ComfortDelGro Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ComfortDelGro Bundle

ComfortDelGro navigates a complex competitive landscape, with intense rivalry among existing players and the constant threat of new entrants impacting its profitability. Understanding the bargaining power of both its buyers and suppliers is crucial for maintaining market share and operational efficiency.

The complete report reveals the real forces shaping ComfortDelGro’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ComfortDelGro's reliance on a select group of global specialized vehicle manufacturers for its extensive fleet, encompassing buses and trains, significantly bolsters these suppliers' bargaining power. This concentration means fewer alternatives are available, giving manufacturers leverage in negotiations.

The substantial capital investment required for acquiring these specialized vehicles, coupled with the long-term commitments inherent in transportation service contracts, creates high switching costs for ComfortDelGro. This financial and operational entrenchment further solidifies the suppliers' influential position.

Fuel and energy providers hold substantial bargaining power over ComfortDelGro due to the company's significant reliance on these inputs. As a major land transport operator, fuel and electricity represent a substantial portion of ComfortDelGro's operational expenditures, making it sensitive to price fluctuations. For instance, the global price of Brent crude oil experienced volatility throughout 2024, impacting fuel costs for the company's extensive fleet.

Technology and software vendors, particularly those providing critical operational systems like fleet management and predictive maintenance, are gaining leverage. ComfortDelGro faces significant switching costs due to the deep integration and customization needed for these platforms, fostering a reliance on specialized providers for operational efficiency.

For instance, the increasing complexity of onboard diagnostics and real-time data analytics platforms means that companies like ComfortDelGro must invest heavily in specific software. This dependence limits their ability to easily change providers, giving these tech suppliers more bargaining power. In 2024, the global market for transportation management software saw continued growth, with specialized solutions becoming even more integral to efficient fleet operations.

Skilled Labour (Drivers, Technicians, Engineers)

The transport sector, including companies like ComfortDelGro, grapples with persistent driver shortages. This scarcity, coupled with the demand for specialized technicians and engineers to maintain modern fleets, significantly amplifies the bargaining power of skilled labor. In 2024, for instance, many logistics and transportation firms reported difficulties filling critical roles, leading to increased wage pressures.

To secure and retain essential personnel, ComfortDelGro is compelled to offer attractive compensation packages and comprehensive benefits. This necessity directly influences operational expenditures and the company's ability to consistently deliver reliable services. Reports from early 2025 indicate a continued upward trend in wages for skilled transport workers across the Asia-Pacific region.

- Driver Shortages: Persistent gaps in driver availability impact service capacity.

- Specialized Talent: Need for qualified technicians and engineers to manage evolving vehicle technology.

- Competitive Compensation: Increased pressure to offer higher wages and better benefits to attract and retain staff.

- Operational Costs: Higher labor costs can affect profitability and pricing strategies.

Infrastructure and Maintenance Service Providers

For large infrastructure projects, such as building new depots or maintaining existing rail lines, ComfortDelGro often partners with specialized construction and engineering companies. These providers possess unique expertise and equipment essential for these complex undertakings.

The specialized nature of infrastructure and maintenance services, coupled with the long-term contracts typically involved, grants these suppliers significant bargaining power. This leverage can translate into influencing pricing and dictating service level agreements, impacting ComfortDelGro's operational costs and flexibility.

- Specialized Expertise: Firms providing rail maintenance or charging station development possess niche skills, limiting the pool of alternative suppliers.

- Long-Term Contracts: The extended duration of these agreements often locks in terms, reducing ComfortDelGro's ability to renegotiate pricing or conditions mid-contract.

- Capital Intensity: The high capital investment required for specialized infrastructure equipment can create barriers to entry for new competitors, further strengthening the position of existing suppliers.

ComfortDelGro's bargaining power with suppliers is influenced by several factors, including the availability of alternatives and the importance of the input to ComfortDelGro's operations. Specialized vehicle manufacturers and technology providers hold significant sway due to high switching costs and the critical nature of their offerings.

Fuel and energy providers also exert considerable power, as these are essential, high-volume inputs for ComfortDelGro's extensive fleet, making the company sensitive to price volatility. For instance, Brent crude oil prices saw fluctuations throughout 2024, directly impacting fuel expenses.

