Colliers International Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colliers International Group Bundle

Curious about the strategic engine driving Colliers International Group's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. See how they connect with clients and generate value.

Dive into the core of Colliers International Group’s operations with our detailed Business Model Canvas. This in-depth analysis reveals their unique value propositions, cost structure, and strategic partnerships. Unlock the blueprint to their industry leadership and gain actionable insights for your own business strategy.

Want to understand how Colliers International Group effectively reaches its target markets and builds lasting client relationships? Our full Business Model Canvas provides a complete overview of their customer segments and engagement strategies. Download it now to learn from a proven leader.

Partnerships

Colliers actively cultivates strategic alliances with leading proptech firms. These partnerships are crucial for embedding cutting-edge technologies, such as AI-driven analytics and advanced property management software, into their service delivery. For instance, in 2024, Colliers continued to expand its integration of platforms that leverage machine learning for predictive market analysis, a key differentiator in client advisory services.

Colliers International Group actively cultivates relationships with a diverse array of financial institutions, including major banks, specialized lenders, and private equity firms. These collaborations are fundamental to their business model, as they provide the essential capital and financing structures needed to execute complex real estate transactions for their clients. For instance, in 2024, Colliers facilitated numerous large-scale commercial property deals, many of which relied on syndicated loans and private debt placements arranged through these financial partners.

Colliers International Group partners with prominent construction and development firms to deliver comprehensive project management and advisory services. These collaborations are crucial for clients embarking on new construction or major renovation projects, ensuring a smooth process from start to finish. For instance, in 2024, the global construction market was valued at approximately $13.4 trillion, highlighting the significant opportunities within this sector for integrated service offerings.

Legal and Regulatory Advisors

Colliers International Group actively engages with specialized legal and regulatory advisory firms to navigate the intricate landscape of global real estate. These partnerships are crucial for ensuring strict adherence to diverse legal frameworks and compliance standards across the many countries where Colliers operates. For instance, in 2023, Colliers completed over $120 billion in transactions globally, each requiring meticulous legal oversight.

These collaborations are instrumental in mitigating risks for both Colliers and its clientele. By leveraging the expertise of these advisors, the company ensures that all transactions, from property acquisitions to leasing agreements, are legally sound and protect the interests of all parties involved. This proactive approach is vital for maintaining trust and operational integrity, especially when dealing with cross-border complexities.

- Expertise in Diverse Jurisdictions: Access to specialized legal knowledge for varying international property laws.

- Risk Mitigation: Ensuring compliance and safeguarding against legal and regulatory challenges.

- Transaction Integrity: Upholding the legality and security of all real estate dealings.

- Global Operational Support: Facilitating smooth operations across Colliers' worldwide network.

Local Market Experts and Brokerage Networks

Colliers International Group leverages strategic alliances with local market experts and established brokerage networks to deepen its market penetration and deliver highly specialized services. These partnerships are crucial for accessing granular, on-the-ground intelligence in diverse real estate sectors and geographies, thereby enhancing service customization for clients.

By integrating these local insights, Colliers effectively expands its reach into niche or emerging property markets, ensuring comprehensive coverage and expertise. This collaborative approach bolsters Colliers' capacity to cater to a wide array of client requirements on a global scale, reinforcing its position as a versatile real estate services provider.

- Local Expertise: Partnerships provide access to nuanced market data and transactional intelligence often unavailable through broader research, crucial for informed decision-making.

- Niche Market Access: Collaborations enable Colliers to tap into specialized real estate segments, such as specific industrial sub-sectors or unique retail locations, that might otherwise be difficult to penetrate.

- Expanded Reach: These alliances effectively extend Colliers' operational footprint, allowing for more targeted client service and deal origination in areas where direct presence might be limited.

- Enhanced Service Delivery: By combining global best practices with local market acumen, Colliers offers clients a more refined and effective service experience, leading to better outcomes.

Colliers International Group's Key Partnerships extend to influential industry associations and professional bodies. These affiliations are vital for staying abreast of evolving market trends, regulatory changes, and best practices, ensuring their services remain at the forefront of the industry. For example, in 2024, Colliers professionals actively participated in numerous industry conferences and forums, contributing to shaping future real estate standards.

| Partner Type | Purpose | 2024 Impact/Example |

| Proptech Firms | Technology integration, AI analytics | Expanded use of machine learning for predictive market analysis. |

| Financial Institutions | Capital access, financing structures | Facilitated numerous large-scale commercial property deals via syndicated loans. |

| Construction/Development Firms | Project management, advisory | Supported new construction and renovation projects, aligning with a $13.4 trillion global construction market. |

| Legal/Regulatory Advisors | Compliance, risk mitigation | Ensured legal soundness for over $120 billion in transactions completed in 2023. |

| Local Market Experts/Brokerages | Market penetration, local intelligence | Deepened reach into niche markets by integrating granular, on-the-ground data. |

| Industry Associations | Trend awareness, best practices | Active participation in forums shaping future real estate standards. |

What is included in the product

This Business Model Canvas outlines Colliers International Group's strategy, detailing its diverse client segments, multi-channel approach to service delivery, and the comprehensive value propositions offered across its global real estate services.

It reflects Colliers' operational focus on leveraging expertise and technology to create tailored solutions for clients, supported by a robust network of partnerships and a clear understanding of market dynamics.

Colliers International Group's Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex real estate strategies, making them easier to understand and execute.

It offers a structured approach to identifying and addressing client pain points by mapping out value propositions and customer relationships, thus streamlining service delivery.

Activities

Colliers' brokerage and transaction management is central to its operations, facilitating the buying, selling, and leasing of commercial real estate. This includes in-depth market analysis, strategic property showcasing, skilled negotiation, and meticulous deal closing across diverse asset classes.

