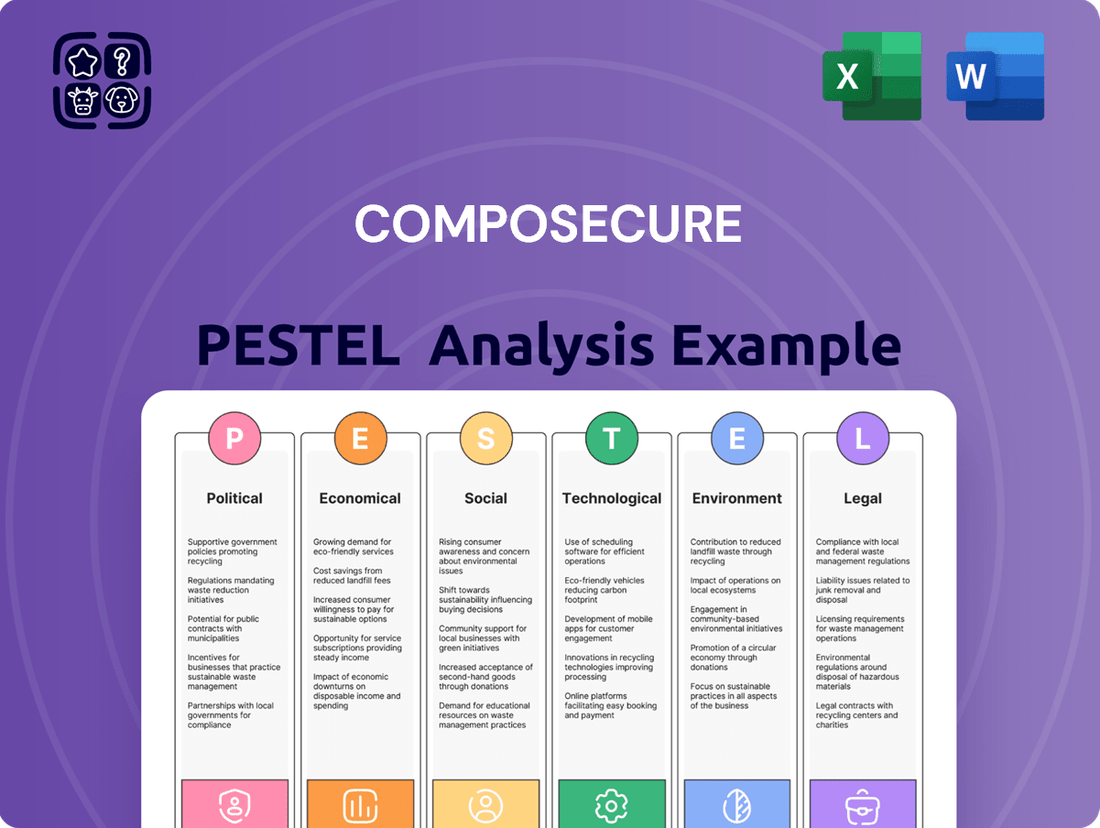

CompoSecure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CompoSecure Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping CompoSecure's trajectory. This comprehensive PESTLE analysis provides the essential external intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

Governments globally are tightening oversight of financial services, aiming to safeguard consumers and ensure market stability. This trend directly affects CompoSecure, especially regarding its premium payment card offerings, by imposing stricter anti-money laundering (AML) and know-your-customer (KYC) mandates. For instance, the European Union's AMLD6 directive, fully transposed into national laws by June 2021, expanded the scope of predicate offenses for money laundering, requiring enhanced due diligence for all financial transactions, which CompoSecure must navigate in its card issuance processes.

Global geopolitical tensions and evolving trade policies present significant considerations for CompoSecure. For instance, ongoing trade disputes between major economic blocs could directly impact the cost and availability of specialized materials crucial for metal card production, potentially increasing operational expenses. The International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, but noted that geopolitical fragmentation could hinder this outlook.

Shifting trade agreements and tariffs can disrupt CompoSecure's supply chain, affecting manufacturing costs and the accessibility of key components. For example, a tariff on imported metals used in premium card manufacturing could necessitate price adjustments or sourcing from alternative, potentially more expensive, suppliers. Political instability in regions where CompoSecure has a significant market presence could also lead to reduced consumer spending on premium financial products, impacting revenue streams.

