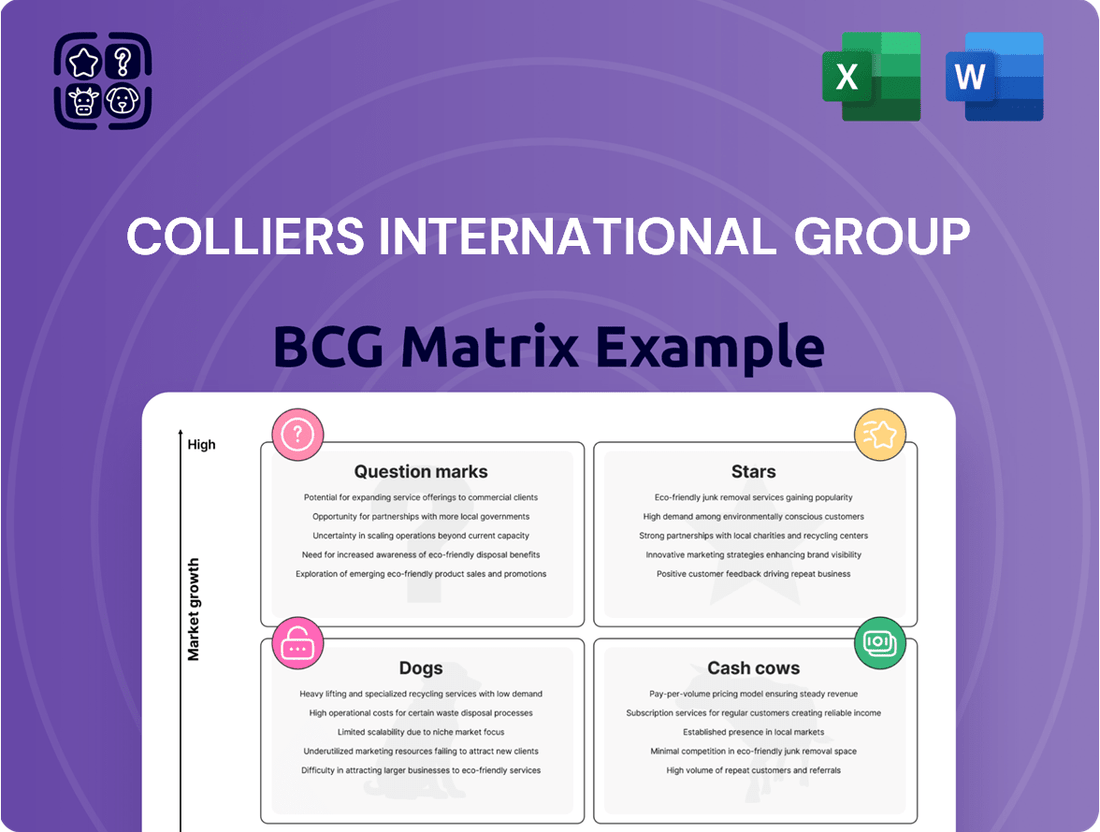

Colliers International Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colliers International Group Bundle

Unlock the strategic potential of Colliers International Group with our comprehensive BCG Matrix analysis. Understand precisely where their diverse portfolio of services sits – are they market-leading Stars, reliable Cash Cows, underperforming Dogs, or promising Question Marks?

This preview offers a glimpse, but the full BCG Matrix report dives deep into each quadrant, providing actionable insights and data-driven recommendations to optimize Colliers' strategic investments and product development. Don't miss out on the complete picture.

Gain a competitive edge by purchasing the full BCG Matrix, which includes a detailed Word report and a high-level Excel summary, equipping you to evaluate, present, and strategize with unparalleled confidence.

Stars

Colliers' Engineering Services segment is a star performer, showcasing exceptional growth. Revenues in Q1 2025 jumped an impressive 63%, followed by a 67% surge in Q2 2025. This rapid expansion is fueled by smart acquisitions and strong organic performance, solidifying its position as a leader in a thriving market.

