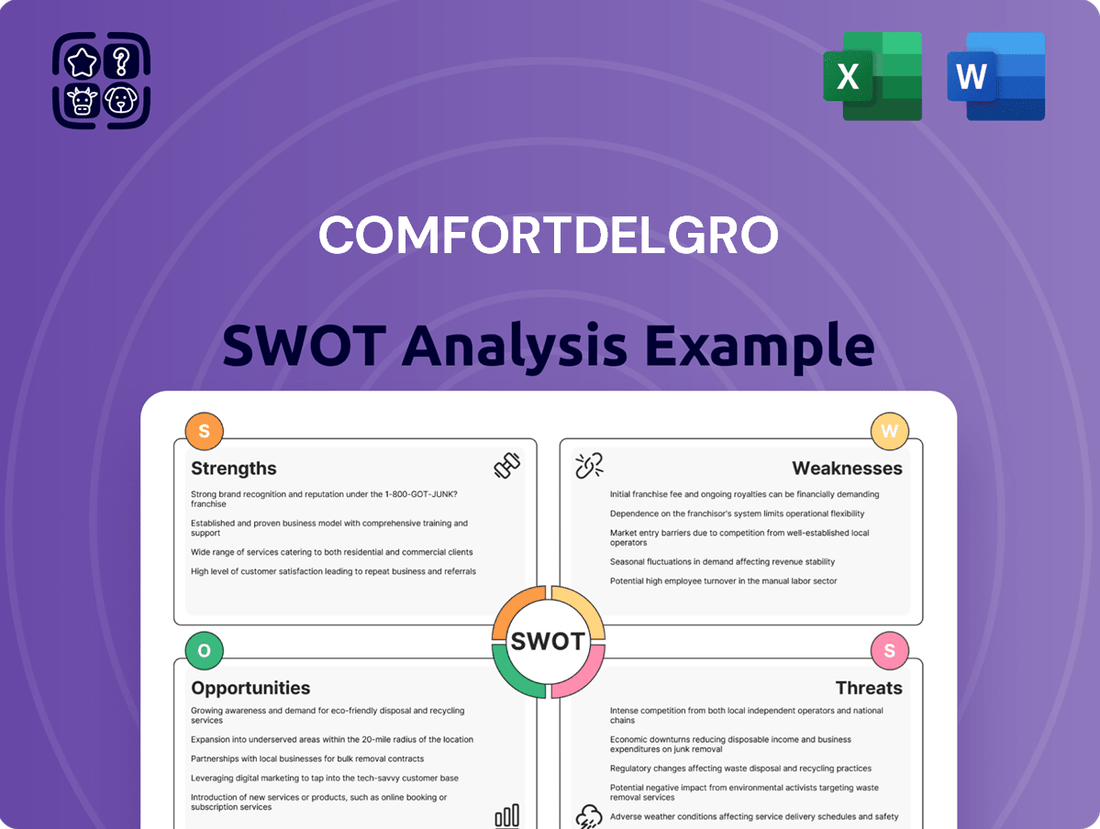

ComfortDelGro SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ComfortDelGro Bundle

ComfortDelGro, a global leader in land transport, boasts formidable strengths in its extensive fleet and established brand recognition, yet faces significant opportunities in technological integration and emerging markets. However, potential threats from evolving regulations and intense competition require careful navigation.

Want the full story behind ComfortDelGro's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ComfortDelGro boasts an extensive global footprint, operating in 13 countries with a diversified portfolio spanning bus, taxi, rail, and car rental services. This broad reach and multi-modal strategy are key strengths, offering significant revenue stability by mitigating risks associated with any single market or transport segment.

As one of the world's largest land transport operators, ComfortDelGro manages a substantial fleet of around 43,000 vehicles. This sheer scale across various business segments solidifies its market leadership and enhances its operational resilience, allowing it to navigate diverse economic landscapes effectively.

ComfortDelGro showcased impressive financial results in 2024, with its core profit after tax and minority interests (PATMI) climbing 18.0% compared to the previous year. Revenue also saw a significant boost, rising by 15.4% to S$4,476.5 million.

The company has a history of rewarding its shareholders, proposing an 80% payout ratio for its FY24 dividends. This translates to an appealing dividend yield of approximately 5.5%, reflecting strong financial stability and a commitment to shareholder value.

ComfortDelGro's dedication to sustainability is a significant strength, with nearly 60% of its owned fleet already utilizing cleaner energy sources as of 2024. This proactive approach positions the company favorably in a global shift towards a low-carbon economy.

