COFORGE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COFORGE Bundle

Coforge demonstrates robust strengths in its digital transformation capabilities and a strong client base, but faces challenges in talent retention and intense market competition. Understanding these dynamics is crucial for any strategic investor or business planner.

Want the full story behind Coforge's market positioning, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Coforge has showcased impressive financial strength, marked by substantial revenue and profit increases. For example, the fourth quarter of fiscal year 2025 saw a remarkable 47% year-on-year revenue jump, alongside a 16.5% rise in net profit. This consistent performance extended through fiscal years 2024 and 2025, with the company reliably meeting its annual growth targets.

Coforge’s strength lies in its deep domain expertise within specific industries such as banking, financial services, insurance, travel, and healthcare. This focused approach allows them to deeply understand client needs and develop highly tailored digital transformation solutions. For instance, their significant investments in industry-specific platforms and talent are evident in their consistent revenue growth in these sectors, with the BFSI segment alone contributing a substantial portion of their overall revenue in fiscal year 2024.

Coforge demonstrates a robust capability in securing substantial client agreements, a key factor bolstering its forward-looking order book. This strength is underscored by significant wins, such as the $1.56 billion deal with Sabre announced in Q4 FY25.

This strategic acquisition of large deals directly translates into a healthier executable order book, providing a strong foundation for future revenue. The company’s executable order book for the upcoming twelve months saw an impressive year-on-year surge of 47.7%, reaching $1.5 billion.

Focus on Emerging Technologies and AI Integration

Coforge's strategic emphasis on emerging technologies, particularly AI, is a significant strength. They are actively integrating AI, cloud, data analytics, and automation into their offerings, positioning them at the forefront of digital transformation. This focus is evidenced by their launch of platforms like Quasar GenAI Central and the establishment of a Copilot Innovation Hub with Microsoft, designed to accelerate enterprise AI adoption.

Their commitment to innovation is further highlighted by investments in AI capabilities. For instance, Coforge reported a robust growth in its AI and Analytics segment, with revenues increasing by approximately 25% year-over-year for the fiscal year ending March 31, 2024. This demonstrates a clear market demand for their AI-driven solutions and their ability to capitalize on this trend.

- Leveraging AI and Cloud: Coforge is actively incorporating advanced technologies like AI, cloud computing, data analytics, and automation into its service portfolio.

- AI Platform Launches: The company has introduced key AI platforms such as Quasar GenAI Central and a Quasar Marketplace, showcasing its commitment to developing proprietary AI solutions.

- Strategic Partnerships for AI: Coforge has partnered with Microsoft to establish a Copilot Innovation Hub, aiming to expedite the adoption of enterprise AI solutions for its clients.

- Revenue Growth in AI/Analytics: The AI and Analytics segment experienced significant growth, with revenues up around 25% year-over-year for FY24, indicating strong market traction for these capabilities.

Low Attrition Rate and Growing Workforce

Coforge demonstrates remarkable employee stability, boasting an attrition rate that stands out as one of the lowest within the competitive IT sector. This suggests a highly engaged and satisfied workforce, crucial for sustained project delivery and client relationships.

The company's strategic workforce expansion is a testament to its growth trajectory and effective talent management. For instance, Coforge reported a net addition of 1,000 employees in the third quarter of fiscal year 2024, bringing its total headcount to over 23,000.

This consistent growth in headcount, coupled with low attrition, signifies a robust talent pipeline and a positive employer brand. Such a stable and expanding workforce is a significant asset, enabling Coforge to scale operations and meet increasing client demands effectively.

- Low Attrition: Coforge's attrition rate remains significantly below the industry average, fostering continuity and expertise.

- Workforce Expansion: The company has actively recruited, adding approximately 1,000 net new employees in Q3 FY24.

- Growing Talent Pool: With a total workforce exceeding 23,000 employees, Coforge is building a substantial and skilled talent base.

- Employee Retention: This combination of low attrition and growth highlights strong employee loyalty and effective retention strategies.

Coforge's financial performance is a significant strength, evidenced by strong revenue and profit growth. For example, Q4 FY25 saw a 47% year-on-year revenue increase and a 16.5% net profit rise, with consistent annual growth targets met through FY24 and FY25.

