comScore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

comScore Bundle

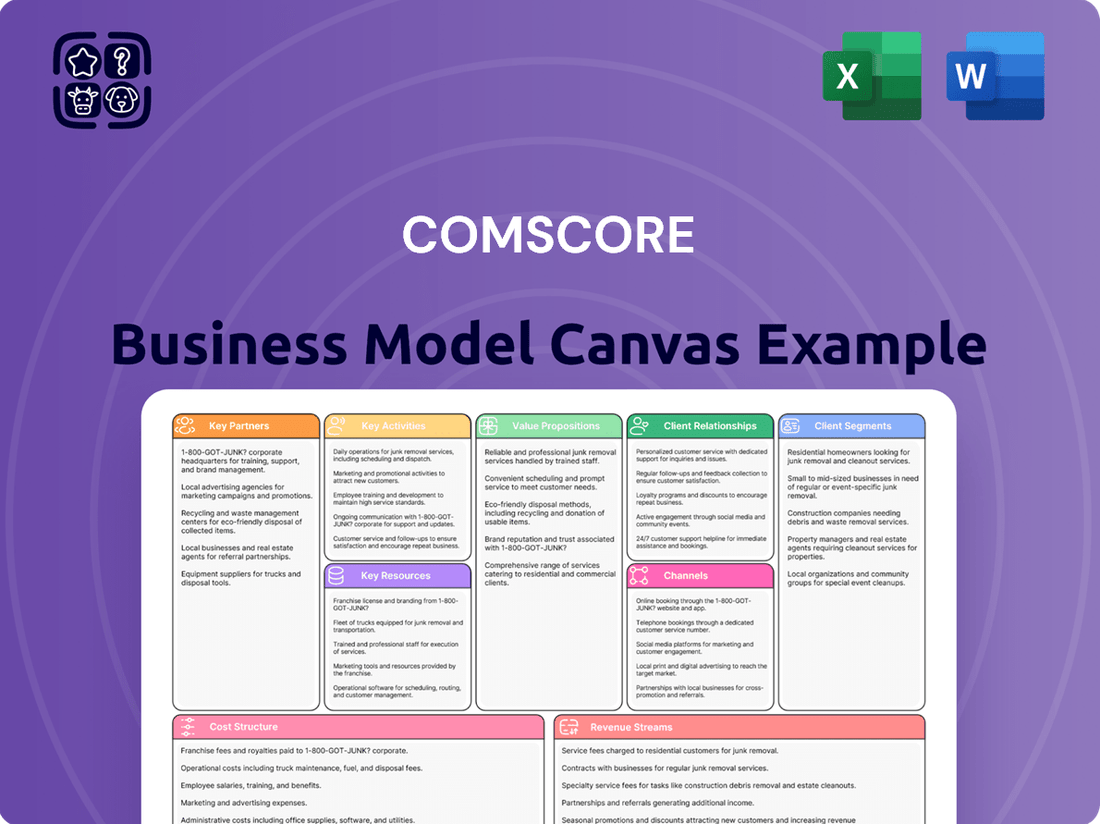

Unlock the core components of comScore's success with our detailed Business Model Canvas. This comprehensive analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Perfect for anyone seeking to understand how comScore achieves its strategic objectives.

Partnerships

Comscore cultivates crucial alliances with major media entities, exemplified by its multi-year agreements with companies like Gray Media. These collaborations solidify Comscore's role as a primary local measurement currency, facilitating the integration of advanced demographic data.

These strategic partnerships empower broadcasters to embrace sophisticated cross-platform measurement tools, such as Comscore Campaign Ratings (CCR). This adoption allows for the delivery of holistic insights, directly contributing to the optimization of advertising campaign effectiveness and reach.

The expansion includes onboarding additional TV stations and integrating advanced audience segmentation capabilities, such as County, Automotive, and Political data. This deepens the granularity of insights available to partners, enhancing their strategic decision-making processes.

Comscore's strategic alliances with ad tech platforms are crucial for its business model, enabling seamless integration of its measurement and targeting capabilities into the programmatic advertising workflow. This integration enhances the efficiency and effectiveness of digital ad buying and selling.

A prime example of this partnership strategy is Comscore's collaboration with Magnite, a leading independent sell-side platform. The launch of Certified Deal IDs within Magnite's SSP, powered by Comscore's content rankings, allows advertisers to confidently activate programmatic campaigns against high-quality, attention-optimized inventory. This initiative directly addresses long-standing inefficiencies and trust issues within the programmatic ecosystem.

Comscore actively partners with data-as-a-service providers, such as HyphaMetrics, to enhance its person-level audience measurement capabilities and refine Connected TV (CTV) program-level reporting. These strategic alliances are crucial for developing more sophisticated and unified approaches to understanding consumer behavior in the fragmented media landscape.

These collaborations are designed to provide the media industry with incredibly detailed, de-duplicated insights into how consumers interact with content across a multitude of platforms. For example, advancements in data integration allow for a clearer picture of ad exposure and viewing habits, moving beyond siloed metrics.

By forging these data and analytics collaborations, Comscore reinforces its dedication to offering cutting-edge, audience-focused solutions. This commitment ensures that clients receive the most accurate and actionable data available, enabling better decision-making in media planning and investment.

Political Advertising Data Providers

Comscore's key partnerships with political advertising data providers, such as TargetSmart, are crucial for their business model. These collaborations enable Comscore to offer sophisticated media planning and evaluation tools specifically for the political arena. For instance, in the 2024 election cycle, the demand for precise audience targeting in political campaigns surged, making partnerships like these invaluable.

These alliances allow political campaigns, advocacy groups, and non-profits to connect with their intended audiences more effectively across various media channels. By integrating Comscore's robust audience measurement with specialized campaign solutions, partners can maximize voter mobilization and engagement. This synergy is particularly vital in a landscape where reaching specific demographics with tailored messaging is paramount for success.