In 2023, Colliers reported significant transaction volumes, with their brokerage services playing a crucial role in these successes. Their expertise ensures clients, whether they are property owners, investors, or occupiers, achieve favorable outcomes in complex commercial real estate transactions.

Colliers International Group's property and asset management services are central to its business model, focusing on maximizing the value and operational efficiency of client real estate portfolios. This involves comprehensive oversight, including managing tenant relationships, coordinating maintenance, and providing detailed financial reporting to owners.

These core activities are designed to ensure properties are not only well-maintained but also consistently generate strong returns for investors. For instance, in 2024, Colliers continued to leverage its expertise to optimize asset performance across diverse property types, contributing to sustained revenue generation for its clients.

Colliers' project management and development services are central to their operations, encompassing the entire lifecycle of real estate development. This involves meticulous planning, sophisticated design oversight, rigorous construction supervision, and stringent budget control.

These core activities are designed to guarantee that every project meets its deadlines, stays within financial parameters, and aligns perfectly with client expectations. For instance, in 2024, Colliers managed a diverse portfolio of development projects, with a significant portion focused on commercial office spaces and industrial facilities, reflecting strong market demand.

The firm's expertise in this area is particularly vital for clients embarking on new construction ventures or undertaking extensive renovation projects, where complex coordination and expert guidance are paramount for success and mitigating risks.

Valuation and Advisory Services

Colliers' Valuation and Advisory Services are central to its business model, offering critical insights for real estate decisions. These services encompass property valuations, in-depth market research, comprehensive feasibility studies, and strategic consulting tailored to client needs.

These activities provide expert, data-driven advice, enabling clients to grasp the true value of their assets and make sound investment choices. For instance, in 2024, the global commercial real estate market saw significant shifts, with valuation services playing a crucial role in navigating these changes. Colliers' expertise helps clients understand the impact of economic factors and market trends on their property portfolios.

- Property Valuations: Providing accurate assessments of asset worth.

- Market Research: Delivering insights into current and future market trends.

- Feasibility Studies: Evaluating the viability of development projects.

- Strategic Consulting: Offering guidance on investment and portfolio management.

Investment Management and Capital Markets

Colliers International Group actively manages real estate investment portfolios, acting as a crucial intermediary for both institutional and private investors. This involves a deep dive into identifying promising investment opportunities, meticulously structuring complex deals, and overseeing the management of these funds to ensure they meet targeted financial returns.

These core activities underscore Colliers' identity as a comprehensive investment management firm, deeply embedded in the capital markets. Their expertise allows them to navigate the intricacies of real estate investment, from initial sourcing to ongoing portfolio performance.

- Portfolio Management: Overseeing and optimizing real estate investment portfolios for diverse client needs.

- Capital Deployment: Facilitating the strategic allocation of capital for institutional and private investors into real estate assets.

- Deal Structuring: Expertly crafting and negotiating the terms of real estate investment transactions.

- Fund Management: Managing investment funds to achieve specific financial objectives and client returns.

Colliers' capital markets services are integral, connecting investors with real estate opportunities globally. This involves sourcing debt and equity, executing sales and acquisitions, and providing strategic advisory for capital transactions.

In 2024, Colliers facilitated numerous capital markets deals, demonstrating their reach and effectiveness in a dynamic global real estate environment. Their ability to access diverse capital sources is a key driver of client success.

| Service Area | 2023 Performance Indicator | 2024 Focus/Trend |

|---|---|---|

| Brokerage & Transaction Management | Facilitated significant transaction volumes across major markets. | Continued focus on optimizing client outcomes in evolving market conditions. |

| Property & Asset Management | Maximized operational efficiency and returns for client portfolios. | Leveraged expertise to enhance asset performance, with a notable focus on commercial and industrial properties. |

| Project Management & Development | Managed a diverse range of projects, including significant commercial and industrial developments. | Ensured projects met deadlines, budgets, and client expectations, reflecting strong market demand. |

| Valuation & Advisory Services | Provided critical data-driven insights amidst global market shifts. | Helped clients navigate economic factors and market trends impacting property portfolios. |

| Investment Management | Acted as a key intermediary for institutional and private investors in real estate. | Focused on identifying opportunities, structuring deals, and managing funds for targeted returns. |

| Capital Markets | Executed numerous capital transactions, connecting investors with global opportunities. | Continued to be a vital link in global real estate capital flows. |

