CompoSecure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CompoSecure Bundle

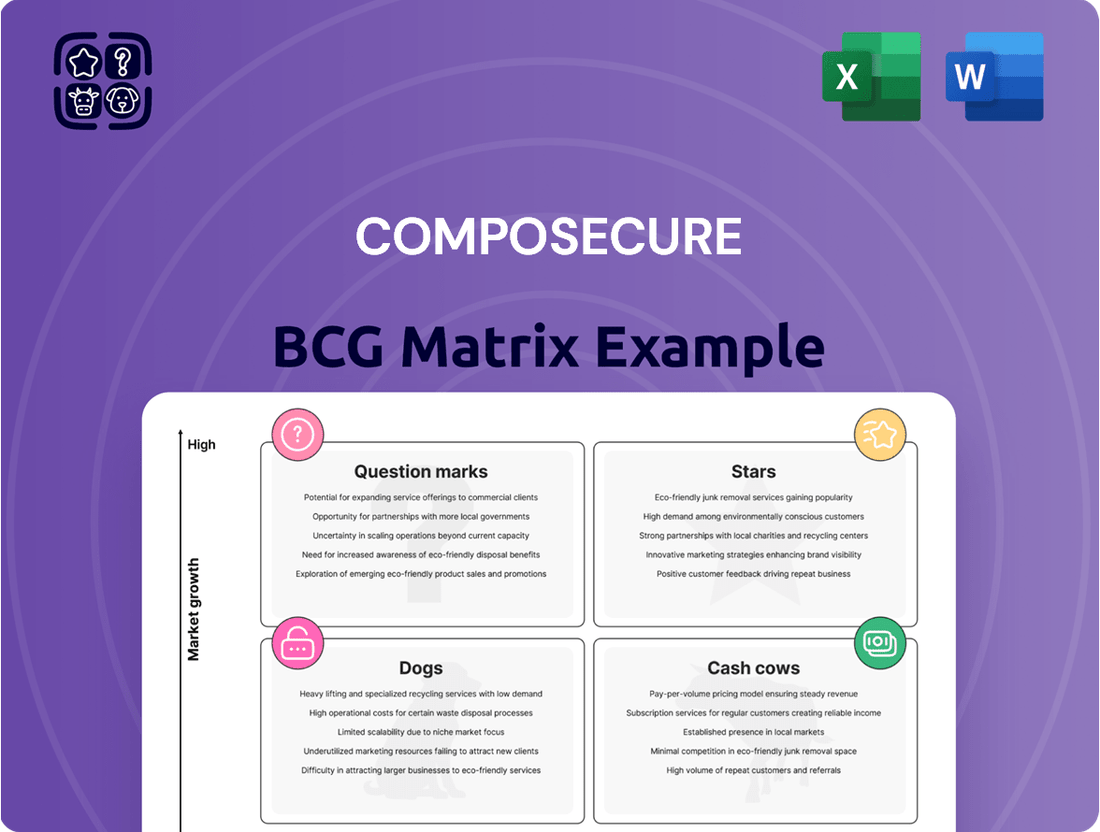

Unlock the strategic potential of CompoSecure's product portfolio with our comprehensive BCG Matrix analysis. See at a glance which products are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially hindering progress (Dogs).

This preview offers a glimpse, but the full CompoSecure BCG Matrix provides the in-depth data and actionable insights needed to make informed investment decisions and optimize your product strategy. Purchase the complete report to gain a clear roadmap for maximizing profitability and market share.

Don't guess where CompoSecure's products stand; know with certainty. Our full BCG Matrix delivers expert analysis and strategic recommendations, empowering you to navigate the competitive landscape with confidence. Buy now for immediate access to this essential strategic tool.

Stars

CompoSecure's premium metal payment cards are a clear Star in the BCG Matrix. The company holds a leading position in this rapidly expanding market, which is projected to grow at an impressive 14.96% annually. This strong market share in a high-growth segment means these cards are a significant revenue driver and a key area of focus for CompoSecure.

CompoSecure's strategic partnerships are a key driver for its Star quadrant performance. The company consistently launches new metal card programs with major financial institutions. For instance, collaborations with Delta Reserve, Robinhood Gold, Citi/American Airlines, and American Express White Gold demonstrate CompoSecure's strong market presence in the premium card sector.

These successful collaborations allow CompoSecure to tap into new customer segments and solidify its leadership position. This expansion fuels continued growth, reinforcing its status as a Star in the BCG matrix. The demand for premium metal cards, a segment CompoSecure excels in, is a significant factor in this ongoing success.

