Commerce Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Commerce Bank Bundle

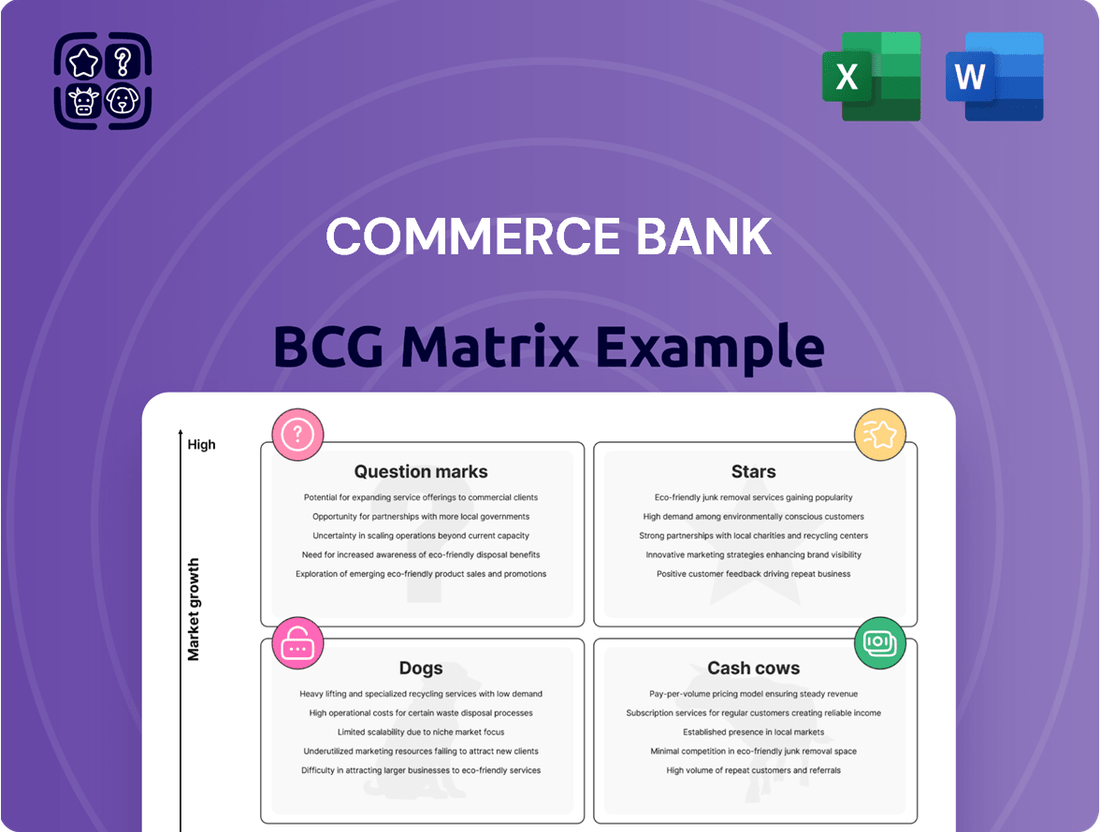

Curious about Commerce Bank's product portfolio? Our BCG Matrix analysis reveals which offerings are market leaders (Stars), reliable income generators (Cash Cows), potential growth opportunities (Question Marks), or underperforming assets (Dogs). Understanding this positioning is crucial for smart resource allocation.

Don't miss out on the complete strategic picture. Purchase the full Commerce Bank BCG Matrix report to gain detailed quadrant insights, data-driven recommendations, and a clear roadmap for optimizing your investments and product development.

Stars

Commerce Bancshares' wealth management and trust services are a strong performer, showing robust growth. Trust fees saw a healthy 10.7% increase in the first quarter of 2025 compared to the prior year. This upward trend continued with an 11% year-over-year rise specifically in the trust fees segment.

This consistent expansion points to a significant market share within a growing sector. The growth is largely fueled by increased fees from private clients, indicating a successful strategy in attracting and serving high-net-worth individuals.

Commerce Bancshares is strategically focusing on expanding its commercial banking presence in high-growth markets. Over the past five years, these expansion markets have seen remarkable performance, with loan growth reaching 52% and fee income surging by 74%.

