comScore Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

comScore Bundle

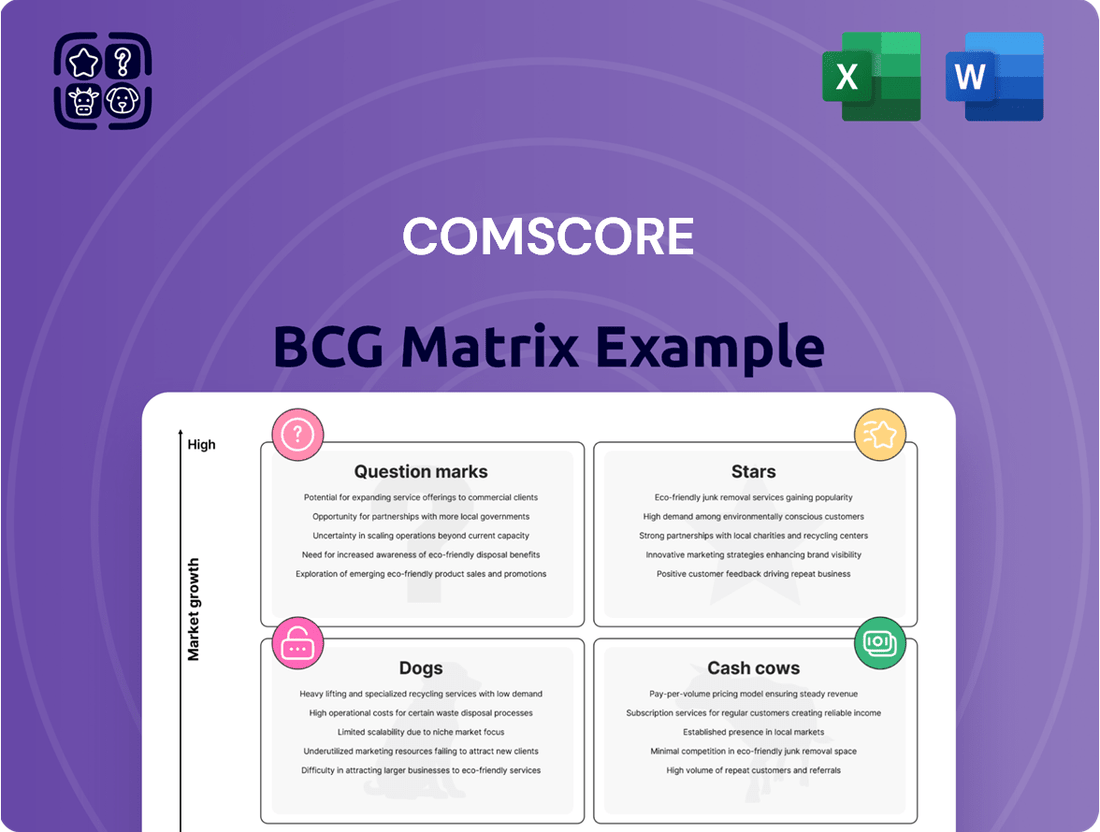

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See where its offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and gain a foundational understanding of market dynamics. Purchase the full BCG Matrix for a comprehensive breakdown, actionable insights, and a clear roadmap to optimize your investments and drive future growth.

Stars

Comscore's cross-platform measurement solutions, like Campaign Ratings (CCR) and Proximic, are seeing impressive gains. Cross-platform revenue jumped 20.5% in Q1 2025, highlighting strong market demand.

These tools are essential for advertisers, offering a unified view of campaigns across TV, streaming, social, and web. This omnichannel insight helps brands connect with audiences in today's fragmented media environment.

Comscore's ongoing Media Rating Council (MRC) accreditation for both national and local TV measurement, crucially including persons-based data, solidifies its standing as a premier, reliable third-party measurement provider. This accreditation is a significant competitive edge in an industry where accuracy and depth are paramount.

