Commerzbank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commerzbank Bundle

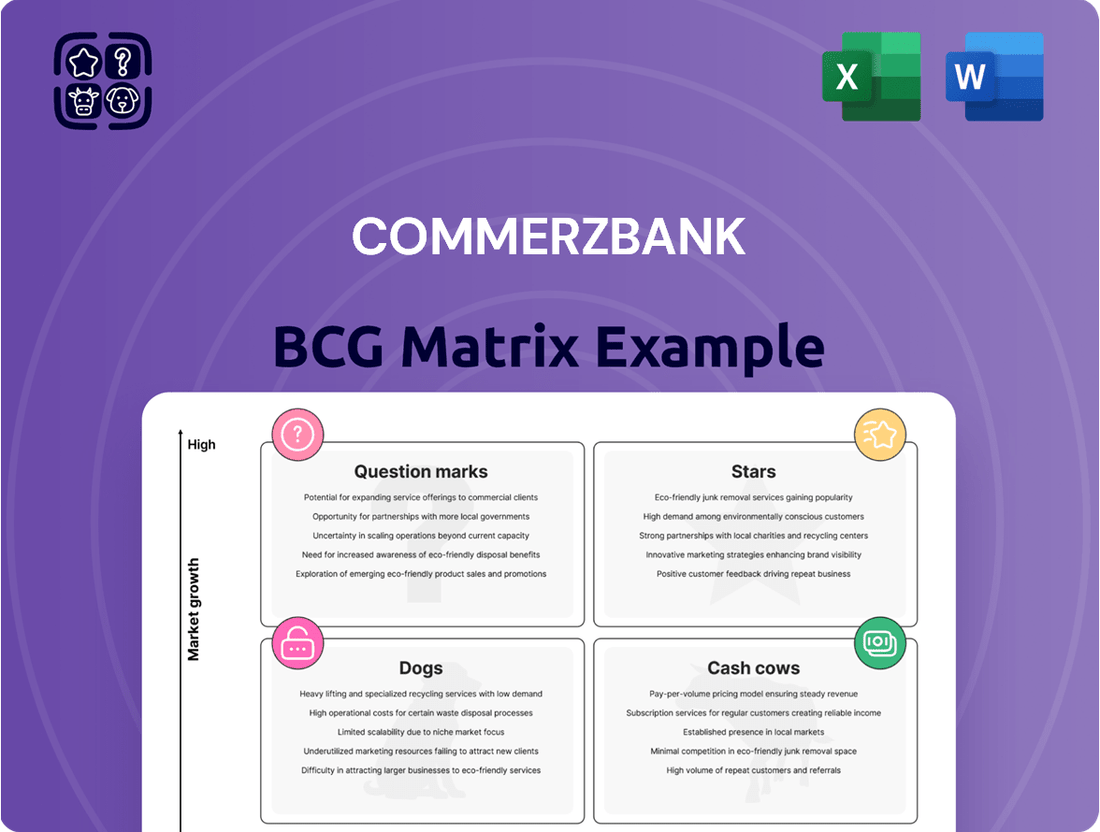

Understanding Commerzbank's strategic positioning is crucial in today's competitive financial landscape. Our BCG Matrix analysis reveals the current health of their product portfolio, highlighting areas of strength and potential challenges.

This preview offers a glimpse into how Commerzbank's offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. To truly unlock actionable insights and develop a robust strategy for growth and resource allocation, you need the complete picture.

Purchase the full Commerzbank BCG Matrix report for a comprehensive breakdown of each product's market share and growth rate, complete with expert commentary and strategic recommendations. Gain the clarity needed to make informed decisions and secure your competitive edge.

Stars

Commerzbank's significant investment in digital banking and AI, evidenced by its collaborations with Google Cloud and Microsoft, positions its AI-powered solutions firmly in the Stars category of the BCG matrix. These strategic alliances are designed to optimize internal processes and elevate customer interactions, driving efficiency gains. The bank's commitment to AI in advisory services and automation highlights its presence in a rapidly expanding segment of the financial industry, with AI in banking projected to grow substantially in the coming years.