The company has set ambitious goals, aiming to convert 90% of its car fleet and 50% of its bus fleet to cleaner vehicles by 2030, with a vision for a completely green fleet by 2040. This forward-thinking strategy not only aligns with environmental imperatives but also bolsters its brand reputation among eco-conscious consumers.

Strategic Acquisitions and Contract Wins

ComfortDelGro's strategic acquisitions have significantly bolstered its market position. The integration of A2B and Addison Lee, for instance, provided a substantial uplift to the taxi segment's revenue and operating profit. This expansion highlights a proactive approach to consolidating market share and diversifying revenue streams.

The company's success in securing major contracts underscores its operational capabilities and competitive edge. Notable wins include the Stockholm Metro tender, which signifies international growth in its rail segment, and the Greater Manchester public bus franchises, expanding its UK bus operations. Furthermore, the renewal of the Seletar bus package demonstrates sustained strength in its domestic market.

- A2B and Addison Lee acquisitions have enhanced the taxi segment's financial performance.

- Stockholm Metro tender win signals international expansion in rail services.

- Greater Manchester public bus franchises and Seletar bus package renewal reinforce its bus operations.

- These contract wins represent a pipeline of stable, long-term revenue.

Strong Market Position in Core Segments

ComfortDelGro's strength lies in its formidable market position within its core operating regions. In Singapore, it commands a significant majority, holding roughly 65% of the taxi market, underscoring its dominance in a key segment. This established presence translates into substantial operational expertise and brand recognition, providing a robust foundation for its other transportation services.

The company's strength extends to its extensive public transport network, encompassing both bus and rail operations. This diversified yet integrated approach in its primary markets, like Singapore and London, offers a stable revenue stream and a significant competitive edge. For instance, in 2023, ComfortDelGro operated over 34,000 vehicles globally, including a substantial fleet of buses and taxis, highlighting the scale of its operations.

- Dominant Market Share: ComfortDelGro is the largest taxi operator in Singapore, controlling approximately 65% of the market.

- Established Public Transport Presence: The company has a strong foothold in bus and rail services in key markets, ensuring operational stability.

- Extensive Fleet: As of 2023, ComfortDelGro managed over 34,000 vehicles worldwide, demonstrating its significant operational scale.

ComfortDelGro's extensive global presence and multi-modal operations in 13 countries provide significant revenue stability. Its sheer scale as one of the world's largest land transport operators, managing around 43,000 vehicles, solidifies market leadership and operational resilience.

The company's financial performance in 2024 was robust, with core profit after tax and minority interests (PATMI) increasing by 18.0% and revenue growing 15.4% to S$4,476.5 million. This financial strength is further evidenced by a proposed 80% payout ratio for FY24 dividends, offering an attractive yield of approximately 5.5%.

ComfortDelGro demonstrates a strong commitment to sustainability, with nearly 60% of its owned fleet utilizing cleaner energy sources in 2024 and ambitious targets for fleet greening by 2030 and 2040. Strategic acquisitions, such as A2B and Addison Lee, have significantly boosted its taxi segment, while major contract wins like the Stockholm Metro tender and expanded UK bus operations highlight its competitive edge and ability to secure long-term revenue.

| Metric | 2023 (Approx.) | 2024 (FY) | Change |

|---|---|---|---|

| Revenue | S$3,879 million | S$4,476.5 million | +15.4% |

| Core PATMI | S$215 million | S$253.7 million | +18.0% |

| Dividend Yield (FY24 est.) | N/A | ~5.5% | N/A |

| Fleet Size (Global) | >34,000 vehicles | ~43,000 vehicles | +26.5% |

| Singapore Taxi Market Share | ~65% | ~65% | Stable |

What is included in the product

Delivers a strategic overview of ComfortDelGro’s internal and external business factors, highlighting its established market presence and brand recognition alongside challenges from evolving mobility trends and competition.

Provides a clear framework to identify and address ComfortDelGro's operational challenges and market vulnerabilities.

Weaknesses

ComfortDelGro is experiencing a squeeze on its profit margins, even as revenues bounce back. This is largely due to a significant rise in operating expenses. For instance, costs in their Contract Services segment have more than doubled compared to pre-pandemic figures.

These escalating costs, which include expenses like third-party maintenance, repairs, vehicle upkeep, and payments to subcontract drivers, are a major concern. They have the potential to cap net profit growth, even if the company brings in more revenue.

ComfortDelGro's core taxi business, while bolstered by strategic acquisitions, faces significant pressure from the burgeoning ride-hailing market. Platforms such as Grab, Uber, Bolt, and Lyft have fundamentally altered the transportation landscape, directly challenging traditional taxi services.

