Commerzbank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commerzbank Bundle

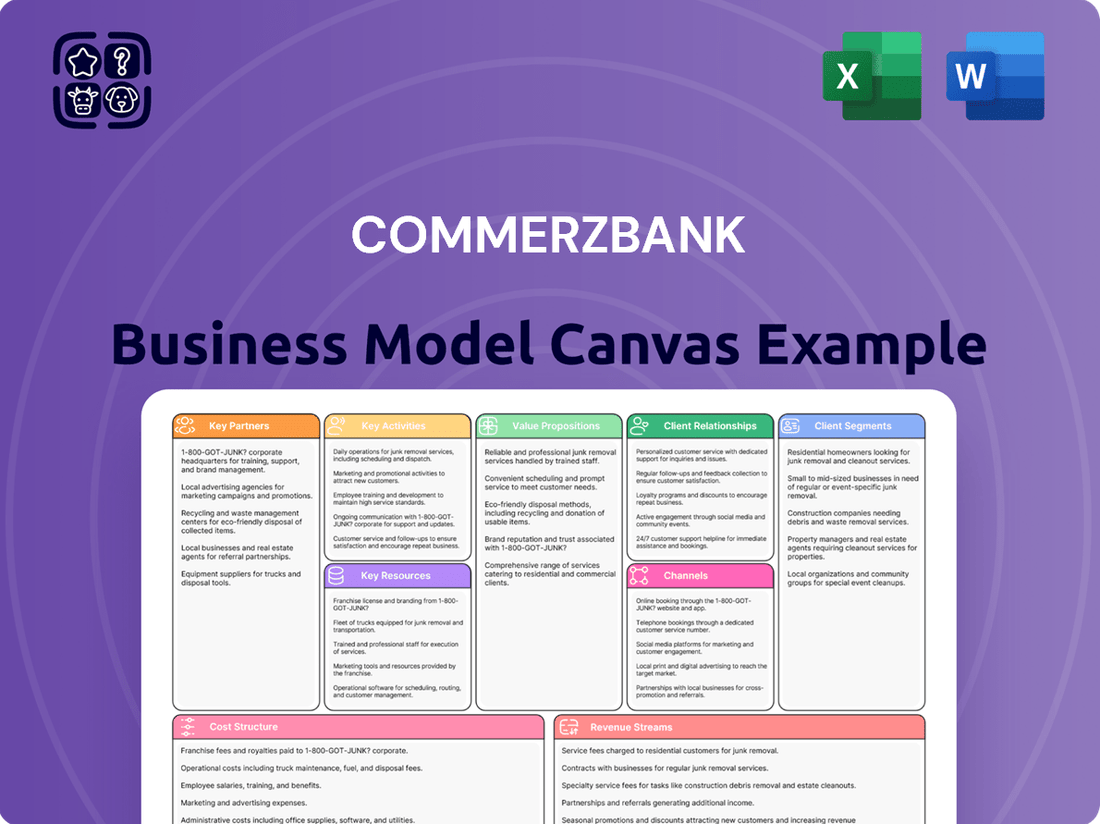

Unlock the strategic core of Commerzbank's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful blueprint for understanding their success. Download the full version to gain actionable insights for your own business strategy.

Partnerships

Commerzbank is forging key alliances with leading technology and AI providers to drive innovation. These partnerships are central to their strategy for creating cutting-edge products and IT services, with a strong emphasis on digitalization and artificial intelligence.

A prime example is their collaboration with Google Cloud, where Commerzbank is integrating Gemini and Vertex AI. This initiative aims to streamline internal processes, such as automating client call documentation. In 2024, this focus on AI is expected to significantly boost operational efficiency, allowing financial advisors to dedicate more time to client-facing, value-added activities.

Commerzbank's strategic alliance with Visa as its primary payment network provider is a cornerstone of its business model. This partnership, solidified through a long-term agreement, positions Visa as the preferred issuer for Commerzbank's debit and credit cards.

This collaboration is designed to bolster Commerzbank's payment strategy, granting them access to Visa's cutting-edge payment technologies and innovations. The preferential issuance of Visa cards to Commerzbank customers aims to strengthen the appeal of their account and card products, particularly for private clients, while simultaneously enhancing the security of transactions.

Commerzbank's extensive global network, reaching over 40 countries, relies heavily on its international correspondent banks. These partnerships are crucial for facilitating foreign trade finance and enabling seamless international transactions for its clients, particularly the German Mittelstand. In 2024, Commerzbank continued to leverage these relationships to support cross-border payments and trade flows, underscoring their importance in maintaining global financial connectivity.

Financial Institutions for Syndication & Issuance

Commerzbank actively partners with other financial institutions to facilitate loan syndications and bond issuances, especially for its corporate clients. These collaborations are crucial for distributing large-scale financing solutions and enabling the bank to participate in significant projects.

In 2024, Commerzbank's commitment to this area is evident through its continued involvement in complex financing structures that often require the expertise and capital of multiple lenders. This strategy allows them to underwrite and distribute a broader range of financial products, enhancing their market reach and client service capabilities.

- Syndication Partnerships: Commerzbank collaborates with a diverse group of banks and financial entities to share the risk and capital requirements for large corporate loans.

- Bond Issuance Support: They work with investment banks and underwriters to bring corporate bonds to market, ensuring efficient distribution to a wide investor base.

- Green Financing Focus: A significant portion of these partnerships is directed towards financing green infrastructure, aligning with sustainability goals and market demand for ESG-linked investments. For instance, by mid-2024, the bank reported a notable increase in its green bond underwriting activities.

- Risk Management: By syndicating loans and co-issuing bonds, Commerzbank effectively manages its balance sheet exposure and capital allocation, allowing for greater flexibility in supporting client needs.

Industry Associations & Regulatory Bodies

Commerzbank's engagement with industry associations and regulatory bodies is crucial for its operational framework. For instance, participation in European Banking Authority (EBA) stress tests directly informs the bank's risk management and capital planning. These collaborations are vital for navigating the complex regulatory landscape and ensuring adherence to evolving banking standards, contributing to overall financial sector stability.