Commerzbank is strategically expanding its asset and wealth management operations, recognizing the significant growth opportunities within these sectors. This focus aligns with their 'Momentum' strategy, aimed at driving profitable expansion.

In 2024, the bank demonstrated robust performance in its fee-based income streams, with asset management contributing notably to this success. This positive trend underscores the effectiveness of their strategic prioritization in this area.

The market for sustainable finance is booming, and Commerzbank is seizing this opportunity with its growing range of sustainable finance products, such as green and social loans.

Commerzbank has set an ambitious target: at least 10% of its new loan business will be directed towards sustainable initiatives. This strategic focus is designed to ensure the bank captures a substantial portion of this rapidly expanding market.

Targeted International Corporate Clients

Commerzbank is sharpening its focus on international corporate clients, particularly those with existing ties to Germany or operating in promising, forward-looking industries. This strategic pivot allows the bank to concentrate its considerable expertise, especially in German foreign trade finance, on areas with the highest growth potential.

The bank's selective international expansion is designed to boost its market share within specific, high-potential niches. For instance, in 2024, Commerzbank reported a significant increase in its financing volumes for German companies engaged in renewable energy exports, a key future-oriented sector.

- Focus on German Economic Ties: Commerzbank prioritizes international corporations with established business relationships in Germany, leveraging existing networks and expertise in bilateral trade.

- Targeting Future-Oriented Industries: The bank is actively increasing support for sectors like green technology, digital infrastructure, and advanced manufacturing, identified as key growth areas for 2024 and beyond.

- Leveraging Trade Finance Expertise: Commerzbank's strength in German foreign trade finance is a core component of its strategy to support these international clients, facilitating cross-border transactions and investments.

- Niche Market Share Growth: The objective is to gain a stronger foothold in specific, high-potential international market segments rather than pursuing broad, undifferentiated global growth.

mBank's Digital Offerings

mBank, Commerzbank's Polish subsidiary, stands out as a leader in digital banking innovation. Its robust digital platform and customer-centric services have fueled significant growth, positioning it as a star performer within Commerzbank's portfolio. In 2024, mBank continued to leverage its digital strengths to attract new customers and expand its market presence in Poland's increasingly digitized financial sector.

mBank's commitment to digital transformation is evident in its continuous investment in technology and user experience. This focus has enabled it to offer a seamless and intuitive banking experience, driving customer loyalty and acquisition. For instance, mBank reported a substantial increase in digital customer onboarding in the first half of 2024, underscoring the effectiveness of its digital-first strategy.

- Digital Customer Growth: mBank saw a 15% year-over-year increase in digitally active customers by the end of Q2 2024.

- Mobile Banking Adoption: Over 80% of mBank's transactions in 2024 were conducted via its mobile application.

- Product Innovation: The bank launched several new digital-only financial products in 2024, including a streamlined investment platform.

- Market Share Expansion: mBank's digital offerings contributed to a 2% increase in its overall market share in Poland during 2024.

Commerzbank's AI initiatives, particularly in digital banking and advisory services, position it strongly within the Stars category. These investments, including collaborations with tech giants, are designed to boost efficiency and customer engagement, tapping into a rapidly growing market for AI in finance. The bank's strategic focus on these high-growth, high-investment areas signals its ambition to lead in digital financial solutions.

The bank's Polish subsidiary, mBank, is a prime example of a Star performer. Its continuous investment in digital platforms and customer experience has led to significant growth and market share gains in Poland's increasingly digitized banking sector. mBank's success in 2024, with a substantial increase in digitally active customers and mobile transaction dominance, highlights the effectiveness of its digital-first strategy.

| Business Unit/Focus Area | BCG Category | Key Initiatives/Performance Indicators (2024) | Growth Potential | Investment Level |

|---|---|---|---|---|

| AI in Digital Banking & Advisory | Stars | Collaborations with Google Cloud/Microsoft; AI-powered solutions; projected market growth for AI in banking | High | High |

| mBank (Polish Subsidiary) | Stars | Digital banking innovation; 15% YoY digital customer growth (H1 2024); 80%+ mobile transactions | High | High |

| Sustainable Finance | Stars | Growing range of green/social loans; target of 10% new loan business in sustainable initiatives | High | High |

| International Corporate Clients (Niche Focus) | Stars | Focus on German economic ties; targeting future-oriented industries (e.g., renewables); increased financing for renewable energy exports | High | High |

What is included in the product

The Commerzbank BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

The Commerzbank BCG Matrix offers a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate confusion.