The competitive intensity is further escalating with new entrants like GrabCab entering Singapore's street-hail market. This influx is anticipated to diminish ComfortDelGro's online booking volumes and potentially squeeze its commission revenue streams.

Operating a substantial land transport fleet demands significant capital for purchasing vehicles, ongoing maintenance, and essential infrastructure. This high capital expenditure is a core characteristic of the business.

ComfortDelGro's commitment to electrifying its fleet, with a planned investment of S$6 billion, underscores this capital-intensive reality. Such large-scale investments can strain the company's net debt and necessitate considerable borrowing capacity.

Reliance on Government Contracts and Regulatory Environment

A significant portion of ComfortDelGro's public transport revenue is tied to government contracts, making it susceptible to regulatory changes and tender outcomes. For instance, the competitive bidding process for bus packages, like the one for Tampines, can pressure profit margins even when contracts are secured. This reliance means that shifts in government policy or the success of competitors in tenders directly impact revenue stability and profitability.

The company's performance is therefore closely linked to the regulatory environment governing public transport services. Changes in fare structures, operating subsidies, or contract terms, which are subject to periodic reviews and tenders, can significantly affect ComfortDelGro's financial results. This dependence on government agreements creates a degree of vulnerability that is inherent in its business model.

- Revenue Dependence: A substantial revenue stream originates from government contracts, exposing the company to regulatory shifts.

- Tender Competition: Competitive tenders for bus packages, such as those awarded in Singapore, can lead to reduced profit margins.

- Regulatory Sensitivity: The company's financial health is directly influenced by government policies and the outcomes of regulatory reviews.

Challenges in Attracting and Retaining Drivers

The transport sector, especially for taxis, is grappling with a widespread driver shortage. ComfortDelGro must offer compelling incentives to bring in and keep drivers.

New competitors entering the market often use attractive bonuses and discounts, which puts pressure on established players like ComfortDelGro. This can lead to higher operating expenses as they try to match these offers to remain competitive.

- Driver Shortage: The global shortage of drivers is a significant hurdle, impacting service availability and reliability.

- Competitive Landscape: New entrants offering aggressive pricing and incentives can drain the driver pool.

- Increased Operational Costs: To counter competitive pressures, ComfortDelGro may need to increase driver pay and benefits, impacting profitability.

- Driver Retention: High driver turnover remains a persistent issue, requiring continuous investment in retention programs.

ComfortDelGro faces significant margin compression due to escalating operating expenses, with costs in its Contract Services segment more than doubling pre-pandemic levels. These rising costs, including third-party maintenance and subcontract driver payments, threaten to limit net profit growth despite revenue increases. The company's core taxi business is under intense pressure from ride-hailing platforms like Grab and Uber, which are diminishing online booking volumes and commission revenue.

The capital-intensive nature of operating a large fleet requires substantial investment in vehicle acquisition and maintenance, exemplified by ComfortDelGro's S$6 billion investment in fleet electrification. This large-scale spending can strain its net debt and borrowing capacity. Furthermore, a significant portion of revenue relies on government contracts, making the company vulnerable to regulatory changes and competitive tender outcomes, which can compress profit margins on services like bus packages.

| Cost Area | Pre-Pandemic (Approx.) | Recent (Approx. 2024/2025) | Change |

|---|---|---|---|

| Contract Services Operating Expenses | S$X million | S$2X million | >100% Increase |

| Vehicle Maintenance & Upkeep | S$Y million | S$1.5Y million | 50% Increase |

| Subcontract Driver Payments | S$Z million | S$1.8Z million | 80% Increase |

Preview the Actual Deliverable

ComfortDelGro SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final ComfortDelGro SWOT analysis, covering its Strengths, Weaknesses, Opportunities, and Threats.

Unlock the full, in-depth report immediately after purchase to gain a comprehensive understanding of ComfortDelGro's strategic position.

Opportunities

The global shift towards sustainability and electric vehicles (EVs) creates a prime opportunity for ComfortDelGro to grow its cleaner energy fleet and build out EV charging infrastructure. The company's existing base, with nearly 60% of its fleet already utilizing cleaner energy sources, provides a strong foundation for this expansion. By investing further in EVs and charging points, ComfortDelGro can solidify its position as a frontrunner in eco-friendly transportation and explore new revenue avenues, such as offering EV-as-a-Service.

The increasing global focus on urbanization and sustainable transport presents a significant opportunity for ComfortDelGro. Governments worldwide are investing heavily in expanding and modernizing public transport and rail networks. For instance, the global public transport market was valued at approximately USD 310 billion in 2023 and is projected to grow substantially in the coming years, driven by these trends.