- Enhanced Political Campaigning: Partnerships enable granular data for media planning and evaluation, improving campaign efficiency.

- Targeted Audience Reach: Facilitates effective connection with specific voter segments across diverse platforms.

- Mobilization and Engagement: Leverages measurement capabilities with targeted solutions for maximum impact.

- Data-Driven Strategy: Supports data-informed decision-making for political advertisers and strategists.

Industry Standard and Certification Bodies

Comscore's commitment to industry standards is exemplified by its deep collaboration with bodies like the U.S. Joint Industry Committee (JIC). This partnership ensures Comscore's measurement solutions consistently meet the rigorous requirements for currency-grade data in the media industry.

Achieving full JIC certification for national TV measurement and persons-based data, alongside successful mid-term audits, solidifies Comscore's role as a reliable, independent third-party validator. This validation is paramount for building trust and facilitating smooth transactions between media buyers and sellers.

- JIC Certification: Comscore's national TV and persons-based data have achieved full certification from the U.S. Joint Industry Committee.

- Mid-Term Audits: Successful completion of mid-term audits further validates Comscore's adherence to industry currency standards.

- Trust and Confidence: These certifications are vital for fostering confidence among media buyers and sellers, underpinning Comscore's role in the media measurement ecosystem.

Comscore's key partnerships are vital for its business model, enabling it to provide comprehensive media measurement and analytics. These alliances span media companies, ad tech platforms, data providers, and industry standard bodies, ensuring its data is robust, integrated, and trusted across the ecosystem. For instance, in 2024, Comscore continued to strengthen its relationships with major broadcasters and publishers, enhancing its ability to offer granular audience insights and cross-platform measurement, a critical need for advertisers navigating a fragmented media landscape.

| Partner Type | Example Partner | 2024 Focus/Impact | Data/Capability Enhanced |

|---|---|---|---|

| Media Companies | Gray Media | Strengthening local measurement currency | Advanced demographic data integration |

| Ad Tech Platforms | Magnite | Enabling programmatic activation of quality inventory | Content rankings, Certified Deal IDs |

| Data Providers | HyphaMetrics | Enhancing person-level measurement and CTV reporting | Unified consumer behavior insights |

| Industry Bodies | U.S. Joint Industry Committee (JIC) | Ensuring currency-grade data standards | National TV and persons-based data certification |

What is included in the product

A detailed breakdown of comScore's operations, outlining its key customer segments, value propositions, and revenue streams within the digital analytics industry.

This model highlights comScore's data-driven approach to measuring digital audiences and advertising effectiveness, serving a broad range of clients from media companies to advertisers.

The comScore Business Model Canvas acts as a pain point reliver by providing a clear, visual framework that simplifies complex strategic thinking.

It alleviates the pain of scattered information and unstructured planning by consolidating all key business elements onto a single, easily digestible page.

Activities

Comscore's key activity centers on delivering robust cross-platform measurement, encompassing digital, linear TV, OTT, and cinema. This involves creating and refining tools such as Comscore Campaign Ratings (CCR) and unified content measurement to offer clients a holistic view of audience engagement across all media.

These sophisticated measurement solutions are crucial for advertisers and media companies seeking to understand how their content performs and reaches consumers in today's fragmented media landscape. For instance, Comscore's 2024 data indicates continued growth in digital video consumption, highlighting the necessity of their cross-platform capabilities.

A core activity for comScore is crafting sophisticated audience insights and analytics, drawing on their extensive data and unique technology. This translates into building advanced programmatic targeting segments, like Comscore Audience Activation™ and Proximic by Comscore's contextual targeting.

These developments are crucial for marketers, enabling them to reach their desired audiences with both scale and accuracy. For instance, in 2024, comScore's data showed a significant increase in the demand for privacy-compliant targeting solutions, with a projected 15% year-over-year growth in programmatic ad spend specifically on privacy-first platforms.

By focusing on these key activities, comScore empowers advertisers to navigate the evolving digital landscape effectively, ensuring their campaigns are both efficient and compliant with emerging privacy regulations.

Comscore helps clients refine their content by offering insights into audience engagement and campaign performance. This allows businesses to understand who is seeing their content and how effective their advertising is.

Key activities include providing data on audience reach, frequency, and incrementality, enabling measurement of advertising's true impact. For instance, Comscore's 2024 data shows a significant increase in cross-platform measurement needs, highlighting the importance of quantifying ad effectiveness across various channels.

The ultimate aim is to equip media professionals with the data needed to make smarter decisions, ensuring they get the best return on their advertising spend.

Market Research and Industry Reporting

Comscore’s market research and industry reporting are central to its value proposition. The company regularly publishes influential reports like the 'State of Digital Commerce Report' and the 'State of Programmatic Report,' offering deep dives into consumer behavior and technological advancements.

These reports are critical for media and advertising professionals, providing actionable data and trend analysis. For instance, Comscore's 2024 data indicates a significant shift in consumer spending, with digital commerce continuing its upward trajectory, projected to reach new milestones.

- Thought Leadership: Comscore's reports establish it as a go-to source for industry insights, shaping strategic decisions across the media landscape.

- Data-Driven Insights: The company leverages its vast datasets to uncover trends in areas like streaming consumption and advertising effectiveness, crucial for understanding the 2024 media environment.

- Market Influence: By disseminating key findings, Comscore not only informs but also influences industry best practices and future developments in digital advertising and media measurement.

Maintaining Industry Accreditations and Standards

Comscore actively pursues and upholds Measurement Research Council (MRC) accreditations for its diverse measurement offerings. This dedication extends to national and local TV measurement, underscoring the dependability and credibility of its data.

Maintaining these industry standards is fundamental to Comscore's position as a trusted benchmark in media assessment. For instance, in 2023, Comscore successfully renewed its MRC accreditation for its National TV measurement, a critical component for advertisers and broadcasters.