CompoSecure is continuously pushing the boundaries of metal card design, exploring advanced materials and unique finishes. This innovation, while initially presenting production challenges, is crucial for retaining their dominant position in a rapidly expanding market segment.

The company's focus on novel features, such as integrated NFC capabilities and enhanced security elements within metal card constructions, directly addresses evolving consumer demands. This strategic investment in R&D is designed to ensure CompoSecure maintains its high market share in the lucrative metal card sector, which has seen significant growth in recent years.

International Expansion of Metal Cards

CompoSecure is seeing significant traction in its metal card offerings internationally. This segment is demonstrating robust growth, with international net sales climbing by 28% in the first quarter of 2025. This suggests CompoSecure is capitalizing on a burgeoning global market for premium payment solutions.

The substantial increase in international sales for metal cards positions this product line as a potential star within CompoSecure's portfolio. While precise market share data for individual new territories is still solidifying, the overall upward trend points to a high-growth environment where the company is effectively increasing its presence.

- International net sales for metal cards grew by 28% in Q1 2025.

- This indicates a high-growth market for premium payment solutions globally.

- CompoSecure is actively expanding its footprint in these international markets.

High-End Payment Solutions for Affluent Consumers

CompoSecure is well-positioned in the high-end payment solutions market, a segment experiencing robust growth driven by affluent consumers and younger demographics. The company's focus on premium products, particularly metal cards, aligns perfectly with evolving consumer preferences.

High-net-worth individuals and younger generations, including Gen Z and Millennials, show a strong affinity for metal payment cards. This trend is a significant growth driver. For instance, the global metal card market was valued at approximately $1.3 billion in 2023 and is projected to reach over $3.5 billion by 2030, exhibiting a compound annual growth rate (CAGR) of over 15% during this period.

- Strong Consumer Preference: High-net-worth individuals and younger demographics (Gen Z, Millennials) increasingly favor metal cards for their premium feel and exclusivity.

- Market Growth: The global metal card market is expanding rapidly, with projections indicating continued strong growth through the end of the decade.

- CompoSecure's Leadership: CompoSecure holds a significant market share in this high-growth segment, catering effectively to the demand for premium payment solutions.

- Future Demand: By continuing to offer these premium products, CompoSecure is poised to maintain and strengthen its leading position in this lucrative market.

CompoSecure's premium metal cards are a prime example of a Star in the BCG matrix, exhibiting strong market share in a high-growth sector. The company's strategic partnerships with major financial institutions, such as Delta Reserve and American Express, underscore its leadership in this expanding premium payment solutions market.

The global metal card market is projected to grow at an impressive CAGR of over 15%, reaching over $3.5 billion by 2030. CompoSecure's international net sales for metal cards surged by 28% in Q1 2025, demonstrating its successful expansion into burgeoning global markets and reinforcing its Star status.

| Product Category | Market Growth Rate | CompoSecure's Market Share | Strategic Focus |

|---|---|---|---|

| Premium Metal Cards | High (15%+ CAGR) | Leading | Innovation, Partnerships, International Expansion |

What is included in the product

The CompoSecure BCG Matrix offers a strategic framework to analyze its product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The CompoSecure BCG Matrix provides a clear, one-page overview, instantly relieving the pain of understanding complex business unit performance.

Cash Cows

CompoSecure's established metal card manufacturing facilities are true cash cows. These operations, serving a loyal base of high-volume clients, generate substantial and predictable cash flow. The company's deep expertise in this mature segment of the payment card market means minimal need for further investment in growth, allowing these divisions to be highly profitable.

CompoSecure's existing financial institution clientele is a significant cash cow, generating consistent revenue through long-term relationships for standard metal card issuance. This established base requires minimal new business development, leading to high profit margins and a reliable cash flow stream for the company.

In 2024, this segment continued to be a bedrock of CompoSecure's financial stability. The company reported that a substantial portion of its revenue, over 60%, was derived from these recurring contracts with major banks and credit unions, underscoring the dependable nature of this business.

CompoSecure’s established metal card production lines are prime examples of optimized efficiency, consistently delivering high profit margins despite potential temporary impacts from new innovations. These mature operations are essentially cash cows, generating a reliable flow of income that can be strategically reinvested into the company’s growth ventures.

This operational excellence is a key driver of CompoSecure’s financial strength. For instance, in 2023, the company reported robust revenue streams from its core offerings, underscoring the sustained profitability of its standardized production processes. This consistent cash generation is vital for funding research and development into new product categories, ensuring CompoSecure remains competitive.