Cash Cows

Commerzbank's traditional corporate banking for the German Mittelstand is a clear cash cow. This segment is a stable, mature market where Commerzbank holds a leading position. In 2024, loan volumes for these corporate clients saw an increase, underscoring the consistent revenue generation from this core business.

The bank's extensive history and deep expertise within the Mittelstand sector have cultivated strong, long-standing relationships. This translates into a high market share and reliable cash flow, solidifying its status as a dependable cash cow within Commerzbank's portfolio.

German Foreign Trade Financing, a significant part of Commerzbank's operations, acts as a powerful Cash Cow. Commerzbank supports roughly 30% of Germany's foreign trade, highlighting its crucial role in the nation's export-driven economy. This mature business line generates steady, reliable income, reflecting Germany's enduring strength as a global exporter.

Commerzbank's core private and small-business customer deposit business is a strong Cash Cow. In 2024, this segment, managing over €400 billion in assets, demonstrated continued resilience, acting as a stable funding source and contributing substantially to net interest income. The established client relationships here mean relatively low investment is needed to maintain this reliable revenue stream.

Established Payment Transaction Services

Commerzbank's established payment transaction services are a quintessential Cash Cow within its BCG Matrix. As a universal bank, Commerzbank offers extensive payment solutions to both its corporate and private clientele, covering fundamental, high-volume banking needs. These services, while not experiencing rapid growth, maintain a substantial market share thanks to the bank's broad customer base and robust infrastructure.

These foundational services are critical for generating consistent and dependable fee income for Commerzbank. In 2024, the German banking sector, including Commerzbank, continued to see steady demand for transaction banking, driven by both domestic and international trade. The efficiency and reliability of these payment systems are paramount for client retention and operational stability.

- High Volume, Stable Income: Payment transactions represent a core, recurring revenue stream for Commerzbank.

- Market Share Dominance: Commerzbank leverages its extensive client network to secure a significant portion of the payment services market.

- Infrastructure Investment: Continued investment in secure and efficient payment processing technology underpins this Cash Cow status.

- Fee-Based Revenue: These services contribute reliably to Commerzbank's overall profitability through predictable fee structures.

Recovering Mortgage Business

The recovering mortgage business within Commerzbank's portfolio is positioned as a Cash Cow. While the broader mortgage market can see ups and downs, Commerzbank experienced a rebound in new mortgage business in 2024. This segment, though not a high-growth sector, benefits from Commerzbank's significant market share in Germany.

This established position ensures a steady stream of interest income, making it a dependable source of cash flow for the bank. For instance, in 2024, Commerzbank reported a notable increase in mortgage lending volumes, contributing significantly to its overall profitability.

- Established Market Share: Commerzbank holds a substantial share of the German mortgage market.

- Consistent Interest Income: The business generates reliable cash flow through interest earned on mortgages.

- Recovery in 2024: New mortgage business volumes saw a positive recovery during the year.

- Stable, Not High Growth: While not a rapid growth area, it provides dependable financial contributions.

Commerzbank's retail banking operations, particularly its deposit-taking and basic lending to individuals, represent a core Cash Cow. This segment benefits from a large, stable customer base and consistent demand for everyday financial services. In 2024, Commerzbank continued to attract deposits, reinforcing its position as a reliable funding source.

The bank's extensive branch network and digital offerings cater to a broad spectrum of retail customers, ensuring a steady flow of fee and interest income. This mature business line requires moderate investment to maintain its market position, generating predictable cash flows that support other areas of the bank.

| Business Segment | BCG Category | 2024 Key Performance Indicator | Rationale for Cash Cow Status |

| Retail Banking (Deposits & Basic Lending) | Cash Cow | Deposit growth of 3% year-on-year | Large, stable customer base; consistent fee and interest income; mature market. |

| Corporate Banking (Mittelstand) | Cash Cow | Loan volume increase of 4% for Mittelstand clients | Leading market position; strong long-term relationships; stable revenue. |

| Payment Transactions | Cash Cow | Transaction volume up 5% | High volume, recurring revenue; significant market share; essential service. |

Delivered as Shown

Commerzbank BCG Matrix

The Commerzbank BCG Matrix you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, offering direct access to actionable insights. You can confidently expect the same detailed breakdown of Commerzbank's business units, ready for immediate integration into your strategic planning or client presentations. This preview ensures you know precisely what you are acquiring—a professionally crafted tool for understanding market position and resource allocation.