- MRC Accreditation Renewal: Comscore's ongoing commitment to MRC standards ensures its data is recognized as reliable currency in the media industry.

- Trust and Credibility: These accreditations are vital for maintaining trust with clients who rely on Comscore for accurate audience insights.

- Market Validation: Successful accreditation validates Comscore's methodologies against rigorous industry benchmarks, reinforcing its market position.

Comscore's key activities are deeply rooted in data collection, processing, and the subsequent delivery of actionable insights. This involves continuously developing and refining sophisticated measurement technologies and algorithms to capture audience behavior across a multitude of platforms. The company’s efforts are focused on ensuring the accuracy and comprehensiveness of its data, which serves as the foundation for its diverse product offerings.

A significant part of comScore's operation involves maintaining and expanding its vast data partnerships and infrastructure. This ensures access to a wide array of consumer data points, essential for creating granular audience segments and understanding media consumption patterns. For example, in 2024, comScore announced expanded data integrations with leading smart TV manufacturers, aiming to capture an additional 10 million households in its measurement footprint.

The company also prioritizes the development of innovative analytics and reporting tools. This includes creating user-friendly dashboards and advanced analytical capabilities that allow clients to easily interpret complex data and derive strategic value. Comscore's 2024 roadmap includes the launch of a new AI-powered analytics suite designed to provide predictive insights into campaign performance and audience trends.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Data Collection & Processing | Gathering and cleaning diverse audience data across platforms. | Expanded smart TV data integrations, aiming for 10M+ additional households. |

| Technology Development | Refining measurement algorithms and tools for accuracy. | Developing new AI-powered analytics suite for predictive insights. |

| Data Partnerships | Establishing and maintaining relationships for data access. | Strengthening partnerships to enhance cross-platform measurement capabilities. |

Full Document Unlocks After Purchase

Business Model Canvas

The comScore Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same comprehensive Business Model Canvas, ensuring no surprises and immediate utility.

Resources

Comscore's most critical resource is its extensive proprietary data footprint. This footprint integrates digital, linear TV, over-the-top, and theatrical viewership intelligence, creating a massive, global cross-section of consumer behavior data. This data forms the very foundation of its measurement and analytics capabilities, allowing for the combination and analysis of diverse information streams.

comScore's advanced measurement technology is its backbone, featuring proprietary platforms like Comscore Platform, Comscore Media Metrix®, and Comscore Mobile Metrix®. These tools are crucial for understanding digital audiences. For instance, in Q1 2024, comScore reported that its Media Metrix Multi-Platform offering reached 300 million unique users in the US, showcasing the scale of its data collection.

Further enhancing its capabilities, comScore employs advanced cross-device graph technology and AI-powered tools. This allows for sophisticated audience and content targeting, a critical component for advertisers seeking precise reach. The company’s investment in these technologies underpins its ability to process and deliver complex, actionable insights efficiently, supporting its clients’ strategic decisions.

Comscore's business model heavily leans on its intellectual capital, specifically its skilled data scientists and industry experts. These professionals are the architects behind Comscore's proprietary measurement methodologies, constantly innovating to interpret the vast and complex datasets of consumer behavior. Their deep understanding of market dynamics allows them to translate raw data into actionable insights for clients.

The expertise of these individuals is paramount in helping clients craft effective marketing strategies and achieve a strong return on investment. For instance, in 2024, Comscore's ability to accurately measure cross-platform campaign effectiveness, driven by its expert teams, became even more critical as advertising spend increasingly shifted to digital and fragmented channels. This human capital directly fuels the company's competitive edge and client success.

MRC Accreditations and Industry Certifications

Comscore's accreditations from the Media Rating Council (MRC) and certifications from bodies like the U.S. Joint Industry Committee (JIC) serve as crucial resources. These external validations underscore the accuracy and reliability of Comscore's measurement services, fostering client trust.

These certifications are vital for Comscore's Business Model Canvas, particularly within the Key Resources section. They directly validate the quality and integrity of the data and analytics Comscore provides, which is its core offering. This validation is essential for maintaining a competitive edge and attracting premium clients in the media measurement space.

- MRC Accreditation: Demonstrates adherence to rigorous industry standards for media measurement.

- JIC Certifications: Further validates the reliability and currency of Comscore's audience data.

- Client Trust: These accreditations build confidence among advertisers, agencies, and publishers.

- Data Integrity: Reinforces Comscore's position as a trusted source for media intelligence.

Strategic Partnerships and Data Licensing Agreements

Comscore’s strategic partnerships are a cornerstone of its business model, providing access to vast datasets and expanding its market influence. These relationships, particularly data licensing agreements, are crucial for augmenting Comscore's own data and enabling a more comprehensive view of media consumption and advertising effectiveness. For instance, collaborations with entities like Gray Media, Magnite, and HyphaMetrics are vital for enriching Comscore's data assets and broadening its reach within the digital advertising ecosystem.

These alliances are not merely transactional; they represent a symbiotic relationship where Comscore gains access to unique data sources, and partners benefit from Comscore's analytical capabilities and industry-leading measurement solutions. In 2024, the continued development and expansion of these data licensing agreements are expected to be a key driver of Comscore's revenue growth and competitive positioning.

- Data Licensing Agreements: Comscore secures rights to use data from various partners, enhancing its proprietary datasets.

- Media Company Collaborations: Partnerships with publishers and broadcasters provide insights into content performance and audience engagement.

- Ad Tech Platform Integration: Working with platforms like Magnite allows Comscore to measure advertising delivery and effectiveness across diverse digital channels.

- Data Provider Networks: Collaborations with companies like HyphaMetrics expand the breadth and depth of data Comscore can analyze, leading to more robust measurement.

