Consolidated Edison PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Edison Bundle

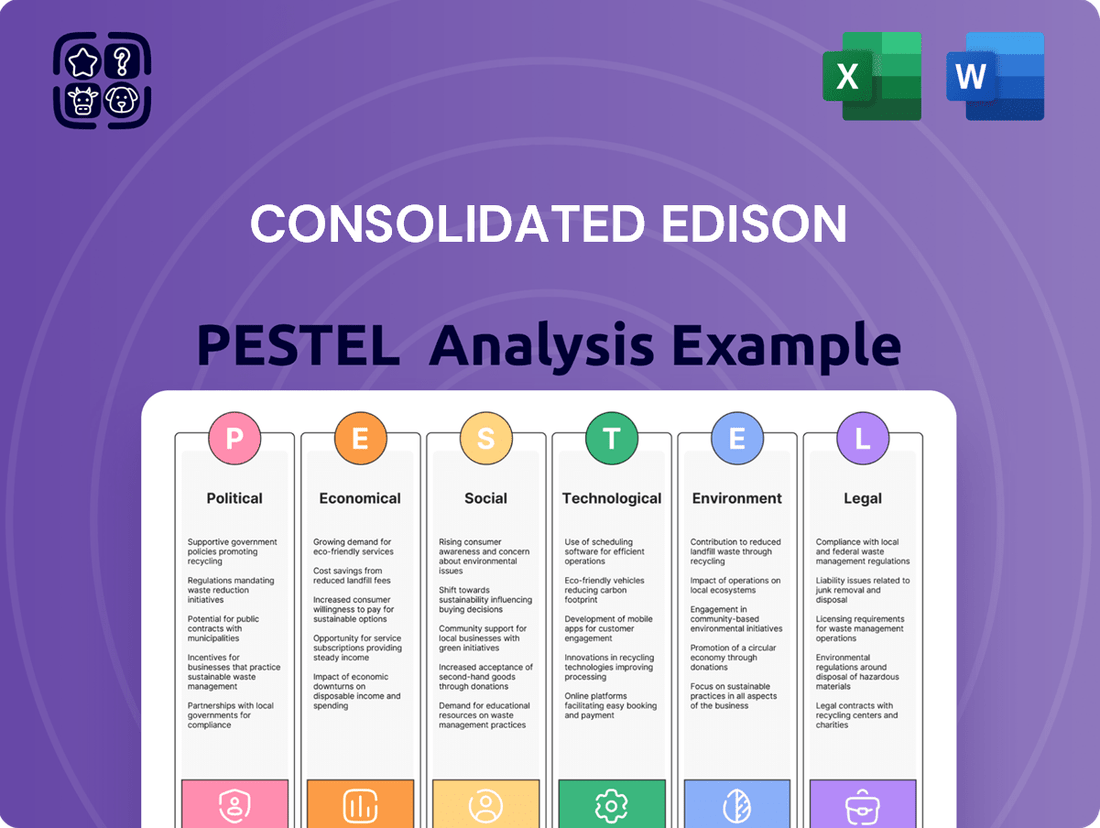

Navigate the complex external forces shaping Consolidated Edison's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that create both challenges and opportunities for this utility giant. Gain a strategic advantage by uncovering critical insights that inform your own market approach. Download the full PESTLE analysis now and empower your decision-making.

Political factors

Con Edison navigates a complex web of government regulations, with the New York State Public Service Commission (PSC) and federal bodies like the Federal Energy Regulatory Commission (FERC) playing significant roles. The PSC, for instance, must approve Con Edison's rates, service terms, and major investment projects, directly impacting its operational and financial strategies.

New York's aggressive clean energy targets, aiming for 70% renewable energy by 2030 and a 100% carbon-free electricity grid by 2040, are a major driver for Con Edison. These mandates necessitate substantial capital expenditures in grid modernization, renewable energy integration, and distributed energy resources, shaping the company's long-term investment plans and business model.

The Climate Leadership and Community Protection Act (CLCPA) is a cornerstone of New York's environmental policy, setting ambitious targets for greenhouse gas emission reductions and a shift towards renewable energy sources. This legislation directly influences Con Edison's strategic direction, necessitating substantial investments in upgrading its infrastructure for grid modernization, incorporating renewable energy, and promoting electrification across its service territory.

A key development illustrating the CLCPA's impact is the New York Public Service Commission's (PSC) December 2024 order in Case E-22-0222. This order greenlit numerous projects and programs specifically designed to enhance climate resilience, directly supporting Con Edison's compliance and adaptation efforts under the CLCPA framework.

