Compal Electronics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compal Electronics Bundle

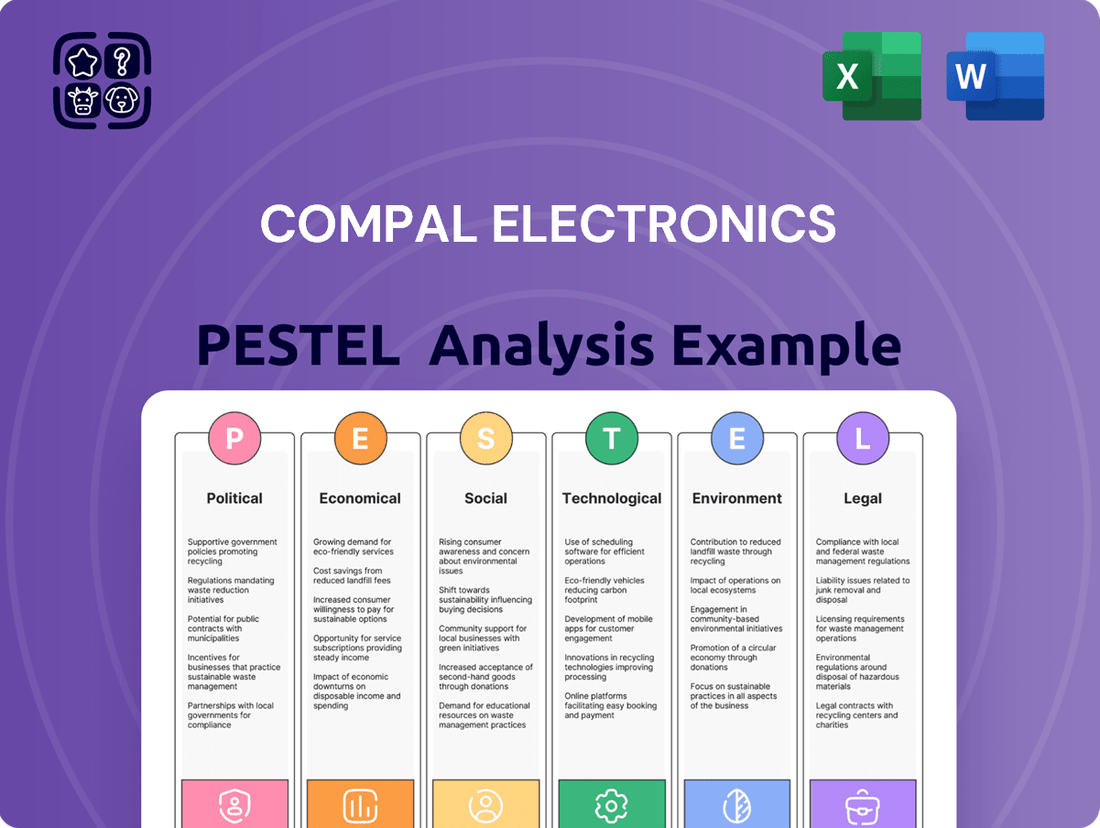

Navigate the complex global landscape impacting Compal Electronics with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their operations and future growth. Unlock actionable intelligence to refine your own market strategy and gain a competitive edge. Download the full analysis now for expert insights.

Political factors

Compal Electronics is strategically navigating heightened geopolitical risks, notably the conflict in Ukraine and economic shifts in China, by actively restructuring and diversifying its global supply chain. This proactive approach is crucial for maintaining operational resilience.

The company has expanded its operational footprint to nine countries, with ongoing considerations for establishing a presence in North America. This move aims to significantly reduce regional dependencies and enhance overall supply chain flexibility, a key strategy for 2024 and beyond.

This diversification is designed to mitigate potential disruptions and ensure business continuity in an increasingly volatile international environment. For instance, the ongoing trade tensions between the US and China continue to pressure electronics manufacturers like Compal to seek alternative production locations.

New US trade policies, including a potential 10% import tax on many goods and escalated rates for countries like China and Mexico, are directly impacting Compal Electronics' strategic planning. These evolving trade dynamics create uncertainty and necessitate adjustments to global supply chains.

In response to these pressures, Taiwanese PC original equipment manufacturers (OEMs) such as Compal are actively investigating the relocation of production facilities away from China. This strategic shift aims to mitigate the financial and operational risks associated with escalating trade disputes.

For example, Dell has already advised Compal to set up new manufacturing plants in Southeast Asian nations. This directive underscores the urgent need for Compal to diversify its production footprint and build resilience against geopolitical trade tensions.

