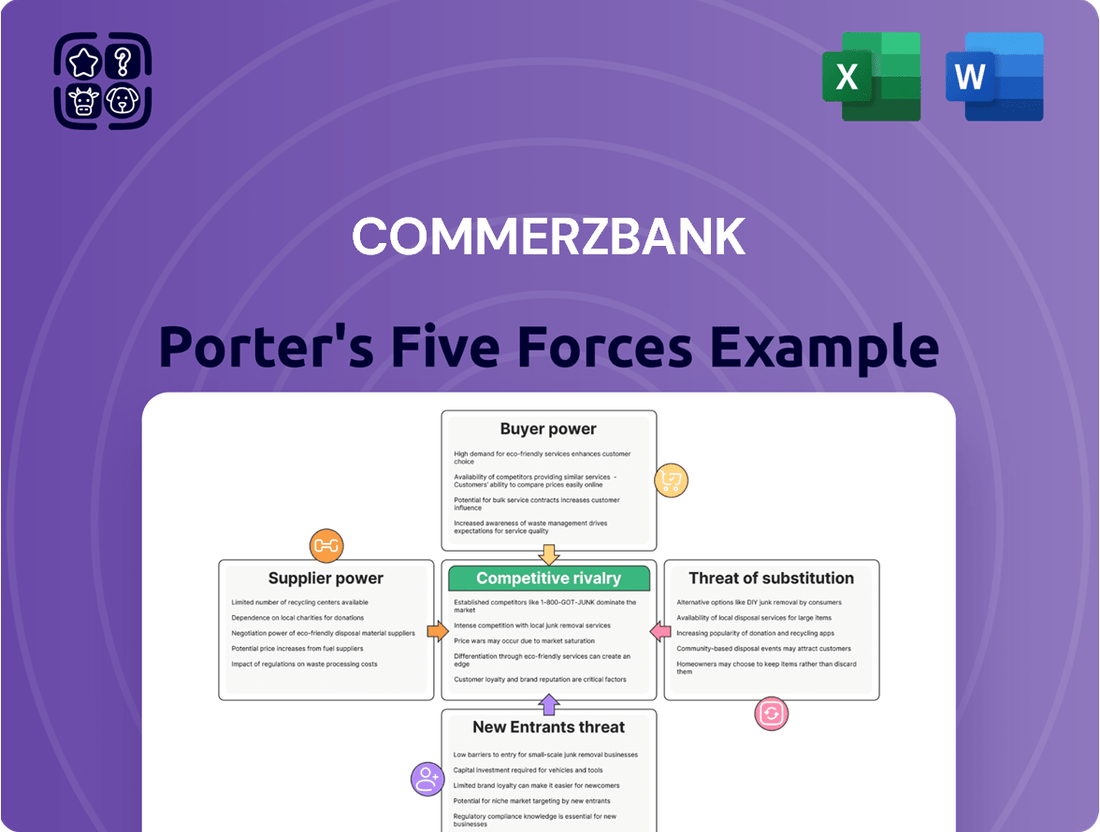

Commerzbank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commerzbank Bundle

Commerzbank operates within a dynamic banking landscape, where intense rivalry among established players and the looming threat of new entrants significantly shape its competitive environment. Understanding the nuanced influence of buyer power and the potential disruption from substitute products is crucial for navigating this complex market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Commerzbank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Commerzbank's increasing reliance on advanced IT infrastructure, cybersecurity solutions, and AI-driven platforms gives specialized technology vendors considerable bargaining power. These suppliers often provide proprietary software and expertise, making switching costs high and limiting Commerzbank's alternatives.

For instance, the global IT spending in the banking sector was projected to reach over $200 billion in 2024, highlighting the critical role of technology providers. Commerzbank's digital transformation initiatives, which aim to enhance customer experience and operational efficiency, further amplify the strategic importance and thus the bargaining power of these specialized tech partners.

The banking industry, including Commerzbank, faces intense competition for highly skilled human capital, especially in fields like digital transformation, data analytics, and artificial intelligence. This elevated demand for specialized talent significantly bolsters the bargaining power of these employees.

Commerzbank's strategic focus on efficiency and ongoing restructuring necessitates access to these advanced skill sets. Consequently, individuals possessing expertise in these critical areas can negotiate for higher salaries and more favorable employment conditions, directly impacting the bank's labor costs and operational flexibility.