Comscore's Connected TV (CTV) measurement solutions are positioned as a strong contender in the BCG matrix, capitalizing on the significant shift in advertising budgets towards CTV. By 2024, CTV advertising is projected to double its share to 28% of total ad spend, highlighting a massive growth opportunity.

The company offers a comprehensive, single-source solution for CTV content and advertising measurement, along with targeting capabilities. This addresses a critical industry need for deduplicated reach measurement across the fragmented CTV landscape, making Comscore a vital partner for advertisers navigating this evolving space.

Programmatic Targeting via Proximic

Proximic, Comscore's specialized arm for programmatic targeting, is strategically positioned to leverage the growing programmatic ad spend and the industry's move towards privacy-focused, cookie-less methods. This is particularly relevant as 72% of industry players anticipate increased programmatic investments in 2025.

The shift to cookie-free targeting is accelerating, with 48% of respondents expecting to primarily utilize these tactics by the close of 2025. Proximic's focus on these evolving solutions directly addresses this critical industry trend.

- Proximic's Role: Comscore's dedicated programmatic targeting division.

- Market Trend 1: 72% of respondents plan to increase programmatic investments in 2025.

- Market Trend 2: 48% expect to primarily use cookie-free targeting by end of 2025.

- Strategic Advantage: Aligned with industry's privacy-compliant, cookie-free targeting needs.

International Expansion of Digital Measurement

Comscore's strategic expansion of its social incremental audiences feature within the MMX Platform suite to nine new international markets highlights its commitment to global digital measurement. This move is particularly significant as it offers publishers and brands a more unified and deduplicated understanding of their audience reach across desktop, mobile, and crucially, social media platforms. By late 2024, the digital advertising market in these expanding regions is projected to reach substantial figures, underscoring the value of such comprehensive measurement tools.

This expansion directly addresses the fragmentation of digital consumption, enabling clients to gain a clearer picture of their total digital footprint. For instance, in markets like Brazil and Mexico, where social media penetration is exceptionally high, this enhanced measurement capability can unlock significant insights for advertisers. Comscore's proactive approach in 2024 aims to solidify its position in these key growth areas.

- Enhanced Audience Insights: Comscore's MMX Platform now offers a more holistic view of digital audiences by integrating social data.

- International Market Focus: Expansion into nine additional international markets demonstrates a commitment to global digital measurement.

- Deduplicated Reach: The feature provides a unified and deduplicated understanding of user engagement across devices and platforms.

- 2024 Market Relevance: This initiative is timely, addressing the increasing complexity and growth of digital advertising in diverse global markets during 2024.

Comscore's advanced cross-platform measurement, including Campaign Ratings and Proximic, is a significant growth driver. Cross-platform revenue saw a substantial 20.5% increase in Q1 2025, reflecting strong market demand for unified campaign insights across diverse media channels.

These solutions are vital for advertisers seeking to understand campaign effectiveness in today's fragmented media landscape. Comscore's commitment to accuracy is underscored by its Media Rating Council (MRC) accreditation for national and local TV measurement, including crucial persons-based data.

Comscore's Connected TV (CTV) measurement is a clear Star. With CTV ad spend projected to reach 28% of total ad spend by 2024, Comscore's single-source solution for CTV content and advertising measurement, along with targeting, is perfectly positioned to capture this growth. This directly addresses the industry's need for deduplicated reach measurement in the expanding CTV market.

Proximic, Comscore's programmatic targeting division, is also a Star. As 72% of industry players anticipate increased programmatic investments in 2025 and 48% expect to rely primarily on cookie-free targeting by the end of 2025, Proximic's focus on privacy-compliant solutions aligns perfectly with these critical industry shifts.