Skilled labor, particularly drivers and maintenance technicians, has increased bargaining power due to persistent shortages in the transport sector, a trend noted in early 2025 reports for the Asia-Pacific region. This scarcity compels ComfortDelGro to offer competitive compensation to secure essential personnel.

| Supplier Type | Key Influences | Impact on ComfortDelGro |

| Specialized Vehicle Manufacturers | Limited alternatives, high switching costs | Leverage in pricing and contract terms |

| Fuel & Energy Providers | Essential input, price sensitivity | Direct impact on operating costs |

| Technology & Software Vendors | Deep integration, high customization costs | Reliance on specific providers for efficiency |

| Skilled Labor (Drivers, Technicians) | Industry-wide shortages, demand for expertise | Upward pressure on wages and benefits |

| Infrastructure Service Providers | Niche expertise, long-term contracts | Potential for influencing pricing and service levels |

What is included in the product

This analysis of ComfortDelGro's competitive landscape reveals the intense pressure from rivals and the growing threat of ride-sharing platforms, while also highlighting the company's established brand and customer loyalty as key strengths.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry rivalry, supplier power, buyer bargaining, new entrant risks, and substitute pressures.

Gain immediate clarity on the strategic landscape, allowing for proactive adjustments to maintain ComfortDelGro's market leadership.

Customers Bargaining Power

Individual commuters using public transport, such as buses and trains operated by ComfortDelGro, generally have low switching costs. This means they can easily opt for alternative transport if dissatisfied or if better prices are available, granting them considerable collective bargaining power. Their sensitivity to price is a key factor influencing demand and, consequently, ComfortDelGro's revenue.

For instance, in 2024, public transport fares are often subject to regulatory oversight, limiting ComfortDelGro's pricing flexibility. However, customer satisfaction remains paramount. High ridership numbers, driven by positive commuter experiences, directly influence government contracts and subsidies, impacting the company's overall profitability and operational stability.

Government bodies and public transport authorities, such as Singapore's Land Transport Authority (LTA), wield substantial bargaining power over ComfortDelGro. These entities are primary customers for ComfortDelGro's extensive bus and rail services, often securing these services through large, multi-year contracts.

The sheer volume of services procured by these authorities, coupled with their capacity to dictate contract terms, issue new operating licenses, and even introduce new competitors, significantly amplifies their leverage. For instance, the introduction of new ride-hailing licenses in Singapore demonstrates the government's ability to reshape the competitive landscape, directly impacting established players like ComfortDelGro.

Corporate and business clients hold significant bargaining power with ComfortDelGro, particularly in areas like car rental, leasing, and private hire services. Their ability to negotiate stems from the potential for bulk purchases and engaging in competitive bidding processes. For instance, in 2024, large corporate fleet contracts represent a substantial portion of revenue for many transportation service providers, allowing these clients to demand better pricing and service level agreements.

These clients often have a wide array of alternative providers to choose from, which amplifies their leverage. When seeking services for extensive fleets or consistent, recurring needs, they can effectively negotiate more favorable terms and pricing structures. This competitive landscape means that ComfortDelGro must continually demonstrate value to retain these important business relationships.

Ride-Hailing Platform Users

Ride-hailing platform users in Singapore exhibit significant bargaining power due to low switching costs and high flexibility. Customers can effortlessly move between various apps like Grab, Gojek, and TADA based on real-time pricing, estimated arrival times, and user reviews. This ease of comparison directly pressures platforms to maintain competitive service offerings and pricing structures.

ComfortDelGro, despite its strong presence in traditional street-hail taxis, faces this intensified customer power in the digital realm. For instance, during peak hours in 2024, ride-hailing surge pricing can push fares significantly higher, prompting users to explore alternative platforms or modes of transport if available. This dynamic environment means customer loyalty is less about brand and more about immediate value proposition.

- High Flexibility: Users can switch between ride-hailing apps instantly.

- Low Switching Costs: No financial penalty or significant effort is required to change providers.

- Price Sensitivity: Customers actively compare prices, especially during surge periods.

- Service Quality Focus: Availability and driver ratings influence user choice.

Vehicle Inspection and Testing Clients

Clients seeking vehicle inspection and testing services generally possess moderate bargaining power. While these services are often mandated by regulations, the availability of multiple certified providers means customers can shop around. For instance, in Singapore, where ComfortDelGro operates, numerous authorized inspection centers exist, creating a competitive landscape.

