricate nature of long-term service agreements with clients. For instance, many IT service providers have multi-year contracts that are costly and complex to terminate prematurely, locking them into ongoing operations even when profitability wanes.

These significant exit barriers mean that even underperforming companies may continue to operate, contributing to sustained competitive rivalry. This situation can keep less efficient players in the market, forcing established companies to compete more aggressively on price and service to maintain market share. By 2024, the IT services market continued to see consolidation, but the inherent stickiness of client relationships and sunk costs in specialized platforms still presented a challenge for firms looking to exit gracefully.

- High Capital Investment: Specialized IT hardware, software licenses, and data center infrastructure represent significant upfront costs that are difficult to recoup upon exit.

- Long-Term Contracts: Client agreements in IT solutions often span several years, creating financial and operational obligations that hinder rapid divestment.

- Brand Reputation and Customer Loyalty: The IT services sector relies heavily on trust and established relationships, making it challenging to transfer customer bases or sell off operational units intact.

- Specialized Workforce: The need for highly skilled IT professionals can make it difficult to redeploy or retrain staff if a company decides to cease operations in a particular segment.

Aggressiveness of Competitors

The IT sector, where PC Connection operates, is characterized by intense competition. Competitors frequently employ aggressive pricing, rapid product development, and strategic mergers or alliances to capture market share. This constant push for advantage means Connection must be highly adaptable and forward-thinking in its strategies.

For instance, in 2024, the IT hardware market saw significant price adjustments due to fluctuating component costs and increased supply chain efficiencies. Companies like Dell and HP have historically engaged in aggressive discounting, particularly during key sales periods, forcing other players, including Connection, to respond with competitive offers to retain customers. The pace of technological advancement also means that staying ahead requires continuous investment in new product lines and services, often through partnerships or acquisitions to accelerate market entry.

- Aggressive Pricing: Competitors often use price wars to gain market share, impacting profit margins across the industry.

- Rapid Innovation: The need to constantly update product offerings and services to meet evolving customer demands is a key competitive driver.

- Strategic Alliances and Acquisitions: Companies leverage partnerships and M&A activity to expand their capabilities, reach new markets, or consolidate their position.

- Market Share Dynamics: In 2023, the global IT services market was valued at approximately $1.3 trillion, highlighting the substantial stakes involved in gaining even small advantages.

Competitive rivalry within the IT solutions and services sector is fierce, with PC Connection facing numerous competitors ranging from global giants to specialized resellers. This intense competition is fueled by a mature market for certain hardware and software, leading to price wars and increased marketing efforts. In 2024, while cloud and cybersecurity segments grow, the PC hardware market, crucial for PC Connection, Inc., experiences slower growth, intensifying the battle for customers.

Differentiation is challenging as many IT products are commoditized, pushing companies like PC Connection to compete fiercely on service quality and technical expertise. Rivals such as CDW and SHI are also heavily investing in these service aspects, making them key battlegrounds. The IT reseller market in 2024 sees competition pivot on solution integration and customer support, with companies needing to be highly adaptable to technological advancements and aggressive pricing strategies from major players like Dell and HP.

| Key Competitors | Market Focus | Competitive Tactics (2024) |

| CDW | Broad IT solutions, hardware, software, services | Solution integration, customer support, aggressive pricing |

| SHI International Corp. | Software licensing, hardware, IT solutions, cloud | Global reach, strong vendor relationships, managed services |

| Dell Technologies | PCs, servers, storage, networking, IT services | Direct sales, aggressive discounting, broad product portfolio |

| HP Inc. | PCs, printers, IT services | Channel partnerships, price competition, innovation |

SSubstitutes Threaten

Larger organizations, especially those with significant IT footprints, increasingly invest in building robust internal IT departments. This trend allows them to manage technology procurement, integration, and ongoing support directly, bypassing external providers like Connection. For instance, a 2024 survey indicated that 65% of Fortune 500 companies have expanded their in-house IT capabilities over the past two years, seeking greater control and cost efficiency.

The threat of substitutes for PC Connection is significant as customers increasingly bypass traditional resellers. Many manufacturers now offer direct sales channels, and major online retailers like Amazon and Newegg provide vast selections of IT hardware and software. For instance, in 2024, the direct-to-consumer (DTC) segment of the IT hardware market continued its robust growth, with many small to medium-sized businesses opting for these channels to secure perceived cost efficiencies.

The rise of cloud-based solutions presents a significant threat of substitutes for traditional IT providers like PC Connection. Companies can now access software (SaaS), infrastructure (IaaS), and platforms (PaaS) directly from major providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. This shift means businesses increasingly bypass the need for on-premise hardware, perpetual software licenses, and the integration services that were once core offerings.

For instance, the global cloud computing market was valued at approximately $590 billion in 2023 and is projected to reach over $1.3 trillion by 2028, demonstrating a robust compound annual growth rate. This rapid expansion highlights how readily available and cost-effective cloud alternatives have become, directly impacting the demand for the hardware and on-site services that PC Connection traditionally supplies.