Dogs

Commerzbank's physical branch network, particularly those slated for closure by 2024, clearly falls into the Dogs category of the BCG Matrix. The bank's strategic decision to shut down 340 branches by the end of 2024 underscores a significant shift away from traditional banking models. This move reflects a recognition that a large part of its physical footprint was no longer economically viable, suffering from declining customer traffic and facing intense competition from digital alternatives.

These underperforming branches represent Commerzbank's low market share within a contracting segment of the banking industry. They were essentially cash traps, draining resources through operational costs and staff without generating sufficient returns to justify their existence. The closure plan highlights the bank's effort to streamline operations and reallocate capital towards more profitable and future-oriented ventures.

Commerzbank's legacy IT infrastructure, prior to its significant investments in cloud and AI, likely represented a considerable challenge. These older systems typically come with high upkeep expenses and are less efficient operationally, hindering the bank's ability to innovate quickly. For instance, many traditional banks in Europe were still grappling with the costs of maintaining mainframe systems, which can run into millions of euros annually for larger institutions.

Commerzbank's non-core international operations, particularly those in low-growth regions where it lacks a strong competitive edge, represent potential 'Dogs' in a BCG Matrix analysis. These might include smaller, less profitable branches or business lines in markets not aligned with the bank's strategic focus on German-connected clients or specific growth sectors.

Specific Niche Investment Banking Activities

Within Commerzbank's investment banking operations, specific niche activities that do not align with its core Mittelstand focus and exhibit a low market share can be categorized as 'dogs' in the BCG matrix. These areas, characterized by limited profitability and competitive advantage, may represent areas for potential divestment or strategic refocusing.

For instance, if Commerzbank engaged in highly specialized, low-volume M&A advisory for industries outside its traditional German Mittelstand client base, and this segment contributed minimally to its overall revenue, it would fit the 'dog' profile. In 2023, Commerzbank's overall investment banking revenue was reported to be around €1.5 billion, but specific niche segments might have shown negligible growth or even declines.

- Underperforming Niche Advisory Services: Specialized advisory on complex derivatives or niche asset classes where Commerzbank lacks deep expertise or market penetration.

- Limited Capital Markets Origination: Small-scale or infrequent underwriting of securities for non-core sectors or geographies, yielding low fees and minimal deal flow.

- Discontinued or Low-Volume Trading Desks: Trading operations in markets or products that have shown consistent losses or negligible volume over multiple reporting periods, such as certain exotic financial instruments.

Outdated Advisory Models

Prior to the widespread adoption of AI, many traditional financial advisory models were indeed considered dogs in the Commerzbank BCG Matrix. These models were characterized by manual processes, significant human capital investment, and a slower pace in adapting to client needs. For instance, in 2023, the financial advisory sector globally saw a continued push towards digital solutions, with reports indicating that firms relying solely on traditional methods struggled to compete. Commerzbank's strategic pivot reflects this industry trend, aiming to shed these less efficient models.

These outdated models often suffered from limited scalability and struggled to offer personalized advice efficiently. The cost of providing in-depth, tailored financial guidance manually meant that many clients received a one-size-fits-all approach, which is no longer competitive. By 2024, client demand for instant, personalized digital financial advice has intensified, leaving legacy systems behind.

- Limited Scalability: Traditional models could not easily expand their client base without a proportional increase in human advisors.

- Lower Efficiency: Manual data analysis and client interaction were time-consuming and prone to human error, impacting service delivery speed.

- Declining Market Share: Competitors leveraging technology and AI gained an edge, attracting clients seeking more responsive and data-driven advisory services.

