comScore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

comScore Bundle

Understanding comScore's competitive landscape is crucial, and a Porter's Five Forces analysis offers a powerful framework. This initial look highlights key industry pressures, but the true depth of strategic insight lies within the complete report.

The full Porter's Five Forces analysis for comScore unpacks the intricate web of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the ever-present danger of substitutes. Equip yourself with this comprehensive data to navigate comScore's market with confidence.

Ready to move beyond the basics? Get a full strategic breakdown of comScore’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Comscore's reliance on data from internet service providers, media companies, and set-top box providers makes these entities powerful suppliers. The unique and extensive nature of this data, particularly for cross-platform measurement, grants them considerable leverage. For instance, in 2024, the increasing fragmentation of media consumption means that comprehensive data from a single source is even more valuable, amplifying supplier bargaining power.

Comscore relies heavily on specialized technology and software for its core operations, including data processing, advanced analytics, and platform delivery. The bargaining power of technology and software vendors becomes significant if there's a limited pool of providers offering critical, proprietary solutions, or if the costs and complexities associated with switching to alternative systems are prohibitively high for Comscore.

The company's competitive edge is deeply intertwined with its proprietary algorithms and sophisticated analytics tools. For instance, in 2024, the market for advanced AI-driven analytics platforms is experiencing consolidation, with a few key players dominating. If Comscore's essential software components are sourced from such dominant vendors, those suppliers could indeed wield considerable bargaining power, potentially impacting Comscore's costs and operational flexibility.

The bargaining power of suppliers, particularly for highly specialized talent like data scientists and engineers, is a significant factor for Comscore. The demand for these professionals remains robust, with the U.S. Bureau of Labor Statistics projecting a 35% growth for data scientists and mathematical occupations from 2022 to 2032, much faster than the average for all occupations. This scarcity directly translates to increased leverage for these skilled individuals, enabling them to negotiate higher salaries and more attractive benefits packages.

This dynamic impacts Comscore by potentially driving up operational costs associated with talent acquisition and retention. Furthermore, the ability of Comscore to attract and keep top-tier data scientists and engineers is crucial for its innovation pipeline and its capacity to develop and refine its complex market research and analytics products. A strong talent pool is essential for maintaining a competitive edge in the data-driven media and advertising landscape.

Hardware and Infrastructure Providers

Comscore's reliance on hardware and cloud infrastructure, such as AWS and Google Cloud, for its extensive data processing and storage needs grants these providers a degree of bargaining power. While the market offers alternatives, Comscore's specific large-scale data requirements and the critical need for scalability and reliability can amplify the influence of these key infrastructure partners. This dependence means that any significant shifts in pricing or service terms from major cloud providers could impact Comscore's operational costs and efficiency.

The bargaining power of hardware and infrastructure providers for Comscore is influenced by several factors:

- Market Concentration: While the cloud market is competitive, a few dominant players like Amazon Web Services (AWS) and Microsoft Azure handle a substantial portion of global cloud infrastructure, potentially concentrating power.

- Switching Costs: Migrating vast datasets and complex processing architectures from one cloud provider to another can be technically challenging and expensive, creating inertia that favors incumbent providers.

- Service Level Agreements (SLAs): Comscore's need for guaranteed uptime and performance for its data analytics services means that providers with robust SLAs can command better terms.

- Innovation and Specialization: Providers offering specialized hardware or software solutions tailored to data-intensive analytics can leverage their unique capabilities to negotiate favorable terms.

Partnerships for Niche Data/Insights

Comscore's reliance on specialized data partners for niche market insights, such as local television viewership or specific digital platform engagement, can significantly influence supplier bargaining power. If these partners hold data that is difficult for Comscore or competitors to replicate, their leverage grows. For instance, a provider of granular data on emerging social media platforms might command higher prices if their insights are critical for Comscore's competitive edge.

The bargaining power of these niche data suppliers is amplified when their data is proprietary and essential for Comscore's product differentiation. Maintaining robust relationships with these entities is therefore paramount for Comscore to secure ongoing access to valuable, hard-to-obtain information. As of early 2024, the increasing fragmentation of media consumption means that such specialized data sources are becoming even more critical for comprehensive audience measurement.