Open-Source Software and Freeware

The rise of open-source software and freeware presents a significant threat of substitutes for PC Connection. These alternatives offer cost-effective solutions for many IT needs, directly competing with the commercial software licenses and support services that form a core part of Connection's offerings. This trend encourages customers to shift their IT spending away from traditional vendor models and towards community-supported, often free, software options.

The increasing maturity and capability of open-source solutions mean they can effectively replace proprietary software in areas like operating systems, office productivity suites, and even specialized business applications. This directly impacts PC Connection's revenue streams as customers opt for zero-cost alternatives rather than purchasing licenses and support contracts. For instance, the global open-source software market was valued at approximately $36.5 billion in 2023 and is projected to grow substantially, indicating a growing preference for these substitute solutions.

- Cost Savings: Open-source and freeware options eliminate or significantly reduce software licensing fees, a major cost driver for businesses.

- Growing Capabilities: Many open-source projects now rival or even surpass proprietary software in terms of features, performance, and security.

- Community Support: Active developer communities provide ongoing updates, bug fixes, and user support, often at no direct cost.

- Flexibility and Customization: Open-source software allows for greater customization and integration, catering to specific business needs more readily than some closed-source alternatives.

Managed Services from Non-Traditional Providers

Telecommunication companies and Internet Service Providers (ISPs) are increasingly offering managed IT services, cybersecurity, and cloud connectivity. For instance, in 2024, many major telecom providers reported significant growth in their enterprise IT service divisions, aiming to capture a larger share of the managed services market. These integrated offerings can directly substitute for some of PC Connection's core IT solutions.

These non-traditional providers leverage their existing infrastructure and customer relationships to bundle IT services. This allows them to present a compelling alternative, especially for businesses seeking a single vendor for connectivity and IT management. The threat is amplified as these companies often compete on price due to their established scale.

- Telecommunication companies are expanding their IT service portfolios.

- ISPs are bundling managed IT, cybersecurity, and cloud connectivity.

- These integrated services can substitute for PC Connection's offerings.

- Non-traditional providers leverage existing infrastructure and customer bases.

The threat of substitutes for PC Connection is amplified by the growing trend of businesses building robust internal IT departments. This allows them to manage technology procurement and support directly, bypassing external resellers. For example, a 2024 survey revealed that 65% of Fortune 500 companies have expanded their in-house IT capabilities, seeking greater control and cost efficiencies.

Manufacturers increasingly offer direct sales channels, and major online retailers provide vast selections of IT hardware and software, acting as significant substitutes. In 2024, the direct-to-consumer segment of the IT hardware market saw continued strong growth, with many small and medium-sized businesses opting for these channels for perceived cost advantages.

Cloud-based solutions from providers like AWS, Microsoft Azure, and Google Cloud directly substitute traditional IT hardware and services. The global cloud computing market, valued at approximately $590 billion in 2023, is projected to exceed $1.3 trillion by 2028, showcasing the widespread adoption of these alternatives.

Open-source software and freeware also pose a threat by offering cost-effective alternatives to commercial licenses and support. The global open-source software market was valued at around $36.5 billion in 2023, with substantial projected growth, indicating a growing preference for these substitute solutions.

| Substitute Category | Key Characteristics | Impact on PC Connection | 2024 Market Trend/Data Point |

|---|---|---|---|

| In-house IT Departments | Greater control, cost efficiency | Reduced reliance on external IT procurement | 65% of Fortune 500 companies expanded in-house IT capabilities (2024) |

| Direct Manufacturer Sales & Online Retailers | Wider selection, perceived cost savings | Bypassing traditional resellers | Continued robust growth in DTC IT hardware segment (2024) |

| Cloud Computing (SaaS, IaaS, PaaS) | Scalability, reduced hardware needs, subscription models | Decreased demand for on-premise hardware and perpetual licenses | Global cloud market projected to reach over $1.3 trillion by 2028 (from ~$590B in 2023) |

| Open-Source Software & Freeware | Cost savings, customization, community support | Shift away from commercial software licenses and support contracts | Global open-source software market valued at ~$36.5 billion (2023) |

Entrants Threaten

While simply reselling hardware might not demand vast sums, establishing a full-fledged IT solutions and services company requires substantial capital. This includes investing in a robust technical team, a widespread sales network, and the infrastructure for nationwide service delivery.

New entrants need significant financial backing to acquire necessary certifications, build brand recognition, and develop the deep technical expertise that established players like PC Connection already possess. For instance, a company aiming to offer managed IT services across multiple states would need to budget for personnel, software licenses, and potentially physical office spaces in key regions.

Established players like Connection leverage significant economies of scale, particularly in bulk purchasing of IT hardware and software. This allows them to negotiate better prices from vendors, a crucial advantage. For instance, in 2024, major IT distributors reported cost savings of up to 5% on large volume orders, a benefit new entrants would find hard to replicate quickly.