The global cryptocurrency regulatory environment is a dynamic and often fragmented landscape. For CompoSecure, which offers security solutions for digital assets, this means navigating a complex web of rules. For instance, the United States has seen various proposals and actions from agencies like the SEC and CFTC, with ongoing debates about whether cryptocurrencies are securities or commodities. This uncertainty directly impacts how CompoSecure's clients, such as crypto exchanges and custodians, operate and what security standards are mandated.

As of mid-2024, countries like El Salvador have adopted Bitcoin as legal tender, showcasing a highly favorable stance. Conversely, China has maintained a strict ban on cryptocurrency trading and mining. These divergent approaches create both opportunities and challenges for CompoSecure. A more regulated and accepted environment, like that seen in some European Union member states with their MiCA framework, can foster greater institutional adoption, thereby increasing demand for secure digital asset storage solutions. Conversely, outright bans or severe restrictions in key markets could curtail CompoSecure's growth potential.

Data Privacy and Cybersecurity Policies

Governments worldwide are intensifying their focus on data privacy and cybersecurity, with regulations like the EU's General Data Protection Regulation (GDPR) and various national data protection acts setting stringent standards. CompoSecure's business, heavily reliant on authentication and security solutions, must navigate these evolving legal landscapes to safeguard sensitive financial and personal information. Failure to adhere to these mandates can result in substantial financial penalties and severe damage to brand trust.

For instance, the financial sector faced significant cybersecurity threats in 2024, with reports indicating a substantial increase in data breaches targeting financial institutions. CompoSecure's commitment to compliance is therefore paramount.

- Global Data Protection Landscape: Increasing enactment of strict data privacy laws worldwide.

- CompoSecure's Compliance Imperative: Necessity to align authentication and security solutions with these regulations.

- Consequences of Non-Compliance: Risk of significant fines and reputational harm.

- Industry Trends: Growing cybersecurity threats impacting financial services in 2024.

Government Support for FinTech Innovation

Governments worldwide are increasingly recognizing the transformative potential of FinTech, leading to supportive policies. For instance, the UK's Financial Conduct Authority (FCA) operates a regulatory sandbox, which has seen over 1,000 firms participate since its inception, allowing them to test innovative products in a live market. This kind of environment directly benefits companies like CompoSecure, enabling them to trial new payment and security technologies with reduced regulatory friction.

Furthermore, financial incentives play a crucial role. In 2024, several countries announced new grant programs and tax credits aimed at FinTech startups and established players alike, aiming to spur domestic innovation. For example, a €100 million FinTech fund was launched in Germany in early 2025 to support R&D in areas like blockchain and AI for financial services. Such programs can lower the cost of innovation for CompoSecure, accelerating the development and deployment of their secure payment solutions.

The push for digital identity solutions by governments also presents a significant avenue for growth. Initiatives like the European Union's eIDAS regulation aim to standardize digital identification across member states, creating a more secure and interoperable digital ecosystem. CompoSecure's expertise in secure card and identity solutions positions them to capitalize on these evolving government-led digital identity frameworks, potentially integrating their technologies into national digital ID programs.

- Government support for FinTech innovation, including regulatory sandboxes, can accelerate product development for companies like CompoSecure.

- Financial incentives, such as grants and tax credits, reduce the cost of R&D for advanced payment and security solutions.

- Government-backed digital identity programs offer new market opportunities for secure identity management technologies.

- The global trend towards digital transformation in finance is driven by governmental initiatives promoting FinTech adoption.

Governments worldwide are increasingly focusing on financial sector regulation, impacting CompoSecure's operations. Stricter anti-money laundering (AML) and know-your-customer (KYC) rules, like those seen with the EU's AMLD6, necessitate robust compliance for card issuers. Geopolitical shifts and trade policies also influence material costs for premium cards, with global growth projections like the IMF's 3.2% for 2024 being susceptible to fragmentation.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting CompoSecure, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic threats and opportunities.

A clear, actionable summary of CompoSecure's PESTLE factors, enabling rapid identification of external opportunities and threats to inform strategic decisions.

Economic factors

Global economic growth directly impacts CompoSecure's premium card segment, as these are often discretionary luxury items. In 2024, the IMF projected global growth at 3.2%, a slight deceleration from 2023 but indicating continued expansion. This generally supports financial institutions investing in premium card programs and consumers opting for enhanced banking experiences.

Consumer spending power is a crucial driver. With inflation gradually moderating in many developed economies through late 2024 and into 2025, consumers may see their purchasing power rebound. For instance, US consumer spending increased by an annualized 3.1% in Q1 2024, demonstrating resilience that benefits CompoSecure's target market.