Governments globally are prioritizing domestic manufacturing, a trend that significantly shapes supply chain decisions for electronics giants like Compal. This push aims to bolster national economies and reduce reliance on foreign production. For instance, the United States' CHIPS and Science Act, with its substantial funding for semiconductor manufacturing, exemplifies this commitment and could influence Compal's strategic manufacturing locations.

Such policies encourage companies to explore reshoring or nearshoring production. This strategy allows firms to capitalize on government incentives, potentially lowering operational costs and mitigating risks associated with international trade tensions and geopolitical instability. Compal might find it advantageous to establish or expand facilities in regions offering such preferential treatment.

These governmental initiatives directly impact Compal's capital expenditure decisions, potentially leading to increased investment in new manufacturing plants and strategic alliances within favored domestic or nearshore markets. The evolving landscape of government support means Compal must continually assess where its production investments yield the greatest strategic and financial benefits, especially considering the ongoing global push for supply chain resilience.

Political Stability in Key Manufacturing Regions

Compal Electronics' reliance on manufacturing in regions like China and Vietnam makes political stability a paramount concern. Geopolitical tensions and trade policy shifts can significantly impact supply chains and operational costs. For instance, the ongoing trade friction between the US and China, which intensified in recent years, has prompted companies like Compal to explore diversification strategies to mitigate risks. The company's ability to navigate these evolving political landscapes directly affects its production continuity and market access.

Assessing and adapting to the political climates of its operational bases is an ongoing necessity for Compal. This includes monitoring government policies on foreign investment, labor laws, and environmental regulations, all of which can influence manufacturing efficiency and expansion plans. For example, Vietnam's proactive approach to attracting foreign direct investment, coupled with its relatively stable political environment, has made it an increasingly attractive manufacturing hub for electronics companies, including Compal, as they seek to de-risk from over-reliance on single regions.

To bolster its resilience, Compal must prioritize strengthening its operational flexibility and fostering robust international partnerships. This involves building redundancy into its supply chains and actively engaging with governments and industry bodies in key manufacturing countries. By doing so, Compal can better anticipate and respond to potential disruptions, ensuring a more stable production flow and safeguarding its competitive position in the global electronics market.

Regulatory Scrutiny and Compliance

Compal Electronics navigates a landscape of increasingly stringent international and domestic regulations. These cover critical areas like global trade policies, data privacy mandates such as GDPR and similar frameworks, and evolving environmental standards impacting manufacturing and supply chains. Staying compliant is paramount to avoid significant financial penalties and protect its brand reputation.

The company's proactive approach to compliance is essential for uninterrupted global operations. For instance, in 2024, the European Union continued to emphasize stricter enforcement of its digital privacy laws, impacting how Compal handles customer data across its service regions. Furthermore, ongoing trade tensions and shifts in tariffs, particularly between major economic blocs, necessitate constant adaptation of its operational strategies to ensure cost-effectiveness and market access.

- Trade Regulations: Compal must adapt to fluctuating tariffs and import/export controls in key markets like the United States and China, impacting its supply chain costs and product pricing strategies.

- Data Privacy: Adherence to evolving data protection laws, such as the California Consumer Privacy Act (CCPA) and its international counterparts, is crucial for maintaining customer trust and avoiding litigation.

- Environmental Standards: Compliance with regulations like the EU's Restriction of Hazardous Substances (RoHS) and initiatives for e-waste management directly influences product design and manufacturing processes.

Compal Electronics operates within a dynamic political arena, where geopolitical shifts and trade policies directly influence its global manufacturing and supply chain strategies. The company's proactive diversification of operations, expanding into nine countries with potential North American expansion, is a direct response to escalating trade tensions, particularly between the US and China, and the broader trend of governments prioritizing domestic manufacturing. This strategic repositioning aims to build resilience against disruptions, capitalize on potential government incentives, and ensure continued market access amidst evolving international trade dynamics.

| Political Factor | Impact on Compal Electronics | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Geopolitical Tensions (e.g., US-China) | Drives supply chain diversification away from China; increases operational risk and costs. | Dell advised Compal to establish plants in Southeast Asia to mitigate US-China trade friction. |

| Government Industrial Policy (e.g., US CHIPS Act) | Creates opportunities for incentives and investment in favored regions; influences manufacturing location decisions. | US CHIPS Act funding aims to boost domestic semiconductor manufacturing, potentially impacting Compal's component sourcing and assembly strategies. |

| Trade Regulations & Tariffs | Necessitates adaptation of supply chain costs and product pricing; impacts market access. | Potential US import tax of 10% on goods from China and Mexico directly affects Compal's strategic planning and cost structures. |

| Data Privacy Regulations (e.g., GDPR, CCPA) | Requires strict adherence to protect customer data and avoid penalties; impacts data handling processes. | Continued emphasis on stricter enforcement of EU digital privacy laws in 2024 affects Compal's data management across service regions. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Compal Electronics, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights into how these global trends present both challenges and strategic opportunities for Compal Electronics's business operations and future growth.

