ComfortDelGro Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ComfortDelGro Bundle

Unlock the strategic potential of ComfortDelGro's business units with our comprehensive BCG Matrix analysis. Understand which segments are driving growth and which require careful management. Get the full report to gain actionable insights and make informed investment decisions for a competitive edge.

Stars

ComfortDelGro's international bus franchising is a key driver of its growth, particularly in the UK and Australia. The company secured a significant franchise in Greater Manchester, UK, demonstrating its ability to win competitive tenders in established public transport markets.

In Australia, ComfortDelGro expanded its Victoria Bus portfolio by a notable 30% in 2024. This expansion highlights the company's success in capturing market share within the growing Australian public transport sector, often in areas undergoing privatization.

ComfortDelGro's joint venture secured an 11-year contract to manage the Stockholm Metro, starting in late 2025. This venture represents their most substantial rail operation beyond Singapore, signaling a strategic expansion into the promising Scandinavian public transport market.

ComfortDelGro's involvement with the Jurong Region Line (JRL) in Singapore, through its subsidiary SBS Transit in partnership with RATP Dev, positions this venture as a potential Star in its BCG Matrix. Passenger services are slated to begin in 2027, marking a significant expansion into Singapore's growing domestic rail market.

The JRL project represents a substantial investment and commitment to public transport infrastructure. This new MRT line is expected to serve approximately 400,000 commuters daily once fully operational, underscoring its high growth potential and market share capture within Singapore's public transportation network.

Acquisitions: CMAC Group, A2B Australia, Addison Lee

ComfortDelGro's strategic acquisitions in 2024, including CMAC Group, A2B Australia, and Addison Lee, significantly bolstered its international presence. These moves have demonstrably increased overseas revenue and operating profit, signaling a robust expansion strategy and a drive for market leadership in key global transport sectors.

The integration of CMAC Group, a UK ground transport specialist, A2B Australia, the largest taxi network in its namesake country, and London's prominent Addison Lee, has reshaped ComfortDelGro's global footprint. This aggressive expansion is reflected in the company's financial performance, with overseas operations now contributing a larger share to overall profitability.

- CMAC Group Acquisition: Enhanced ComfortDelGro's capabilities in managing complex ground transportation logistics in the UK.

- A2B Australia Acquisition: Positioned ComfortDelGro as a dominant player in the Australian taxi and ride-sharing market.

- Addison Lee Acquisition: Strengthened ComfortDelGro's premium transport offering in the competitive London market.

- Financial Impact: These acquisitions have directly contributed to a notable increase in ComfortDelGro's overseas revenue and operating profit for the 2024 fiscal year.

Transition to Cleaner Energy Vehicles

ComfortDelGro is making significant strides in its fleet modernization, aiming for a greener future. By 2030, the company plans to have 90% of its car fleet and 50% of its bus fleet running on cleaner energy sources. This strategic move is in direct response to the escalating global demand for sustainable transportation solutions.

This transition positions ComfortDelGro as a frontrunner in the environmentally conscious transport sector, a market segment experiencing robust growth. The company's commitment reflects a broader industry shift, aligning with sustainability goals and potentially attracting a growing base of eco-aware consumers.

- Fleet Transition Target: 90% of car fleet and 50% of bus fleet to be cleaner vehicles by 2030.

- Market Alignment: Addresses the growing global megatrend of sustainability in transportation.

- Competitive Positioning: Establishes ComfortDelGro as a leader in the environmentally conscious transport segment.

Stars in ComfortDelGro's BCG Matrix represent high-growth, high-market-share ventures. The company's aggressive international expansion, particularly through strategic acquisitions in 2024 like CMAC Group, A2B Australia, and Addison Lee, has significantly boosted its global presence and revenue in these high-growth markets. These acquisitions have solidified its market position in key regions, driving substantial overseas profit contributions.