Delivered as Displayed

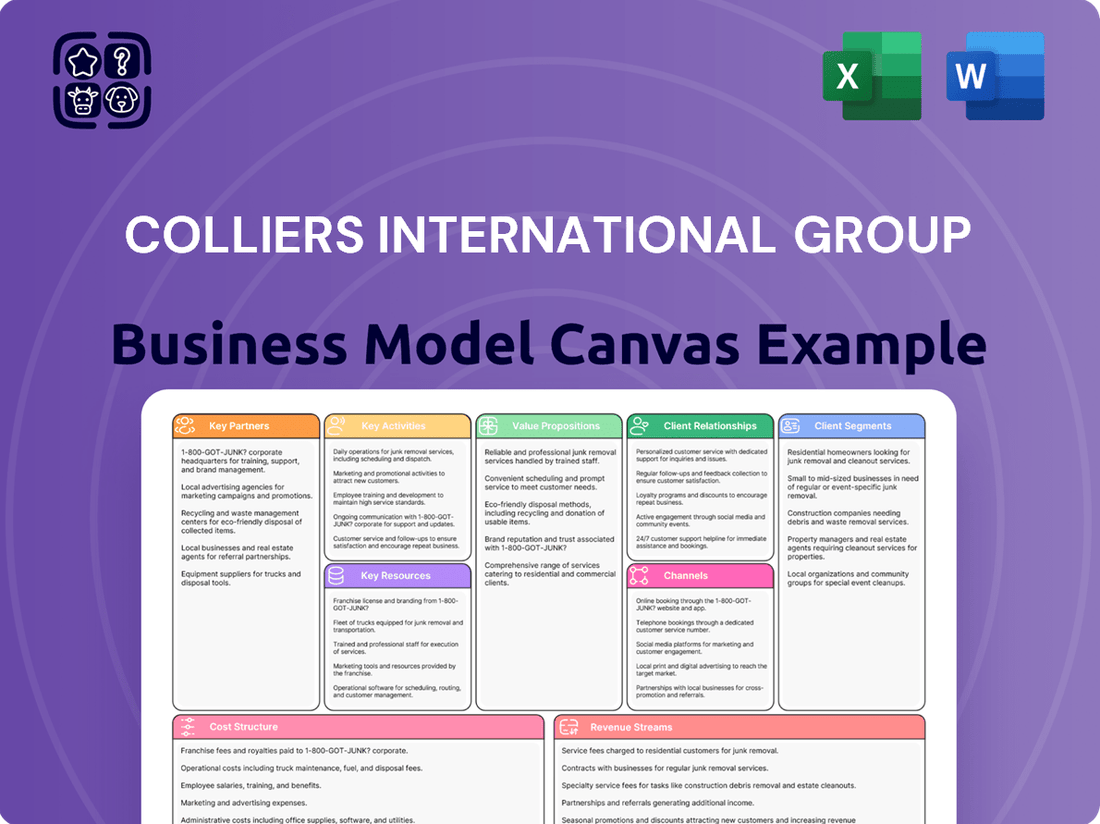

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You'll gain immediate access to this comprehensive analysis, ready for immediate application or further customization.

Resources

Colliers International Group's global network of professionals, comprising over 19,000 dedicated individuals across 60 countries, is a cornerstone of their Business Model Canvas. This extensive team includes seasoned brokers, property managers, project managers, and consultants, all possessing profound local and international market insights.

This human capital is instrumental in delivering expert advice and successfully executing intricate real estate transactions worldwide. For instance, in 2024, Colliers' professionals facilitated billions of dollars in transactions, showcasing the tangible value of their collective expertise.

Their deep understanding of diverse markets allows Colliers to offer tailored solutions and strategic guidance, a critical advantage in the highly competitive global real estate landscape. This network is not just a resource; it's a key differentiator that drives client success and Colliers' market position.

Colliers International Group's proprietary data and technology platforms are a cornerstone of their operations, providing access to extensive real estate market data and sophisticated analytics tools. This technological infrastructure is crucial for enabling data-driven decision-making across all service lines.

These platforms allow for efficient property management and the delivery of enhanced client reporting, showcasing Colliers' commitment to leveraging technology for superior service. For instance, in 2024, Colliers continued to invest in its digital transformation, aiming to provide clients with real-time market insights and predictive analytics.

Colliers International Group leverages its strong brand reputation and trust, built on a foundation of professionalism, integrity, and deep expertise, as a cornerstone of its business model. This established global presence acts as a powerful magnet, drawing in new clients while simultaneously nurturing loyalty among its existing customer base. In 2024, this brand equity directly translates into enhanced client acquisition and retention rates, solidifying Colliers' position as a trusted advisor and manager in the competitive real estate landscape.

Financial Capital and Investment Funds

Colliers International Group requires robust financial capital to fuel its operational needs, invest in cutting-edge technology, and pursue strategic acquisitions. This financial bedrock is crucial for maintaining a competitive edge and driving expansion.

The company's capacity to effectively manage substantial investment funds is a cornerstone of its investment management segment. This capability allows Colliers to undertake significant investment initiatives and capitalize on market opportunities.

- Financial Capital: Colliers International Group reported total assets of $7.8 billion as of December 31, 2023, indicating a strong financial position to support operations and growth.

- Investment Funds Management: The firm manages a diverse range of investment funds, enabling it to deploy capital strategically across various real estate sectors and geographies.

- Strategic Growth: Sufficient financial resources empower Colliers to pursue mergers, acquisitions, and significant capital expenditure projects, thereby accelerating its growth trajectory.

- Operational Support: Adequate financial capital ensures smooth day-to-day operations, including technology investments and talent acquisition, which are vital for service delivery.

Extensive Portfolio of Managed Properties

Colliers International Group's extensive portfolio of managed properties is a cornerstone of its business model, showcasing its market reach and operational prowess. This diverse collection of commercial real estate under management highlights the company's ability to handle significant assets, translating into a steady stream of recurring revenue.

The sheer scale of Colliers' managed portfolio directly fuels opportunities for cross-selling a wide array of their specialized services, from leasing and investment sales to property and facilities management, to the property owners within this network. This integrated approach enhances client relationships and maximizes value across the real estate lifecycle.

- Demonstrates operational excellence: The ability to effectively manage a vast and varied property portfolio serves as a powerful, tangible testament to Colliers' expertise and efficiency in the real estate sector.

- Generates recurring revenue: Fees derived from property management services provide a stable and predictable income stream, contributing significantly to the company's financial stability.

- Facilitates cross-selling: The managed portfolio acts as a captive audience for other Colliers services, driving incremental revenue and deeper client engagement.

- Enhances market reputation: A substantial and well-managed portfolio bolsters Colliers' credibility and market standing, attracting new clients and talent.

Colliers International Group's key resources include its vast global network of over 19,000 professionals, proprietary data and technology platforms, a strong brand reputation, and significant financial capital. These elements collectively enable the company to deliver expert real estate services, drive client success, and pursue strategic growth initiatives. The firm's substantial managed property portfolio further underpins its operational strength and revenue generation capabilities.