Offers a concise, easily digestible overview of Compal Electronics' external environment, alleviating the pain of sifting through complex data for strategic decision-making.

Economic factors

The International Monetary Fund (IMF) projects global economic growth to remain steady at 3.2% for both 2024 and 2025. This consistent expansion offers a generally favorable economic environment for the electronics sector, including companies like Compal Electronics.

This stable growth forecast suggests sustained demand for electronic goods, a crucial factor for Compal's revenue streams. The expectation of continued, though perhaps moderating, global economic momentum provides a solid foundation for Compal's financial planning and market strategies heading into 2025.

Inflationary pressures, partly fueled by shifts in US trade policy, directly impact Compal Electronics by driving up the costs of essential raw materials and manufacturing processes. This necessitates robust cost management strategies to safeguard profitability in an environment of escalating expenses.

Despite a 4% dip in consolidated revenue during 2024, Compal demonstrated resilience by improving its gross margin and operating profit margin. This financial performance suggests effective cost optimization and strategic adjustments to its product mix, allowing it to navigate rising costs.

Compal Electronics faced a revenue dip in 2024 due to softer demand for its electronic products. However, the market is showing signs of recovery and expansion, particularly for key segments like computers, servers, and smartphones.

Looking ahead to 2025, market research forecasts a significant uplift in demand. This growth is anticipated to be fueled by widespread corporate PC refresh cycles and the burgeoning market for AI-enabled PCs, creating new avenues for Compal's core product lines.

This projected market demand provides a strong foundation for Compal's strategic direction. The company can leverage these positive trends to reinforce its existing business segments while also capitalizing on emerging opportunities in high-growth technology sectors.

Investment in Emerging Sectors

Compal Electronics is strategically boosting its investment in emerging sectors, signaling a clear focus on future growth. The company plans to increase its capital expenditure to NT$10 billion in 2025, a significant jump from NT$7 billion in 2024.

This increased investment is primarily channeled into areas like servers and the establishment of overseas manufacturing facilities. These moves are designed to position Compal to capitalize on the rapid expansion within key growth industries.

The company's strategic allocation of capital highlights its commitment to leveraging opportunities in:

- AI applications

- Cloud servers

- Automotive electronics

- Advanced communications

- Medical technology

Fluctuations in Revenue and Profitability

Compal Electronics experienced revenue fluctuations in 2024, with consolidated revenue reaching NT$910.25 billion, a 4% decrease from the previous year. This dip was attributed to shifting market demands and ongoing business adjustments.

Despite the revenue decline, Compal demonstrated improved profitability. The company's operating margin rose to 1.6%, and net profit attributable to the parent company surged by 31%, reaching NT$10 billion. This performance highlights Compal's successful execution of strategies aimed at boosting profitability and operational efficiency, even amidst a less favorable market environment.

- 2024 Consolidated Revenue: NT$910.25 billion (4% decrease year-on-year)

- 2024 Operating Margin: 1.6% (increase)

- 2024 Net Profit Attributable to Parent Company: NT$10 billion (31% increase)

Global economic growth is projected to remain steady at 3.2% for both 2024 and 2025, providing a stable backdrop for Compal Electronics. However, inflationary pressures, partly from trade policy shifts, are increasing raw material costs, impacting Compal's profitability despite efforts in cost optimization.

Compal's consolidated revenue saw a 4% dip in 2024 to NT$910.25 billion, yet operating and net profit margins improved significantly. This resilience is attributed to effective cost management and strategic product mix adjustments, with net profit jumping 31% to NT$10 billion.

Market demand for electronics is showing recovery, with forecasts indicating strong growth in 2025 driven by PC refresh cycles and AI-enabled PCs, creating new opportunities for Compal's core products.

Compal is increasing its capital expenditure to NT$10 billion in 2025 from NT$7 billion in 2024, focusing on servers and overseas manufacturing to capitalize on growth in AI, cloud computing, automotive, and medical technology sectors.

| Metric | 2023 (Approx.) | 2024 (Actual/Est.) | 2025 (Forecast) |

|---|---|---|---|

| Global Economic Growth | ~3.0% | 3.2% | 3.2% |

| Compal Consolidated Revenue | ~NT$948B | NT$910.25B (-4%) | Projected Growth |

| Compal Operating Margin | ~1.5% | 1.6% | Expected Improvement |

| Compal Net Profit | ~NT$7.6B | NT$10B (+31%) | Continued Growth |

| Compal Capital Expenditure | NT$7B | NT$7B | NT$10B |

Full Version Awaits

Compal Electronics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Compal Electronics delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed examination of Compal's operational landscape. Understand the external forces shaping its strategy and future growth.