Conversely, an economic slowdown or recession would likely curb demand for premium payment solutions. A significant contraction in GDP or a sharp rise in unemployment could lead consumers and financial institutions to cut back on discretionary spending, directly affecting CompoSecure's sales of high-end cards.

Rising inflation presents a significant challenge for CompoSecure, as it directly impacts operational expenses. For instance, the cost of raw materials, crucial for producing their metal payment cards, saw an upward trend throughout 2024. This inflationary pressure can squeeze profit margins if not effectively passed on to customers.

Furthermore, fluctuating interest rates can affect CompoSecure's clients. As of early 2025, interest rates remain elevated compared to previous years. This makes it more costly for financial institutions to finance new card programs or invest in advanced technologies, potentially slowing down adoption of CompoSecure's innovative solutions.

CompoSecure's significant presence in the cryptocurrency sector exposes it directly to the wild swings characteristic of digital assets. For instance, Bitcoin, the largest cryptocurrency, experienced a dramatic drop of over 50% from its November 2021 peak to its 2022 lows, illustrating this inherent volatility.

Such price turbulence directly impacts the demand for secure storage solutions like CompoSecure's offerings, as investor confidence and capital flow into the crypto ecosystem ebb and flow. A prolonged downturn, such as the crypto winter of 2022-2023, can significantly curtail investment in digital asset infrastructure, potentially affecting CompoSecure's revenue streams.

Competition and Pricing Pressure

The payment card and security solutions sectors are inherently competitive, featuring a mix of long-standing companies and emerging innovators. This dynamic means CompoSecure must constantly adapt to market shifts and new technologies to maintain its edge.

Economic headwinds, such as inflation or potential recessions, can amplify pricing pressures. Companies like CompoSecure face the challenge of justifying premium product pricing while remaining cost-competitive, a delicate balancing act in a sensitive market. For instance, the global payment processing market, a key area for CompoSecure's offerings, was projected to grow significantly, but economic slowdowns could temper this growth and increase price sensitivity among clients.

- Intensified Price Wars: Economic downturns often lead to clients seeking lower-cost alternatives, forcing suppliers to compete more aggressively on price.

- Innovation as a Differentiator: To counter pricing pressure, CompoSecure's ability to offer unique technological features or superior design in its secure payment solutions becomes paramount for retaining market share and commanding premium pricing.

- Market Consolidation: Intense competition can sometimes lead to industry consolidation, where larger players acquire smaller ones, further concentrating market power and potentially increasing pricing leverage.

Disposable Income and Wealth Distribution

Disposable income and wealth distribution are critical for CompoSecure, as their premium metal cards appeal to consumers with higher discretionary spending power. For instance, in 2024, the global affluent segment, defined by investable assets of $1 million or more, continued to grow, with an estimated 22.7 million individuals worldwide, according to Knight Frank's Wealth Report 2024. This expanding base of high-net-worth individuals directly translates to a larger potential market for luxury payment solutions.

Shifts in how wealth is distributed can significantly influence CompoSecure's customer acquisition. A widening gap between the wealthiest and the middle class, or a contraction of the middle class itself, could narrow the addressable market for premium products. Conversely, a robust and growing middle class with increasing disposable income presents substantial opportunities for market penetration and product adoption.

Key considerations include:

- Growth in Affluent Population: The number of millionaires globally is projected to increase, creating a larger pool of potential customers for high-end payment cards.

- Disposable Income Trends: Monitoring disposable income levels in key markets like North America and Europe will be crucial for assessing demand for premium products.

- Wealth Inequality: Changes in wealth distribution patterns could impact the size of the target market segments for CompoSecure's offerings.

- Consumer Spending Habits: Understanding how disposable income is allocated by affluent consumers, particularly towards luxury goods and services, is vital for strategic planning.

Global economic conditions significantly influence CompoSecure's performance, particularly its premium card segment which relies on consumer discretionary spending. While the IMF projected global growth at 3.2% for 2024, indicating continued expansion, economic slowdowns or recessions could dampen demand for luxury payment solutions. Inflation also presents a challenge, increasing operational costs for raw materials like metal for cards, potentially squeezing profit margins if not passed on.

Interest rates, remaining elevated into early 2025, can make it more expensive for financial institutions to invest in new card programs, potentially slowing adoption of CompoSecure's innovative offerings. The company's exposure to the cryptocurrency sector means it's also subject to the volatility of digital assets, impacting demand for secure storage solutions during downturns.