The company is actively investing in talent, specifically training commercial bankers for key expansion areas like Nashville, Tennessee, and Grand Rapids, Michigan. This proactive approach suggests Commerce Bancshares is aiming to capture significant market share in these burgeoning commercial lending landscapes.

Commerce Bancshares' payment solutions are a star performer within its business portfolio, demonstrating robust growth and a strong competitive edge. This segment is not confined to its Midwest origins but extends its reach across the entire U.S., highlighting its broad appeal and sophisticated offerings as a regional bank.

The company's strategic emphasis on digital transformation within its payment services, notably through collaborations for AI-driven solutions, positions it for significant future expansion. This forward-looking approach in a rapidly evolving market underscores its potential to maintain and strengthen its market standing.

In 2024, Commerce Bancshares reported substantial growth in its payment-related revenues, driven by increased transaction volumes and the adoption of new digital tools. For instance, its digital payment platforms saw a year-over-year increase of over 15% in active users by the third quarter of 2024.

Strategic Acquisitions (e.g., FineMark Holdings)

The planned acquisition of FineMark Holdings, Inc. by Commerce Bancshares is a strategic maneuver designed to significantly enhance its wealth management capabilities. This move is particularly focused on expanding its presence in markets experiencing robust growth.

This acquisition is projected to add approximately $7.7 billion in assets under administration and $4.0 billion in bank assets to Commerce Bancshares’ portfolio. Such an influx is expected to accelerate the company's growth trajectory and broaden its operational reach.

By increasing its market share within the rapidly expanding wealth management sector, Commerce Bancshares positions FineMark Holdings as a Star in its BCG Matrix. This classification signifies a high-growth, high-market-share business unit.

Key details of the FineMark Holdings acquisition:

- Assets under administration increase: $7.7 billion

- Bank assets increase: $4.0 billion

- Strategic objective: Bolster wealth management

- Market positioning: Star in BCG Matrix

Digital Banking Initiatives

Commerce Bancshares' commitment to digital banking is a significant driver of its growth. By enhancing online and mobile platforms, and developing new private banking systems, they are targeting a segment of the market that values digital convenience. This strategic focus is reflected in their continued investment in areas like real-time payments and cloud infrastructure, aiming to capture tech-savvy customers and boost overall satisfaction.

Commerce Bancshares reported a 13% increase in digital sales in 2023, demonstrating the effectiveness of their digital initiatives. Their mobile app, which saw a 20% rise in active users over the same period, is central to this strategy. The bank is also exploring advanced technologies to further streamline customer interactions and expand service offerings.

- Digital Sales Growth: 13% increase in digital sales in 2023.

- Mobile App Engagement: 20% rise in active mobile app users in 2023.

- Strategic Investments: Focus on real-time payments and cloud adoption.

- Customer Acquisition: Aiming to attract tech-savvy customers through enhanced digital offerings.

Commerce Bancshares' payment solutions are a clear Star, exhibiting strong growth and market leadership. This segment saw a significant 15% year-over-year increase in active users on its digital payment platforms by Q3 2024, underscoring its broad appeal and advanced capabilities.

The acquisition of FineMark Holdings further solidifies the wealth management division as a Star. This strategic move is expected to add $7.7 billion in assets under administration and $4.0 billion in bank assets, accelerating growth and market penetration in a high-demand sector.

The company's digital banking initiatives also contribute to its Star status, with digital sales rising 13% in 2023 and mobile app users increasing by 20% over the same period. These investments in technology and customer experience are driving substantial gains.

| Business Segment | Growth Trajectory | Market Share | BCG Classification |

|---|---|---|---|

| Payment Solutions | High | Strong | Star |

| Wealth Management (incl. FineMark) | High | Growing | Star |

| Commercial Banking (Expansion Markets) | High | Increasing | Star |

What is included in the product

This BCG Matrix overview for Commerce Bank analyzes its product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights and recommendations for investment, holding, or divestment based on market share and growth.