Sociological factors

Consumer demand for sophisticated smart devices, from advanced smartphones and tablets to a burgeoning market for wearables, continues its upward trajectory. This evolving preference directly benefits Compal Electronics, a key Original Design Manufacturer (ODM), as they are instrumental in designing and producing these sought-after products for leading global brands.

The expansion of the Internet of Things (IoT) ecosystem is a significant driver, further amplifying the market for interconnected and intelligent devices. For instance, the global IoT market was projected to reach over $1.1 trillion by the end of 2023, with continued strong growth expected through 2024 and 2025, indicating a sustained demand for the types of devices Compal manufactures.

Societal awareness around environmental impact is significantly reshaping consumer choices, with a growing preference for sustainable products. This shift directly influences the electronics industry, compelling manufacturers like Compal to integrate eco-friendly practices throughout their operations. For instance, by 2024, over 60% of global consumers indicated that sustainability is an important factor in their purchasing decisions, a figure projected to climb further.

The electronics manufacturing sector, including companies like Compal, faces a critical need for workforce development driven by accelerating technological shifts. The integration of artificial intelligence, for instance, demands that employees acquire new competencies in areas like AI-assisted quality control and robotic system maintenance. This isn't just about learning new software; it's about adapting to fundamentally different ways of working on the factory floor.

To stay competitive, Compal must prioritize substantial investment in upskilling its current workforce. This means providing training programs focused on advanced automation, the practical application of AI in manufacturing processes, and understanding novel production techniques. For example, reports from industry bodies in late 2024 indicated a growing skills gap in advanced manufacturing, with a significant percentage of employers struggling to find workers with expertise in automation and data analytics.

The concept of lifelong learning is no longer a buzzword but a necessity for the modern manufacturing employee. Workers who are adaptable and committed to continuous skill acquisition will be best positioned to navigate the evolving demands of the industry. This adaptability ensures that Compal's operations can leverage the latest technological advancements without being hindered by a lack of skilled personnel, a challenge echoed by many global manufacturers throughout 2024 and projected into 2025.

Emphasis on Corporate Social Responsibility (CSR) and ESG

Societal expectations for corporate social responsibility and strong ESG performance are rapidly growing. Consumers, investors, and employees increasingly demand that companies operate ethically and sustainably. This trend is particularly evident in the technology sector, where supply chain transparency and environmental impact are under close scrutiny.

Compal Electronics has proactively responded to these evolving societal demands. The company has demonstrated a significant commitment to sustainable development, evidenced by its consistent high scores in prestigious corporate governance and sustainability indices. For instance, Compal has been recognized for its ESG efforts, including its inclusion in the Dow Jones Sustainability Index (DJSI) for multiple years, a testament to its robust performance in environmental, social, and governance factors.

This strong focus on CSR and ESG is not merely about compliance; it's a strategic imperative that builds trust with a wide array of stakeholders. By aligning its operations with global sustainability trends and transparently reporting its progress, Compal enhances its brand reputation and fosters stronger relationships with customers, investors, and the communities in which it operates. This commitment is crucial for long-term business resilience and competitive advantage in the current global landscape.

- Increased Stakeholder Scrutiny: Growing public and investor demand for ethical business practices and transparent reporting.

- DJSI Recognition: Compal's consistent inclusion in the Dow Jones Sustainability Index highlights its leadership in ESG performance.

- Brand Reputation Enhancement: Strong CSR and ESG initiatives bolster Compal's image as a responsible corporate citizen.

- Alignment with Global Trends: Adherence to sustainability goals resonates with a global consumer base and regulatory bodies.

Impact of Hybrid Work Models

The shift towards hybrid work models significantly reshapes consumer demand for personal computing. Compal, a major notebook and tablet manufacturer, must align its product development with these evolving user requirements. For instance, a 2024 survey indicated that 60% of employees prefer a hybrid work arrangement, driving demand for devices with robust video conferencing capabilities and enhanced battery life, areas Compal is actively addressing.

This sociological trend necessitates a strategic product evolution for Compal. The company needs to focus on devices that seamlessly transition between home and office use, prioritizing features like improved portability, integrated security solutions, and ergonomic designs. By 2025, the global market for business laptops is projected to see continued growth, largely fueled by the sustained need for flexible work setups.

- Increased demand for versatile devices: Hybrid work fuels the need for laptops and tablets that can perform equally well in diverse environments.

