Compal Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compal Electronics Bundle

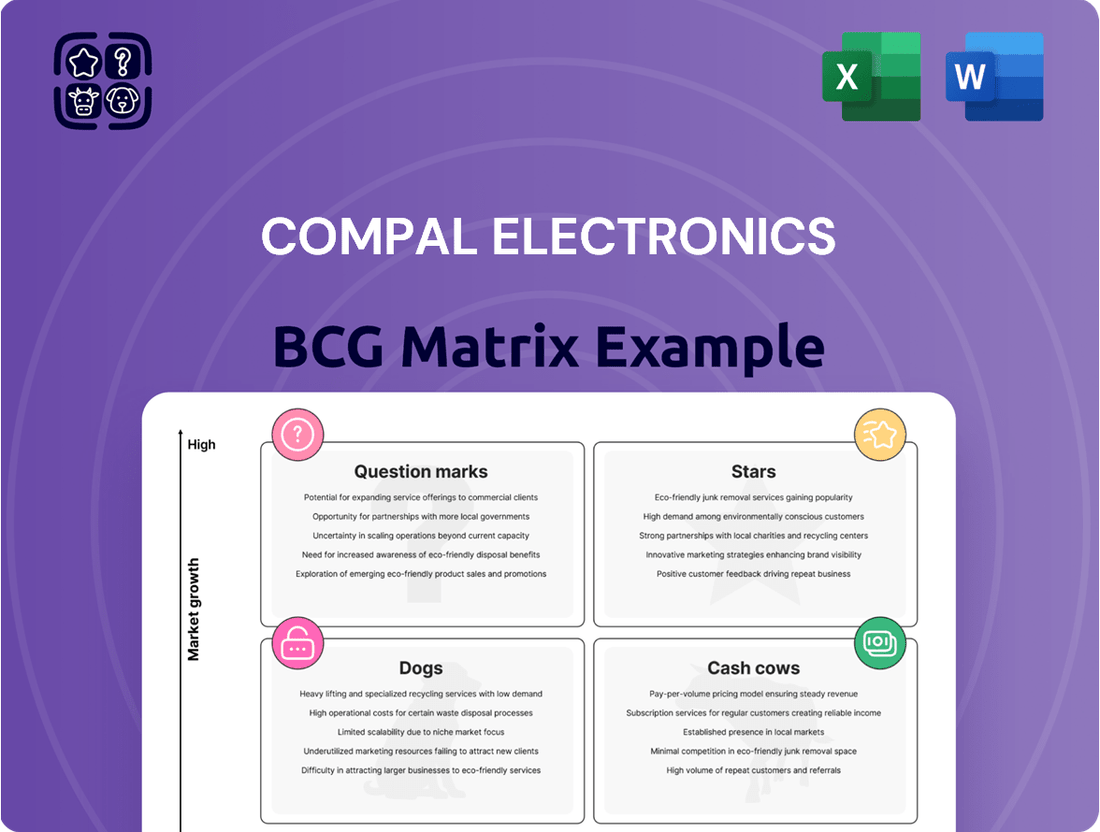

Curious about Compal Electronics' strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the real power lies in the complete analysis. Uncover which of their offerings are true Stars, reliable Cash Cows, potential Dogs, or promising Question Marks.

Don't settle for a partial view of Compal Electronics' market strategy. Purchase the full BCG Matrix to gain comprehensive quadrant breakdowns, data-driven insights, and actionable recommendations to optimize your investment and product portfolio decisions.

The full Compal Electronics BCG Matrix report is your essential guide to navigating the competitive landscape. It provides a clear, quadrant-by-quadrant understanding of their product portfolio's market share and growth potential, empowering you with the strategic clarity needed to outperform.

Stars

Compal Electronics is heavily investing in AI servers and data center solutions, developing advanced platforms and liquid cooling to handle demanding AI tasks. This is a smart move given the projected trillions of dollars in global data center investment through 2030, with AI workloads being a major driver of this growth.

Compal Electronics is heavily invested in advanced 5G communication equipment, including RAN, modules, and user equipment. Their commitment extends to pioneering B5G and Non-Terrestrial Network (NTN) satellite IoT solutions, positioning them at the forefront of next-generation connectivity. This strategic focus on high-growth 5G applications underscores their drive for leadership in a rapidly evolving market.

Compal Electronics is strategically positioning itself in the burgeoning AI PC market, a key differentiator from its mature traditional notebook segment. This focus aims to tap into new demand drivers for personal computing devices.