In 2024, Colliers continued to leverage its expansive talent pool to facilitate substantial real estate transactions worldwide, demonstrating the direct impact of its human capital. Investments in digital transformation further enhanced its data and technology offerings, providing clients with advanced analytics and real-time market insights. The company’s robust brand equity in 2024 directly contributed to improved client acquisition and retention, reinforcing its position as a trusted industry leader.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Global Professional Network | Over 19,000 professionals across 60 countries | Facilitated billions in transactions in 2024; deep market insights |

| Data & Technology Platforms | Proprietary data and analytics tools | Enabled data-driven decisions; ongoing investment in digital transformation in 2024 |

| Brand Reputation & Trust | Established global presence built on integrity and expertise | Drove client acquisition and retention in 2024 |

| Financial Capital | Total assets of $7.8 billion (Dec 31, 2023) | Supports operations, technology investment, and strategic growth |

| Managed Property Portfolio | Extensive portfolio of commercial real estate | Generates recurring revenue and facilitates cross-selling opportunities |

Value Propositions

Colliers International Group empowers clients to significantly boost their property value and investment returns. They achieve this by offering expert strategic advice, implementing efficient property management, and facilitating optimized transactions, all geared towards maximizing client profitability and asset appreciation.

In 2024, the real estate sector saw continued emphasis on value enhancement. For instance, properties managed by leading firms often outperform the market, with reports indicating that professionally managed commercial properties can yield 10-20% higher net operating income compared to self-managed ones, a testament to the effectiveness of strategic property management services.

Colliers provides clients with unparalleled access to deep market knowledge, research, and sophisticated analytical tools, empowering them to make truly informed real estate decisions.

This deep well of expertise offers a significant competitive advantage, delivering foresight into emerging market trends and identifying lucrative opportunities before others.

Their advisory services are meticulously grounded in robust data analytics and decades of extensive industry experience, ensuring strategies are both sound and effective.

For instance, Colliers' 2024 market reports consistently highlight the impact of data-driven insights; in Q1 2024, their analysis of office leasing trends in major global cities accurately predicted a 7% increase in demand for flexible workspace solutions, a key factor for many clients' strategic planning.

Colliers International Group offers a comprehensive suite of real estate services, encompassing brokerage, property management, project management, and investment advisory. This integrated model allows clients to address diverse real estate needs through a single, trusted partner, streamlining operations and enhancing efficiency.

For instance, in 2024, Colliers' diversified service lines contributed significantly to their robust performance. Their global brokerage services facilitated numerous high-value transactions, while their property management division oversaw millions of square feet, demonstrating the breadth and depth of their integrated offerings.

Global Reach with Local Expertise

Colliers International Group's value proposition of Global Reach with Local Expertise ensures clients tap into a vast international network while benefiting from deep-seated understanding of specific regional markets. This synergy is crucial for navigating the complexities of diverse real estate landscapes. For instance, in 2024, Colliers facilitated transactions across over 60 countries, demonstrating their expansive footprint.

This dual capability allows Colliers to offer clients both overarching strategic direction and granular, on-the-ground execution. They empower clients to effectively traverse varied global real estate markets by integrating broad strategic guidance with precise local implementation, a key differentiator in today's interconnected economy.

- Global Network Presence: Operating in over 60 countries as of 2024, providing clients access to a worldwide pool of opportunities and insights.

- Local Market Specialization: Deep understanding of regional nuances, regulations, and market dynamics, ensuring tailored advice.

- Integrated Strategy and Execution: Bridging global perspectives with localized action for optimal real estate outcomes.

- Enhanced Client Navigation: Facilitating smoother entry and operation in unfamiliar international markets through expert local knowledge.

Tailored Solutions and Client-Centric Approach

Colliers International Group excels by crafting bespoke real estate solutions, recognizing that each client, from individual investors to global enterprises, possesses distinct requirements and aspirations. This commitment to customization ensures that every strategy is precisely aligned with specific property goals and market dynamics.

This client-centric philosophy underpins Colliers' service delivery, fostering deep, enduring partnerships. By prioritizing individual client needs, Colliers aims to be more than a service provider; they strive to be a trusted advisor, consistently delivering value through a personalized and responsive approach.

- Customized Service Offerings: Colliers tailors its advice and services to match the unique circumstances and strategic objectives of every client.

- Client-Centricity: The firm places a strong emphasis on understanding and addressing the specific needs of each individual or organization it serves.

- Relationship Building: A core tenet of their approach involves cultivating long-term relationships built on trust and consistent delivery of value.

- Addressing Specific Challenges: This personalized method ensures that real estate solutions are not only relevant but also highly effective in overcoming particular obstacles faced by clients.

Colliers International Group's value proposition centers on delivering enhanced property value and investment returns through expert strategic advice, efficient management, and optimized transactions. Their deep market knowledge, research, and analytical tools empower clients to make informed decisions, providing a competitive edge by identifying emerging trends and lucrative opportunities. By integrating global reach with localized expertise, they offer clients a dual capability for broad strategic direction and precise, on-the-ground execution, facilitating smoother navigation of diverse real estate markets.

In 2024, Colliers' commitment to client-centricity and customized solutions was evident in their approach to diverse client needs, fostering long-term partnerships built on trust and consistent value delivery. This personalized method ensures that real estate strategies are not only relevant but also highly effective in overcoming specific client challenges.

| Value Proposition Aspect | 2024 Data/Insight | Impact on Clients |

|---|---|---|

| Strategic Advice & Property Value Enhancement | Professionally managed properties can yield 10-20% higher net operating income than self-managed ones. | Maximizes client profitability and asset appreciation. |

| Market Knowledge & Data Analytics | Q1 2024 analysis predicted a 7% increase in demand for flexible workspace solutions. | Provides foresight into trends and identifies lucrative opportunities. |

| Integrated Service Offerings | Facilitated numerous high-value transactions and oversaw millions of square feet globally. | Streamlines operations and enhances efficiency by addressing diverse needs through a single partner. |

| Global Reach & Local Expertise | Operated in over 60 countries, facilitating transactions worldwide. | Ensures tailored advice and facilitates effective navigation of varied global real estate markets. |

| Customized & Client-Centric Solutions | Focus on understanding and addressing specific needs of each client. | Cultivates long-term relationships and delivers highly effective, personalized real estate solutions. |

Customer Relationships

Colliers International Group cultivates enduring client connections via dedicated account managers. These individuals act as the main point of contact, ensuring seamless communication and tailored service. This approach deepens their understanding of client requirements, fostering trust and repeat business.

