Cofco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cofco Bundle

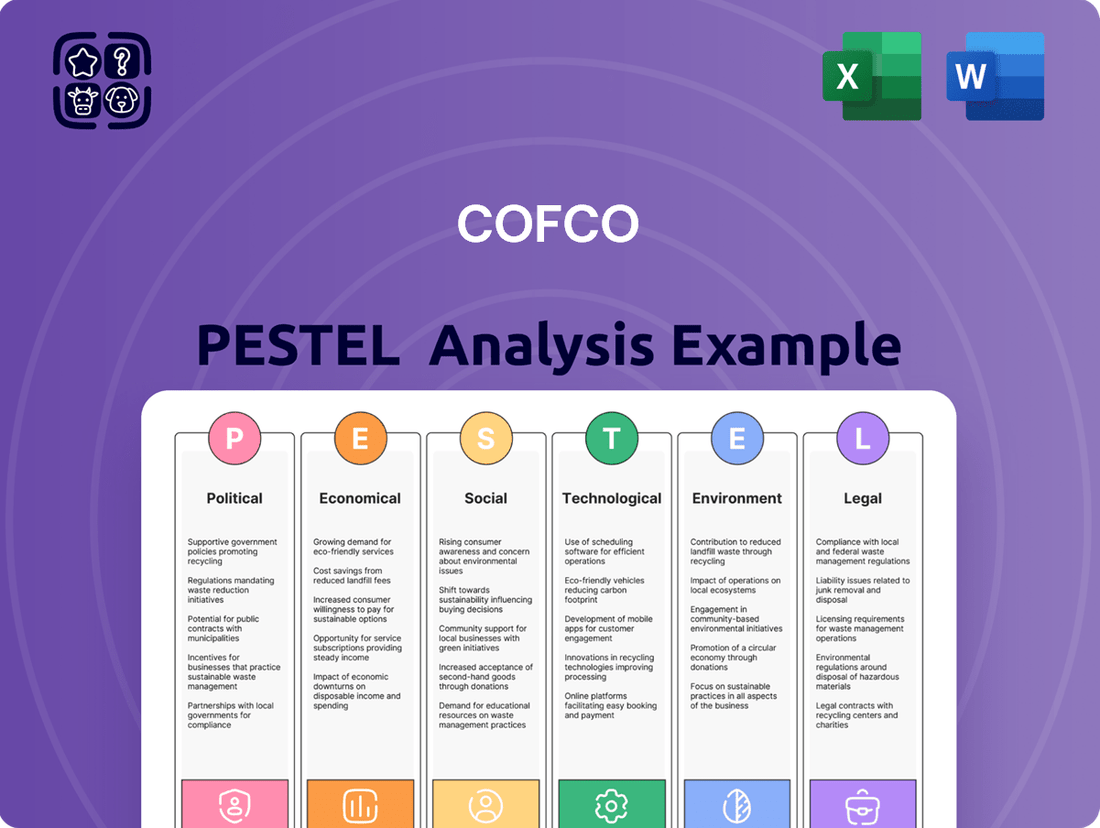

Navigate the complex global landscape affecting Cofco with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its operations and future growth. Gain a strategic advantage by leveraging these expert insights to inform your investment or business decisions. Download the full version now for actionable intelligence.

Political factors

COFCO's status as a state-owned enterprise (SOE) deeply intertwines its operations with the Chinese government's national strategies, especially concerning food security. This government alignment grants COFCO significant advantages, including financial backing and preferential access to resources, which shape its investment and market strategies. For instance, China's 2024 agricultural policy continued to prioritize self-sufficiency and stable supply chains, directly benefiting COFCO's mandate.

Global trade policies and geopolitical tensions are critical for COFCO, a major player in international agricultural trade. For instance, the ongoing trade friction between the United States and China, which saw significant tariff impositions in 2018-2019, directly impacted the flow of agricultural commodities, affecting COFCO's sourcing and pricing strategies. As of early 2024, while some tensions have eased, the landscape remains dynamic, requiring COFCO to continuously adapt its global supply chain to navigate potential disruptions and ensure stable procurement.