Con Edison's proposed rate increases, including an 11.4% hike for electricity and 13.3% for gas beginning in January 2026, face intense public and political scrutiny. Governor Kathy Hochul, for instance, has voiced opposition to these proposed changes.

These rate cases are critical for Con Edison to recoup substantial capital expenditures on vital infrastructure upgrades and clean energy projects. The outcomes of these regulatory reviews directly impact the company's financial stability and its capacity to finance upcoming initiatives.

Political Engagement and Lobbying

Consolidated Edison, while not making direct corporate political donations, actively participates in shaping energy policy through industry associations. For instance, their engagement with the American Gas Association (AGA) and the Edison Electric Institute (EEI) allows them to collectively advocate for their interests. These associations undertake significant lobbying efforts, with reported expenses in the millions annually, to influence regulatory frameworks and legislation impacting the utility industry. Con Edison prioritizes transparency in these disclosures, ensuring stakeholders are aware of their political engagement activities.

These engagements are crucial for navigating the complex regulatory landscape that governs utility operations. By participating in industry groups, Con Edison can voice its perspectives on critical issues such as climate policy, grid modernization, and rate setting. For example, in 2023, the Edison Electric Institute reported spending over $4.5 million on federal lobbying, reflecting the significant investment utilities make in influencing policy decisions that directly affect their business models and customer rates.

- Industry Association Influence: Con Edison leverages groups like the AGA and EEI to collectively lobby for favorable energy policies.

- Lobbying Expenditures: The Edison Electric Institute alone reported over $4.5 million in federal lobbying expenses in 2023, highlighting the scale of industry advocacy.

- Policy Impact: These engagements aim to shape regulations concerning climate, grid upgrades, and pricing, directly impacting Con Edison's operations.

- Transparency Commitment: The company maintains a strong focus on transparency regarding its political disclosure and lobbying activities.

Investment in Disadvantaged Communities

New York State's commitment to climate action, coupled with Con Edison's strategic initiatives, places a significant emphasis on channeling investments into disadvantaged communities. This focus is a direct result of environmental justice policies designed to ensure that the benefits of clean energy transition are shared equitably.

Con Edison's 2023 filings with the Public Service Commission (PSC) highlight this dedication. The company reported that nearly half of its clean energy investments during that year were directed towards these underserved areas. This demonstrates a tangible commitment to fostering economic opportunities and improving access to cleaner energy resources where they are most needed.

- Environmental Justice Focus: Con Edison's investment strategy is guided by New York's environmental justice policies.

- Disadvantaged Community Investment: Nearly 50% of Con Edison's clean energy investments in 2023 benefited disadvantaged communities.

- Equitable Access Goal: The aim is to ensure fair access to clean energy and related economic benefits for all communities.

Con Edison operates under stringent regulatory oversight from bodies like the New York State Public Service Commission (PSC), which approves rates and major projects, directly impacting financial strategies. New York's ambitious clean energy mandates, aiming for a 100% carbon-free grid by 2040, necessitate significant capital investment in grid modernization and renewables.

The Climate Leadership and Community Protection Act (CLCPA) is a key driver, pushing Con Edison to upgrade infrastructure for renewable integration and electrification. For instance, a December 2024 PSC order in Case E-22-0222 approved projects supporting climate resilience, aligning with CLCPA goals.

Proposed rate increases, such as the 11.4% electricity and 13.3% gas hikes for 2026, face scrutiny, with Governor Hochul opposing them. These increases are vital for recouping substantial investments in infrastructure and clean energy, directly affecting financial stability.

Con Edison influences policy through industry associations like the Edison Electric Institute (EEI), which reported over $4.5 million in federal lobbying in 2023, demonstrating significant investment in shaping regulatory frameworks. Furthermore, nearly 50% of Con Edison's clean energy investments in 2023 were directed toward disadvantaged communities, reflecting New York's environmental justice policies.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Consolidated Edison, providing a comprehensive overview of its operating landscape.

It offers actionable insights for strategic decision-making, highlighting key trends and potential challenges relevant to the utility sector.

A clear, actionable summary of Consolidated Edison's PESTLE factors, presented in an easily digestible format, helps alleviate the pain of navigating complex external influences during strategic planning.

This PESTLE analysis provides a concise, shareable overview that simplifies understanding of the external landscape, reducing the burden of information overload for Consolidated Edison's diverse teams.

Economic factors

Consolidated Edison (Con Edison) has ambitious capital investment plans, projecting nearly $20 billion for transmission infrastructure and climate resilience initiatives through 2028.

