Consolidated Edison Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Consolidated Edison Bundle

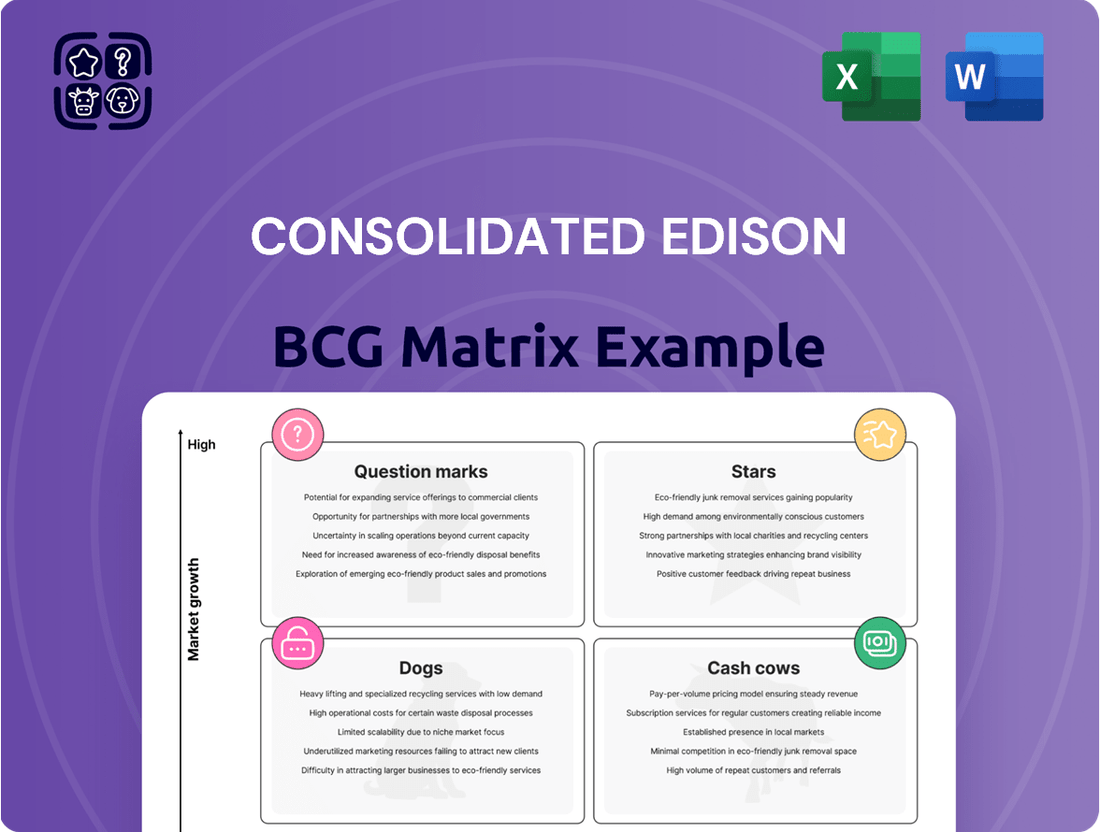

Curious about Consolidated Edison's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio of energy services might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understanding these dynamics is crucial for any investor or stakeholder looking to navigate the complex energy market.

To truly grasp Consolidated Edison's competitive advantage and identify future growth opportunities, dive into the full BCG Matrix report. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions and optimize your investment strategy.

Don't miss out on the actionable insights contained within the complete Consolidated Edison BCG Matrix. Purchase the full report today to unlock detailed quadrant placements, expert analysis, and a clear roadmap for strategic capital allocation and product development.

Stars

Con Edison is channeling significant capital into large-scale grid modernization, with nearly $72 billion earmarked for the next decade. This massive investment is primarily aimed at bolstering its infrastructure to support the growing electrification of buildings and transportation.

A key focus of these upgrades is expanding the grid's capacity to handle the surge in demand from electric vehicles and heat pumps. This strategic move aligns with New York's ambitious clean energy mandates, positioning Con Edison to capitalize on a high-growth market.

These substantial capital expenditures are essential for ensuring grid reliability during this transformative period. By investing in modernization, Con Edison is actively enabling the transition to a cleaner energy future.

