Commerce Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commerce Bank Bundle

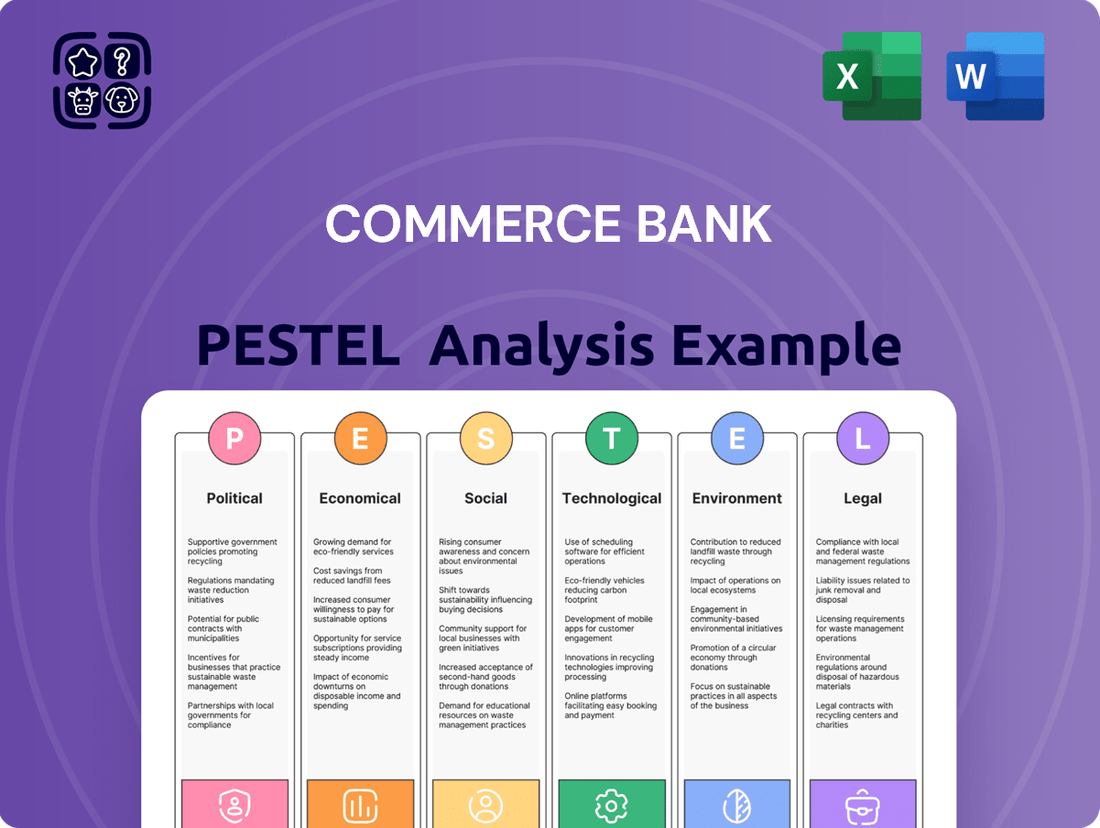

Unlock the strategic advantages Commerce Bank can leverage by understanding the complex interplay of Political, Economic, Social, Technological, Legal, and Environmental factors. Our expertly crafted PESTLE analysis delves deep into these external forces, revealing critical insights into market dynamics, potential risks, and emerging opportunities. Don't just react to change; anticipate it. Download the full PESTLE analysis now to gain the foresight needed to propel Commerce Bank and your own strategic planning forward.

Political factors

Government policies, especially those concerning banking and finance, significantly shape Commerce Bancshares' operating landscape. For instance, the Federal Reserve's monetary policy, including its key interest rate decisions, directly influences the bank's ability to set competitive lending and deposit rates. As of mid-2024, the Federal Reserve maintained a target range for the federal funds rate, impacting borrowing costs across the economy.

Regulatory oversight from bodies like the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) sets crucial operational standards for Commerce Bancshares. These regulations dictate compliance requirements, risk management practices, and capital adequacy, ensuring the bank operates within a stable financial framework. For example, the Dodd-Frank Act, though enacted earlier, continues to influence regulatory requirements for banks of Commerce Bancshares' size and scope.

Global and national trade policies, including the imposition of tariffs, can introduce economic uncertainty. Commerce Bancshares' CEO, John Kemper, has noted that recent news related to tariffs and trade restrictions contributes to an increasingly uncertain outlook for the future.

Such policies can affect business activity and, consequently, demand for commercial lending and other financial services in the Midwest. For instance, changes in agricultural trade policies, a key sector for Commerce Bank's Midwest operations, could directly impact loan demand and the financial health of its clients.

Commerce Bancshares' operational focus on the Midwest means that political stability within these specific U.S. regions is paramount for its business. Local and state government policies directly impact banking regulations, taxation, and economic development initiatives that can affect Commerce Bank's profitability and growth prospects.