The international expansion of Comscore's social incremental audiences feature within the MMX Platform further solidifies its Star status. This move enhances audience understanding across desktop, mobile, and social media, crucial for publishers and brands navigating complex digital ecosystems, especially in high-social-penetration markets.

| Comscore Product/Solution | BCG Matrix Category | Key Growth Driver/Market Trend | 2024/2025 Data Point |

| Cross-Platform Measurement (Campaign Ratings, Proximic) | Star | Demand for unified campaign insights | 20.5% revenue jump in Q1 2025 |

| Connected TV (CTV) Measurement | Star | Shift in ad budgets to CTV | CTV ad spend projected to reach 28% of total by 2024 |

| Proximic (Programmatic Targeting) | Star | Growth in programmatic and cookie-free targeting | 72% anticipate increased programmatic investments in 2025; 48% expect to use cookie-free targeting by end of 2025 |

| Social Incremental Audiences (MMX Platform) | Star | Need for deduplicated audience understanding across social and digital | Expansion into nine new international markets in 2024 |

What is included in the product

The comScore BCG Matrix analyzes product portfolios by market share and growth rate, guiding investment decisions.

The comScore BCG Matrix offers a clear, one-page overview, instantly relieving the pain of deciphering complex market data.

Cash Cows

Comscore's local TV measurement services are a strong performer, acting as a cash cow for the company. This stability is fueled by impressive renewal rates from existing clients and successful acquisition of new business. For instance, in 2023, Comscore reported continued growth in its revenue streams, with its audience measurement solutions, including local TV, showing resilience.

The recent expansion of Comscore's partnership with Gray Media, a significant player in the TV station group landscape, underscores the value and trust placed in its local measurement capabilities. This strategic alliance, which deepened in 2023, reinforces Comscore's standing as a vital currency for local television advertising. Such partnerships are critical for maintaining market share and driving consistent revenue in this segment.

Comscore's established syndicated audience offerings, especially in national TV and digital syndicated products, continue to be a substantial revenue generator, even as they navigate market shifts. These mature services, benefiting from a deeply entrenched market presence and a loyal client roster, reliably contribute to the company's cash flow.

The movies business, a classic "cash cow," consistently generates revenue through global box office performance. In 2024, the worldwide box office reached an estimated $88 billion, demonstrating its enduring financial contribution.

This segment operates within a mature market, characterized by predictable cash flows. While growth prospects are modest compared to newer digital platforms, the established nature of movie releases ensures a reliable income stream for studios.

Core Digital Audience Measurement

Comscore's core digital audience measurement services represent a stable revenue generator within their business. These foundational offerings, which have been a cornerstone of the company for years, continue to be utilized by a wide array of clients seeking insights into digital consumer behavior.

Despite increasing competition in certain digital measurement segments, the persistent need for understanding how audiences interact online ensures a reliable income for comScore. This enduring demand underpins the "Cash Cow" classification for this business unit.

For instance, in 2024, comScore reported revenue from its Digital Ad Ratings and related audience measurement products continued to be a significant contributor, reflecting the ongoing reliance of advertisers and publishers on these insights. While specific figures are often proprietary, industry analysts consistently point to audience measurement as a consistent performer for established players like comScore.

- Foundational Strength: Comscore's legacy in digital audience measurement provides a stable client base and consistent revenue.

- Market Demand: The ongoing need to understand digital consumer behavior ensures sustained demand for these services.

- Revenue Stability: Despite competitive pressures, these core services maintain a reliable income stream for the company.

- 2024 Performance: Digital Ad Ratings and similar audience measurement tools remained a key revenue driver in the past year.

Existing Client Relationships and Renewals

Existing client relationships and renewals are a significant cash cow for comScore, particularly within its Content & Ad Measurement segment. This focus highlights a stable foundation of recurring revenue, underscoring the importance of nurturing these established partnerships.

Maintaining strong relationships and consistently delivering value to existing clients is paramount for generating dependable cash flow. For instance, in 2024, comScore reported that renewals from its existing client base contributed a substantial portion of its revenue, demonstrating the segment's maturity and stability.