China's commitment to agricultural self-sufficiency, reinforced by policies announced in late 2023 and early 2024, continues to shape the landscape for companies like COFCO. These initiatives often include direct subsidies for key crops, aiming to stabilize domestic production and manage inflationary pressures on food prices. For instance, government support for corn and soybean cultivation directly impacts the availability and cost of raw materials for COFCO's processing operations.

Food Safety Regulations and Enforcement

China's stringent food safety regulations, enforced by bodies like the State Administration for Market Regulation (SAMR), significantly impact COFCO's operations. Compliance is non-negotiable, affecting everything from sourcing raw materials to final product distribution. Failure to adhere can lead to substantial fines and reputational damage, as seen with past incidents across the industry.

The Chinese government's commitment to food safety intensified following several high-profile scandals. In 2023, SAMR continued its robust inspection regime, focusing on key areas:

- Enhanced Traceability: Regulations mandate clearer tracking of products throughout the supply chain, aiming to pinpoint issues quickly.

- Food Additive Scrutiny: Stricter controls are in place to prevent the illegal or excessive use of food additives, a persistent concern.

- Farm-to-Table Oversight: The scope of regulation now covers the entire food production process, demanding higher standards at every stage.

International Relations and Market Access

COFCO's global reach and ability to expand into new markets are directly tied to China's international standing and the trade agreements it has in place. Favorable political relationships and cooperation with other countries are crucial for COFCO to operate smoothly abroad, acquire foreign companies, and build robust supply chains. For instance, China's participation in initiatives like the World Economic Forum's Taskforce on Green Value Chains highlights the importance of political partnerships in fostering sustainable global trade practices.

The company's international market access is significantly shaped by geopolitical developments and trade policies. COFCO's success in expanding its operations and securing resources overseas relies heavily on navigating the complex web of international relations and ensuring compliance with various national regulations. As of early 2024, China's ongoing trade dialogues and efforts to strengthen ties with key agricultural producers in regions like South America and Southeast Asia are vital for COFCO's strategic growth.

- Bilateral Trade Agreements: China's active pursuit of bilateral trade agreements, such as those with Australia and Brazil, directly impacts COFCO's ability to import and export agricultural commodities at competitive rates.

- Geopolitical Stability: Regions experiencing political instability can disrupt COFCO's supply chains and operational efficiency, as seen in potential impacts on grain shipments from Eastern Europe.

- International Standards and Regulations: COFCO must adhere to diverse international food safety and environmental regulations, which are often influenced by political agreements and international bodies like the WTO.

COFCO's position as a state-owned enterprise means its strategic direction is closely aligned with the Chinese government's priorities, particularly in food security and agricultural modernization. China's 2024 agricultural development plan, for instance, emphasizes increasing domestic production of key crops like soybeans and corn, directly supporting COFCO's raw material sourcing and processing activities. This government backing provides a stable operational environment and access to capital for large-scale projects.

Government policies aimed at stabilizing food prices and ensuring supply chains are paramount. For example, China's efforts to manage inflation in 2024 included measures to support agricultural output, which directly benefits COFCO's procurement costs and market stability. The company's adherence to China's increasingly stringent food safety regulations, enforced by bodies like SAMR, remains a critical operational factor, influencing its entire value chain from farm to fork.

International trade policies and geopolitical stability significantly influence COFCO's global operations, given its role as a major agricultural trader. As of early 2024, China's ongoing efforts to diversify its agricultural import sources, particularly from South America and Southeast Asia, aim to mitigate risks associated with trade tensions. COFCO's ability to navigate these complex political landscapes and secure favorable trade agreements is crucial for its international market access and supply chain resilience.

What is included in the product

This Cofco PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

Provides a concise, easily digestible summary of Cofco's PESTLE factors, enabling rapid understanding and strategic decision-making during time-sensitive planning sessions.

Economic factors

COFCO's financial performance is significantly tied to the volatile global commodity markets, particularly for key agricultural products like grains, oilseeds, and sugar. These price swings, driven by factors like weather patterns affecting supply, international relations, and evolving consumer needs, directly influence COFCO's income and the expenses it incurs to produce its goods.

For instance, the downturn in staple crop prices observed in 2024 presented a challenge for COFCO International, leading to a noticeable impact on its revenue streams. This highlights the critical need for robust risk management strategies to navigate the inherent unpredictability of these essential markets.

