CompoSecure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CompoSecure Bundle

CompoSecure operates within a dynamic landscape shaped by intense rivalry, the bargaining power of buyers, and the constant threat of substitutes. Understanding these forces is crucial for navigating its competitive environment and identifying strategic opportunities.

The complete report reveals the real forces shaping CompoSecure’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CompoSecure's reliance on a concentrated supplier base for specialized materials like specific metals and security chips significantly impacts its bargaining power. A limited number of suppliers for these critical components means they often hold considerable market sway, potentially dictating terms and pricing.

In 2024, the semiconductor industry, crucial for security chips, faced ongoing supply chain challenges, with lead times for certain advanced chips extending well into the year. This scarcity enhances the leverage of chip manufacturers, allowing them to command higher prices and favorable contract conditions, directly affecting CompoSecure's input costs.

CompoSecure's reliance on specialized materials, like advanced polymer films and secure microchip components, can significantly influence supplier bargaining power. If these inputs are proprietary or have limited manufacturers, CompoSecure faces higher switching costs. For instance, in the secure payment card industry, the chips and the specialized security features embedded within them are often developed by a handful of technology providers, granting these suppliers considerable leverage.

CompoSecure faces significant switching costs when changing suppliers for its specialized payment card materials and manufacturing components. These costs can include the substantial expense of retooling production lines, obtaining new certifications for materials, and the complex integration processes required to ensure compatibility and quality with new suppliers. For instance, the transition to a new supplier for advanced security chip embedding technology would necessitate extensive testing and validation, potentially delaying production and incurring considerable engineering resources.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into CompoSecure's operations, such as by manufacturing metal cards or security solutions directly, could significantly enhance their bargaining power. This would allow them to capture a larger portion of the value chain, potentially reducing CompoSecure's margins.

For instance, if a key supplier of specialized metal alloys or advanced security printing technology were to develop its own card manufacturing capabilities, it could directly compete with CompoSecure. This scenario would shift the power dynamic, giving the supplier more leverage in negotiations over pricing and terms.

- Potential for Supplier Forward Integration: Suppliers of critical raw materials or specialized manufacturing processes could establish their own card production facilities.

- Impact on CompoSecure: Direct competition from suppliers would increase pricing pressure and potentially reduce CompoSecure's market share.

- Strategic Implications: CompoSecure must monitor supplier capabilities and consider strategies to mitigate this risk, such as long-term supply agreements or diversification of supplier base.

Importance of CompoSecure to Suppliers

The bargaining power of CompoSecure's suppliers is influenced by how crucial CompoSecure's business is to their overall revenue. If CompoSecure constitutes a minor segment of a supplier's sales, that supplier may have less motivation to concede on pricing or terms, thereby enhancing their leverage. For instance, if a key material supplier for CompoSecure's secure payment solutions derives only 2% of its total annual revenue from CompoSecure, it possesses significant power to dictate terms.

Conversely, if CompoSecure represents a substantial portion of a supplier's income, CompoSecure gains more influence. This dynamic is critical as it can impact the cost of raw materials and components. For example, in 2023, CompoSecure reported total cost of revenues of $203.9 million. The ability to negotiate favorable terms with suppliers contributing to this figure directly affects CompoSecure's profitability and competitive pricing.

- Supplier Dependence: A supplier's reliance on CompoSecure's orders directly correlates with their bargaining power. Low dependence grants suppliers more leverage.

- Revenue Contribution: If CompoSecure accounts for a small percentage of a supplier's total sales, the supplier is less incentivized to offer preferential terms.

- Cost of Goods Sold Impact: Negotiating power with suppliers is crucial, as evidenced by CompoSecure's 2023 cost of revenues totaling $203.9 million.

- Strategic Sourcing: CompoSecure's strategy to diversify its supplier base can mitigate the bargaining power of individual suppliers.

CompoSecure's suppliers wield significant power due to the specialized nature of materials like security chips and advanced metals, often sourced from a limited number of providers. This concentration means suppliers can dictate terms and pricing, especially as seen in 2024 with extended lead times for critical semiconductors, increasing input costs for CompoSecure.