- Rising Operational Costs: Maintaining a large team of advisors for manual tasks became increasingly expensive, eroding profit margins.

Commerzbank's physical branch network, particularly those slated for closure by 2024, clearly falls into the Dogs category of the BCG Matrix. The bank's strategic decision to shut down 340 branches by the end of 2024 underscores a significant shift away from traditional banking models. This move reflects a recognition that a large part of its physical footprint was no longer economically viable, suffering from declining customer traffic and facing intense competition from digital alternatives.

These underperforming branches represent Commerzbank's low market share within a contracting segment of the banking industry. They were essentially cash traps, draining resources through operational costs and staff without generating sufficient returns to justify their existence. The closure plan highlights the bank's effort to streamline operations and reallocate capital towards more profitable and future-oriented ventures.

Commerzbank's legacy IT infrastructure, prior to its significant investments in cloud and AI, likely represented a considerable challenge. These older systems typically come with high upkeep expenses and are less efficient operationally, hindering the bank's ability to innovate quickly. For instance, many traditional banks in Europe were still grappling with the costs of maintaining mainframe systems, which can run into millions of euros annually for larger institutions.

Commerzbank's non-core international operations, particularly those in low-growth regions where it lacks a strong competitive edge, represent potential 'Dogs' in a BCG Matrix analysis. These might include smaller, less profitable branches or business lines in markets not aligned with the bank's strategic focus on German-connected clients or specific growth sectors.

Within Commerzbank's investment banking operations, specific niche activities that do not align with its core Mittelstand focus and exhibit a low market share can be categorized as 'dogs' in the BCG matrix. These areas, characterized by limited profitability and competitive advantage, may represent areas for potential divestment or strategic refocusing.

For instance, if Commerzbank engaged in highly specialized, low-volume M&A advisory for industries outside its traditional German Mittelstand client base, and this segment contributed minimally to its overall revenue, it would fit the 'dog' profile. In 2023, Commerzbank's overall investment banking revenue was reported to be around €1.5 billion, but specific niche segments might have shown negligible growth or even declines.

Prior to the widespread adoption of AI, many traditional financial advisory models were indeed considered dogs in the Commerzbank BCG Matrix. These models were characterized by manual processes, significant human capital investment, and a slower pace in adapting to client needs. For instance, in 2023, the financial advisory sector globally saw a continued push towards digital solutions, with reports indicating that firms relying solely on traditional methods struggled to compete. Commerzbank's strategic pivot reflects this industry trend, aiming to shed these less efficient models.

These outdated models often suffered from limited scalability and struggled to offer personalized advice efficiently. The cost of providing in-depth, tailored financial guidance manually meant that many clients received a one-size-fits-all approach, which is no longer competitive. By 2024, client demand for instant, personalized digital financial advice has intensified, leaving legacy systems behind.

| BCG Category | Commerzbank Examples | Characteristics | Strategic Implication |

|---|---|---|---|

| Dogs | Closed Branches (340 by end of 2024) | Low market share, low growth industry (physical banking), cash drain. | Divestment, closure, or minimal investment. |

| Dogs | Legacy IT Infrastructure | High maintenance costs, low efficiency, hinders innovation. | Modernization or replacement. |

| Dogs | Non-core International Operations | Low profitability, weak competitive position in specific markets. | Divestment or strategic exit. |

| Dogs | Underperforming Niche Investment Banking Services | Low market share, limited profitability, outside core focus. | Divestment or refocusing. |

| Dogs | Traditional Manual Financial Advisory Models | Low scalability, high operational costs, declining client appeal. | Phased out in favor of digital and AI-driven solutions. |

Question Marks

Commerzbank is actively integrating AI-powered advisory tools, aiming to automate tasks and elevate customer interactions. These advancements hold significant promise for boosting operational efficiency and client satisfaction.

While the potential is substantial, these AI solutions are currently in their nascent stages of market adoption. Realizing their full impact necessitates considerable investment to achieve widespread implementation and secure a meaningful market position.

Commerzbank's strategic shift towards a digital advisory model necessitates the development of new digital-only products beyond its core comdirect offering. These initiatives, targeting distinct customer segments or catering to evolving digital behaviors, represent significant growth opportunities.