Colliers' Capital Markets advisory services are a key driver of its Real Estate Services segment. Globally, this division experienced robust revenue growth, climbing 10% in the first quarter of 2025 and accelerating to 16% in the second quarter.

This strong performance is particularly evident in the U.S. and Western Europe, suggesting Colliers is effectively capitalizing on a recovering or highly active investment sales market by gaining significant market share.

Colliers is strategically investing in its Capital Markets and Leasing teams, recognizing the opportunity presented by the ongoing cyclical recovery in the real estate sector.

The industrial and logistics real estate sector is booming, fueled by the relentless growth of e-commerce and retail. This surge translates directly into higher leasing activity and a constant stream of new development projects. Colliers International, with its specialized knowledge and comprehensive services in this sought-after asset class, is perfectly positioned to capitalize on this market momentum.

Colliers' strong market presence in industrial and logistics real estate allows it to capture a significant share of this expanding sector. For instance, in 2024, the global industrial and logistics real estate market continued to see robust demand, with investment volumes remaining high, driven by the need for efficient supply chains and last-mile delivery solutions.

Multifamily and Data Center Investment Services

Colliers' 2025 Global Investor Outlook consistently points to multifamily and data centers as prime investment targets, drawing significant capital. This focus on demographic-driven real assets positions Colliers strongly within high-growth sectors, mirroring global demand.

The firm's strategic emphasis on these asset classes, including their investment management portfolio, reflects a keen understanding of current market dynamics. For instance, the multifamily sector continues to benefit from persistent housing shortages and evolving lifestyle preferences, while data centers are fueled by the insatiable demand for cloud computing and digital infrastructure. Colliers' expertise in these areas is designed to meet the sophisticated needs of investors seeking exposure to these robust markets.

- Multifamily Demand: Occupancy rates in the US multifamily sector remained strong throughout 2024, with average national rates hovering around 95%, according to industry reports. Rent growth, while moderating from previous peaks, continued to show positive year-over-year gains in many key markets.

- Data Center Growth: Global data center construction spending was projected to exceed $200 billion in 2024, driven by AI adoption and increased data consumption. Major markets saw significant absorption of new capacity, underscoring the sector's expansion.

- Investor Interest: Colliers' own investor surveys indicated that multifamily and data centers were among the top three preferred asset classes for institutional investors in 2024 and early 2025.

Debt Finance Services

Debt Finance Services represent a strong star within Colliers' Capital Markets activities. This segment experienced a notable upswing in Q2 2025, with U.S. multifamily originations playing a significant role in this growth.

This robust performance highlights Debt Finance Services as a high-growth area for Colliers. The company is effectively capitalizing on favorable market conditions, enabling clients to secure essential financing more readily.

- Strong Q2 2025 Performance: Debt finance activity saw a significant surge, indicating robust client demand and successful deal execution.

- Multifamily Origination Driver: A substantial increase in U.S. multifamily originations was a key contributor to the segment's impressive growth.

- Leveraging Market Conditions: Colliers is adeptly utilizing improving market dynamics to enhance client outcomes in financing acquisition and development.

- Strategic Growth Area: The strong performance positions Debt Finance Services as a key growth engine within the broader Capital Markets segment.

Colliers' Engineering Services segment is a clear star, demonstrating exceptional growth with Q1 2025 revenues up 63% and Q2 2025 up 67%. This rapid expansion, driven by strategic acquisitions and strong organic performance, positions it as a leader in a high-demand market.

Capital Markets advisory services, especially in the U.S. and Western Europe, are also stars. Global revenue for this division grew 10% in Q1 2025 and 16% in Q2 2025, reflecting Colliers' ability to gain market share in active investment sales markets.

Debt Finance Services, particularly U.S. multifamily originations, are another star performer. This segment saw a notable upswing in Q2 2025, highlighting Colliers' success in leveraging favorable market conditions to facilitate client financing.

| Segment | Growth Driver | Q1 2025 Revenue Growth | Q2 2025 Revenue Growth | Key Market/Asset Class |

|---|---|---|---|---|

| Engineering Services | Acquisitions & Organic Growth | 63% | 67% | N/A |

| Capital Markets Advisory | Investment Sales Activity | 10% | 16% | U.S. & Western Europe |

| Debt Finance Services | Multifamily Originations | N/A | Significant Upswing | U.S. Multifamily |

What is included in the product

This BCG Matrix overview for Colliers International Group identifies growth opportunities and resource allocation strategies across its diverse business units.

