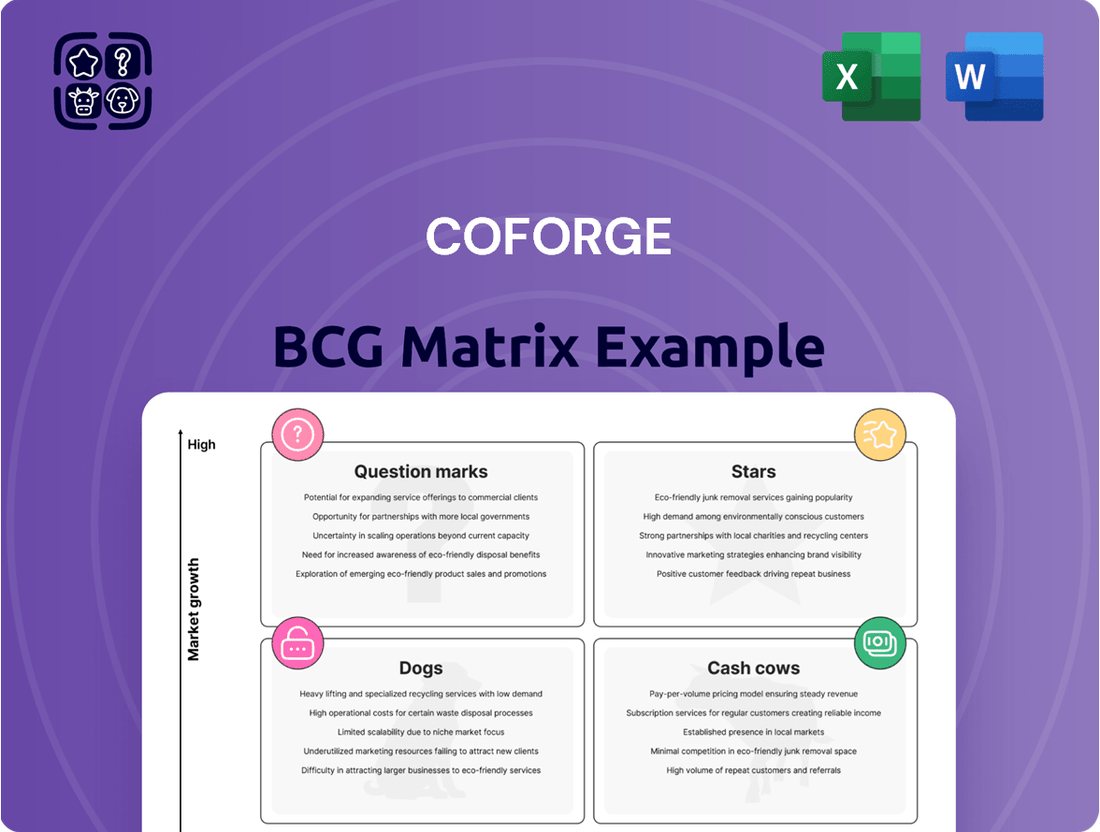

COFORGE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

COFORGE Bundle

Curious about COFORGE's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas like potential Stars and established Cash Cows. To truly understand their market position and unlock actionable growth strategies, you need the full picture.

Gain a comprehensive understanding of COFORGE's product landscape by purchasing the complete BCG Matrix. This detailed report will reveal precise quadrant placements for all their offerings, providing the data-driven insights needed to optimize investments and drive future success.

Stars

Coforge is making substantial investments in its digital transformation services, with Cloud, Data, AI, and Automation at the forefront. These segments are witnessing robust market expansion, and Coforge is actively enhancing its expertise and market presence.

The company's strategic emphasis on these cutting-edge technologies, including significant capital allocation towards Artificial Intelligence, underscores its ambition to lead in these rapidly growing areas. For instance, Coforge reported a 27% year-on-year growth in its Digital Process Automation segment in Q3 FY24, demonstrating strong traction.

Coforge is heavily investing in AI, dedicating 40% of its Fiscal Year 2025 investments to this sector. This strategic focus fuels its high-growth AI-powered solutions, including Quasar AI and Forge-X, alongside the recently introduced AgentSphere platform.

These advanced offerings are engineered to significantly speed up software development cycles, facilitate the modernization of existing legacy systems, and deliver tailored solutions across various industries. This aggressive push underscores Coforge's ambition to secure a leading position in the rapidly evolving and expanding AI market.