Broader geopolitical events, such as international conflicts or trade disputes, introduce a layer of global uncertainty. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East, as of early 2024, have contributed to volatility in energy prices and global supply chains, indirectly influencing consumer spending and business investment decisions across the U.S., including the Midwest.

These global uncertainties can create ripple effects on financial markets, leading to fluctuations in interest rates and stock market performance. Such market shifts can impact Commerce Bank's investment portfolios, loan demand, and overall economic sentiment, potentially slowing down credit growth and affecting consumer confidence in making major financial commitments.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly influence the economic environment, directly affecting the demand for banking services. For example, increased government investment in infrastructure, such as the Biden-Harris Administration's Infrastructure Investment and Jobs Act, which allocated $1.2 trillion in 2021, can boost economic activity. This surge in activity translates to higher demand for business loans, construction financing, and increased deposit levels as companies and individuals see greater opportunities.

Changes in fiscal policy, like tax rate adjustments or stimulus packages, also play a crucial role. For instance, if the government implements tax cuts in 2024, it could leave businesses and consumers with more disposable income, potentially leading to increased borrowing and investment, which benefits banks like Commerce Bank. Conversely, austerity measures or tax hikes could dampen economic activity, reducing loan demand and investment opportunities.

- Stimulus Measures: Government stimulus programs, like those seen during economic downturns, can inject liquidity into the economy, boosting consumer spending and business investment, thereby increasing demand for banking products.

- Infrastructure Spending: Large-scale government infrastructure projects create jobs and stimulate economic growth, leading to increased demand for corporate lending and project finance from banks.

- Tax Policy: Changes in corporate and individual tax rates directly impact disposable income and business profitability, influencing savings, investment, and borrowing behavior.

- Fiscal Deficits: High government deficits can lead to increased government borrowing, potentially driving up interest rates and affecting the cost of capital for businesses and consumers.

Regulatory Enforcement and Scrutiny

Regulatory enforcement and scrutiny are critical political factors impacting banks like Commerce Bancshares. Increased oversight in areas such as anti-money laundering (AML), consumer protection, and data privacy directly influences operational costs and requires strategic adjustments. For instance, new regulations concerning digital FDIC signage and the reporting of medical debt are examples of evolving compliance demands.

The intensity of regulatory enforcement can lead to significant financial and operational impacts. For example, a bank facing stricter AML rules might need to invest more in technology and personnel for transaction monitoring. In 2024, the financial sector continued to see robust regulatory activity, with agencies like the Consumer Financial Protection Bureau (CFPB) actively issuing guidance and enforcement actions related to fair lending and data security.

- Increased Compliance Costs: New regulations, such as those related to digital disclosures and data privacy, necessitate investment in technology and training, potentially raising operating expenses for Commerce Bancshares.

- Focus on Consumer Protection: Regulatory bodies are intensifying their focus on consumer protection, leading to greater scrutiny of lending practices, fee structures, and complaint resolution processes.

- Data Security and Privacy Mandates: Evolving data privacy laws and cybersecurity threats mean banks must continuously update their security protocols and compliance measures, impacting IT budgets and risk management strategies.

Government fiscal policies, including spending and taxation, directly influence economic activity and, consequently, demand for banking services. For example, the Biden-Harris Administration's Infrastructure Investment and Jobs Act, passed in 2021 with $1.2 trillion, aims to stimulate economic growth, potentially boosting loan demand for Commerce Bank. Changes in tax rates, such as potential adjustments in 2024, can also affect consumer and business spending, impacting the bank's lending and deposit volumes.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Commerce Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies, empowering stakeholders to navigate market shifts and capitalize on emerging opportunities.

Commerce Bank's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliever by simplifying complex external factors.

Economic factors

The Federal Reserve's monetary policy, particularly its interest rate decisions, plays a crucial role in Commerce Bancshares' financial performance. In the first quarter of 2025, the bank reported a record net interest income of $269 million, a figure directly influenced by the prevailing interest rate environment.

Fluctuations in the federal funds rate directly affect the interest Commerce Bank earns on its loan portfolio and the interest it pays on customer deposits. This dynamic directly impacts the bank's net interest margin and overall profitability.

Looking ahead to the latter half of 2025, economic forecasts indicate a possibility of interest rate cuts. Such a shift could significantly alter the banking sector, potentially compressing net interest margins for institutions like Commerce Bancshares.

The overall health of the U.S. and Midwest economies significantly impacts Commerce Bancshares. A robust economy, as seen in Q1 2025 where Commerce Bancshares reported solid loan growth and maintained strong credit quality, directly fuels the bank's profitability. This stability supports increased lending and a lower risk of defaults.

Conversely, any downturn or recessionary pressure poses a substantial risk. An economic slowdown typically leads to higher loan defaults and a reduced demand for banking services, potentially impacting Commerce Bancshares' revenue streams and asset quality. For instance, if GDP growth falters significantly in late 2024 or early 2025, the bank could face increased provisioning for loan losses.