- Niche Data Dependence: Comscore's need for specialized data sets increases the bargaining power of suppliers holding unique information.

- Proprietary Data Value: Data that is difficult to replicate or is proprietary to a supplier enhances their leverage.

- Relationship Management: Strong partnerships are crucial for Comscore to ensure continued access to vital niche data.

- Market Fragmentation Impact: The growing diversity of media platforms in 2024 makes specialized data providers more influential.

Comscore's dependence on data providers, especially those with unique or hard-to-replicate information, grants these suppliers significant leverage. This is particularly true in 2024, where media fragmentation makes comprehensive data from any single source highly valuable, increasing supplier bargaining power. The cost and complexity of switching data sources further solidify this power, impacting Comscore's operational costs and strategic flexibility.

What is included in the product

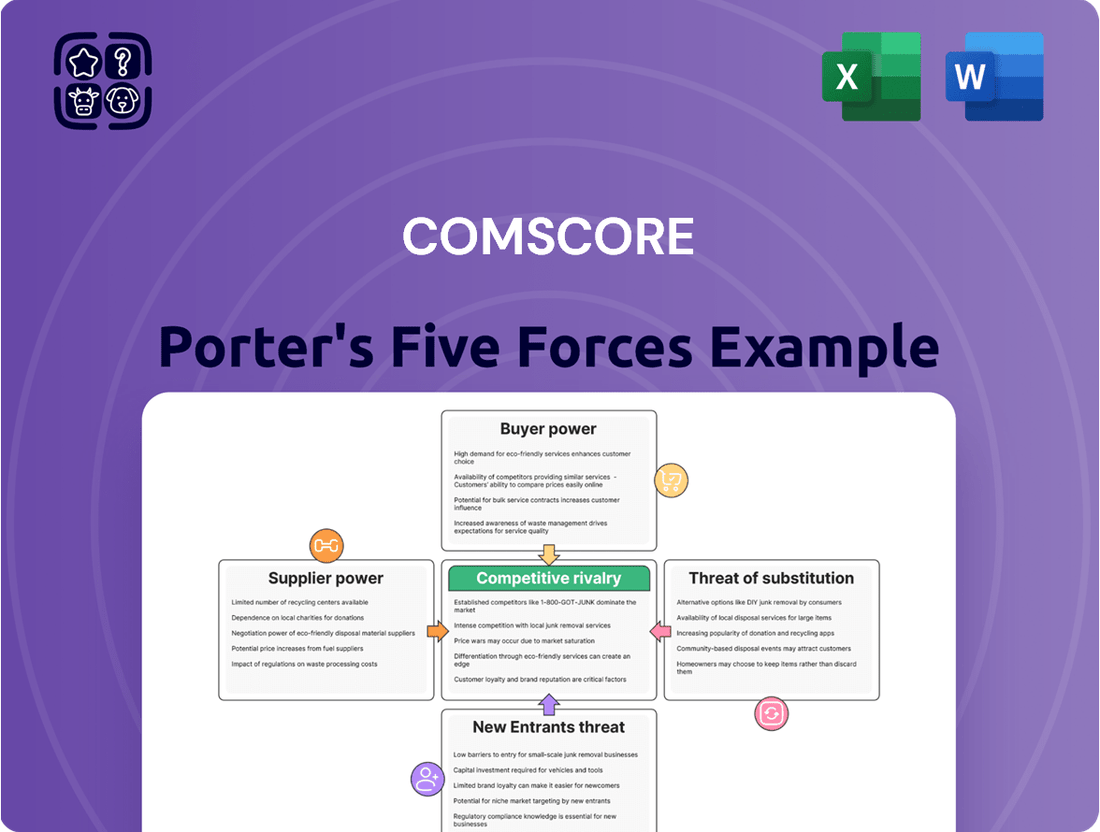

comScore's Porter's Five Forces Analysis dissects the competitive intensity within the digital analytics market, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly identify and address competitive threats with a visual, data-driven overview of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Large media and advertising agencies hold considerable bargaining power with comScore. These major clients, including advertising giants and entertainment firms, represent a significant portion of comScore's revenue, giving them leverage in price negotiations and demands for tailored services. For instance, in 2023, the top 10 clients accounted for a substantial percentage of comScore's total revenue, underscoring their influence.