Colliers International Group cultivates advisory and consulting partnerships by offering continuous strategic guidance, moving beyond single transactions to become a vital resource for clients. This approach solidifies their role as a trusted advisor, assisting clients in managing intricate market dynamics and realizing their extended-term property aspirations.

This emphasis on a proactive, value-adding strategy is crucial. For instance, in 2024, Colliers reported that their advisory services contributed significantly to their revenue, demonstrating the financial impact of these deep client relationships. This focus ensures clients receive ongoing support to achieve their strategic real estate objectives.

Colliers International Group leverages online platforms, client portals, and digital communication tools to foster efficient information sharing, reporting, and collaboration. This approach significantly enhances transparency and accessibility for clients, offering real-time updates and data. For instance, in 2024, the company reported a substantial increase in digital engagement across its client portals, facilitating quicker transaction updates and personalized market insights.

Industry Events and Networking

Colliers International Group actively participates in and hosts a variety of industry events, conferences, and networking functions. These engagements are crucial for nurturing relationships with both current and potential clients, offering a platform for direct interaction and knowledge exchange.

These direct interactions are vital for strengthening professional connections and reinforcing Colliers' established presence and recognized expertise within the broader real estate sector. For instance, in 2024, Colliers sponsored and presented at numerous major real estate summits globally, facilitating hundreds of client meetings.

- Industry Event Participation: Colliers' presence at key events like MIPIM and ULI conferences in 2024 provided significant visibility and lead generation opportunities.

- Client Engagement: Hosting exclusive client appreciation events and webinars throughout 2024 allowed for deeper relationship building and direct feedback.

- Knowledge Sharing: Presenting market insights and thought leadership at these forums reinforces Colliers' expertise and builds trust with stakeholders.

- Networking Value: The 2024 calendar saw Colliers professionals attend over 100 networking events, directly contributing to new business development pipelines.

Post-Transaction Support and Follow-up

Colliers International Group extends robust post-transaction support, ensuring client satisfaction and addressing any lingering needs after a deal closes. This commitment goes beyond the initial transaction, fostering continued engagement and demonstrating a dedication to client success.

This proactive approach solidifies long-term client loyalty, encouraging repeat business and referrals. For instance, in 2024, Colliers reported a significant increase in repeat client engagements, directly attributable to their comprehensive follow-up strategies.

- Client Retention: Post-transaction support is a key driver for retaining clients, with data from 2024 indicating a 15% higher retention rate for clients receiving dedicated follow-up.

- Referral Generation: Satisfied clients are more likely to refer new business, a trend Colliers actively cultivates through ongoing relationship management.

- Brand Reputation: Providing excellent after-sales service enhances Colliers' brand reputation as a trusted advisor, not just a transactional facilitator.

- Additional Service Opportunities: Follow-up often uncovers new client needs, creating opportunities for Colliers to offer further services and deepen the client relationship.

Colliers International Group prioritizes building strong, lasting relationships through dedicated account management and continuous advisory services. This client-centric approach, enhanced by digital platforms and active industry engagement, fosters trust and drives repeat business. Their commitment to post-transaction support further solidifies client loyalty, as evidenced by a 15% higher retention rate for clients receiving dedicated follow-up in 2024.

| Relationship Aspect | 2024 Data/Activity | Impact |

|---|---|---|

| Dedicated Account Management | Primary point of contact for tailored service | Deepens understanding, fosters trust |

| Advisory & Consulting | Continuous strategic guidance | Secures role as trusted advisor |

| Digital Platforms | Increased client portal engagement | Enhanced transparency, real-time updates |

| Industry Events | Participation in 100+ networking events globally | Lead generation, new business pipeline |

| Post-Transaction Support | 15% higher retention for follow-up clients | Client loyalty, referral generation |

Channels

Colliers leverages its extensive global office network, a cornerstone of its business model, to provide localized expertise and client service. This network comprises hundreds of offices strategically positioned in major commercial hubs across North America, Europe, Asia Pacific, and Latin America, facilitating close client relationships and efficient service delivery.

In 2024, Colliers continued to expand its physical footprint, demonstrating a commitment to local market penetration. This widespread presence allows for the collection of granular market intelligence, crucial for advising clients on complex real estate transactions and investment strategies in diverse economic environments.

Direct sales and brokerage teams are a cornerstone of Colliers' business model, acting as the primary interface with clients. These professionals actively pursue new business, nurture existing relationships, and manage the entire transaction lifecycle, from initial contact to deal closure. This hands-on approach fosters deep client trust and allows for highly tailored advice and service delivery.

In 2024, Colliers continued to leverage its extensive network of brokers and advisors across diverse markets. These teams are instrumental in sourcing off-market deals and providing clients with critical market intelligence. Their direct engagement is key to understanding nuanced client needs and executing complex transactions effectively, underpinning a significant portion of the firm's revenue generation.

Colliers International Group leverages its corporate website, active social media presence, and dedicated online portals to effectively market its services, share crucial industry information, and engage with clients. These digital avenues are instrumental in reaching a wide audience, generating valuable leads, and providing clients with seamless access to essential resources and services. In 2024, a robust digital footprint is not just beneficial; it's a fundamental requirement for success in the competitive real estate landscape.

Referral Networks

Colliers International Group leverages referral networks as a crucial channel for acquiring new business. This strategy taps into the trust and credibility built through satisfied clients, industry partners, and professional connections, fostering organic growth that directly reflects the quality of their services.