The company's deep industry expertise, particularly in BFSI, travel, and healthcare, allows for tailored digital transformation solutions. This specialization is reflected in their robust revenue generation from these sectors, with BFSI being a major contributor in FY24.

Coforge's ability to secure large client deals, such as the $1.56 billion Sabre agreement in Q4 FY25, bolsters its future revenue prospects. This is further supported by a 47.7% year-on-year increase in its executable order book, reaching $1.5 billion for the upcoming twelve months.

A key strength is Coforge's strategic focus on emerging technologies like AI, cloud, and data analytics, exemplified by platforms like Quasar GenAI Central and the Microsoft Copilot Innovation Hub. Their AI and Analytics segment saw approximately 25% year-over-year revenue growth in FY24, demonstrating market demand for these advanced capabilities.

| Metric | FY24 (Approx.) | Q4 FY25 (YoY Growth) | Key Deals (FY25) |

|---|---|---|---|

| Revenue Growth | Consistent Target Achievement | 47% | Sabre ($1.56B) |

| Net Profit Growth | N/A | 16.5% | N/A |

| AI & Analytics Growth | ~25% | N/A | N/A |

| Executable Order Book | N/A | 47.7% increase | N/A |

What is included in the product

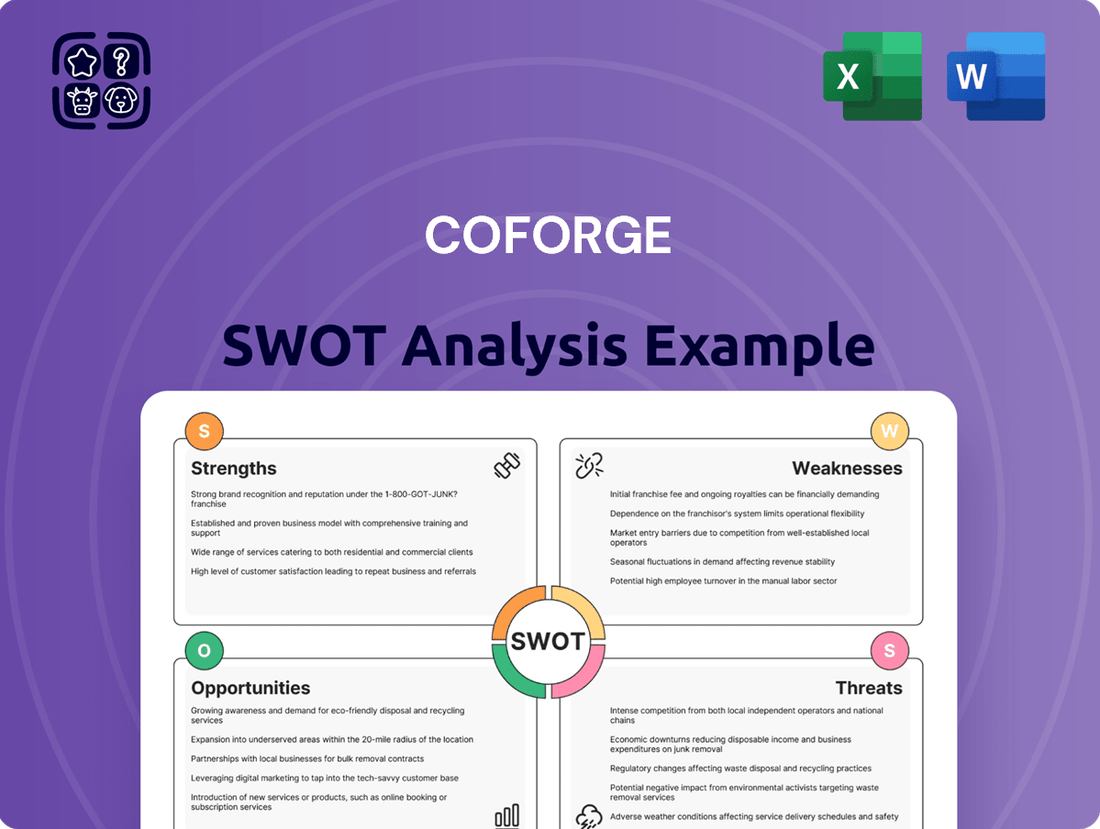

Delivers a strategic overview of COFORGE’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies key strengths and weaknesses to proactively address potential threats and capitalize on opportunities.