The bargaining power of CompoSecure's suppliers is amplified by high switching costs for the company, which include retooling production and extensive validation for new components. Furthermore, the threat of suppliers integrating forward into card manufacturing itself presents a direct competitive risk, potentially squeezing CompoSecure's margins.

The extent to which CompoSecure contributes to a supplier's overall revenue is a key factor in supplier leverage. If CompoSecure represents a small portion of a supplier's sales, that supplier has more power to resist price concessions, impacting CompoSecure's cost of goods sold, which was $203.9 million in 2023.

| Factor | Impact on CompoSecure | 2024/2023 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited suppliers can dictate terms and pricing. | Ongoing semiconductor supply chain challenges in 2024. |

| Switching Costs | High costs to change suppliers (retooling, validation). | Significant investment required for new component integration. |

| Forward Integration Threat | Suppliers entering card manufacturing creates direct competition. | Potential for increased pricing pressure and market share erosion. |

| Revenue Dependence | Supplier reliance on CompoSecure affects negotiation leverage. | CompoSecure's 2023 cost of revenues was $203.9 million. |

What is included in the product

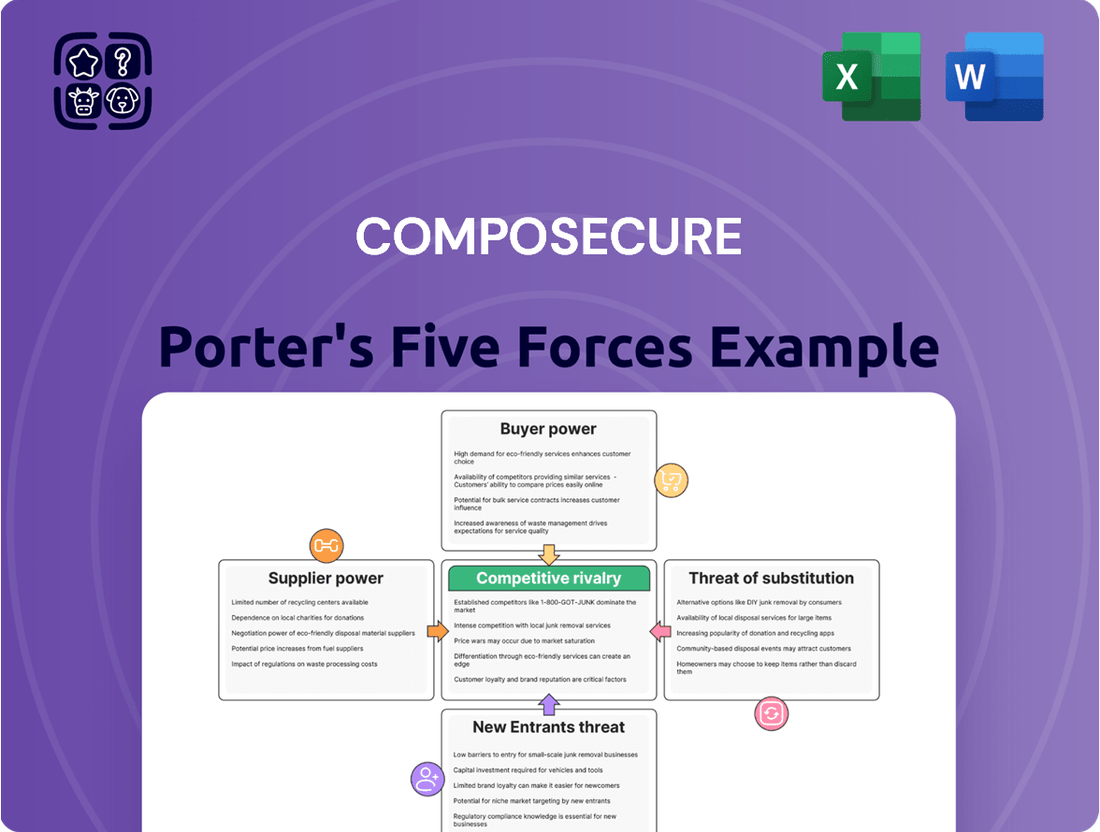

CompoSecure's Porter's Five Forces Analysis reveals the intensity of industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes, providing a strategic view of its competitive environment.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of CompoSecure's industry landscape.