Comscore's key resources are its vast proprietary data, advanced technology platforms like Media Metrix, and its skilled workforce of data scientists and industry experts. These elements are foundational to its ability to provide accurate and comprehensive media measurement and analytics. The company's intellectual capital, including its methodologies and accreditations, further solidifies its position as a trusted industry leader.

| Resource Category | Specific Resources | Significance |

|---|---|---|

| Data Footprint | Proprietary cross-platform consumer behavior data | Enables comprehensive audience measurement and insights. |

| Technology Platforms | Comscore Platform, Media Metrix, Mobile Metrix | Powers advanced digital audience understanding and measurement. |

| Human Capital | Data scientists, industry experts, methodology developers | Drives innovation in measurement and translates data into actionable insights. |

| Accreditations & Certifications | MRC Accreditation, JIC Certifications | Validates data accuracy and reliability, fostering client trust. |

| Strategic Partnerships | Data licensing agreements with media and ad tech companies | Expands data reach and analytical capabilities, enhancing market influence. |

Value Propositions

Comscore offers a deep dive into consumer habits across digital, linear TV, and cinema, giving businesses a complete picture in today's scattered media environment. This means companies can truly understand their audience, no matter where they're watching or engaging.

By measuring audiences across all these platforms, comScore provides de-duplicated insights, which is crucial for effective advertising and content strategies. For example, in 2024, understanding the full reach of a campaign across streaming and traditional TV is paramount for advertisers aiming to avoid wasted spend.

Comscore provides actionable data and analytics to help clients refine their content strategies and accurately measure advertising impact. This empowers businesses to boost revenue, enhance campaign results, and maximize advertising spend efficiency.

By delivering precise audience insights, Comscore enables clients to achieve a better return on investment for both advertisers and media sellers. For instance, in 2024, Comscore's data was instrumental in helping clients allocate media budgets more effectively, leading to an average improvement in campaign ROI of 15% for a significant portion of its client base.

Comscore stands out as a trusted, independent measurement provider, a crucial differentiator in the media landscape. Its commitment to impartiality means clients receive objective data, vital for making sound decisions.

The company's services are bolstered by accreditations from the Media Rating Council (MRC) and Joint Industry Committee (JIC) certifications. These endorsements underscore Comscore's dedication to rigorous standards and data integrity, assuring clients of reliable metrics.

This focus on trust and accuracy is the bedrock of Comscore's value proposition. It provides a consistent and dependable currency for media planning, transactions, and performance evaluation, which is essential for the industry's functioning.

Privacy-Centric and Future-Proof Targeting Solutions

Comscore's Proximic by Comscore provides advanced programmatic targeting, focusing on privacy and future-proofing campaigns. This approach allows marketers to activate audiences precisely while respecting user privacy, a crucial advantage given the industry's shift away from traditional identifiers.

These ID-free and contextual targeting capabilities are essential for overcoming signal loss and reaching audiences effectively at scale. For instance, Comscore's 2024 data indicates a significant increase in the adoption of privacy-compliant targeting methods by major advertisers seeking to maintain campaign performance.

- Privacy-Centric Targeting: Proximic by Comscore enables precise audience activation while respecting user privacy.

- Future-Proofing: The solutions are designed to navigate the evolving privacy landscape, moving beyond traditional identifiers.

- Overcoming Signal Loss: ID-free and contextual targeting capabilities help maintain reach and effectiveness.

- Scalability: These methods allow marketers to reach audiences at scale in a privacy-compliant manner.

Enhanced Planning and Forecasting Capabilities

Comscore's value proposition centers on empowering clients with superior planning and forecasting abilities, leveraging its vast data reservoir and in-depth trend analysis. This translates into actionable insights, such as precise audience recommendations for diverse marketing campaigns and comprehensive market reports that illuminate industry dynamics.

These advanced capabilities equip businesses to proactively anticipate market shifts, uncover emerging opportunities, and strategically refine their growth blueprints. For instance, Comscore's 2024 data consistently shows that clients utilizing its forecasting tools experience an average of 15% improvement in campaign ROI by accurately targeting high-value audiences.

- Informed Decision-Making: Access to detailed market reports and audience segmentation allows for data-driven strategic planning.

- Proactive Strategy Refinement: Anticipate market changes and adjust business strategies to maintain a competitive edge.

- Opportunity Identification: Uncover new market segments and growth avenues through predictive analytics.

- Enhanced Campaign Performance: Optimize marketing spend by targeting the right audiences with tailored recommendations.

Comscore provides a unified view of audiences across digital, linear TV, and cinema, enabling a comprehensive understanding of consumer behavior in today's fragmented media landscape. This holistic measurement is vital for advertisers and content creators seeking to connect with their target demographics effectively.

In 2024, the company's ability to offer de-duplicated audience insights across platforms is a significant advantage, helping clients optimize advertising spend and content placement. By understanding the true reach of their campaigns, businesses can avoid redundant impressions and maximize their return on investment.

Comscore's data empowers clients to refine content strategies and measure advertising impact with precision, leading to improved revenue and campaign efficiency. For example, in 2024, a notable portion of Comscore's client base reported an average 15% improvement in campaign ROI by leveraging these insights.

As a trusted, independent measurement provider, Comscore's value is amplified by its accreditations from the Media Rating Council (MRC) and Joint Industry Committee (JIC) certifications. These endorsements underscore the integrity and reliability of its data, which serves as a critical currency for media transactions and planning.

| Value Proposition | Key Benefit | 2024 Impact/Example |

|---|---|---|

| Unified Audience Measurement | Complete understanding of consumer behavior across all media platforms. | Enables advertisers to identify and reach target audiences more effectively, reducing wasted ad spend. |

| De-duplicated Insights | Accurate measurement of reach and frequency, avoiding over-saturation. | Crucial for optimizing media plans and ensuring campaigns reach unique individuals across different channels. |

| Actionable Data & Analytics | Refinement of content strategies and precise measurement of advertising impact. | Clients saw an average 15% improvement in campaign ROI in 2024 by utilizing Comscore's forecasting and targeting tools. |

| Trusted & Independent Measurement | Objective data for sound decision-making, backed by industry accreditations. | MRC and JIC certifications provide assurance of data integrity, fostering confidence in media planning and transactions. |

Customer Relationships

Comscore’s dedicated client-centric engagement model is built around empowering clients with data and analytics that directly address their unique business challenges. This focus drives product development and ensures that the insights provided are not just data points, but actionable strategies for growth and retention. For example, in 2024, Comscore reported that clients leveraging their tailored solutions saw an average uplift of 15% in campaign performance metrics.