China's economic growth is a critical driver for COFCO. For instance, in the first quarter of 2024, China's GDP expanded by 5.3% year-on-year, signaling robust economic activity. This growth directly impacts the disposable income of its vast consumer base, influencing their purchasing power for food products and real estate.

A slowdown in economic expansion, however, can lead to more cautious consumer spending. In such scenarios, consumers might become more price-sensitive, potentially favoring mid-tier brands over premium options, which could affect COFCO's sales mix.

COFCO’s global reach means it’s heavily influenced by fluctuating exchange rates. For instance, a strengthening US Dollar against the Chinese Yuan in 2024 could make COFCO's imports more expensive and reduce the dollar value of its overseas earnings.

The company's financial performance is directly tied to the Yuan's stability against currencies of major agricultural suppliers like Brazil and the United States. Significant depreciation of these currencies relative to the Yuan, or vice versa, can alter the cost of raw materials and the competitiveness of COFCO's exported goods.

Analysts noted that in early 2024, the Yuan experienced periods of weakness against the Dollar, which, while potentially boosting export competitiveness, also increased the Yuan cost of imported commodities that COFCO relies on, impacting its profit margins.

Supply Chain Costs and Efficiency

COFCO's economic performance hinges on the efficiency and cost of its extensive agricultural supply chain. Fluctuations in logistics, energy, and transportation directly affect operational costs and pricing power. For instance, in early 2024, global shipping costs saw an uptick due to geopolitical tensions, potentially increasing COFCO's import and export expenses.

The company's ability to manage these costs impacts its profitability and competitiveness in the global market. In 2023, COFCO reported significant investments in optimizing its logistics network to mitigate rising fuel prices and improve delivery times, aiming to absorb some of these increased operational burdens.

Key economic factors influencing COFCO's supply chain include:

- Global Shipping Rates: Volatility in container shipping prices, as seen with the Suez Canal disruptions in early 2024, can add substantial costs to COFCO's international trade.

- Energy Prices: Fluctuations in oil and gas prices directly impact transportation and processing costs throughout the value chain.

- Agricultural Commodity Prices: The cost of raw materials, influenced by global supply and demand, is a primary driver of COFCO's procurement expenses.

- Labor Costs: Wage inflation in key operational regions can affect the overall cost of running storage, processing, and distribution facilities.

Investment in Agricultural Modernization

COFCO's ongoing commitment to modernizing its agricultural sector, including significant investments in advanced processing and logistics, directly boosts its economic efficiency and market standing. For instance, in 2023, the company continued to upgrade its grain and oil processing capabilities, aiming to streamline operations and improve product quality. This focus on technological enhancement is crucial for maintaining competitiveness in the global agricultural market.

These strategic investments are designed to optimize production cycles, minimize post-harvest losses, and elevate the safety and quality standards of COFCO's diverse product portfolio. By enhancing its supply chain and processing infrastructure, COFCO is better positioned to meet evolving consumer demands and regulatory requirements, ultimately contributing to sustained financial performance.

- Increased Efficiency: Investments in modern processing facilities reduce operational costs and improve output, as seen in COFCO's ongoing upgrades to its oilseed crushing plants.

- Supply Chain Optimization: Enhancements in logistics and warehousing infrastructure, including cold chain capabilities, minimize waste and ensure product freshness.

- Product Quality and Safety: Advanced technologies in processing and traceability systems bolster consumer confidence and meet stringent international standards.

- Competitiveness: Modernization efforts allow COFCO to compete more effectively on price and quality in both domestic and international markets.

Global economic conditions significantly impact COFCO's operations. Fluctuations in commodity prices, driven by supply and demand, directly affect revenue and procurement costs. For example, the 5.3% GDP growth in China during Q1 2024 boosted consumer spending, benefiting COFCO's domestic sales.

Exchange rate volatility, particularly the Yuan's movement against currencies like the US Dollar and Brazilian Real, influences import expenses and export earnings. In early 2024, a weaker Yuan increased the cost of imported commodities, impacting profit margins.