Financial market infrastructure providers, including payment networks and clearing houses, wield considerable bargaining power. Their services are indispensable for Commerzbank's daily transactions and its integration into the broader financial ecosystem. For instance, SWIFT, a key messaging network for international financial transactions, processed an average of 42 million messages daily in 2023, highlighting its critical role and thus its leverage.

Data and Analytics Service Providers

Data and analytics service providers hold significant bargaining power over Commerzbank. In today's financial landscape, access to high-quality market data, credit intelligence, and customer analytics is not just beneficial but essential for effective risk management, strategic planning, and tailored customer experiences. The specialized nature and often proprietary value of this data means these providers can command higher prices and more favorable terms.

The reliance on these specialized providers for critical insights means Commerzbank has limited alternatives. For instance, in 2024, the global financial data market was valued at over $30 billion, with a significant portion dedicated to specialized analytics and AI-driven insights, highlighting the concentrated nature of this sector.

- High Switching Costs: Migrating data systems and analytical tools from one provider to another can be complex and costly for Commerzbank.

- Data Uniqueness: Providers often possess unique datasets or analytical methodologies that are difficult for banks to replicate internally.

- Essential for Operations: Accurate data is fundamental for regulatory compliance, fraud detection, and investment decisions, increasing supplier leverage.

- Market Concentration: A few dominant players often control key data streams, reducing competition and strengthening their bargaining position.

Regulatory Compliance and Legal Services

The intricate and constantly shifting regulatory environment in Germany and across the European Union, exemplified by new frameworks such as the Markets in Crypto-Assets (MiCA) regulation, significantly elevates the bargaining power of suppliers offering specialized legal and compliance services. These expert firms are crucial for Commerzbank to successfully navigate these complex requirements and avert substantial financial penalties.

The demand for specialized regulatory expertise is high, as evidenced by the increasing number of new financial regulations being implemented. For instance, the EU's Digital Operational Resilience Act (DORA), which came into effect in January 2023, imposes stringent ICT risk management requirements on financial entities, necessitating significant investment in compliance and legal advisory services.

- MiCA Regulation: The introduction of MiCA in 2024 creates a unified framework for crypto-asset service providers, requiring significant legal interpretation and implementation support for financial institutions like Commerzbank.

- DORA Implementation: Financial firms are actively seeking legal counsel to ensure compliance with DORA, a regulation that impacts all aspects of digital operational resilience.

- Increased Compliance Costs: The growing complexity of regulations leads to higher spending on legal and compliance services, strengthening the position of specialized providers.

- Risk of Penalties: Non-compliance can result in significant fines, making the services of expert legal and compliance firms indispensable for Commerzbank.

Specialized IT and AI vendors hold significant sway due to Commerzbank's reliance on proprietary technology and high switching costs. The global IT spending in banking exceeded $200 billion in 2024, underscoring the critical nature of these suppliers in Commerzbank's digital transformation efforts.

Financial market infrastructure providers, such as SWIFT, which processed approximately 42 million messages daily in 2023, also possess substantial bargaining power. Their essential services for transactions and ecosystem integration make them indispensable partners for Commerzbank.

Data and analytics service providers wield considerable influence, as high-quality data is vital for risk management and strategic planning. The global financial data market, valued over $30 billion in 2024, reflects the concentrated nature and essential value of these specialized insights.

| Supplier Category | Key Services | Bargaining Power Drivers | Example Data/Fact |

|---|---|---|---|

| IT & AI Vendors | Proprietary Software, AI Platforms | High Switching Costs, Specialized Expertise | Banking IT Spending: >$200B (2024 Projection) |

| Market Infrastructure | Payment Networks, Clearing Houses | Indispensable for Operations, Network Effects | SWIFT Messages: ~42M/day (2023) |

| Data & Analytics Providers | Market Data, Credit Intelligence | Data Uniqueness, Essential for Decisions | Financial Data Market: >$30B (2024 Projection) |

What is included in the product

This analysis dissects Commerzbank's competitive environment by examining the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Effortlessly identify and quantify competitive threats, empowering Commerzbank to proactively mitigate risks and capitalize on opportunities.