- Recurring Revenue Stability: The Content & Ad Measurement segment benefits from high client retention rates, providing a predictable revenue stream.

- Client Loyalty: comScore's emphasis on existing relationships fosters loyalty, reducing churn and ensuring consistent business.

- 2024 Performance: Renewals in 2024 played a critical role in comScore's financial performance, solidifying its position as a cash cow.

- Value Proposition: Continued delivery of demonstrable value keeps clients engaged and committed to long-term partnerships.

Comscore's established syndicated audience offerings, particularly in national TV and digital, are a significant revenue generator. These mature services benefit from a deeply entrenched market presence and a loyal client roster, reliably contributing to the company's cash flow.

The movies business, a classic cash cow, consistently generates revenue through global box office performance. In 2024, the worldwide box office reached an estimated $88 billion, demonstrating its enduring financial contribution.

Comscore's core digital audience measurement services represent a stable revenue generator. Despite increasing competition, the persistent need to understand online consumer behavior ensures a reliable income for the company, solidifying its cash cow status.

Existing client relationships and renewals are a significant cash cow, particularly within its Content & Ad Measurement segment. In 2024, renewals from its existing client base contributed a substantial portion of revenue, demonstrating the segment's maturity and stability.

What You See Is What You Get

comScore BCG Matrix

The comScore BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections—just the comprehensive, analysis-ready report designed for strategic decision-making.

Dogs

Comscore's syndicated digital products are showing signs of weakness, with the company reporting lower revenue from this segment. This suggests these offerings might be struggling to maintain their market position or are facing declining customer interest. For instance, in 2023, comScore's revenue from syndicated digital products saw a noticeable dip, prompting a closer look at their performance.

These products could be operating in mature or slow-growth digital markets, or they might be encountering significant competition from rivals. Such conditions naturally lead to reduced profitability and necessitate a strategic review to determine their future viability within comScore's portfolio.

Certain custom digital products within comScore's Research & Insight Solutions experienced a revenue decline. This dip suggests a potential softening in demand for these bespoke digital offerings, possibly indicating they cater to niche markets or are facing obsolescence.

Underperforming legacy measurement services, particularly those tied to traditional linear TV, often fall into the dog category of the BCG matrix. These offerings struggle to adapt to evolving media habits and lack the cross-platform integration essential in today's fragmented landscape. For instance, as of 2024, linear TV viewership continues its downward trend, with many younger demographics shifting to streaming services, leaving traditional measurement models increasingly irrelevant and unable to capture the full audience picture.

Products with Declining Revenue Trends

Products within comScore's portfolio that consistently exhibit a year-over-year revenue decline, without a discernible strategy for revitalization, are classified as Dogs in the BCG Matrix. This suggests these offerings are losing market traction or are outpaced by competitors.

For instance, if a specific data analytics platform within comScore saw its revenue drop by 15% in 2023 compared to 2022, and projections for 2024 indicate a further 10% decline, it would likely fall into the Dog category. This trend points to a diminishing market share and potential obsolescence.

- Diminishing Market Relevance: Products with declining revenue often struggle to adapt to evolving consumer needs or technological advancements.

- Competitive Disadvantage: A consistent revenue drop can indicate an inability to compete effectively on price, features, or innovation.

- Resource Drain: These underperforming units may consume resources that could be better allocated to more promising areas of the business.

Offerings with High Maintenance/Low Return

These are the offerings that demand substantial resources for upkeep but offer minimal financial gains. Think of legacy software systems or outdated data analytics platforms that continue to consume capital without generating significant market traction or revenue. In 2024, companies continue to grapple with these "cash traps," where ongoing maintenance costs for such assets can drain budgets that could otherwise be allocated to more promising growth areas.