Inflation significantly affects purchasing power and consumer spending habits, while also increasing operational costs for businesses like Commerce Bancshares. Although inflation showed signs of moderating through 2024, ongoing pressures and higher interest rates continued to influence financial markets.

These elevated interest rates, a direct consequence of efforts to curb inflation, directly impact Commerce Bancshares' cost of funding and can strain the financial well-being of its customer base, potentially affecting loan demand and credit quality.

Consumer Spending and Debt Levels

Consumer spending is a major engine for the economy, directly impacting demand for retail banking products such as checking accounts, savings, and personal loans. Commerce Bancshares, with its broad suite of consumer banking services, is intrinsically linked to the financial well-being of individuals.

High consumer debt levels represent a significant risk, potentially leading to a rise in loan defaults and impacting the profitability of financial institutions. For example, as of Q1 2024, total household debt in the U.S. reached approximately $17.7 trillion, with credit card debt showing a notable increase.

- Consumer spending growth: In Q1 2024, U.S. real personal consumption expenditures increased at an annual rate of 2.0%, indicating continued, albeit moderate, consumer activity.

- Household debt trends: The Federal Reserve Bank of New York reported that total household debt rose by $184 billion to $17.7 trillion in the first quarter of 2024.

- Credit card delinquency: Delinquency rates for credit card debt saw an uptick, reaching 3.13% in Q1 2024, a level not seen since 2011, signaling potential strain on consumer finances.

- Commerce Bancshares' exposure: The bank's retail loan portfolio, including credit cards and personal loans, is directly affected by these consumer spending and debt trends.

Competition in the Financial Sector

Commerce Bancshares operates in a highly competitive financial sector. This includes not only traditional banks and credit unions but also a growing number of agile fintech companies. This dynamic environment directly impacts Commerce's ability to capture market share and dictates its pricing strategies, particularly in the crucial area of deposit gathering.

The banking industry has seen significant shifts, with a more intense competition for deposits becoming a defining characteristic. As of early 2024, the pursuit of stable funding sources has intensified, with many institutions offering more attractive rates to attract and retain customer balances.

Furthermore, the increasing prevalence of digital-only banks and the integration of financial services into non-financial platforms, known as embedded finance, introduce novel competitive pressures. These innovations challenge traditional banking models by offering convenience and specialized services, forcing established players like Commerce to adapt and enhance their digital offerings.

- Increased Deposit Competition: As of Q1 2024, average deposit growth across major US banks slowed, indicating a tighter market for funding.

- Fintech Market Share: Fintech companies, particularly in payments and lending, continued to gain traction, with some estimates suggesting they handle over 30% of consumer payment transactions in the US.

- Digital Banking Adoption: By the end of 2024, it's projected that over 70% of banking customers will primarily interact with their banks through digital channels.

The Federal Reserve's monetary policy, particularly its interest rate decisions, plays a crucial role in Commerce Bancshares' financial performance. In the first quarter of 2025, the bank reported a record net interest income of $269 million, a figure directly influenced by the prevailing interest rate environment.

Fluctuations in the federal funds rate directly affect the interest Commerce Bank earns on its loan portfolio and the interest it pays on customer deposits. This dynamic directly impacts the bank's net interest margin and overall profitability.

Looking ahead to the latter half of 2025, economic forecasts indicate a possibility of interest rate cuts. Such a shift could significantly alter the banking sector, potentially compressing net interest margins for institutions like Commerce Bancshares.

The overall health of the U.S. and Midwest economies significantly impacts Commerce Bancshares. A robust economy, as seen in Q1 2025 where Commerce Bancshares reported solid loan growth and maintained strong credit quality, directly fuels the bank's profitability. This stability supports increased lending and a lower risk of defaults.

Conversely, any downturn or recessionary pressure poses a substantial risk. An economic slowdown typically leads to higher loan defaults and a reduced demand for banking services, potentially impacting Commerce Bancshares' revenue streams and asset quality. For instance, if GDP growth falters significantly in late 2024 or early 2025, the bank could face increased provisioning for loan losses.

Inflation significantly affects purchasing power and consumer spending habits, while also increasing operational costs for businesses like Commerce Bancshares. Although inflation showed signs of moderating through 2024, ongoing pressures and higher interest rates continued to influence financial markets.

These elevated interest rates, a direct consequence of efforts to curb inflation, directly impact Commerce Bancshares' cost of funding and can strain the financial well-being of its customer base, potentially affecting loan demand and credit quality.

Consumer spending is a major engine for the economy, directly impacting demand for retail banking products such as checking accounts, savings, and personal loans. Commerce Bancshares, with its broad suite of consumer banking services, is intrinsically linked to the financial well-being of individuals.

High consumer debt levels represent a significant risk, potentially leading to a rise in loan defaults and impacting the profitability of financial institutions. For example, as of Q1 2024, total household debt in the U.S. reached approximately $17.7 trillion, with credit card debt showing a notable increase.