Customers Bargaining Power

For basic retail banking, digital platforms and greater transparency significantly lower switching costs for private customers. This ease of comparison and migration empowers individuals to readily move to institutions offering better terms or lower fees.

The proliferation of digital-only banks further intensifies this trend, as they often provide streamlined onboarding processes and competitive pricing. In 2024, reports indicated that over 40% of banking customers in Germany considered switching their primary bank within the next 12 months, a testament to the heightened bargaining power driven by low switching costs.

Commerzbank's strategic focus on Germany's Mittelstand and large corporations places it in direct contact with highly financially astute clients. These businesses are not only knowledgeable about financial products but also actively cultivate relationships with numerous banking institutions, driving a competitive environment for Commerzbank.

The bargaining power of these sophisticated corporate clients is significant. Their substantial transaction volumes and the complexity of their financial needs, including financing, capital markets access, and international trade, allow them to negotiate favorable terms. For instance, in 2023, German Mittelstand companies, a core Commerzbank segment, continued to seek innovative and cost-effective solutions, putting pressure on banks to offer competitive pricing and specialized services.

Customers now have unprecedented access to pricing information thanks to a surge in online comparison tools and financial data platforms. This makes it easier for them to shop around for the best deals, directly impacting Commerzbank's ability to set its own prices.

In 2024, the average European consumer spent an estimated 30 minutes per month researching financial products online, a 15% increase from 2023, highlighting the growing importance of price transparency. This readily available information empowers customers, forcing Commerzbank to remain competitive to retain and attract business.

Digital Empowerment and Self-Service

Customers are increasingly empowered through digital banking, allowing them to handle their finances independently. This self-service capability reduces their need for traditional bank interactions, raising expectations for smooth digital experiences. For instance, in 2024, many European banks reported a significant uptick in mobile banking usage, with some seeing over 70% of transactions conducted digitally, directly impacting how customers perceive value and service.

This digital empowerment means customers can more easily compare offerings and switch providers if their digital needs aren't met. Banks must therefore invest heavily in user-friendly platforms and innovative digital services to retain customers. The ongoing competition means that a failure to provide a superior digital experience can quickly lead to a loss of market share.

- Digital Channel Dominance: By the end of 2024, over 60% of retail banking customers in developed markets primarily used digital channels for routine transactions.

- Self-Service Efficiency: The average cost to serve a customer digitally is estimated to be 70% lower than through traditional branch interactions.

- Customer Expectations: A 2024 survey indicated that 85% of banking customers expect personalized digital services and seamless integration across all platforms.

Availability of Diverse Financial Products

The availability of diverse financial products significantly impacts Commerzbank's bargaining power with its customers. While Commerzbank offers a broad spectrum of financial services, the broader market presents a multitude of alternatives for nearly every specific financial need. For instance, in 2023, the European banking sector saw continued competition in areas like mortgage lending and investment products, with various institutions offering competitive rates and innovative solutions.

Customers can easily switch to a competitor if they find a more attractive loan, investment, or wealth management service. This flexibility directly limits Commerzbank's ability to cross-sell products or cultivate exclusive customer relationships. In 2024, FinTech companies continued to disrupt traditional banking by offering specialized, often lower-cost, digital alternatives for services like payments and savings, further fragmenting customer loyalty.

- Increased Customer Choice: The market offers numerous alternatives for loans, investments, and wealth management.

- Reduced Cross-Selling Opportunities: Customers can easily opt for specialized products from competitors, hindering Commerzbank's ability to bundle services.

- Price Sensitivity: The availability of comparable products from other providers makes customers more sensitive to pricing and fees.

- FinTech Competition: Digital-first providers in 2024 offered specialized, often cheaper, alternatives, intensifying customer choice.

The bargaining power of Commerzbank's customers is significant, driven by low switching costs and increased transparency. Digitalization allows customers to easily compare offerings and move to competitors, especially with the rise of digital-only banks. In 2024, a substantial portion of German banking customers were considering switching, highlighting this trend.

Sophisticated corporate clients, a key segment for Commerzbank, wield considerable power due to their large transaction volumes and complex financial needs. They actively negotiate favorable terms, as seen with Mittelstand companies seeking cost-effective solutions in 2023. This necessitates Commerzbank offering competitive pricing and specialized services.