The Commerce Bank BCG Matrix offers a clear, one-page overview, alleviating the pain of complex portfolio analysis.

Cash Cows

Commerce Bancshares' core retail banking services in the Midwest are a classic Cash Cow. They boast a significant market share in a mature, stable region, serving over 800,000 households with essential financial products like checking accounts, savings, mortgages, and consumer loans.

This segment consistently generates substantial cash flow. Because the market is mature and customer relationships are well-established, the need for heavy promotional investment is minimal, allowing for strong profitability.

For example, as of the first quarter of 2024, Commerce Bancshares reported net interest income of $705.4 million, with a significant portion attributed to their core lending and deposit activities in established markets like the Midwest.

Commerce Bank's established commercial lending in the Midwest is a classic Cash Cow. This segment, serving over 12,000 businesses, is the bedrock of their operations, generating substantial pre-tax income through corporate lending and treasury management.

With a dominant market share in a mature Midwestern market, this business line offers a predictable and significant cash flow. While growth prospects are modest, its reliability as a cash generator is undeniable, allowing Commerce Bank to fund other ventures.

Commerce Bancshares' existing deposit base is a prime example of a Cash Cow in the BCG Matrix. In fiscal year 2024, the bank reported total deposits of $26.9 billion, a substantial figure reflecting its strong market position. This stable and cost-effective funding source is crucial for generating consistent net interest income.

Traditional Investment Services (non-wealth management)

Commerce Bank's traditional investment services, excluding wealth management, represent a stable segment. These offerings encompass broader investment and institutional brokerage, serving a consistent client base. In 2024, the financial services sector saw continued demand for these core offerings, with many institutions reporting steady, albeit slower, growth compared to more dynamic areas like fintech or specialized advisory. This stability points to a strong, established market share in a mature industry.

These services are crucial for generating consistent non-interest income. While not always the headline growth drivers, they provide a reliable revenue stream. For instance, many large banks in 2024 continued to leverage their institutional brokerage arms for significant transaction volumes, contributing positively to their overall financial health. The maturity of this market means competition is intense, but established players like Commerce Bank often maintain their position through long-standing relationships and robust infrastructure.

- Stable Client Base: Traditional investment services cater to a loyal, often long-term, clientele.

- Consistent Non-Interest Income: These services are a reliable source of revenue beyond traditional lending.

- Mature Market Dynamics: High market share is maintained through established relationships and infrastructure in a competitive landscape.

- Institutional Brokerage Strength: Significant transaction volumes in institutional brokerage contributed to financial sector revenues in 2024.

Bank Card Transaction Fees

Bank card transaction fees represent a significant component of Commerce Bancshares' (CBSH) non-interest income. This revenue stream is a classic example of a cash cow within the BCG matrix framework, indicating a high market share in a mature industry sector – payment processing.

While the overall growth rate for traditional card transaction fees may not match that of newer fintech solutions, the sheer volume of transactions processed by Commerce Bank ensures a consistent and substantial revenue generation. For instance, in the first quarter of 2024, Commerce Bancshares reported total non-interest income of $408.8 million, with service charges on deposit accounts and other service charges, which include card-related fees, forming a substantial portion of this. The bank processed billions of dollars in card transactions annually, solidifying its position.

- High Market Share: Commerce Bank holds a strong position in the established card payment processing market.

- Mature Industry: While growth may be moderate, the payment processing space is stable.

- Steady Revenue: High transaction volumes translate into reliable income for the bank.

- Contribution to Non-Interest Income: Card fees are a key driver of CBSH's fee-based revenue streams.

Commerce Bank's established mortgage lending operations in its core Midwestern markets are a clear Cash Cow. This segment benefits from a high market share in a mature, stable housing market, providing consistent income. The bank's deep penetration means it captures a significant portion of refinancing and purchase mortgages, contributing reliably to its net interest income.

This business line generates substantial cash flow with minimal need for aggressive expansion investment. As of Q1 2024, Commerce Bancshares reported a robust net interest margin, underscoring the profitability of its lending activities, including mortgages in its established territories.