| Venture | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| International Bus Franchising (UK/Australia) | High | High | Star |

| CMAC Group (Acquisition 2024) | High | High | Star |

| A2B Australia (Acquisition 2024) | High | High | Star |

| Addison Lee (Acquisition 2024) | High | High | Star |

What is included in the product

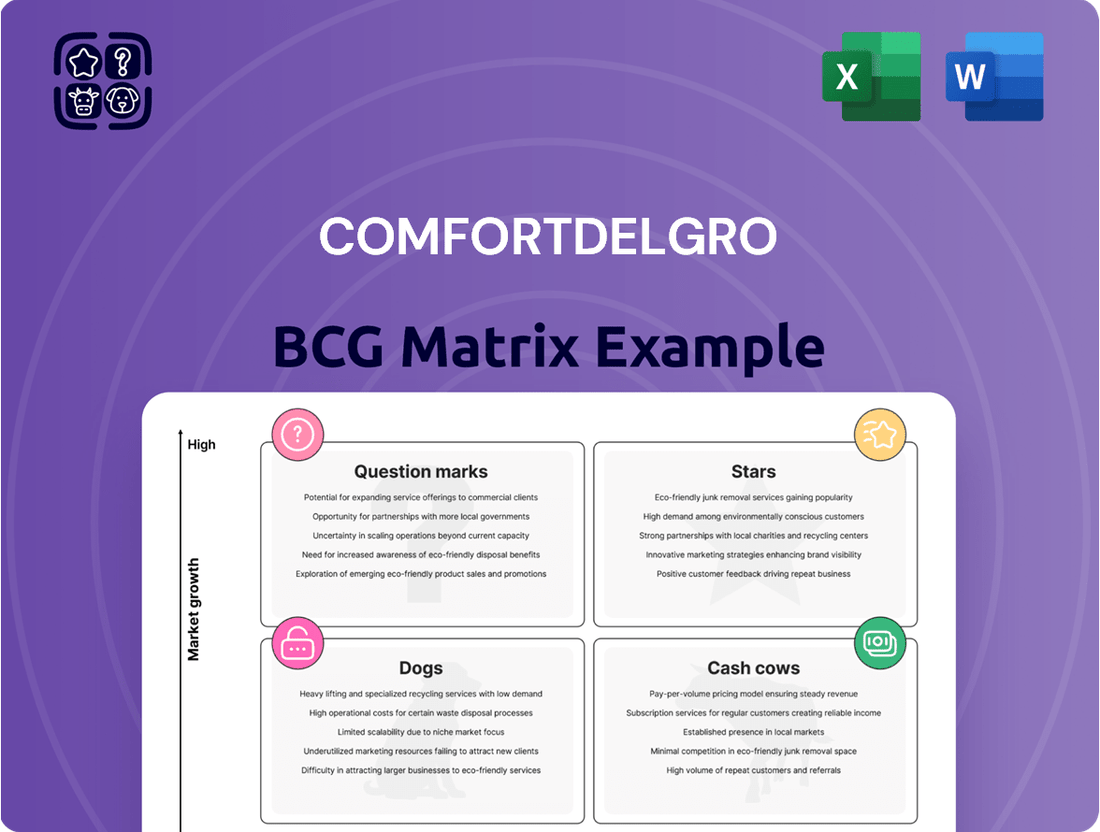

This BCG Matrix overview of ComfortDelGro analyzes its business units as Stars, Cash Cows, Question Marks, and Dogs.

It highlights which units to invest in, hold, or divest for optimal resource allocation.

A clear BCG matrix visualizes ComfortDelGro's portfolio, easing the pain of strategic decision-making by highlighting growth opportunities and areas needing divestment.

Cash Cows

SBS Transit, a key player in Singapore's public transport, operates as a subsidiary of ComfortDelGro. The company recently secured the Seletar bus package for another five years, highlighting its established position.

This mature market offers stable, predictable revenue streams, characteristic of a cash cow. The long-term contracts and essential service nature mean SBS Transit enjoys a high market share with minimal need for aggressive marketing, ensuring consistent cash flow generation.

ComfortDelGro's Singapore rail operations, specifically the North-East MRT Line and Downtown Line managed by SBS Transit, are firmly positioned as Cash Cows. These established public transport networks are vital to Singapore's daily commute, generating consistent and substantial revenue.

The robust performance is supported by rising domestic rail ridership, which saw significant increases in 2024. Coupled with fare adjustments implemented in December 2024, these factors ensure stable and high revenue generation within a mature market, making these lines dependable sources of cash flow for ComfortDelGro.

ComfortDelGro's automotive engineering services and vehicle inspection and testing, represented by VICOM, function as a classic Cash Cow. These operations cater to a stable, mature market driven by ongoing regulatory mandates and the consistent need for vehicle upkeep, ensuring a predictable revenue stream.

VICOM, a key player in Singapore's vehicle inspection sector, reported a net profit of S$59.2 million for the fiscal year 2023, a 6.9% increase from the previous year, underscoring its robust and consistent performance. This steady profitability is a hallmark of a Cash Cow, generating significant cash flow that can be reinvested in other business segments or distributed to shareholders.