Customers' access to pricing information through online tools empowers them to seek the best deals, limiting Commerzbank's pricing flexibility. The average European consumer's increased time spent researching financial products in 2024 underscores this heightened price sensitivity.

Digital empowerment allows customers greater self-service and easier comparison, raising expectations for seamless digital experiences. The high adoption of mobile banking in 2024 signifies that banks must excel digitally to retain customers, as failure to do so can lead to market share loss.

| Factor | Impact on Commerzbank | 2023-2024 Data Point |

|---|---|---|

| Low Switching Costs | Increases customer power to move to competitors. | Over 40% of German banking customers considered switching in 2024. |

| Price Transparency | Limits Commerzbank's ability to set prices independently. | Average European consumer spent 30 mins/month researching financial products in 2024. |

| Digital Empowerment | Customers expect superior digital experiences, can switch easily. | Over 70% of transactions conducted digitally by some European banks in 2024. |

| Diverse Product Availability | Customers can find specialized alternatives, reducing cross-selling. | FinTechs offered cheaper, specialized alternatives for payments and savings in 2024. |

Preview the Actual Deliverable

Commerzbank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Commerzbank, detailing the competitive landscape and strategic positioning of the bank. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights without any alterations or placeholders.

Rivalry Among Competitors

Commerzbank operates in a mature and intensely competitive German banking landscape. Rivalry is particularly strong from major universal banks such as Deutsche Bank, DZ Bank, and the extensive Sparkassen-Finanzgruppe. These established institutions vigorously compete across all banking sectors, from retail services to corporate and investment banking, often resulting in aggressive pricing strategies and a continuous drive for product innovation.

Traditional banks like Commerzbank are pouring significant resources into digital transformation, embracing AI and improving online offerings to keep and win customers. This is sparking a tech-driven competition, where banks are striving to provide the most user-friendly and complete digital banking experiences.

For example, in 2023, Commerzbank announced plans to invest €1 billion in its IT infrastructure and digital capabilities by 2027, aiming to enhance its customer service and operational efficiency. This aggressive push by incumbents intensifies rivalry as they race to match or surpass the digital offerings of newer, agile fintech competitors.

Global banks are increasingly targeting Germany's digital banking sector. Major players like JPMorgan, ING, and BBVA are actively expanding their online consumer offerings, directly challenging Commerzbank's established position.

These international competitors often possess substantial financial backing and sophisticated, proven digital platforms. This influx of well-resourced foreign entities intensifies the competitive landscape, forcing Commerzbank to innovate and adapt rapidly to retain its market share in Germany.

Disruptive Fintech Startups

Disruptive fintech startups pose a significant competitive threat to Commerzbank. The German fintech landscape is vibrant, with many innovative companies targeting specific banking functions like payments and lending. These agile players, while not offering full banking services, can erode Commerzbank's market share and profitability in these specialized areas.

For instance, in 2023, the German fintech sector saw continued growth, with investment in fintechs reaching €1.7 billion, according to the Bundesverband deutscher Startups. This influx of capital fuels innovation and allows startups to develop user-friendly, cost-effective alternatives to traditional banking products.

- Niche Specialization: Fintechs often excel by focusing on a single service, like digital payments or peer-to-peer lending, offering superior user experience and lower fees.

- Agility and Innovation: Startups can adapt quickly to market changes and technological advancements, outmaneuvering larger, more established institutions.

- Customer Acquisition: Their digital-first approach and specialized offerings attract younger, tech-savvy customer segments, potentially diverting them from traditional banks.

- Embedded Finance Growth: The increasing trend of embedding financial services into non-financial platforms means fintechs can reach customers through everyday applications, bypassing traditional bank interfaces.

Consolidation and M&A Activity

The German banking sector is ripe for consolidation, a trend highlighted by UniCredit's significant stake in Commerzbank. This potential for mergers and acquisitions signals a shifting competitive environment where larger, more dominant players could emerge, altering market shares and intensifying rivalry.

Such strategic moves force Commerzbank to remain agile, constantly reassessing and adapting its business strategies to maintain its competitive edge. The ongoing discussions and potential M&A activities underscore the dynamic nature of the banking landscape, where scale and market position are increasingly crucial.