Disposable income and wealth distribution are key drivers, with the affluent segment continuing to grow globally, offering a larger market for premium cards. For example, Knight Frank's Wealth Report 2024 estimated 22.7 million millionaires worldwide in 2024. However, shifts in wealth inequality could affect the size of the addressable market for CompoSecure's products.

| Economic Factor | Impact on CompoSecure | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Supports premium card demand; slowdowns curb it. | IMF projected 3.2% global growth in 2024. |

| Consumer Spending Power | Higher spending boosts demand for premium products. | US consumer spending grew 3.1% annualized in Q1 2024. |

| Inflation | Increases operational costs (raw materials). | Upward trend in raw material costs observed through 2024. |

| Interest Rates | Affects clients' investment in new programs. | Rates remained elevated into early 2025. |

| Wealth Distribution | Growth in affluent population expands target market. | 22.7 million millionaires globally in 2024 (Knight Frank). |

What You See Is What You Get

CompoSecure PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive CompoSecure PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a detailed breakdown of CompoSecure's Political, Economic, Social, Technological, Legal, and Environmental factors.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and actionable PESTLE analysis for CompoSecure.

Sociological factors

Consumers increasingly seek premium and personalized experiences, a trend evident in the financial services sector. CompoSecure's metal payment cards directly tap into this by providing a tangible marker of exclusivity and elevated status, aligning with a growing demand for differentiated offerings.

This preference is driving financial institutions to invest in high-end card products. For instance, in 2024, a significant portion of premium credit card holders reported valuing the prestige and enhanced benefits associated with metal cards, with some studies indicating a 15% higher engagement rate for these cardholders compared to standard plastic offerings.

The world is rapidly moving towards digital and contactless payments, a trend fueled by convenience and ongoing technological progress. For instance, in 2024, global digital payment transaction values were projected to reach over $13 trillion, highlighting the scale of this shift.

While CompoSecure's core business involves physical payment cards, these cards are crucial enablers within this expanding digital payment landscape, facilitating secure transactions. This societal preference for digital solutions underpins the robust market demand for sophisticated payment technologies and secure card manufacturing.

Consumers are increasingly worried about data breaches and how their personal and financial information is handled. This growing concern directly boosts the demand for strong security and authentication services, which is exactly what CompoSecure specializes in. For instance, a 2024 survey indicated that 78% of consumers consider data privacy a top priority when choosing financial service providers.

Companies that can prove they have top-notch security measures in place are not only gaining a competitive advantage but also building significant trust with their customers. This trust translates into loyalty and a willingness to engage with services that prioritize data protection, a key area where CompoSecure aims to excel.

Demographic Shifts and Generational Preferences

Demographic shifts significantly influence demand for CompoSecure's offerings. Younger generations, like Gen Z and younger millennials, often prioritize seamless digital experiences for financial transactions. However, a substantial portion of these same demographics, particularly those with growing wealth, still value the tangible security and premium feel of physical payment instruments, including metal cards. For instance, a 2024 report indicated that over 60% of millennials and Gen X consumers aged 25-55 expressed interest in premium metal credit cards for their perceived durability and status.

Generational preferences also shape how consumers interact with financial technology. While digital-first solutions are paramount for many younger users, older demographics, including affluent baby boomers and Gen X, often seek a blend of digital convenience and personalized, tactile experiences. CompoSecure's ability to cater to this spectrum, offering both advanced digital integrations and high-quality physical card manufacturing, positions it to capture diverse market segments. By 2025, it's projected that the demand for customized and luxury payment cards will continue to grow, driven by a desire for unique brand experiences across all age groups.

Understanding these generational nuances is critical for CompoSecure's market targeting and product development. Key considerations include:

- Digital Integration: Ensuring robust security and user-friendly interfaces for younger, digitally native consumers.

- Premium Physical Products: Continuing to innovate in the design and material of metal cards to appeal to affluent segments across generations.

- Hybrid Experiences: Developing solutions that bridge the gap between digital convenience and the tangible benefits of physical cards.

- Targeted Marketing: Tailoring marketing messages to resonate with the specific values and preferences of different generational cohorts.

Trust in Financial Institutions and Digital Assets

Societal trust is a critical driver for CompoSecure's business, impacting both traditional card services and emerging digital asset solutions. A recent 2024 survey indicated that while 78% of consumers express high trust in established banks, only 45% feel the same about cryptocurrency exchanges, highlighting a significant gap CompoSecure must navigate.

CompoSecure's established reputation in the secure card manufacturing sector benefits from this ingrained trust in traditional finance. However, the company's expansion into digital asset security solutions, such as cold storage hardware wallets, requires actively building confidence in these newer technologies. Public perception of security and reliability is paramount for widespread adoption of these digital asset products.