ComfortDelGro's established brand and the convenience it offers can certainly help in retaining clients. However, the decision to choose a specific service provider often hinges on competitive pricing and the efficiency of the inspection process. Customers are likely to compare costs and turnaround times across different service centers.

- Regulatory Mandates: Vehicle inspections are often legally required, giving providers a baseline demand.

- Provider Competition: The presence of multiple certified inspection centers allows customers to compare prices and service quality.

- Price Sensitivity: Despite regulatory needs, cost remains a significant factor in customer choice.

- Efficiency Matters: Quick and hassle-free inspection processes are highly valued by customers.

The bargaining power of customers for ComfortDelGro is significant, particularly for individual commuters and corporate clients. Individual commuters benefit from low switching costs and a wide array of public and private transport options, making them highly price-sensitive. Corporate clients, by leveraging bulk purchases and competitive bidding, can negotiate favorable terms for services like fleet management and car rentals.

The ride-hailing segment further intensifies customer power due to instant switching between apps based on price and availability, pressuring ComfortDelGro to remain competitive. Even in regulated areas like vehicle inspections, the presence of multiple service providers allows customers to compare prices and efficiency, influencing their choice.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Example Data (2024 Context) |

|---|---|---|---|

| Individual Commuters | High | Low switching costs, price sensitivity, availability of alternatives | Public transport fare reviews often consider commuter affordability, impacting revenue potential. |

| Corporate Clients | High | Bulk purchasing, competitive bidding, negotiation of service level agreements | Large corporate fleet contracts can represent a substantial portion of revenue, enabling strong negotiation leverage. |

| Ride-Hailing Users | High | Instant app switching, price comparison, service quality (ratings) | Surge pricing during peak hours can lead users to seek cheaper alternatives if available. |

| Vehicle Inspection Clients | Moderate | Availability of multiple certified providers, price comparison, efficiency | Multiple authorized inspection centers in Singapore offer choice, driving competition on price and turnaround time. |