These partnerships allow Commerzbank to actively contribute to shaping financial regulations and industry best practices. By engaging with bodies like the EBA, the bank not only ensures compliance but also gains insights into future regulatory directions. This proactive stance is essential for maintaining its competitive edge and demonstrating robust financial health, especially in light of recent economic shifts.

- Regulatory Compliance: Commerzbank actively engages with regulatory bodies like the European Banking Authority (EBA) to ensure adherence to banking laws and directives.

- Financial Stability Contribution: Participation in EBA stress tests, for example, helps Commerzbank assess and demonstrate its resilience against adverse economic conditions, contributing to broader financial stability.

- Industry Best Practices: Collaboration within industry associations allows Commerzbank to influence and adopt evolving best practices in areas like risk management and digital transformation.

Commerzbank's key partnerships extend to fintech companies and startups, fostering innovation in niche financial services. These collaborations are vital for integrating new technologies and expanding service offerings beyond traditional banking. For example, in 2024, Commerzbank continued to explore partnerships with specialized AI firms to enhance its wealth management advisory tools.

These strategic alliances enable Commerzbank to leverage external expertise, accelerate product development, and access new customer segments. By working with external innovators, the bank can more effectively adapt to evolving market demands and maintain a competitive edge in the rapidly changing financial landscape.

| Partnership Type | Key Collaborators | Strategic Benefit | 2024 Focus Area |

|---|---|---|---|

| Technology & AI | Google Cloud, AI Startups | Digitalization, Process Automation, Enhanced Client Services | AI-driven client interaction, operational efficiency |

| Payment Networks | Visa | Card Issuance, Payment Technology Access, Enhanced Security | Strengthening debit/credit card offerings |

| Correspondent Banking | Global Financial Institutions | Facilitating International Trade, Cross-Border Transactions | Supporting German Mittelstand's global reach |

| Syndication & Issuance | Other Banks, Investment Banks | Risk Sharing, Capital Distribution, Large-Scale Financing | Green financing, complex corporate deals |

| Fintech & Startups | Specialized Financial Innovators | Niche Service Integration, New Technology Adoption | Wealth management tools, AI in advisory |

What is included in the product

A detailed breakdown of Commerzbank's operations, illustrating its core banking services and customer relationships.

This model outlines Commerzbank's approach to serving both retail and corporate clients through various financial products and digital channels.

Commerzbank's Business Model Canvas offers a structured approach to pinpointing and addressing inefficiencies, streamlining complex banking operations.

It provides a clear, visual representation of Commerzbank's strategic elements, simplifying the identification of areas for improvement and innovation.

Activities

Commerzbank's core operations revolve around delivering a wide array of financial services to both individuals and businesses, primarily within Germany but also on an international scale. This encompasses fundamental banking products like account management and payment processing for daily financial transactions.

The bank structures its activities across two key segments: Private and Small-Business Customers, and Corporate Clients. This segmentation allows Commerzbank to offer specialized financial solutions designed to meet the distinct needs of each customer group, from personal banking to complex corporate finance.

In 2023, Commerzbank reported a net profit of €5.6 billion, a significant increase from the previous year, reflecting the strength of its diverse banking operations. The bank's retail and corporate banking activities form the backbone of its business, driving revenue and customer engagement.

Commerzbank's core activity involves providing a wide range of lending and financing solutions. This spans everything from home loans for individuals to sophisticated syndicated loans and bond issuances for large corporations.

A key focus is on enabling the growth and strategic shifts of Germany's Mittelstand, including crucial investments in green infrastructure. This commitment is reflected in ongoing loan volume growth, underscoring the bank's vital role in the economy.

Commerzbank actively participates in capital markets, offering a range of investment services and growing its asset and wealth management operations. This segment is crucial for generating net commission income through activities like securities trading and providing expert advisory services.

The bank is strategically focused on accelerating profitable expansion within these capital markets and asset management areas. This growth strategy is designed to effectively serve a broad client base, encompassing both individual private investors and larger institutional clients seeking sophisticated financial solutions.

In 2024, Commerzbank's net commission income from its brokerage and advisory services within capital markets played a significant role in its overall financial performance. The bank's commitment to enhancing its offerings in asset and wealth management reflects a clear objective to capture greater market share and drive sustained revenue growth in these key areas.

Digitalization and IT Transformation

Commerzbank is actively pursuing a significant digitalization and IT transformation to boost operational efficiency and enrich its customer propositions. This strategic push involves substantial capital allocation towards expanding digital distribution channels and integrating artificial intelligence (AI) across its services. By embracing these advancements, the bank aims to seamlessly blend the advantages of a fully digitalized banking experience with the crucial element of personal, human advice.

Key activities central to this transformation include:

- Investing in advanced digital platforms and customer interfaces to streamline banking operations.

- Leveraging Artificial Intelligence (AI) for enhanced data analysis, personalized customer interactions, and process automation.

- Expanding the use of international shoring locations to optimize IT infrastructure and service delivery.

- Focusing on a hybrid model that combines digital convenience with accessible personal advisory services to meet diverse customer needs.

In 2024, Commerzbank continued to prioritize its IT modernization, with a significant portion of its €1.1 billion IT budget dedicated to these transformation efforts. This investment is geared towards creating a more agile and future-proof banking infrastructure, ultimately improving the customer journey and operational effectiveness.

Risk Management and Compliance

Commerzbank's key activities heavily involve maintaining a robust loan portfolio and strong capital buffers. This requires continuous, diligent risk management, including rigorous stress tests, such as those conducted by the European Banking Authority (EBA). Ensuring strict compliance with all financial regulations is paramount to the bank's stability and operational integrity.

The bank's proactive approach to risk management is evident in its performance metrics. For instance, as of the first quarter of 2024, Commerzbank reported a Common Equity Tier 1 (CET1) ratio of 13.8%, demonstrating a solid capital foundation. This focus on risk resilience allows the bank to effectively absorb potential economic shocks and maintain the quality of its lending operations.