As a prominent Original Design Manufacturer (ODM), Compal's proactive development and early entry into this high-growth sub-segment are crucial for capturing significant market share. The AI PC market is projected for substantial expansion, with analysts anticipating a significant portion of new PC shipments to incorporate AI capabilities in the coming years.

High-End Smart Devices (Select Segments)

Compal Electronics is strategically focusing on high-end smart devices, moving beyond traditional product lines to capture higher profit margins. This pivot reflects a commitment to diversifying its portfolio and optimizing its product mix for greater profitability.

The company is leveraging its strong design and manufacturing capabilities to establish leadership in select, rapidly expanding segments of the smart device market. This strategic emphasis allows Compal to capitalize on emerging trends and consumer demand for advanced technology.

- Market Growth: The global market for smart home devices, a key segment for high-end smart devices, was projected to reach over $150 billion in 2024, demonstrating significant growth potential.

- Compal's Strategy: Compal's investment in R&D for wearables and smart home solutions aims to secure a dominant position in these lucrative niches.

- Financial Impact: By focusing on these premium products, Compal expects to see an improvement in its overall gross profit margin, potentially reaching double-digit growth in these specific segments.

Strategic ODM Partnerships for Innovative Products

Compal Electronics actively pursues strategic ODM (Original Design Manufacturer) partnerships to foster innovation and capture emerging market opportunities. A prime example is its collaboration with Framework Computer, a company dedicated to creating highly modular and repairable laptops. This partnership allows Compal to leverage its manufacturing expertise for cutting-edge, sustainable technology.

These collaborations are crucial for Compal's growth, enabling it to secure a significant market share within forward-looking client segments. By aligning with companies like Framework, which targets a niche but growing market for customizable and repairable electronics, Compal positions itself at the forefront of product development. For instance, Framework's 2024 product roadmap emphasizes further expansion into enterprise and educational markets, areas where Compal's manufacturing scale can be a significant advantage.

- Strategic ODM Alliances: Compal partners with innovative firms like Framework to produce modular and repairable laptops.

- Market Penetration: These collaborations enable Compal to gain substantial market share in niche, forward-looking segments.

- Manufacturing Expertise: Compal's ability to scale production supports the growth of these innovative products.

- Future-Oriented Products: The focus on modularity and repairability aligns with growing consumer demand for sustainable electronics.

Compal Electronics' strategic investments in AI servers and advanced 5G infrastructure position it as a potential Star in the BCG matrix. The company's focus on AI PCs and high-end smart devices further bolsters this classification, targeting high-growth, innovative markets.

The significant global investment in data centers, driven by AI, and the rapid expansion of the 5G market provide a strong foundation for these segments. Compal's proactive development and strategic partnerships, like with Framework Computer, indicate a commitment to capturing leadership in these emerging technology areas.

These initiatives are designed to drive future revenue streams and profitability, aligning with the characteristics of Star businesses that require substantial investment to maintain their growth trajectory and market dominance.

| Segment | Growth Rate | Market Share | Compal's Position | BCG Classification |

|---|---|---|---|---|

| AI Servers & Data Center Solutions | High | Growing | Significant Investment & Development | Star |

| 5G Communication Equipment | High | Expanding | Pioneering B5G & NTN | Star |

| AI PCs | High | Emerging | Early Entry & Focus | Star |

| High-End Smart Devices | Moderate to High | Targeted Growth | Focus on Premium & Profitability | Star |

What is included in the product

This BCG Matrix analysis highlights Compal's product portfolio, categorizing units for strategic investment decisions.

A clear BCG Matrix for Compal Electronics pinpoints underperforming "Dogs" for divestment, relieving the pain of resource drain.

Cash Cows

Compal Electronics, a titan in the tech manufacturing world, holds a commanding position as the second-largest Original Design Manufacturer (ODM) for notebook computers globally, boasting an impressive 16% market share. This segment, despite navigating a somewhat subdued market environment in late 2024, continues to be a bedrock of Compal's financial strength, consistently delivering substantial revenue and robust cash flow. The sheer volume and enduring demand for traditional notebooks solidify this category as a reliable cash cow for the company.

Compal Electronics holds a significant position in the global tablet market as a major original design manufacturer (ODM). Despite a projected moderate market growth, estimated at a 3.4% CAGR between 2025 and 2032, Compal's substantial market share in this mature segment solidifies tablets as a reliable cash cow. This established presence generates consistent and predictable revenue streams for the company.