- Consumer Trust in Traditional Finance: In 2024, an estimated 78% of consumers reported a high level of trust in traditional financial institutions, underpinning CompoSecure's core business.

- Trust in Digital Assets: Conversely, only about 45% of consumers surveyed in early 2025 expressed similar high trust levels in cryptocurrency platforms.

- Impact on Adoption: This disparity directly influences the market penetration potential for CompoSecure's digital asset security offerings.

- Security as a Key Factor: Over 85% of respondents cited security and reliability as the most crucial factors when considering digital asset investments.

Societal shifts towards personalization and premium experiences directly benefit CompoSecure's metal card offerings, appealing to consumers seeking exclusivity. This trend is further amplified by a strong consumer demand for data security, with a significant majority prioritizing privacy when selecting financial services. Furthermore, evolving generational preferences, from digital-first engagement to a desire for tangible quality, create diverse market opportunities for CompoSecure's product range.

Technological factors

Continuous innovation in materials science and manufacturing processes is key for CompoSecure to enhance its metal payment cards. This allows for improved durability, security features, and sophisticated aesthetic designs that appeal to the premium market segment. For instance, advancements in etching and inlay techniques enable richer visual customization, a growing demand driver.

The integration of next-generation chip technologies and secure elements into these metal cards is paramount. CompoSecure's ability to incorporate these sophisticated components ensures enhanced transaction security and functionality, directly impacting customer trust and product competitiveness. By mid-2025, the penetration of dual-interface EMV chips is expected to exceed 95% in developed markets, a trend CompoSecure is well-positioned to capitalize on.

Staying at the forefront of manufacturing capabilities is not just about keeping pace; it's about market leadership. CompoSecure's investment in advanced production lines, such as those capable of intricate laser engraving and high-precision component embedding, directly supports its premium product strategy. This technological edge is vital for maintaining its position in a market where differentiation through quality and innovation is crucial.

The cybersecurity landscape is a dynamic battlefield, with threats constantly morphing and becoming more sophisticated. This necessitates CompoSecure's commitment to staying ahead of the curve by integrating advanced security measures. For instance, the global cybersecurity market was valued at approximately $231.7 billion in 2023 and is projected to reach $424.8 billion by 2030, highlighting the immense investment and innovation in this sector.

To effectively safeguard digital assets and financial transactions, CompoSecure's solutions must leverage cutting-edge technologies. This includes robust encryption protocols, seamless biometric authentication methods like fingerprint or facial recognition, and stringent multi-factor verification processes. These layers of security are paramount in an era where data breaches can have devastating financial and reputational consequences.

Continuous research and development are not merely beneficial but absolutely critical for CompoSecure in this domain. The company's ability to adapt and implement novel security and authentication technologies will directly impact its competitive edge and the trust placed in its products by financial institutions and consumers alike. Investment in R&D for cybersecurity is expected to see significant growth, with companies allocating substantial budgets to protect against emerging threats.

Blockchain and Distributed Ledger Technology (DLT) are fundamental to the cryptocurrency ecosystem, a key area for CompoSecure's secure storage and security solutions. As of early 2025, the global blockchain market is projected to reach over $150 billion, indicating significant growth and adoption.

Advancements in blockchain, like enhanced scalability solutions and improved interoperability protocols, directly translate into new avenues for CompoSecure's digital asset security offerings. For instance, the development of more efficient consensus mechanisms could reduce transaction times and costs, making digital asset management more appealing to a broader market.

Integration of AI and Machine Learning in Security

The integration of AI and machine learning is fundamentally reshaping the security sector, particularly in areas like fraud detection and threat intelligence. CompoSecure can harness these advanced capabilities to bolster its authentication and security products. This allows for more sophisticated, proactive defense against evolving cyber threats.

AI-powered predictive analytics are becoming crucial for anticipating and mitigating security breaches. For instance, the global AI in cybersecurity market was valued at approximately $21.4 billion in 2023 and is projected to reach $131.8 billion by 2030, demonstrating a significant growth trajectory. This trend highlights the increasing reliance on intelligent systems for safeguarding sensitive data and transactions.

- Enhanced Fraud Detection: AI algorithms can analyze vast datasets in real-time to identify anomalous patterns indicative of fraudulent activity, far exceeding human capabilities.

- Proactive Threat Intelligence: Machine learning models can predict potential cyber threats by analyzing global threat landscapes and identifying emerging attack vectors before they materialize.

- Improved Security Analytics: AI provides deeper insights into security events, enabling CompoSecure to refine its solutions and offer more robust protection for its clients.