- Emphasis on connectivity and collaboration: Products must offer superior Wi-Fi, Bluetooth, and integrated webcam/microphone solutions.

- Growing importance of security features: Remote work environments require enhanced data protection and device security.

- Focus on user experience and productivity: Devices need to be lightweight, have long battery life, and offer comfortable input methods for extended use.

Societal expectations for corporate social responsibility and strong ESG performance are rapidly growing, with consumers and investors increasingly demanding ethical and sustainable operations. Compal's consistent inclusion in the Dow Jones Sustainability Index for multiple years underscores its leadership in these areas.

The shift towards hybrid work models significantly reshapes consumer demand for personal computing, driving the need for devices with enhanced portability and robust collaboration features. By 2025, the global market for business laptops is projected to see continued growth, fueled by these flexible work setups.

Societal awareness around environmental impact is reshaping consumer choices, leading to a growing preference for sustainable products. By 2024, over 60% of global consumers indicated sustainability is important in purchasing decisions, a figure projected to climb further.

The electronics manufacturing sector, including Compal, faces a critical need for workforce development driven by accelerating technological shifts, such as AI integration.

| Sociological Factor | Impact on Compal | Supporting Data/Trend |

|---|---|---|

| Hybrid Work Models | Increased demand for versatile, portable, and secure computing devices. | 60% of employees preferred hybrid work in 2024; projected growth in business laptops by 2025. |

| Environmental Consciousness | Preference for eco-friendly products and sustainable manufacturing practices. | Over 60% of consumers consider sustainability in purchasing decisions (2024). |

| Corporate Social Responsibility (CSR) & ESG | Enhanced brand reputation and stakeholder trust through ethical operations. | Compal's consistent inclusion in the Dow Jones Sustainability Index (DJSI). |

| Workforce Development Needs | Necessity for upskilling employees in AI, automation, and new production techniques. | Growing skills gap in advanced manufacturing reported in late 2024. |

Technological factors

Compal Electronics is heavily invested in AI and High-Performance Computing (HPC), evidenced by its development and showcasing of advanced GPU server solutions, including those utilizing NVIDIA MGX architecture. The company has already commenced shipments of servers featuring NVIDIA GH200 Grace Hopper Superchips, signaling robust market demand for cutting-edge HPC infrastructure. This strategic focus allows Compal to capitalize on its technical prowess to enhance AI training efficiency and expedite data center operations.

Compal Electronics is actively driving advancements in 5G communication technologies, building on its core strengths in 5G RF and PHY layer development, as well as Open Radio Access Network (O-RAN) solutions.

The company's commitment to innovation in wireless communication is evident in its development of integrated systems such as the '5G x AI Smart Retail' solution, which aims to revolutionize retail operations.

This integration of 5G and AI is designed to significantly boost network intelligence and operational efficiency, delivering the high-speed, low-latency connectivity crucial for next-generation applications.

The expanding landscape of the Internet of Things (IoT) and smart solutions offers Compal Electronics substantial technological avenues for growth. The company is strategically broadening its business into sectors like smart healthcare and intelligent displays, tapping into the increasing demand for connected devices and integrated systems.

This diversification positions Compal to capitalize on the global surge in IoT adoption, with the market for IoT platforms alone projected to reach $1.6 billion in 2024, according to Statista. Compal's focus on these emerging areas reflects a keen understanding of the market's trajectory towards more interconnected and data-driven environments across numerous industries.

Innovations in Manufacturing Processes

Compal Electronics is actively integrating advanced manufacturing processes to enhance operational efficiency, precision, and environmental responsibility. This strategic focus includes the adoption of sophisticated automation and cutting-edge Printed Circuit Board (PCB) assembly methods.

A key area of innovation is the development of liquid cooling solutions, particularly Direct Liquid Cooling (DLC), designed to manage the substantial thermal demands of high-density artificial intelligence (AI) workloads. These advancements are vital for the performance and longevity of next-generation AI data centers.

- Automation Adoption: Compal is increasing its use of robotic systems in assembly lines, aiming to reduce human error and speed up production cycles.

- PCB Assembly Enhancements: Investments are being made in advanced machinery for finer pitch component placement and improved solder joint integrity, critical for complex electronics.

- Liquid Cooling Solutions: The company is developing and implementing DLC technologies, which can offer significantly better thermal management compared to traditional air cooling, supporting higher-performance computing.

Diversification into Specialized Tech Sectors

Compal Electronics is actively expanding beyond its core PC and tablet manufacturing, making strategic inroads into high-growth technology areas. This diversification is a key technological factor influencing its future. The company has identified automotive electronics, smart healthcare solutions, and advanced communications as crucial new investment priorities, signaling a clear shift in its strategic focus.