- Loan Portfolio Quality: Commerzbank actively monitors and manages the credit quality of its loan book, a critical component of its risk management strategy.

- Regulatory Compliance: Adherence to a complex web of financial regulations, including Basel III and forthcoming Basel IV standards, is a non-negotiable key activity.

- Capital Buffers: Maintaining sufficient capital buffers, exceeding regulatory minimums, is essential for absorbing potential losses and ensuring financial stability.

- Stress Testing: Regular participation in and successful navigation of regulatory stress tests, like those from the EBA, validates the bank's resilience against adverse economic scenarios.

Commerzbank's key activities are centered on providing comprehensive banking services to individuals and businesses, with a strong emphasis on Germany's Mittelstand. This includes offering a diverse range of lending and financing solutions, from mortgages to corporate finance. The bank also actively engages in capital markets, growing its asset and wealth management operations to serve a broad client base. Furthermore, a significant focus is placed on digital transformation and IT modernization to enhance efficiency and customer experience.

| Key Activity Area | Description | 2024 Data/Focus |

|---|---|---|

| Core Banking Services | Account management, payment processing, lending, and financing solutions for retail and corporate clients. | Continued focus on supporting the German Mittelstand with growth financing, including green infrastructure investments. Loan volume growth remains a key indicator. |

| Capital Markets & Wealth Management | Investment services, securities trading, and advisory services. | Accelerating profitable expansion in these areas, driving net commission income. Significant growth in asset and wealth management operations. |

| Digitalization & IT Transformation | Streamlining operations, enhancing customer propositions, and automating processes through technology. | Investing €1.1 billion in IT, with a substantial portion dedicated to digital platforms, AI integration, and international shoring for efficiency. |

| Risk Management & Compliance | Maintaining robust loan portfolios, strong capital buffers, and adhering to financial regulations. | Demonstrated by a CET1 ratio of 13.8% in Q1 2024. Continuous stress testing and regulatory compliance are paramount. |

Full Document Unlocks After Purchase

Business Model Canvas

The Commerzbank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting you see are precisely what will be delivered, ensuring no discrepancies or surprises. You'll gain full access to this comprehensive analysis, ready for your immediate use.

Resources

Commerzbank's strong financial capital base is a cornerstone of its business model, highlighted by its consistently high Common Equity Tier 1 (CET1) ratio. As of the first quarter of 2024, this ratio stood at an impressive 13.7%, comfortably exceeding the regulatory minimums. This robust capital position acts as a crucial safeguard, allowing the bank to withstand economic downturns and pursue strategic growth opportunities.

This solid capital foundation empowers Commerzbank to invest in its future, whether through technological advancements, market expansion, or returning value to its shareholders. For instance, the bank's capital strength supports its ongoing digital transformation initiatives, ensuring it remains competitive in a rapidly evolving financial landscape. It's a fundamental resource that underpins both stability and forward momentum.

Commerzbank's skilled human capital, encompassing financial advisors, IT specialists, and management, forms a cornerstone of its operations. This expertise is vital for delivering high-quality products and services, offering tailored financial guidance, and spearheading the bank's digital advancements.

The bank actively pursues strategies to attract and retain top talent, understanding that its employees are instrumental to achieving its growth objectives. In 2024, Commerzbank continued its focus on employee development, with a significant portion of its workforce participating in training programs aimed at enhancing digital literacy and customer service skills.

Commerzbank's advanced technology infrastructure is a cornerstone of its business model, featuring robust digital platforms and sophisticated IT systems. This includes the strategic deployment of artificial intelligence, exemplified by the AI agent powered by Gemini 1.5 Pro for efficient client call documentation, and 'Ava' designed to enhance customer interactions.

The bank also utilizes 'cobaGPT' to streamline internal workflows, significantly boosting operational efficiency. These technological investments are critical for expanding digital service offerings and bolstering cybersecurity measures, ensuring a secure and modern banking experience for its clients.

Extensive Branch Network and Digital Platforms

Commerzbank employs a hybrid distribution strategy, blending a physical presence with robust digital capabilities. This approach is designed to meet diverse customer needs, offering flexibility in how banking services are accessed.

The bank maintains a physical branch network, complemented by extensive digital platforms. This omni-channel model ensures customers can engage through online portals, mobile applications, remote advisory services via phone or video, and traditional in-branch interactions. As of early 2024, Commerzbank operates approximately 400 branches across Germany, providing a tangible touchpoint for many clients.

- Hybrid Distribution: Combines physical branches with digital channels.

- Omni-Channel Access: Services available online, mobile, phone, video, and in-person.

- Digital Expansion: The comdirect brand focuses on digital-first savings, investment, and trading.

- Branch Network: Approximately 400 physical locations support customer interactions.

Established Brand Reputation and Trust

Commerzbank leverages its established brand reputation and trust, particularly as the premier bank for Germany's Mittelstand, a segment representing over 99% of German businesses. This deep-rooted presence and identity as the bank for Germany are significant intangible assets.

This strong brand signifies security and reliability, crucial for attracting and retaining clients in the dynamic financial sector. In 2024, Commerzbank's brand strength continues to be a cornerstone of its business model, underpinning its relationships with millions of customers.

- Brand Recognition: Commerzbank is widely recognized as a leading financial institution in Germany.

- Customer Trust: A high level of trust is maintained, especially among the vital Mittelstand sector.

- Market Position: The bank is positioned as 'the bank for Germany', reflecting its broad reach and influence.

- Competitive Advantage: This established identity provides a distinct advantage in a competitive banking landscape.