Weaknesses

Coforge's deep specialization in sectors like Banking, Financial Services, Insurance (BFSI), Travel, and Healthcare, while a core strength, also creates a significant weakness due to concentration risk. A slowdown or disruption within these key industries could have a disproportionately negative effect on the company's overall financial performance.

For instance, if the BFSI sector, which represented a substantial portion of Coforge's revenue in fiscal year 2024, experiences a significant downturn due to regulatory changes or economic recession, Coforge's growth trajectory could be severely impacted. This reliance means that a localized industry problem can quickly become a company-wide challenge.

Coforge's acquisition strategy, including the notable purchase of Cigniti Technologies, presents a potential weakness if integration proves difficult. In a market characterized by subdued demand, successfully merging new entities without creating operational friction or diluting profitability is a significant hurdle. This can manifest as increased costs or slower revenue realization than initially projected.

While Coforge has seen revenue expansion, profitability has faced headwinds. For example, in the first quarter of fiscal year 2026, the company's net profit, despite a substantial year-on-year increase, fell short of analyst expectations. This performance highlights ongoing margin pressures that the company is navigating.

Furthermore, the same Q1 FY26 results indicated a sequential decline in the Earnings Before Interest and Taxes (EBIT) margin. This dip suggests that while the top line is growing, the cost of generating that revenue is also increasing, impacting the company's ability to translate sales into profits effectively.

Market Volatility and Share Price Fluctuations

Coforge's share price has demonstrated considerable volatility, with notable fluctuations observed. For instance, in the fiscal year 2024, the company's stock experienced periods of sharp declines followed by swift recoveries, a pattern that can create unease for investors prioritizing capital preservation and predictable income streams. This inherent price instability often mirrors broader market sentiment and the company's reaction to quarterly financial disclosures.

The sensitivity of Coforge's stock to market shifts and specific company news, such as earnings announcements, contributes to its price swings. This can be seen in the reactions of its share price to key financial reports throughout 2024, where significant drops or surges were recorded in response to performance metrics and future guidance. Such movements highlight the challenges in forecasting short-term returns for investors.

- High Price Volatility: Coforge's stock has exhibited significant upswings and downturns within brief intervals during fiscal year 2024.

- Investor Concern: This volatility can be a deterrent for investors seeking stable, predictable returns on their investments.

- Market Sensitivity: Share price fluctuations are often tied to broader market uncertainties and the impact of Coforge's earnings reports.

- Example: Specific earnings releases in 2024 saw immediate and pronounced stock price reactions, underscoring this sensitivity.

Dependency on Macroeconomic Conditions

Coforge's performance is significantly tied to broader economic trends. The company has noted that a generally tight macro demand outlook has previously led to slower growth in its executable order book. This reliance on external economic conditions presents a vulnerability, as challenging macroeconomic environments can directly hinder future revenue expansion and overall financial stability.

For instance, during periods of economic contraction or uncertainty, clients may scale back IT spending, directly impacting Coforge's project pipeline and revenue realization. This sensitivity to the global economic climate means that factors outside of the company's direct control can materially affect its business trajectory.

- Macroeconomic Sensitivity: Coforge's revenue growth is susceptible to fluctuations in global IT spending, which is heavily influenced by macroeconomic conditions.

- Order Book Impact: Challenging economic environments have historically led to a slowdown in the growth of Coforge's executable order book, affecting future revenue streams.

- External Dependency: The company's financial performance exhibits a notable dependency on external economic factors rather than solely internal operational efficiencies.

Coforge's concentrated revenue streams, particularly from BFSI and Travel, pose a significant risk. A downturn in these sectors, which together accounted for a substantial portion of revenue in fiscal year 2024, could disproportionately impact the company. For example, if the BFSI sector faces regulatory headwinds or economic contraction, Coforge's growth could be severely hampered.

The company's integration of acquisitions, like Cigniti Technologies, presents a potential hurdle. Difficulties in merging operations could lead to increased costs or slower revenue realization, especially in a market with subdued demand. This risk was evident in the Q1 FY26 results, where while revenue grew, net profit missed expectations, indicating margin pressures.