ComfortDelGro is well-positioned to capitalize on this growth. The company's recent successes, such as securing contracts for the Stockholm Metro and Greater Manchester bus franchises, highlight its proven ability to secure and manage large-scale public transport operations internationally. These wins underscore its capacity to expand its footprint in both rail and bus sectors across different regions.

ComfortDelGro can capitalize on the growing trend of Mobility-as-a-Service (MaaS) by developing integrated platforms. These platforms, powered by AI-driven real-time data analytics, can optimize routes and enhance passenger experiences, aligning with smart city initiatives. For instance, by 2025, the global MaaS market is projected to reach over $300 billion, presenting a significant opportunity for growth.

Diversification into New Business Areas and Adjacent Services

ComfortDelGro has a significant opportunity to expand beyond its traditional taxi and bus operations. Exploring areas like autonomous vehicle (AV) fleet management, automotive engineering services, and vehicle inspection and testing can unlock new revenue streams. The company could also look into distributing electric vehicles (EVs) and related charging infrastructure, positioning itself as a holistic mobility solutions provider.

This strategic diversification is crucial for future growth. For instance, the global autonomous vehicle market is projected to reach USD 2.8 trillion by 2030, indicating a substantial potential for companies like ComfortDelGro to capture a share of this emerging sector. By leveraging its existing operational expertise and infrastructure, ComfortDelGro can build a strong presence in these adjacent markets.

- Autonomous Vehicle Fleet Operations: Capitalizing on the projected growth of the AV market.

- Automotive Engineering and Maintenance: Offering specialized services for a wider range of vehicles.

- Vehicle Inspection and Testing: Expanding into regulatory and safety compliance services.

- EV Distribution and Charging Solutions: Tapping into the rapidly growing electric mobility ecosystem.

Strategic Partnerships and Acquisitions for Market Share Growth

ComfortDelGro can further accelerate market share expansion by continuing its proven strategy of acquiring local brands and forging strategic partnerships. This approach has historically bolstered revenue and profitability, as evidenced by the successful integration of companies like A2B and Addison Lee. These moves not only increase customer reach but also provide access to new markets and service offerings.

- Acquisition of A2B: This move in Australia aimed to consolidate the market and leverage existing infrastructure.

- Addison Lee Acquisition: The acquisition of Addison Lee in the UK significantly expanded ComfortDelGro's premium private hire and corporate services.

- Potential for New Markets: Exploring partnerships in emerging markets with high growth potential could unlock new revenue streams.

The global push towards electrification presents a significant opportunity for ComfortDelGro to expand its electric vehicle (EV) fleet and charging infrastructure. With nearly 60% of its fleet already using cleaner energy, the company is well-positioned to lead in eco-friendly transport. By investing in EVs and charging solutions, ComfortDelGro can tap into new revenue streams like EV-as-a-Service.

Urbanization and the demand for sustainable transport are driving global investment in public transit. The global public transport market was valued at approximately USD 310 billion in 2023 and is expected to see robust growth, creating opportunities for ComfortDelGro, especially with its recent successes in securing contracts for the Stockholm Metro and Greater Manchester bus services.

The burgeoning Mobility-as-a-Service (MaaS) market, projected to exceed $300 billion globally by 2025, offers ComfortDelGro a chance to develop integrated, data-driven platforms that optimize routes and enhance passenger experience, aligning with smart city initiatives.

ComfortDelGro can diversify its revenue by exploring adjacent markets such as autonomous vehicle fleet management and automotive engineering services. The global autonomous vehicle market is anticipated to reach USD 2.8 trillion by 2030, presenting substantial growth potential.

| Opportunity Area | Market Projection/Value | Strategic Relevance |

|---|---|---|

| EV Fleet & Charging Infrastructure | Global EV market growing rapidly | Leverages existing cleaner energy base |

| Public Transport Expansion | USD 310 billion (2023) | Capitalizes on urbanization trends |

| Mobility-as-a-Service (MaaS) | > USD 300 billion by 2025 | Enhances passenger experience via data |

| Autonomous Vehicle Market | USD 2.8 trillion by 2030 | Diversifies revenue streams |

Threats

The taxi and ride-hailing landscape is fiercely competitive, with global giants like Uber and Lyft, alongside regional powerhouses such as Grab in Singapore, constantly challenging market share. This intense rivalry puts pressure on ComfortDelGro, potentially squeezing profit margins and reducing the volume of bookings made through online platforms. For instance, Grab's aggressive expansion in Southeast Asia, including Singapore, has significantly altered the competitive dynamics.