Established Taxi Operations (Singapore)

ComfortDelGro’s established taxi operations in Singapore function as a prime cash cow. Despite the rise of ride-sharing platforms, the company maintained its dominant position in 2024, operating a fleet of approximately 10,000 taxis. This extensive network ensures a steady stream of rental and commission revenue, underpinning the company’s financial stability in a mature market.

These operations consistently generate substantial cash flow due to their established brand recognition and the sheer volume of daily rides. In 2024, the taxi segment continued to be a bedrock of ComfortDelGro’s earnings, contributing significantly to its overall profitability. The company’s ability to leverage its scale and brand loyalty in this segment allows it to weather market shifts effectively.

- Dominant Market Share: ComfortDelGro held a commanding presence in Singapore’s taxi market throughout 2024.

- Consistent Revenue: The large fleet generates reliable rental and commission income, a hallmark of a cash cow.

- Brand Strength: Established brand recognition in a mature market supports sustained customer demand.

- Adaptability: The company continues to adapt its taxi services to evolving market dynamics, ensuring long-term viability.

Car Rental and Leasing Services (ComfortDelGro Rent-A-Car)

ComfortDelGro Rent-A-Car operates as a significant Cash Cow within the ComfortDelGro portfolio, dominating Singapore's car rental and leasing landscape. This segment benefits from a mature market, ensuring a steady stream of revenue through both short-term rentals and long-term leasing agreements. Their established infrastructure and robust brand recognition are key drivers of this consistent cash generation.

The car rental and leasing market in Singapore, while mature, continues to be a reliable revenue generator. In 2023, the industry saw steady demand, with companies like ComfortDelGro Rent-A-Car leveraging their extensive fleet and service network to maintain market share. The segment's strength lies in its ability to generate predictable cash flows, a hallmark of a Cash Cow.

- Market Leadership: ComfortDelGro Rent-A-Car holds a commanding position in Singapore's car rental and leasing sector.

- Stable Revenue: The mature nature of the market ensures consistent and predictable cash flow generation.

- Brand Strength: A strong brand reputation allows them to attract and retain customers, further solidifying their cash cow status.

- Infrastructure Advantage: Existing operational infrastructure supports efficient service delivery and cost management, contributing to profitability.

ComfortDelGro's automotive engineering services, including vehicle inspection and testing through VICOM, are strong Cash Cows. These operations serve a stable, mature market driven by consistent regulatory requirements and the ongoing need for vehicle maintenance. This ensures a predictable and reliable revenue stream for the company.

VICOM's performance in 2023, with a net profit of S$59.2 million, a 6.9% increase year-on-year, highlights its consistent profitability. This financial strength is a key indicator of a Cash Cow, providing substantial cash flow that can be strategically allocated across ComfortDelGro's business units.

The company’s taxi segment in Singapore also operates as a prime Cash Cow. Despite the competitive landscape, ComfortDelGro maintained its leading market position in 2024, operating around 10,000 taxis. This extensive fleet generates consistent revenue from rentals and commissions, reinforcing its financial stability.

These taxi operations are a bedrock of ComfortDelGro's earnings, consistently producing significant cash flow due to strong brand recognition and high daily ridership. In 2024, the segment's contribution to overall profitability remained substantial, demonstrating its resilience and ability to leverage scale and brand loyalty effectively.

| Business Segment | BCG Matrix Category | Key Performance Indicators (2023/2024 Data) | Rationale for Classification |

| Automotive Engineering Services (VICOM) | Cash Cow | Net Profit: S$59.2 million (2023, +6.9% YoY) | Mature market, regulatory mandates, consistent demand for vehicle upkeep, stable revenue generation. |

| Taxi Operations (Singapore) | Cash Cow | Fleet Size: ~10,000 taxis (2024) | Dominant market share, consistent rental/commission revenue, strong brand loyalty in a mature market. |

What You’re Viewing Is Included

ComfortDelGro BCG Matrix

The preview you are currently viewing is the exact, fully formatted ComfortDelGro BCG Matrix report you will receive immediately after purchase. This comprehensive document is ready for immediate use, offering strategic insights without any watermarks or demo content, ensuring a professional and actionable analysis.