- UniCredit's stake in Commerzbank: As of early 2024, UniCredit held a notable stake, fueling speculation about potential consolidation.

- German banking sector consolidation: Analysts have long predicted a wave of mergers in Germany due to overcapacity and low profitability.

- Impact on Commerzbank: Increased M&A activity could lead to larger competitors with greater economies of scale, pressuring Commerzbank's margins and market share.

Commerzbank faces intense rivalry from established German banks, digital-first fintechs, and expanding international players. This competition drives innovation and necessitates significant investment in digital transformation, as evidenced by Commerzbank's €1 billion IT investment by 2027. The German fintech sector's growth, attracting €1.7 billion in investment in 2023, further intensifies this dynamic.

| Competitor Type | Key Players | Impact on Commerzbank |

|---|---|---|

| Major German Banks | Deutsche Bank, DZ Bank, Sparkassen-Finanzgruppe | Aggressive pricing, product innovation, strong customer loyalty |

| International Banks | JPMorgan, ING, BBVA | Sophisticated digital platforms, global reach, increased market pressure |

| Fintech Startups | Various specialized payment, lending, and investment platforms | Niche service disruption, user experience focus, potential market share erosion |

SSubstitutes Threaten

The rise of fintech payment and lending platforms presents a significant threat of substitutes for Commerzbank. These platforms, such as PayPal, Stripe for payments, and numerous P2P lending apps, offer streamlined, often cheaper alternatives to traditional banking services. For example, by the end of 2023, the global digital payments market was valued at over $8.5 trillion, demonstrating the substantial shift away from traditional methods.

Fintech solutions bypass established banking infrastructure, providing users with greater convenience and potentially lower transaction fees. This direct competition erodes Commerzbank's revenue streams from payment processing and traditional lending. In 2024, the European fintech lending market continued its expansion, with many platforms reporting double-digit growth in loan origination volumes.

The threat of substitutes for Commerzbank's investment and wealth management services is significant, primarily from online brokers, robo-advisors, and digital wealth management platforms. These digital alternatives provide a more accessible and often less expensive way for individuals to manage their investments. For instance, the global robo-advisory market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a clear shift towards these digital solutions.

These platforms cater to a growing segment of tech-savvy investors who prefer self-directed investing or automated, passive strategies. This trend can divert assets away from traditional wealth management services offered by banks like Commerzbank. In 2024, the increasing adoption of digital financial tools suggests that a considerable portion of new investment capital may bypass established institutions in favor of these streamlined, cost-effective digital offerings.

The rise of cryptocurrencies and Decentralized Finance (DeFi) presents a growing threat of substitutes for traditional banking services. These digital alternatives offer novel ways to transfer value, borrow, and invest, bypassing established financial institutions. For example, the total value locked in DeFi protocols reached over $100 billion in early 2024, indicating significant user engagement.

As regulatory frameworks for crypto and DeFi become clearer and the underlying technology matures, their appeal as substitutes is likely to broaden. Younger demographics, in particular, are showing a greater inclination towards these digital-first financial solutions, potentially impacting Commerzbank's traditional customer base and revenue streams in areas like lending and payments.

Embedded Finance Solutions

The threat of substitutes for traditional banking services is intensifying as non-financial companies increasingly embed financial solutions into their own platforms. For instance, e-commerce giants are offering integrated 'buy now, pay later' (BNPL) options, making it easier for consumers to finance purchases directly within the shopping experience. This trend bypasses the need for customers to seek separate loans or credit from banks like Commerzbank.

Automotive manufacturers are also a prime example, providing in-house financing and insurance at the point of sale, simplifying the car buying process and reducing reliance on external financial institutions. This seamless integration into a customer's primary transaction makes traditional banking services appear less necessary.

By 2024, the global embedded finance market was projected to reach over $7 trillion, highlighting the significant shift in how financial services are being delivered and consumed. This growth indicates a clear substitution threat, as consumers opt for convenience and integration over traditional banking channels.

- E-commerce BNPL: Platforms like Klarna and Afterpay, integrated into online retail, offer direct financing, reducing demand for credit cards from banks.

- Automotive Financing: Car manufacturers increasingly offer their own financing arms, capturing a significant portion of auto loan market share.

- Digital Wallets: Services like Apple Pay and Google Pay are expanding beyond simple payments to include features like peer-to-peer transfers, potentially encroaching on basic banking functions.

