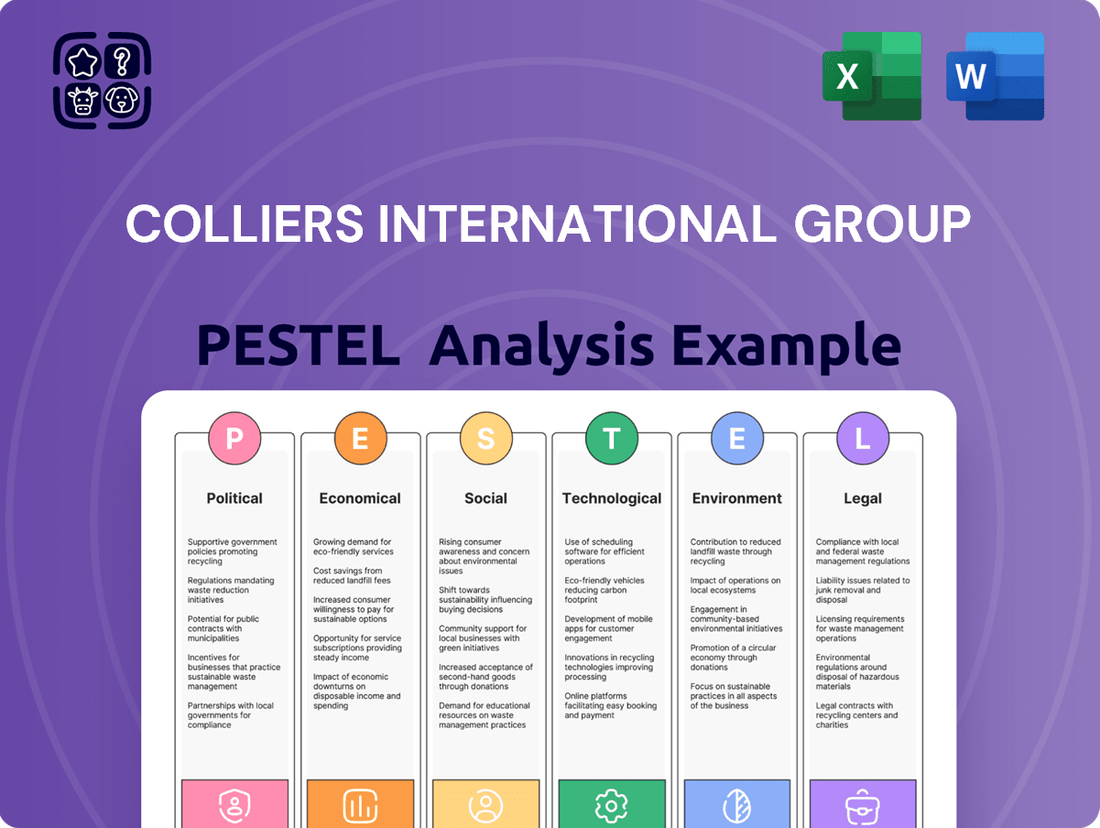

Colliers International Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colliers International Group Bundle

Unlock the strategic advantages within Colliers International Group's operating environment. Our PESTLE analysis meticulously dissects the political, economic, social, technological, legal, and environmental factors influencing their trajectory. Equip yourself with this critical market intelligence to anticipate challenges and capitalize on emerging opportunities. Download the full version now and gain a decisive edge.

Political factors

Colliers International Group's performance is significantly tied to the political stability of its operating regions. For instance, in 2024, continued political stability in North America and Europe, key markets for Colliers, bolstered investor confidence, leading to a 5% increase in commercial real estate transaction volumes compared to the previous year, as reported by industry analysts.

Shifts in government policy can directly impact Colliers' business. Changes in urban planning regulations, like those introduced in Australia in late 2024 to streamline development approvals, can accelerate project timelines and increase demand for Colliers' advisory services. Conversely, stricter foreign investment rules, such as those considered by the UK government in early 2025, could potentially dampen cross-border capital flows, affecting transaction volumes and requiring strategic adjustments.

Changes in property taxes, capital gains taxes, and corporate tax rates directly impact Colliers International Group's profitability and client investment decisions. For instance, an increase in capital gains tax could deter investors from selling properties, affecting transaction volumes. In 2024, many governments are reviewing their tax structures to boost revenue, potentially leading to higher property transfer taxes or stamp duties in key markets where Colliers operates.