Profitability challenges are also a concern, with the EBIT margin showing a sequential decline in Q1 FY26. This suggests that while Coforge is expanding its top line, the costs associated with generating that revenue are rising, impacting its ability to translate sales into profits effectively.

Coforge's stock has shown considerable volatility, with notable price swings throughout fiscal year 2024. This instability can deter investors seeking predictable returns and highlights the company's sensitivity to market sentiment and earnings reports. For instance, specific earnings releases in 2024 triggered immediate and pronounced stock price reactions.

Full Version Awaits

COFORGE SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You can see the detailed breakdown of Coforge's Strengths, Weaknesses, Opportunities, and Threats here. Purchase unlocks the complete, in-depth analysis.

Opportunities

The global digital transformation market is booming, and Coforge is well-positioned to capitalize on this trend. With businesses increasingly investing in modernizing their IT infrastructure and operations, there's a substantial opportunity for Coforge to expand its offerings in application modernization, cloud migration, and data analytics. For instance, the digital transformation market was valued at approximately $500 billion in 2023 and is projected to reach over $1 trillion by 2027, showcasing significant growth potential.

Coforge's established expertise in areas like cloud computing and data analytics directly addresses the core needs of companies undergoing digital shifts. This allows them to offer integrated solutions that drive efficiency and innovation for their clients. The company's commitment to these high-demand services means they can capture a larger share of this expanding market, potentially boosting revenue streams significantly in the coming years.

The widespread integration of artificial intelligence across various sectors offers a significant avenue for Coforge to innovate and launch novel AI-driven solutions and platforms. Their proactive investments, including the Copilot Innovation Hub and Quasar GenAI Central, strategically place them to harness this burgeoning market demand.

Strategic partnerships are crucial for expanding Coforge's capabilities and market presence. For instance, their collaboration with Nylas to enhance Salesforce ecosystem integration directly addresses a growing demand for seamless data exchange within the CRM space. This type of alliance allows Coforge to offer more robust solutions without the immediate need for extensive in-house development.

Targeted acquisitions also play a vital role in Coforge's growth strategy. The acquisition of Cigniti Technologies, for example, significantly bolsters Coforge's digital assurance and testing services. This move not only broadens their service portfolio but also provides access to a larger client base and new geographical markets, contributing to their ambitious revenue goals.

Global Market Expansion and Diversification

Coforge's existing global footprint, with established operations in North America, Europe, and Asia Pacific, provides a solid foundation for further international growth. This presence allows them to leverage existing client relationships and infrastructure as they explore new markets.

Strategic expansion into emerging economies and underpenetrated developed markets presents a significant opportunity. By diversifying its geographical reach, Coforge can tap into new customer bases and mitigate risks associated with economic downturns in any single region. For instance, continued investment in regions like Southeast Asia or Latin America could yield substantial returns.

Diversifying across various client segments, beyond its current strengths, is also a key opportunity. This includes targeting new industries or deepening engagement with existing ones through specialized service offerings. This strategic move aims to reduce over-reliance on any particular sector, thereby enhancing revenue stability and growth potential.

- Geographic Reach: Coforge operates in over 20 countries, demonstrating a solid international presence.

- Emerging Market Potential: Significant growth opportunities exist in regions like India, Southeast Asia, and parts of Eastern Europe where digital transformation is accelerating.

- Client Diversification: Expanding into new verticals such as healthcare, manufacturing, or public sector can balance its portfolio, which is historically strong in BFS and Travel & Transportation.

- Service Offering Expansion: Developing and marketing niche solutions for specific industry challenges in new geographies can unlock incremental revenue streams.

Increased Demand for Cloud Solutions and Cybersecurity

The ongoing digital transformation fuels a substantial increase in demand for cloud solutions. Coforge is well-positioned to capitalize on this trend, with a strategic focus on expanding its cloud revenue streams. This presents a significant opportunity for growth as businesses continue to adopt cloud-native architectures and seek specialized cloud services.