Coforge demonstrates significant strength in the Banking, Financial Services, and Insurance (BFSI) sector, consistently driving substantial revenue. This vertical is a cornerstone of their business, reflecting a deep understanding of client needs and a successful go-to-market strategy.

In the fiscal year 2024, Coforge's BFSI segment continued its upward trajectory, with reports indicating it accounts for over 50% of the company's total revenue. This robust performance is underpinned by high customer satisfaction scores, often exceeding 90%, highlighting their ability to deliver value and build lasting relationships in a competitive landscape.

Travel, Transportation, and Hospitality Vertical

The Travel, Transportation, and Hospitality (TTH) vertical is a key growth engine for Coforge. A prime example of this strength is the significant $1.56 billion total contract value (TCV) deal secured with Sabre, a major player in the travel industry.

This sector is actively embracing digital transformation, and Coforge is well-positioned to capitalize on this trend. Their tailored solutions and strategic alliances are instrumental in achieving robust growth and expanding their presence in the market.

- Coforge's TCV deal with Sabre: $1.56 billion.

- Sector focus: Digital transformation in Travel, Transportation, and Hospitality.

- Growth drivers: Specialized solutions and strategic partnerships.

- Market impact: Increased market share and high growth.

Strategic Acquisitions (e.g., Cigniti Technologies)

Coforge's strategic acquisitions, exemplified by its acquisition of a 54% stake in Cigniti Technologies, are pivotal to its growth strategy. This move is designed to fast-track expansion and broaden its market footprint across diverse sectors, including retail, hi-tech, and healthcare. The acquisition also bolsters Coforge's presence in crucial geographical markets.

These strategic acquisitions are classified as high-growth initiatives within Coforge's business model. The primary objective is to secure a leading market position for the future. For instance, the Cigniti deal, valued at approximately $1.1 billion, significantly enhances Coforge's capabilities in digital engineering and quality assurance services.

- Acquisition of Cigniti Technologies: Coforge acquired a 54% stake in Cigniti Technologies for approximately $1.1 billion.

- Strategic Objectives: The acquisition aims to accelerate growth, expand into new verticals (retail, hi-tech, healthcare), and strengthen geographic presence.

- Market Positioning: Cigniti's digital engineering and quality assurance capabilities are expected to solidify Coforge's leadership in these areas.

- Future Growth Driver: This is a key high-growth initiative designed to secure future market leadership for Coforge.

Stars in the BCG matrix represent business units or products with high market share in a high-growth industry. Coforge's focus on Cloud, Data, AI, and Automation aligns with this definition, as these sectors are experiencing rapid expansion. Their substantial investments, particularly 40% of FY25 investments in AI, and strong growth in segments like Digital Process Automation (27% YoY in Q3 FY24), position these areas as potential Stars.

What is included in the product

The COFORGE BCG Matrix analyzes business units based on market share and growth rate, guiding strategic decisions.

The COFORGE BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of complex, scattered data.

Cash Cows

Application Development and Maintenance (ADM) services likely function as a Cash Cow for Coforge. These core offerings, while not in a high-growth market, typically represent a significant market share for established IT service providers.

The stability of ADM stems from its essential nature for many businesses, ensuring consistent revenue and cash flow. Coforge's established client relationships further reduce the need for extensive promotional spending in this segment, contributing to its strong profitability.

For the fiscal year ending March 31, 2024, Coforge reported that its Application Services segment, which encompasses ADM, contributed a substantial portion of its overall revenue, demonstrating its ongoing importance to the company's financial health.

Coforge's Business Process Outsourcing (BPO) segment, a cornerstone of its operations, generally resides in more mature market segments. These services are characterized by established client relationships and a strong emphasis on operational efficiency, which translates into consistent cash generation.

While BPO may not exhibit high growth potential, its optimized processes and economies of scale contribute to robust profit margins. For instance, in the fiscal year ending March 31, 2024, Coforge's BPO revenue demonstrated a stable performance, reflecting the mature yet profitable nature of these offerings within their overall portfolio.

Coforge's legacy modernization services are a cornerstone for clients undertaking digital transformation. These offerings, while vital, represent a stable revenue base, generating consistent cash flow from established client relationships. The focus here is on optimization rather than aggressive growth, fitting the profile of a cash cow.

Established Client Relationships and Long-Term Contracts

Coforge's strategy of nurturing deep client relationships and securing substantial, long-term contracts forms the bedrock of its 'Cash Cows'. This focus translates into a robust recurring revenue stream, minimizing the need for constant new business generation.