Customers Bargaining Power

CompoSecure's customer concentration is a key factor influencing its bargaining power. If a few major financial institutions or cryptocurrency platforms represent a significant portion of CompoSecure's revenue, these large clients gain considerable leverage.

For instance, if CompoSecure's top 10 customers accounted for over 70% of its revenue in 2023, as is common in some specialized manufacturing sectors, it would indicate high concentration. This concentration empowers these key customers to negotiate more favorable terms, potentially impacting CompoSecure's pricing and profitability.

CompoSecure's customers, primarily financial institutions and crypto clients, face relatively low switching costs when it comes to premium metal cards and security solutions. The process of changing card manufacturers or security providers typically involves a moderate effort in vendor qualification, integration, and potential retooling, but it's not inherently prohibitive. This ease of transition means CompoSecure's clients can readily explore alternatives if pricing or service levels are not competitive.

CompoSecure's customers, particularly those in the financial services sector, often exhibit a degree of price sensitivity. While they value security and reliability, significant price increases for payment cards and related solutions can lead them to explore alternative suppliers or negotiate harder. For instance, in 2024, many businesses faced increased operational costs, making them more receptive to competitive pricing from CompoSecure's rivals.

Threat of Backward Integration by Customers

CompoSecure's customers, particularly large financial institutions, possess significant bargaining power. A key aspect of this is the potential for backward integration, where these customers could develop or acquire the capabilities to produce their own premium payment cards or in-house security solutions. This threat increases their leverage in negotiations with CompoSecure.

For instance, major banks often have substantial R&D budgets and the technical expertise to explore such vertical integration. If CompoSecure's pricing or service levels become unfavorable, a large client might indeed invest in developing proprietary card manufacturing or security technology. This is particularly relevant in the evolving landscape of payment security and advanced card features.

- Customer Leverage: The ability of large banks to potentially bring card production or security solutions in-house directly impacts CompoSecure's pricing power and contract terms.

- Industry Trends: As technology advances, the feasibility of in-house solutions for some aspects of card production and security may increase for large, technologically adept customers.

- Strategic Considerations: For a large bank, controlling a critical component like premium card manufacturing or advanced security features could offer strategic advantages in branding and customer experience.

Product Differentiation and Uniqueness

CompoSecure's premium metal cards are a significant differentiator, offering a tangible sense of luxury and exclusivity that standard plastic cards lack. This uniqueness directly impacts customer bargaining power by making direct alternatives less appealing to their target demographic. For instance, while the exact market share of premium metal cards within the broader payment card industry isn't precisely detailed in publicly available data, the growing demand for personalized and high-end financial products suggests a niche where differentiation is key.

The company's focus on advanced security solutions, such as secure element technology and advanced personalization, further strengthens its product differentiation. These features provide added value and peace of mind to customers, reducing their inclination to switch to competitors offering less sophisticated or less secure options. This enhanced security and unique product offering effectively mitigates the bargaining power of customers who prioritize these attributes.

- Premium Metal Cards: CompoSecure's metal cards offer a unique tactile experience and perceived value, setting them apart from standard plastic offerings.

- Advanced Security Solutions: Integration of secure elements and robust personalization techniques enhances product uniqueness and customer trust.

- Reduced Customer Alternatives: The specialized nature of CompoSecure's differentiated products limits the availability of directly comparable alternatives for discerning customers.

CompoSecure's customers, particularly large financial institutions, hold significant bargaining power due to the potential for switching and backward integration. The relatively low switching costs for premium card solutions mean clients can explore alternatives if pricing or service isn't competitive. For example, in 2024, increased operational costs made many businesses more receptive to competitive pricing from rivals.