Commerzbank's key resources include its robust financial capital, exemplified by a CET1 ratio of 13.7% in Q1 2024, providing stability and enabling strategic investments. Its skilled human capital, from advisors to IT specialists, drives service quality and digital innovation, with ongoing employee development programs in 2024. The bank's advanced technology infrastructure, featuring AI tools like Gemini 1.5 Pro for client calls and 'Ava' for customer interactions, enhances efficiency and security. Furthermore, its strong brand reputation, particularly as the bank for Germany's Mittelstand, fosters trust and provides a significant competitive edge.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Financial Capital | Strong capital base for stability and growth | CET1 Ratio: 13.7% (Q1 2024) |

| Human Capital | Skilled workforce driving innovation and service | Focus on digital literacy and customer service training |

| Technology Infrastructure | Advanced digital platforms and IT systems | AI deployment (Gemini 1.5 Pro, Ava), cobaGPT for efficiency |

| Brand Reputation | Established trust and market position | Premier bank for Germany's Mittelstand; ~400 branches |

Value Propositions

Commerzbank's value proposition centers on its comprehensive and universal banking services, designed to meet the varied financial needs of both individual and business customers. This holistic approach offers a convenient, single point of contact for a wide array of financial solutions.

By providing everything from everyday banking and tailored financing to sophisticated capital markets access and asset management, Commerzbank ensures clients can consolidate their financial activities. In 2024, Commerzbank continued to emphasize its universal banking model, serving millions of private and corporate clients across Germany and key international markets.

Commerzbank offers a powerful blend of personal guidance and digital ease, a core value proposition. This hybrid approach lets customers connect through its extensive branch network and remote advisory centers, ensuring face-to-face support for intricate matters. For everyday banking, customers can leverage 24/7 digital self-service options, making transactions efficient and accessible.

This model caters to diverse customer preferences, allowing them to select the interaction channel that best suits their needs. Whether it's a complex investment discussion or a simple account inquiry, Commerzbank aims to deliver tailored solutions precisely when and how the customer wants them. This commitment to personalized service, amplified by digital convenience, is central to their customer engagement strategy.

Commerzbank's core value proposition is its leading expertise tailored for the German Mittelstand, the backbone of Germany's economy. This means offering specialized knowledge and solutions specifically designed for medium-sized companies.

This expertise is backed by a strong regional presence across Germany, ensuring accessibility and understanding of local market dynamics. Furthermore, Commerzbank leverages its global network to support these businesses as they expand internationally, providing crucial services for foreign trade financing and facilitating cross-border growth.

In 2024, Commerzbank continued to solidify its role as a trusted partner, offering vital financing solutions such as loan syndications to support significant investment needs. The bank actively supports the ongoing transformation journeys of these companies, adapting to evolving market demands and technological shifts.

Innovative and Secure Payment Solutions

Commerzbank's commitment to innovative and secure payment solutions is a cornerstone of its value proposition. Through its strategic partnership with Visa, the bank delivers robust payment offerings characterized by worldwide acceptance and enhanced online security.

This collaboration directly benefits customers by simplifying the integration of payment methods into mobile wallets, a trend that saw a significant surge in adoption throughout 2024. Commerzbank's focus on payment security and embracing future innovations ensures that both private and business clients receive cutting-edge, reliable transaction capabilities.

- Worldwide Acceptance: Visa partnership ensures global reach for Commerzbank's payment solutions.

- Enhanced Online Security: Robust measures protect transactions in the digital space.

- Mobile Wallet Integration: Facilitates seamless use of payments via smartphones.

- Future-Ready Innovation: Continuous development for evolving payment needs.

Commitment to Shareholder Value and Capital Returns

Commerzbank is dedicated to boosting shareholder value by focusing on profitability and returning capital to its investors. The bank aims to deliver attractive capital returns through a combination of dividends and share repurchases, underscoring its financial strength and optimistic outlook.

This commitment is evident in their strategic financial planning, which prioritizes efficient operations and sustainable growth to ensure consistent returns. For instance, Commerzbank has signaled its intent to maintain a competitive dividend payout ratio, aiming to provide a reliable income stream for shareholders.

- Enhanced Profitability: Commerzbank's strategic initiatives are designed to improve its core profitability, directly contributing to increased shareholder value.

- Attractive Capital Returns: The bank plans to return capital to shareholders through significant dividend payments and potential share buyback programs.

- Financial Health and Confidence: These actions reflect Commerzbank's robust financial position and its confidence in achieving future performance targets.

- Investor Appeal: This value proposition is particularly appealing to investors looking for dependable returns from a securely managed financial institution.

Commerzbank's value proposition is built on its comprehensive banking services, catering to both individuals and businesses with a strong emphasis on personalized guidance and digital convenience. This hybrid approach ensures customers can access support through its branch network or digital channels, adapting to their preferences for everything from simple transactions to complex financial advice.

A key strength lies in its specialized expertise and deep understanding of the German Mittelstand, offering tailored solutions and global network support for these vital companies. Commerzbank also prioritizes innovative and secure payment solutions, notably through its Visa partnership, enhancing global acceptance and mobile wallet integration.

Furthermore, the bank is committed to delivering strong shareholder value through enhanced profitability and attractive capital returns, aiming for sustainable growth and reliable investor income.

| Value Proposition Area | Key Offering | 2024 Focus/Data Point |

|---|---|---|

| Universal Banking | Comprehensive financial services for all customer segments | Millions of private and corporate clients served |

| Mittelstand Expertise | Specialized solutions and global support for German SMEs | Continued focus on financing and transformation support |

| Digital & Personal Service | Hybrid model with branch access and 24/7 digital self-service | Emphasis on seamless customer journeys |

| Payment Solutions | Secure and globally accepted payment methods via Visa partnership | Facilitating mobile wallet integration |

| Shareholder Value | Profitability enhancement and capital returns (dividends, buybacks) | Commitment to competitive dividend payout ratio |

Customer Relationships

Commerzbank places a strong emphasis on personalized advisory services, especially within its Private Banking and Wealth Management divisions. This focus is designed to foster deeper customer connections by offering tailored guidance on intricate financial needs, such as investing in securities and securing mortgages.