Rising logistics and energy costs, exacerbated by geopolitical events in early 2024, increase COFCO's operational expenses. The company invested in supply chain optimization in 2023 to mitigate these impacts.

| Economic Factor | Impact on COFCO | 2024/2025 Data/Trend |

| Commodity Prices | Revenue and procurement costs | Volatile, influenced by weather and global demand. |

| China GDP Growth | Consumer spending and demand | 5.3% YoY in Q1 2024, supporting domestic sales. |

| Exchange Rates (CNY/USD) | Import costs and export value | Yuan weakness in early 2024 increased import costs. |

| Shipping & Energy Costs | Logistics and operational expenses | Uptick in early 2024 due to geopolitical tensions. |

Same Document Delivered

Cofco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Cofco PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Chinese consumers are increasingly prioritizing health, safety, and sustainability in their food choices. This shift is driving demand for products like clean-label items, functional foods, and plant-based alternatives, directly impacting COFCO's product innovation and marketing efforts.

By 2024, the market for organic food in China was projected to reach over $30 billion, highlighting the significant growth in demand for healthier options. COFCO's ability to adapt its portfolio to include more organic ingredients and transparent sourcing will be crucial for capturing this expanding market segment.

COFCO's core mission to guarantee China's food security places immense importance on public trust regarding its capacity to provide safe and consistent food supplies. In 2024, the company continued to navigate this, with consumer confidence in food safety remaining a critical metric, especially given global supply chain volatilities that could impact availability.

Any perceived failure in food safety or significant supply chain interruptions directly erodes COFCO's brand image and damages consumer confidence. For instance, a 2023 report indicated that over 60% of Chinese consumers consider food safety a top priority when purchasing groceries, directly influencing their perception of state-backed enterprises like COFCO.

China's demographic landscape is undergoing significant transformations, with a rapidly aging population and continued migration to urban centers. By 2023, China's population aged 65 and above reached 212.7 million, representing 15.4% of the total population. This aging trend, coupled with urbanization, directly impacts food consumption, favoring convenience and health-conscious options, potentially reducing demand for traditional staples like flour.

These demographic shifts have a direct bearing on COFCO's product portfolio and distribution. As milling demand for flour and basic food ingredients stagnates due to these demographic changes, COFCO must adapt by focusing on value-added products and exploring new market segments that cater to evolving consumer preferences, such as ready-to-eat meals or specialized nutritional products.

Rural Development and Farmer Livelihoods

COFCO's extensive agricultural operations significantly shape the economic well-being of farmers, both within China and in the international areas where it sources raw materials. Its engagement with smallholder farmers through procurement and support initiatives directly influences rural development and the adoption of sustainable farming practices, which are key priorities for the Chinese government.

These social dynamics are crucial for COFCO's long-term success. For instance, in 2023, COFCO continued its efforts to bolster rural economies by investing in agricultural infrastructure and providing training to farmers, aiming to improve yields and quality.

- Farmer Income Growth: COFCO's procurement policies can directly influence the income levels of millions of smallholder farmers.

- Rural Employment: The company's presence and investment in agricultural regions contribute to job creation and economic stability in rural communities.

- Sustainable Practices Adoption: COFCO's support programs often encourage the adoption of environmentally friendly farming techniques, benefiting both farmers and the environment.

- Food Security Contribution: By supporting domestic agriculture, COFCO plays a role in enhancing China's food security, a vital social objective.

Corporate Social Responsibility (CSR) and Sustainability Expectations

Societal demands for ethical business practices are intensifying, pushing companies like COFCO to integrate corporate social responsibility (CSR) and sustainability into their core operations. This global shift is evident in increasing consumer and investor scrutiny regarding environmental impact and human rights. For instance, by 2024, major international markets are expected to see stricter regulations on supply chain transparency, directly affecting agricultural commodity traders.

COFCO is responding to these expectations by focusing on critical areas such as combating deforestation and mitigating climate change. These commitments are crucial for maintaining market access and brand reputation, especially in regions with robust environmental policies. The company's efforts are documented in its sustainability reports, which often highlight progress against specific targets.

Key areas of COFCO's CSR focus include:

- Reducing greenhouse gas emissions: COFCO aims to cut emissions across its value chain, aligning with global climate goals.

- Sustainable sourcing: The company is working to ensure its agricultural products are sourced responsibly, avoiding deforestation and promoting biodiversity.