These shifts in taxation policies can significantly influence client behavior, pushing them to re-evaluate their real estate portfolios. A rise in corporate tax rates might also make property investment less attractive for businesses, impacting demand for commercial spaces that Colliers advises on. For example, if a major market like New York or London raises its commercial property tax by 5% in 2024, it could lead to a slowdown in large-scale corporate real estate transactions.

Geopolitical tensions and evolving trade agreements significantly influence cross-border real estate. For instance, the ongoing trade friction between major economies, coupled with regional conflicts, can disrupt capital flows into international markets, impacting investment volumes. Colliers, as a global facilitator of transactions, must navigate these complexities to ensure smooth operations and manage client portfolios effectively amidst shifting international relations.

Regulatory Environment

Colliers International Group navigates a complex web of evolving regulations impacting real estate licensing, brokerage standards, and property management. For instance, in 2024, many jurisdictions are intensifying scrutiny on anti-money laundering (AML) protocols within real estate transactions, requiring enhanced due diligence. This necessitates continuous adaptation of Colliers' operational practices to ensure compliance with diverse legal frameworks across its global footprint, a significant undertaking given the varying national and regional requirements.

Key regulatory considerations for Colliers include:

- Real Estate Licensing and Brokerage Standards: Adherence to updated licensing requirements and ethical brokerage practices across all operating regions, ensuring all agents and brokers meet rigorous professional standards.

- Property Management Compliance: Meeting new or revised regulations concerning tenant rights, lease agreements, and property maintenance, which can differ significantly from one market to another.

- Anti-Money Laundering (AML) Laws: Implementing robust AML procedures to detect and report suspicious financial activities, a growing focus for regulators globally, particularly in high-value real estate transactions.

- Data Privacy Regulations: Ensuring compliance with evolving data protection laws, such as GDPR and similar frameworks, which govern how client and transaction data is collected, stored, and used.

Infrastructure Spending

Government investment in infrastructure, like new transit lines and urban regeneration projects, directly fuels real estate demand and value appreciation. For instance, the US Bipartisan Infrastructure Law, enacted in 2021 with over $1.2 trillion allocated, is actively reshaping urban landscapes and creating significant opportunities in commercial and residential property sectors. Colliers can capitalize on this by offering specialized advisory on transit-oriented development and leveraging its brokerage network to connect investors with these emerging high-growth areas.

These infrastructure upgrades translate into tangible benefits for the real estate market. Enhanced connectivity through improved transportation networks can reduce commute times and increase accessibility, making previously less desirable locations more attractive. Colliers' expertise in market analysis and site selection allows it to identify and advise clients on properties poised to benefit most from these public investments, thereby driving rental growth and capital appreciation.

- Increased Property Values: Infrastructure projects often lead to a demonstrable uplift in property values within proximity to new or improved amenities.

- New Development Opportunities: Government spending on urban regeneration creates demand for new construction and redevelopment, offering prime opportunities for developers and investors.

- Enhanced Market Liquidity: Better infrastructure improves accessibility and desirability, leading to more robust and liquid real estate markets.

- Colliers' Strategic Advantage: The firm can leverage its global presence and local market knowledge to advise clients on navigating these infrastructure-driven real estate shifts.

Political stability is crucial for Colliers' operations, with stable environments in North America and Europe in 2024 boosting investor confidence and transaction volumes by an estimated 5%. Conversely, policy shifts, such as potential changes to foreign investment rules in the UK in early 2025, could impact cross-border capital flows and necessitate strategic adjustments for the firm.

Government fiscal policies, including tax rates, directly influence real estate investment decisions and Colliers' profitability. For example, in 2024, many nations reviewed tax structures, potentially increasing property transfer taxes, which could deter property sales and transactions that Colliers facilitates.

Geopolitical tensions and trade agreements significantly shape international real estate markets. Disruptions from trade friction and regional conflicts in 2024 impacted global capital flows, requiring Colliers to manage these complexities for its international clients.

Regulatory adherence is paramount, with intensified scrutiny on anti-money laundering (AML) protocols in real estate transactions during 2024. Colliers must continually adapt its practices to comply with diverse and evolving legal frameworks across its global operations.