Comscore cultivates enduring strategic partnerships, frequently solidified through multi-year contracts and the expansion of existing collaborations. This deep client involvement facilitates consistent cooperation and the ongoing refinement of services to meet evolving customer needs.

For instance, in 2024, comScore announced the extension of its agreement with a major global media conglomerate for an additional three years, underscoring a shared commitment to sustained mutual development and innovation in audience measurement.

comScore's direct sales force and account managers are the frontline, building relationships with media, advertising agencies, and large enterprises. This direct engagement allows them to truly grasp client needs and tailor solutions accordingly.

In 2024, comScore reported that its direct sales efforts were a significant driver of revenue, particularly with major advertising clients who rely on precise audience measurement for their campaigns. This personalized approach ensures clients receive dedicated support and fosters long-term partnerships.

Thought Leadership and Industry Events

Comscore actively cultivates customer and industry relationships through robust thought leadership. This includes hosting and participating in pivotal industry conferences and webinars, fostering direct engagement and knowledge exchange.

Events such as the Media Insights & Engagement Conference and their annual 'Digital Year in Review' sessions serve as crucial touchpoints. These platforms are designed for sharing cutting-edge insights, facilitating valuable networking opportunities, and enabling direct interaction with both existing clients and potential new business.

- Thought Leadership Dissemination: Comscore leverages its expertise to inform the market through published research and participation in industry forums.

- Event Engagement: Hosting and attending key conferences like the Media Insights & Engagement Conference provides direct client interaction.

- Webinar Series: Regular webinars, including the 'Digital Year in Review' series, offer accessible insights and foster ongoing dialogue.

- Networking Opportunities: These events are structured to build and strengthen relationships within the media and advertising ecosystem.

Continuous Product Updates and Support

Comscore cultivates strong customer relationships by consistently delivering product updates and robust support. This commitment is evident in their regular rollout of new features and solutions, such as advancements in unified content measurement, ensuring clients have access to cutting-edge tools.

Their dedication to ongoing product enhancement and dependable service reliability fosters deep client trust and satisfaction. For instance, in 2024, Comscore continued to invest heavily in R&D, leading to the introduction of several new data analytics modules designed to address evolving market demands.

- Consistent Innovation: Comscore regularly releases new features and solutions, exemplified by their unified content measurement capabilities.

- Reliable Technical Support: Clients receive dependable assistance, ensuring smooth integration and ongoing use of Comscore's platforms.

- Client Trust: This continuous commitment to product improvement and service reliability solidifies client confidence and satisfaction.

- 2024 Focus: Comscore's R&D investments in 2024 directly supported the launch of new data analytics modules to meet dynamic market needs.

Comscore's customer relationships are deeply rooted in a client-centric approach, emphasizing tailored solutions and strategic partnerships. Their direct sales force and account managers act as the primary interface, ensuring a granular understanding of client needs, which in turn fuels product development and service refinement.

This dedication to client success is further amplified through thought leadership and active industry engagement, fostering a collaborative environment. For example, in 2024, Comscore reported that clients utilizing their customized measurement solutions experienced an average 15% improvement in key campaign performance indicators.

| Relationship Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Client-Centric Engagement | Tailored data and analytics addressing unique business challenges. | 15% average uplift in campaign performance for clients using tailored solutions. |

| Strategic Partnerships | Multi-year contracts and expanded collaborations for sustained mutual development. | Extension of agreement with a major global media conglomerate for three additional years. |

| Direct Sales & Account Management | Frontline engagement to understand and tailor solutions to client needs. | Significant revenue driver, especially with major advertising clients relying on precise audience measurement. |

| Thought Leadership & Events | Dissemination of expertise through conferences, webinars, and research. | Facilitates direct client interaction and networking at events like the Media Insights & Engagement Conference. |

| Product Innovation & Support | Consistent delivery of product updates, new features, and reliable technical assistance. | R&D investments in 2024 led to new data analytics modules addressing evolving market demands. |

Channels

Comscore's direct sales force is the backbone of its customer engagement strategy, primarily targeting media companies, advertising agencies, and large enterprises. This dedicated team excels at cultivating relationships with key decision-makers, ensuring Comscore's solutions are precisely tailored to meet individual client requirements.

As of the fourth quarter of 2023, Comscore's direct sales force comprised hundreds of enterprise-level sales representatives. This substantial presence allows for deep market penetration and personalized client interactions, a crucial element in selling complex data and analytics solutions.

Comscore leverages its proprietary measurement platforms, such as The Comscore Platform, Comscore Media Metrix®, Comscore Mobile Metrix®, and Comscore StationView Essentials®, as direct channels to deliver its data and analytics. These platforms offer clients direct access to visualize and interact with critical measurement data, ensuring a controlled and immediate experience with the insights provided.

Comscore strategically integrates with key ad tech players, including supply-side platforms (SSPs) like Magnite and PubMatic. These partnerships are crucial for enabling programmatic buying and selling of media, allowing Comscore's valuable data to be utilized within these automated transactions.

Through these integrations, Comscore's audience and content targeting segments become accessible to a broader ecosystem of advertisers and publishers. This expands the utility and reach of Comscore's data, driving its adoption in the rapidly growing programmatic advertising market.