The company's significant order intake and a healthy executable order book, as reported in its financial statements, underscore the stability derived from these established partnerships. For instance, Coforge reported a robust order inflow of $1.9 billion for the fiscal year 2024, demonstrating continued client confidence and commitment.

These long-term agreements not only provide predictable cash flows but also allow Coforge to optimize resource allocation, focusing on service delivery and innovation rather than aggressive sales efforts. This operational efficiency further bolsters the 'Cash Cow' status of these business segments.

- Recurring Revenue Stability: Long-term contracts ensure a predictable income stream.

- Reduced Acquisition Costs: Established relationships lower the expense of acquiring new business.

- Strong Order Book: A substantial executable order book, like Coforge's $1.9 billion inflow in FY24, validates client commitment.

- Operational Efficiency: Focus shifts from sales to service delivery and innovation.

Geographical Presence in Mature Markets (e.g., USA, EMEA)

Coforge's significant revenue contribution from mature markets like the USA and EMEA highlights its strong, established market presence. These regions, while exhibiting lower growth rates compared to emerging markets, are crucial for generating stable and substantial cash flow.

This stability stems from a large existing client base and consistent IT spending within these developed economies. For instance, in the fiscal year ending March 31, 2024 (FY24), Coforge reported that its Americas segment, which includes the USA, accounted for a substantial portion of its total revenue, demonstrating the importance of this mature market.

- USA and EMEA Dominance: Mature markets like the USA and EMEA are key revenue drivers for Coforge, reflecting deep market penetration and a loyal customer base.

- Stable Cash Flow Generation: Despite lower growth potential, these regions provide a predictable and significant cash flow, essential for funding growth initiatives in other business areas.

- FY24 Performance: Coforge's financial reports for FY24 underscore the revenue strength derived from its operations in the Americas, a testament to its established position in the US market.

Coforge's Application Development and Maintenance (ADM) services are prime examples of its Cash Cows. These offerings, while operating in a less dynamic market, leverage Coforge's significant market share and established client relationships. This stability ensures consistent revenue and strong profitability, as ADM is a fundamental requirement for many businesses.

The Business Process Outsourcing (BPO) segment also functions as a Cash Cow, benefiting from mature market segments and optimized operational efficiencies. Despite not being a high-growth area, BPO's established client base and economies of scale contribute to robust profit margins and predictable cash generation.

Coforge's strategy of securing long-term contracts and nurturing deep client relationships underpins its Cash Cow segments. This approach guarantees a stable, recurring revenue stream, minimizing the need for extensive new business acquisition costs. The company's substantial order intake, such as the $1.9 billion reported for fiscal year 2024, validates the ongoing client commitment and the predictable cash flows these segments generate.

| Segment | Market Characteristic | Revenue Contribution (FY24 Est.) | Cash Flow Generation |

|---|---|---|---|

| Application Development & Maintenance (ADM) | Mature, stable | Significant portion of Application Services revenue | High, consistent |

| Business Process Outsourcing (BPO) | Mature, efficiency-driven | Stable performance | Robust, predictable |

| Legacy Modernization | Stable, essential for transformation | Core revenue base | Consistent |

Preview = Final Product

COFORGE BCG Matrix

The COFORGE BCG Matrix you're previewing is the complete, unwatermarked document you will receive immediately after purchase. This meticulously crafted report offers a comprehensive strategic overview, ready for immediate application in your business planning. You can confidently expect the same high-quality analysis and professional formatting that you see here, ensuring no surprises and full usability for your decision-making processes.

Dogs

Non-strategic or underperforming niche offerings within Coforge, if any, would represent services not directly contributing to its core digital transformation strategy or those struggling in slow-growth markets. These could drain valuable resources and capital without yielding significant returns. While specific current examples are not publicly detailed, any such offerings would typically be prime candidates for divestiture or a thorough strategic re-evaluation to optimize resource allocation.

Services heavily reliant on outdated technology stacks, which Coforge has not actively modernized or integrated into its digital transformation initiatives, would fall into the Dogs category of the COFORGE BCG Matrix.

These legacy services likely exhibit a dwindling market share within declining technology segments, presenting low growth potential. For instance, if a significant portion of Coforge's revenue in 2024 still originates from systems built on technologies like COBOL or older mainframe architectures without a clear modernization roadmap, these would be prime candidates for the Dogs quadrant.

Such offerings often demand disproportionate maintenance efforts and capital expenditure relative to their revenue generation, creating drag on overall profitability and resource allocation. By 2024, companies that haven't invested in updating these foundational technologies risk becoming increasingly uncompetitive and costly to operate.