- Consumer spending growth: In Q1 2024, U.S. real personal consumption expenditures increased at an annual rate of 2.0%, indicating continued, albeit moderate, consumer activity.

- Household debt trends: The Federal Reserve Bank of New York reported that total household debt rose by $184 billion to $17.7 trillion in the first quarter of 2024.

- Credit card delinquency: Delinquency rates for credit card debt saw an uptick, reaching 3.13% in Q1 2024, a level not seen since 2011, signaling potential strain on consumer finances.

- Commerce Bancshares' exposure: The bank's retail loan portfolio, including credit cards and personal loans, is directly affected by these consumer spending and debt trends.

Commerce Bancshares operates in a highly competitive financial sector. This includes not only traditional banks and credit unions but also a growing number of agile fintech companies. This dynamic environment directly impacts Commerce's ability to capture market share and dictates its pricing strategies, particularly in the crucial area of deposit gathering.

The banking industry has seen significant shifts, with a more intense competition for deposits becoming a defining characteristic. As of early 2024, the pursuit of stable funding sources has intensified, with many institutions offering more attractive rates to attract and retain customer balances.

Furthermore, the increasing prevalence of digital-only banks and the integration of financial services into non-financial platforms, known as embedded finance, introduce novel competitive pressures. These innovations challenge traditional banking models by offering convenience and specialized services, forcing established players like Commerce to adapt and enhance their digital offerings.

- Increased Deposit Competition: As of Q1 2024, average deposit growth across major US banks slowed, indicating a tighter market for funding.

- Fintech Market Share: Fintech companies, particularly in payments and lending, continued to gain traction, with some estimates suggesting they handle over 30% of consumer payment transactions in the US.

- Digital Banking Adoption: By the end of 2024, it's projected that over 70% of banking customers will primarily interact with their banks through digital channels.

Commerce Bancshares' net interest income is highly sensitive to interest rate changes, as evidenced by its $269 million net interest income in Q1 2025. Economic growth and consumer spending directly influence loan demand and credit quality, impacting the bank's overall performance.

Inflationary pressures and the resulting higher interest rates can compress net interest margins and potentially strain consumer finances, as seen in the Q1 2024 credit card delinquency rate of 3.13%.

The competitive landscape, marked by increased deposit competition and the rise of fintech, necessitates continuous adaptation and investment in digital offerings for institutions like Commerce Bancshares.

| Economic Factor | Impact on Commerce Bancshares | Key Data/Trend (2024-2025) |

|---|---|---|

| Interest Rates | Affects net interest income, loan demand, and cost of funds. | Q1 2025 Net Interest Income: $269 million. Forecasted potential rate cuts in H2 2025. |

| Economic Growth (GDP) | Drives loan growth and credit quality. Slowdowns increase default risk. | Q1 2024 Real Personal Consumption Expenditures growth: 2.0%. Potential GDP faltering in late 2024/early 2025 could increase loan loss provisions. |

| Inflation | Impacts purchasing power, consumer spending, and operational costs. | Inflationary pressures continued through 2024, influencing higher interest rates. |

| Consumer Spending & Debt | Directly impacts retail banking product demand and loan default risk. | Q1 2024 Total Household Debt: $17.7 trillion. Credit card delinquency rate rose to 3.13% in Q1 2024. |

| Competition | Pressures pricing, deposit gathering, and necessitates digital innovation. | Slowing deposit growth across major US banks in Q1 2024. Fintechs handle over 30% of consumer payment transactions. 70%+ banking interactions projected to be digital by end of 2024. |

Preview Before You Purchase

Commerce Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Commerce Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Commerce Bank's market landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a robust framework for understanding Commerce Bank's opportunities and threats.

Sociological factors

Demographic shifts are reshaping banking needs across the Midwest. The region's aging population, with a notable increase in those over 65, is driving greater demand for wealth management and retirement planning services. Conversely, a growing influx of younger professionals and families, particularly in urban centers, is fueling the adoption of digital banking platforms and mobile payment solutions.

Consumer preferences are rapidly evolving, with a significant lean towards digital banking solutions. In 2024, it's estimated that over 80% of banking interactions for many institutions will occur through mobile or online channels. This trend necessitates that Commerce Bancshares invests heavily in user-friendly digital platforms and mobile app functionality to meet customer expectations for convenience and accessibility.

Customers now expect more than just basic transactions; they seek personalized financial guidance and tailored product offerings. Data from early 2025 indicates that consumers who receive personalized financial advice are 25% more likely to deepen their relationship with their bank. Commerce Bancshares must leverage data analytics to provide proactive, relevant financial insights and product recommendations.

The general level of financial literacy significantly influences customer demand for financial products. A population with higher financial literacy is more likely to understand and utilize complex instruments, while lower literacy may lead to a preference for simpler solutions. For instance, a 2024 survey indicated that only 52% of American adults felt confident in their ability to manage their finances effectively, suggesting a substantial segment of the population may require more basic financial education and products.