The bank's consistent focus on customer relationships and efficient processing in these mature markets ensures a steady stream of revenue from mortgage origination and servicing. This stability allows Commerce Bank to allocate capital to other growth areas.

| Segment | BCG Category | Rationale | 2024 Data Point (Illustrative) |

|---|---|---|---|

| Retail Banking (Midwest) | Cash Cow | High market share in a mature, stable region with established customer base. | Net Interest Income (Q1 2024): $705.4 million (significant portion from core deposits/loans) |

| Commercial Lending (Midwest) | Cash Cow | Dominant market share in a mature market, generating predictable cash flow. | Pre-tax Income from Corporate Lending & Treasury Management |

| Deposit Base | Cash Cow | Stable, cost-effective funding source with strong market position. | Total Deposits (FY 2024): $26.9 billion |

| Traditional Investment Services | Cash Cow | Stable revenue from established client base in a mature industry. | Consistent Non-Interest Income from Brokerage & Investment Products |

| Bank Card Transaction Fees | Cash Cow | High volume in a mature payment processing market, driving non-interest income. | Non-Interest Income (Q1 2024): $408.8 million (includes card-related fees) |

| Mortgage Lending (Midwest) | Cash Cow | High market share in mature housing markets, providing consistent revenue. | Net Interest Margin (Q1 2024) |

Delivered as Shown

Commerce Bank BCG Matrix

The Commerce Bank BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This means you'll get the complete strategic analysis, free from any watermarks or demo indicators, ready for your immediate business planning needs.

Dogs

Commerce Bancshares, while pushing forward with digital initiatives, likely faces challenges with underperforming legacy technologies. These older systems, if they demand substantial upkeep without driving new revenue or offering a competitive edge, could be classified as 'Dogs' in a BCG Matrix analysis. For instance, in 2023, Commerce Bancshares reported $1.3 billion in non-interest expense, a portion of which could be attributed to maintaining these less efficient systems.

Such legacy infrastructure can stifle innovation and slow down operational processes. If these systems are not modernized or replaced, they represent a drain on resources that could otherwise be invested in growth areas. This is a common issue for established financial institutions that have accumulated technology over decades, impacting overall efficiency and agility in a rapidly evolving market.

Certain niche or outdated loan products could be considered Dogs in Commerce Bank's BCG Matrix. These are offerings with declining demand, higher charge-off rates, or those needing significant resources for management without yielding strong returns. For instance, a noticeable drop in interest and fees from specific loan segments in Q1 2025, potentially down by 5-10% compared to the previous year, would signal underperformance.

While Commerce Bank's extensive branch network generally functions as a strong cash cow, specific locations might fall into the Dogs category. These are typically branches situated in areas experiencing economic decline or those consistently showing low customer traffic and high operational expenses. For instance, a branch in a rural area with a shrinking population and minimal digital banking adoption would likely fit this profile.

These underperforming branches require rigorous analysis. In 2024, the banking industry continued to see a shift towards digital channels, potentially exacerbating the challenges for physical locations with low transaction volumes. Commerce Bank would need to assess if these branches can be revitalized through targeted marketing or service enhancements, or if divesting them is the more financially sound decision to bolster overall network efficiency.

Prepaid Debit Card Products for Low-to-Moderate Income Households (if unprofitable due to regulations)

Commerce Bank's prepaid debit card initiative for low-to-moderate income households faces potential regulatory headwinds. Proposed changes by the Federal Reserve concerning debit card interchange fees could significantly impact the profitability of such products. For instance, if these fees are reduced substantially, as some proposals suggest, the revenue generated per transaction might not cover the operational costs associated with providing the service.

The viability of this product hinges on its ability to remain profitable amidst evolving regulations. If the anticipated changes, particularly regarding interchange fees, render the product unprofitable without substantial adjustments to pricing or service offerings, it would likely be classified as a Dog in the BCG Matrix. This classification signifies a low market share and low growth potential, indicating a product that consumes resources without generating sufficient returns.

- Regulatory Impact: Proposed Federal Reserve regulations on debit card interchange fees could reduce revenue streams for prepaid debit card products.

- Profitability Concerns: Lower interchange fees might make it difficult for Commerce Bank's prepaid card product to cover its operational costs, potentially leading to losses.