Their ability to shift their substantial advertising spend to alternative measurement providers or even invest in developing their own data analytics capabilities further amplifies their negotiating strength. This potential for client churn or disintermediation forces comScore to remain competitive on pricing and responsive to evolving client needs and contract terms.

While Comscore serves a diverse market, a significant portion of its revenue often comes from a few key accounts. This concentration means these major clients, such as large media conglomerates or advertising agencies, can exert considerable bargaining power due to the substantial revenue they represent. For instance, if a top 10 client were to significantly reduce spending, it could impact Comscore's financial performance.

Conversely, Comscore also has a broad, fragmented customer base across various industries like media, advertising, and technology. This wide distribution of clients generally dilutes the power of any single smaller customer. However, Comscore must still invest in understanding and catering to the unique data and analytics needs of these different industry segments to maintain its market reach and revenue streams.

Customers can easily access alternative measurement and analytics solutions. Competitors like Nielsen, Kantar, and GfK offer similar services, while in-house capabilities and platforms such as Google Analytics and Similarweb provide further options. This abundance of choice significantly amplifies customer bargaining power.

Cost of Switching for Customers

The cost for customers to switch from one measurement provider to another, like moving away from comScore, can be quite substantial. These costs often include the expense of integrating new data feeds, which can be complex and time-consuming, as well as retraining employees on new systems and adapting established workflows to accommodate the change. For example, a media company might spend thousands of dollars on IT resources and employee training to implement a new analytics platform.

These significant switching costs tend to diminish the bargaining power of customers. Once a customer has invested heavily in comScore's services and data, they become more dependent on the provider, making it less feasible to seek out alternatives. This reliance can lead to customers being locked into comScore's offerings, reducing their ability to negotiate better terms or pricing.

However, comScore must continually demonstrate that the value it provides justifies these switching costs for its clients. In 2023, the digital measurement industry saw continued innovation, with companies like Nielsen and others enhancing their cross-platform measurement capabilities, potentially offering competitive alternatives that could influence customer willingness to incur switching expenses if comScore's value proposition doesn't keep pace. The ability of comScore to offer unique insights and a superior user experience is crucial in retaining customers despite these potential switching barriers.

- High Integration Costs: Implementing new data feeds and ensuring compatibility with existing systems can cost businesses tens of thousands of dollars in IT resources.

- Staff Retraining Expenses: Onboarding employees to new measurement tools and methodologies can require significant investment in training programs.

- Workflow Adaptation: Modifying established business processes to align with a new provider's reporting and analysis can lead to temporary productivity dips and associated costs.

- Data Migration Challenges: Transferring historical data and ensuring its integrity during a provider switch presents technical and financial hurdles.

Demand for Cross-Platform and Privacy-Centric Measurement

Customers are increasingly vocal about their need for measurement solutions that span across various platforms, from digital to traditional media. This demand is coupled with a growing emphasis on privacy-centric approaches, driven by evolving regulations and consumer awareness. Comscore's strength lies in its capacity to provide these integrated, privacy-compliant insights.

However, if Comscore or similar providers fail to adapt quickly to these shifting customer expectations, the bargaining power of these customers significantly increases. They can then more readily switch to competitors offering more advanced or specialized cross-platform and privacy-focused solutions. For instance, a recent survey in early 2024 indicated that over 60% of marketers are prioritizing privacy-preserving measurement technologies for their campaigns.

- Growing Demand for Unified Measurement: Marketers are seeking a single view of campaign performance across all touchpoints.

- Privacy as a Key Differentiator: Solutions that respect user privacy are becoming non-negotiable for many advertisers.

- Customer Leverage Through Agility: Customers can exert pressure by threatening to move to more responsive measurement providers.

- Impact on Comscore's Position: Comscore's ability to meet these evolving needs directly influences its competitive standing and customer retention.

Customers wield significant bargaining power due to the availability of numerous alternative measurement and analytics providers, including direct competitors and in-house solutions. This competitive landscape allows clients to negotiate pricing and service terms more effectively, as they can readily switch if comScore's offerings do not meet their expectations. For example, in 2023, the digital measurement market saw increased competition, with platforms like Similarweb gaining traction, offering alternatives that put pressure on established players.