Commerce Bancshares can leverage this by offering a spectrum of services, from introductory budgeting tools to advanced investment guidance. By segmenting its customer base according to financial sophistication, Commerce Bank can tailor its product development and marketing efforts. This approach ensures that customers receive solutions that match their understanding and needs, fostering greater engagement and loyalty.

Trust and Reputation in Banking

Public trust is a cornerstone of the banking industry, directly influencing customer behavior and institutional stability. Following the 2008 financial crisis, consumer confidence in banks dipped significantly, and while it has seen some recovery, events like the Silicon Valley Bank failure in early 2023, which saw a rapid outflow of deposits, highlight the fragility of this trust. Data breaches, such as the one impacting Capital One in 2019, also serve as stark reminders of how quickly trust can be eroded, impacting customer retention and the ability to attract new clients.

Commerce Bancshares, with its extensive history dating back to 1865, has consistently prioritized building and maintaining customer trust. Their emphasis on personalized service and community involvement aims to foster long-term relationships, which are vital in an era where digital alternatives are abundant. For instance, in Q1 2024, Commerce Bancshares reported a strong customer retention rate, a testament to their ongoing efforts in this area.

The sociological landscape for banks in 2024 and 2025 continues to be shaped by these trust dynamics. Consumer expectations are higher than ever, demanding transparency and robust security. A recent survey indicated that over 60% of banking customers consider trust and security to be the most important factors when choosing a financial institution. This underscores the critical need for banks like Commerce Bancshares to continually demonstrate their reliability and integrity.

- Customer Trust as a Key Differentiator: In 2024, over 70% of consumers stated that trust is paramount when selecting a bank, influencing their willingness to adopt new digital services.

- Impact of Data Security: Following major data breaches in previous years, 2024 saw increased customer scrutiny of banks' cybersecurity measures, with a significant percentage willing to switch providers over security concerns.

- Reputation Management: Commerce Bancshares' long-standing reputation for stability and customer service, evidenced by consistent positive customer satisfaction scores, remains a critical asset in navigating the current sociological environment.

- Generational Trust Differences: While older generations may rely more on established reputations, younger demographics in 2024 are increasingly influenced by online reviews and social proof, making digital trust-building equally important.

Workforce Demographics and Talent Availability

The availability of skilled talent in the Midwest, especially in crucial sectors like technology, finance, and wealth management, directly influences Commerce Bancshares' capacity to attract and keep employees. A tight labor market can hinder operational effectiveness and the execution of growth plans.

As of early 2024, the unemployment rate in key Midwest states where Commerce Bancshares operates, such as Missouri and Kansas, remained notably low, hovering around 3.0% to 3.5%. This competitive landscape means that securing specialized talent, particularly in areas like cybersecurity and data analytics which are vital for modern banking, presents an ongoing challenge.

- Talent Shortage Impact: A scarcity of experienced financial analysts and wealth managers can slow down expansion into new markets or the development of innovative financial products.

- Wage Pressures: Low unemployment often leads to increased wage demands, impacting the bank's operating costs and profitability.

- Digital Skills Gap: The rapid evolution of banking technology necessitates a workforce proficient in digital tools and platforms, a skill set that may not be readily abundant in all segments of the Midwest labor pool.

- Retention Challenges: In a strong job market, retaining top performers becomes more difficult as competitors actively recruit skilled professionals.

Sociological factors significantly shape customer behavior and trust in the banking sector. In 2024, over 70% of consumers prioritize trust when selecting a bank, directly impacting their willingness to adopt new digital services. Data security is a major concern, with a notable percentage of customers considering switching providers due to cybersecurity worries. Commerce Bancshares' established reputation and focus on customer service are crucial assets in this environment, though generational differences in trust building, with younger demographics influenced by online reviews, necessitate a strong digital presence.

Technological factors

The banking industry's digital transformation is accelerating, driven by consumer expectations for intuitive online and mobile banking. Commerce Bancshares recognizes this, offering robust services via its online portal, mobile app, and extensive ATM network, reflecting significant investment in digital infrastructure. For instance, as of Q1 2024, Commerce Bancshares reported a substantial portion of its customer interactions occurring through digital channels, underscoring the importance of these platforms.

To maintain its competitive edge, Commerce Bancshares must continuously innovate and enhance its digital offerings. This includes improving user experience, expanding mobile payment capabilities, and potentially integrating advanced features like AI-powered financial advice. The bank's commitment to digital innovation is crucial for attracting and retaining customers in an increasingly tech-savvy market.

The financial services sector, including institutions like Commerce Bancshares, is a constant target for cyber threats such as phishing, ransomware, and distributed denial-of-service (DDoS) attacks. These attacks pose a significant risk to sensitive customer data.