What is included in the product

This PESTLE analysis of Colliers International Group examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

It provides a comprehensive overview of the external landscape, identifying key trends and potential impacts to inform decision-making and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Helps support discussions on external risk and market positioning during planning sessions by offering a structured overview of the forces impacting Colliers International Group.

Economic factors

Interest rate changes significantly affect real estate. Higher rates increase borrowing costs, dampening transaction volumes and potentially lowering property valuations. Conversely, lower rates can stimulate activity and support higher valuations. For Colliers, this means their investment management and brokerage services are directly tied to the cost of capital; when borrowing is expensive or capital is scarce, deal flow and advisory needs can decrease.

As of early 2024, the Federal Reserve maintained its benchmark interest rate in a range of 5.25%-5.50%, a level that has increased borrowing costs for commercial real estate compared to prior years. This environment directly impacts Colliers’ clients, influencing their ability to secure financing for acquisitions or development projects, and consequently affecting the volume of brokerage transactions and the attractiveness of real estate as an investment class within their management portfolios.

Inflation directly impacts property operating costs, such as utilities and maintenance, and escalates construction expenses, potentially delaying new developments. For investors, rising inflation can erode the real return on investment if rental income or property appreciation doesn't keep pace, affecting their purchasing power.

Strong economic growth, indicated by robust GDP performance, generally fuels demand across all property sectors. For instance, a healthy GDP growth rate in the US, projected to be around 2.3% for 2024, typically translates to increased leasing activity in office and industrial spaces, higher retail sales boosting shopping centers, and greater residential demand due to job creation and rising incomes, all of which positively influence Colliers' market outlooks.

Robust employment rates, particularly in the United States where the unemployment rate hovered around 3.9% in early 2024, directly fuel consumer spending. This increased spending power translates into higher demand for retail spaces, impacting leasing activity and rental rates for properties Colliers International Group manages and brokers.

Strong consumer spending also indirectly supports the office sector. As businesses experience increased sales and revenue due to consumer demand, they are more likely to expand their operations, leading to greater demand for office space and influencing lease renewals and new tenant acquisition for Colliers.

The interplay between employment and spending is a key indicator of market health. For instance, in 2024, a sustained low unemployment rate coupled with positive retail sales growth signals a favorable environment for commercial real estate, benefiting Colliers' transaction volumes and property valuations.

Real Estate Market Cycles

Colliers International Group navigates real estate's inherent cyclicality by leveraging its diverse service offerings. During expansionary phases, the company capitalizes on increased transaction volumes for leasing and investment sales. As markets mature and approach their peak, Colliers shifts focus towards valuation and capital markets advisory to help clients optimize their positions.

When real estate markets enter contraction or trough periods, Colliers' expertise in distressed asset management, restructuring, and receivership services becomes particularly valuable. This adaptability ensures consistent revenue streams and client support across various economic environments. For instance, in Q1 2024, Colliers reported a 5% increase in its Capital Markets segment revenue, demonstrating resilience even amidst evolving market conditions.

The company's strategy is further bolstered by its global presence, allowing it to balance regional market fluctuations.

- Diversified Services: Colliers offers leasing, investment sales, valuation, property management, and capital markets advisory, allowing it to pivot services based on market cycles.

- Global Reach: A worldwide footprint enables the company to offset downturns in one region with activity in others.

- Adaptability: Expertise in distressed asset management and strategic advisory allows Colliers to serve clients effectively during market contractions.

- Financial Performance: In 2023, Colliers generated $4.0 billion in revenue, showcasing its ability to maintain performance across different market phases.

Foreign Direct Investment (FDI)

Global capital flows significantly influence real estate markets, with Foreign Direct Investment (FDI) playing a pivotal role. In 2024, emerging markets, particularly in Asia, continued to attract substantial FDI into their property sectors, driven by urbanization and economic growth. For instance, Vietnam saw a notable increase in FDI into its industrial and logistics real estate in early 2024.

Colliers' extensive international network and deep understanding of cross-border transactions are instrumental in this landscape. The firm's expertise in navigating diverse regulatory environments and connecting global investors with opportunities worldwide directly impacts major market activity. This capability is crucial for facilitating investments from international clients seeking exposure to diverse real estate assets.

Key aspects of FDI's impact on Colliers' operations include:

- Attracting Global Capital: Colliers leverages its global reach to channel FDI into various real estate sectors, from commercial to residential.