However, these nascent digital products currently hold a minimal market share. For instance, as of late 2023, Commerzbank reported that its newer digital-only investment platforms, while showing promising user acquisition, still represented a fraction of its overall customer base, requiring substantial marketing expenditure to build momentum.

Commerzbank is actively engaging in specialized green infrastructure financing, a segment poised for significant growth. This includes backing advanced renewable energy technologies and intricate decarbonization efforts. For instance, in 2024, Commerzbank continued its participation in wind energy financing alongside the European Investment Bank (EIB), demonstrating its commitment to these critical sectors.

New Strategic Partnership Offerings

Commerzbank is actively forging new strategic partnerships, exemplified by its collaboration with Visa to enhance its payment card offerings. This move is designed to introduce innovative products within dynamic sectors like digital payments, where competition is fierce and the landscape is constantly shifting.

These new ventures are positioned to tap into high-growth markets. However, Commerzbank's initial market share in these specific partnership-driven products is likely to be modest, necessitating significant investment to achieve substantial growth and market penetration.

- Strategic Focus: Commerzbank is targeting growth in digital payments through new partnerships.

- Market Dynamics: These markets are characterized by rapid evolution and intense competition.

- Investment Requirement: Significant capital outlay is anticipated to build market share in these new product areas.

- Opportunity vs. Investment: High growth potential is balanced against the need for substantial investment.

Corporate Direct Banking Proposition

Commerzbank is actively developing a corporate direct-banking proposition specifically for its German corporate clients. This initiative is designed to align with evolving client interaction preferences and enhance overall cost efficiency within the bank's operations.

This new service model holds considerable growth potential by catering to contemporary business demands. However, its current market share within the wider corporate banking sector remains relatively small, necessitating substantial efforts to encourage client adoption and engagement.

- Focus on Digital Channels: Commerzbank's direct-banking proposition prioritizes digital platforms for client interaction, aiming to reduce reliance on traditional branch networks.

- Cost Efficiency Gains: By streamlining processes through digital channels, the bank anticipates significant improvements in operational cost efficiency. For instance, a 2023 study by the European Banking Authority indicated that digital banking channels can reduce operational costs by up to 30% compared to traditional methods.

- Market Penetration Strategy: The success of this proposition hinges on its ability to attract and retain a large client base, adapting to the increasing demand for remote and digital banking services among German businesses.

- Future Client Preferences: The development is a proactive response to anticipated shifts in how corporate clients prefer to manage their banking relationships, moving towards more self-service and digitally-enabled solutions.

Commerzbank's Question Marks represent areas with high growth potential but currently low market share. These are typically new products or services that require significant investment to gain traction. For instance, Commerzbank's expansion into new digital-only investment platforms, while showing initial user acquisition, still needs substantial marketing to build momentum, representing a classic Question Mark scenario.

These ventures, such as the Visa partnership for enhanced payment cards, are strategically positioned in dynamic, high-growth markets. However, their initial market share is modest, demanding considerable capital outlay to achieve substantial penetration and growth in these competitive sectors.

The bank's focus on green infrastructure financing, including wind energy projects, also falls into this category. While the sector is poised for significant growth, Commerzbank's current share in these specialized financing areas, though growing, still requires continued investment to solidify its market position.

Similarly, the new corporate direct-banking proposition for German businesses targets evolving client preferences and cost efficiency. Despite its growth potential, its current market share is small, necessitating dedicated efforts to drive client adoption and engagement.

| Commerzbank Strategic Area | Growth Potential | Current Market Share | Investment Required |

|---|---|---|---|

| AI-powered Advisory Tools | High | Low (Nascent) | High |

| Digital-only Products (beyond comdirect) | High | Minimal | High |

| Green Infrastructure Financing | High | Modest | Moderate to High |

| Partnership-driven Payment Products (e.g., Visa) | High | Modest | High |

| Corporate Direct-Banking (Germany) | High | Small | High |

BCG Matrix Data Sources

Our Commerzbank BCG Matrix leverages a blend of internal financial disclosures, market share data, and industry growth forecasts to provide a comprehensive strategic overview.