Commerce Bancshares, like all financial institutions, must invest heavily in robust cybersecurity measures to protect against data breaches. The potential financial and reputational damage from a successful cyberattack can be immense, impacting customer trust and operational continuity.

The financial fallout from cyber incidents is substantial. For instance, in 2023, the average cost of a data breach in the financial sector reached $5.9 million, a figure that underscores the critical need for proactive and advanced security protocols.

Artificial intelligence and automation are increasingly woven into the fabric of banking, transforming everything from how customers interact with institutions through chatbots to sophisticated fraud detection and risk management. Commerce Bancshares can harness these advancements to streamline internal workflows, leading to significant cost reductions and a more engaging customer journey. For instance, by mid-2024, many leading banks reported using AI for anomaly detection, reducing false positives in fraud alerts by up to 30%.

Fintech Innovation and Partnerships

Fintech innovations, particularly embedded finance and Banking-as-a-Service (BaaS), are rapidly transforming the financial sector. These advancements allow non-financial companies to integrate financial services directly into their platforms, creating new customer touchpoints and revenue streams. For instance, the global embedded finance market was projected to reach $2.4 trillion by 2024, highlighting its significant growth potential.

To stay competitive, traditional banks like Commerce Bancshares are increasingly exploring strategic partnerships with fintech companies. These collaborations enable banks to leverage cutting-edge technology, expand their service offerings, and reach new customer segments more efficiently. By embracing these partnerships, Commerce Bancshares can enhance its digital capabilities and provide more integrated, user-friendly financial solutions.

- Embedded Finance Growth: The embedded finance market is expected to see substantial expansion, offering new avenues for banks to embed their services within non-financial platforms.

- Banking-as-a-Service (BaaS): BaaS models allow third-party companies to access banking infrastructure, creating opportunities for revenue generation through API-driven services.

- Digital Offering Enhancement: Banks are focusing on improving their digital platforms and mobile banking experiences to meet evolving customer expectations for seamless, on-demand financial services.

- Fintech Collaboration: Partnerships with fintech firms are crucial for traditional banks to adopt new technologies and offer innovative solutions, thereby maintaining market relevance.

Payment Processing Advancements

The payment processing landscape is rapidly evolving, directly influencing Commerce Bancshares' offerings. The shift towards real-time payments (RTP) and the adoption of advanced messaging standards like ISO 20022 are reshaping how transactions occur, demanding significant infrastructure updates from financial institutions.

Consumers now anticipate payment options that are not only faster but also more user-friendly and intelligent. This expectation fuels the need for banks to continuously modernize their payment systems to remain competitive and meet evolving customer demands.

- Real-Time Payments (RTP) Growth: The RTP network in the U.S. processed an average of 170 million payments per month in the first quarter of 2024, a substantial increase from previous periods, highlighting the growing consumer preference for instant transactions.

- ISO 20022 Adoption: Major financial networks are transitioning to ISO 20022, a global messaging standard that offers richer data and greater interoperability, enabling more sophisticated payment solutions and improved data analytics for banks like Commerce Bancshares.

- Digital Wallet Dominance: By the end of 2024, it's projected that over 80% of consumers in developed markets will use digital wallets, underscoring the critical need for banks to integrate seamlessly with these platforms.

Technological advancements are fundamentally reshaping the banking sector, pushing institutions like Commerce Bancshares to prioritize digital innovation and cybersecurity. The increasing adoption of real-time payments and evolving messaging standards necessitates continuous investment in infrastructure to meet customer expectations for speed and convenience.

Fintech, particularly embedded finance and Banking-as-a-Service, presents both opportunities and challenges, driving banks to explore strategic partnerships to leverage new technologies and expand service offerings. Artificial intelligence is also being integrated to enhance operational efficiency and customer engagement, as evidenced by its use in fraud detection.

| Key Technology Trend | Impact on Commerce Bancshares | Supporting Data (2024/2025) |

| Digital Transformation & Mobile Banking | Enhanced customer experience, increased digital interaction | Significant portion of Q1 2024 customer interactions via digital channels; projected 80%+ consumer digital wallet usage by end of 2024. |

| Cybersecurity Threats | Need for robust security investments to protect data | Average financial sector data breach cost reached $5.9 million in 2023. |

| Artificial Intelligence (AI) & Automation | Streamlined operations, improved fraud detection | AI used to reduce fraud alert false positives by up to 30% by mid-2024. |

| Fintech & Embedded Finance | Opportunities for partnerships, new revenue streams | Global embedded finance market projected to reach $2.4 trillion by 2024. |

| Payment Modernization (RTP, ISO 20022) | Demand for faster, more integrated payment solutions | U.S. RTP network processed ~170 million payments/month in Q1 2024. |

Legal factors

Commerce Bancshares navigates a complex web of federal and state banking laws, demanding strict adherence to maintain operational integrity. Upcoming regulatory shifts in 2025, such as updated US Basel III Capital Rules and enhanced anti-money laundering (AML) program requirements, will necessitate significant compliance efforts. These changes, alongside new mandates for digital FDIC signage, underscore the dynamic nature of the regulatory landscape for financial institutions.