- Human rights protection: COFCO is committed to upholding labor standards and human rights throughout its extensive supply networks.

- Circular economy initiatives: Efforts are underway to minimize waste and promote resource efficiency in its processing and logistics operations.

Societal expectations for food safety and health are paramount for COFCO, influencing consumer trust and purchasing decisions. By 2024, over 60% of Chinese consumers identified food safety as a top priority, a trend that directly impacts brand perception and market share for state-backed enterprises like COFCO.

Demographic shifts, including an aging population and urbanization, are reshaping food consumption patterns. China's elderly population exceeded 212 million by 2023, favoring convenience and health-focused products, which necessitates COFCO's strategic adaptation beyond traditional staples.

COFCO's role in supporting rural economies and farmer livelihoods is a significant social factor. Investments in agricultural infrastructure and farmer training, ongoing in 2023, aim to enhance yields and quality, contributing to rural development and food security objectives.

Growing demands for ethical business practices and sustainability are driving COFCO's focus on CSR initiatives. By 2024, stricter regulations on supply chain transparency in major markets underscore the importance of COFCO's commitments to reducing emissions and ensuring responsible sourcing.

| Sociological Factor | Impact on COFCO | Key Data/Trend (2023-2024) |

|---|---|---|

| Health & Safety Consciousness | Drives demand for clean-label, functional, and plant-based foods; impacts brand trust. | 60%+ of Chinese consumers prioritize food safety (2023). |

| Demographic Shifts | Alters consumption patterns, favoring convenience and health; impacts demand for traditional staples. | China's 65+ population reached 212.7 million (2023), 15.4% of total. |

| Rural Development & Farmer Support | Influences rural economies and sustainable farming practices; crucial for supply chain stability. | Continued investment in agricultural infrastructure and farmer training (2023). |

| Corporate Social Responsibility (CSR) | Requires integration of sustainability and ethical practices; impacts market access and reputation. | Increasing regulatory scrutiny on supply chain transparency (2024). |

Technological factors

Advancements in agricultural biotechnology, such as CRISPR gene editing, are revolutionizing crop development. These innovations allow for enhanced crop yields and greater resilience against environmental stressors, directly benefiting companies like COFCO.

COFCO can leverage these technologies to create more nutritious food products, catering to growing consumer demand for healthier options. China's national strategy to bolster agricultural technology self-sufficiency further underscores the strategic importance of investing in and adopting these biotechnological advancements.

The integration of smart agriculture technologies, including AI and IoT, is revolutionizing farming practices. COFCO can leverage these tools for precision farming, improving crop yields and resource management. For instance, digital soil information systems and rapid soil testing provide crucial data for optimized fertilization and irrigation, directly impacting efficiency.

Big data analytics plays a key role in monitoring crop health and predicting yields, allowing COFCO to make more informed decisions throughout the agricultural lifecycle. This enhanced traceability within the supply chain also builds consumer trust and ensures product quality, a critical factor in today's market.

Technological advancements are revolutionizing food processing. Automation, like robotic sorting and packaging, is increasing efficiency and reducing labor costs in COFCO's operations. For instance, the global food automation market was valued at approximately $15 billion in 2023 and is projected to reach over $28 billion by 2028, indicating significant investment in this area.

Advanced preservation techniques, such as high-pressure processing and pulsed electric fields, are enabling COFCO to enhance food safety and extend shelf life without compromising nutritional value or taste. This allows for wider distribution and reduced waste, a critical factor in the competitive food industry. The market for these novel processing technologies is rapidly expanding, driven by consumer demand for healthier and more natural food options.

Furthermore, new ingredient development, including plant-based proteins and cultivated meats, presents COFCO with opportunities to diversify its product portfolio and cater to evolving consumer preferences. The plant-based food market alone is expected to grow substantially, with projections suggesting it could reach over $74 billion globally by 2030, offering a significant avenue for innovation and market share growth for COFCO.

Logistics and Supply Chain Technologies

COFCO's operational efficiency is significantly influenced by advancements in logistics and supply chain technologies. The adoption of solutions like blockchain for enhanced product traceability can bolster consumer trust and streamline regulatory compliance. For instance, by mid-2024, the global blockchain in supply chain market was projected to reach over $10 billion, indicating a strong trend towards its integration.