Their cumulative five-year capital investment plan totals $28 billion, with a significant portion, $10.1 billion, earmarked for 2024 and 2025 alone.

These substantial investments are crucial for modernizing Con Edison's grid, facilitating the integration of renewable energy sources, and bolstering overall system reliability.

Consolidated Edison anticipates significant rate base growth, projecting a 6.4% annual increase through 2028. This expansion is directly tied to regulatory approvals for its substantial capital investment plans, which are crucial for modernizing infrastructure and meeting future energy demands.

The company's earnings outlook for 2025 is robust, with adjusted earnings per share expected to fall between $5.50 and $5.70. Looking ahead, Con Edison forecasts a five-year compounded annual adjusted earnings per share growth rate of 6% to 7%, underscoring a period of steady financial performance.

This predictable financial trajectory is largely a function of Con Edison's regulated business model. This structure inherently provides stability and ensures relatively predictable returns for investors, as it operates under established regulatory frameworks that allow for cost recovery and a fair rate of return on invested capital.

Consolidated Edison acknowledges the economic pressures on its customers from increasing energy expenses and potential rate hikes. In 2024 alone, the company distributed more than $300 million via its Energy Affordability Program (EAP), aiming to ease these burdens.

The company is committed to broadening its reach for the EAP in 2025, ensuring more eligible households can access support. Beyond direct assistance, property taxes levied on energy infrastructure represent a substantial component that impacts overall customer bills.

Economic Impact and Job Creation

Consolidated Edison's economic footprint in New York State is substantial, underscoring its role as a key economic driver. In 2023 alone, the company generated an impressive economic impact of $22.6 billion. This significant contribution highlights Con Edison's deep integration into the state's financial landscape.

The company's operations directly and indirectly support a vast workforce. Con Edison is responsible for sustaining 38,600 jobs across New York State, encompassing direct employment, indirect jobs through its supply chain, and induced employment stemming from employee spending. This extensive job creation demonstrates the company's broad-reaching employment influence.

Furthermore, Con Edison's strategic investments in critical areas like clean energy and infrastructure resilience are yielding tangible employment growth. These initiatives have fueled an 18% surge in total jobs supported by the company since 2021, showcasing a commitment to both economic development and future-proofing its operations.

- Economic Impact: $22.6 billion in 2023 for New York State.

- Job Creation: Supports 38,600 jobs in New York State (direct, indirect, induced).

- Investment-Driven Growth: 18% increase in total jobs since 2021 due to clean energy and resilience projects.

Transition to Clean Energy and Market Shifts

The global push towards a clean energy economy, marked by the electrification of buildings and transportation, presents significant opportunities and challenges for utilities like Con Edison. The company is actively investing in this transition, offering programs such as heat pump incentives and expanding electric vehicle (EV) charging infrastructure to facilitate customer adoption. This strategic focus aligns with evolving market demands and regulatory landscapes.

Con Edison's strategic divestment of its large-scale renewable energy generation assets in 2023 signaled a sharpening of its focus on its core utility operations. However, the company remains committed to integrating renewable energy sources by supporting customer-sited installations, such as rooftop solar. This approach allows Con Edison to participate in the clean energy transition while leveraging its existing infrastructure and expertise.

- Investment in EV Charging: Con Edison aims to support the growing EV market by expanding its charging infrastructure, a critical component for widespread electric transportation adoption.

- Heat Pump Incentives: The company is providing financial incentives to encourage the adoption of heat pumps, promoting energy efficiency and reducing reliance on fossil fuels in buildings.

- Customer-Sited Renewables: Con Edison continues to facilitate the integration of renewables generated at the customer level, such as solar panels, into its grid.

- Focus on Core Utility Business: The sale of its large-scale renewable generation portfolio in 2023 allows Con Edison to concentrate resources on its regulated utility operations and grid modernization efforts.

Con Edison's economic strategy centers on substantial capital investments, with $10.1 billion allocated for 2024-2025 to upgrade infrastructure and integrate renewables.

The company anticipates a 6.4% annual rate base growth through 2028, driven by regulatory approvals for these investments, and projects adjusted EPS between $5.50-$5.70 for 2025, with a 6%-7% CAGR forecast.

Economically, Con Edison generated $22.6 billion in impact in New York in 2023, supporting 38,600 jobs, and has seen an 18% job increase since 2021 due to clean energy projects.