Dogs

The traditional taxi business, especially in regions heavily impacted by ride-hailing, is experiencing significant headwinds. This intense competition often translates to fewer completed bookings and reduced commission revenue, painting a picture of a low-growth market. For instance, in Singapore, while ComfortDelGro's overall revenue saw a slight increase in 2023, the taxi segment faced challenges, with taxi revenue contributing a smaller portion compared to other segments like private hire and bus services, reflecting this competitive pressure.

While ComfortDelGro's bus segment shows overall growth, certain legacy contracts, especially those up for renewal with potentially less favorable terms or in less dynamic markets, could see their profit margins squeezed. These contracts, if not actively managed, may represent areas of low growth alongside reduced profitability.

ComfortDelGro's portfolio likely includes smaller, non-core ventures or older technologies that don't fit its strategic focus on global expansion and cleaner energy. These might be legacy operations with limited market share and low growth potential, consuming valuable resources without generating substantial returns. For instance, if ComfortDelGro still operates a small fleet of older, less fuel-efficient buses in a niche market, it would fall into this category.

Underperforming International Taxi Markets (e.g., China)

China's taxi market, for companies like ComfortDelGro, is currently facing headwinds. Taxi rentals there are expected to stay low due to the ongoing economic slowdown. This points to a market with limited growth prospects, which can make it tough to earn significant profits, especially if these economic conditions continue.

This situation places China's taxi operations within the Dogs quadrant of the BCG Matrix. It's characterized by low market growth and, potentially, a low market share for ComfortDelGro if current trends persist. Generating substantial returns from this segment is a significant challenge.

- Subdued Demand: Economic slowdown in China is directly impacting taxi rental demand.

- Low Growth Environment: The market is not expanding, limiting opportunities for increased revenue.

- Profitability Concerns: Persistent low demand and growth can lead to reduced profitability for operations in this region.

- Strategic Re-evaluation: Companies may need to consider restructuring or divesting from such markets if improvements are not anticipated.

Segments heavily reliant on outdated technology

Segments heavily reliant on outdated technology within ComfortDelGro's operations would be classified as Dogs in the BCG Matrix. These are business units that have not fully embraced digital transformation, continuing to depend on legacy systems. This reliance on inefficient technology likely leads to a low market share, as they struggle to compete effectively in a rapidly digitizing transport sector. Furthermore, their growth potential is severely limited in an environment where technological advancement is paramount for customer acquisition and operational efficiency.

For instance, consider traditional taxi dispatch systems that haven't integrated with modern ride-hailing apps. ComfortDelGro's taxi segment, while a significant player, faces increasing competition from digital-first platforms. In 2024, the global ride-sharing market is projected to reach hundreds of billions of dollars, showcasing the growth in digitally enabled transportation. Those segments within ComfortDelGro that lag in adopting such technologies would find it challenging to capture this growth, thus fitting the 'Dog' profile.

- Outdated Technology: Reliance on manual or legacy booking and dispatch systems.

- Low Market Share: Inability to compete with digitally integrated transport services.

- Low Growth Potential: Limited ability to attract customers in a digitized marketplace.

- Inefficiency: Higher operational costs due to non-optimized processes.

ComfortDelGro's taxi operations in markets with strong ride-hailing penetration, like parts of China, can be categorized as Dogs. These segments operate in low-growth environments due to intense competition, leading to subdued demand and profitability concerns. The company's reliance on legacy systems or less efficient technologies in certain areas also contributes to their classification as Dogs, as they struggle to compete in a rapidly digitizing transport sector.

In 2024, the global ride-sharing market is projected to surpass $200 billion, highlighting the shift towards digitally enabled transportation. ComfortDelGro's segments that haven't fully integrated with these digital platforms, such as traditional taxi dispatch systems, face challenges in capturing this growth and are likely to remain in the Dog quadrant. This necessitates strategic re-evaluation, potentially involving restructuring or divestment from these underperforming units.

| Segment Example | Market Growth | Market Share | Profitability | BCG Quadrant |

| Traditional Taxi (High Ride-Hailing Penetration) | Low | Low to Medium | Low | Dog |

| Legacy Tech Operations | Low | Low | Low | Dog |

| Taxi Operations in Slowdown Markets (e.g., China) | Low | Low | Low | Dog |

Question Marks

ComfortDelGro's collaboration with Pony.ai for robotaxi services positions them in a nascent but rapidly expanding market, characteristic of a question mark in the BCG matrix. This venture into autonomous vehicle technology in China, a key player in the global mobility landscape, signifies a strategic bet on future growth, even as current market penetration remains minimal.