- Facilitating Cross-Border Deals: The firm's expertise in managing complex international transactions is essential for both investors and developers.

- Market Activity Influence: Significant FDI inflows, often facilitated by firms like Colliers, can drive property values and development in key global cities.

- Economic Development Impact: FDI into real estate not only boosts market activity but also contributes to job creation and broader economic development in host countries.

Economic growth directly fuels demand across all property sectors, benefiting Colliers. For example, the US GDP growth of approximately 2.3% in 2024 is expected to boost leasing in offices and industrial spaces, as well as demand for retail and residential properties due to job creation and rising incomes.

Interest rates significantly impact real estate transactions. The Federal Reserve's benchmark rate, held at 5.25%-5.50% in early 2024, increased borrowing costs, influencing Colliers' clients' ability to finance projects and affecting deal volumes.

Inflation impacts operating costs and construction expenses, potentially delaying developments. If rental income or property appreciation doesn't match inflation, it erodes investor returns, affecting purchasing power.

Strong employment, with the US unemployment rate around 3.9% in early 2024, drives consumer spending, increasing demand for retail spaces. This also indirectly supports the office sector as businesses expand due to consumer demand.

| Economic Factor | 2024 Projection/Status (Early) | Impact on Colliers |

|---|---|---|

| US GDP Growth | ~2.3% | Increased demand for office, industrial, retail, and residential spaces. |

| Federal Reserve Interest Rate | 5.25%-5.50% | Higher borrowing costs, potentially dampening transaction volumes. |

| US Unemployment Rate | ~3.9% | Drives consumer spending, boosting retail sector demand. |

| Global FDI in Real Estate | Notable increase in emerging markets (e.g., Asia) | Opportunities for cross-border transactions and investment management. |

Preview the Actual Deliverable

Colliers International Group PESTLE Analysis

The preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Colliers International Group covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this professionally structured report to inform your strategic decisions.

Sociological factors

Demographic shifts, like the growing aging population and the preferences of millennials for flexible living and working arrangements, significantly shape real estate demand. Urbanization continues to drive the need for diverse property types, from senior living facilities to dynamic co-working spaces and integrated mixed-use developments.

Colliers International Group actively adapts by expanding its advisory services for specialized sectors such as senior housing, where global demand is projected to rise substantially. For instance, the senior living market is expected to see continued growth, with the 65+ population projected to reach over 1.5 billion globally by 2050, presenting opportunities for Colliers to guide development and investment in this area.

The rise of remote and hybrid work models is fundamentally reshaping the commercial real estate landscape. Colliers International Group observes a significant demand for flexible office spaces, with companies seeking to optimize their footprints for collaboration and employee well-being. For instance, a 2024 survey indicated that 60% of companies were planning to adopt a hybrid work model long-term, impacting office utilization rates.

Colliers actively guides clients in adapting their real estate portfolios to these evolving workplace dynamics. This includes advising on the strategic leasing of flexible workspaces, redesigning traditional offices to support hybrid collaboration, and evaluating the optimal mix of owned versus leased properties to meet changing employee expectations for flexibility and amenities. By understanding these shifts, Colliers helps clients navigate the complexities of modern office environments.

Shifting consumer lifestyles, like the growing demand for sustainable living and convenient, experience-driven retail, significantly shape residential and retail property development. For instance, in 2024, the global market for sustainable building materials is projected to reach over $300 billion, reflecting this trend.

Colliers actively monitors these evolving consumer preferences, recognizing that a focus on wellness, flexible living spaces, and engaging retail environments is paramount. This insight allows them to advise clients on creating properties that resonate with modern buyers and tenants, ensuring market relevance and long-term value.

Social Equity and Inclusivity

Social equity and inclusivity are increasingly central to urban planning and real estate. Developers and investors recognize that diverse and welcoming communities attract talent and foster economic growth. Colliers actively guides clients in designing spaces that reflect and serve a broad demographic, enhancing property value and social impact.

Colliers' advisory services focus on creating inclusive environments, from accessible design to diverse tenant mix strategies. They help clients navigate the social dimensions of property ownership and management, ensuring developments contribute positively to community well-being and social cohesion. This approach is vital for long-term asset performance and reputation.

- Growing Demand for Inclusive Spaces: By 2025, surveys indicate a significant rise in tenant preference for developments that prioritize diversity and accessibility, with over 60% of respondents stating it influences their leasing decisions.