What You See Is What You Get

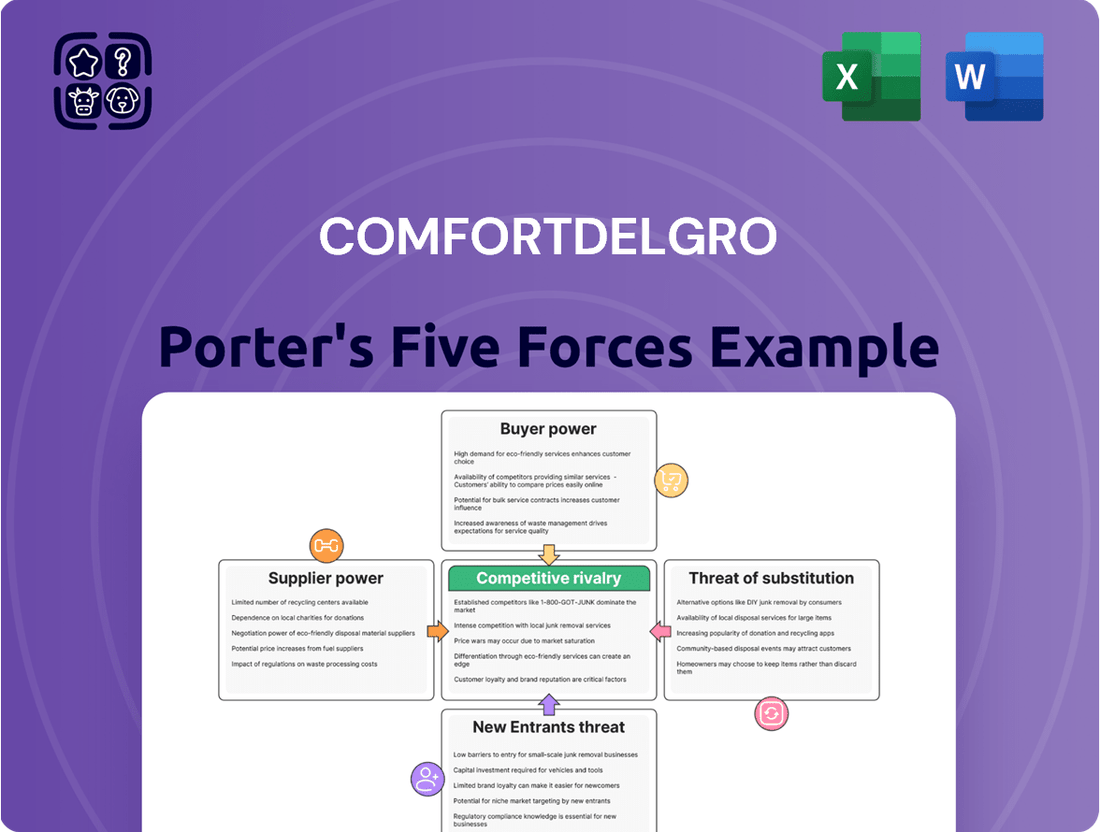

ComfortDelGro Porter's Five Forces Analysis

This preview shows the exact ComfortDelGro Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders, and no missing sections. You're looking at the actual, comprehensive document that details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The taxi and private hire sector, particularly in Singapore, is characterized by fierce rivalry. ComfortDelGro, a long-standing leader in street-hail taxis, is experiencing significant pressure from emerging ride-hailing platforms. This dynamic has intensified as new operators, including GrabCab and other Land Transport Authority (LTA)-licensed entities, continue to enter the market in 2025.

This heightened competition directly impacts ComfortDelGro by creating downward pressure on commission rates and fares. As more players vie for market share, the ability to dictate pricing becomes more challenging, potentially affecting profitability and the company's traditional revenue streams.

Competition in public bus and rail contracts is a significant factor for ComfortDelGro. While these contracts are typically long-term, the real battleground emerges during tender renewals and when new routes or services are up for grabs. Operators like ComfortDelGro constantly engage in bidding processes to secure these government-backed opportunities, highlighting a dynamic and competitive environment where securing and retaining these lucrative franchises is key.

ComfortDelGro's strategic global expansion, including significant acquisitions such as A2B Australia and Addison Lee, directly addresses and diversifies its exposure to regional competitive rivalries. This approach allows the company to mitigate intense local competition by leveraging scale and operational efficiencies across a broader geographic base.

The company's international presence means it contends with a varied landscape of competitors, ranging from large, established players in mature markets to smaller, agile disruptors in emerging ones. For instance, in the UK, Addison Lee competes with numerous taxi and private hire firms, while in Australia, A2B faces competition from various transport operators.

This global diversification is crucial as it dilutes the impact of any single market's competitive intensity. By operating in multiple regions, ComfortDelGro can reallocate resources and adapt strategies based on the unique competitive dynamics present in each territory, thereby strengthening its overall market position.

Innovation and Technology Adoption

Competitive rivalry within the transport sector is increasingly shaped by rapid technological advancements. Companies are investing heavily in areas like AI for optimizing service control and predictive maintenance, aiming to reduce downtime and enhance operational efficiency. For instance, ComfortDelGro has been exploring and implementing various digital solutions to streamline its operations and improve customer engagement.

The adoption of new technologies directly impacts a company's ability to compete. Those that successfully integrate innovations such as enhanced dispatch systems or advanced fleet management software can offer superior service reliability and customer experiences. This technological edge allows them to differentiate themselves in a crowded market.

- AI in Operations: ComfortDelGro has been actively involved in pilot programs and digital transformation initiatives, aiming to leverage AI for better route planning and customer service.

- Predictive Maintenance: Investments in technology for vehicle upkeep are crucial for minimizing service disruptions and controlling maintenance costs, a key factor in operational competitiveness.

- Autonomous Vehicle Exploration: While still in early stages for widespread commercial use, the potential of autonomous vehicles represents a significant future competitive differentiator that many players are monitoring and investing in research for.

Price and Service Quality as Differentiators

In mature transportation markets, ComfortDelGro faces intense competition where price and service quality are paramount. Balancing fare adjustments, such as potential increases in ride-hailing commissions or public transport fares, against the imperative to maintain high service standards is a constant challenge. For instance, while ride-hailing platforms might adjust commission rates, ComfortDelGro's ability to retain drivers and attract passengers hinges on the perceived value and reliability of its services.