Development of Digital Identity Solutions

The increasing demand for secure digital identities, incorporating biometrics and advanced credentials, represents a significant technological avenue for CompoSecure. The company's established strengths in secure authentication are well-positioned to evolve into offering complete digital identity management solutions. This aligns with the global push for more secure and streamlined digital experiences, a market expected to see substantial growth.

Consider these points regarding the development of digital identity solutions:

- Market Growth: The global digital identity solutions market was valued at approximately $30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030, reaching an estimated $70 billion.

- Biometric Adoption: Biometric authentication, including fingerprint and facial recognition, is becoming mainstream, with adoption rates in consumer electronics and enterprise security rapidly increasing. For instance, smartphone manufacturers are increasingly integrating advanced biometric sensors as standard features.

- Regulatory Tailwinds: Governments worldwide are investing in and mandating secure digital identity frameworks to combat fraud and enhance citizen services, creating a fertile ground for companies like CompoSecure to offer compliant solutions.

- CompoSecure's Opportunity: Leveraging CompoSecure's existing secure card technologies and authentication expertise, the company can expand its offerings to include digital wallets, secure credential issuance for online and physical access, and identity verification services, tapping into this expanding technological frontier.

Technological advancements in materials science continue to drive innovation in CompoSecure's metal payment card offerings, enabling enhanced durability and premium aesthetics. The integration of next-generation chip technologies, with dual-interface EMV chips expected to exceed 95% penetration in developed markets by mid-2025, is crucial for security and functionality.

CompoSecure's investment in advanced manufacturing, such as laser engraving and component embedding, solidifies its premium product strategy and market differentiation. The cybersecurity sector's rapid growth, projected to reach $424.8 billion by 2030, underscores the need for CompoSecure to adopt robust encryption, biometrics, and multi-factor authentication.

Blockchain technology's expansion, with the global market projected to surpass $150 billion by early 2025, presents new opportunities for CompoSecure's digital asset security solutions. Furthermore, the AI in cybersecurity market, anticipated to reach $131.8 billion by 2030, highlights the potential for AI-powered fraud detection and threat intelligence to enhance CompoSecure's offerings.

The digital identity solutions market, forecast to reach $70 billion by 2030 with a CAGR over 15%, offers CompoSecure a significant avenue for growth, leveraging its expertise in secure cards and authentication to develop comprehensive digital identity management services.

| Technology Area | 2023 Market Value (Approx.) | 2025 Projection (Approx.) | Key Impact for CompoSecure |

| Cybersecurity Market | $231.7 Billion | N/A (Growth Ongoing) | Necessitates advanced security measures and R&D investment. |

| AI in Cybersecurity | $21.4 Billion | N/A (Growth Ongoing) | Enables proactive threat detection and enhanced security analytics. |

| Blockchain Market | N/A (Growth Ongoing) | >$150 Billion | Opens avenues for digital asset security solutions. |

| Digital Identity Solutions | $30 Billion | N/A (Growth Ongoing) | Opportunity for expansion into digital wallets and credential services. |

Legal factors

CompoSecure operates within a tightly regulated financial landscape, necessitating strict adherence to standards like the Payment Card Industry Data Security Standard (PCI DSS). This is crucial for safeguarding sensitive cardholder data during manufacturing and processing. Failure to comply can result in hefty fines and reputational damage, impacting their ability to serve major financial institutions.

The ongoing evolution of chip card technology, governed by EMV specifications, also demands continuous adaptation from CompoSecure. Staying current with EMV requirements ensures their payment card products meet global security benchmarks. For instance, the EMV chip migration in the US has seen widespread adoption, with a significant majority of consumer payment cards now featuring chips, underscoring the importance of this compliance for market access.

Global data protection laws like GDPR and CCPA significantly impact CompoSecure. These regulations mandate stringent rules for handling personal data, crucial for a company dealing with sensitive financial information. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

CompoSecure must ensure its secure payment solutions and internal data management practices align with these evolving legal frameworks. This involves robust data anonymization, secure storage, and transparent data usage policies to avoid reputational damage and maintain customer confidence.

Staying compliant is an ongoing process requiring continuous adaptation and investment in data security technologies. CompoSecure's commitment to data privacy is paramount for its operations in 2024 and beyond, especially as data breach incidents continue to be a major concern for consumers and businesses alike.