These products or services are characterized by high operational costs and a declining or stagnant revenue stream. They represent a drain on financial resources, tying up capital and personnel that could be better utilized elsewhere. For instance, a company might still be investing heavily in maintaining a proprietary data collection method developed in the early 2000s, which is now largely superseded by more efficient and cost-effective cloud-based solutions. This often results in a negative return on investment.

- High Maintenance Costs: Significant expenditure on keeping older technologies operational.

- Low Market Adoption: Limited customer interest or demand for the offering.

- Diminishing Returns: Revenue generated is insufficient to justify the investment.

- Resource Drain: Ties up capital and skilled personnel, hindering investment in growth areas.

Comscore's "Dogs" represent products with low market share and low growth prospects. These offerings often require significant resources for maintenance but generate minimal returns. For example, legacy measurement services for linear TV, facing declining viewership in 2024, are prime candidates for this category.

These products are characterized by diminishing relevance and a competitive disadvantage, often leading to a consistent year-over-year revenue decline. A data analytics platform seeing a 15% revenue drop in 2023 and a projected 10% further decline in 2024 exemplifies this trend.

The core issue with Dogs is their inability to generate sufficient revenue to justify their operational costs, creating a resource drain. Companies must carefully assess whether to divest or revitalize these underperforming assets to reallocate capital effectively.

Consider the following scenario for Comscore's product portfolio:

| Product Category | Market Share (2024 Est.) | Market Growth Rate (2024 Est.) | Revenue Trend (YoY) | BCG Classification |

|---|---|---|---|---|

| Syndicated Digital Products | Low | Low | Declining | Dog |

| Custom Digital Products (Specific Niches) | Low | Low | Declining | Dog |

| Legacy Linear TV Measurement | Very Low | Negative | Significant Decline | Dog |

Question Marks

Comscore's new AI tool usage data is a classic question mark in the BCG matrix. It's a product in a market that's booming, but Comscore's piece of that pie is still quite small. Think of it like a brand new app in a crowded app store; it has potential but needs to prove itself.

The market for understanding how consumers use AI is definitely a high-growth area, with many companies scrambling to get a foothold. However, Comscore is just entering this specific niche, meaning its current market share is minimal. This makes it a question mark because while the potential is huge, the current reality is low penetration.

For instance, a recent report indicated that by the end of 2024, over 60% of major companies were expected to be implementing AI in some capacity, highlighting the rapid adoption of AI technologies. Comscore's data aims to capture the consumer side of this trend, but its current market share in this specific data measurement area is still developing.

Expanding digital measurement internationally is a strong performer, a Star, for Comscore. However, entering new, specific international markets for comprehensive cross-platform measurement, especially to capture incremental social audiences, presents a Question Mark.

These new markets offer significant growth opportunities, but Comscore's current market share is still in its early stages of development. This means substantial investment is likely needed to gain traction and compete effectively.

For instance, while Comscore's global digital audience measurement reached over 2 billion unique users in Q1 2024, their penetration in emerging markets for nuanced social audience data is still being established, requiring strategic focus.

Comscore's advanced audience solutions, such as County, Automotive, and Political data, are seeing increased adoption as advertisers explore more granular targeting. This expansion into new contexts, like hyper-local campaigns or niche automotive segments, represents a significant growth opportunity. For instance, in 2024, the automotive advertising market alone is projected to reach over $30 billion, with digital channels playing an increasingly dominant role, highlighting the potential for Comscore's specialized data.

Integration with Programmatic SSPs (e.g., Certified Deal IDs in Magnite)

Comscore's integration with programmatic SSPs, specifically its Certified Deal IDs within Magnite, represents a strategic push into the burgeoning programmatic advertising space. This move aims to capitalize on the increasing demand for transparent and efficient ad buying. The success of these deal IDs hinges on their ability to capture significant market share and achieve widespread adoption by advertisers and publishers alike.