Leveraging its robust integrated hardware and software research and development capabilities, Compal aims to develop innovative solutions tailored for these burgeoning markets. This strategic move allows Compal to capitalize on the increasing demand for connected devices and sophisticated electronic components across various industries.

- Automotive Electronics: Compal is investing in technologies for connected cars and advanced driver-assistance systems (ADAS).

- Smart Healthcare: The company is developing wearable health monitoring devices and connected medical equipment.

- Advanced Communications: This includes a focus on 5G infrastructure components and related networking solutions.

Compal Electronics is heavily invested in AI and High-Performance Computing (HPC), evidenced by its development and showcasing of advanced GPU server solutions, including those utilizing NVIDIA MGX architecture. The company has already commenced shipments of servers featuring NVIDIA GH200 Grace Hopper Superchips, signaling robust market demand for cutting-edge HPC infrastructure. This strategic focus allows Compal to capitalize on its technical prowess to enhance AI training efficiency and expedite data center operations.

Compal Electronics is actively driving advancements in 5G communication technologies, building on its core strengths in 5G RF and PHY layer development, as well as Open Radio Access Network (O-RAN) solutions. The company's commitment to innovation in wireless communication is evident in its development of integrated systems such as the '5G x AI Smart Retail' solution, which aims to revolutionize retail operations.

The expanding landscape of the Internet of Things (IoT) and smart solutions offers Compal Electronics substantial technological avenues for growth. The company is strategically broadening its business into sectors like smart healthcare and intelligent displays, tapping into the increasing demand for connected devices and integrated systems. This diversification positions Compal to capitalize on the global surge in IoT adoption, with the market for IoT platforms alone projected to reach $1.6 billion in 2024, according to Statista.

Compal Electronics is actively integrating advanced manufacturing processes to enhance operational efficiency, precision, and environmental responsibility. This strategic focus includes the adoption of sophisticated automation and cutting-edge Printed Circuit Board (PCB) assembly methods, alongside the development of liquid cooling solutions, particularly Direct Liquid Cooling (DLC), designed to manage the substantial thermal demands of high-density artificial intelligence (AI) workloads.

| Technology Area | Key Developments | Market Impact/Opportunity |

|---|---|---|

| AI & HPC | NVIDIA GH200 Grace Hopper Superchip servers, GPU server solutions | Enhanced AI training efficiency, expedited data center operations |

| 5G & Communications | 5G RF & PHY development, O-RAN solutions, 5G x AI Smart Retail | Revolutionizing retail, boosting network intelligence and operational efficiency |

| IoT & Smart Solutions | Smart healthcare, intelligent displays, connected devices | Capitalizing on global IoT adoption; IoT platforms market projected at $1.6 billion in 2024 |

| Advanced Manufacturing | Automation, advanced PCB assembly, Direct Liquid Cooling (DLC) | Improved production efficiency, thermal management for AI workloads |

| Diversification | Automotive electronics, smart healthcare, advanced communications | Entering high-growth markets, leveraging R&D for innovative solutions |

Legal factors

Governments worldwide are strengthening e-waste recycling mandates, with many new regulations set to take full effect by 2025. This means manufacturers like Compal will face increased obligations for product end-of-life management. For example, the European Union’s Ecodesign Directive, which is continuously updated, places a strong emphasis on repairability and recyclability, impacting how products are designed and managed after sale.

These stricter laws often compel companies to establish more convenient and widespread recycling programs for consumers. They may also include financial incentives to encourage proper disposal of old electronics, aiming to divert waste from landfills. Compal will need to integrate these requirements into its product development and supply chain strategies to ensure compliance and maintain market access.

The increasing global adoption of Extended Producer Responsibility (EPR) frameworks presents a critical legal challenge for electronics manufacturers like Compal. By 2025, numerous nations are anticipated to enact or strengthen EPR legislation, mandating that producers manage the end-of-life of their products, particularly electronic waste. This means Compal will face greater responsibility for product take-back, recycling infrastructure, and the use of eco-friendly materials.

These evolving legal mandates directly influence Compal's operational and product design strategies. For instance, the European Union's Ecodesign Directive, continually updated, sets stringent requirements for energy efficiency and material recyclability. Companies that fail to comply risk substantial fines, impacting profitability and market access. Compal must proactively invest in sustainable design and robust recycling partnerships to navigate this complex legal landscape effectively.

Governments worldwide are intensifying scrutiny on battery disposal, driven by the proliferation of electronics and electric vehicles. New regulations, anticipated in 2025, aim to curb environmental damage and fire hazards linked to improper battery management, especially for lithium-ion types.