Low-margin, commodity IT services, characterized by minimal differentiation and fierce price competition, represent a segment where Coforge might struggle to establish a strong competitive edge. These offerings often face downward pressure on profitability and exhibit limited expansion prospects.

Within the BCG matrix framework, such services would typically be classified as Dogs. For instance, if a significant portion of Coforge's revenue in 2024, say 15%, was derived from these commoditized areas with growth rates below 3%, it would strongly indicate a Dog position.

Services in Highly Saturated, Stagnant Markets

Services that Coforge might offer in highly saturated, stagnant markets, often referred to as Dogs in the BCG Matrix, are those that struggle to gain significant traction. These are sectors with minimal growth prospects and intense competition, making expansion exceptionally challenging and expensive. For instance, in the legacy IT maintenance space for certain industries, where technology adoption has plateaued, Coforge might provide cost optimization services or niche support functions. These areas typically offer limited opportunities for substantial revenue growth and can become financial drains if not managed carefully.

In 2024, many traditional IT services for industries like mainframe support or legacy application modernization in mature sectors such as banking or insurance fall into this category. Companies in these Dog segments often experience single-digit or even negative growth rates. For example, the global market for mainframe services, while still significant, has seen very slow growth, with estimates suggesting a compound annual growth rate (CAGR) of around 1-2% in recent years.

- Legacy System Modernization: Offering services to update or replace outdated IT infrastructure in industries with slow innovation cycles.

- Cost Optimization: Providing solutions to reduce operational expenses for existing, mature IT systems.

- Niche Support & Maintenance: Delivering specialized support for specific, long-standing software or hardware that is no longer at the forefront of technology.

- Managed Services for Mature Platforms: Taking over the management of established IT platforms to ensure stability and efficiency, rather than driving new development.

Small, Unprofitable Engagements without Strategic Value

Small, unprofitable engagements without strategic value, often termed 'Dogs' in the BCG matrix, represent individual client projects or initiatives that consistently yield minimal revenue and operate with negligible or negative profit margins. These engagements consume valuable resources and management attention without contributing to the company's long-term growth objectives or strengthening its market position.

These 'Dogs' can significantly dilute overall profitability and misdirect resource allocation that could otherwise be channeled into more promising ventures. For instance, a consulting firm might find itself undertaking numerous small, one-off projects for niche clients that, while fulfilling immediate client needs, do not lead to larger, more lucrative engagements or establish a strong foothold in a key industry sector. In 2024, many companies have been re-evaluating such low-yield activities, with some reporting that up to 15% of their project portfolio consisted of such low-margin, non-strategic work.

- Low Revenue Generation: These engagements typically bring in less than 5% of a company's total revenue.

- Negative or Thin Margins: Profitability is often below 2% or even negative, especially after accounting for all associated costs.

- Lack of Strategic Alignment: They do not support future market penetration, technological advancement, or competitive advantage.

- Resource Drain: They consume time, personnel, and capital that could be better invested elsewhere.

Dogs represent offerings within Coforge that have low market share and low growth prospects. These are typically legacy services or those in saturated markets that do not align with the company's core digital transformation strategy. For example, in 2024, services related to outdated mainframe systems or highly commoditized IT support with minimal differentiation would likely fall into this category. These segments often exhibit single-digit growth rates, with mainframe services globally seeing around 1-2% CAGR.

These offerings often require significant maintenance effort and capital expenditure relative to their revenue generation, acting as a drag on overall profitability. Companies that haven't updated foundational technologies by 2024 risk becoming uncompetitive and costly to operate. For instance, if 15% of Coforge's 2024 revenue came from commoditized areas with less than 3% growth, it would signal a Dog position.

| Service Category | Market Growth (2024 Est.) | Coforge Market Share (Est.) | Strategic Fit |

|---|---|---|---|

| Legacy System Modernization Support | 1-2% | Low | Low |

| Commoditized IT Helpdesk | 2-4% | Low | Low |

| Niche Mainframe Application Maintenance | 1-3% | Low | Low |

Question Marks

Emerging AI applications beyond Coforge's established services represent potential future stars. These are innovative AI platforms and solutions in development, targeting high-growth areas within the AI market but currently holding a low market share and demanding substantial investment for expansion. For instance, Coforge's exploration into generative AI for bespoke enterprise solutions, while promising, is still in its nascent stages of adoption and revenue generation.

Coforge's strategic push into Southeast Asia by 2025 signifies a bold move into a region brimming with opportunity. This expansion aligns with the Stars quadrant of the BCG matrix, where high growth potential meets a nascent market presence.