ComfortDelGro's competitive strategy in 2024 and beyond will heavily rely on its ability to differentiate through service excellence. This includes factors like fleet modernization, driver training, and efficient dispatch systems. In Singapore, for example, public transport fares are regulated, but the quality of the passenger experience, including cleanliness and punctuality, remains a key competitive edge against private hire options.

- Price Sensitivity: Customers across all segments are highly sensitive to pricing, especially in urban areas with multiple transport options.

- Service Quality Metrics: ComfortDelGro must continuously monitor and improve key service indicators such as vehicle cleanliness, driver professionalism, and on-time performance.

- Fare Structures: The company needs to strategically manage fare structures for its various services, including taxis, private hire, and public transport, to remain competitive without eroding profitability.

- Customer Loyalty: Maintaining a strong reputation for reliability and safety is crucial for fostering customer loyalty in a crowded market.

ComfortDelGro faces intense competition across its various business segments, particularly in its core taxi and private hire operations. The rise of ride-hailing platforms has significantly intensified rivalry, forcing traditional operators to adapt. In 2024, the Singapore taxi market saw continued competition from platforms like Grab, with ComfortDelGro maintaining a substantial fleet but facing pressure on pricing and driver retention.

The public transport sector also presents competitive challenges, especially during tender periods for bus and rail contracts. While these are often long-term, the bidding process itself is highly competitive, with multiple operators vying for lucrative government concessions. ComfortDelGro's strategic international acquisitions, such as its Australian and UK operations, aim to diversify revenue and mitigate the impact of intense local competition by leveraging scale.

Technological advancements are a key battleground, with companies investing in AI and advanced fleet management to improve efficiency and customer experience. ComfortDelGro's commitment to digital transformation, including pilot programs for AI in operations, highlights the necessity of innovation to stay competitive. For instance, the company's investment in predictive maintenance aims to reduce vehicle downtime, a critical factor in service reliability and cost management.

In mature markets, price sensitivity remains high, and ComfortDelGro must balance fare competitiveness with service quality. Maintaining customer loyalty through factors like fleet modernization and driver training is crucial. The company's ability to manage fare structures strategically across its diverse service offerings is paramount to its sustained competitiveness.

| Segment | Key Competitors (2024) | Competitive Pressure | ComfortDelGro's Strategy |

|---|---|---|---|

| Taxis/Private Hire (Singapore) | Grab, GoJek, other LTA-licensed operators | High (Pricing, driver acquisition) | Fleet modernization, digital services, loyalty programs |

| Public Bus/Rail Contracts | SMRT, SBS Transit (for rail), various bus operators | Moderate to High (Tender bids) | Operational efficiency, service quality, bid competitiveness |

| International Operations (e.g., UK, Australia) | Addison Lee competitors, A2B Australia competitors | Varies by market (Established players, local disruptors) | Leveraging scale, operational synergies, market-specific strategies |

SSubstitutes Threaten

The most significant substitute for ComfortDelGro's transport services is personal vehicle ownership, providing unparalleled convenience and flexibility for individuals. However, Singapore's government actively discourages this through substantial ownership costs, including Certificate of Entitlement (COE) premiums, which reached an average of S$117,971 for Category A cars in the first bidding exercise of 2024.

While ComfortDelGro does offer car rental and leasing options, a broader societal trend towards increased reliance on personal cars directly challenges the demand for its core public bus and taxi services. This shift can impact ridership numbers and, consequently, revenue streams for these essential transport segments.

For shorter journeys, especially within cities, walking and cycling are strong substitutes for traditional transport. Singapore's commitment to enhancing its cycling and pedestrian networks, with over 700 km of cycling paths planned by 2025, directly supports these alternatives, potentially impacting demand for short-distance public transport and ride-hailing services.

Customers can switch to alternative public transport providers, such as other bus operators or the Mass Rapid Transit (MRT) system, if these options offer greater convenience or cost savings. For instance, in Singapore, commuters might choose between ComfortDelGro buses and the MRT for their daily commute, depending on route accessibility and travel time. This availability of choice puts pressure on ComfortDelGro to maintain competitive pricing and service quality.

Emerging Mobility Solutions

Emerging mobility solutions, such as e-scooters and shared micro-mobility services, present a growing threat to ComfortDelGro's traditional taxi and bus operations. These alternatives often provide a more flexible and cost-effective option for short-distance urban travel.