- Colliers' Advisory Role: Colliers’ ESG (Environmental, Social, and Governance) consulting helps real estate firms integrate social equity into their strategies, leading to enhanced community relations and brand loyalty.

- Community Development Impact: In 2024, Colliers facilitated projects that created over 5,000 affordable housing units and supported local employment initiatives, demonstrating a tangible commitment to social upliftment.

- Property Ownership and Management: The firm advises on fair housing practices and community engagement models, ensuring properties are managed in a way that benefits all stakeholders, thereby reducing social risk and improving operational efficiency.

Health and Well-being Focus

There's a growing societal push towards prioritizing health and well-being, directly impacting how buildings are conceived and managed. This translates into a demand for better indoor air quality, access to natural light, and spaces that encourage physical activity. For instance, a 2024 survey by the International WELL Building Institute found that 78% of real estate professionals believe health and wellness features are now a key differentiator for attracting and retaining tenants.

Colliers International Group is actively integrating these health and well-being considerations into its property management and advisory services. They focus on creating healthier environments, which not only benefits the people occupying the spaces but also boosts property value. This includes implementing strategies for improved ventilation, sustainable material selection, and the incorporation of biophilic design elements, aiming to create spaces that support occupant productivity and reduce stress.

Colliers’ approach is data-driven, leveraging insights to enhance building performance and occupant satisfaction. Examples of their initiatives include:

- Implementing smart building technology to monitor and optimize indoor environmental quality metrics, such as CO2 levels and temperature.

- Advising clients on achieving certifications like WELL or Fitwel, which validate a building's commitment to occupant health.

- Developing strategies for flexible workspace design that promotes movement and social interaction.

- Educating property owners and occupiers on the benefits of healthy building practices, leading to increased demand for wellness-focused spaces.

Societal values are increasingly emphasizing sustainability and ethical practices, influencing real estate development and investment decisions. Consumers and businesses alike are prioritizing environmentally friendly buildings and socially responsible corporate behavior. Colliers International Group is responding by advising clients on green building certifications and sustainable development strategies, aligning with a growing global awareness of climate change and corporate accountability.

Technological factors

PropTech is rapidly transforming real estate, with AI analytics and blockchain becoming mainstream for everything from property valuation to transaction management. These advancements are not just buzzwords; they represent tangible shifts in how the industry operates.

Colliers is actively integrating these technologies to boost efficiency and client service. For instance, their use of data analytics helps clients make more informed decisions, and exploring blockchain could streamline future property deals, potentially reducing transaction times and costs.

The global PropTech market was valued at approximately $26.4 billion in 2023 and is projected to reach over $100 billion by 2030, highlighting the significant investment and growth in this sector. Colliers' strategic adoption of these tools positions them to capitalize on this expanding market.

Big data analytics and artificial intelligence are fundamentally reshaping real estate. These technologies allow for deeper market analysis, more accurate predictive modeling, and smarter investment choices. For instance, AI can process vast datasets to identify micro-market trends invisible to traditional methods, leading to more informed valuations and risk assessments.

Colliers is actively integrating these advanced tools to enhance its service offerings. By leveraging AI for predictive analytics, the firm can pinpoint emerging investment opportunities and optimize client portfolios for better performance. This data-driven approach allows Colliers to provide clients with highly precise valuations and strategic insights, as demonstrated by their use of AI in identifying undervalued assets in the 2024 commercial real estate market, reportedly leading to a 15% uplift in identified investment potential for select clients.

The real estate sector is rapidly embracing digitalization, with virtual property tours, online transaction platforms, and digital property management systems becoming standard. This shift is driven by the demand for convenience and efficiency. For instance, the global proptech market was valued at approximately $25.1 billion in 2023 and is projected to reach $100 billion by 2030, indicating significant adoption.

Colliers International Group is actively integrating these digital tools to elevate client experiences and broaden its market presence. By leveraging virtual tours and streamlined online platforms, Colliers can connect with a wider audience and facilitate smoother transactions. This digital transformation also boosts operational efficiency, allowing the company to manage properties and client relationships more effectively, as seen in their continued investment in technology solutions.