Offshore wind energy integration is a significant growth area for Con Edison. New York's commitment to offshore wind, with a target of 9 gigawatts by 2035, necessitates substantial grid upgrades. Con Edison's investments in projects like the Brooklyn Clean Energy Hub are critical for connecting these massive renewable power sources, positioning the company as a vital player in this expanding market and a key facilitator of the state's clean energy transition.

Con Edison's strategic energy storage development, particularly its investments in battery storage, positions it as a potential Star in the BCG Matrix. These initiatives are crucial for managing renewable energy fluctuations and bolstering grid reliability, a sector experiencing robust growth driven by grid modernization efforts. For instance, in 2023, Con Edison announced plans to deploy over 100 megawatts of battery storage in Queens, New York, a significant step towards grid flexibility.

Reliable Clean City Projects

The Reliable Clean City projects represent Con Edison's strategic investment in enhancing transmission capacity across Queens, Staten Island, and Brooklyn. These vital infrastructure upgrades are on track and are crucial for bolstering grid reliability and accommodating the increasing electricity demand in these densely populated urban centers, especially as they embrace clean energy solutions.

These initiatives are designed to maintain Con Edison's strong market share in essential service territories while simultaneously fostering growth in the adoption of clean energy technologies.

- Project Scope: Significant infrastructure upgrades focused on adding substantial transmission capacity.

- Geographic Focus: Queens, Staten Island, and Brooklyn.

- Key Objectives: Improve grid reliability and meet growing electricity demand, supporting clean energy transitions.

- Status: Projects are currently on schedule.

Advanced Climate Resiliency Investments

Con Edison is significantly investing in advanced climate resiliency measures to safeguard its energy infrastructure. These proactive efforts are designed to counter the escalating impact of extreme weather events, a direct consequence of climate change.

These critical resiliency upgrades, guided by comprehensive climate studies, are essential for minimizing service disruptions and ensuring the dependable delivery of power. For instance, in 2024, Con Edison committed billions towards grid modernization and resiliency projects, including hardening substations and undergrounding critical infrastructure in flood-prone areas.

- Infrastructure Hardening: Con Edison is investing in reinforcing substations and critical facilities against high winds and flooding.

- Undergrounding Initiatives: A significant portion of capital expenditure is directed towards burying power lines in vulnerable areas to protect them from weather damage.

- Smart Grid Technology: Deployment of advanced sensors and automation systems allows for faster detection and restoration of power during outages.

- Climate Risk Assessments: Continuous evaluation of climate projections informs the strategic allocation of resources for maximum impact.

Con Edison's investments in offshore wind integration and strategic energy storage development position it as a Star in the BCG Matrix. These initiatives are crucial for grid modernization and capitalizing on the growing demand for renewable energy solutions, aligning with New York's clean energy goals.

The company's commitment to integrating offshore wind power, with New York targeting 9 gigawatts by 2035, requires significant grid upgrades. Con Edison's projects, like the Brooklyn Clean Energy Hub, are vital for connecting these large-scale renewable sources, solidifying its role in a high-growth market.

Furthermore, Con Edison's expansion of battery storage, such as the planned deployment of over 100 megawatts in Queens in 2023, enhances grid flexibility and reliability. This positions the company to benefit from the increasing need for energy storage as renewable penetration grows.

These strategic investments, coupled with the Reliable Clean City projects enhancing transmission capacity in urban areas, aim to maintain market share while driving growth in clean energy adoption.

| Initiative | Market Growth | Con Edison's Position | Key Data Point |

| Offshore Wind Integration | High | Star | NY target of 9 GW by 2035 |

| Energy Storage (Battery) | High | Star | 100+ MW planned in Queens (2023) |

| Grid Modernization & Resiliency | Moderate to High | Cash Cow / Star | $72 billion planned over 10 years |

What is included in the product

This BCG Matrix overview highlights Consolidated Edison's strategic positioning by categorizing its business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights on which segments to invest in, maintain, or divest to optimize the company's portfolio.

A clear BCG Matrix visualizes Con Edison's portfolio, easing strategic decision-making by highlighting areas needing investment or divestment.