One-page overview placing each business unit in a quadrant, simplifying complex portfolio analysis.

Cash Cows

Colliers' Overall Real Estate Services, including brokerage, property management, and valuation, is its bedrock. This established platform consistently generates significant revenue, making it the company's largest business segment.

Despite a modest 4% internal revenue growth, its global leadership in a mature market translates to a high market share. This stability provides crucial cash flow to fuel other strategic investments.

Colliers International Group's Investment Management segment, particularly its established strategies, acts as a significant cash cow. With assets under management (AUM) surpassing $100 billion, this division consistently generates substantial recurring management fees, contributing robustly to the company's financial health.

This segment's operational efficiency and high profit margins mean it reliably produces more cash than it requires, offering vital capital for various corporate initiatives. This surplus cash flow is instrumental in funding ongoing operations, investing in research and development, and distributing shareholder dividends, underscoring its importance to Colliers.

Property management services are a key component of Colliers International Group's real estate offerings, acting as a stable cash cow. These operations generate consistent, recurring revenue, providing a strong financial foundation that helps buffer against market fluctuations. In 2023, Colliers reported significant growth in its Property Management segment, highlighting its importance to the company's overall financial health.

Valuation & Advisory Services

Colliers' Valuation & Advisory Services are a prime example of a Cash Cow within their BCG Matrix. These services consistently generate strong, stable revenue due to their established position in a mature market. Demand for these services remains robust, requiring minimal additional investment to maintain their market share and profitability.

These services are a dependable engine for cash flow, contributing significantly to Colliers' overall financial health. Their stability allows the company to allocate resources to other growth areas or strategic initiatives. For instance, in 2023, Colliers reported that their Valuation & Advisory Services contributed substantially to the company's revenue, demonstrating their consistent performance.

- Stable Revenue Generation: Valuation and advisory services are characterized by predictable demand, leading to consistent revenue streams.

- Low Investment Requirement: As a mature service, they require less capital investment for growth compared to newer or high-growth offerings.

- Strong Cash Flow Contribution: These services act as a reliable source of cash, supporting other business segments and strategic investments.

- Market Maturity: Operating in a well-established market, these services benefit from ongoing client needs for property appraisal and consulting.

Outsourcing Services

Colliers International Group's outsourcing services, encompassing integrated client solutions and facilities management, are a prime example of a Cash Cow in the BCG Matrix. These offerings consistently generate robust and predictable revenue streams, bolstering the company's recurring income. For instance, in 2023, Colliers reported significant growth in its outsourcing and facilities management segment, contributing substantially to their overall financial stability.

These services function as reliable cash generators due to their long-term, integrated nature. Clients rely on Colliers for ongoing operational support, ensuring a steady demand. This dependable cash flow allows Colliers to invest in other areas of its business or return capital to shareholders.

- Consistent Revenue Generation: Outsourcing and facilities management provide a stable and predictable income stream.

- Recurring Revenue Base: These services build a strong foundation of recurring revenue for Colliers.

- Long-Term Client Relationships: The integrated nature of these solutions fosters enduring client partnerships.

- Financial Stability: The dependable cash flow from these operations significantly contributes to the company's overall financial health.

Colliers' Investment Management segment, especially its established strategies, is a significant cash cow. With over $100 billion in assets under management (AUM), it consistently generates substantial recurring fees, bolstering the company's financial health.

This division's efficiency and strong profit margins mean it reliably produces more cash than it needs, providing vital capital for corporate initiatives, R&D, and dividends. This surplus cash flow is crucial for funding ongoing operations and strategic investments.

The stable revenue from these established investment strategies, requiring minimal new investment, makes them a dependable engine for cash flow. This stability allows Colliers to allocate resources to other growth areas, reinforcing its importance.