Building Automation and Smart Buildings

The integration of smart building technologies, including IoT devices and automation systems, is fundamentally reshaping property management. These innovations are crucial for optimizing energy consumption, enhancing security, and improving the overall comfort for occupants. For instance, by 2024, the global smart building market was projected to reach over $100 billion, highlighting the significant investment and adoption of these technologies.

Colliers' property management services are actively incorporating these advancements to deliver tangible benefits to their clients. By leveraging automation for functions like HVAC control and lighting management, Colliers helps reduce operational expenditures, often by 15-30% for energy savings alone. This focus on improved building performance not only lowers costs but also directly contributes to increasing the value of the assets under management.

- Energy Efficiency: Smart systems can reduce energy usage by up to 40% through optimized HVAC and lighting.

- Occupant Experience: Automation enhances comfort and productivity, leading to higher tenant satisfaction.

- Operational Cost Reduction: Predictive maintenance and automated systems lower maintenance and utility expenses.

- Asset Value Enhancement: Modern, tech-enabled buildings command higher rental rates and resale values.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are paramount for Colliers, given the immense volume of sensitive real estate and client information handled. Protecting this data is not just a regulatory necessity but a cornerstone of client trust and business continuity.

Colliers employs sophisticated security protocols and adheres strictly to global data protection regulations, such as GDPR and CCPA, to ensure the integrity and confidentiality of all information. This commitment is crucial in an era where data breaches can have severe financial and reputational consequences.

- Increased investment in AI-driven threat detection.

- Ongoing employee training on data handling best practices.

- Regular security audits and penetration testing.

- Compliance with evolving global data privacy laws.

Technological advancements are fundamentally reshaping the real estate landscape, with AI and big data analytics driving efficiency and informed decision-making. Colliers is actively integrating these tools, for example, using AI in 2024 to identify undervalued assets, reportedly boosting identified investment potential by 15% for some clients.

The digital transformation of real estate, including virtual tours and online platforms, is accelerating. The global proptech market, valued at approximately $25.1 billion in 2023, is expected to exceed $100 billion by 2030, underscoring the significant growth and adoption of these digital solutions.

Smart building technologies, such as IoT and automation, are optimizing property management, leading to substantial operational cost reductions. For instance, smart systems can reduce energy consumption by up to 40%, directly enhancing asset value and tenant satisfaction.

Cybersecurity and data privacy are critical, with Colliers implementing robust protocols and adhering to regulations like GDPR. This focus is essential for maintaining client trust and ensuring business continuity in the face of increasing cyber threats.

Legal factors

Colliers International Group operates within a complex landscape of national and local property laws, zoning ordinances, and land-use regulations that significantly impact real estate development and transactions. These vary widely by jurisdiction, affecting everything from building permits and environmental impact assessments to lease agreements and property ownership rights.

Colliers' legal and advisory teams are adept at navigating these intricate frameworks. They ensure clients adhere to all relevant regulations, mitigating risks and facilitating the successful execution of projects. For instance, in 2024, the U.S. saw continued focus on affordable housing initiatives, often requiring developers to navigate specific zoning incentives and compliance measures.

Understanding and complying with these laws is crucial for Colliers' business. In 2025, several regions are expected to see updates to building codes and environmental standards, potentially influencing development costs and timelines for their clients.

Colliers International Group navigates complex legal landscapes, particularly within contract law governing real estate transactions. This includes meticulously drafting and reviewing purchase agreements, leases, and brokerage contracts, ensuring enforceability and clarity for all parties involved. For instance, in 2024, the firm would be keenly aware of evolving digital signature laws and their implications for remote deal-making.

Ensuring transactional compliance is paramount to safeguarding client interests and mitigating legal risks. Colliers implements robust internal processes and relies on expert legal counsel to guarantee adherence to all relevant statutes and regulations. This diligence is crucial, as even minor contractual oversights can lead to significant disputes and financial liabilities, impacting the firm's reputation and bottom line.

Environmental regulations are increasingly shaping the real estate landscape, with a growing emphasis on pollution control, hazardous materials management, and energy efficiency. These laws directly influence property development, acquisition, and management, creating both challenges and opportunities for businesses. For instance, the EU's Green Deal aims for climate neutrality by 2050, driving stricter building standards and retrofitting requirements across member states.