Cash Cows

Con Edison's regulated electric distribution service in New York City and Westchester County is a classic Cash Cow. This mature business, holding a dominant market share, consistently generates robust and stable revenue, forming the bedrock of the company's financial strength.

The service boasts exceptional reliability, exceeding the U.S. average, which solidifies its strong market position and customer loyalty. In 2023, Con Edison reported that its electric delivery segment saw operating revenue of $7.9 billion, a testament to its consistent performance.

Consolidated Edison's regulated gas distribution service, serving New York City and Westchester County, operates as a utility with a dominant market share among its existing customer base. This segment functions as a cash cow within the BCG matrix, generating stable and predictable cash flow.

While long-term decarbonization initiatives may temper future growth in traditional gas sales, the service's regulated nature ensures a consistent revenue stream. For instance, in 2023, Con Edison reported approximately $3.7 billion in revenue from its gas operations, highlighting its significant contribution to the company's overall financial health.

Investments in this area are primarily directed towards ensuring the safety and reliability of the existing infrastructure for current customers. Concurrently, the company is exploring avenues for future low-carbon gas alternatives, such as renewable natural gas, to adapt to evolving energy landscapes.

The Manhattan Steam Distribution Network is a classic cash cow for Con Edison, operating as a near-monopoly that consistently generates stable revenue. Its essential nature and lack of direct competition solidify its position as a reliable income stream for the company.

In 2023, Con Edison reported that its steam business generated approximately $700 million in revenue, highlighting its significant contribution to the company's overall financial health. This segment benefits from ongoing investments aimed at modernization and environmental improvements.

Consistent Dividend Payouts

Consolidated Edison's consistent dividend payouts firmly place it in the Cash Cows category of the BCG Matrix. The company has achieved 'Dividend King' status, marking an exceptional 51 consecutive years of increasing its dividends. This sustained growth in payouts underscores Con Edison's robust financial health and its reliable capacity to generate substantial cash flow year after year.

This predictable dividend policy is a direct reflection of the mature and stable characteristics inherent in its core utility operations. These operations provide a steady stream of revenue, enabling the company to offer dependable returns to its shareholders.

- Dividend Aristocrat Status: 51 consecutive years of dividend increases.

- Financial Stability: Demonstrates strong and consistent cash flow generation.

- Mature Operations: Reflects the stable nature of its utility business.

- Shareholder Returns: Provides reliable and predictable income for investors.

Stable Regulatory Framework

The regulated utility model in New York creates a predictable revenue stream for Con Edison, enabling cost recovery and a fair return on investments. This stability, supported by approved rate hikes and capital spending, ensures consistent cash flow from its core business.

This regulatory environment significantly reduces exposure to market volatility, positioning the traditional utility operations as a dependable source of funds for the company.

- Stable Revenue: The regulated nature of the utility business provides a predictable revenue base, insulated from market fluctuations.

- Cost Recovery: Regulators allow Con Edison to recover its operating costs and earn a reasonable profit on its infrastructure investments.

- Approved Rate Increases: Periodic approvals for rate adjustments ensure that the company can maintain profitability as costs change.

- Mitigated Volatility: The framework shields Con Edison's core utility operations from the unpredictable swings common in less regulated industries.

Con Edison's regulated electric and gas distribution services in New York City and Westchester County are prime examples of Cash Cows. These mature businesses benefit from dominant market shares and a regulatory framework that ensures cost recovery and a fair return on investment, leading to stable and predictable revenue streams. For instance, the electric delivery segment generated $7.9 billion in operating revenue in 2023, while gas operations brought in approximately $3.7 billion.

| Business Segment | 2023 Revenue (approx.) | BCG Matrix Category | Key Characteristics |

|---|---|---|---|

| Electric Distribution (NYC & Westchester) | $7.9 billion | Cash Cow | Dominant market share, high reliability, stable revenue. |

| Gas Distribution (NYC & Westchester) | $3.7 billion | Cash Cow | Dominant market share, stable cash flow, regulated revenue. |

| Steam Distribution (Manhattan) | $700 million | Cash Cow | Near-monopoly, essential service, consistent revenue. |

What You’re Viewing Is Included

Consolidated Edison BCG Matrix

The Consolidated Edison BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content, ensuring you get a professional, ready-to-use strategic analysis for Consolidated Edison's business units. You can confidently use this preview as a direct representation of the comprehensive report that will be delivered to you, enabling immediate application in your business planning and decision-making processes.