The threat of backward integration, where clients might produce their own cards or security solutions, further amplifies their leverage. Major banks possess the R&D budgets and technical expertise to pursue such vertical integration, especially as payment security technology evolves. This capability allows them to negotiate more favorable terms with CompoSecure.

| Customer Bargaining Power Factor | Impact on CompoSecure | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | High concentration empowers large clients. | If CompoSecure's top 10 customers represented over 70% of revenue in 2023, this would indicate significant leverage for those clients. |

| Switching Costs | Low switching costs increase customer flexibility. | The process of changing card manufacturers involves moderate effort, not prohibitive barriers. |

| Price Sensitivity | Customers are sensitive to price increases. | In 2024, clients facing rising operational costs were more open to competitive pricing from CompoSecure's competitors. |

| Backward Integration Potential | Threat of in-house production limits CompoSecure's pricing power. | Large banks have the R&D and technical expertise to explore producing their own premium cards or security solutions. |

Same Document Delivered

CompoSecure Porter's Five Forces Analysis

This preview showcases the complete CompoSecure Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file. This comprehensive analysis will equip you with a thorough understanding of the industry's dynamics, ready for immediate use.

Rivalry Among Competitors

CompoSecure operates in markets with a moderate number of direct competitors, though the landscape is somewhat fragmented. In the premium metal card segment, while there are several smaller players, the field is not dominated by a few giants, suggesting a degree of competitive intensity. This means CompoSecure needs to constantly innovate and differentiate itself to stand out.

The digital security solutions space, however, presents a different dynamic. Here, CompoSecure faces competition from both established technology firms and specialized security providers. The size and resources of these competitors can vary significantly, from large, diversified tech companies with substantial R&D budgets to more niche players focusing on specific security niches, impacting the pressure CompoSecure experiences.

For instance, in 2024, the market for secure credentialing and payment cards continues to see growth. While specific market share data for premium metal card manufacturers is often proprietary, industry reports indicate a steady demand. CompoSecure’s ability to secure partnerships, such as its ongoing collaborations with major financial institutions, is crucial in navigating this competitive environment and maintaining its position.

The premium payment card and digital asset security industries are experiencing robust growth. For instance, the global digital payment market was projected to reach over $15.5 trillion by 2027, indicating a strong upward trend. This expansion generally tempers intense rivalry, as companies can grow by capturing new market segments rather than solely by taking share from competitors.

CompoSecure's product differentiation is a key factor in its competitive landscape. The company specializes in high-security, premium payment cards, often incorporating advanced features like metal alloys and complex security elements. This focus on niche, high-value products sets it apart from competitors who may offer more commoditized plastic card solutions.

The degree of differentiation directly impacts rivalry. If CompoSecure's offerings were easily replicable, competition would likely intensify on price. However, the specialized nature of its products, coupled with strong brand recognition in the premium segment, allows CompoSecure to command higher margins and reduce direct price-based competition. For instance, in 2024, the demand for luxury and personalized payment solutions continued to grow, a trend CompoSecure is well-positioned to capitalize on due to its differentiated product portfolio.

Exit Barriers in the Industry

Exit barriers in the premium card and security solutions market can be substantial, making it challenging for companies to leave. These barriers often stem from specialized assets, sunk costs, and the difficulty of redeploying capital. For instance, CompoSecure, a key player, has invested heavily in proprietary manufacturing technologies and highly specialized equipment for producing secure credentials. This makes it difficult to simply sell off these assets or repurpose them for other industries, effectively trapping capital within the sector.

The costs associated with exiting can also include contractual obligations, such as long-term supply agreements or customer contracts, that are not easily terminated. Furthermore, the brand reputation and customer relationships built within this niche market are difficult to replicate elsewhere. This forces companies to continue competing, even in less profitable periods, rather than incurring significant losses upon exit.

- Specialized Assets: CompoSecure's significant investment in unique, high-security manufacturing equipment creates a high barrier to redeploying capital.

- Sunk Costs: Extensive R&D and capital expenditures on proprietary technologies represent costs that cannot be recovered upon exit.

- Contractual Obligations: Existing agreements with clients and suppliers can impose penalties or require continued service, deterring immediate departure.

- Brand and Relationships: The established trust and specific expertise required in the security solutions market make it hard to transfer these assets to other industries.

Strategic Stakes of Competitors

The premium card and security market segments are highly strategic for CompoSecure's competitors. These areas represent lucrative niches with high customer loyalty and potential for premium pricing. For instance, major players like Entrust and CPI Card Group heavily invest in advanced security features and premium materials, recognizing these segments as crucial for differentiation and sustained profitability.