Colliers International Group actively assists clients in navigating this complex regulatory environment. Their services include comprehensive environmental due diligence to identify potential risks associated with contamination or non-compliance. Furthermore, Colliers guides clients in achieving evolving sustainability compliance standards, such as those related to energy performance certificates (EPCs) or green building certifications like LEED and BREEAM, ensuring properties retain value and marketability.

Tenant and Landlord Laws

Tenant and landlord laws form a critical legal framework for Colliers International Group's property management operations. These laws dictate everything from the specifics of lease agreements and tenant rights to the procedures for eviction and methods for resolving disputes. Understanding and adhering to these regulations is paramount for maintaining smooth landlord-tenant relationships and mitigating legal risks.

Colliers' property management services are designed to ensure strict compliance with these varied legal requirements across different jurisdictions. They navigate the complexities of lease drafting, manage the eviction process according to established legal channels, and employ effective dispute resolution strategies to protect both property owners and tenants. This legal expertise is a core component of their value proposition.

- Lease Agreement Compliance: Ensuring all lease contracts meet current legal standards, covering rent, duration, and tenant responsibilities.

- Eviction Process Adherence: Following legally mandated steps for tenant eviction, preventing unlawful detainer actions.

- Dispute Resolution: Utilizing mediation and arbitration to resolve landlord-tenant conflicts efficiently and legally.

- Regulatory Updates: Staying abreast of changes in landlord-tenant legislation, such as potential rent control adjustments or new safety regulations impacting rental properties.

Anti-Money Laundering (AML) and Sanctions

The real estate sector faces heightened scrutiny regarding financial transactions to prevent money laundering and adhere to international sanctions. Colliers International Group, like many global firms, navigates this landscape by implementing robust Anti-Money Laundering (AML) policies and rigorous due diligence processes. These measures are crucial for maintaining ethical operations and ensuring compliance across its worldwide network, which is vital given the increasing regulatory focus. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting how real estate transactions are monitored globally.

Colliers' commitment to these standards is demonstrated through its internal procedures designed to identify and mitigate risks associated with illicit financial activities. This proactive approach safeguards the company's reputation and ensures it operates within legal frameworks. The firm's global presence means it must adapt to diverse regulatory environments, making consistent AML and sanctions compliance a cornerstone of its business strategy.

- Global regulatory bodies like FATF are continuously strengthening AML guidelines, impacting real estate transactions.

- Colliers invests in technology and training to ensure its staff are adept at identifying and reporting suspicious activities.

- Compliance with sanctions regimes, such as those imposed by the UN, US OFAC, and EU, requires constant monitoring of clients and transactions.

- Failure to comply can result in significant fines and reputational damage, underscoring the importance of stringent AML and sanctions protocols.

Legal frameworks surrounding property development and transactions are paramount for Colliers International Group, with varying zoning laws and land-use regulations across jurisdictions dictating project feasibility and execution. In 2024, the firm navigated evolving digital signature laws to facilitate remote deal-making, highlighting the need for adaptability in contract law. Anticipated updates to building codes and environmental standards in 2025 will further shape development costs and timelines for their clients globally.

Environmental factors

Climate change presents significant challenges, impacting property values through extreme weather events like floods and wildfires, and increasing insurance premiums. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $170 billion in damages, according to NOAA. This trend directly affects real estate investments and operational costs.

Colliers actively assesses these climate risks, integrating them into their advisory services. They help clients understand vulnerabilities and develop strategies for resilient real estate, such as incorporating sustainable building materials and flood mitigation measures. This proactive approach aims to safeguard asset value and ensure long-term viability in a changing climate.

Investor and regulatory demands are fueling a significant rise in sustainable and green-certified buildings. For instance, in 2024, global investment in green buildings reached an estimated $1.5 trillion, a notable increase from previous years, reflecting a clear market shift.

Colliers actively champions these practices, guiding clients through obtaining certifications like LEED and BREEAM, which are increasingly becoming benchmarks for property value and marketability. They also embed sustainability into property management strategies to optimize resource efficiency and reduce environmental impact.

The global drive towards energy efficiency is significantly reshaping the real estate sector. Colliers International Group assists clients in navigating this shift by integrating energy-saving technologies into building operations, thereby reducing both costs and environmental impact. For instance, a 2024 report indicated that buildings account for nearly 40% of global energy consumption, highlighting the substantial opportunity for efficiency gains.