These scale advantages extend to distribution and customer service. Connection can operate a more efficient logistics network and provide a wider range of support services at a lower per-unit cost than a smaller, newer competitor. Achieving similar operational efficiencies requires substantial upfront investment, creating a high barrier for potential new entrants aiming to compete on price.

The IT solutions market, including companies like PC Connection, thrives on brand reputation and customer trust. Newcomers must overcome the considerable hurdle of establishing credibility in a sector where reliability and proven expertise are non-negotiable. For instance, in 2023, IT solution providers with strong brand recognition often commanded higher customer retention rates, a testament to the value placed on trust.

Access to Distribution Channels and Supplier Relationships

Existing IT solution providers, like PC Connection, often possess deeply entrenched relationships with key hardware and software manufacturers. These established partnerships grant them preferential pricing, guaranteed access to new product releases, and dedicated support channels. For instance, in 2024, major vendors continued to consolidate their partner programs, making it harder for newcomers to gain entry without significant prior business volume or strategic alliances.

Forging similar critical supplier relationships presents a substantial hurdle for new entrants. The time and capital investment required to build trust and demonstrate value to these vendors can be prohibitive. This access to distribution channels and supplier relationships acts as a significant barrier, limiting the ease with which new competitors can enter the market and effectively compete on product availability and cost.

- Established Vendor Partnerships: Leading IT solution providers in 2024 maintained exclusive or near-exclusive agreements with major technology brands, influencing product availability and pricing.

- Barriers to Entry: New entrants face considerable challenges in replicating these supplier networks, requiring substantial investment in time and relationship building.

- Competitive Advantage: Existing players leverage these supplier relationships to secure better margins and earlier access to innovative products, creating a competitive moat.

Specialized Skills and Regulatory Compliance

The IT solutions sector demands specialized expertise, making it a barrier for newcomers. Companies like PC Connection rely on engineers with advanced certifications in areas like cloud computing and cybersecurity, which are crucial for delivering complex solutions. For instance, the demand for cloud security engineers saw a significant increase in 2024, with many roles requiring specific vendor certifications.

New entrants also confront substantial regulatory and compliance challenges. Obtaining industry-specific certifications and adhering to data privacy laws, such as GDPR or CCPA, can be a costly and lengthy process. These requirements often necessitate significant upfront investment in legal counsel, compliance officers, and technology infrastructure, thereby increasing the threat of new entrants.

- Specialized Workforce: High demand for certified IT professionals in cloud, cybersecurity, and project management.

- Regulatory Hurdles: Significant costs and time associated with obtaining industry certifications and ensuring data privacy compliance.

- High Initial Investment: New entrants must invest heavily in skilled personnel and compliance infrastructure, raising the barrier to entry.

The threat of new entrants for PC Connection is moderate, primarily due to the significant capital and expertise required to compete effectively in the IT solutions and services market. While reselling hardware might have lower entry barriers, building a comprehensive IT solutions provider demands substantial investment in skilled personnel, robust infrastructure, and established vendor relationships.

New companies need considerable financial backing to acquire necessary certifications, build brand recognition, and develop the deep technical expertise that established players already possess. For instance, a company aiming to offer managed IT services across multiple states would need to budget for personnel, software licenses, and potentially physical office spaces in key regions, with costs easily running into millions of dollars annually for a robust operation.

The IT solutions sector demands specialized expertise, making it a barrier for newcomers. Companies like PC Connection rely on engineers with advanced certifications in areas like cloud computing and cybersecurity, which are crucial for delivering complex solutions. For example, the demand for cloud security engineers saw a significant increase in 2024, with many roles requiring specific vendor certifications, often costing thousands of dollars per engineer.

New entrants also confront substantial regulatory and compliance challenges. Obtaining industry-specific certifications and adhering to data privacy laws, such as GDPR or CCPA, can be a costly and lengthy process. These requirements often necessitate significant upfront investment in legal counsel, compliance officers, and technology infrastructure, thereby increasing the threat of new entrants.

| Barrier Type | Description | Estimated Cost/Time for New Entrant (Illustrative) |

| Capital Investment | Infrastructure, personnel, software, certifications | $1M - $5M+ initial, $500K - $2M+ annual operating |

| Technical Expertise | Skilled workforce, certifications (e.g., AWS, Cisco, Microsoft) | $10K - $50K+ per certification per employee; recruitment costs |

| Vendor Relationships | Access to products, preferential pricing, support | Years of relationship building, significant sales volume required |

| Brand Reputation & Trust | Customer loyalty, proven track record | Years to build, significant marketing investment |

| Regulatory Compliance | Data privacy, industry-specific standards | $50K - $200K+ for initial setup and ongoing maintenance |

Porter's Five Forces Analysis Data Sources

Our PC Connection Porter's Five Forces analysis is built upon a robust foundation of data, drawing from annual reports, industry-specific market research, and competitor financial statements to provide a comprehensive view of the competitive landscape.