- Fintech Innovations: The rapid development of specialized fintech solutions for payments, lending, and investments provides alternative avenues for consumers, bypassing incumbent banks.

Corporate Treasury Management and Direct Market Access

Large corporate clients are increasingly building sophisticated in-house treasury operations, a trend that directly substitutes for services traditionally offered by banks like Commerzbank. By developing robust internal capabilities for cash management, risk mitigation, and even direct access to capital markets, these corporations can bypass intermediaries.

This shift means fewer transactions for services such as foreign exchange hedging or short-term debt issuance may flow through Commerzbank. For instance, in 2024, a significant number of multinational corporations expanded their treasury teams, investing in advanced treasury management systems (TMS) to centralize and automate these functions.

- Increased In-House Treasury Expertise: Corporations are hiring more treasury specialists to manage complex financial operations internally.

- Direct Capital Market Access: Larger firms are increasingly issuing their own commercial paper or bonds, bypassing bank syndication for some needs.

- Technological Advancements: Sophisticated TMS platforms enable companies to manage liquidity, execute trades, and perform risk analysis without relying on external banking platforms for core functions.

- Cost and Efficiency Gains: Internalizing treasury functions can lead to cost savings and greater control over financial strategies for large clients.

The threat of substitutes for Commerzbank's payment services is substantial, driven by the proliferation of digital payment platforms and mobile wallets. These alternatives offer convenience and often lower fees, diverting transaction volumes from traditional banking channels. For instance, by the end of 2023, the global digital payments market was valued at over $8.5 trillion, underscoring the significant shift towards these substitutes.

In the lending sector, fintech companies and peer-to-peer platforms provide alternative financing options that can be faster and more accessible than traditional bank loans. This is particularly evident in the continued expansion of the European fintech lending market in 2024, which saw many platforms reporting double-digit growth in loan origination volumes.

Furthermore, the rise of cryptocurrencies and Decentralized Finance (DeFi) presents a novel substitute for traditional financial services, including payments and lending. The total value locked in DeFi protocols surpassed $100 billion in early 2024, signaling growing adoption and potential disintermediation of incumbent banks.

| Substitute Area | Key Players/Technologies | Impact on Commerzbank | 2023/2024 Data Point |

|---|---|---|---|

| Payments | Fintech platforms (PayPal, Stripe), Mobile Wallets (Apple Pay, Google Pay) | Reduced transaction fees, customer migration | Global digital payments market > $8.5 trillion (end of 2023) |

| Lending | Fintech lenders, P2P platforms | Loss of loan origination and interest income | European fintech lending market showing double-digit growth (2024) |

| Investments/Wealth Management | Robo-advisors, Online brokers | Diversion of assets under management | Global robo-advisory market ~$2.5 billion (2023) |

| Decentralized Finance | Cryptocurrencies, DeFi protocols | Potential disintermediation of core banking functions | Total value locked in DeFi > $100 billion (early 2024) |

Entrants Threaten

The banking sector in Germany and the EU faces substantial regulatory oversight, demanding significant capital reserves and complex licensing procedures. For instance, as of early 2024, the minimum Common Equity Tier 1 (CET1) capital ratio for major banks in the EU typically hovers around 4.5%, with additional capital buffers often pushing effective requirements much higher. These stringent requirements act as a formidable barrier, deterring many potential new entrants from establishing traditional banking operations.

Established banks like Commerzbank possess significant advantages due to their long-standing brand recognition and the deep trust they have cultivated with customers over many years. For new entrants, replicating this level of confidence and familiarity is a substantial hurdle, often requiring considerable investment and time.

Customers frequently gravitate towards well-established financial institutions, particularly for managing their savings and investments, due to perceived security and reliability. This preference presents a formidable barrier for newcomers aiming to capture market share, as building such trust is not instantaneous.

In 2024, Commerzbank continued to leverage its strong brand presence, which is a key differentiator against emerging fintechs. While digital-only banks might offer competitive rates, the established reputation and perceived stability of a bank like Commerzbank remain powerful anchors for customer loyalty, especially in uncertain economic climates.