Strong Free Cash Flow Generation

CompoSecure's financial performance in fiscal year 2024 showcased exceptional strength in its cash-generating capabilities. The company reported a substantial 62% surge in Free Cash Flow, reaching $84.9 million. This impressive growth underscores the inherent profitability and self-sufficiency of its core, mature business segments.

This robust free cash flow generation provides CompoSecure with significant financial flexibility. It allows the company to comfortably fund strategic investments, pursue growth opportunities, and efficiently manage its debt obligations. The consistent and strong cash inflows are a hallmark of a healthy Cash Cow business.

- Free Cash Flow Growth: 62% increase to $84.9 million in FY 2024.

- Business Health: Indicates highly profitable and self-sustaining established operations.

- Financial Flexibility: Enables investments, debt reduction, and operational stability.

Reduced Net Debt and Strong Balance Sheet

CompoSecure's financial health is robust, highlighted by a significant 60% reduction in net debt, bringing it down to $120 million as of 2024. This achievement underscores the company's operational efficiency and its capacity to generate substantial cash flow.

This strong balance sheet, bolstered by its cash-generating business segments, provides a stable foundation. It allows CompoSecure the flexibility to pursue strategic growth opportunities and investments, a hallmark of a mature and profitable cash cow.

- Net Debt Reduction: Decreased by 60% to $120 million in 2024.

- Operational Strength: Demonstrates effective cash generation from core business units.

- Financial Stability: A strong balance sheet provides resources for future strategic initiatives.

- Cash Cow Characteristics: Exhibits stability and cash-generating capacity typical of mature businesses.

CompoSecure's established metal card manufacturing and existing financial institution clientele are prime examples of its cash cows. These mature segments generate consistent, predictable cash flow with minimal need for further investment, allowing for high profitability. The company’s deep expertise in these areas ensures sustained revenue streams.

In fiscal year 2024, CompoSecure demonstrated exceptional cash-generating capabilities. The company reported a significant 62% increase in Free Cash Flow, reaching $84.9 million, which highlights the inherent profitability and self-sufficiency of its core, mature business segments. This robust free cash flow provides CompoSecure with substantial financial flexibility, enabling strategic investments and debt management.

| Metric | Value (FY 2024) | Significance |

|---|---|---|

| Free Cash Flow | $84.9 million | 62% increase, indicates strong profitability of mature segments |

| Net Debt | $120 million | 60% reduction, demonstrates effective cash generation and financial health |

| Revenue Source | Over 60% from recurring contracts | Highlights dependability of established client base |

Preview = Final Product

CompoSecure BCG Matrix

The CompoSecure BCG Matrix preview you're viewing is the identical, fully polished document you will receive upon purchase, ensuring no surprises and immediate usability. This comprehensive report is meticulously designed to offer actionable strategic insights, allowing you to confidently assess CompoSecure's product portfolio. You'll gain access to a professionally formatted analysis, ready for immediate integration into your business planning or presentations without any additional editing or formatting required.

Dogs

The spin-off of Resolute Holdings on February 28, 2025, signals a divestiture of a business unit likely considered non-core or not fitting CompoSecure's strategy for accelerated growth and diversification. While not officially labeled a 'Dog' by CompoSecure, such actions often stem from segments exhibiting low growth potential or minimal contribution to the main business operations.

Outdated payment card technologies, such as older magnetic stripe cards or basic plastic cards without advanced security features, would likely fall into the Dogs quadrant for a company like CompoSecure, which emphasizes premium metal card solutions. These legacy products face declining demand as consumers and businesses shift towards more secure and innovative payment methods.

For instance, while specific market share data for CompoSecure's legacy card offerings isn't publicly detailed, the broader market trend shows a significant decline in magnetic stripe card usage. In 2023, EMV chip transactions accounted for over 95% of all card transactions in the US, highlighting the obsolescence of older technologies.

These outdated technologies represent a low-growth, low-market-share segment. Investing resources in maintaining or developing these offerings would likely yield minimal returns, tying up capital that could be better utilized in CompoSecure's high-growth premium card segments.

Underperforming niche security offerings, excluding the Arculus platform, would likely be classified as Dogs in CompoSecure's BCG Matrix. These might be older authentication technologies or specialized security solutions that haven't captured substantial market share.

Such products would be positioned in markets with limited growth potential or even contraction. For instance, if CompoSecure had a legacy physical security token product that has been largely superseded by digital solutions, it would fit this description. Its market share would be small within a shrinking segment.

Unsuccessful Pilot Programs or Ventures

Unsuccessful pilot programs or ventures in CompoSecure's portfolio, like many in the tech sector, would fall into the Dogs category. These are initiatives that consumed capital and management attention but failed to gain traction or show a clear path to profitability. For instance, a hypothetical digital payment solution pilot in 2023 that saw low user adoption and high development costs would fit here.