The company is investing substantial capital into this initiative, a common requirement for question mark businesses aiming to capture emerging market share. For instance, Pony.ai has secured significant funding rounds, with reports indicating over $1 billion raised by early 2024, underscoring the capital-intensive nature of robotaxi development and deployment.

ComfortDelGro’s existing rail contracts are likely Stars, generating consistent revenue. However, the pursuit of new major metro contracts, like the Melbourne Metro, positions these ventures as Question Marks in the BCG Matrix. These represent high-growth opportunities in new territories where ComfortDelGro’s rail market share is currently minimal.

The significant investment of resources in bidding for these large-scale projects, such as the Melbourne Metro, carries inherent risks due to uncertain outcomes. For instance, major rail infrastructure projects often involve billions in capital expenditure, and the success rate of bids can be low, impacting resource allocation.

ComfortDelGro's ventures into adjacent mobility services, such as car-sharing partnerships like the one with Drivelah in Australia, represent a strategic move towards high-growth, evolving markets. These initiatives, while promising, are in their nascent stages for the company, suggesting a low initial market share that necessitates significant investment to achieve scalability and competitive positioning.

Development of new digital platforms and solutions

ComfortDelGro's development of new digital platforms and solutions, such as the 'ComfortConnect' portal for bus bookings and its expansion into digital outdoor advertising, positions it as a potential star in the BCG matrix. These initiatives represent significant investments in digital transformation, aiming to secure a larger share of the burgeoning digital mobility market. While these ventures are still in their nascent stages of development and market penetration, they signal a strategic move towards capturing future growth opportunities.

The company's commitment to digital innovation is evident in its ongoing efforts to enhance user experience and explore new revenue streams. For instance, the 'ComfortConnect' platform is designed to streamline the booking process for bus services, offering greater convenience to customers. This focus on digital solutions is crucial for ComfortDelGro to remain competitive in an evolving industry landscape.

Key digital initiatives and their implications:

- ComfortConnect Portal: Enhancing customer convenience for bus bookings, aiming to increase ridership and customer loyalty.

- Digital Outdoor Advertising: Expanding into new advertising channels, leveraging its physical assets for digital revenue generation.

- Market Share Capture: Targeting growth in the digital mobility space, which is experiencing rapid expansion and technological advancements.

- Early Stage Development: These platforms are still maturing, indicating potential for significant future growth but also inherent risks associated with new market entries.

Rapid Fleet Electrification in newer markets

ComfortDelGro's rapid fleet electrification in newer markets is a classic 'Question Mark' in the BCG matrix. While the long-term vision is for these to become Stars, the immediate reality is high growth potential coupled with significant investment needs and currently low market share for electric vehicles.

The company's ambitious targets, aiming for 90% cleaner energy cars and 50% cleaner energy buses by 2030 in various international markets, highlight this growth trajectory. However, this rapid transition is particularly challenging in markets with less developed electric vehicle (EV) infrastructure, demanding substantial capital expenditure for charging stations and vehicle acquisition.

For instance, in markets like Australia, ComfortDelGro is actively investing in EV charging infrastructure to support its growing electric fleet. This strategic push, while promising high future returns as EV adoption accelerates, currently represents a capital-intensive endeavor with initial low market penetration for electric fleets.

- High Growth Potential: Newer markets are experiencing rapid EV adoption, offering significant expansion opportunities for ComfortDelGro's electric fleets.

- Capital Intensive: Achieving ambitious electrification targets requires substantial upfront investment in vehicles and charging infrastructure, particularly in regions with nascent EV ecosystems.

- Low Initial Market Penetration: Despite growth, electric vehicles still represent a small fraction of the total fleet in many of these emerging markets, indicating a need for further market development.

- Strategic Importance: This segment is crucial for ComfortDelGro's long-term sustainability and competitive positioning in the evolving transportation landscape.

ComfortDelGro's ventures into robotaxi services with Pony.ai and new major metro contracts represent significant investments in high-growth, but currently low-market-share segments. These initiatives demand substantial capital and face uncertain outcomes, characteristic of Question Marks in the BCG matrix. The company's strategic focus on these emerging areas, despite the inherent risks and high investment needs, signals a clear intent to capture future market leadership in evolving mobility sectors.

BCG Matrix Data Sources

Our ComfortDelGro BCG Matrix leverages comprehensive data from annual reports, investor presentations, and industry-specific market research to accurately assess business unit performance and market dynamics.