Despite economic pressures on customers, evidenced by over $300 million distributed via its Energy Affordability Program in 2024, the company is committed to expanding this support in 2025.

| Economic Factor | 2023/2024 Data | 2025 Outlook | Impact on Con Edison |

|---|---|---|---|

| Capital Investment | $10.1 billion (2024-2025) | Continued significant investment | Drives rate base growth and infrastructure modernization |

| Rate Base Growth | Projected 6.4% annually through 2028 | Expected to continue | Supports revenue and earnings stability |

| Adjusted EPS | $5.50 - $5.70 expected for 2025 | 6%-7% CAGR forecast | Indicates financial health and investor returns |

| Economic Impact (NY) | $22.6 billion (2023) | Likely to remain substantial | Demonstrates significant contribution to state economy |

| Job Support (NY) | 38,600 jobs (2023) | Expected to grow with investments | Highlights broad employment influence |

| Customer Affordability Programs | >$300 million distributed (2024) | Commitment to expand in 2025 | Addresses customer economic challenges and regulatory scrutiny |

Preview Before You Purchase

Consolidated Edison PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Consolidated Edison delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations. It provides a strategic overview essential for understanding the external landscape.

Sociological factors

Consolidated Edison is actively prioritizing social justice and bolstering community resilience, especially within disadvantaged areas that often bear the brunt of environmental challenges and climate change impacts. The company's strategic investments and charitable efforts are geared towards uplifting these communities through essential infrastructure improvements, ensuring fair access to clean energy solutions, and creating pathways for green job development.

Con Edison actively educates its customer base through diverse platforms, including social media, to highlight energy-saving initiatives and available support. These campaigns aim to foster a more informed and engaged customer community.

The widespread implementation of smart meters by Con Edison is a key sociological driver, enabling customers to track their energy consumption in near real-time. This transparency empowers individuals to manage their usage more effectively and actively participate in programs designed to balance energy demand. For instance, by mid-2024, Con Edison reported over 5 million smart meters installed across its service territory, directly impacting how customers interact with their energy consumption.

Consolidated Edison actively cultivates a diverse workforce, aiming to mirror the communities it serves. This commitment is evident in its hiring practices, with over half of its new hires in 2023 originating from disadvantaged communities.

The company's dedication to inclusivity is further underscored by the fact that 59% of its employees are people of color. Additionally, Con Edison champions green job training, specifically targeting residents in underserved areas, contributing to workforce development and economic opportunity.

A significant portion of Con Edison's employees, exceeding 55%, are unionized, reflecting a strong labor presence within the organization and its development initiatives.

Public Perception and Trust

Public perception and trust are paramount for Consolidated Edison, a regulated utility. Maintaining high reliability, especially during challenging weather, and actively supporting energy affordability initiatives are key to fostering a positive public image. For instance, Con Edison's investments in grid modernization aim to improve service reliability, a factor directly impacting public satisfaction.

However, proposed rate increases can generate significant public opposition. In 2023, Con Edison sought rate increases that drew considerable attention, with concerns raised about the impact on low-income households and overall affordability. This highlights the delicate balance the company must strike between operational costs and public acceptance.

- Reliability Investments: Con Edison's ongoing grid modernization efforts, including smart meter deployment and undergrounding projects, directly influence public trust by aiming to reduce outages.

- Energy Affordability Programs: The company's participation in and promotion of energy assistance programs are critical for maintaining goodwill, particularly with vulnerable customer segments.

- Rate Case Scrutiny: Proposed rate adjustments, like those seen in 2023, often face intense public and regulatory review, underscoring the sensitivity of pricing decisions.

Changing Customer Energy Consumption Patterns

Sociological factors are significantly reshaping how customers use energy, a trend Consolidated Edison must navigate. The growing push for electrification, particularly in home heating and vehicle use, is a major driver. This shift is fueled by increasing environmental awareness and government incentives aimed at reducing carbon emissions. For instance, by the end of 2024, it's projected that over 1.5 million electric vehicles will be registered in New York State, a substantial increase from previous years, directly impacting electricity demand patterns.

Con Edison is actively responding to these evolving customer behaviors. The company is investing in grid modernization to handle the increased load from electrification. Furthermore, they are rolling out customer-facing programs designed to manage this demand more effectively. These initiatives include offering financial incentives for customers who charge their electric vehicles during off-peak hours, thereby smoothing out demand spikes. Similarly, incentives for installing high-efficiency heat pumps are encouraging a transition away from fossil fuel heating systems.

- Electrification Trend: Growing adoption of electric vehicles and heat pumps is a primary driver of changing energy consumption.

- Climate Goals: Societal pressure and regulatory mandates for climate action are accelerating the shift towards cleaner energy sources and electric appliances.