These ventures, having used resources without delivering expected results, represent a drain on the company. A 2024 analysis might reveal that such a pilot program, designed to capture a niche market, only achieved a 2% market penetration rate, significantly below the 15% target, and incurred $5 million in development and marketing expenses without generating substantial revenue.

- Low Market Adoption: A pilot for a new secure credentialing technology in early 2024 failed to secure any major client contracts, indicating a lack of market demand.

- Resource Drain: The venture consumed $3 million in R&D and operational costs over 18 months without generating any significant revenue.

- No Viable Growth Path: Subsequent market research confirmed limited scalability and high competitive barriers, making future investment unlikely to yield positive returns.

Commoditized Payment Card Components

Commoditized payment card components, like basic plastic card stock, represent a Dogs category within the BCG matrix. These products are characterized by minimal differentiation and extremely tight profit margins, struggling to attract distinct market appeal or achieve significant growth. In 2024, the global payment card market, while large, sees a significant portion of its volume in these undifferentiated segments, leading to intense price competition.

Companies focused on premium, innovative card solutions, such as CompoSecure, would likely have a low market share in this low-growth, highly competitive segment. The value proposition here is purely cost-driven, with little room for value-added services or unique features.

- Low Market Share: Typically possess a small percentage of the overall commoditized card component market.

- Low Growth: The segment experiences minimal expansion due to saturation and lack of innovation.

- Low Profitability: Razor-thin margins are common, driven by intense price wars.

- Intense Competition: Numerous suppliers vie for business based primarily on price.

Dogs in CompoSecure's BCG Matrix represent business segments with low market share in low-growth industries. These are often legacy products or ventures that have failed to gain traction. For example, outdated payment card technologies like basic magnetic stripe cards would fit this category as demand has shifted towards more secure EMV chip cards. In 2023, EMV chip transactions represented over 95% of US card transactions, underscoring the decline of older technologies.

Another example could be unsuccessful pilot programs or niche security offerings that haven't achieved significant market penetration. A hypothetical 2024 digital payment pilot that saw only 2% market adoption against a 15% target, while costing $5 million, exemplifies a Dog. These segments drain resources with little prospect of future returns.

Commoditized payment card components, such as basic plastic card stock, also fall into the Dogs quadrant. These items have minimal differentiation, low profit margins, and face intense price competition. While the global payment card market is substantial, these undifferentiated segments offer little growth and are often characterized by small market share for companies focused on premium solutions.

The divestiture of Resolute Holdings on February 28, 2025, suggests a strategic move away from a business unit that likely exhibited characteristics of a Dog, such as low growth potential or minimal contribution to CompoSecure's core strategy.

| Business Segment Example | Market Growth | Market Share | Rationale |

| Legacy Magnetic Stripe Cards | Low (Declining) | Low | Obsolete technology, superseded by EMV chips (95%+ of US transactions in 2023). |

| Unsuccessful Pilot Programs (e.g., 2024 Digital Payment Pilot) | Low (or Negative) | Very Low (e.g., 2% adoption vs. 15% target) | Consumed resources ($5M cost) without achieving traction or profitability. |

| Commoditized Plastic Card Stock | Low (Saturated) | Low | Highly competitive, low-margin segment with minimal differentiation. |

| Underperforming Niche Security Offerings (excluding Arculus) | Low (or Shrinking) | Low | Limited market adoption, high competitive barriers, or superseded by newer solutions. |

Question Marks

Arculus, a player in the burgeoning crypto security sector, is positioned in a market expected to expand significantly, with a projected compound annual growth rate of 21.7% between 2025 and 2035. This high growth potential aligns with the Stars quadrant of the BCG matrix, suggesting Arculus has substantial room for future expansion.

Despite achieving its first quarter of positive net contribution in Q4 2024 and anticipating a net positive year in 2025, Arculus's current market share in the broader crypto security space remains modest. This indicates that while the business is gaining traction and showing profitability, it still requires substantial investment to scale and capture a more dominant position, characteristic of a business in the Question Marks quadrant that is beginning to show promising results.

CompoSecure is actively exploring Web3 payment capabilities, aiming to facilitate digital asset transactions for everyday use. This strategic move targets the burgeoning digital asset market, which, while still in its early stages, represents a significant growth opportunity. By venturing into this space, CompoSecure seeks to capture a share of this evolving landscape.

The company's efforts in Web3 payments position it to capitalize on the increasing adoption of cryptocurrencies and other digital assets. For instance, the global digital asset market was valued at over $1 trillion in early 2024, indicating substantial underlying growth potential. CompoSecure's initiatives are designed to build a strong presence as this market matures.