To facilitate this, Commerzbank ensures dedicated financial advisors are accessible both in its physical branches and at central advisory hubs. This direct access allows for comprehensive support, aiming to build lasting relationships through expert, individualized advice.

In 2024, Commerzbank continued to invest in its advisory capabilities, recognizing that personalized support is a key differentiator. The bank's strategy reflects a commitment to providing high-touch service, a crucial element in retaining and growing its customer base in a competitive financial landscape.

Commerzbank cultivates customer relationships via an omni-channel strategy, enabling clients to engage through their preferred channels. This encompasses digital platforms like online and mobile banking, remote advisory services via phone or video, and traditional in-branch interactions. This integrated approach ensures a seamless and consistent customer experience across all touchpoints, reflecting a commitment to accessibility and client convenience.

Commerzbank prioritizes robust client relationships within its Corporate Clients segment, aiming for deeper penetration and active support. This is exemplified by their investment in specialized teams like Mittelstandsbank Direkt, designed to offer more proactive and comprehensive assistance to their Mittelstand and large corporate clients.

Digital Self-Service and Convenience

Commerzbank emphasizes digital self-service, allowing customers to manage their banking needs anytime, anywhere. This approach ensures convenience and security for everyday transactions, from account management to payments. The bank actively invests in enhancing its digital platforms to meet the evolving expectations of its increasingly tech-savvy customer base.

- Digital Adoption: Commerzbank reported that over 90% of its customer transactions were conducted digitally in 2023, highlighting the success of its self-service strategy.

- Platform Enhancements: Continuous updates to the mobile app and online banking portal in 2024 focused on streamlining user workflows and introducing new features like AI-powered financial advice.

- Customer Empowerment: The self-service model gives customers greater control over their finances, reducing reliance on branch visits for routine banking activities.

Long-Term Client Focus

Commerzbank's strategy is deeply rooted in a consistent customer focus, positioning itself as a partner to help clients navigate and shape their future. This long-term vision is cultivated through a reliable and supportive approach, fostering enduring relationships.

The bank prioritizes understanding and proactively addressing the evolving needs of its clients. By doing so, Commerzbank aims to create sustained value and cultivate strong client loyalty.

- Customer-Centric Strategy: Commerzbank emphasizes being a steadfast partner, committed to co-creating the future with its clients.

- Relationship Building: The bank fosters long-term relationships through a dependable and supportive partnership model.

- Evolving Needs: A core tenet is understanding and meeting the dynamic requirements of clients to ensure ongoing relevance and value.

- Loyalty and Value Creation: This focus on client needs is designed to generate lasting value and build strong customer loyalty.

Commerzbank fosters customer relationships through a blend of personalized advisory, digital self-service, and an omni-channel approach. This strategy aims to build lasting partnerships by understanding and proactively meeting evolving client needs across all engagement points. The bank's commitment to digital adoption and platform enhancements in 2024 underscores its focus on client empowerment and convenience.

| Customer Relationship Strategy | Key Initiatives | 2023/2024 Data/Focus |

|---|---|---|

| Personalized Advisory | Dedicated financial advisors, tailored guidance for complex needs (investing, mortgages) | Continued investment in advisory capabilities, focus on Private Banking & Wealth Management |

| Omni-channel Engagement | Digital platforms (online/mobile), remote advisory (phone/video), in-branch interactions | Seamless experience across all touchpoints, ensuring accessibility and convenience |

| Digital Self-Service | Empowering clients to manage banking needs anytime, anywhere | Over 90% of transactions digital (2023), platform enhancements for user workflows and AI features (2024) |

| Corporate Client Support | Specialized teams (e.g., Mittelstandsbank Direkt) for proactive assistance | Deeper penetration and active support for Mittelstand and large corporate clients |

| Long-term Partnership | Understanding and meeting evolving client needs, fostering loyalty | Commitment to being a steadfast partner, co-creating the future with clients |

Channels

Commerzbank maintains an extensive physical branch network, a cornerstone of its customer engagement strategy. As of early 2024, the bank operates around 400 branches throughout Germany, providing a tangible presence for its services.

These branches are crucial for offering personalized advice, especially for more intricate financial matters, and for fostering strong, direct relationships with clients. This physical presence remains vital for customers who value face-to-face interaction and a broad spectrum of banking services.

While Commerzbank is actively developing its digital offerings, the branch network continues to be a significant channel. It caters to customers who prefer or require in-person support, ensuring accessibility and a comprehensive service experience for a diverse customer base.

Commerzbank's online and mobile banking platforms provide customers with constant 24/7 access to manage their finances and conduct a broad range of banking operations. These digital tools are engineered for ease of use, strong security, and streamlined transaction processing.

In 2024, Commerzbank continued its focus on enhancing these digital channels. For instance, the bank reported that the number of active users on its mobile banking app grew by 7% year-over-year, reaching over 7 million users by the end of the first half of 2024. This growth underscores the increasing reliance on digital banking solutions for everyday financial management.

The bank's strategy involves ongoing investment in digitalization to improve user experience and introduce new features. This commitment is reflected in Commerzbank's IT spending, which in 2023 was approximately €1.2 billion, with a significant portion allocated to the development and enhancement of its digital banking infrastructure and services.

Commerzbank's Remote Advisory Centers are a key channel within its business model, offering personalized banking support via phone and video calls. This caters to customers who favor digital interactions or face geographical limitations to branch visits.

These centers are staffed by skilled banking advisors ready to assist with a wide array of service needs, from day-to-day banking to more complex financial planning like investments and mortgages. This approach significantly broadens the bank's ability to deliver tailored advice beyond its physical footprint.

In 2024, Commerzbank continued to invest in digital channels, enhancing its remote advisory capabilities to meet evolving customer expectations for convenient and accessible financial guidance.

Comdirect Digital Brand

The comdirect brand functions as Commerzbank's dedicated digital primary bank and performance broker. This channel is tailored for customers who want core digital banking services alongside specialized offerings for saving, investing, and securities trading.