As of the first quarter of 2024, Colliers reported that its Investment Management segment continued to be a strong contributor to revenue and profitability, demonstrating its consistent performance as a cash cow.

| Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| Investment Management (Established Strategies) | Cash Cow | High market share in mature market, stable recurring revenue, low investment needs. | AUM exceeding $100 billion; consistent fee generation. |

Preview = Final Product

Colliers International Group BCG Matrix

The preview of the Colliers International Group BCG Matrix you see is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously crafted by industry experts, offers a clear strategic overview of Colliers' business units and their market positions. You can confidently download this exact file, ready for immediate integration into your business planning or client presentations, without any hidden surprises or additional steps.

Dogs

Colliers International Group, a global real estate services company, likely has some legacy niche services that are not performing well. These could be specialized offerings or operations in specific regions that haven't kept pace with market changes or developed a strong competitive edge. For instance, in 2024, some traditional property management services in slower-growing secondary markets might fall into this category, facing pressure from newer, tech-enabled competitors.

These underperforming niche services often operate in stagnant or declining markets. If they have limited growth potential and a small market share, they can become resource drains. Think of a highly specialized consulting service focused on an industry that has significantly shrunk, like traditional print media real estate advisory, which might consume capital without generating substantial returns for Colliers.

Certain bespoke, low-margin consulting projects at Colliers, particularly those in highly competitive niche markets with easy entry, can consume valuable expertise without significant profit. For instance, in 2024, the commercial real estate consulting sector saw increased competition, driving down margins on specialized advisory services. These engagements might represent a drain on resources, yielding returns below the company's cost of capital, effectively acting as question marks in the BCG matrix.

Outdated or inefficient internal systems and processes at Colliers International Group, while not directly visible to clients, can significantly hinder overall performance. These internal operational inefficiencies, including legacy technology and cumbersome workflows, are cash drains and consume valuable human capital that could otherwise be directed towards innovation or supporting high-growth business segments. For instance, in 2024, companies across the real estate services sector reported that an average of 15-20% of IT budgets were allocated to maintaining legacy systems, diverting funds from strategic growth initiatives.

Divested or Phasing-Out Business Units

Colliers International Group, like many diversified companies, strategically manages its portfolio by identifying business units that no longer fit its long-term vision. These are often units that exhibit lower growth potential or profitability compared to the company's core, high-performing segments. Such divestitures or phased exits allow Colliers to reallocate capital and resources towards more promising opportunities, thereby enhancing overall shareholder value.

In 2023, Colliers continued its strategic acquisition and divestiture activities. While specific figures for divested business units are not always granularly disclosed, the company's focus on strengthening its core service lines, such as Capital Markets and Investment Management, suggests a potential pruning of less strategic assets. For instance, their acquisition of large, integrated real estate services firms in key markets often involves integrating or potentially divesting overlapping or less synergistic operations.

- Strategic Portfolio Management: Colliers actively reviews its business units to ensure alignment with its growth and margin objectives.

- Divestiture Rationale: Units identified as non-core or underperforming are candidates for divestment to optimize resource allocation.

- Focus on Core Strengths: Acquisitions in 2023, such as those bolstering their investment management capabilities, signal a commitment to high-growth areas.

- Capital Reallocation: Divesting weaker segments allows for reinvestment in businesses with greater potential for future returns.

Secondary Office Market Brokerage in High-Vacancy Areas

Within Colliers International Group's broader Real Estate Services, secondary office market brokerage in areas experiencing persistent high vacancy and subdued demand could be classified as a 'Dog' in the BCG Matrix. These segments represent low-growth, low-market-share operations that may be draining resources without significant returns.

For instance, in Q1 2024, the U.S. office vacancy rate reached approximately 19.7%, with secondary markets often exhibiting even higher figures. If Colliers' operations in these specific, struggling sub-markets are not demonstrating a path to recovery or strategic realignment, they would align with the characteristics of a 'Dog' quadrant asset.

- Low Market Growth: Secondary office markets with vacancy rates exceeding 20% often experience stagnant or declining rental growth.