The increasing adoption of these new modes could divert a segment of commuters, particularly younger demographics seeking convenience and affordability. For instance, the e-scooter market has seen significant growth, with cities worldwide implementing and regulating these services. In 2024, several major urban centers reported millions of shared e-scooter trips annually, indicating a substantial shift in short-trip preferences.

- E-scooter adoption: Cities like Paris reported over 15 million e-scooter trips in 2023, a trend expected to continue in 2024.

- Micro-mobility growth: The global micro-mobility market was valued at over $100 billion in 2023 and is projected to grow substantially by 2025.

- Autonomous vehicle potential: While still in development, future autonomous vehicle services could offer an entirely new substitute for private and public transport.

- Changing commuter behavior: A significant portion of urban commuters are actively seeking multi-modal transport options, integrating services like ride-sharing and micro-mobility.

Remote Work and Virtual Connectivity

The rise of remote work and virtual connectivity presents a significant threat of substitutes for traditional transportation services like those offered by ComfortDelGro. As more companies embrace flexible work policies, the need for daily commutes diminishes, directly impacting demand for public transport and ride-sharing options. This trend was notably accelerated during the COVID-19 pandemic, with many businesses permanently adopting hybrid or fully remote models.

Consider the impact on business travel and daily commutes. For instance, a 2024 survey indicated that over 60% of companies were offering some form of remote or hybrid work. This societal shift means fewer people are relying on buses, trains, or taxis for their daily journeys. The convenience and cost savings associated with working from home or attending virtual meetings serve as powerful substitutes for physical travel.

- Reduced Commuting Needs: Widespread adoption of remote work means fewer daily trips to offices, directly substituting for public transport and ride-hailing services.

- Virtual Meetings: Increased reliance on video conferencing platforms like Zoom and Microsoft Teams replaces the need for business travel and associated transportation.

- Cost Savings: Employees and businesses save on travel expenses, making remote work a more attractive and cost-effective alternative.

- Societal Shift: Post-pandemic, a sustained preference for flexible work arrangements continues to suppress demand for traditional commuting.

The threat of substitutes for ComfortDelGro is significant, encompassing personal vehicles, alternative public transport, micro-mobility, and even the reduction in travel demand due to remote work. Personal car ownership, despite high Certificate of Entitlement (COE) costs in Singapore, averaging S$117,971 for Category A cars in early 2024, remains a primary substitute offering unmatched convenience. Walking and cycling are also viable for shorter trips, supported by Singapore's expansion of cycling paths to over 700 km by 2025.

Other public transport options, like the MRT, compete directly with ComfortDelGro's bus and taxi services, forcing the company to remain competitive in pricing and service. Emerging micro-mobility solutions, such as e-scooters, are gaining traction for short urban travel, with cities reporting millions of trips annually in 2023 and 2024, indicating a shift in commuter preferences.

Furthermore, the widespread adoption of remote and hybrid work models, with over 60% of companies offering such flexibility in 2024, fundamentally reduces the need for daily commutes. This trend, amplified by virtual meetings, directly substitutes for traditional transportation demand.

| Substitute Type | Example | Impact on ComfortDelGro | Key Data Point (2024) | Trend |

| Personal Vehicle Ownership | Private Cars | Reduces demand for taxis and buses | Avg. COE for Cat A: S$117,971 (Early 2024) | High ownership cost discourages but convenience remains key |

| Alternative Public Transport | MRT | Direct competition for commuters | N/A (System-wide) | Convenience and cost-effectiveness drive modal choice |

| Micro-mobility | E-scooters | Threatens short-distance taxi/bus trips | Millions of trips annually in major cities | Growing adoption, especially among younger demographics |

| Remote Work | Work From Home | Reduces overall travel demand | >60% of companies offer remote/hybrid work | Sustained preference for flexible work suppresses commuting |

Entrants Threaten

The land transport sector, particularly bus and rail operations, demands immense upfront capital. This includes purchasing fleets of vehicles, establishing and maintaining depots, and potentially investing in specialized infrastructure. For instance, acquiring a single modern bus can cost upwards of S$500,000, and a new train can run into the tens of millions of dollars, making it a significant hurdle for potential new entrants aiming to compete with established players like ComfortDelGro.

The land transport sector, especially public transit and taxi operations, faces a formidable barrier to entry due to stringent regulatory frameworks and licensing requirements. Companies must navigate a complex web of permits and adhere to rigorous safety and operational standards, a process that can be both time-consuming and costly.