- High Strategic Value: Competitors view premium card offerings and advanced security solutions as core to their business, not just ancillary products.

- Aggressive Investment: This strategic importance drives significant R&D and marketing expenditure from rivals aiming to capture or defend market share in these high-margin areas.

- Market Share Focus: Companies like Idemia, a global leader in identity solutions, actively pursue market dominance in secure credential issuance, including premium payment cards.

- Profitability Driver: The premium segment allows for higher average selling prices, making it a key focus for competitors seeking to boost overall financial performance.

CompoSecure faces moderate rivalry in the premium metal card market, where fragmentation allows for differentiation rather than direct price wars. In digital security, it contends with both large tech firms and specialized providers, with varying competitive strengths. The growth in digital payments, projected to exceed $15.5 trillion by 2027, generally eases intense competition by offering avenues for expansion.

CompoSecure's specialization in high-security, premium metal cards with advanced features distinguishes it from competitors offering standard plastic cards. This product differentiation, coupled with strong brand recognition in the luxury segment, enables higher margins and reduces direct price competition, a trend supported by growing demand for personalized payment solutions in 2024.

High exit barriers, including specialized assets and sunk costs in proprietary technology, along with contractual obligations and established brand relationships, keep companies like CompoSecure invested in the premium card and security sectors. This strategic importance drives competitors such as Entrust and CPI Card Group to invest heavily in advanced features and premium materials to capture high-margin market segments.

| Competitor | Key Focus Area | 2024 Strategic Emphasis |

| Entrust | Digital security, secure credentials | Expanding cloud-based security solutions and advanced authentication methods. |

| CPI Card Group | Payment cards, EMV solutions | Innovating in sustainable card materials and enhancing contactless payment features. |

| Idemia | Identity solutions, secure payments | Strengthening biometric authentication and digital identity management. |

SSubstitutes Threaten

CompoSecure faces a significant threat from substitutes, particularly in the form of purely digital payment methods and software-only security solutions. These alternatives can fulfill the same customer needs for secure and convenient transactions without requiring physical payment cards. For instance, the rapid growth of mobile payment platforms and biometric authentication systems bypasses the need for traditional card form factors.

The threat of substitutes for CompoSecure's advanced payment solutions hinges on the price-performance trade-off. While CompoSecure offers premium, secure, and feature-rich products, alternative payment methods or technologies might present a more budget-friendly option for some segments of the market. For instance, while CompoSecure's secure card solutions are robust, the growing adoption of contactless mobile payments, which can be cheaper to implement for consumers and merchants, represents a potential substitute.

Customers face relatively low switching costs when considering alternatives to CompoSecure's physical metal cards and hardware-based security solutions. The transition to digital wallets or simpler plastic cards typically involves minimal financial outlay and technical complexity for the end-user.

For instance, the widespread adoption of contactless payment technologies and mobile payment platforms like Apple Pay and Google Pay means consumers can easily shift their payment methods without needing new physical cards, thereby reducing the perceived value of CompoSecure's specialized offerings.

The increasing integration of security features directly into smartphones and other devices further lowers the barrier for customers to move away from dedicated hardware security tokens, which CompoSecure also provides.

Perceived Value of Premium Features

The perceived value of premium features in metal cards, such as enhanced prestige and superior durability, directly influences the threat of substitutes. If customers highly value these attributes, they are less likely to switch to simpler, less expensive alternatives like standard plastic cards. CompoSecure's focus on these premium aspects aims to create a differentiation that makes substitutes less appealing.

Hardware-based security features, often integrated into advanced payment cards, also contribute to this perceived value. When customers believe these security measures offer significant protection and convenience, the appeal of basic, unsecure substitutes naturally declines. This is a key area where companies like CompoSecure invest to maintain customer loyalty.

If the perceived value of these premium features, like the tactile feel and robust construction of metal cards, were to diminish, the attractiveness of simpler, cheaper substitutes would inevitably increase. For instance, if a competitor offered a similarly premium-feeling card at a significantly lower price point, it could erode CompoSecure's market position.

- Customer Perception: The degree to which customers associate prestige and durability with metal cards is a critical factor.

- Security Value: The perceived benefit of hardware-based security features in preventing fraud directly impacts the willingness to pay for premium cards.