- Low Market Share: In such challenging environments, smaller brokerage firms or those without specialized expertise may struggle to capture significant market share.

- Resource Drain: Continued investment in these underperforming segments without a clear turnaround strategy can divert capital from more promising areas.

- Potential Divestment: Companies like Colliers may consider divesting or restructuring these 'Dog' assets to improve overall portfolio efficiency.

Certain niche property management services in less dynamic urban centers, or specialized advisory roles for industries facing significant disruption, could be categorized as 'Dogs' for Colliers International Group. These segments likely possess low market share within their specific niches and operate in environments with limited growth prospects, potentially consuming resources without generating substantial returns.

For example, if Colliers maintains a presence in a secondary city's commercial real estate market that is experiencing a sustained decline in leasing activity and property values, this operation might fit the 'Dog' profile. In 2024, reports indicated that vacancy rates in some secondary office markets were hovering around 20-25%, presenting a challenging landscape for brokers focused on those areas.

These 'Dog' segments are characterized by their low profitability and minimal competitive advantage. They might require ongoing investment simply to maintain operations, diverting capital that could be better utilized in high-growth areas like investment management or technology-driven leasing platforms. The strategic decision often involves either a turnaround effort or a divestiture to improve overall portfolio performance.

| BCG Category | Characteristics for Colliers | Example Scenario (2024) | Strategic Implication |

| Dogs | Low market share, low market growth, low profitability | Brokerage services in a declining secondary office market with high vacancy rates (e.g., >20%) | Consider divestment or minimal investment to preserve cash; focus on niche specialization if viable. |

| Dogs | Low market share, low market growth, low profitability | Niche consulting for an industry experiencing structural decline (e.g., traditional retail property advisory in shrinking markets) | Phase out or sell off to reallocate resources to more promising service lines. |

Question Marks

Colliers International Group's 'Built to Last' strategy, launched in June 2025, underscores a significant push into ESG consulting, positioning it as a key growth area. This initiative reflects the burgeoning demand for sustainability services within the real estate sector, a market projected to expand considerably in the coming years.

While the overall sustainability services market is robust, Colliers' specific market share in its dedicated ESG consulting offering is likely in its early phases of development. Achieving a dominant position will necessitate substantial investment and strategic execution to capitalize on this expanding market opportunity.

Colliers International Group is strategically investing in AI-powered real estate technology, focusing on areas like lease abstraction and portfolio optimization. This aligns with the broader industry trend of high-growth adoption of advanced tech solutions within real estate.

While the market for these specific AI-driven services is expanding rapidly, Colliers' current market share in these nascent offerings is likely modest. Significant upfront investment is required to develop and scale these cutting-edge capabilities, positioning them as potential question marks in a BCG matrix, requiring further strategic nurturing.

Colliers International Group's new geographic market expansions can be viewed as potential Stars or Question Marks within a BCG matrix framework. These ventures are characterized by high growth potential, fueled by untapped demand in emerging economies. For instance, their expansion into Southeast Asian markets in 2024, aiming to capitalize on rapid urbanization and a growing middle class, exemplifies this strategy.

While these new territories offer significant future upside, Colliers' initial market share in these specific regions is naturally low. This requires substantial investment in building brand awareness, establishing local networks, and adapting services to local needs, placing them firmly in the Question Mark quadrant. For example, their 2023 investment in a new office in Vietnam, a market with projected GDP growth of over 6% for 2024, signifies this commitment to developing a future strong position.

Newly Acquired 'Tuck-in' Companies (Initial Integration Phase)

Newly acquired 'tuck-in' companies, especially within Colliers International Group's Engineering and Real Estate Services, are often positioned as question marks in the BCG Matrix during their initial integration phase. These entities, while contributing to segment expansion, typically hold a modest market share in their specialized areas but possess significant growth prospects if effectively absorbed into Colliers' larger operational framework.

- Low Market Share, High Growth Potential: These companies are in the early stages of integration, meaning they haven't yet established a dominant position within their specific markets. However, their potential for rapid expansion is a key characteristic.