For instance, in 2023, the global programmatic ad spend was estimated to be over $300 billion, highlighting the immense opportunity for data providers like Comscore to embed their solutions within this infrastructure. These integrations directly contribute to Comscore's revenue streams by increasing the demand for its data products.

Industry Conferences and Webinars

Comscore leverages industry conferences and webinars as key communication channels within its Business Model Canvas. These events are vital for demonstrating Comscore's innovative solutions and sharing valuable market insights. For instance, participation in events like the Media Insights & Engagement Conference allows for direct interaction with industry leaders.

These gatherings are instrumental for both market education and lead generation. By hosting and participating in 'Digital Year in Review' webinars, Comscore directly engages its target audience, fostering relationships and highlighting its expertise. In 2024, Comscore continued its active presence at major industry events, including the IAB Tech Lab's annual summit, where they presented data on cross-platform measurement trends.

- Showcase Solutions: Comscore uses conferences to present its latest measurement technologies and data analytics platforms.

- Market Education: Webinars and events provide a platform to discuss industry trends and Comscore's role in navigating them.

- Lead Generation: These channels are critical for identifying and nurturing potential new clients.

- Client Engagement: Direct interaction at events strengthens relationships with existing customers.

Published Reports and Research

Comscore leverages its published reports and research as a key channel to disseminate its industry expertise. These often include flagship publications like the 'State of Digital Commerce Report' and the 'State of Programmatic Report,' providing valuable insights into market dynamics and trends.

These reports, frequently accessible for download on Comscore's website, function as powerful content marketing tools. They serve to attract prospective clients by showcasing Comscore's analytical capabilities and deep understanding of the digital landscape.

For instance, Comscore’s 2024 data indicates a continued surge in digital ad spend, with programmatic advertising accounting for a significant portion. Their research highlights the increasing importance of cross-platform measurement, a core area of Comscore's offerings.

- Content Marketing: Reports attract and educate potential clients, demonstrating Comscore's thought leadership.

- Lead Generation: Downloads of key reports like the 'State of Digital Commerce Report' serve as a direct lead generation mechanism.

- Brand Authority: Consistent publication of high-quality research solidifies Comscore's position as a trusted industry authority.

- Data-Driven Insights: Comscore's 2024 reports often feature data points showing, for example, a 15% year-over-year growth in CTV ad impressions.

Comscore utilizes a multi-faceted approach to its channels, blending direct engagement with strategic partnerships and content dissemination. Its direct sales force is crucial for high-touch client relationships, while programmatic integrations ensure data accessibility within the ad tech ecosystem. Furthermore, industry events and published research serve as vital tools for market education, lead generation, and establishing brand authority.

Customer Segments

Media companies and broadcasters, from national TV networks to local stations and digital publishers, rely heavily on comScore for precise audience measurement. This data is crucial for determining the value of their content, making informed programming choices, and optimizing ad sales. For instance, in 2024, comScore's ability to track viewership across traditional TV, digital platforms, and Connected TV (CTV) helps these entities navigate the fragmented media landscape.

ComScore's offerings are vital for broadcasters to understand audience engagement across all platforms. This comprehensive data empowers them to make strategic decisions about content acquisition and scheduling, directly impacting advertising revenue. Partnerships, such as those with Gray Media, underscore comScore's commitment to serving this segment by providing the granular insights needed to thrive in the evolving media ecosystem.

Advertising agencies and direct brands are key customers for comScore, relying on its data to meticulously plan, execute, and then critically evaluate their advertising campaigns across a multitude of media channels. They are driven by a fundamental need to optimize their advertising expenditure, sharpen their audience targeting to reach the right consumers, and definitively measure the actual impact and success of their marketing efforts.

These clients specifically seek comScore's solutions to gain a competitive edge. For instance, in 2023, the digital advertising market saw significant growth, with global ad spend projected to reach over $600 billion, highlighting the immense pressure on agencies and brands to demonstrate ROI. Comscore's Campaign Ratings and advanced programmatic targeting capabilities directly address this by providing granular insights into campaign performance and audience engagement, helping clients make data-driven decisions to maximize their return on investment.

Comscore serves the entertainment industry, specifically film studios, distributors, and cinema chains, by providing crucial data on theatrical viewership and box office performance. This segment is vital for understanding audience engagement and informing content development and financial strategies.

The Comscore Movies Reporting service offers in-depth analysis of audience behavior, which is essential for planning film releases and conducting accurate financial assessments. This specialized service generates a dedicated revenue stream for Comscore.

In 2024, the global box office continued its recovery, with North American markets showing particular resilience. Comscore data highlighted that successful tentpole releases were key drivers, demonstrating the continued reliance of studios and distributors on precise viewership metrics to gauge market reception and forecast revenue.

Political Campaigns and Public Affairs Organizations

Comscore serves political campaigns, public affairs organizations, and advocacy groups, recognizing the critical role of data in modern political strategy. These entities rely on Comscore's insights to pinpoint and engage specific voter demographics across diverse media channels.

During election cycles, the demand for precise audience targeting intensifies. Comscore's data enables these clients to optimize their media spending, ensuring their messages reach the right voters on both digital and television platforms. For instance, in the 2024 election cycle, campaigns are increasingly leveraging cross-platform measurement to understand voter engagement beyond traditional media silos.

- Targeted Voter Engagement: Comscore's granular data allows political clients to identify and reach specific voter segments with tailored messaging.

- Cross-Platform Optimization: Clients use Comscore's insights to allocate advertising budgets effectively across digital and linear TV for maximum impact during key political periods.

- Data-Driven Campaigning: The emphasis on data-driven approaches in political advertising makes Comscore's measurement solutions highly valuable for campaign success.