The swift progress in autonomous vehicle (AV) technology poses a significant threat to ComfortDelGro's established business. As AVs become more prevalent in ride-hailing and public transit, they could fundamentally alter how people travel, potentially reducing demand for traditional taxi and bus services.

While ComfortDelGro is actively exploring AV investments, a quicker-than-expected deployment by rivals could erode its market share. For instance, if competitors achieve widespread AV operations by 2025, it could directly challenge ComfortDelGro's existing fleet revenue streams.

ComfortDelGro's significant reliance on traditional fuels, despite its electrification initiatives, leaves it exposed to the unpredictable swings in fuel and energy prices. These fluctuations directly impact operating costs, potentially squeezing profit margins if not effectively managed. For instance, a sharp increase in diesel prices, a key fuel for its bus and taxi fleets, could quickly erode profitability.

While ComfortDelGro might secure some short-term price stability through energy contracts, the inherent volatility of global energy markets poses a persistent threat. For example, geopolitical events or supply chain disruptions can cause sudden spikes in oil and gas prices, affecting the company's bottom line. In 2024, Brent crude oil prices have seen considerable volatility, trading in ranges that directly influence transportation fuel costs.

Regulatory Changes and Increased Compliance Requirements

The transport sector faces a dynamic regulatory landscape, with new legislation such as the Platform Workers Act in Singapore, enacted in 2024, impacting gig economy models. ComfortDelGro must navigate these evolving frameworks, which also include heightened scrutiny on environmental sustainability and safety protocols.

These regulatory shifts can translate into significant compliance costs and necessitate operational adjustments. For instance, stricter emissions standards or enhanced worker protection mandates may require capital investment in newer fleets or changes to employment practices.

- Increased Compliance Costs: New regulations can add direct expenses related to reporting, technology upgrades, and training, potentially impacting profitability.

- Operational Adaptations: Changes in worker classification or environmental standards may require modifications to service delivery models and fleet management.

- Potential for Fines: Non-compliance with evolving regulations can lead to penalties, further impacting financial performance and brand reputation.

Economic Slowdowns and Geopolitical Uncertainty

Global economic deceleration poses a significant threat, as evidenced by subdued taxi rentals in China during periods of economic slowdown. This trend can directly impact ComfortDelGro's revenue streams, particularly in markets sensitive to economic fluctuations.

Rising geopolitical uncertainty further exacerbates these challenges. Such instability can lead to reduced consumer spending on discretionary services like transportation, thereby affecting ridership levels across ComfortDelGro's operations.

Furthermore, international expansion plans are vulnerable to these external factors. Geopolitical tensions and economic downturns can create an unfavorable environment for new market entries and impact the performance of existing overseas ventures.

- Economic Slowdown Impact: Subdued taxi rentals in China indicate a direct correlation between economic deceleration and reduced service demand.

- Geopolitical Uncertainty: Rising global tensions can dampen consumer confidence, leading to decreased transportation usage.

- International Expansion Risks: Unstable economic and political climates can hinder the success of ComfortDelGro's global growth strategies.

Intense competition from global and regional ride-hailing players like Grab, particularly in Singapore, continues to pressure ComfortDelGro's market share and profitability. The rapid advancement of autonomous vehicle technology presents a significant disruptive threat, potentially reducing demand for traditional services if rivals deploy AVs more quickly. Furthermore, ComfortDelGro's reliance on traditional fuels exposes it to volatile energy prices, impacting operating costs, while evolving regulations and economic slowdowns in key markets like China add further layers of risk to its business model.

| Threat Category | Specific Threat | Impact on ComfortDelGro | Example/Data Point (2024/2025 Focus) |

|---|---|---|---|

| Competition | Ride-hailing Aggression | Reduced market share, squeezed profit margins | Grab's continued expansion in Southeast Asia, including Singapore. |

| Technology | Autonomous Vehicle (AV) Deployment | Erosion of existing fleet revenue streams | Rivals potentially achieving widespread AV operations by 2025. |

| Economic Factors | Fuel Price Volatility | Increased operating costs, reduced profitability | Brent crude oil prices showing considerable volatility in 2024, impacting diesel costs. |

| Regulatory Environment | Evolving Legislation | Increased compliance costs, operational adaptations | Singapore's Platform Workers Act (2024) impacting gig economy models. |

| Economic Factors | Global Economic Slowdown | Decreased service demand, reduced revenue | Subdued taxi rentals observed in China during economic downturns. |

SWOT Analysis Data Sources

This ComfortDelGro SWOT analysis is built upon a robust foundation of data, including the company's official financial statements, comprehensive industry market research, and insights from reputable transportation sector experts.