Comdirect significantly enhances Commerzbank's digital reach, appealing to a customer base that prefers a digital-first approach to their financial management. In 2024, comdirect continued to focus on expanding its digital product suite and user experience, aiming to capture a larger share of the digitally active banking and brokerage market.

- Digital-First Focus: Serves customers prioritizing online and mobile banking experiences.

- Performance Brokerage: Offers specialized solutions for active investors and traders.

- Distribution Channel: Strengthens Commerzbank's digital presence and customer acquisition.

- Customer Segment: Targets digitally savvy individuals seeking efficient financial tools.

International Network and Partnerships

Commerzbank's extensive international network, spanning over 40 countries, acts as a vital channel to support its corporate clients with global operations and strong German ties. This expansive reach, augmented by strategic alliances with correspondent banks, is instrumental in facilitating complex foreign trade financing and enabling clients' international expansion strategies.

This global infrastructure is particularly critical for servicing large corporations and institutional clients engaged in cross-border activities, offering them seamless access to international markets and financial solutions. For instance, in 2024, Commerzbank continued to leverage these partnerships to facilitate significant volumes of export finance, supporting German businesses in their global trade endeavors.

- Global Reach: Presence in over 40 countries to serve international corporate needs.

- Correspondent Banking: Collaborations to facilitate foreign trade finance and international growth.

- Client Focus: Crucial channel for large corporates and institutional clients with cross-border operations.

- Trade Facilitation: Enabling German companies' access to global markets through robust international banking relationships.

Commerzbank utilizes a multi-channel approach to reach its diverse customer base. This includes a substantial physical branch network, robust digital platforms, dedicated remote advisory centers, and the specialized comdirect brand for digitally-focused clients. The bank also leverages its international presence to serve corporate clients with global needs.

The physical branch network, comprising approximately 400 locations in Germany as of early 2024, remains a key channel for personalized advice and relationship building. Simultaneously, digital channels, including the mobile app with over 7 million active users by mid-2024, are experiencing significant growth, supported by substantial IT investments, such as the €1.2 billion spent in 2023.

Remote advisory centers extend personalized support via phone and video, enhancing accessibility. The comdirect brand specifically targets digitally savvy customers with performance brokerage services, strengthening Commerzbank's digital market share.

Commerzbank's international network, active in over 40 countries, is crucial for facilitating global trade finance and supporting corporate clients' international expansion, with significant volumes of export finance facilitated in 2024.

| Channel | Key Characteristics | 2024 Data/Focus | Customer Segment |

|---|---|---|---|

| Physical Branches | Personalized advice, relationship building | Approx. 400 branches in Germany | Customers valuing face-to-face interaction |

| Digital Platforms (Online/Mobile) | 24/7 access, ease of use, security | Mobile app users grew 7% YoY (H1 2024) | All customer segments for everyday banking |

| Remote Advisory Centers | Phone/video support, expert advice | Enhanced digital advisory capabilities | Customers preferring digital or remote interaction |

| comdirect | Digital primary bank, performance broker | Expanding digital product suite | Digitally savvy individuals, active investors |

| International Network | Global support for corporate clients | Facilitated significant export finance volumes | Corporates and institutions with cross-border operations |

Customer Segments

Private customers are the bedrock of Commerzbank's retail operations, encompassing individuals seeking everyday banking solutions like checking and savings accounts, personal loans, and mortgages. In 2024, Commerzbank continued to emphasize its omni-channel strategy, blending digital ease with personalized advice to cater to diverse customer preferences.

The bank strives to offer a comprehensive suite of products designed to meet the unique financial needs of each individual, from first-time homebuyers to those planning for retirement. This segment represents a significant portion of Commerzbank's customer base, driving transaction volumes and deposit growth.

Commerzbank actively supports small businesses and entrepreneurs by offering a comprehensive suite of financial services. This includes essential business accounts, various financing options to fuel growth, and valuable advisory services tailored to their unique needs. The bank is particularly focused on increasing its new loan volume for this crucial segment.

In 2024, Commerzbank continued its commitment to the small business sector, recognizing its vital role in the economy. The bank's strategy includes strengthening its relationships with these clients, often serving them in conjunction with private banking offerings, to ensure their operational and expansion goals are met. This focus is reflected in their ongoing efforts to provide accessible and supportive financial solutions.

The German Mittelstand, comprising medium-sized enterprises, represents a cornerstone of Germany's economic strength and a strategically vital customer segment for Commerzbank. The bank actively cultivates these relationships, recognizing their significant contribution to national and global markets.

Commerzbank has established itself as the premier financial institution for the Mittelstand, providing tailored corporate banking services, robust trade finance solutions, and essential international support. This deep specialization allows the bank to effectively address the unique needs of these dynamic businesses.

In 2024, Commerzbank continued its strategic focus on deepening client penetration within the Mittelstand, aiming to offer even more comprehensive financing solutions. This commitment underscores the bank's dedication to fostering the growth and international competitiveness of these crucial economic players.

Large Corporates

Large corporates represent a crucial segment for Commerzbank, demanding highly specialized financial services. These clients often need complex financing structures, access to capital markets for raising funds, and advanced treasury management solutions to optimize their global cash flows. Commerzbank leverages its integrated expertise, combining corporate banking capabilities with strong capital markets knowledge, to serve these demanding clients effectively.

The bank's extensive international network is a key asset in supporting large corporate clients with their cross-border operations and financing needs. Commerzbank is actively working to deepen its penetration within this segment, aiming to increase its market share and enhance capital efficiency by offering tailored solutions that meet the unique challenges of global enterprises. For instance, in 2024, Commerzbank reported significant growth in its corporate client business, particularly in areas like syndicated loans and trade finance, reflecting its commitment to this segment.

Key aspects of Commerzbank's strategy for large corporates include:

- Sophisticated Financing Solutions: Providing access to complex debt and equity capital markets, alongside structured finance options.

- International Network Utilization: Facilitating global trade and investment through its robust international presence and expertise.