Compal, as a significant producer of electronic devices, must navigate these evolving legal landscapes. Compliance with these battery disposal and recycling mandates is crucial for mitigating operational risks and maintaining its environmental stewardship image.

Circular Economy Initiatives and Repairability Laws

Governments worldwide are increasingly implementing legislation to foster circular economy principles, directly impacting electronics manufacturers like Compal. These laws mandate that products be designed for longevity, easier repair, and eventual recycling. For instance, the European Union's Ecodesign for Sustainable Products Regulation (ESPR), which began phased implementation in 2024, sets requirements for product durability, reusability, and repairability, including access to spare parts and repair information. This regulatory shift means Compal must adapt its product development cycles and after-sales strategies to comply with these emerging repairability standards.

The emphasis on repairability translates into concrete legal obligations. Companies may be required to make spare parts, diagnostic tools, and repair manuals available to independent repair providers and consumers. This could affect Compal's current business models, potentially necessitating changes in how they manage their supply chains and offer customer support. For example, the Right to Repair movement has gained significant traction, with several US states considering or passing legislation in 2024 and 2025 that would mandate access to repair resources for electronic devices.

Compal's adherence to these evolving legal frameworks will be crucial for its market access and brand reputation. Failure to comply with repairability mandates could result in penalties and reputational damage. Conversely, proactively integrating circular economy design principles and robust repair services can create a competitive advantage, appealing to environmentally conscious consumers and B2B clients seeking sustainable supply chain partners. By 2025, many regions are expected to have comprehensive regulations in place, making compliance a non-negotiable aspect of business operations in the electronics sector.

International Trade Regulations and Tariffs

Compal Electronics operates within a global environment shaped by evolving international trade regulations and tariffs. These rules, often influenced by geopolitical realignments, directly impact sourcing strategies and manufacturing site selections. For instance, the ongoing trade tensions between major economic blocs can lead to sudden changes in import duties, affecting the cost of components and finished goods. In 2024, the World Trade Organization (WTO) reported that the average applied tariff for electronics globally remained a key consideration for companies like Compal.

Navigating these legal frameworks is paramount for Compal's financial stability and continued market access. Laws governing import duties, stringent country-of-origin labeling requirements, and the terms of various bilateral and multilateral trade agreements significantly shape the company's operational footprint. Failure to comply can result in substantial penalties, supply chain disruptions, and reputational damage, underscoring the critical need for robust legal and compliance teams.

Key considerations for Compal include:

- Tariff Rates: Understanding and adapting to fluctuating import duties on electronic components and finished products across different markets.

- Trade Agreements: Leveraging preferential trade agreements, such as those within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or regional blocs, to optimize costs and supply chains.

- Country of Origin Rules: Ensuring accurate compliance with origin marking requirements, which can impact market access and tariff eligibility.

- Export Controls: Adhering to regulations on the export of sensitive technologies and goods to specific countries, which is increasingly pertinent in the current geopolitical climate.

Legal frameworks surrounding e-waste and product lifecycle management are tightening globally, with significant implications for Compal. By 2025, many regions will have enhanced Extended Producer Responsibility (EPR) laws, increasing manufacturer obligations for recycling and end-of-life product handling. For instance, the EU's Ecodesign for Sustainable Products Regulation (ESPR), with phased implementation starting in 2024, mandates improved durability, repairability, and recyclability, directly influencing Compal's design and supply chain strategies.

The increasing focus on the "Right to Repair" movement, with several US states considering or passing legislation in 2024 and 2025, requires companies like Compal to provide greater access to spare parts and repair information. This legal shift could necessitate adjustments to Compal's business models and customer support infrastructure to ensure compliance and avoid penalties.

International trade regulations and tariffs continue to be a critical legal factor for Compal's global operations. Fluctuating import duties and stringent country-of-origin labeling requirements, as highlighted by the WTO's ongoing monitoring of global tariffs in 2024, directly impact sourcing costs and market access. Compal must maintain robust compliance measures to navigate these complex trade laws effectively.

Environmental factors

Compal Electronics is significantly enhancing its commitment to sustainable manufacturing, a move directly influenced by escalating global environmental awareness and a strong consumer push for eco-friendly electronics. This strategic shift is evident in their proactive efforts to reduce their carbon emissions, incorporate more recyclable materials into their product development, and optimize production lines for greater energy efficiency.

In 2023, Compal reported a 5% reduction in greenhouse gas emissions intensity compared to their 2022 baseline, a testament to their ongoing investment in greener technologies. Furthermore, their target for 2025 is to increase the use of recycled plastics in their products to 15%, up from 8% in 2023, demonstrating a concrete step towards a circular economy model.