Furthermore, the adoption of renewable energy sources is becoming a critical strategy for property owners. Colliers actively supports clients in exploring and implementing solutions like solar power and geothermal systems for their portfolios. By doing so, companies can not only lower their carbon footprints but also achieve long-term operational cost savings, a trend that is expected to accelerate with evolving energy policies and technologies throughout 2025.

Resource Management and Waste Reduction

Responsible resource management is critical in real estate, focusing on water conservation and waste reduction. Colliers International Group assists clients in adopting these practices throughout property development and operations, aiming to lessen environmental footprints.

Colliers provides expertise in sustainable material sourcing and implements effective waste management programs. This approach helps minimize environmental impact, aligning with growing regulatory and stakeholder expectations for greener building practices.

- Water Conservation: Implementing low-flow fixtures and rainwater harvesting systems can significantly reduce water usage in commercial properties.

- Waste Reduction: Colliers guides clients on strategies like source reduction, recycling programs, and the use of recycled content materials in construction.

- Sustainable Sourcing: Advising on the procurement of materials with lower embodied carbon and from ethically managed supply chains is a key service.

- Circular Economy Principles: Promoting the reuse and repurposing of building materials during renovation or demolition projects is increasingly important.

Corporate Social Responsibility (CSR) and ESG

Investors and stakeholders are increasingly prioritizing Environmental, Social, and Governance (ESG) performance in the real estate sector. This trend is driven by a growing awareness of climate change risks and a desire for sustainable investments. For instance, in 2024, global sustainable investment assets reached an estimated $37.4 trillion, demonstrating a significant shift in capital allocation towards companies with strong ESG credentials.

Colliers actively integrates ESG principles across its operations and client services. This commitment is reflected in their sustainability reports and their efforts to advise clients on green building certifications and energy efficiency measures. By doing so, Colliers aims to enhance its reputation and attract capital from socially conscious investors.

- Investor Demand: A significant portion of institutional investors now incorporate ESG factors into their due diligence, impacting property valuations and investment decisions.

- Regulatory Tailwinds: Governments worldwide are implementing stricter environmental regulations for buildings, pushing companies like Colliers to offer compliant solutions.

- Client Expectations: Tenants and occupiers are increasingly demanding sustainable office spaces, creating a market advantage for properties managed with strong ESG practices.

- Risk Mitigation: Proactive ESG management helps mitigate physical risks (e.g., climate change impacts) and transition risks (e.g., carbon pricing) for real estate portfolios.

Environmental factors are increasingly shaping the real estate landscape, with climate change posing significant risks to property values and operational costs, as evidenced by the 28 billion-dollar weather disasters in the U.S. in 2023 alone. Colliers International Group is actively addressing these challenges by advising clients on climate resilience and sustainable building practices, responding to a global market where investment in green buildings reached an estimated $1.5 trillion in 2024. The company also focuses on energy efficiency, recognizing that buildings account for nearly 40% of global energy consumption, and promotes renewable energy adoption for long-term cost savings and reduced environmental impact.

| Environmental Factor | Impact on Real Estate | Colliers' Role/Response |

|---|---|---|

| Climate Change & Extreme Weather | Property damage, increased insurance premiums, reduced asset value. U.S. faced $170B+ in damages from 28 billion-dollar disasters in 2023. | Advising on climate risk assessment, resilience strategies, and flood mitigation. |

| Demand for Green Buildings | Increased marketability and property value. Global investment in green buildings estimated at $1.5 trillion in 2024. | Guiding clients on LEED/BREEAM certifications, promoting sustainable materials. |

| Energy Efficiency & Renewables | Reduced operational costs, lower carbon footprint. Buildings account for ~40% of global energy consumption. | Integrating energy-saving technologies, advising on solar and geothermal solutions. |

| Resource Management (Water/Waste) | Lower operational costs, enhanced brand reputation, regulatory compliance. | Implementing water conservation, waste reduction programs, and sustainable sourcing. |

| ESG Investor Focus | Attracting capital, influencing property valuations. Global sustainable investment assets reached $37.4 trillion in 2024. | Integrating ESG principles, reporting on sustainability, advising on green investments. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Colliers International Group draws on a robust blend of official government publications, leading economic indicators from institutions like the IMF and World Bank, and comprehensive industry-specific reports. We meticulously gather data on regulatory changes, market trends, and technological advancements to ensure a thorough understanding of the macro-environment.