- Treasury and Cash Management: Offering advanced tools and services to manage liquidity, risk, and payments efficiently across multiple jurisdictions.

- Strategic Partnerships: Building long-term relationships by understanding and addressing the evolving strategic needs of large corporate clients.

Institutional Clients

Commerzbank actively engages with a broad range of institutional clients, including other financial institutions, asset managers, and significant institutional investors. This segment is a cornerstone of the bank's operations, relying on its expertise in capital markets.

These clients primarily leverage Commerzbank's capital markets division for a suite of services. These include crucial offerings such as bond issuance, sophisticated securities trading, and comprehensive asset management solutions tailored to large-scale portfolios.

The bank's robust international network is a key differentiator for its institutional clients. This global reach is particularly beneficial for those institutions that have established business relationships with Germany, Austria, or Switzerland, facilitating cross-border financial activities.

In 2024, Commerzbank's institutional client business demonstrated resilience, with its Corporate Clients segment, which includes many of these institutional relationships, reporting a net profit of €1.7 billion for the first nine months of the year. This performance underscores the bank's strong standing in serving these sophisticated market participants.

- Capital Markets Services: Bond issuance, securities trading, and asset management are core offerings for institutional clients.

- International Reach: Commerzbank supports institutional clients with German, Austrian, or Swiss business ties through its global presence.

- Segment Performance: The Corporate Clients segment, encompassing many institutional relationships, achieved a net profit of €1.7 billion in the first nine months of 2024.

Commerzbank serves a diverse clientele, from individual consumers needing everyday banking to large corporations requiring complex financial solutions. The bank strategically caters to the German Mittelstand, recognizing its economic significance, and also engages with institutional clients through its capital markets expertise.

In 2024, Commerzbank's Corporate Clients segment, which includes many institutional relationships and the Mittelstand, reported a net profit of €1.7 billion for the first nine months, highlighting the strength of these relationships.

The bank's approach is to offer tailored services, from personal loans for individuals to international support and treasury management for large corporates. This segmentation allows Commerzbank to effectively address the unique financial needs across its customer base.

| Customer Segment | Key Offerings | 2024 Relevance/Data |

|---|---|---|

| Private Customers | Everyday banking, loans, mortgages | Omni-channel strategy focus |

| Small Businesses | Business accounts, financing, advisory | Increased new loan volume focus |

| Mittelstand | Corporate banking, trade finance, international support | Deepening client penetration, comprehensive financing |

| Large Corporates | Complex financing, capital markets access, treasury management | Growth in syndicated loans and trade finance |

| Institutional Clients | Capital markets services, securities trading, asset management | Corporate Clients segment net profit: €1.7 billion (Jan-Sep 2024) |

Cost Structure

Personnel expenses are a major part of Commerzbank's cost base, reflecting its substantial employee count, which stood at approximately 39,000 as of the end of 2023. These costs are influenced by the bank's ongoing digital transformation, which, while seeking efficiency, also necessitates investment in employee skills and development. Strategic workforce adjustments, including targeted job reductions and new hires in growth areas, contribute to the dynamic nature of these expenses.

Commerzbank's commitment to becoming a digital advisory bank necessitates significant expenditure on IT and digitalization, forming a core component of its cost structure. These investments are geared towards modernizing infrastructure and integrating advanced technologies.

In 2023, Commerzbank continued its strategic IT investments, with a notable focus on cloud migration and enhancing cybersecurity measures. These efforts are designed to improve operational resilience and pave the way for future digital innovations.

Expenditures in this area cover the implementation of artificial intelligence for customer service and risk management, alongside the continuous development and upkeep of its digital banking platforms. These digital capabilities are vital for driving efficiency and delivering a superior customer experience.

General administrative expenses and other operating costs form a significant part of Commerzbank's cost structure. These encompass a wide range of expenditures necessary for the day-to-day functioning of a large universal bank.

Key components include costs associated with maintaining the bank's physical premises, essential marketing and advertising efforts to attract and retain customers, and general overheads like IT infrastructure and personnel support. For instance, in 2023, Commerzbank reported administrative expenses as a notable portion of its overall operational outlay, reflecting the complexities of managing a broad financial services portfolio.

While the bank actively pursues strict cost discipline, these administrative expenses can see an increase. This often occurs when the bank embarks on growth initiatives or makes strategic investments aimed at future expansion and technological advancement, as seen in its ongoing digital transformation efforts.

Restructuring Charges

Commerzbank faces restructuring charges as a key element of its ongoing strategic transformation and efficiency initiatives. These costs are directly linked to implementing significant organizational changes.

These charges primarily stem from workforce adjustments, such as early retirement programs, and the necessary reorganization of its sales structures to adapt to evolving market demands. For instance, in 2023, Commerzbank reported restructuring expenses of €370 million, a notable increase from €206 million in 2022, reflecting the intensified efforts in its transformation program.

- Workforce Adjustments: Includes costs associated with early retirement schemes and severance packages to streamline the employee base.

- Sales Structure Reorganization: Expenses related to redesigning and consolidating sales channels and teams for greater efficiency.

- Financing Strategy: Commerzbank intends to cover these restructuring expenses using its existing financial resources, aiming to avoid external financing for these specific measures.

- Impact on Financials: While significant charges are anticipated in certain years, the bank manages these within its overall financial planning to support long-term strategic goals.

Regulatory and Compliance Costs

Commerzbank's cost structure is significantly influenced by expenses related to regulatory compliance and risk management. These are essential for meeting stringent supervisory requirements and maintaining financial stability.

These costs encompass adherence to directives from bodies like the European Banking Authority (EBA), including participation in stress tests. Such activities ensure the bank maintains adequate capital buffers and a strong internal control framework, directly impacting operational expenses.

- Regulatory Compliance: Costs incurred to meet national and international banking regulations, including reporting and legal fees.

- Risk Management: Investments in systems and personnel for credit, market, and operational risk assessment and mitigation.

- Supervisory Requirements: Expenses related to capital adequacy ratios, liquidity coverage, and stress testing exercises, such as those mandated by the EBA.