In parallel, the escalating landscape of cyber threats creates a robust market for advanced cybersecurity solutions. Coforge's investments in cutting-edge cybersecurity technologies and services directly address this critical need. Their expertise in protecting digital assets and ensuring data privacy is a key differentiator in this expanding market segment.

Coforge's commitment to enhancing its cloud and cybersecurity capabilities aligns perfectly with market demands. For instance, the company has highlighted its ambition to achieve substantial growth in its cloud business, aiming for a significant portion of its revenue to come from these services in the coming years, underscoring the market's potential.

- Growing Cloud Adoption: Businesses are increasingly migrating workloads to cloud platforms, driving demand for migration, management, and optimization services.

- Cybersecurity Imperative: Heightened cyber risks necessitate robust security solutions, creating opportunities for specialized cybersecurity consulting and implementation.

- Coforge's Strategic Focus: The company is actively investing in and expanding its cloud offerings, targeting significant revenue growth in this area.

- Demand for Integrated Solutions: Clients seek comprehensive solutions that seamlessly integrate cloud adoption with strong cybersecurity measures, a niche Coforge aims to fill.

Coforge is strategically positioned to benefit from the accelerating global demand for digital transformation services, with the market projected to exceed $1 trillion by 2027. The company's focus on application modernization, cloud migration, and data analytics directly addresses this growing need, allowing it to capture a larger market share.

The increasing integration of AI across industries presents a significant opportunity for Coforge to develop and market innovative AI-driven solutions, bolstered by their investments in AI hubs. Furthermore, strategic partnerships and targeted acquisitions, such as the integration of Cigniti Technologies, enhance their service portfolio and market reach, driving revenue growth.

Coforge's established global presence across North America, Europe, and Asia Pacific provides a strong foundation for expansion into emerging economies and underpenetrated markets, diversifying its revenue streams and mitigating regional economic risks. Expanding into new client segments and offering specialized services across various industries will further strengthen its market position and revenue stability.

The company's commitment to expanding its cloud and cybersecurity offerings aligns with the market's increasing reliance on cloud platforms and the imperative for robust security solutions. Coforge aims to achieve substantial revenue growth in its cloud business, highlighting the significant potential in these areas.

| Opportunity Area | Market Trend | Coforge's Position/Action | Projected Impact |

|---|---|---|---|

| Digital Transformation | Market to exceed $1 trillion by 2027 | Focus on app modernization, cloud migration, data analytics | Increased market share, revenue growth |

| Artificial Intelligence | Widespread integration across sectors | Investments in AI hubs (Copilot Innovation Hub, Quasar GenAI Central) | Development of novel AI solutions |

| Cloud Services | Growing adoption of cloud-native architectures | Strategic expansion of cloud revenue streams | Significant growth in cloud business |

| Cybersecurity | Escalating landscape of cyber threats | Investments in cutting-edge cybersecurity technologies | Addressing critical needs, market differentiation |

Threats

The IT services sector is a crowded arena, with both global giants and nimble regional players vying for market share. This intense rivalry puts pressure on pricing and makes securing new contracts a significant challenge for companies like Coforge.

Coforge contends with competition from larger, well-established IT service providers who often possess greater resources and brand recognition. Additionally, specialized firms focusing on niche areas can also present a competitive threat, potentially siphoning off business in specific segments.

For instance, the global IT services market was valued at approximately $1.2 trillion in 2023, with projections indicating continued growth. Within this vast market, companies like Tata Consultancy Services, Infosys, and Wipro, alongside specialized players, represent significant competitive forces that Coforge must navigate.

The relentless march of technological innovation, especially in artificial intelligence and automation, presents a significant challenge for Coforge. While the company is actively investing in these areas, the sheer speed at which new paradigms emerge means a lag in adoption could quickly erode its competitive standing. For instance, the global AI market was valued at approximately $150 billion in 2023 and is projected to reach over $1.3 trillion by 2030, highlighting the immense growth and potential for disruption.

While Coforge boasts a low attrition rate, the intensifying global demand for specialized tech talent, particularly in emerging fields like AI and advanced digital solutions, presents a significant challenge. This fierce competition for skilled professionals can strain recruitment efforts and increase operational costs.