Dogs

Consolidated Edison's divestment of its clean energy businesses in 2023 marked a significant strategic pivot. This move away from owning large-scale renewable generation assets, which previously encompassed solar and wind projects, suggests these ventures were not aligning with the company's core regulated utility strategy or were not delivering the expected returns.

The exit from this segment positions it as a past 'dog' or a 'question mark' in the BCG matrix, indicating it was an area the company chose not to further invest in or develop. For context, in the first nine months of 2023, Con Edison's regulated utility operations, primarily electric and gas delivery, represented the vast majority of its earnings, highlighting the continued focus on its core business.

Con Edison has largely exited direct ownership of legacy fossil fuel power generation, having divested its final nuclear plant, Indian Point 2. This strategic shift means any remaining, minuscule legacy generation assets would be classified as dogs in a BCG matrix. They face significant challenges from high maintenance costs and increasing environmental regulations, offering little to no growth prospects in an industry prioritizing decarbonization.

Outdated or inefficient IT systems within Consolidated Edison can be categorized as dogs in the BCG Matrix. These legacy systems, while perhaps functional, often incur high maintenance costs and are prone to operational disruptions. For instance, in 2023, IT infrastructure upgrades were a significant focus, with Con Edison reporting substantial investments in modernizing its operational technology to enhance reliability and efficiency.

Specific Leak-Prone Gas Infrastructure

Consolidated Edison's specific leak-prone gas infrastructure segments can be categorized as Dogs in the BCG matrix. These aging pipe sections present significant liabilities due to their high maintenance costs and the environmental risks associated with gas leaks. For instance, in 2023, Con Edison continued its aggressive infrastructure replacement program, retiring approximately 30 miles of older gas main and service pipes. This strategic initiative aims to phase out these low-growth, high-risk assets, thereby improving overall system safety and reducing methane emissions.

The company's commitment to modernizing its gas network means these leak-prone sections offer no future growth potential and are a drain on resources. The ongoing replacement efforts, such as those targeting older cast iron and bare steel pipes, directly address the 'Dog' quadrant. By investing in new, more robust materials, Con Edison is effectively shedding these problematic assets. In 2024, the company planned to invest billions in infrastructure upgrades, including significant capital for gas system modernization, underscoring the strategy to eliminate these liabilities.

- Aging Infrastructure Liability: Leak-prone gas pipes represent a significant financial and environmental burden with no prospect for growth.

- Strategic Retirement: Con Edison's ongoing replacement programs actively work to divest these 'Dog' assets.

- Investment in Modernization: Billions are allocated annually for infrastructure upgrades, including gas system modernization, to eliminate these liabilities.

Non-Strategic, High-Cost Physical Assets

Non-strategic, high-cost physical assets in Con Edison's portfolio could represent 'dogs' in a BCG matrix analysis. These are assets that drain resources without contributing to the company's forward-looking objectives, such as grid modernization or clean energy initiatives. For instance, older, inefficient power generation facilities or surplus real estate not aligned with future infrastructure needs would fit this category.

These assets often require significant capital for maintenance and operation, diverting funds that could be better invested in growth areas. In 2023, Con Edison reported capital expenditures of $6.9 billion, with a significant portion allocated to infrastructure upgrades and clean energy projects. Assets classified as 'dogs' would likely represent a drag on these strategic investments.

- Underutilized or Obsolete Infrastructure: Physical assets like older substations or transmission lines that are no longer essential for the current or future grid, but still incur maintenance costs.

- Non-Core Real Estate Holdings: Properties or land parcels that are not integral to Con Edison's operational strategy or clean energy transition plans, leading to carrying costs without strategic benefit.

- Legacy Equipment with High Operating Expenses: Specific machinery or technology that is expensive to maintain and operate, offering limited efficiency gains or strategic advantage compared to modern alternatives.

Consolidated Edison's legacy fossil fuel power generation assets, particularly those nearing the end of their operational life or facing stringent environmental regulations, can be classified as Dogs. These assets require substantial upkeep and offer limited growth potential in an industry rapidly shifting towards cleaner energy sources. For example, Con Edison has been actively divesting from such assets, including the sale of its last nuclear plant, Indian Point 2, in 2021, signaling a strategic move away from these capital-intensive, low-growth segments.