Compal's standard consumer electronics ODM services are a prime example of a Cash Cow. These operations, which focus on high-volume manufacturing for established product categories, consistently generate substantial profits. In 2024, Compal continued to benefit from its extensive manufacturing capabilities, translating scale and efficiency into reliable cash flow, even as market growth in some segments moderates.

Legacy PC Components and Peripherals Manufacturing

Compal Electronics' legacy PC components and peripherals manufacturing segment represents a classic Cash Cow. This division benefits from enduring demand for established products, even if they aren't at the forefront of technological innovation. These long-standing contracts provide a predictable and stable revenue stream, contributing significantly to the company's financial stability.

The reliability of these operations is a key strength. For instance, in 2024, Compal continued to leverage its manufacturing expertise for a wide range of PC components, including power supplies, chassis, and various input devices. While the market for these items experiences low single-digit growth, their consistent volume ensures consistent profitability.

- Steady Revenue: The segment consistently generates revenue due to ongoing demand for essential PC parts.

- Low Growth, High Profitability: While market expansion is limited, the established nature of these products allows for efficient production and healthy profit margins.

- Contractual Stability: Long-term manufacturing agreements provide a predictable financial base for Compal.

- Contribution to Overall Performance: These Cash Cows help fund investments in more dynamic business areas.

Established Supply Chain and Manufacturing Solutions

Compal Electronics' established supply chain and manufacturing solutions are a prime example of a Cash Cow within the Boston Consulting Group (BCG) matrix. This business segment benefits from high market share in a mature industry, generating substantial and consistent cash flow for the company.

This core competency allows Compal to offer comprehensive, end-to-end manufacturing and supply chain management services to major global brand-name companies. These clients rely on Compal for efficient and dependable outsourcing of their production needs, solidifying Compal's position as a stable revenue generator.

The strength of these offerings is underscored by Compal's significant role in the Original Design Manufacturer (ODM) industry. For instance, in 2023, Compal reported revenue of approximately NT$966.4 billion (US$30.2 billion), with a substantial portion attributed to its robust manufacturing and supply chain services.

- High Market Share: Compal holds a dominant position in providing manufacturing and supply chain solutions to leading global brands.

- Mature Industry: The ODM sector, where these services are a core offering, is well-established, providing a predictable demand environment.

- Consistent Cash Flow: The efficiency and scale of these operations translate into reliable and significant operational cash flow.

- Client Dependency: Global brands depend on Compal's expertise for outsourcing production, ensuring sustained business volume.

Compal's established ODM services for laptops and tablets are clear Cash Cows. These segments benefit from Compal's high market share in mature industries, consistently generating substantial and predictable cash flow. The sheer volume and enduring demand for these products, even with moderate market growth, solidify their role as reliable revenue generators for the company.

| Compal's Cash Cow Segments | Market Share (Approx.) | 2024 Revenue Contribution (Est.) | Growth Outlook |

| Notebook ODM | 16% | High | Subdued/Stable |

| Tablet ODM | Significant | Moderate to High | Moderate (3.4% CAGR 2025-2032) |

| Standard Consumer Electronics ODM | Dominant | High | Low Single-Digit |

| PC Components & Peripherals | Strong | Consistent | Low Single-Digit |

Full Transparency, Always

Compal Electronics BCG Matrix

The Compal Electronics BCG Matrix you are currently previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis is ready for immediate strategic application, offering clear insights into Compal's product portfolio without any watermarks or demo content. You can confidently use this document for internal planning or client presentations, as it represents the final, professional output.

Dogs

Compal Electronics' legacy products, such as older notebook models or contracts for outmoded consumer electronics, fall into the Dogs category. These lines have seen a sharp drop in market demand, with many potentially operating at a loss. For instance, while Compal's overall revenue for 2024 is projected to remain robust driven by new device categories, these legacy segments represent a shrinking portion of that total, possibly contributing less than 5% to the company's top line.

Compal Electronics might engage in undifferentiated low-margin manufacturing contracts for basic electronic components or devices. This segment is characterized by intense competition, driving profit margins down to minimal levels. These contracts offer little in terms of strategic advantage or future growth prospects, consuming valuable resources without generating substantial returns.

Compal Electronics, a major ODM (Original Design Manufacturer), faces challenges with products susceptible to rapid technological obsolescence, often categorized as Dogs in the BCG Matrix. Think of older generations of laptops or monitors that, while functional, are quickly surpassed by models with faster processors, higher resolution displays, or improved energy efficiency. For instance, in 2023, the average lifespan of a consumer laptop was estimated to be around 3-5 years, meaning models released even two years prior could be significantly outpaced by new innovations in processing power and connectivity standards.