In 2024, for instance, obtaining a Public Service Vehicle (PSV) license in many jurisdictions still involves extensive background checks, vehicle inspections, and driver training certifications, significantly increasing the initial investment and operational complexity for newcomers looking to compete with established players like ComfortDelGro.

ComfortDelGro's established brand reputation and extensive operational networks significantly deter new entrants. In 2023, the company continued to leverage its decades-long presence in Singapore and Australia, where brand loyalty plays a crucial role in customer choice.

For its taxi and ride-hailing services, powerful network effects are in play; a larger fleet of drivers naturally attracts more passengers, and vice versa. This creates a virtuous cycle that new competitors struggle to break into, requiring substantial investment and time to build comparable scale and reliability.

Government-Controlled Contracts

ComfortDelGro's significant reliance on government-issued public transport contracts presents a substantial barrier to new entrants. These contracts, often awarded through competitive tenders, are typically long-term and require considerable capital investment and operational expertise to secure. For instance, in Singapore, ComfortDelGro operates under various land transport authority contracts, such as those for bus services, which are periodically renewed or re-tendered.

The nature of these government tenders inherently favors established players with proven track records and existing infrastructure. New companies face a steep challenge in acquiring the necessary licenses, capital, and operational experience to even bid effectively. This limited window of opportunity for new entrants to break into the market is further amplified by the scale and complexity of the contracts, making it difficult for smaller or less experienced firms to compete.

- Government Contracts as Entry Barriers: ComfortDelGro's operational model heavily relies on securing long-term contracts from government bodies for public transport services, particularly in its core markets like Singapore.

- Competitive Tendering Process: These contracts are typically awarded through competitive bidding processes, which are infrequent and require significant upfront investment and proven operational capabilities.

- Limited Opportunities for New Entrants: The infrequent nature of these tenders and the high bar for entry make it exceptionally difficult for new companies to gain a foothold in the market, thus limiting the threat of new entrants.

- Incumbent Advantage: Established players like ComfortDelGro benefit from existing infrastructure, operational expertise, and established relationships with government authorities, further solidifying their position against potential new competitors.

Access to Skilled Workforce and Technology

New entrants into the transportation sector, like those looking to compete with ComfortDelGro, face significant hurdles in securing a skilled workforce. For instance, in 2024, many regions continued to report shortages of qualified bus and taxi drivers, a trend exacerbated by an aging workforce and competition from gig economy platforms. This makes it difficult for new companies to recruit the necessary personnel to operate their fleets effectively.

Beyond driver recruitment, acquiring and implementing advanced technology presents another substantial barrier. Companies need sophisticated fleet management systems, real-time tracking, and integrated customer service platforms. The investment required for such technology, coupled with the time needed for development and staff training, can easily run into millions of dollars, creating a high entry cost that deters potential new competitors.

- Skilled Driver Shortages: In 2024, the global transportation industry continued to grapple with a deficit of experienced drivers, impacting operational capacity.

- Technological Investment: New entrants must allocate substantial capital towards advanced fleet management and customer-facing technologies.

- Training and Development Costs: Significant expenses are associated with training new staff on both driving protocols and new technological systems.

The threat of new entrants for ComfortDelGro is significantly low due to substantial capital requirements for fleet acquisition and infrastructure, coupled with rigorous licensing and regulatory hurdles. For example, in 2024, the cost of a new bus can exceed S$500,000, and obtaining necessary public service vehicle licenses involves extensive checks and certifications.

ComfortDelGro's established brand reputation, extensive networks, and powerful network effects in its taxi and ride-hailing services create a strong barrier. Furthermore, its reliance on long-term government contracts, awarded through infrequent and competitive tenders, favors incumbents with proven track records and existing infrastructure, making it exceptionally difficult for new companies to gain a foothold.

The sector also faces skilled labor shortages, particularly for drivers, as seen in 2024 trends, and requires significant investment in advanced technology like fleet management systems. These combined factors—high capital needs, regulatory complexity, established brand loyalty, contract dependencies, workforce challenges, and technological investment—collectively minimize the threat of new entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ComfortDelGro is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and regulatory filings. We supplement this with insights from reputable industry publications and market research reports that track the transportation and mobility sectors.