- Substitute Attractiveness: A decline in the perceived value of premium features would make standard plastic cards or digital payment solutions more appealing.

- Market Dynamics: Competitors offering comparable premium features at lower price points could intensify the threat of substitutes.

Technological Advancements in Alternatives

The rapid evolution of alternative technologies poses a significant threat to CompoSecure. For instance, advancements in biometrics, such as facial recognition and fingerprint scanning, are becoming more sophisticated and widely adopted, potentially reducing the need for physical cards. By 2024, the global biometrics market was valued at over $30 billion, with continuous innovation driving its growth.

Furthermore, the emergence of quantum-resistant encryption could render current security measures on physical cards obsolete, necessitating costly upgrades or a shift to entirely new digital authentication methods. Fully integrated digital wallets, already a common feature on smartphones, offer a convenient and secure alternative for many transactions, bypassing the need for a physical card altogether.

- Biometric Market Growth: The global biometrics market surpassed $30 billion in 2024, indicating strong consumer and industry adoption of alternative authentication methods.

- Digital Wallet Penetration: Mobile payment transaction volume is projected to reach trillions of dollars globally by 2025, highlighting the increasing preference for digital alternatives.

- Security Innovation: The development of quantum-resistant encryption signals a future where current card security protocols may become vulnerable, forcing a re-evaluation of physical card reliance.

The threat of substitutes for CompoSecure is substantial, driven by the increasing prevalence and sophistication of digital payment solutions and software-based security. These alternatives directly address the core needs of secure and convenient transactions, often without requiring a physical card. For instance, the rapid expansion of mobile payment platforms and advanced biometric authentication systems bypasses the necessity of traditional card form factors.

The competitive landscape is further shaped by the price-performance trade-off. While CompoSecure offers premium, secure, and feature-rich products, alternative payment methods might present a more cost-effective option for certain market segments. For example, the growing adoption of contactless mobile payments, which can be less expensive to implement for both consumers and merchants, poses a viable substitute to CompoSecure's specialized card solutions.

Switching costs for customers moving away from CompoSecure's physical cards and hardware security are generally low. Transitioning to digital wallets or simpler plastic cards typically involves minimal financial investment and technical complexity for the end-user. By 2024, the global biometrics market was valued at over $30 billion, underscoring the significant adoption of alternative authentication methods.

| Substitute Type | Key Features | Customer Value Proposition | CompoSecure's Counter |

|---|---|---|---|

| Mobile Payment Platforms (e.g., Apple Pay, Google Pay) | Convenience, contactless, integrated security | Eliminates need for physical wallet, fast transactions | Premium materials, enhanced security features, brand prestige |

| Biometric Authentication | Fingerprint, facial recognition, voice ID | High security, passwordless access | Hardware security tokens, secure element technology in cards |

| Software-only Security Solutions | Digital encryption, tokenization | Cost-effective, adaptable to various devices | Physical card durability, tangible security assurance |

Entrants Threaten

The premium metal card manufacturing and advanced security solutions sector demands substantial upfront capital. Companies need significant investment for specialized machinery, research and development, and securing necessary certifications, creating a formidable barrier for potential new entrants. For instance, establishing a state-of-the-art manufacturing facility capable of producing high-security metal cards can easily run into tens of millions of dollars, a cost prohibitive for many startups.

CompoSecure, a leader in secure payment and identity solutions, benefits significantly from established economies of scale in its specialized manufacturing processes. This scale allows for lower per-unit production costs in areas like card personalization and secure material sourcing. For instance, in 2023, CompoSecure reported net sales of $1.1 billion, indicating substantial operational volume that new entrants would struggle to match immediately without significant upfront investment.

The experience curve also plays a crucial role, as CompoSecure has honed its operational efficiencies and product development over years in the industry. This accumulated know-how, particularly in handling sensitive data and meeting stringent security standards, creates a substantial barrier. New entrants would face a steep learning curve and potentially higher initial costs to achieve comparable levels of quality and reliability, making it challenging to compete on price or performance.