- Compliance Technology: Spending on software and platforms to automate and enhance regulatory adherence and reporting.

Commerzbank's cost structure is heavily weighted towards personnel, IT, and administrative expenses, reflecting its operational scale and digital transformation efforts. Significant investments in technology and ongoing restructuring charges, particularly in 2023, underscore the bank's strategic shift. Regulatory compliance and risk management also represent substantial, unavoidable costs for a major financial institution.

| Cost Category | 2023 Figures (Approx.) | Key Drivers |

|---|---|---|

| Personnel Expenses | Significant portion of total costs (approx. 39,000 employees end of 2023) | Salaries, benefits, training, workforce adjustments |

| IT & Digitalization | Core component of cost structure | Modernization, cloud migration, cybersecurity, AI implementation |

| General Administrative Expenses | Notable portion of operational outlay | Premises, marketing, IT infrastructure, overheads |

| Restructuring Charges | €370 million (2023) | Workforce adjustments, sales structure reorganization |

| Regulatory Compliance & Risk Management | Essential operational expenses | Adherence to EBA directives, stress tests, capital buffers |

Revenue Streams

Net Interest Income (NII) stands as Commerzbank's primary revenue engine, stemming from the core banking activities of lending and deposit-taking. This income represents the spread between the interest the bank earns on its assets, such as loans to individuals and businesses, and the interest it pays out on its liabilities, including customer deposits. In 2023, Commerzbank reported a significant increase in NII, reaching €6.5 billion, a substantial jump from €4.8 billion in 2022, demonstrating its resilience and ability to capitalize on evolving market conditions.

The bank's ability to sustain and grow its NII, even amidst periods of lower interest rates from the European Central Bank, is a testament to its strategic management. Commerzbank has effectively navigated these challenges by focusing on expanding its deposit base and making astute adjustments to its replication portfolio, which involves managing the interest rate risk associated with its assets and liabilities. This proactive approach ensures that the bank can continue to generate a healthy net interest margin.

Net commission income is a crucial revenue generator for Commerzbank, fueled by its robust securities business, asset management services, and a variety of other fee-generating activities. This income encompasses commissions earned from trading, providing investment advice, and executing numerous banking transactions for its clients.

In 2024, Commerzbank demonstrated impressive growth in this segment, with net commission income reaching €2.0 billion in the first nine months, surpassing previous performance and exceeding internal forecasts. This upward trend highlights the bank's successful strategy in expanding its fee-based services and capitalizing on market opportunities.

Commerzbank's corporate banking segment generates significant revenue through a variety of services. These include income from arranging syndicated loans, facilitating bond issuances, and providing foreign trade financing. In 2024, this segment is expected to see continued growth, bolstered by the bank's strong relationships with German small and medium-sized enterprises (Mittelstand).

A key driver for revenue expansion in corporate banking is the increasing demand for financing green infrastructure projects. This focus on sustainability aligns with market trends and opens new avenues for income generation for Commerzbank.

Asset and Wealth Management Fees

Fees from asset and wealth management are a growing source of income for Commerzbank. The bank is actively working to grow this segment, which includes acquiring other businesses. This involves managing investments and offering financial solutions to both individual and institutional customers.

Commerzbank's strategy emphasizes expanding its asset and wealth management capabilities. This focus is reflected in their efforts to grow assets under management, which reached €224 billion by the end of 2023. These fees are crucial for diversifying revenue beyond traditional lending activities.

- Growing Importance: Asset and wealth management fees are becoming a more significant revenue component.

- Strategic Expansion: Commerzbank is prioritizing growth in this sector, including through acquisitions.

- Client Focus: Services include managing portfolios and providing investment solutions for diverse client needs.

- Assets Under Management: The bank managed €224 billion in assets by the close of 2023, highlighting the scale of this revenue stream.

International Business Contributions (e.g., mBank)

Commerzbank's international operations, notably its Polish subsidiary mBank S.A., are a significant contributor to its revenue streams. mBank's robust performance, fueled by favorable interest rate environments and strong demand for foreign currency deposits in Poland, has directly bolstered Commerzbank's overall earnings. This geographic diversification is a key element in strengthening the group's financial resilience.

In 2023, mBank demonstrated impressive growth, with its net profit reaching €706 million, a substantial increase from the previous year. This performance highlights the effectiveness of its strategy in a dynamic market. The bank's ability to capitalize on high interest rates in Poland and cater to the demand for foreign currency accounts has been a primary driver of this success, positively impacting Commerzbank's consolidated financial results.

- mBank's Net Profit: €706 million in 2023.

- Key Growth Drivers: High interest rates in Poland and demand for foreign currency deposits.

- Strategic Importance: Geographic diversification enhances Commerzbank's revenue base and resilience.

Commerzbank's revenue is diversified across several key areas. Net interest income remains the largest contributor, reflecting the bank's core lending and deposit-taking activities. Net commission income, driven by securities and asset management, shows strong growth, as does income from corporate banking services, particularly those supporting green finance and Mittelstand clients. Furthermore, its international operations, notably mBank in Poland, significantly bolster overall earnings through strategic geographic diversification.

| Revenue Stream | 2023 (EUR billions) | Key Drivers |

|---|---|---|

| Net Interest Income | 6.5 | Lending, deposits, interest rate management |

| Net Commission Income | 2.0 (first 9 months 2024) | Securities, asset management, transaction fees |

| Corporate Banking | (Not specified separately, but significant) | Syndicated loans, bond issuance, trade finance, green projects |

| Asset & Wealth Management Fees | (Included in commission income, AUM €224bn) | Investment management, financial solutions |

| International Operations (mBank) | (Net profit €706m in 2023) | Polish market, foreign currency deposits |

Business Model Canvas Data Sources

The Commerzbank Business Model Canvas is informed by a robust blend of internal financial statements, customer transaction data, and regulatory filings. This ensures a data-driven foundation for understanding the bank's operations and strategic direction.