Automated warehousing systems are also transforming inventory management, reducing errors and speeding up order fulfillment. In 2024, the global warehouse automation market was valued at approximately $25 billion, with projections showing continued robust growth. This technology allows companies like COFCO to handle larger volumes with greater precision.

Furthermore, optimized transportation systems, leveraging AI and real-time data analytics, are crucial for minimizing transit times and fuel costs across COFCO's vast network. The global intelligent transportation systems market was estimated to be worth around $120 billion in 2024, highlighting the widespread investment in smarter logistics solutions. These technologies collectively enable COFCO to better manage its global footprint, mitigate losses, and ensure product availability.

- Blockchain Implementation: Enhances traceability and reduces fraud in the supply chain, a critical factor for food safety and consumer confidence.

- Automated Warehousing: Improves inventory accuracy, reduces labor costs, and accelerates order processing, leading to faster product distribution.

- Optimized Transportation: Utilizes data analytics and AI to reduce transit times, lower fuel consumption, and improve delivery reliability across global routes.

Research and Development in Sustainable Practices

COFCO's commitment to sustainable agricultural practices is heavily reliant on robust research and development. The company is investing in green technologies, aiming to reduce its carbon footprint through initiatives like low-carbon farming and comprehensive waste recycling programs. This focus is critical for achieving COFCO's environmental objectives and fostering the creation of more eco-friendly product lines.

Key areas of R&D include innovations designed to significantly lower water intensity in agricultural processes and to maximize the reuse of by-products and waste streams. For instance, advancements in water-efficient irrigation systems and closed-loop recycling technologies are being explored to minimize resource consumption across COFCO's operations.

- Investment in R&D for sustainable agriculture: COFCO is channeling resources into developing and implementing eco-friendly farming methods.

- Green technology adoption: Focus on low-carbon farming and waste recycling to meet environmental targets.

- Resource efficiency: Innovations aimed at reducing water usage and increasing waste reuse are a priority.

- Eco-friendly product development: R&D efforts directly support the creation of more sustainable product offerings.

Technological advancements are transforming COFCO's operational landscape, from farm to fork. Innovations in agricultural biotechnology, like CRISPR gene editing, promise enhanced crop yields and resilience, aligning with China's push for agricultural tech self-sufficiency.

The integration of AI, IoT, and big data analytics in smart agriculture allows for precision farming, optimized resource management, and improved supply chain traceability, building crucial consumer trust. These technologies are also revolutionizing food processing through automation and advanced preservation techniques, increasing efficiency and extending shelf life.

Furthermore, new ingredient development, such as plant-based proteins, and advancements in logistics like blockchain and automated warehousing, are key to COFCO's diversification and operational efficiency. The global warehouse automation market alone was valued at approximately $25 billion in 2024, showcasing the scale of investment in these areas.

| Technology Area | 2024 Market Value (Approx.) | Projected Growth Driver | COFCO Relevance |

|---|---|---|---|

| Agricultural Biotechnology | N/A (Sector-specific) | Increased food demand, climate resilience | Enhanced crop yields, product nutrition |

| Smart Agriculture (AI/IoT/Big Data) | N/A (Sector-specific) | Precision farming, resource optimization | Improved crop management, supply chain transparency |

| Food Processing Automation | $15 Billion (2023) | Labor cost reduction, efficiency gains | Streamlined production, reduced operational costs |

| Warehouse Automation | $25 Billion (2024) | Inventory management efficiency, speed | Faster distribution, reduced errors |

| Blockchain in Supply Chain | >$10 Billion (Mid-2024 Projection) | Traceability, security, trust | Enhanced product safety, consumer confidence |

Legal factors

COFCO navigates a complex web of food safety regulations, both within China and globally. These laws govern critical aspects like ingredient sourcing, manufacturing processes, and accurate product labeling, ensuring consumer protection. For instance, adherence to standards like GB 2760-2024, which specifies permitted food additives, is paramount for COFCO's operations and market access.