Similarly, outdated IT systems that are costly to maintain and prone to inefficiencies represent Dogs. Con Edison has been investing heavily in modernizing its technology infrastructure, with significant capital allocated in 2023 and planned for 2024 to enhance operational reliability. This focus on upgrades implies that older systems are being phased out due to their poor performance and high operational expenses, fitting the 'Dog' profile.

Aging, leak-prone gas infrastructure, such as older cast iron and bare steel pipes, are prime examples of Dogs. These segments incur high maintenance costs and pose environmental risks, with limited to no growth prospects. Con Edison’s aggressive infrastructure replacement program, which saw approximately 30 miles of older gas pipes retired in the first nine months of 2023, aims to eliminate these liabilities. The company planned to invest billions in infrastructure upgrades in 2024, specifically targeting gas system modernization to phase out these problematic assets.

Non-strategic, high-cost physical assets, including underutilized infrastructure or non-core real estate, can also be categorized as Dogs. These assets drain resources without contributing to Con Edison's strategic goals, such as grid modernization or clean energy transitions. In 2023, Con Edison reported capital expenditures of $6.9 billion, with a significant portion directed towards strategic investments, further highlighting how 'Dog' assets would divert necessary capital from growth-oriented initiatives.

| Asset Type | BCG Classification | Rationale | 2023/2024 Data Relevance |

| Legacy Fossil Fuel Generation | Dog | High maintenance, low growth, regulatory pressure | Divestment of older assets continues; focus on regulated utility |

| Outdated IT Systems | Dog | High maintenance costs, operational inefficiencies | Significant IT modernization investments in 2023 and 2024 |

| Aging Gas Infrastructure (Leak-Prone) | Dog | High maintenance, environmental risk, no growth | ~30 miles of old gas pipes retired in first 9 months of 2023; billions planned for gas system modernization in 2024 |

| Non-Strategic Physical Assets | Dog | High operating expenses, no strategic benefit | Capital expenditures of $6.9 billion in 2023 allocated to strategic upgrades, not legacy assets |

Question Marks

Consolidated Edison is heavily invested in exploring hydrogen and other low-to-zero carbon gaseous fuels as a way to clean up its gas and steam infrastructure. This is a forward-looking move into a sector with immense potential for growth.

Currently, these advanced fuel technologies are in their nascent stages, meaning they have a very small slice of the market. Significant investment in research and development is crucial to demonstrate their cost-effectiveness and ability to be scaled up for widespread use.

Successful trials in 2024, for instance, could position these initiatives as future market leaders. The U.S. Department of Energy, through its Hydrogen Shot initiative, aims to reduce the cost of clean hydrogen to $1 per kilogram by 2031, highlighting the government's commitment to this burgeoning sector.

Consolidated Edison is actively promoting heat pump adoption through substantial incentives, aiming to accelerate building electrification. This initiative targets a market poised for high growth, fueled by ambitious climate objectives. In 2024, Con Edison's direct involvement in the installation and long-term servicing of these technologies for individual customers is still in its nascent stages, reflecting an evolving market presence.

The company's strategy acknowledges the need for sustained, significant investment to foster widespread customer uptake and ensure these clean heat solutions integrate smoothly with the existing grid infrastructure. This ongoing commitment is crucial for realizing the full potential of heat pumps in meeting environmental targets and modernizing energy delivery.

Con Edison's electric vehicle (EV) charging infrastructure programs are positioned as a potential star in a BCG matrix, reflecting the high growth of EV adoption. The company is actively supporting the installation of thousands of EV charging plugs across its service territory, with a target of 15,000 by 2025. This initiative aims to facilitate the burgeoning EV market, which saw over 1.2 million EVs sold in the US in 2023 alone, a significant jump from previous years.

While Con Edison isn't directly operating a vast network of charging stations itself, its role as an enabler and incentivizer is crucial for this rapidly expanding sector. The company is investing in grid upgrades and offering various programs to encourage the build-out of charging points. This strategic focus on infrastructure development is designed to capture future revenue streams as EV penetration continues to climb, potentially turning this segment into a significant contributor to its portfolio.