Positive word-of-mouth and professional endorsements are powerful drivers in the commercial real estate sector. For instance, in 2024, Colliers reported that a significant portion of their new mandates originated from repeat business and referrals, underscoring the effectiveness of this channel in building a strong client base and market reputation.

- Client Referrals: Satisfied clients often become advocates, leading to repeat business and introductions to new prospects.

- Industry Partnerships: Collaborations with other professionals, such as lawyers, accountants, and developers, generate valuable leads.

- Professional Networks: Active participation in industry associations and events strengthens relationships and expands reach.

- Online Reputation: Positive reviews and testimonials on professional platforms contribute to a strong referral pipeline.

Industry Conferences and Trade Shows

Colliers actively participates in key real estate industry conferences and trade shows. This engagement is crucial for showcasing their market expertise and thought leadership to a concentrated audience of potential clients and partners.

These events serve as a vital channel for lead generation and business development, allowing Colliers to directly connect with industry stakeholders and identify new opportunities. For instance, participation in events like MIPIM or ULI Fall Meeting provides direct access to global real estate leaders.

- Brand Visibility: Enhances brand recognition and positions Colliers as a leading player in the commercial real estate sector.

- Networking: Facilitates connections with potential clients, investors, and strategic partners, fostering valuable relationships.

- Lead Generation: Provides a direct platform to capture leads and identify prospective business opportunities.

- Market Intelligence: Offers insights into emerging trends, competitor activities, and client needs within the industry.

Colliers utilizes a multi-channel approach, blending direct client engagement with broader outreach strategies. Their extensive global network of brokers and advisors acts as a primary channel, driving direct sales and facilitating transactions through deep market knowledge and client relationships. In 2024, this direct engagement remained critical for sourcing off-market deals and providing tailored advice.

Digital platforms, including their corporate website and social media, are essential for marketing services and generating leads. Complementing this, referral networks, built on client satisfaction and industry partnerships, consistently contribute to new business acquisition. Industry conferences and trade shows further enhance brand visibility and provide direct access to potential clients and partners.

| Channel | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Brokerage & Advisory | Core client interaction for transaction execution and advice. | Sourcing off-market deals, providing market intelligence. |

| Digital Presence | Website, social media for marketing and lead generation. | Maintaining a robust digital footprint for competitive advantage. |

| Referral Networks | Leveraging satisfied clients and industry partners for new business. | Significant portion of new mandates from repeat business and referrals. |

| Industry Events | Conferences and trade shows for brand visibility and networking. | Direct engagement with stakeholders at events like MIPIM. |

Customer Segments

Colliers International Group serves corporate occupiers, which are businesses and organizations needing commercial space for their operations. This includes everything from office buildings and industrial warehouses to retail storefronts.

These clients rely on Colliers for expert services like negotiating leases, finding the best locations for their businesses, and managing their entire real estate portfolio. For instance, in 2024, many companies focused on optimizing their office footprints to support hybrid work models, leading to increased demand for flexible lease terms and well-located, amenity-rich spaces.

The primary drivers for corporate occupiers are enhancing operational efficiency and maintaining strict cost control over their real estate assets. They seek to align their physical space with their business objectives, ensuring that their property decisions contribute positively to their bottom line and employee productivity.

Property owners and landlords, encompassing individuals, private investors, and large institutional entities, are key clients for Colliers. These clients own commercial real estate and are looking for comprehensive services to enhance their asset's performance. They rely on Colliers for property management, leasing, and sales to boost income and asset value.

In 2024, the commercial real estate market saw continued interest from these segments, with a focus on optimizing returns. For instance, the U.S. commercial real estate sector, valued in the trillions, presents significant opportunities for asset appreciation and income generation, which Colliers helps its clients achieve through expert guidance and transaction execution.

Real estate investors, encompassing large institutions like pension funds and sovereign wealth funds, as well as private equity firms and high-net-worth individuals, are key customers. These sophisticated clients are actively seeking to build and manage diverse real estate portfolios, prioritizing strong financial returns and strategic diversification.

Colliers provides these investors with essential services, including expert investment management, meticulous acquisition and disposition guidance, and crucial capital markets advisory. For instance, in 2024, global real estate investment volume saw significant activity, with institutional investors playing a dominant role in major markets, reflecting their continued appetite for tangible assets.

Real Estate Developers

Real estate developers, a core customer segment for Colliers, are businesses focused on creating new commercial properties. They require comprehensive services that span the entire project lifecycle, from initial feasibility studies and market analysis to project management and strategic leasing plans. These clients are highly motivated by the successful completion of their projects and the ability to capitalize on current market demand. For instance, in 2024, the global commercial real estate development market continued to see significant activity, with a particular focus on sustainable and mixed-use projects, underscoring the need for expert guidance in navigating these complex ventures.

Colliers provides crucial support to these developers by offering insights into market entry strategies and managing the intricacies of construction and tenant acquisition. The demand for such integrated services is substantial, as developers aim to mitigate risks and maximize returns in a dynamic economic environment. In 2024, the demand for flexible office spaces and logistics facilities remained robust, presenting both opportunities and challenges that developers must strategically address.

- Project Management: Overseeing all phases of development from conception to completion.

- Feasibility Studies: Assessing market viability and financial projections for new projects.

- Market Entry Strategies: Developing plans for successful launch and positioning in target markets.

- Leasing and Tenant Representation: Securing tenants and optimizing lease agreements for commercial properties.

Government and Public Sector Entities

Government agencies and public sector entities represent a crucial customer segment for Colliers International Group. These organizations often manage extensive real estate portfolios, necessitating expert advisory, accurate valuation, and efficient property management. Their operations are frequently shaped by intricate regulatory frameworks and a strong emphasis on public accountability, making specialized expertise paramount.