While switching costs can be substantial, involving IT integration and staff retraining, the growing demand for unified, privacy-centric measurement solutions can still empower customers. If comScore fails to adapt to these evolving needs, clients may find the cost of switching less prohibitive than the cost of using a less suitable provider. A survey in early 2024 revealed that over 60% of marketers prioritize privacy-preserving measurement technologies.

| Factor | Impact on Comscore | Supporting Data/Example |

|---|---|---|

| Availability of Alternatives | Increases customer bargaining power | Competitors like Nielsen, Kantar, Similarweb offer comparable services. |

| Switching Costs | Can diminish customer bargaining power | High integration and retraining expenses can lock in clients. |

| Evolving Customer Needs | Can increase bargaining power if not met | Demand for cross-platform and privacy-focused solutions (60% of marketers prioritized in early 2024). |

Preview Before You Purchase

comScore Porter's Five Forces Analysis

This preview showcases the complete comScore Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently download and utilize this exact file to gain valuable strategic insights into comScore's market position.

Rivalry Among Competitors

The media measurement and analytics arena is a battlefield, teeming with giants like Nielsen and Kantar, alongside nimble digital analytics newcomers. This crowded landscape means intense competition for every customer, as these players often offer very similar, if not identical, services. For instance, Nielsen reported approximately $3.6 billion in revenue for 2023, highlighting its substantial market presence, while Kantar also maintains a significant global footprint.

The market for media measurement is quite fragmented, with many companies focusing on specific areas like digital ads, television viewership, cinema attendance, or social media engagement. This means comScore, while aiming for a comprehensive cross-platform view, still contends with rivals who excel in these specialized niches, potentially offering more granular data in their chosen domains.

The competitive landscape in the digital analytics and measurement industry is intensely shaped by innovation and technological progress. Companies like comScore are constantly pushed to integrate cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) to enhance data accuracy and predictive capabilities. For instance, the increasing sophistication of AI in audience segmentation and content personalization is a key differentiator.

This relentless pursuit of technological superiority means that firms must continuously invest in research and development to offer more comprehensive and privacy-compliant solutions. In 2024, the emphasis on data privacy regulations, like GDPR and CCPA, has further accelerated the need for innovative data handling and measurement techniques. Companies that fail to adapt risk falling behind in providing reliable and actionable insights to their clients, impacting their market share and revenue streams.

Pricing Pressures and Value Proposition

The digital measurement and analytics market, where comScore operates, is intensely competitive, leading to significant pricing pressures. Companies like Nielsen, Innovid, and DoubleVerify are all vying for market share, often through aggressive pricing strategies. For instance, in 2024, the digital advertising market saw continued pressure on ad tech fees, with many platforms offering tiered pricing based on volume and service level. This environment necessitates that comScore clearly articulate its unique value proposition.

Comscore's ability to command its pricing hinges on demonstrating superior data accuracy, the breadth of its insights, and the actionability of its analytics. Clients are increasingly scrutinizing the return on investment (ROI) from their media and advertising expenditures. Comscore's platform aims to provide this by enabling clients to optimize campaign performance, understand audience engagement across various platforms, and make data-driven decisions that ultimately boost their bottom line.

- Intense Competition: The digital measurement landscape features numerous players, including Nielsen, Innovid, and DoubleVerify, all competing for advertiser and publisher budgets.

- Pricing Sensitivity: Clients, particularly in 2024, are highly sensitive to pricing due to economic pressures and a focus on ad spend efficiency.

- Value Demonstration: Comscore must continually prove its value through superior data accuracy, comprehensive insights, and actionable analytics to justify its pricing.

- ROI Focus: The core of comScore's value proposition lies in its ability to help clients optimize media spend and maximize their return on investment.

Consolidation and Partnerships

The competitive landscape is marked by significant consolidation and strategic partnerships. Companies are joining forces to offer more comprehensive solutions and broaden their market presence. For instance, comScore has actively pursued partnerships, such as its collaborations with Nexstar and Yahoo DSP, which directly influence competitive dynamics by forging more robust alliances within the industry.