Small-Scale Distributed Energy Resources (DER) Integration

Con Edison is actively facilitating the integration of small-scale distributed energy resources (DERs), like customer-owned solar and battery storage, and deploying grid-edge technologies. This aligns with a high-growth trend in the energy sector.

While Con Edison is a key enabler, its direct market share in the *ownership* of these smaller, distributed assets remains relatively low compared to its traditional utility operations. This positions DER integration as a potential Stars or Question Marks category within a BCG-like framework, depending on future strategic investments and market capture.

- Growth Potential: DERs are a rapidly expanding segment of the energy market, driven by customer adoption and technological advancements.

- Investment Needs: Significant capital is required to upgrade infrastructure and develop the necessary systems to manage and integrate these decentralized energy sources effectively.

- Market Position: Con Edison's role is primarily as a facilitator and grid operator, with lower direct ownership of individual DER assets compared to its core transmission and distribution business.

- Strategic Focus: The company's emphasis on grid modernization and enabling DER deployment indicates a strategic effort to capitalize on this evolving market landscape.

Advanced Customer Energy Efficiency Programs

Con Edison is making substantial investments in customer energy efficiency programs and incentives. These initiatives are vital for achieving societal climate goals and effectively managing energy demand. For instance, in 2023, Con Edison reported that its energy efficiency programs helped customers save over 1.7 million megawatt-hours of electricity, avoiding approximately 700,000 metric tons of carbon dioxide emissions.

While these programs contribute to reduced overall demand, which benefits the utility, the direct revenue generation beyond these savings can be limited. The impact on Con Edison's traditional energy sales market share remains a point of consideration.

- Societal Goal Alignment: Programs support climate targets and grid stability.

- Limited Direct Revenue: Beyond demand reduction, direct revenue impact is not the primary driver.

- Market Share Question: The direct impact on traditional energy sales volume is uncertain.

- Strategic Investment: Continued investment is needed to realize broader system benefits and customer engagement.

Consolidated Edison's investments in low-to-zero carbon gaseous fuels represent a high-growth, uncertain market. While promising, these technologies are still in early development, requiring substantial R&D to prove scalability and cost-effectiveness. Successful 2024 trials could be pivotal, aligning with the U.S. Department of Energy's goal to lower clean hydrogen costs significantly by 2031.

Heat pump adoption is a high-growth area, but Con Edison's direct customer involvement in installation and servicing is still developing in 2024. The company's strategy emphasizes ongoing investment to drive customer uptake and ensure seamless grid integration, crucial for meeting environmental targets.

Con Edison's EV charging infrastructure programs are a strong contender for a Star, given the rapid growth in EV adoption. The company is actively supporting the installation of thousands of charging plugs, aiming for 15,000 by 2025, and investing in grid upgrades to facilitate this expansion. The US saw over 1.2 million EVs sold in 2023.

Distributed Energy Resources (DERs), like solar and battery storage, represent a high-growth market where Con Edison acts as a facilitator. While its direct ownership of these assets is low compared to traditional operations, its focus on grid modernization aims to capitalize on this evolving landscape, positioning DER integration as a potential Star or Question Mark.

Customer energy efficiency programs are vital for climate goals, with Con Edison customers saving over 1.7 million MWh in 2023, avoiding significant CO2 emissions. However, the direct revenue impact beyond demand reduction is limited, and the effect on traditional energy sales market share remains a consideration.

| Category | Growth Rate | Market Share | Con Edison's Position | Strategic Implication |

|---|---|---|---|---|

| Low-to-Zero Carbon Gaseous Fuels | High | Low | Nascent R&D, potential future player | Invest for growth, high risk/reward |

| Heat Pump Adoption | High | Developing | Enabler, limited direct customer operations | Strategic investment for market penetration |

| EV Charging Infrastructure | High | Expanding | Key enabler, grid upgrades | Capitalize on rapid growth, future revenue |

| Distributed Energy Resources (DERs) | High | Low (direct ownership) | Facilitator, grid operator | Focus on grid modernization, potential growth |

| Customer Energy Efficiency | Moderate | Established | Demand reduction, limited direct revenue | Maintain for grid stability and customer engagement |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.