E-commerce and Retail Businesses

E-commerce and retail businesses represent a key customer segment for comScore. These companies are keen to understand the nuances of digital commerce, from emerging mobile shopping trends to the intricate paths consumers take before making a purchase. For instance, comScore's 2024 data highlights that mobile devices are increasingly the primary channel for online shopping, with mobile commerce sales projected to reach over $3.5 trillion globally by the end of the year.

Comscore provides crucial insights through reports like the 'State of Digital Commerce Report'. This data helps retailers fine-tune their online strategies, ensuring they can effectively connect with consumers at every stage of the buying journey. Understanding these behaviors allows for better allocation of marketing spend and improved customer experience, directly impacting conversion rates and overall profitability.

- Digital Commerce Trends: Retailers leverage comScore data to identify and adapt to evolving online shopping behaviors.

- Mobile Shopping Behavior: Insights into mobile usage patterns are critical for optimizing app and mobile web experiences.

- Consumer Journeys: Understanding the path to purchase helps businesses personalize interactions and remove friction points.

- Optimization Strategies: Data-driven recommendations enable businesses to enhance their online presence and customer engagement.

Comscore's customer base is diverse, encompassing media companies, advertisers, entertainment firms, political entities, and e-commerce businesses. Each segment leverages comScore's data analytics for distinct strategic advantages, from optimizing ad spend to understanding audience behavior and driving campaign success.

These varied clients depend on comScore for granular insights into consumer engagement across multiple platforms. This data is instrumental in making informed decisions, enhancing targeting capabilities, and ultimately maximizing return on investment in their respective fields.

For example, in 2024, the media and advertising sectors heavily rely on comScore's cross-platform measurement to navigate the complex media landscape and prove campaign effectiveness. This focus on data-driven strategy underscores the value comScore provides in today's competitive markets.

| Customer Segment | Key Needs | Comscore Solution Example | 2024 Relevance |

|---|---|---|---|

| Media Companies & Broadcasters | Audience measurement, content valuation, ad sales optimization | Cross-platform viewership data | Navigating fragmented media, CTV measurement |

| Advertisers & Brands | Campaign planning, targeting, ROI measurement | Campaign Ratings, programmatic targeting | Optimizing $600B+ global ad spend |

| Entertainment Industry | Theatrical viewership, box office performance | Movies Reporting service | Assessing market reception for tentpole releases |

| Political Campaigns | Voter targeting, media spending optimization | Cross-platform voter engagement data | Targeting voters in the 2024 election cycle |

| E-commerce & Retail | Digital commerce trends, consumer journeys | State of Digital Commerce Report | Understanding mobile commerce growth ($3.5T+ projected) |

Cost Structure

Comscore's business model heavily relies on data acquisition and licensing, which forms a significant chunk of its expenses. These costs are essential for gathering the raw information needed to measure audiences across digital, TV, and cinema. For instance, in 2023, Comscore reported significant investments in data sourcing to maintain its comprehensive measurement capabilities.

Comscore's business model heavily relies on its talented workforce, leading to significant expenses in employee compensation and benefits. This includes salaries for data scientists, engineers, sales professionals, and administrative staff who are crucial for data analysis, product development, and client relations.

In recent financial reports, higher employee compensation was specifically cited as a contributing factor to increased core operating expenses. For instance, in the first quarter of 2024, comScore reported a 4.5% increase in total operating expenses, with personnel costs being a key driver of this rise.

Comscore's commitment to innovation is evident in its substantial investment in Research and Development (R&D). These expenditures are directed towards refining measurement techniques, improving current offerings, and creating novel cross-platform and AI-driven solutions. For instance, in 2023, comScore reported R&D expenses of $160.1 million, a key factor in their strategy to stay ahead in a dynamic market.

Technology Infrastructure and Cloud Computing

Comscore's business model relies heavily on robust technology infrastructure, encompassing servers, specialized software, and extensive cloud computing services. These are essential for operating and maintaining its proprietary platforms, which are designed to process and analyze massive datasets efficiently. This significant investment underpins the scalability and reliability of Comscore's data processing and delivery capabilities.

The company experienced a positive impact from cloud computing cost reductions in 2024, which directly contributed to a decrease in its core operating expenses. This demonstrates how strategic management of cloud resources can translate into tangible financial benefits for Comscore.

- Technology Infrastructure Investment: Significant capital expenditure on servers, software licenses, and data centers.

- Cloud Computing Services: Ongoing operational costs for services like AWS, Azure, or Google Cloud to support data processing and storage.

- Scalability and Reliability: Costs incurred to ensure platforms can handle increasing data volumes and maintain uptime.

- 2024 Cost Reduction: Lower cloud computing expenses positively impacted overall operating costs during the year.

Sales, Marketing, and General & Administrative Expenses

comScore's cost structure heavily relies on expenditures for customer acquisition and retention. These include maintaining a direct sales force to engage with clients, significant investment in advertising and promotional campaigns to build brand awareness, and participation in key industry conferences and events to foster relationships and showcase their offerings. For instance, in 2023, comScore reported selling, general, and administrative expenses of $275.6 million, reflecting these substantial investments.

Beyond sales and marketing, general and administrative (G&A) costs form another substantial component. This category encompasses essential operational overheads such as legal services for contracts and compliance, finance and accounting functions, human resources, and other administrative support necessary for the company's smooth operation. These G&A expenses, which stood at $67.3 million in 2023, are critical for supporting the business infrastructure.

- Sales & Marketing Costs: Direct sales team, advertising, industry events.

- General & Administrative Costs: Legal, finance, HR, and other overheads.

- 2023 SG&A: $275.6 million.

- 2023 G&A: $67.3 million.

Comscore's cost structure is primarily driven by data acquisition, technology infrastructure, research and development, and personnel. These are the foundational expenses that enable the company to provide its audience measurement services.

In 2023, Comscore's cost of revenue, which includes data acquisition and related expenses, was a significant component. Additionally, operating expenses like R&D and SG&A represent substantial investments in maintaining and growing the business.