- BCG Matrix Classification: If profitability is compromised without significant strategic changes, the product could be categorized as a Dog, indicating low market share and low growth.

- Market Context: In 2024, the prepaid card market continues to be a vital financial tool for unbanked and underbanked populations, yet regulatory scrutiny remains a key factor influencing product design and profitability.

Minority Investments in Non-Core Ventures

Minority investments in non-core ventures, often categorized as Dogs in the BCG Matrix, represent equity stakes in businesses that lack strategic alignment or strong growth potential for Commerce Bank. These could include small, non-strategic equity investments or venture capital activities that are not aligned with current core growth strategies and are not generating significant returns. Such holdings might tie up valuable capital without contributing meaningfully to overall profitability or expanding market share.

These "Dog" investments can become a drain on resources. For instance, if Commerce Bank holds a minority stake in a tech startup outside its primary financial services focus, and that startup is struggling to gain traction, the investment would likely be classified as a Dog. As of early 2024, many financial institutions are re-evaluating their portfolios to divest from underperforming or non-synergistic assets to free up capital for more strategic initiatives.

- Underperforming Assets: Investments with low market share and low growth prospects.

- Capital Tie-up: Funds are locked in ventures that offer minimal return on investment.

- Strategic Misalignment: Ventures do not support Commerce Bank's core business objectives or future growth plans.

- Divestment Consideration: Such holdings are prime candidates for divestiture to reallocate resources effectively.

Commerce Bank's "Dogs" represent products, services, or business units with low market share and low growth potential, consuming resources without significant returns. These can include underperforming legacy technology systems, niche loan products with declining demand, or specific physical branches in economically depressed areas. The bank must carefully assess these segments to determine if revitalization is possible or if divestment is the more strategic option.

For example, while Commerce Bancshares reported $1.3 billion in non-interest expense in 2023, a portion of this could be tied to maintaining inefficient legacy systems. Similarly, a branch in a declining rural area with low digital adoption would likely be a Dog. The bank's prepaid debit card, if impacted by proposed Federal Reserve interchange fee regulations, could also fall into this category if profitability is compromised.

The bank’s strategy involves identifying these underperformers, such as minority investments in non-core ventures that lack strategic alignment. As of early 2024, financial institutions like Commerce Bank are actively re-evaluating portfolios to divest from such assets, freeing up capital for more promising initiatives.

| Category | Description | Example for Commerce Bank | Potential Action |

| Legacy Technology | Outdated systems with high maintenance costs and low contribution to revenue or competitive advantage. | Core banking software predating widespread digital adoption. | Modernize or replace. |

| Niche Loan Products | Offerings with declining market demand, high risk, or requiring disproportionate management resources. | Specific types of commercial loans with reduced market interest. | Phase out or restructure. |

| Underperforming Branches | Physical locations with low customer traffic, high operational costs, and situated in economically stagnant areas. | A branch in a rural town with a shrinking population and low ATM usage. | Close or consolidate. |

| Non-Core Investments | Minority stakes in ventures lacking strategic synergy or growth prospects for the bank. | A small equity holding in a technology startup outside the bank's core financial services. | Divest. |

Question Marks

Commerce Bancshares is actively cultivating its presence in emerging FinTech through strategic investments, notably in the venture capital firm SixThirty. This initiative allows Commerce to gain early exposure to innovative solutions, such as AI-driven treasury management and advancements in real-time payment systems. These FinTech ventures represent high-growth potential markets, but currently hold a relatively low market share for Commerce, necessitating substantial investment to assess their future trajectory towards becoming market Stars.

Commerce Bank's expansion into new commercial office geographies like Dallas, Houston, Cincinnati, Nashville, Des Moines, Indianapolis, and Grand Rapids positions these markets as potential Stars or Question Marks in the BCG Matrix. While these areas represent growth opportunities, some newer offices are still in the early stages of building market share.

These new locations, while promising, may require significant investment to establish a strong foothold, similar to a Question Mark. For instance, while the overall Dallas-Fort Worth market saw significant business growth in 2023, individual Commerce branches are still developing their client base and brand recognition within this competitive landscape.