While programmatic advertising saw significant growth, with global programmatic ad spend projected to reach over $430 billion in 2024, the specific market penetration of Comscore's Certified Deal IDs remains a key factor in its BCG matrix positioning. For Comscore to transition from a Question Mark to a Star, demonstrating a clear competitive advantage and substantial user uptake for these specific deal IDs is crucial. This involves proving their value proposition in a crowded marketplace.

- Market Share Growth: Comscore needs to show a measurable increase in the adoption and usage of its Certified Deal IDs within Magnite's platform.

- Programmatic Spend: The overall growth of programmatic advertising, estimated to account for over 80% of digital ad spend in key markets by 2024, provides a fertile ground for Comscore's offerings.

- Competitive Landscape: Comscore's ability to differentiate its Certified Deal IDs from other solutions in the programmatic ecosystem will be vital for its success.

- Publisher and Advertiser Adoption: Demonstrating a strong uptake from both publishers and advertisers will be a clear indicator of the deal IDs' market viability.

New Partnerships for Advanced Measurement (e.g., HyphaMetrics, TargetSmart)

Comscore's strategic moves into advanced measurement, exemplified by partnerships with HyphaMetrics and TargetSmart, signal a proactive approach to capturing high-growth market segments. The collaboration with HyphaMetrics aims to enhance person-level audience measurement and provide CTV program-level reporting, addressing a critical need for granular data in the rapidly expanding connected TV landscape. Similarly, the alliance with TargetSmart focuses on the lucrative political advertising sector, a market that saw significant investment in 2024, with campaigns increasingly relying on precise audience targeting.

These new ventures are positioned to potentially become Stars within the Comscore BCG Matrix. The success of these partnerships hinges on their ability to scale effectively and demonstrate superior performance in their respective high-growth areas. For instance, the political advertising market in the US alone was projected to reach over $16 billion in 2024, highlighting the substantial revenue potential Comscore could tap into through its TargetSmart collaboration. If Comscore can successfully leverage these alliances to gain significant market share and establish itself as a leader in these advanced measurement domains, they will undoubtedly ascend to the Star quadrant.

- HyphaMetrics Partnership: Focuses on person-level audience measurement and CTV program-level reporting, addressing demand for granular data in the growing CTV market.

- TargetSmart Partnership: Targets the political advertising sector, a high-spending area where precise audience targeting is crucial. US political ad spending was estimated to exceed $16 billion in 2024.

- Star Potential: The success and scalability of these ventures will determine if they contribute to Comscore's market share growth and elevate them to the Star category.

- Market Opportunity: These partnerships represent Comscore's strategy to capitalize on emerging trends and secure leadership in advanced measurement solutions.

Comscore's AI tool usage data is a classic question mark. It operates in a booming market, but Comscore's current share is small, much like a new app in a crowded store. The potential is high, but it needs to prove its value.

The market for AI usage insights is growing rapidly, with many companies vying for position. Comscore is just entering this niche, meaning its market share is minimal, classifying it as a question mark due to high potential and low current penetration.

By the end of 2024, over 60% of major companies were expected to implement AI, underscoring rapid adoption. Comscore's data aims to capture consumer AI usage, but its market share in this specific measurement area is still developing.

| Comscore Product/Service | Market Growth | Comscore Market Share | BCG Matrix Category |

| AI Tool Usage Data | High | Low | Question Mark |

| International Digital Measurement | High | High | Star |

| New International Markets (Social Audience Data) | High | Low | Question Mark |

| Advanced Audience Solutions (County, Auto, Political) | High | Growing | Question Mark (potential Star) |

| Certified Deal IDs (Magnite Integration) | High | Low | Question Mark |

| HyphaMetrics Partnership (CTV Measurement) | High | Low | Question Mark (potential Star) |

| TargetSmart Partnership (Political Advertising) | High | Low | Question Mark (potential Star) |

BCG Matrix Data Sources

Our BCG Matrix leverages robust market data, including sales figures, market share reports, and industry growth rates, to accurately position each business unit.