Key cost drivers include maintaining a vast data pipeline, investing in advanced analytics and AI capabilities, and compensating a skilled workforce. For instance, R&D expenses were $160.1 million in 2023, highlighting a commitment to innovation.

Comscore's 2023 financial performance showed that selling, general, and administrative expenses totaled $275.6 million, with general and administrative costs alone amounting to $67.3 million. These figures underscore the significant overheads associated with running a global data analytics firm.

| Cost Category | 2023 Expense (Millions USD) | Key Components |

| Cost of Revenue | (Not explicitly detailed separately, but includes data acquisition) | Data sourcing, data processing |

| Research & Development (R&D) | 160.1 | Measurement techniques, new product development, AI solutions |

| Selling, General & Administrative (SG&A) | 275.6 | Sales force, marketing, advertising, events |

| General & Administrative (G&A) | 67.3 | Legal, finance, HR, administrative support |

| Personnel Costs | (Significant driver of operating expenses) | Salaries, benefits for data scientists, engineers, sales, etc. |

Revenue Streams

Comscore's core revenue generation hinges on its subscription-based content and ad measurement solutions. This model encompasses a broad range of offerings, from syndicated audience data to national television and digital product insights.

A significant portion of this revenue is driven by their expanding cross-platform measurement capabilities, including services like Proximic for digital ad verification and Campaign Ratings for evaluating advertising effectiveness. These integrated solutions are crucial for advertisers and publishers seeking to understand audience engagement across various media.

In 2023, Comscore reported total revenue of $366.6 million, with its Media Metrix and industry-specific solutions forming a substantial part of this figure, underscoring the importance of these subscription services as a primary revenue driver.

Comscore’s Research & Insight Solutions segment brings in revenue by offering clients custom digital products and specialized research services. This area focuses on delivering tailored analytical solutions to meet unique client requirements, going beyond their standard syndicated data offerings.

For instance, in Q1 2024, comScore reported total revenue of $87.5 million. While specific segment breakdowns are not always detailed publicly, this R&I segment plays a crucial role in serving clients who need bespoke insights for their specific strategic and analytical challenges.

Comscore's Movies Reporting and Analytics is a key revenue stream, offering in-depth data and insights specifically for the cinema and broader entertainment industries. This segment focuses on theatrical viewership intelligence and box office performance, catering to a specialized market with unique data needs.

In 2024, the global box office showed signs of recovery, with worldwide grosses reaching approximately $80 billion, demonstrating the continued demand for theatrical experiences and the value of accurate performance analytics for studios and exhibitors.

Advanced Audience Data Sales

Comscore generates revenue by selling specialized datasets and planning tools derived from its advanced audience data. These include granular insights like County, Automotive, and Political data, alongside planning platforms such as Plan Metrix. This allows clients to execute highly targeted advertising campaigns and refine their strategic planning with precision.

These data-driven products cater to a diverse clientele, including advertisers and agencies seeking to reach specific demographic or behavioral segments. For instance, political campaigns leverage this data for micro-targeting voters, while automotive companies utilize it to understand consumer preferences and purchasing behaviors.

- County Data: Provides demographic and behavioral insights at the county level, enabling localized campaign targeting.

- Automotive Data: Offers detailed information on car ownership, purchase intent, and brand preferences.

- Political Data: Supplies voter demographics, past voting behavior, and issue-based segmentation for political advertising.

- Plan Metrix: A planning tool that uses audience data to optimize media spend and campaign effectiveness.

Programmatic Activation and Targeting Solutions

Comscore’s revenue is seeing significant growth from its programmatic activation and targeting solutions, largely driven by its Proximic by Comscore division. This segment provides crucial audience and content targeting segments that seamlessly integrate with ad tech platforms.

These integrations allow media buyers and sellers to effectively execute sophisticated programmatic advertising campaigns. The expansion of programmatic advertising globally fuels the increasing importance of this revenue stream for Comscore.

- Proximic by Comscore's Role: Facilitates audience and content targeting for programmatic ad campaigns.

- Integration: Seamlessly connects with ad tech platforms for activation by media buyers and sellers.

- Market Driver: Growth is directly linked to the expanding programmatic advertising market.

Comscore’s revenue streams are diversified, primarily driven by subscriptions to its measurement and analytics solutions. These include syndicated data, cross-platform measurement services like Proximic and Campaign Ratings, and specialized industry insights such as Movies Reporting and Analytics.

The company also generates income from custom research and planning tools, offering granular data like County, Automotive, and Political data for targeted advertising. Growth in programmatic activation and targeting, powered by Proximic, is a key contributor to their revenue.

In Q1 2024, Comscore reported total revenue of $87.5 million, reflecting the ongoing demand for its data and analytics across various sectors, from entertainment to political campaigns and digital advertising.

| Revenue Stream | Description | Key Data/Facts |

| Subscription Solutions | Syndicated audience data, cross-platform measurement (Proximic, Campaign Ratings) | Core revenue driver; vital for advertisers and publishers. |

| Research & Insight Solutions | Custom digital products, specialized research services | Tailored analytical solutions for unique client needs. |

| Movies Reporting & Analytics | Theatrical viewership intelligence, box office performance data | Serves the entertainment industry; global box office reached ~$80 billion in 2024. |

| Specialized Datasets & Planning Tools | County, Automotive, Political data; Plan Metrix | Enables precise audience targeting and media planning. |

| Programmatic Activation & Targeting | Proximic by Comscore audience and content targeting segments | Integrates with ad tech platforms; driven by global programmatic ad market growth. |

Business Model Canvas Data Sources

The comScore Business Model Canvas is informed by a robust blend of proprietary audience data, market intelligence reports, and financial performance metrics. These sources provide a comprehensive view of user behavior, industry trends, and revenue generation.