Compal Electronics is deeply invested in e-waste management and fostering a circular economy. A prime example is its participation in Taiwan's Ministry of Economic Affairs' Supply Chain ONE+N Carbon Reduction Program, which specifically targets reducing greenhouse gas emissions. This initiative underscores Compal's commitment to extending product lifecycles through robust recycling and material reuse strategies.

These circular economy efforts are not just about environmental responsibility; they are a strategic move to transform Compal's industrial supply chain. By embracing circular principles, the company aims to optimize resource utilization and minimize waste, aligning its operations with global sustainability trends and potentially unlocking new efficiencies and revenue streams through material recovery and remanufacturing.

Climate change and greenhouse gas (GHG) management are central to Compal's environmental strategy. The company is actively engaged in global dialogues and initiatives aimed at mitigating climate impact. For instance, Compal has set an ambitious target to source 100% renewable energy by 2050, reflecting a significant commitment to decarbonization.

Compal's approach extends beyond its own operations, focusing on driving substantial carbon reductions across its supply chain. This collaborative effort underscores a holistic view of climate action, recognizing the interconnectedness of emissions throughout the product lifecycle.

Green Product Development

Compal Electronics is increasingly focusing on green product development, integrating sustainable materials like bio-based polymers and recyclable metals into their designs. This shift is driven by growing regulatory pressures and consumer demand for eco-friendly electronics. For instance, the global market for sustainable electronics is projected to reach over $15 billion by 2027, indicating a significant opportunity for companies that prioritize environmental responsibility.

The company's product development strategy now emphasizes durability, energy efficiency, and ease of recycling. This approach not only aims to meet evolving environmental standards but also to enhance the long-term value proposition of their offerings. In 2024, Compal reported a 15% increase in the use of recycled materials across its product lines compared to the previous year.

- Sustainable Materials: Incorporation of bio-based polymers and recyclable metals in new product designs.

- Product Lifecycle Focus: Emphasis on durability, energy efficiency, and end-of-life recyclability.

- Market Alignment: Responding to regulatory demands and growing consumer preference for eco-conscious electronics.

- Performance Improvement: 15% year-over-year increase in recycled material usage in 2024.

Resource Scarcity and Energy Efficiency

Resource scarcity and the push for energy efficiency are significant drivers of change for Compal. This necessitates innovation in how they operate and design their products. For instance, the increasing demand for AI computing power means that managing energy consumption in data centers is paramount.

Advanced cooling solutions, like direct liquid cooling, are becoming essential for high-density AI data centers. These technologies are key to reducing the substantial energy footprint associated with these powerful systems and effectively managing heat. Compal's engagement with these advancements directly impacts its environmental stewardship and operational costs.

- Energy Consumption: Global data center energy consumption is projected to rise significantly, with AI workloads potentially doubling this demand by 2026.

- Cooling Efficiency: Direct liquid cooling can be up to 50% more energy-efficient than traditional air cooling methods, a critical factor for Compal's clients.

- Resource Management: The scarcity of critical minerals used in electronics production underscores the need for efficient manufacturing processes and product longevity.

Compal Electronics is actively responding to environmental pressures by integrating sustainable materials, such as bio-based polymers, into its product designs, a trend supported by a projected global market for sustainable electronics exceeding $15 billion by 2027. The company reported a 15% increase in recycled material usage in 2024, demonstrating a commitment to circular economy principles.

Addressing the rising energy demands of AI computing, Compal is exploring advanced cooling solutions like direct liquid cooling, which is up to 50% more energy-efficient than traditional air cooling. This focus on energy efficiency is crucial as global data center energy consumption is expected to surge, with AI workloads potentially doubling demand by 2026.

Compal's environmental strategy includes ambitious targets like sourcing 100% renewable energy by 2050 and a 5% reduction in greenhouse gas emissions intensity achieved in 2023. Their participation in programs like Taiwan's Supply Chain ONE+N Carbon Reduction Program highlights a dedication to reducing emissions across their entire supply chain.

| Environmental Focus Area | Compal's Action/Target | 2023/2024 Data/Projection |

|---|---|---|

| Greenhouse Gas Emissions | Reduce emissions intensity | 5% reduction in 2023 (vs. 2022 baseline) |

| Recycled Materials | Increase use in products | 15% target for recycled plastics by 2025; 15% YoY increase in recycled material usage in 2024 |

| Renewable Energy | Source renewable energy | 100% target by 2050 |

| E-Waste Management | Promote circular economy | Participation in Supply Chain ONE+N Carbon Reduction Program |

| Energy Efficiency (Data Centers) | Implement advanced cooling | Exploring direct liquid cooling (up to 50% more efficient) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Compal Electronics is built on a robust foundation of data from official government publications, reputable financial institutions like the World Bank and IMF, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.