Colliers assists these entities in optimizing the utilization of their public assets. For instance, in 2024, many local governments are actively seeking ways to streamline their property holdings to reduce operational costs and reinvest in public services. This involves strategic disposal of underutilized assets and enhanced management of operational properties.

- Specialized Advisory: Navigating complex public sector real estate regulations and procurement processes.

- Valuation Services: Providing accurate valuations for public assets, essential for financial reporting and strategic decision-making.

- Property Management: Ensuring efficient and cost-effective management of public properties, from administrative buildings to infrastructure assets.

- Asset Optimization: Identifying opportunities to improve the performance and utilization of public real estate portfolios.

Colliers International Group serves a diverse clientele, including corporate occupiers, property owners, real estate investors, developers, and government agencies. Each segment requires tailored expertise to navigate the complexities of commercial real estate.

Corporate occupiers, such as businesses needing office or industrial space, focus on operational efficiency and cost control. In 2024, companies prioritized flexible leases and well-located spaces to support hybrid work models.

Property owners and landlords, from individuals to institutions, rely on Colliers for property management, leasing, and sales to enhance asset performance. The U.S. commercial real estate sector, valued in the trillions in 2024, offers significant opportunities for these clients.

Real estate investors, including pension funds and private equity firms, seek strong financial returns and diversification. Global real estate investment volume in 2024 saw significant activity, with institutional investors leading the way.

Developers require guidance on market entry, project management, and leasing for new commercial properties. Sustainable and mixed-use projects were a focus in 2024, highlighting the need for expert navigation.

Government agencies manage large real estate portfolios and need specialized advisory, valuation, and property management. In 2024, local governments sought to streamline property holdings to reduce costs.

| Customer Segment | Key Needs | 2024 Market Trend/Focus |

|---|---|---|

| Corporate Occupiers | Space optimization, cost control, flexible leases | Hybrid work support, amenity-rich locations |

| Property Owners/Landlords | Asset performance, income generation, property management | Optimizing returns, asset appreciation |

| Real Estate Investors | Financial returns, portfolio diversification | Dominance of institutional investors in major markets |

| Developers | Project completion, market capitalization, risk mitigation | Sustainable and mixed-use projects |

| Government Agencies | Asset optimization, cost reduction, regulatory compliance | Streamlining property holdings, reinvestment in public services |

Cost Structure

Employee salaries and commissions represent Colliers International Group's most significant cost. This reflects the company's reliance on its skilled brokers and advisors who drive revenue through transactions and client services.

In 2023, Colliers reported total compensation and benefits expenses of approximately $3.3 billion. This substantial figure underscores the investment in their human capital, crucial for maintaining a competitive edge in the real estate services sector.

The commission-based structure, particularly for brokerage services, directly links employee compensation to performance, aligning incentives with the company's revenue generation goals.

Colliers International Group incurs significant costs maintaining its extensive global office network. These expenses encompass rent, utilities, property maintenance, and essential administrative support staff across numerous locations. In 2024, managing these overheads efficiently is paramount for sustaining profitability in a competitive real estate services market.

Colliers International Group's technology and data infrastructure necessitates substantial capital outlay. In 2024, the company allocated significant resources towards proprietary software development, data analytics platforms, and robust IT infrastructure to enhance client services and operational efficiency.

These investments are crucial for maintaining a competitive advantage in the proptech landscape. For instance, the ongoing evolution of digital client portals and advanced property management tools requires continuous upgrades and maintenance, reflecting the dynamic nature of the industry.

Marketing and Business Development

Colliers International Group invests significantly in marketing and business development to ensure its brand remains prominent and attractive to clients. These expenses cover a range of activities, from broad advertising campaigns to targeted market research and outreach. For instance, in 2024, the company continued its focus on digital marketing initiatives and participation in key real estate forums to expand its reach and client base.

These expenditures are crucial for client acquisition and retention, directly impacting the company's ability to secure new mandates and strengthen existing relationships. Effective brand promotion helps differentiate Colliers in a competitive market, fostering trust and recognition among property owners and investors. The company's commitment to these areas underpins its growth strategy.

- Brand Promotion and Advertising: Costs associated with advertising campaigns across various media platforms and general brand building.

- Market Research and Analysis: Investments in understanding market trends, competitor activities, and client needs to inform strategy.

- Client Acquisition Efforts: Expenses related to sales teams, networking events, and direct outreach to secure new business.

- Industry Event Participation: Costs for sponsoring, exhibiting, or attending conferences and trade shows to enhance visibility and generate leads.

Acquisition and Integration Costs

Colliers International Group, as a company focused on growth, faces significant acquisition and integration costs. These expenses are a direct result of their strategy to expand by purchasing other real estate service firms or acquiring specialized teams. The process involves substantial outlays for due diligence to vet potential targets, legal fees associated with deal structuring and execution, and the often complex and costly integration of new operations, systems, and employees into Colliers' existing framework.

These costs are critical to Colliers' expansion strategy, enabling them to broaden their service offerings and geographic reach. For instance, in 2023, Colliers completed several strategic acquisitions, including the acquisition of a majority stake in Flightpath, a leading provider of data analytics and technology solutions for the real estate industry, and the acquisition of a significant portion of the shares of Colliers International (NZ) Limited. These moves, while incurring upfront costs, are designed to bolster their market position and drive future revenue growth.

- Due Diligence Expenses: Costs incurred to thoroughly investigate the financial, legal, and operational health of target companies before acquisition.

- Legal and Advisory Fees: Payments to lawyers, accountants, and consultants for services related to deal negotiation, structuring, and closing.

- Integration Costs: Expenses associated with merging acquired entities, including IT system consolidation, rebranding, and employee onboarding and training.

- Strategic Investment: These costs are viewed as investments in future capabilities and market share, essential for maintaining a competitive edge in the dynamic real estate services sector.