These consolidations and partnerships can lead to a more concentrated market, where fewer, larger entities command greater market share and influence. This trend is particularly evident as companies seek to provide end-to-end solutions in areas like digital advertising and media measurement, where integration is key to client value. The ability to offer a wider suite of services through these alliances can create a competitive advantage.

- Consolidation Trend: Industry players are merging or acquiring smaller competitors to gain scale and market share.

- Partnership Examples: comScore's alliances with Nexstar and Yahoo DSP exemplify the strategy of leveraging partnerships for expanded capabilities.

- Impact on Competition: These moves can intensify rivalry by creating stronger, more integrated competitors.

- Market Dynamics: The drive for integrated solutions is a key factor pushing companies towards consolidation and strategic alliances.

The media measurement sector is a highly competitive arena, featuring established giants like Nielsen and Kantar alongside emerging digital analytics specialists. This crowded market forces companies to constantly innovate and differentiate their offerings, as many provide similar services. For example, Nielsen's 2023 revenue of approximately $3.6 billion underscores its significant market position, while Kantar also maintains a substantial global presence, indicating the scale of competition.

The intense rivalry, characterized by pricing pressures and a strong client focus on demonstrable ROI, compels companies like comScore to continually highlight their unique value. In 2024, the emphasis on data privacy regulations has further amplified the need for advanced, compliant measurement techniques, making technological superiority a critical differentiator.

| Competitor | Approximate 2023 Revenue | Key Differentiator Focus |

|---|---|---|

| Nielsen | $3.6 billion | Broad media measurement, established client base |

| Kantar | Not publicly disclosed, but significant global presence | Brand insights, market understanding |

| Innovid | Not publicly disclosed, but active in ad tech | Video advertising measurement and optimization |

| DoubleVerify | Not publicly disclosed, but active in ad verification | Ad fraud prevention, brand safety |

SSubstitutes Threaten

Large media companies and major advertisers are increasingly building their own in-house measurement and analytics teams. This trend is driven by the desire to leverage proprietary first-party data, offering a potent substitute for third-party measurement providers like comScore. For instance, in 2024, many large enterprises reported significant investments in data science and analytics infrastructure, aiming for more tailored insights.

These in-house capabilities can be particularly attractive to clients with substantial financial resources and highly specific, unique measurement requirements that off-the-shelf solutions may not fully address. As of early 2024, the demand for custom analytics solutions saw a notable uptick, with companies seeking to gain a competitive edge through proprietary data interpretation.

The proliferation of alternative data sources, such as direct publisher data and social media analytics, presents a significant threat of substitution to traditional syndicated measurement services like comScore. These new avenues provide granular insights into consumer behavior, often in real-time. For instance, publishers increasingly offer their own first-party data, allowing advertisers to bypass third-party measurement altogether.

New measurement methodologies, including attention-based metrics and incrementality testing, also act as substitutes by offering more sophisticated ways to understand campaign effectiveness beyond simple reach and frequency. By 2024, the digital advertising industry is seeing a substantial shift towards these more nuanced approaches, with many brands prioritizing metrics that demonstrate actual impact on sales or conversions rather than just exposure.

Clients can opt for specialized consulting firms and custom research providers to delve into very specific market questions. These bespoke solutions can offer tailored insights that go beyond the standardized offerings of companies like comScore. For instance, a firm might commission a deep dive into a niche consumer behavior pattern, something a syndicated report wouldn't typically cover in that detail.

The threat here is that these custom studies can provide highly granular and proprietary analyses, potentially substituting for the broader, syndicated data comScore provides. In 2024, the market for custom market research continued to grow, with many businesses prioritizing unique data sets to gain a competitive edge. This can divert spending that might otherwise go towards off-the-shelf analytics.

Simpler, More Affordable Analytics Tools

For businesses with less intricate data requirements or tighter budgets, readily available and cost-effective digital analytics platforms present a significant threat of substitution. Tools like Google Analytics, which boasts over 10 million active websites using it as of 2024, and Similarweb offer robust features for tracking website traffic, user behavior, and conversion rates. While these might not match Comscore's comprehensive cross-platform and audience measurement capabilities, they often fulfill the core analytical needs of smaller enterprises or those in earlier growth stages.