- Demand Management: Con Edison's strategies include incentivizing off-peak usage for EVs and promoting heat pump installations to balance grid load.

- Customer Engagement: Programs that encourage behavioral shifts in energy use are crucial for grid stability and customer satisfaction in this evolving landscape.

Societal expectations for utility companies are shifting, with a greater emphasis on environmental stewardship and community support. Consolidated Edison is responding by investing in disadvantaged communities and promoting clean energy access, aiming to build trust and enhance its social license to operate.

Public perception is heavily influenced by service reliability and affordability. Con Edison's proactive investments in grid modernization, such as the installation of over 5 million smart meters by mid-2024, directly address customer concerns about outages and empower them to manage usage. However, proposed rate increases, like those in 2023, highlight the ongoing challenge of balancing operational costs with public affordability demands.

The increasing adoption of electrification, driven by environmental awareness and incentives, is reshaping energy demand. By the end of 2024, New York State is projected to have over 1.5 million electric vehicles registered, a trend Con Edison is supporting with programs that encourage off-peak charging and the adoption of high-efficiency heat pumps.

| Sociological Factor | Con Edison's Response/Impact | Key Data Point (2023-2025 Projection) |

|---|---|---|

| Community Resilience & Social Justice | Investments in disadvantaged areas, clean energy access, green job development. | Over half of new hires in 2023 from disadvantaged communities. |

| Customer Engagement & Transparency | Smart meter deployment, energy-saving education campaigns. | Over 5 million smart meters installed by mid-2024. |

| Workforce Diversity & Inclusion | Hiring practices mirroring communities served, green job training. | 59% of employees are people of color. |

| Public Trust & Affordability | Grid modernization for reliability, energy assistance programs. | 2023 rate increase proposals faced public scrutiny regarding affordability. |

| Electrification Trend | Grid upgrades, incentives for EV charging and heat pumps. | Projected 1.5 million+ EVs in NYS by end of 2024. |

Technological factors

Consolidated Edison's (Con Edison) commitment to smart grid technology is evident in its substantial investment in Advanced Metering Infrastructure (AMI). The company has already deployed millions of smart meters, creating a sophisticated communication network that supports enhanced grid management and customer engagement.

This AMI deployment facilitates near real-time monitoring of energy consumption, empowering customers with greater insight into their usage patterns. Furthermore, it underpins crucial grid optimization initiatives, such as Conservation Voltage Optimization (CVO), which has demonstrated success in reducing overall energy consumption across its service territory.

Consolidated Edison is heavily investing in grid modernization to bolster resilience against severe weather. These upgrades include fortifying substations and reinforcing underground cables.

The company is deploying AI-driven weather forecasting and vegetation management systems to proactively prevent outages. These technological advancements are central to their strategy for mitigating disruption and speeding up recovery.

In 2023, Consolidated Edison reported capital expenditures of $5.7 billion, with a significant portion allocated to grid modernization and resilience initiatives, reflecting a commitment to operational stability in the face of increasing climate challenges.

Con Edison is actively upgrading its grid infrastructure to seamlessly integrate a growing influx of renewable energy sources, notably solar and wind power. This strategic expansion is crucial for meeting evolving energy demands and environmental goals.

Significant investments are being channeled into large-scale projects such as the Brooklyn Clean Energy Hub and essential transmission upgrades designed to deliver offshore wind energy directly to consumers. These initiatives underscore Con Edison's commitment to a cleaner energy future.

Beyond grid modernization, the company is a strong proponent of battery storage solutions and is actively researching advanced technologies like long-duration energy storage and hydrogen power. This forward-looking approach aims to enhance grid reliability and energy resilience.

Electrification Technologies and Infrastructure

Consolidated Edison is actively investing in infrastructure to facilitate the widespread adoption of electrification across buildings and transportation sectors. This strategic focus is crucial for meeting future energy demands and supporting environmental goals. The company is rolling out programs designed to encourage this transition.

Key initiatives include incentives for installing heat pumps, which offer a more energy-efficient alternative to traditional heating systems. Additionally, Con Edison's PowerReady program is specifically designed to expand the availability of electric vehicle (EV) charging infrastructure. These efforts are vital for building a robust ecosystem that supports electrification.

Con Edison has set ambitious targets, aiming to electrify more than 150,000 buildings by the year 2030. This significant undertaking will require substantial upgrades to the existing grid and distribution network. The company also plans to enhance EV charging availability, with a particular emphasis on ensuring equitable access in disadvantaged communities.