CompoSecure's entry into the crypto-integrated card market, notably through its collaboration with Mastercard and the upcoming MetaMask metal card launch in Q2 2025, positions it within a high-growth, albeit nascent, sector. This strategic move aims to bridge traditional financial systems with digital assets, tapping into a market segment experiencing rapid innovation. While specific market share data for these niche products is still emerging, the broader digital asset payment market is projected to reach significant valuations, indicating substantial future potential.

Early-Stage Innovative Card Constructions

Early-stage innovative card constructions represent CompoSecure's investment in the future of payment and identity technologies. These are the bleeding-edge products, still finding their footing in the market.

While these novel constructions, such as advanced biometrics integrated into cards or unique material compositions for enhanced durability and security, might currently have higher production costs and consequently lower gross margins, their strategic importance is undeniable. For instance, CompoSecure's focus on materials science and embedded technologies aims to unlock new functionalities that differentiate their offerings in a competitive landscape.

The goal here is to secure a significant share of emerging, high-growth market segments. By investing now, CompoSecure is positioning itself to be a leader as these innovative card types become mainstream. This forward-thinking approach is crucial for long-term revenue generation and market leadership.

- Focus on Disruptive Technologies: Investments target card constructions with the potential to fundamentally change the market, such as those incorporating advanced security features or novel user experiences.

- Early Market Entry Costs: Expect initial higher production expenses and potentially lower profit margins as these innovative products move from R&D to early-stage production and market adoption.

- Future Market Share Capture: The primary objective is to establish a strong foothold in nascent, high-potential market niches, ensuring CompoSecure benefits from future growth as these technologies mature.

- Strategic R&D Investment: CompoSecure dedicates resources to exploring and developing these next-generation card materials and functionalities, anticipating future consumer and industry demands.

Untapped Emerging International Markets

CompoSecure's expansion into emerging international markets, such as India and select Asia-Pacific regions, currently positions these ventures as Question Marks within the BCG matrix. While these territories exhibit robust growth trajectories, CompoSecure's market penetration and brand establishment are still in nascent stages, necessitating significant capital allocation for infrastructure, marketing, and distribution networks.

The potential for CompoSecure to capture substantial market share in these high-growth economies is considerable, but it is coupled with the inherent risks and uncertainties associated with developing markets. For instance, the digital payment landscape in India is rapidly evolving, with a projected market size of over $3 trillion by 2026, presenting a compelling opportunity for CompoSecure's secure payment solutions.

- High Growth Potential: Emerging markets like India are experiencing rapid economic expansion and increasing adoption of digital technologies.

- Substantial Investment Required: Building brand awareness and establishing distribution channels in new territories demands significant financial commitment.

- Limited Existing Presence: CompoSecure's current market share and brand recognition in these specific regions are relatively low, increasing the risk profile.

- Strategic Importance: These markets are crucial for long-term global diversification and revenue stream enhancement.

CompoSecure's ventures into new, high-growth international markets, such as India, are currently categorized as Question Marks. These regions offer significant future potential, but CompoSecure's market share and brand recognition are still developing, requiring substantial investment to build infrastructure and marketing presence.

The company is investing heavily in these emerging markets to capture future growth, acknowledging the inherent risks and the need for significant capital. This strategic positioning aligns with the characteristics of Question Marks, where potential rewards are high but current market position is weak.

The digital payment market in India, for example, is projected to exceed $3 trillion by 2026, presenting a substantial opportunity for CompoSecure's secure payment solutions. This underscores the strategic rationale behind the investment, despite the current uncertainties.

CompoSecure's early-stage innovative card constructions, such as those with advanced biometrics or unique materials, are also Question Marks. While these products have high growth potential and aim to differentiate CompoSecure, they currently have higher production costs and lower market share, necessitating ongoing investment.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Strategic Rationale |

|---|---|---|---|---|

| Emerging International Markets (e.g., India) | High | Low | Question Mark | Capture future growth in rapidly expanding economies; requires significant investment for market penetration. |

| Web3 Payment Capabilities | High | Low | Question Mark | Tap into the burgeoning digital asset market; requires investment to establish presence and adoption. |

| Innovative Card Constructions (e.g., Biometrics, Advanced Materials) | High | Low | Question Mark | Develop next-generation payment technologies; higher initial costs and lower market share, aiming for future leadership. |

BCG Matrix Data Sources

Our CompoSecure BCG Matrix leverages comprehensive data, including financial disclosures, market share analysis, and industry growth forecasts, to accurately position each business unit.