The accessibility and lower price points of these alternative solutions mean that potential Comscore clients may opt for them, especially if their analytical demands are not at the enterprise level. This can limit Comscore's market penetration, particularly within segments prioritizing cost-efficiency over granular, in-depth cross-media analysis. The continued innovation and feature expansion of these substitute tools further solidify their position as viable alternatives.

- Google Analytics: Used by over 10 million websites in 2024, offering free basic web analytics.

- Similarweb: Provides website traffic analysis and competitive intelligence, often at a lower cost point than enterprise solutions.

- Cost-Effectiveness: These tools cater to businesses prioritizing budget-friendly analytics over Comscore's premium offerings.

- Sufficiency for Basic Needs: For many businesses, the analytical depth provided by these substitutes is adequate for core measurement and decision-making.

Shifting Industry Standards and Currency

The media landscape is in constant flux, with measurement standards and 'currency' frequently reviewed and updated. If new measurement methodologies gain broad adoption across the industry, they could emerge as significant substitutes for Comscore's existing services.

This evolution is partly driven by a significant shift towards privacy-first strategies. For instance, the deprecation of third-party cookies by major browsers like Google Chrome, which is expected to be largely completed by late 2024, fundamentally alters how digital audiences can be tracked and measured. This necessitates new approaches that Comscore must adapt to or risk losing market share to alternative solutions that better align with these privacy-centric methodologies.

- Evolving Measurement Standards: The industry's ongoing search for more robust and privacy-compliant measurement solutions poses a direct threat.

- Privacy-First Imperative: The move away from third-party cookies, impacting digital advertising measurement throughout 2024, creates an opening for alternative measurement providers.

- Acceptance of Alternatives: Widespread industry endorsement of new measurement frameworks could diminish reliance on Comscore's current offerings.

The threat of substitutes for comScore's services is substantial, stemming from various sources that offer alternative ways to measure media consumption and advertising effectiveness. These substitutes range from in-house analytics teams built by large media companies and advertisers to readily available, cost-effective digital analytics platforms.

The increasing capability of businesses to conduct their own data analysis, coupled with the rise of specialized consulting firms and new measurement methodologies, directly challenges comScore's market position. For example, by late 2024, the deprecation of third-party cookies by browsers like Chrome necessitates new measurement approaches, creating opportunities for alternative providers.

Platforms like Google Analytics, used by over 10 million websites in 2024, and Similarweb offer robust features that can fulfill the core analytical needs of many businesses, especially those prioritizing cost-efficiency. These alternatives are becoming increasingly sophisticated, forcing comScore to continually innovate to maintain its competitive edge.

| Substitute Type | Key Characteristics | 2024 Relevance/Data Point |

| In-house Analytics Teams | Proprietary data leverage, tailored insights | Significant investment in data science infrastructure by enterprises |

| Alternative Data Sources | Direct publisher data, social media analytics | Publishers offering first-party data bypass third-party measurement |

| Specialized Consulting Firms | Bespoke solutions, deep dives into niche markets | Growing market for custom research prioritizing unique data sets |

| Cost-Effective Digital Platforms | Google Analytics, Similarweb | Google Analytics used by over 10 million websites; cost-efficiency focus |

| New Measurement Methodologies | Attention metrics, incrementality testing | Shift towards metrics demonstrating actual impact on sales |

Entrants Threaten

Entering the cross-platform media measurement industry, where comScore operates, demands substantial financial outlay. This includes acquiring vast datasets, building robust technological infrastructure, and attracting highly skilled professionals, creating a significant hurdle for newcomers.

For instance, developing and maintaining the sophisticated data processing and analytics platforms necessary for accurate cross-platform measurement can easily run into tens of millions of dollars. Companies like comScore invest heavily in data partnerships and proprietary technology, making it difficult for smaller entities to compete on a similar scale.

The threat of new entrants in the data analytics and measurement space, particularly concerning data access, is significantly mitigated by established players' advantages. Comscore, for instance, benefits from deep-seated relationships with data providers and sophisticated proprietary data collection methods. These long-standing partnerships and accumulated data assets create substantial barriers to entry for newcomers seeking to gather comparable, high-quality datasets at scale.