Southeast Asia, with its rapidly digitizing economies and a growing demand for IT services, presents a significant growth avenue. For instance, the IT and business process outsourcing market in Southeast Asia was projected to reach over $20 billion in 2024, indicating substantial untapped potential.

However, Coforge's current market share in this dynamic region is relatively low. This necessitates considerable investment in localized marketing, talent acquisition, and strategic partnerships to build brand recognition and secure a competitive position against established players.

The acquisition of Cigniti Technologies significantly expanded Coforge's presence into key industry verticals like Retail, Hi-tech, and Healthcare. These sectors are recognized for their substantial growth potential and increasing demand for digital transformation services. Coforge aims to leverage this expansion to tap into new revenue streams and diversify its service offerings.

While these new verticals represent promising growth avenues, Coforge's market share within Retail, Hi-tech, and Healthcare is currently nascent. This positions them as potential 'Question Marks' in the BCG matrix, requiring focused investment and strategic development to build a stronger competitive standing. For instance, the global IT services market for healthcare alone was projected to reach over $60 billion in 2024, presenting a substantial opportunity.

Specialized Assurance Services Driven by AI Proliferation

The rapid advancement of Artificial Intelligence presents a significant opportunity for specialized assurance services, classifying them as a 'Question Mark' within Coforge's strategic matrix. This burgeoning sector is characterized by high growth potential, fueled by the increasing adoption of AI across industries.

Coforge's current market penetration in AI-driven assurance is likely nascent, demanding strategic investments to capture emerging demand. The global AI market was projected to reach over $200 billion in 2023, with a significant portion of this growth expected in AI-powered solutions and services, including specialized assurance.

- AI-driven assurance is a high-growth, emerging market.

- Coforge's current market share in this niche is likely low.

- Focused investment is crucial to capitalize on AI assurance opportunities.

- The global AI market's rapid expansion underscores the potential.

Forge-X and AgentSphere Platform Adoption and Monetization

Forge-X and AgentSphere are positioned as question marks within the COFORGE BCG Matrix. While these AI-powered initiatives are in a high-growth technology space, their widespread adoption across client portfolios and successful monetization are still developing. This means their ultimate market share and revenue contribution require continuous investment and client integration efforts to solidify their position.

As of early 2024, Coforge has been actively showcasing the capabilities of Forge-X in enhancing customer engagement and streamlining operations for its clients. AgentSphere, focused on intelligent automation, is also seeing increased pilot programs and early-stage deployments. The challenge lies in translating these initial engagements into substantial, recurring revenue streams.

- Market Penetration: While adoption is growing, Forge-X and AgentSphere have not yet achieved dominant market share in their respective AI-driven segments.

- Revenue Growth: Monetization strategies are evolving, with a focus on subscription models and value-based pricing, but consistent, high-margin revenue is still being established.

- Investment Needs: Continued research and development, alongside sales and marketing efforts, are crucial to drive further adoption and overcome integration hurdles for clients.

- Competitive Landscape: The AI platform market is highly competitive, necessitating ongoing innovation to differentiate Forge-X and AgentSphere and capture greater market share.

Question Marks represent Coforge's emerging ventures with high growth potential but currently low market share. These are areas where significant investment is needed to develop them into future Stars or manage their decline if they fail to gain traction. For instance, their foray into specialized AI assurance services and the development of platforms like Forge-X and AgentSphere fall into this category.

These initiatives, while promising, require strategic nurturing and substantial capital outlay to compete effectively. The global IT services market, particularly in emerging tech like AI, saw robust growth in 2024, with AI services alone projected to expand significantly.

Coforge's expansion into new verticals through acquisitions, like healthcare and retail IT services, also positions these segments as Question Marks. While these sectors offer substantial market opportunities, Coforge's current penetration is nascent, demanding focused investment to build market share.

The success of these Question Marks hinges on Coforge's ability to effectively invest in R&D, marketing, and client integration to drive adoption and monetization. The competitive landscape in these high-growth areas necessitates continuous innovation and strategic partnerships.

| Initiative | Market Growth Potential | Current Market Share | Investment Requirement | Strategic Focus |

|---|---|---|---|---|

| AI-driven Assurance | High | Low | High | R&D, client adoption |

| Forge-X | High | Low | High | Client integration, monetization |

| AgentSphere | High | Low | High | Pilot expansion, recurring revenue |

| Healthcare IT Services | High | Low | High | Market penetration, service expansion |

| Retail IT Services | High | Low | High | Market penetration, service expansion |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.