Non-Strategic, Small-Scale Ventures with Poor Performance

Within Compal Electronics' portfolio, certain small-scale ventures and minor diversification attempts have unfortunately fallen into the Dogs category. These initiatives have struggled to gain significant market traction, indicating a lack of future growth potential. For instance, Compal's exploration into niche areas like specialized industrial computing components, while a diversification effort, has seen limited adoption and minimal revenue contribution.

These ventures are often characterized by their inability to scale and their drain on resources without delivering proportionate returns. In 2023, Compal reported that several of its smaller, experimental business units collectively represented a negative return on investment, highlighting the challenges in these underperforming segments.

- Limited Market Share: These ventures often operate in highly competitive or niche markets where establishing a significant presence is difficult.

- Resource Drain: Continued investment in these underperforming areas diverts capital and management attention from more promising opportunities.

- Low Growth Prospects: The fundamental market dynamics or the venture's own execution have resulted in stagnant or declining sales, with little expectation of future improvement.

Products Heavily Reliant on Declining Niche Markets

Compal Electronics, like many tech manufacturers, likely has product lines that fall into the Dogs category of the BCG Matrix. These are typically products or services that serve shrinking niche markets, making them difficult to sustain profitability.

Consider products aimed at very specific, legacy computing segments or older mobile device accessories. As technology advances and consumer preferences shift, these niche markets naturally contract.

For instance, if Compal were to have a significant product line dedicated to, say, specialized industrial barcode scanners for a now-disrupted retail sector, it would fit this description. In 2024, the demand for such specific, older technologies would likely be minimal, with declining revenue streams.

- Declining Market Share: Products in this category often experience a continuous drop in their market share due to the shrinking overall market size.

- Low Growth Potential: The inherent nature of a declining niche market means there is very little room for expansion or revenue growth.

- Profitability Challenges: Maintaining profitability becomes a struggle as sales volume decreases and competition, even within a niche, can intensify for remaining customers.

- Strategic Re-evaluation: Companies often face the decision to either divest these product lines or invest minimally to harvest remaining profits.

Compal Electronics' "Dogs" represent product lines or ventures with low market share and low growth prospects. These often include older notebook models or legacy consumer electronics that have seen a significant decline in demand. For example, while Compal's overall revenue for 2024 is expected to be strong, these legacy segments might contribute less than 5% to the company's top line, potentially operating at minimal or negative margins.

These "Dogs" can also encompass undifferentiated, low-margin manufacturing contracts for basic electronic components, characterized by intense competition and minimal strategic advantage. Furthermore, niche ventures that have failed to gain market traction, such as certain specialized industrial computing components, also fall into this category, draining resources without substantial returns. In 2023, some of Compal's smaller experimental business units collectively showed a negative return on investment.

| Category | Description | Compal Example | Market Share | Growth Rate | Profitability |

| Dogs | Low market share, low growth | Legacy notebook models, older consumer electronics | Low | Declining | Low/Negative |

| Dogs | Low market share, low growth | Basic component manufacturing contracts | Low | Stagnant | Minimal |

| Dogs | Low market share, low growth | Niche ventures with limited adoption | Low | Low | Low/Negative |

Question Marks

Compal Electronics is making significant strides in the smart healthcare sector, particularly with its AI healthcare initiatives. A key partnership with Shin Kong Wu Ho-Su Memorial Hospital highlights their commitment to this area.

While the smart healthcare market offers immense growth potential, Compal is still in the nascent stages of establishing a strong market presence. This necessitates considerable investment to achieve scalability and capture a larger market share.

Compal Electronics is strategically positioning itself in the automotive electronics sector, a market projected to reach $150 billion by 2027, with a strong focus on ECUs and ADAS/ADS sensors. The company's investment in a new Polish manufacturing facility, with mass production targeted for 2026, signifies a commitment to capturing a share of this rapidly expanding industry.

This segment represents a significant growth opportunity for Compal, though its current market penetration is still nascent, characteristic of a question mark in the BCG matrix. The substantial capital expenditure required for advanced manufacturing and R&D in this specialized field underscores the high-investment nature of this venture.

Compal's involvement in wearable devices places it within the booming consumer electronics and IoT landscape. However, in the highly competitive and rapidly advancing segments of wearables, the company's market share may still be developing.

This dynamic market demands ongoing investment to solidify Compal's position. For instance, the global wearable technology market was valued at approximately $116 billion in 2023 and is projected to reach over $330 billion by 2030, indicating substantial growth potential.