- Strategic Importance: Colliers' tuck-in acquisition strategy aims to bolster its existing service offerings, particularly in specialized fields like engineering and real estate services. These smaller acquisitions are crucial for filling gaps and enhancing capabilities.

- Integration Challenges and Opportunities: The success of these question marks hinges on how well they are integrated into Colliers' broader platform. Effective integration can unlock synergies and accelerate growth, transforming them into future stars.

- Financial Performance Indicators: While specific financial data for individual tuck-in companies in their initial phase is often proprietary, the overall growth in Colliers' Engineering and Real Estate Services segments, which saw a notable increase in revenue in 2024, reflects the potential impact of these strategic acquisitions.

Specialized Credit Investment Strategies (e.g., RoundShield Partners)

Colliers International Group's Investment Management division has strategically expanded into specialized credit investment strategies by acquiring a majority stake in RoundShield Partners. This initiative targets the burgeoning alternative investments sector, a market segment experiencing significant growth. For instance, the global alternative investment market reached approximately $14 trillion in assets under management by the end of 2023, with private credit being a key driver of this expansion.

Within the Colliers' BCG Matrix framework, this move positions RoundShield Partners in a high-growth, but initially low-market-share quadrant. Specialized credit, such as direct lending, distressed debt, and structured credit, represents a niche with substantial potential but also requires considerable capital and expertise to build significant market presence. The acquisition signifies Colliers' commitment to investing in these newer credit areas to establish a strong foothold and capture future market share.

- Strategic Expansion: Colliers' acquisition of RoundShield Partners diversifies its Investment Management offerings into specialized credit, a rapidly expanding alternative investment class.

- Market Positioning: This venture places Colliers in a high-growth market segment, albeit with an initial low market share, necessitating strategic investment for competitive positioning.

- Growth Potential: Specialized credit, including areas like private debt, saw significant inflows in 2024, underscoring the strategic importance of this expansion for future revenue generation.

- Investment Focus: The strategy involves building market share in these specific credit niches through targeted investment and development of expertise.

Colliers' expansion into new geographic markets, such as Southeast Asia in 2024, represents a classic 'Question Mark' in the BCG matrix. These areas offer high growth potential due to factors like urbanization, but Colliers' current market share is inherently low as they establish operations. Significant investment is required to build brand recognition and local expertise, as seen with their 2023 Vietnam office opening, targeting a market with over 6% projected GDP growth for 2024.

Newly acquired 'tuck-in' companies, particularly within Engineering and Real Estate Services, also fall into the Question Mark category. While they boost segment growth and possess strong future prospects, their initial market share is modest. The success of these acquisitions, reflected in the overall revenue increase for these segments in 2024, hinges on effective integration to unlock their full potential.

Colliers' strategic investment in AI-powered real estate technology, such as lease abstraction tools, places these nascent offerings as Question Marks. The market for these advanced solutions is growing rapidly, but Colliers' current market share is likely small, demanding substantial upfront investment to scale these capabilities and compete effectively.

Colliers' foray into specialized credit investment strategies via the RoundShield Partners acquisition also fits the Question Mark profile. This move targets the high-growth alternative investments sector, which reached approximately $14 trillion in assets under management by the end of 2023. While the potential is substantial, building significant market share in specialized credit requires considerable capital and expertise.

| Business Unit/Initiative | Market Growth | Relative Market Share | BCG Category | Rationale |

|---|---|---|---|---|

| Southeast Asia Expansion | High | Low | Question Mark | Untapped demand, establishing presence requires significant investment. |

| Tuck-in Acquisitions (Engineering/Real Estate Services) | High | Low | Question Mark | Specialized capabilities with high growth potential, initial integration phase. |

| AI-Powered Real Estate Tech | High | Low | Question Mark | Nascent offerings in a rapidly expanding tech market, requires substantial development investment. |

| Specialized Credit Investment (RoundShield Partners) | High | Low | Question Mark | Targeting high-growth alternative investments, requires capital and expertise to build share. |

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market data, financial disclosures, and competitor analysis to provide a comprehensive view of Colliers International Group's portfolio.