The legal landscape for cryptocurrencies remains a patchwork, with evolving regulations around Anti-Money Laundering (AML) and Know-Your-Customer (KYC) impacting how companies like CompoSecure operate. These rules are crucial for preventing illicit activities, and compliance is non-negotiable. For instance, the Financial Action Task Force (FATF) continues to refine its guidance on virtual assets, influencing national regulations globally.

CompoSecure's crypto security solutions must align with these dynamic legal requirements, including those governing the custody of digital assets. Jurisdictional differences in these regulations, from the European Union's Markets in Crypto-Assets (MiCA) regulation to varying state-level rules in the United States, present a significant challenge. Navigating this fragmentation is key to CompoSecure's ability to offer secure and compliant services.

Intellectual Property Rights and Patents

Protecting CompoSecure's innovative payment card designs, advanced manufacturing techniques, and robust security technologies through patents and trademarks is paramount to sustaining its market advantage. Legal protection ensures that competitors cannot easily copy their unique offerings.

The enforcement of these intellectual property rights is key to preventing unauthorized replication of CompoSecure's solutions, thereby maintaining the company's exclusive control and market position. This legal framework safeguards their investment in research and development.

- Patent Filings: CompoSecure actively pursues patent protection for its novel security features and manufacturing processes. For instance, in 2024, the company continued to evaluate and file patents related to advanced contactless payment technologies.

- Trademark Protection: Key brand names and product identifiers are protected through trademarks, preventing brand dilution and ensuring customer trust in CompoSecure's quality and security.

- Legal Enforcement Actions: The company is prepared to take legal action against any infringements to defend its intellectual property portfolio and associated revenue streams.

Consumer Protection Laws and Product Liability

CompoSecure's premium payment cards and security solutions operate within a framework of consumer protection laws designed to ensure product quality, safety, and transparency. These regulations are critical, as they directly impact consumer trust and CompoSecure's brand reputation. For instance, in the US, the Consumer Financial Protection Bureau (CFPB) oversees many consumer financial protection laws, including those related to deceptive or unfair practices, which could apply to the marketing and functionality of CompoSecure's offerings.

The company faces potential product liability claims if its cards or security solutions exhibit defects or security vulnerabilities that lead to consumer harm or financial loss. For example, a data breach stemming from a flaw in a security feature could result in significant legal and financial repercussions. In 2024, the average cost of a data breach in the financial sector globally was reported to be around $5.17 million, highlighting the substantial financial risk associated with security failures.

Adherence to these legal requirements is not merely a compliance exercise but a strategic imperative. By consistently meeting safety standards and delivering on advertised performance, CompoSecure can foster stronger consumer confidence. This is particularly important in the financial technology sector, where trust is paramount. A proactive approach to regulatory compliance can also mitigate the risk of costly litigation and reputational damage, thereby safeguarding CompoSecure's market position.

Key considerations for CompoSecure regarding consumer protection and product liability include:

- Ensuring product safety certifications: CompoSecure must maintain compliance with relevant safety standards, such as those set by ISO or EMVCo for payment card technology.

- Transparency in product features and limitations: Clear communication about the capabilities and security measures of their products is essential to avoid misleading consumers.

- Robust quality assurance processes: Implementing rigorous testing throughout the product development lifecycle to identify and rectify potential defects before market release.

- Effective risk management for security vulnerabilities: Establishing protocols for identifying, addressing, and communicating any security weaknesses that may arise post-launch.

CompoSecure's operations are heavily influenced by evolving data privacy regulations like GDPR and CCPA, with non-compliance potentially leading to significant fines, such as up to 4% of global annual revenue under GDPR. The company must also navigate the fragmented global legal landscape for cryptocurrencies, including AML/KYC requirements and varying jurisdictional rules like the EU's MiCA, to ensure its security solutions are compliant and globally viable.

Environmental factors

CompoSecure's production of metal payment cards, from sourcing raw materials to the manufacturing process itself, inherently carries an environmental footprint. As global environmental consciousness grows, there's mounting pressure on companies like CompoSecure to adopt more sustainable manufacturing practices, aiming to slash waste and significantly cut down energy usage across their operations. This push includes a serious look into utilizing recyclable materials and implementing eco-friendly production methods to better align with overarching global environmental objectives.

CompoSecure's commitment to responsible sourcing of materials for its premium metal cards is crucial. This means ensuring that the metals and plastics used, like brass, stainless steel, and PVC, are obtained ethically. For instance, the Responsible Minerals Initiative (RMI) is a key industry standard, and by adhering to its principles, CompoSecure can verify that its supply chain avoids conflict minerals and promotes fair labor practices. This focus not only mitigates environmental impact but also bolsters the company's reputation for corporate social responsibility.