The persistent upward pressure on wages, driven by this talent scarcity, could directly impact Coforge's profitability and its ability to maintain consistent service delivery. Attracting and retaining top-tier talent in a highly competitive market remains a critical hurdle for sustaining growth and innovation.

Economic Slowdowns and Client Budget Constraints

Uncertain macroeconomic conditions and the specter of economic slowdowns in key markets, particularly in North America and Europe, pose a significant threat. These factors can directly translate into tighter IT budgets for Coforge's clients, potentially dampening order intake and impacting overall revenue growth. This is a recognized challenge that can affect their financial performance, especially in sectors sensitive to economic cycles.

For instance, global economic growth forecasts for 2024 have been subject to revisions, with organizations like the IMF adjusting their outlooks. This volatility creates a challenging environment for IT service providers like Coforge, as businesses may postpone or scale back discretionary spending on technology projects.

- Reduced IT Spending: Clients may cut back on IT services and project investments due to economic uncertainty.

- Impact on Order Intake: A slowdown can lead to fewer new contracts and a decrease in the size of existing deals.

- Revenue Growth Pressure: Client budget constraints directly affect Coforge's ability to achieve its revenue targets.

- Sectoral Vulnerability: Industries more exposed to economic downturns might disproportionately reduce their IT expenditures.

Cybersecurity Risks and Data Breaches

Coforge, as a digital services provider, faces significant cybersecurity risks. Handling vast amounts of sensitive client data makes it a prime target for cyberattacks and potential data breaches. These threats could result in substantial financial penalties, severe damage to its reputation, and a critical erosion of client confidence.

The increasing sophistication of cyber threats presents a persistent challenge. For instance, in 2023, the IT services sector experienced a notable rise in ransomware attacks, with average recovery costs escalating significantly. A successful breach for Coforge could lead to not only direct financial losses from remediation and potential lawsuits but also indirect costs associated with business disruption and lost revenue.

- Increased Regulatory Scrutiny: Data protection regulations like GDPR and CCPA impose hefty fines for breaches, with penalties potentially reaching millions of dollars or a percentage of global revenue.

- Reputational Damage: A publicized data breach can severely impact client trust, leading to client attrition and difficulty in acquiring new business.

- Operational Disruption: Cyberattacks can halt critical business operations, impacting service delivery and revenue generation.

- Financial Losses: Costs include incident response, forensic investigations, legal fees, and potential compensation to affected parties.

Intense competition within the IT services sector, particularly from larger players with greater resources, poses a continuous threat to Coforge's market share and pricing power. The rapid evolution of technologies like AI necessitates significant and ongoing investment to maintain relevance, risking a competitive disadvantage if adoption lags. Furthermore, the global demand for specialized tech talent, especially in AI and advanced digital solutions, creates upward pressure on wages and recruitment costs, impacting profitability and service delivery consistency.

| Threat Category | Description | Impact on Coforge | Example Data/Context |

|---|---|---|---|

| Intense Competition | Rivalry from established IT giants and niche specialists. | Pressure on pricing, challenges in securing new contracts. | Global IT services market valued at ~$1.2 trillion in 2023. |

| Technological Disruption | Rapid advancements in AI, automation, and other digital paradigms. | Risk of obsolescence, need for continuous investment, potential lag in adoption. | Global AI market projected to exceed $1.3 trillion by 2030 from ~$150 billion in 2023. |

| Talent Scarcity & Wage Inflation | High demand for specialized tech skills, especially in AI/digital. | Increased recruitment costs, potential strain on operations, impact on profit margins. | IT sector wage growth outpaced general wage growth in many developed economies in 2023-2024. |

| Macroeconomic Volatility | Economic slowdowns in key markets like North America and Europe. | Reduced client IT spending, dampened order intake, pressure on revenue growth. | IMF revised global growth forecasts for 2024 multiple times, indicating uncertainty. |

| Cybersecurity Risks | Sophisticated cyber threats and potential data breaches. | Financial penalties, reputational damage, loss of client trust, operational disruption. | Ransomware attack costs for IT firms saw significant increases in 2023. |

SWOT Analysis Data Sources

This COFORGE SWOT analysis is constructed using comprehensive data from financial reports, market intelligence, and expert industry analysis. These sources provide a robust foundation for understanding the company's strategic position.