CompoSecure's significant investment in proprietary technology and a robust patent portfolio creates a substantial barrier for potential new entrants. These intellectual property assets, covering areas like secure payment card manufacturing and advanced materials, are not easily replicated. For instance, CompoSecure holds numerous patents related to their secure credential technologies, making it challenging for newcomers to match their product innovation and security features without extensive R&D and legal investment.

Access to Distribution Channels and Relationships

Newcomers face significant hurdles in building the necessary connections with major financial institutions and cryptocurrency exchanges. These established relationships act as a formidable barrier, making it difficult for new entrants to secure the distribution channels vital for CompoSecure's payment card and security solutions.

CompoSecure's existing partnerships, cultivated over years, provide preferential access and trust. For instance, in 2024, the payment processing industry saw continued consolidation, with larger players leveraging their extensive networks. This trend means that new entrants must invest heavily in developing their own distribution networks or acquire existing ones, a costly and time-consuming endeavor.

- Established Partnerships: CompoSecure benefits from long-standing relationships with banks and payment networks, which are difficult for new entrants to replicate.

- High Switching Costs: Financial institutions often face high costs and regulatory hurdles when switching or onboarding new suppliers for critical components like secure payment cards.

- Brand Trust and Reputation: CompoSecure's reputation for security and reliability in sensitive financial transactions is a significant advantage, requiring new entrants substantial time and effort to build comparable trust.

Regulatory and Certification Requirements

The financial and security sectors, where CompoSecure operates, are heavily regulated. New entrants must navigate complex compliance standards, such as those mandated by the Payment Card Industry Data Security Standard (PCI DSS), which ensures secure handling of cardholder data. Obtaining necessary certifications is a significant hurdle, often requiring substantial investment in time and resources. For instance, achieving PCI DSS Level 1 compliance, the highest level, involves rigorous audits and ongoing security measures that can cost tens of thousands of dollars annually. This stringent regulatory environment acts as a substantial barrier, deterring potential new competitors from entering the market.

Meeting these demanding requirements is not a one-time effort but an ongoing commitment. Companies must continuously invest in security infrastructure, personnel training, and regular audits to maintain compliance. The evolving nature of cybersecurity threats and data privacy regulations means that these costs and efforts are persistent. For example, in 2024, the global cost of data breaches reached an average of $4.45 million, highlighting the financial implications of failing to meet security standards. This continuous expenditure and the need for specialized expertise make it difficult for smaller or less capitalized new entrants to compete effectively.

The necessity for specialized certifications, such as those related to secure credential manufacturing and data handling, further elevates the barrier to entry. These certifications often require a proven track record and adherence to strict operational protocols. For example, companies producing secure payment cards often need certifications like ISO 27001 for information security management, which involves a comprehensive assessment of an organization's security policies and procedures. The process can take months and involve significant consultation fees, adding to the initial capital outlay for any new player.

Consequently, the high cost and complexity associated with regulatory compliance and certification create a formidable threat of new entrants for CompoSecure. Established players have already invested in building the necessary infrastructure and expertise, giving them a significant advantage. The financial burden and the time required to achieve and maintain these standards mean that only well-funded and strategically prepared companies can realistically consider entering this market.

The threat of new entrants for CompoSecure is relatively low due to substantial capital requirements for specialized manufacturing and advanced security solutions. Significant investment in machinery, R&D, and certifications, easily reaching tens of millions of dollars, deters many startups from entering the premium metal card sector.

CompoSecure's established economies of scale, as evidenced by $1.1 billion in net sales in 2023, provide cost advantages that new entrants would struggle to match. This scale, coupled with years of operational experience and a strong patent portfolio, creates significant barriers to entry, making it difficult for newcomers to compete on price or innovation.

Furthermore, the high switching costs for financial institutions and the stringent regulatory environment, including PCI DSS compliance, demand continuous investment in security and ongoing audits. The average cost of a data breach in 2024 was $4.45 million, underscoring the financial commitment needed to maintain compliance, which acts as a powerful deterrent to potential new competitors.

Porter's Five Forces Analysis Data Sources

Our CompoSecure Porter's Five Forces analysis is built upon a foundation of robust data, including CompoSecure's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Statista.

We also incorporate insights from financial news outlets, competitor press releases, and macroeconomic data to provide a comprehensive view of the competitive landscape.