- Building Electrification Goal: Over 150,000 buildings targeted for electrification by 2030.

- Heat Pump Incentives: Programs to encourage the adoption of electric heat pumps.

- EV Charging Expansion: The PowerReady program aims to increase EV charging infrastructure availability.

- Community Focus: Prioritizing EV charging deployment in disadvantaged communities.

Data Analytics and AI for Operational Efficiency

Con Edison is actively employing advanced data analytics and artificial intelligence to streamline its operations. Their Enterprise Data Analytics Platform (EDAP) and sophisticated machine learning models are instrumental in optimizing the performance of their electrical grid, forecasting potential equipment failures, and bolstering public safety measures. This data-driven approach allows for proactive maintenance and more efficient resource allocation.

The integration of near real-time data from Advanced Metering Infrastructure (AMI) systems is a key enabler for Con Edison's demand response programs. These initiatives are designed to manage energy consumption more effectively by providing incentives for customers to reduce their electricity usage during periods of high demand. For instance, in 2024, Con Edison reported significant participation in its demand response programs, contributing to grid stability and potentially reducing the need for peaker plant activations.

- Grid Optimization: EDAP and AI models analyze vast datasets to identify inefficiencies and optimize power distribution, leading to improved reliability.

- Predictive Maintenance: Machine learning algorithms forecast equipment failures, allowing for timely repairs and minimizing service disruptions.

- Demand Response: AMI data supports programs that incentivize customers to shift energy usage, enhancing grid flexibility and reducing peak load.

- Public Safety: Data analytics contribute to identifying and mitigating potential safety hazards across Con Edison's infrastructure.

Consolidated Edison is significantly investing in technological advancements to modernize its infrastructure. This includes deploying millions of smart meters through its Advanced Metering Infrastructure (AMI) program, which enhances grid management and customer engagement. The company also utilizes AI-driven weather forecasting and vegetation management to proactively prevent outages, demonstrating a commitment to operational resilience.

Further technological integration involves upgrading the grid to seamlessly incorporate renewable energy sources like solar and wind. Con Edison is also exploring advanced energy storage solutions, such as long-duration storage and hydrogen power, to bolster grid reliability and support a cleaner energy future.

The company is actively using data analytics and AI, through platforms like EDAP, to optimize grid performance, predict equipment failures, and improve public safety. This data-driven approach is crucial for managing demand response programs effectively, as seen in 2024's strong program participation which aids grid stability.

| Technology Initiative | Key Details | Impact/Goal |

|---|---|---|

| Advanced Metering Infrastructure (AMI) | Millions of smart meters deployed | Enhanced grid management, customer engagement, near real-time usage data |

| Grid Modernization & Resilience | Substation fortification, underground cable reinforcement | Improved resilience against severe weather, operational stability |

| AI & Data Analytics | EDAP, machine learning models | Grid optimization, predictive maintenance, public safety enhancement |

| Renewable Energy Integration | Upgrades for solar and wind integration | Facilitates cleaner energy transition, meets environmental goals |

Legal factors

Consolidated Edison's operations are significantly shaped by the New York State Public Service Commission (PSC) and the Federal Energy Regulatory Commission (FERC). These agencies dictate crucial aspects of Con Edison's business, including the rates customers pay, the terms of service, and the company's substantial infrastructure investments. For instance, the PSC requires utilities like Con Edison to submit comprehensive resilience plans every five years, a process that directly influences capital expenditure and operational strategies.

Consolidated Edison's operations are significantly shaped by New York's Climate Leadership and Community Protection Act (CLCPA). This landmark legislation mandates a 70% reduction in greenhouse gas emissions by 2030 and a carbon-free electricity system by 2040.

Con Edison's strategic investments, such as its commitment to expanding renewable energy sources and modernizing its grid infrastructure, are directly influenced by the CLCPA's ambitious clean energy targets. For instance, the company is actively investing in offshore wind transmission and solar projects to meet these mandates.

Failure to comply with the CLCPA's requirements could expose Con Edison to substantial financial penalties and operational limitations, impacting its ability to serve customers and achieve its growth objectives. The company's 2024-2025 capital expenditure plans reflect a significant allocation towards grid modernization and clean energy initiatives to ensure alignment.

Securing rate increases for utilities like Con Edison is a legally intricate process, involving formal proceedings and public hearings before regulatory bodies such as the New York Public Service Commission (PSC). These rate cases are crucial, as proposed hikes, like those Con Edison might seek in 2024 or 2025 to fund infrastructure upgrades, face scrutiny and potential legal challenges from consumer advocacy groups or political entities aiming to shield customers from significant cost increases.