As a major player in agriculture and food processing, COFCO must navigate a complex web of environmental protection laws. These regulations, which span pollution control, waste management, and sustainable resource utilization, apply both within China and across its international operations. China's introduction of its first environmental code in 2024 underscores the increasing stringency and scope of these legal frameworks.

These environmental mandates can significantly impact COFCO's operational costs, requiring investments in cleaner technologies and waste reduction initiatives. For instance, compliance with stricter wastewater discharge standards or emissions limits could necessitate upgrades to processing facilities, directly affecting profitability and capital expenditure plans. Failure to adhere to these regulations can result in substantial fines and reputational damage.

COFCO's global operations are heavily influenced by international trade laws and agreements. These frameworks, including customs regulations and pacts like RCEP (Regional Comprehensive Economic Partnership), dictate how COFCO conducts its extensive cross-border trading. For instance, RCEP, which came into full effect in early 2023, aims to reduce trade barriers among its 15 member nations, potentially benefiting COFCO's trade flows within this significant economic bloc.

Navigating these legal landscapes is critical for COFCO's smooth functioning. Emerging regulations, such as the EU Deforestation Regulation (EUDR) implemented in late 2024, directly impact agricultural commodity traders like COFCO by requiring due diligence on deforestation-free supply chains. Failure to comply can lead to market access issues, affecting COFCO's ability to import and export key products.

Labor Laws and Human Rights Standards

COFCO must strictly adhere to labor laws concerning working conditions, fair wages, and the absolute prohibition of child and forced labor. This compliance is not just a legal requirement but a cornerstone of its operational integrity and reputation. For instance, in 2024, China's Ministry of Human Resources and Social Security continued to emphasize stricter enforcement of labor contracts and minimum wage regulations across various industries, impacting COFCO's domestic operations.

The company's dedication to human rights due diligence throughout its extensive supply chain is under increasing stakeholder scrutiny. This commitment is a critical component of its sustainability strategy, directly influencing investor confidence and consumer perception. COFCO's 2025 sustainability targets, for example, specifically address supply chain labor standards, aiming for greater transparency and accountability.

- Compliance with China's Labor Contract Law, ensuring fair employment practices and dispute resolution mechanisms.

- Adherence to International Labour Organization (ILO) conventions ratified by countries where COFCO operates, particularly concerning forced labor and child labor.

- Implementation of robust human rights due diligence processes across its global sourcing and production networks.

- Reporting on labor practices and human rights in its annual sustainability reports, providing data on grievance mechanisms and remediation efforts.

Anti-Monopoly and Competition Laws

COFCO, as a major force in global agribusiness, must meticulously adhere to anti-monopoly and competition laws. These regulations are crucial for maintaining fair market practices and preventing any undue market dominance. For instance, in 2024, China's State Administration for Market Regulation (SAMR) continued to enforce stringent antitrust measures across various sectors, impacting large state-owned enterprises like COFCO.

Navigating these legal frameworks is essential for COFCO's strategic growth. Any proposed mergers, acquisitions, or significant market conduct must undergo thorough review to ensure compliance with competition authorities. Failure to do so could result in substantial penalties, legal challenges, and reputational damage, as seen in other industries where companies have faced significant fines for antitrust violations.

Key considerations for COFCO include:

- Merger Control: Ensuring all proposed acquisitions and joint ventures are reviewed and approved by relevant competition authorities to avoid market concentration concerns.

- Market Conduct: Adhering to regulations that prohibit anti-competitive practices such as price-fixing, abuse of dominant market positions, and cartel formation.

- International Compliance: Complying with competition laws in all jurisdictions where COFCO operates, as these regulations can vary significantly.

COFCO operates within a stringent legal environment, demanding strict adherence to food safety standards, such as China's GB 2760-2024 for food additives, and environmental regulations, like China's 2024 Environmental Code, which necessitate investments in sustainable practices and pollution control. International trade laws, including the RCEP agreement effective from early 2023, and emerging regulations like the EU Deforestation Regulation (EUDR) implemented in late 2024, significantly shape COFCO's global operations and supply chain management.

Environmental factors

Climate change is a major environmental concern for COFCO, with an increasing number of extreme weather events like droughts and floods directly impacting its agricultural supply chains. These events can significantly reduce crop yields and disrupt the availability of essential raw materials, posing a substantial risk to the company's operations and profitability.