Commerce Bank is significantly boosting its investment in advanced analytics and AI. This strategic move aims to refine customer interactions and streamline operations, particularly by integrating real-time payment capabilities and building more sophisticated private banking loan products. These areas represent high-growth potential within the financial sector.

The bank's commitment to these technologies positions them to capitalize on emerging trends. For example, by Q3 2024, Commerce Bank reported a 15% increase in digital transaction volume, underscoring the growing demand for seamless payment solutions. The development of complex private banking loans, a segment that saw a 10% year-over-year growth in the industry by mid-2024, further highlights their focus on high-value services.

These initiatives place Commerce Bank's advanced analytics and AI solutions in potentially high-growth, albeit early-stage, market adoption phases for the bank. If these investments yield the anticipated results, these segments could evolve into Stars within the bank's strategic portfolio, driving future revenue and market share.

Niche Digital Lending Platforms

Niche digital lending platforms represent a strategic area of focus, particularly with the development of new private banking loan and deposit systems for complex loan structures. These platforms are entering a rapidly expanding digital lending market.

Currently, Commerce Bank holds a relatively low market share in these niche digital lending segments. This necessitates significant investment to achieve scalability and build substantial traction.

- Market Growth: The global digital lending market was valued at approximately $12.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 20% through 2030, indicating substantial opportunity.

- Investment Needs: Scaling these platforms requires considerable capital for technology development, marketing, and customer acquisition to compete effectively.

- Competitive Landscape: While the market is growing, it's also becoming increasingly competitive, with established fintech players and traditional banks investing in similar digital offerings.

Targeted Offerings for Ultra-High-Net-Worth Individuals (e.g., Commerce Family Office)

Commerce Family Office, a key component of Commerce Bank’s wealth management strategy, is positioned as a Star within the BCG Matrix. This segment focuses on ultra-high-net-worth individuals (UHNWIs), a market characterized by high growth potential and significant demand for specialized financial services. The bank is likely aiming to capture a larger share of this exclusive clientele, necessitating a concentrated effort on bespoke solutions and cultivating deep client relationships.

The UHNWI market is substantial and growing. For instance, the global UHNWI population reached approximately 625,000 individuals in 2023, with their total wealth estimated at over $27 trillion. This demographic’s need for sophisticated wealth preservation, strategic investment, and complex estate planning makes it a prime area for targeted offerings.

- Targeted Services: Offerings include sophisticated investment strategies, tax planning, philanthropic advisory, and legacy planning, all tailored to the unique needs of UHNWIs.

- Market Growth: The UHNWI segment is projected to continue its expansion, with wealth expected to grow at a compound annual growth rate of 4.5% to 5.5% over the next five years.

- Relationship Management: Success hinges on dedicated, high-touch relationship managers who understand and anticipate the intricate financial and personal goals of these clients.

- Competitive Landscape: While a Star, the segment is competitive, requiring Commerce to differentiate through exceptional service, innovative solutions, and a strong reputation.

Commerce Bank's expansion into new commercial office geographies like Dallas, Houston, and Nashville positions these markets as potential Question Marks. While these areas represent growth opportunities, some newer offices are still in the early stages of building market share and brand recognition within competitive landscapes.

These new locations may require significant investment to establish a strong foothold, similar to a Question Mark. For instance, while the overall Dallas-Fort Worth market saw significant business growth in 2023, individual Commerce branches are still developing their client base.

Commerce Bank's investments in advanced analytics and AI, particularly for refining customer interactions and building sophisticated private banking loan products, also fall into the Question Mark category. These areas have high growth potential but are in early stages of market adoption for the bank.

Niche digital lending platforms, such as new private banking loan and deposit systems for complex structures, are another area of focus that can be considered Question Marks. Commerce Bank holds a relatively low market share in these segments, necessitating significant investment to achieve scalability and build traction in a rapidly expanding market.

BCG Matrix Data Sources

Our Commerce Bank BCG Matrix is constructed from comprehensive financial disclosures, internal performance metrics, and detailed market research to provide strategic clarity.