Consumer protection laws significantly shape Commerce Bancshares' operations. Regulations like the Equal Credit Opportunity Act and the Fair Housing Act directly influence their retail banking and lending, ensuring fair treatment across all applicants. For instance, the Consumer Financial Protection Bureau (CFPB) continues to scrutinize lending practices, with proposed rules regarding medical debt and its impact on credit reporting potentially affecting how Commerce Bancshares assesses borrower risk and offers credit products.

Data privacy and security laws are becoming increasingly critical for financial institutions like Commerce Bancshares. With cyber threats on the rise, regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) demand greater transparency and robust protection for customer data. These laws necessitate significant investment in advanced security systems and clear policies to ensure compliance and safeguard sensitive financial information.

Anti-Money Laundering (AML) and Sanctions Laws

Commerce Bank, like all financial institutions, operates under rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations. These laws are designed to prevent illicit financial activities and ensure the integrity of the global financial system. Failure to comply can result in substantial fines and reputational damage.

Mid-2024 saw proposed enhancements to these frameworks, pushing financial institutions to proactively identify and address AML/CFT priorities. This includes a greater emphasis on risk-based approaches and the implementation of robust internal controls. For Commerce Bank, this means continuous investment in technology and training to stay ahead of evolving threats.

- Regulatory Scrutiny: Banks face intense oversight regarding AML/CFT compliance, with significant penalties for violations.

- Evolving Landscape: New proposals in mid-2024 signal a trend towards more stringent and modernized AML/CFT programs.

- Risk-Based Approach: Institutions must integrate AML/CFT priorities into their core business strategies and risk management frameworks.

- Financial Integrity: Adherence to these laws is paramount for preventing financial crime and maintaining public trust.

Merger and Acquisition Regulations

Regulations governing bank mergers and acquisitions significantly influence Commerce Bancshares' strategic expansion. For instance, the definitive merger agreement to acquire FineMark Holdings, Inc. in late 2023, valued at approximately $1.5 billion, necessitates rigorous regulatory scrutiny.

Compliance with antitrust guidelines and obtaining approval from bodies like the Federal Reserve are critical hurdles. These processes ensure fair competition and prevent market concentration, directly impacting the feasibility and timeline of such growth initiatives.

- Antitrust Review: Regulators assess potential market impact, especially in concentrated banking regions, to prevent anti-competitive practices.

- Federal Reserve Approval: The Federal Reserve Board must approve significant bank mergers, evaluating financial stability and community impact.

- State-Level Approvals: Depending on the target's location, state banking authorities also play a role in the approval process, adding another layer of compliance.

Upcoming regulatory shifts in 2025, such as updated US Basel III Capital Rules and enhanced anti-money laundering (AML) program requirements, will necessitate significant compliance efforts for Commerce Bancshares. New mandates for digital FDIC signage also highlight the evolving regulatory environment.

Consumer protection laws, including the Equal Credit Opportunity Act and the Fair Housing Act, directly influence Commerce Bancshares' lending practices. The CFPB's ongoing scrutiny of credit reporting, particularly regarding medical debt, could impact risk assessment and credit product offerings.

Data privacy laws like CCPA and GDPR demand robust protection for customer data, requiring substantial investment in security systems and clear compliance policies for Commerce Bancshares.

Commerce Bank's acquisition of FineMark Holdings for approximately $1.5 billion in late 2023 faced rigorous antitrust review and required Federal Reserve approval, underscoring the legal complexities of strategic expansion.

Environmental factors

While Commerce Bancshares' primary operations are in the Midwest, the bank is not immune to the indirect physical risks of climate change. Extreme weather events, such as the increased frequency of severe storms and flooding observed in recent years, can significantly impact the local businesses and real estate that form the backbone of its loan portfolios. For instance, a severe drought in 2024 across parts of the Midwest could strain agricultural borrowers, a key sector for regional banks.

These events can directly affect property valuations and the ability of borrowers to repay loans, potentially leading to increased non-performing assets. The Federal Reserve Board, recognizing these growing concerns, is actively emphasizing how financial institutions like Commerce Bancshares assess the resilience of their business models against these evolving climate-related risks, pushing for more robust risk management frameworks.

Commerce Bancshares, like many financial institutions, is navigating increasing investor and public scrutiny regarding Environmental, Social, and Governance (ESG) factors. This translates into a demand for sustainable financing options, such as green bonds, and a greater emphasis on responsible lending practices, impacting how the bank approaches its portfolio. For instance, the global sustainable bond market reached an estimated $1.2 trillion in 2024, a significant increase reflecting this trend.

Regulatory bodies are also playing a crucial role, with tightening ESG disclosure requirements becoming a norm. This necessitates that Commerce Bancshares diligently track and report on its ESG-related activities, ensuring transparency and compliance. The Securities and Exchange Commission (SEC) in the US, for example, has been developing new rules for climate-related disclosures, which will directly affect reporting for banks by 2025.