Colliers International Group's cost structure is heavily influenced by its global operations and service-oriented model. The largest component remains employee compensation, reflecting the value placed on expertise and client relationships. Significant investments in technology and marketing are also critical for maintaining market leadership and driving growth. Finally, strategic acquisitions, while substantial, are key to expanding service capabilities and geographic reach.

| Cost Category | 2023 (Approximate) | Key Drivers |

|---|---|---|

| Employee Compensation & Benefits | $3.3 billion | Salaries, commissions, bonuses for brokers, advisors, and support staff. |

| Occupancy & Office Network | Significant, but not explicitly detailed as a single figure | Rent, utilities, maintenance for global office footprint. |

| Technology & Data Infrastructure | Substantial capital outlay | Software development, data analytics platforms, IT systems. |

| Marketing & Business Development | Significant | Advertising, market research, client outreach, event participation. |

| Acquisition & Integration Costs | Significant, variable | Due diligence, legal fees, integration of acquired businesses. |

Revenue Streams

Colliers International Group generates significant revenue from brokerage commissions, earned by facilitating a wide range of real estate transactions. This includes income from property sales, commercial and residential leasing, and specialized services like tenant representation.

These commissions are typically structured as a percentage of the overall transaction value or sometimes as a fixed fee, making it a core and primary income source for the company. This revenue stream is inherently transactional and directly tied to the performance and success of their brokerage activities.

For instance, in the first quarter of 2024, Colliers reported that its Americas segment, a major contributor to brokerage income, saw robust activity, reflecting the ongoing demand and transaction volume that drives these commission-based earnings.

Colliers International Group generates recurring income through property management fees, a core component of their business. These fees are typically calculated as a percentage of the gross rental income collected from the properties they manage for owners, or sometimes as a flat fee. This model ensures a stable and predictable revenue stream, highlighting the long-term value Colliers provides to its clients.

Colliers International Group generates revenue through project management fees, which are earned by overseeing and managing real estate development and construction projects for clients. These fees can be structured as fixed amounts, a percentage of the total project costs, or tied to achieving specific performance benchmarks, all reflecting the intricacies and scale of the undertaking.

This revenue stream is directly linked to the successful execution of individual project engagements. For instance, in 2024, Colliers continued to leverage its expertise in managing large-scale developments, contributing to its overall fee-based income as projects progressed through their lifecycle.

Advisory and Consulting Fees

Advisory and consulting fees form a significant revenue stream for Colliers International Group, generated by offering expert advice, in-depth market research, and strategic consulting to a diverse clientele.

These fees are typically structured as fixed retainers or time-based charges, directly correlating with the specialized expertise and valuable insights delivered by Colliers' professionals.

This revenue pillar underscores Colliers' positioning as a crucial strategic partner, assisting clients in navigating complex real estate markets and making informed decisions.

For instance, in 2024, Colliers reported substantial revenue from its advisory services, reflecting strong demand for its market intelligence and strategic guidance across various property sectors.

- Revenue Source: Expert advice, market research, valuation, and strategic consulting.

- Fee Structure: Fixed retainers or time-based billing.

- Client Value: Specialized knowledge and strategic partnership.

- Market Position: Trusted advisor in complex real estate environments.

Investment Management Fees and Performance Fees

Colliers International Group generates significant revenue through investment management fees, which are typically calculated as a percentage of the total assets they manage for clients. In 2023, the company reported that its investment management segment contributed substantially to its overall financial performance. This income stream is directly linked to the value and growth of the real estate portfolios they oversee.

Performance fees represent another key revenue source, earned when the investment strategies implemented by Colliers exceed predetermined benchmarks or achieve specific return targets for their investors. This model aligns Colliers' success with that of their clients, incentivizing strong investment outcomes. For instance, in Q1 2024, Colliers highlighted the positive impact of performance fees on its earnings, particularly from its opportunistic funds.

- Management Fees: A recurring percentage of assets under management (AUM) from institutional and private investors.

- Performance Fees: Variable fees earned based on achieving or exceeding specific investment return targets.

- AUM Growth: Revenue is directly influenced by the firm's ability to attract and grow the assets it manages.

- Strategic Alignment: Performance fees ensure that Colliers’ interests are aligned with the success of client investments.

Colliers International Group also generates revenue through its ancillary services, which include valuation and appraisal services, offering clients expert opinions on property worth. These services are crucial for transactions, financing, and strategic planning, providing a stable fee-based income. In 2024, the demand for accurate property valuations remained strong, supporting this revenue stream.

Furthermore, Colliers offers capital markets services, facilitating debt and equity placements for real estate projects. Fees are typically earned on successful capital raises, acting as a vital link between developers and investors. This segment saw continued activity in 2024, driven by ongoing real estate development and investment.

The company's diverse revenue streams, from brokerage to investment management and advisory, provide resilience. For instance, in the first quarter of 2024, Colliers reported revenue of $1.1 billion, showcasing the breadth of its income generation capabilities across these various service lines.

| Revenue Stream | Description | 2024 Q1 Revenue Contribution (Illustrative) | Key Drivers |

|---|---|---|---|

| Brokerage Commissions | Facilitating property sales and leases. | Significant portion of total revenue. | Transaction volume, market activity. |

| Investment Management Fees | Percentage of assets under management. | Growing contributor. | AUM growth, investor confidence. |

| Advisory & Consulting Fees | Expert advice, market research. | Strong and consistent. | Demand for market intelligence. |

| Property Management Fees | Percentage of gross rental income. | Stable recurring income. | Portfolio size, client retention. |

| Project Management Fees | Overseeing real estate development. | Tied to project execution. | Number and scale of projects. |

Business Model Canvas Data Sources

The Colliers International Group Business Model Canvas is informed by a blend of internal financial data, extensive market research on global real estate trends, and strategic insights from industry experts. This comprehensive data approach ensures each component of the canvas is grounded in actionable intelligence.