Brand reputation and accreditation are significant hurdles for new entrants in the digital measurement space. Comscore's established trust and credibility, bolstered by industry accreditations like Media Rating Council (MRC) certification, create a substantial barrier. Building this level of confidence and securing necessary certifications can take years and substantial investment, making it difficult for newcomers to compete effectively.

Technological Complexity and Expertise

The significant technological complexity and the need for specialized expertise act as a substantial barrier to entry for new companies in the cross-platform measurement space. Developing and maintaining sophisticated technologies, especially those incorporating advanced analytics and artificial intelligence, demands a deep well of technical knowledge.

New entrants must either build this expertise from scratch or acquire it, which presents a considerable challenge and investment. For instance, companies like comScore invest heavily in R&D, which was reflected in their operating expenses. In 2023, comScore reported research and development expenses of $58.8 million, highlighting the ongoing investment required to stay competitive in technological innovation.

- High R&D Investment: Competitors must commit substantial resources to research and development to create and refine measurement technologies.

- Talent Acquisition Costs: Recruiting and retaining top talent in areas like data science, AI, and software engineering is expensive and competitive.

- Intellectual Property: Established players often possess proprietary algorithms and patents that are difficult for newcomers to replicate.

Regulatory and Privacy Landscape

The intensifying scrutiny on data privacy, exemplified by regulations like the GDPR and CCPA, alongside the phased elimination of third-party cookies, significantly raises the barrier to entry. New companies must invest heavily in compliant data infrastructure and ethical data sourcing from day one, a substantial hurdle compared to established players who may have legacy systems. For instance, in 2024, companies faced increased spending on privacy compliance, with estimates suggesting that businesses globally spent over $10 billion annually on GDPR compliance alone, a cost disproportionately impacting startups.

This evolving regulatory environment creates a deterrent for potential new entrants, as the upfront investment and ongoing operational costs associated with navigating complex data privacy laws are considerable. Companies that can demonstrate robust privacy practices and offer privacy-centric solutions may find this a competitive advantage, but the initial capital and expertise required to achieve this are substantial.

- Regulatory Compliance Costs: New entrants must allocate significant resources to understand and implement data privacy regulations, impacting initial operational budgets.

- Third-Party Cookie Phase-Out: The decline of third-party cookies necessitates new strategies for data collection and audience targeting, requiring investment in alternative technologies.

- Data Ethics and Trust: Building consumer trust in data handling practices is paramount, demanding transparent policies and secure data management from the outset.

- Navigating Evolving Laws: The dynamic nature of privacy legislation requires continuous adaptation and legal counsel, adding ongoing operational expenses.

The threat of new entrants into the cross-platform media measurement industry, where comScore operates, is considerably low due to several high barriers. Significant capital investment is required for data acquisition, technology development, and skilled talent, making it difficult for smaller players to compete. For example, comScore's 2023 R&D expenses were $58.8 million, illustrating the substantial ongoing investment in innovation necessary to maintain market position.

Established players like comScore benefit from deep-seated data provider relationships and proprietary data collection methods, creating a formidable hurdle for newcomers seeking comparable data quality and scale. Furthermore, brand reputation and industry accreditations, such as Media Rating Council (MRC) certifications, are crucial for trust and can take years to build, acting as a significant deterrent to new entrants.

| Barrier | Description | Example Data (2023/2024) |

|---|---|---|

| Capital Requirements | High costs for data, technology, and talent. | comScore R&D: $58.8 million (2023) |

| Data Access & Relationships | Established partnerships with data providers. | N/A (Proprietary relationships) |

| Brand Reputation & Accreditation | Industry trust and certifications are vital. | MRC accreditation for key metrics. |

| Technological Complexity & Expertise | Need for advanced analytics and AI skills. | Significant investment in data science talent. |

| Regulatory Compliance (Privacy) | Costs associated with GDPR, CCPA, and cookie phase-out. | Global GDPR compliance spending > $10 billion annually (2024 est.) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and publicly available financial statements. We also leverage data from reputable market intelligence platforms and economic indicators to ensure a comprehensive understanding of the competitive landscape.