The PSC's decision on rate cases directly impacts Con Edison's financial health, influencing its revenue streams and its ability to undertake necessary capital investments. For instance, a proposed rate increase of 8.7% for electric and gas customers in New York City and Westchester, filed in July 2023, sought to generate an additional $600 million annually, highlighting the substantial financial implications of these regulatory approvals.

Environmental Regulations and Emissions Limits

Consolidated Edison faces significant legal obligations stemming from environmental regulations, particularly concerning emissions. A key development is the New York State Department of Environmental Conservation's (DEC) adoption of strict new sulfur hexafluoride (SF6) emissions limits, effective at the close of 2024. This mandates substantial changes in how Con Edison manages its electrical equipment.

In response to these stringent SF6 regulations, Con Edison is actively engaged in developing a comprehensive, long-term strategy. This program focuses on the systematic replacement of existing SF6-containing equipment with environmentally friendlier alternatives. Such initiatives are crucial for ensuring compliance and mitigating potential penalties, while also aligning with broader sustainability goals.

- SF6 Emissions Limits: New York DEC imposed strict SF6 emissions limits effective late 2024.

- Equipment Replacement Program: Con Edison is implementing a long-term plan to swap out SF6 equipment.

- Regulatory Compliance: Adherence to these environmental laws is critical for operational continuity and avoiding fines.

- Environmental Impact: The transition to alternative equipment aims to reduce the company's environmental footprint.

Legal Framework for Renewable Energy Development

New York State's legal framework significantly shapes the energy landscape for companies like Consolidated Edison (Con Edison). Legislation empowering the New York Power Authority (NYPA) to develop renewable energy and battery storage projects, such as the recent $1.5 billion investment announced in 2024 for offshore wind transmission, directly influences market dynamics and competition.

While Con Edison has divested its large-scale renewable generation assets, it remains deeply integrated within a regulatory environment that actively promotes and often mandates the adoption of renewable energy sources. This legal push is evident in the state's ambitious climate goals, like the Climate Leadership and Community Protection Act (CLCPA), which sets targets for 70% renewable electricity by 2030.

- New York State's CLCPA mandates 70% renewable electricity by 2030.

- NYPA's $1.5 billion investment in offshore wind transmission in 2024 highlights state-led renewable development.

- Regulatory bodies like the New York Public Service Commission (NYPSC) set policies for grid modernization and clean energy integration, impacting Con Edison's operational and investment strategies.

- Federal legislation, such as the Inflation Reduction Act (IRA) of 2022, also provides tax credits and incentives that influence the economic viability of renewable projects within New York, indirectly affecting Con Edison's business environment.

Consolidated Edison operates under a stringent legal framework, primarily dictated by New York State's Public Service Commission (PSC) and federal agencies. The PSC's oversight extends to setting customer rates, defining service terms, and approving significant infrastructure investments, directly impacting Con Edison's financial performance and strategic planning for 2024-2025.

The state's Climate Leadership and Community Protection Act (CLCPA) mandates ambitious emissions reductions, pushing Con Edison to invest heavily in grid modernization and renewable energy sources like offshore wind transmission projects. Failure to comply with these environmental mandates, such as the strict SF6 emissions limits effective late 2024, could result in substantial penalties.

Securing necessary rate increases is a legally complex process involving public hearings and potential challenges from consumer groups, as seen with Con Edison's proposed 8.7% rate hike in July 2023. Federal legislation, including the Inflation Reduction Act of 2022, also offers incentives that influence the economic viability of renewable projects within Con Edison's service territory.

Environmental factors

Consolidated Edison is acutely aware of the escalating threats posed by climate change, with projections indicating more intense hurricanes, prolonged heat waves, and rising sea levels impacting its service territories. These environmental shifts necessitate substantial adaptation strategies.

To address these risks, Con Edison submitted its Climate Change Resilience Plan (CCRP) to regulators, detailing planned investments totaling $1.2 billion through 2025. This plan focuses on hardening critical infrastructure against extreme weather and improving response capabilities.

Consolidated Edison is aggressively pursuing decarbonization, aiming for 100% clean electricity by 2040 and net-zero emissions from its operations by the same year. This commitment translates into tangible actions like reducing emissions from its steam operations and promoting building electrification.

These ambitious targets are supported by significant investments; in 2023, Con Edison invested $2.1 billion in its clean energy transition, a substantial portion of its overall capital expenditures. The company is focused on modernizing its infrastructure to support these environmental goals.