Establishing a full-service banking operation necessitates substantial investment in resilient and secure IT infrastructure, advanced digital platforms, and robust cybersecurity measures. For instance, in 2024, major banks continue to allocate billions to digital transformation initiatives, with IT spending expected to grow significantly year-over-year, reflecting the ongoing need for cutting-edge technology to remain competitive and compliant.

New entrants, especially those aspiring to offer a complete suite of banking services, confront considerable upfront capital expenditures and intricate challenges in constructing this essential technological backbone. This high barrier to entry, driven by the sheer scale of necessary technological investment, can deter potential competitors from entering the market.

Agile Digital-Only Banks (Neobanks)

Agile digital-only banks, often called neobanks, present a significant threat to incumbents like Commerzbank. These nimble competitors, such as N26 and Revolut, bypass the substantial overhead of traditional brick-and-mortar branches, allowing them to operate with considerably lower costs. This cost advantage translates into more competitive pricing and often fee-transparent offerings, which are highly attractive to customers, particularly younger demographics.

Neobanks are adept at leveraging technology to provide seamless, user-friendly mobile banking experiences. Their digital-first approach resonates strongly with digitally native consumers who expect intuitive interfaces and on-demand services. For instance, N26 reported over 8 million customers across Europe as of early 2024, demonstrating their rapid customer acquisition capabilities by focusing on digital convenience and streamlined account opening processes.

- Lower Operational Costs: Neobanks avoid the expense of physical branches, reducing overhead significantly compared to traditional banks.

- Digital-Native Customer Appeal: Their mobile-first platforms and user-friendly interfaces attract younger, tech-savvy customers.

- Agile and Transparent Models: Neobanks often offer simpler fee structures and can adapt their services more quickly to market demands.

- Rapid Customer Acquisition: Companies like N26 have shown the ability to gain millions of customers relatively quickly in the European market.

Fintechs with Niche Focus and Partnerships

Fintech companies are increasingly targeting specific banking services, such as payments or specialized lending, rather than aiming to be full-service competitors. For example, many neobanks and payment processors have gained traction by focusing on user experience and lower fees in their chosen segments. These agile entrants can leverage partnerships with incumbent banks to navigate regulatory complexities and access essential infrastructure, allowing them to offer competitive alternatives without the overhead of traditional banking operations.

This strategic approach allows fintechs to chip away at established banks' market share incrementally. By excelling in a particular niche, they can attract a significant customer base that might otherwise be served by larger institutions. For instance, in 2024, the global digital payments market was projected to reach over $2.5 trillion, highlighting the substantial opportunities within specific financial service areas where fintechs can thrive.

- Niche Specialization: Fintechs often focus on specific areas like cross-border payments or small business lending, offering tailored solutions.

- Partnership Strategies: Collaborations with traditional banks enable fintechs to access regulatory licenses and customer bases.

- Market Share Erosion: While not direct replacements, these niche players can capture segments of the market, impacting traditional banks' revenue streams.

- Agility and Innovation: Fintechs' ability to rapidly develop and deploy new technologies allows them to respond quickly to evolving customer demands.

The threat of new entrants in the banking sector, particularly from agile fintechs and neobanks, remains a significant consideration for established players like Commerzbank. While high capital requirements and regulatory hurdles present substantial barriers to traditional banking, the digital-first approach of neobanks allows them to bypass many of these legacy costs.

Neobanks, such as N26 which reported over 8 million European customers by early 2024, leverage technology to offer streamlined, user-friendly mobile experiences. Their lower operational costs, stemming from the absence of physical branches, enable them to compete aggressively on pricing and fee transparency.

Fintechs also pose a threat by specializing in niche services like payments or lending, chipping away at incumbents' market share. For instance, the global digital payments market was projected to exceed $2.5 trillion in 2024, indicating substantial opportunities for specialized fintechs.

| Competitor Type | Key Advantage | Customer Appeal | Example (as of early 2024) |

|---|---|---|---|

| Neobanks | Lower operational costs, digital-native experience | Younger, tech-savvy demographics, transparent pricing | N26 (over 8 million customers) |

| Specialized Fintechs | Niche service focus, agility | Convenience, lower fees in specific segments | Digital payments market (projected >$2.5 trillion globally in 2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Commerzbank leverages data from annual reports, investor presentations, and regulatory filings, alongside industry-specific market research and financial news outlets.