While Commerce Bank isn't directly impacted by resource scarcity like a manufacturing firm, rising energy costs due to water scarcity or other environmental factors could indirectly increase operational expenses for its physical branches and data centers. For instance, in 2024, global energy prices saw fluctuations, impacting utility bills for businesses across sectors.

Adopting sustainable practices, such as improving energy efficiency in its buildings and implementing robust waste management programs, can lead to significant cost savings and enhance Commerce Bank's reputation. Studies in 2024 continued to highlight the correlation between strong Environmental, Social, and Governance (ESG) performance and improved operational efficiency for financial institutions.

Pollution and Environmental Regulations

Commerce Bancshares, while not directly involved in heavy industry, must consider environmental regulations affecting its clients. Stricter pollution controls and emissions standards can impact the financial health and credit risk of businesses in sectors like manufacturing, energy, and agriculture, which are significant borrowers. For instance, increased compliance costs for clients could strain their ability to repay loans, influencing Commerce Bank's lending decisions and portfolio risk management.

The evolving landscape of environmental regulations, particularly concerning climate change and sustainability, presents both challenges and opportunities. As of early 2024, there's a growing emphasis on Environmental, Social, and Governance (ESG) factors in lending and investment. Banks are increasingly scrutinizing the environmental impact of their loan portfolios. For example, the U.S. Securities and Exchange Commission (SEC) proposed new climate disclosure rules in 2022, which, though facing legal challenges, signal a trend towards greater transparency and accountability for companies regarding their environmental footprint.

- Increased Compliance Costs for Clients: Businesses facing tougher environmental regulations might incur higher operational expenses, potentially affecting their profitability and loan servicing capacity.

- Shifting Investment Trends: A growing focus on sustainable finance means clients with strong environmental performance may find it easier to secure financing, while those with poor records could face higher borrowing costs or limited access to capital.

- Reputational Risk: Commerce Bancshares' association with clients who violate environmental laws or have significant negative environmental impacts could lead to reputational damage.

- Emerging Green Finance Opportunities: The bank can capitalize on the demand for green loans and sustainable financing solutions, supporting clients in their transition to more environmentally friendly practices.

Reputational Risks from Environmental Incidents

Public awareness and concern regarding environmental responsibility continue to escalate, significantly influencing consumer and investor decisions. Commerce Bancshares, like other financial institutions, faces reputational risks if associated with environmentally damaging practices, even indirectly through its lending portfolio. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental stance when making purchasing decisions, a trend likely to grow.

This growing emphasis on sustainability presents both challenges and opportunities. Negative publicity stemming from investments in or loans to industries with poor environmental records could damage Commerce Bancshares' brand image. Conversely, a proactive approach to environmental, social, and governance (ESG) principles can bolster its reputation, attract a broader customer base, and potentially lead to better access to capital. In 2023, banks with strong ESG ratings often saw improved stock performance compared to their peers.

- Growing Public Scrutiny: Over 60% of consumers consider environmental factors in purchasing decisions (2024 data).

- Indirect Risk Exposure: Lending to carbon-intensive industries can create reputational liabilities for Commerce Bancshares.

- Brand Enhancement Opportunity: Prioritizing sustainability can attract environmentally conscious customers and investors.

- Financial Performance Link: Banks with strong ESG ratings showed better stock performance in 2023.

Commerce Bancshares faces indirect risks from climate change, with extreme weather events potentially impacting its loan portfolios, particularly in agriculture. Growing investor and public demand for ESG compliance means the bank must increasingly offer sustainable financing options, a trend reflected in the global sustainable bond market's estimated $1.2 trillion valuation in 2024. Regulatory bodies like the SEC are also pushing for greater climate-related disclosures, which will affect banks by 2025, requiring diligent tracking and reporting of ESG activities.

| Environmental Factor | Impact on Commerce Bancshares | Data/Trend (2024-2025) |

| Extreme Weather Events | Increased risk for agricultural and real estate loan portfolios. | Increased frequency of severe storms and flooding observed. Potential drought impact on agricultural borrowers. |

| ESG Scrutiny & Demand | Need for sustainable financing options and responsible lending. | Global sustainable bond market estimated at $1.2 trillion in 2024. Over 60% of consumers consider environmental stance in 2024. |

| Regulatory Changes | Mandatory climate-related disclosures and reporting. | SEC developing new climate disclosure rules, impacting banks by 2025. |

| Client Environmental Compliance | Potential impact on client financial health and loan repayment. | Stricter pollution controls can increase compliance costs for clients in manufacturing, energy, and agriculture. |

PESTLE Analysis Data Sources

Our Commerce Bank PESTLE Analysis is meticulously constructed using a blend of official government data, reputable financial news outlets, and industry-specific market research reports. This comprehensive approach ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in factual and current information.