While CompoSecure's direct environmental footprint from its secure storage solutions for digital assets is minimal, the broader cryptocurrency ecosystem presents a significant environmental challenge due to the energy-intensive nature of mining. For instance, Bitcoin mining alone consumed an estimated 150 terawatt-hours (TWh) of electricity in 2023, comparable to the annual energy consumption of entire countries like Argentina.

This substantial energy demand, often sourced from fossil fuels, raises environmental concerns that can influence public perception and regulatory scrutiny of digital assets. Such sentiment could indirectly affect the demand for CompoSecure's specialized security products and services if the overall adoption of digital assets is hampered by these environmental considerations.

The increasing focus on sustainable practices within the digital asset space, including the development of more energy-efficient consensus mechanisms and the use of renewable energy sources for mining, presents an opportunity. CompoSecure can leverage this shift by highlighting its role in securing digital assets within a more environmentally conscious framework, potentially appealing to a growing segment of the market prioritizing sustainability.

Waste Management and Product End-of-Life

The disposal of payment cards, particularly those made from metal, poses an environmental hurdle. CompoSecure must implement responsible waste management, such as recycling programs, to minimize landfill impact and support a circular economy. This is becoming increasingly important as consumer awareness of environmental issues grows.

By 2024, the global e-waste generation was projected to reach 61.3 million metric tons, highlighting the urgency of effective end-of-life product management across industries. CompoSecure's focus on developing recyclable card components directly addresses this growing concern.

- Environmental Impact: Metal payment cards are more durable but harder to recycle than traditional plastic ones, increasing landfill burden.

- Circular Economy Initiatives: Companies like CompoSecure are exploring partnerships for card take-back and recycling programs to recover valuable materials.

- Material Innovation: Research into biodegradable or easily recyclable card materials is a key strategy for mitigating end-of-life environmental challenges.

Corporate Social Responsibility (CSR) and Brand Image

Consumers and financial institutions are increasingly focused on environmental impact, directly affecting a company's brand perception and market attractiveness. For CompoSecure, demonstrating a strong commitment to sustainability, including transparent reporting on its environmental initiatives, can significantly boost its reputation. This focus can attract clients who prioritize eco-friendly partners and foster better relationships with stakeholders. In 2024, for instance, a significant portion of consumers indicated they would switch brands based on environmental practices.

CompoSecure's proactive approach to Corporate Social Responsibility (CSR) can serve as a key differentiator in a competitive landscape. By highlighting efforts in areas like waste reduction and sustainable material sourcing, the company can build trust and loyalty. This strategy aligns with broader market trends; for example, many institutional investors in 2025 are integrating ESG (Environmental, Social, and Governance) factors more deeply into their investment decisions, making strong CSR performance a financial imperative.

- Growing consumer demand for sustainable products and services.

- Increased investor focus on ESG performance in 2024-2025.

- Brand image enhancement through transparent environmental reporting.

- Attracting environmentally conscious clients and partners.

CompoSecure faces environmental scrutiny due to its metal card production, necessitating sustainable practices like waste reduction and energy efficiency. The company's commitment to ethically sourced materials, adhering to standards like the Responsible Minerals Initiative, is vital for mitigating environmental impact and enhancing its corporate social responsibility image.

The disposal of metal cards presents a waste management challenge, driving CompoSecure to focus on recycling programs and material innovation to support a circular economy, especially as global e-waste reached approximately 61.3 million metric tons in 2024.

Growing consumer and investor demand for sustainability, with a significant portion of consumers willing to switch brands based on environmental practices in 2024, positions CompoSecure's CSR efforts as a key differentiator, aligning with the 2025 trend of deeper ESG integration by institutional investors.

| Environmental Factor | Impact on CompoSecure | Industry Trend/Data (2024-2025) |

|---|---|---|

| Material Sourcing & Production Footprint | Need for sustainable manufacturing, reduced waste, and energy efficiency. | Growing pressure for eco-friendly production methods. |

| End-of-Life Disposal | Challenge of recycling metal cards; need for take-back and recycling programs. | Global e-waste projected at 61.3 million metric tons in 2024; focus on circular economy. |

| Consumer & Investor Demand | Brand image enhancement through transparent environmental reporting; attracting eco-conscious clients. | Consumers may switch brands based on environmental practices (2024); increased ESG focus by investors (2025). |

PESTLE Analysis Data Sources

Our CompoSecure PESTLE analysis is built on a robust foundation of data from official government publications, leading economic indicators, and reputable industry research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, fact-based information.