Consolidated Edison's environmental strategy heavily emphasizes integrating renewable energy sources, such as solar and wind, into its existing grid infrastructure. This transition is crucial for meeting ambitious clean energy goals and state mandates.

The company is making significant capital investments to upgrade its transmission systems, a key component in enabling the reliable delivery of renewable electricity. For instance, Con Edison has committed billions towards modernizing its grid to accommodate increased renewable penetration, aiming to support New York's goal of 70% renewable electricity by 2030.

Methane Emission Reduction and Gas System Modernization

Consolidated Edison is making significant strides in reducing methane emissions, a key environmental concern. The company is actively replacing older, leak-prone natural gas pipelines with more robust and less permeable materials. This initiative is crucial for minimizing fugitive emissions and improving the overall safety and efficiency of its gas distribution network.

Looking ahead, Con Edison is exploring innovative ways to decarbonize its operations, including its substantial steam system. A forward-thinking strategy involves assessing the potential to repurpose its existing gas infrastructure for the distribution of low-carbon fuels. This includes evaluating the feasibility of utilizing renewable natural gas (RNG) and hydrogen blends, which could significantly reduce the carbon footprint of its energy delivery.

Con Edison's commitment to environmental stewardship is underscored by its ongoing investments in infrastructure upgrades. For instance, in 2023, the company reported investing approximately $1.5 billion in its gas infrastructure modernization programs. These efforts are designed to not only enhance reliability but also to meet increasingly stringent environmental regulations and customer expectations for cleaner energy solutions.

- Methane Emission Reduction: Con Edison is replacing aging natural gas pipes, with over 200 miles of leak-prone pipes targeted for replacement in 2024, a significant increase from 150 miles in 2023.

- Steam System Decarbonization: The company is piloting a project to explore using captured carbon dioxide in its steam system, aiming to reduce greenhouse gas emissions by up to 15% by 2030.

- Low-Carbon Fuel Integration: Con Edison has initiated studies on the technical and economic viability of injecting up to 5% hydrogen into its natural gas network, with initial tests planned for late 2024.

Environmental Justice and Community Impact

Con Edison is actively integrating environmental justice principles into its operations, aiming for an equitable distribution of clean energy benefits. This includes prioritizing investments in disadvantaged communities, ensuring they gain access to cleaner air and new economic prospects stemming from the energy transition. The company recognizes that these communities have historically faced greater environmental challenges.

For instance, Con Edison's 2024-2028 capital investment plan of $17.7 billion includes significant allocations towards grid modernization and clean energy infrastructure. A portion of this investment is specifically earmarked to address environmental justice concerns, focusing on areas with high concentrations of low-income customers and communities of color. The company's commitment is reflected in its efforts to:

- Invest in renewable energy projects located in or benefiting underserved areas.

- Develop targeted workforce development programs for residents in these communities.

- Enhance energy efficiency programs for low-income households.

- Improve air quality through infrastructure upgrades in historically impacted neighborhoods.

Consolidated Edison is navigating a landscape significantly shaped by environmental regulations and the urgent need for climate resilience. The company is actively investing in infrastructure upgrades to combat climate change impacts, such as more severe weather events. For example, in 2023, Con Edison invested $2.1 billion in its clean energy transition, demonstrating a commitment to sustainability.

The company's decarbonization goals are ambitious, targeting 100% clean electricity by 2040 and net-zero operational emissions by the same year. This includes substantial efforts in reducing methane emissions by replacing aging natural gas pipelines; over 200 miles are slated for replacement in 2024. Furthermore, Con Edison is exploring innovative solutions like integrating hydrogen into its natural gas network, with initial tests planned for late 2024.

Environmental justice is a core component of Con Edison's strategy, with investments directed towards disadvantaged communities. The 2024-2028 capital investment plan of $17.7 billion includes specific allocations for grid modernization and clean energy infrastructure in these areas, aiming for equitable distribution of clean energy benefits.

| Initiative | 2023 Investment (Approx.) | 2024 Target | Long-Term Goal |

|---|---|---|---|

| Clean Energy Transition | $2.1 billion | N/A | 100% Clean Electricity by 2040 |

| Gas Infrastructure Modernization | $1.5 billion | N/A | Reduce methane emissions |

| Methane Emission Reduction (Pipeline Replacement) | 150 miles | 200+ miles | N/A |

PESTLE Analysis Data Sources

Our Consolidated Edison PESTLE analysis is grounded in comprehensive data from regulatory filings, financial reports, and market research firms. We incorporate insights from government agencies, industry associations, and economic forecasting services to ensure a robust understanding of the external environment.