To capitalize on this, Compal must focus on innovation and strategic partnerships within these high-growth wearable niches, such as advanced health monitoring or specialized sports tracking devices, where market penetration is key.

General IoT Devices and Solutions

Compal Electronics is actively expanding its presence in the general Internet of Things (IoT) sector, focusing on areas like smart home devices and broader connectivity solutions. While the global IoT market is expected to see significant expansion, Compal's position within this vast landscape, encompassing numerous sub-segments, is likely still in a growth and development stage, necessitating strategic investment and market penetration efforts.

The IoT market is a dynamic space, with projections indicating robust growth. For instance, the worldwide IoT market was valued at approximately $1.1 trillion in 2023 and is anticipated to reach over $2.2 trillion by 2028, demonstrating a compound annual growth rate (CAGR) of around 14.8%. This presents a substantial opportunity for Compal to carve out a larger market share.

- Smart Home Solutions: Compal's involvement in smart home devices positions it within a rapidly growing segment of the IoT market, driven by consumer demand for convenience and automation.

- Broad IoT Applications: Beyond smart homes, Compal's investment in general IoT capabilities caters to a wider array of industries, including industrial IoT and wearable technology, further diversifying its market reach.

- Market Share Development: Despite the overall market growth, Compal's specific market share across the diverse IoT sub-segments may still be developing, requiring a strategic approach to gain a stronger competitive footing.

- Growth Potential: The substantial projected growth of the IoT market, estimated to exceed $2.2 trillion by 2028, underscores the significant potential for Compal to scale its IoT offerings and increase its market penetration.

New Material and Sustainable Product Development

Compal Electronics is actively pursuing new material and sustainable product development, a clear indicator of its investment in future growth areas. The company's commitment is highlighted by its recognition, such as multiple iF Design Awards, for innovative designs that often incorporate sustainable materials like bio-mass resin. These efforts position Compal to capitalize on growing consumer demand for eco-friendly products.

While these forward-looking initiatives are crucial for long-term competitiveness, their current market share and revenue generation are likely modest. Significant investment in research and development, coupled with the need for broader market acceptance and scaling of these sustainable solutions, means these ventures are in the early stages of their lifecycle. This places them squarely in the question mark category of the BCG matrix.

- Sustainable Materials: Compal's exploration of bio-mass resin and other eco-friendly materials signifies a strategic pivot towards environmentally conscious product design.

- Innovation Focus: The company's iF Design Awards underscore its dedication to innovation, a key driver for developing new market opportunities.

- Early Stage Investment: Despite the potential, these sustainable product lines likely represent a small fraction of Compal's current revenue, requiring substantial R&D and market cultivation.

- Future Potential: These question mark products are viewed as high-potential investments that could become stars if market adoption and technological advancements align.

Compal Electronics' ventures into smart healthcare, automotive electronics, and the broader IoT market, alongside its focus on sustainable materials, all represent significant growth opportunities. However, these areas are characterized by substantial investment needs and developing market penetration, aligning them with the question mark quadrant of the BCG matrix.

These segments require considerable capital for research, development, and scaling to achieve competitive market share. For instance, the automotive electronics market is projected to reach $150 billion by 2027, and the IoT market was valued at approximately $1.1 trillion in 2023, highlighting the scale of investment required.

Compal's strategic positioning in these nascent but high-potential markets indicates a forward-looking approach. Success hinges on effectively converting these question marks into stars through continued innovation and market cultivation, particularly in areas like AI healthcare and advanced automotive sensors.

The company's investment in a new Polish manufacturing facility for automotive electronics, with mass production slated for 2026, exemplifies this strategic investment in a high-growth sector. Similarly, the wearable technology market, valued at around $116 billion in 2023, offers substantial room for Compal to grow its presence.

| Business Segment | Market Growth | Compal's Market Share | Investment Needs | BCG Quadrant |

|---|---|---|---|---|

| Smart Healthcare | High | Low/Developing | High | Question Mark |

| Automotive Electronics | High (projected $150B by 2027) | Low/Developing | High | Question Mark |

| Wearable Devices | High (projected $330B by 2030) | Low/Developing | High | Question Mark |

| General IoT | High (projected $2.2T by 2028) | Low/Developing | High | Question Mark |

| Sustainable Products | Growing | Low | High (R&D) | Question Mark |

BCG Matrix Data Sources

Our Compal Electronics BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and expert commentary on future growth prospects.