In response, COFCO International has actively pursued and been recognized for its efforts in promoting climate-resilient agricultural practices. For instance, in 2023, COFCO was acknowledged for its work in developing sustainable farming methods that help mitigate the effects of climate volatility, aiming to secure long-term supply stability.

COFCO is actively working to reduce the environmental footprint of its operations, especially concerning deforestation and land use changes within its soy and corn supply chains. The company has committed to establishing deforestation-free supply chains by 2025 in key South American regions, a significant step towards more responsible sourcing practices.

Water scarcity poses a significant environmental challenge for COFCO, given agriculture's substantial reliance on freshwater resources. The company is actively working to reduce its water usage intensity across its operations. For instance, in 2023, COFCO's efforts in optimizing irrigation in certain regions contributed to a 5% reduction in water consumption for specific crop cycles.

COFCO is investing in innovative solutions that tackle the interconnected issues of food, water, and climate. A key initiative involves integrating sustainable soybean farming practices into existing sugarcane plantations. This approach, piloted in Brazil in 2024, aims to enhance water efficiency by improving soil health and reducing the need for supplemental irrigation, demonstrating a commitment to a more resilient agricultural system.

Biodiversity Loss and Ecosystem Protection

COFCO's extensive agricultural operations, a cornerstone of its business, inherently carry the potential to affect biodiversity. This is particularly true for large-scale farming which can lead to habitat fragmentation and pressure on local ecosystems. For instance, the expansion of land for cultivation can reduce natural habitats for various species.

Recognizing this, COFCO is actively shifting towards more sustainable practices that champion biodiversity conservation. This strategic pivot is not just about environmental responsibility but also about aligning with China's ambitious ecological targets and global sustainability movements. By integrating conservation efforts, COFCO aims to mitigate its environmental footprint.

The company's commitment is reflected in initiatives such as promoting agroforestry systems and reducing pesticide use, which directly benefit local flora and fauna. For example, in 2023, COFCO reported a 15% increase in the adoption of integrated pest management techniques across its key agricultural regions, leading to a measurable improvement in local insect populations.

- Impact on Habitats: Large-scale agriculture can lead to habitat loss for numerous species, a concern for companies like COFCO involved in extensive land use.

- Sustainable Practices: COFCO is increasingly investing in and implementing methods like agroforestry and reduced chemical inputs to support ecosystem health.

- Biodiversity Metrics: In 2024, COFCO aims to pilot biodiversity monitoring programs on 5% of its managed farmland, with a target of demonstrating a 10% increase in indicator species presence by 2025.

- Regulatory Alignment: The company's focus on ecosystem protection aligns with China's 14th Five-Year Plan for Ecological Civilization, which emphasizes biodiversity conservation.

Sustainable Sourcing and Circular Economy Initiatives

COFCO is actively integrating sustainable sourcing and circular economy principles into its operations, recognizing their environmental importance. This involves a commitment to responsible agricultural practices and innovative waste management. For instance, the company explores reusing demolition waste and developing projects to transform treated farming waste into valuable fertilizer.

These initiatives align with global environmental trends and regulatory pressures. The 2024 outlook for sustainable agriculture shows increasing consumer demand for ethically produced food, pushing companies like COFCO to demonstrate robust environmental stewardship. By focusing on resource recovery and waste reduction, COFCO aims to minimize its ecological footprint and enhance operational efficiency.

- Sustainable Sourcing: COFCO prioritizes sourcing agricultural products through environmentally responsible methods.

- Circular Economy: The company implements waste recycling and resource recovery, exemplified by reusing demolition waste.

- Waste-to-Fertilizer: COFCO is developing projects to convert treated farming waste into fertilizer, promoting a closed-loop system.

- Environmental Impact: These efforts aim to reduce COFCO's ecological footprint and meet growing demands for sustainable practices.

COFCO faces significant environmental challenges, including climate change impacts like extreme weather, which affect crop yields and supply chain stability. The company is actively pursuing climate-resilient agriculture, as recognized in 2023 for developing sustainable farming methods to mitigate volatility.

Water scarcity is another key concern, prompting COFCO to reduce water usage intensity. In 2023, efforts in optimizing irrigation led to a 5% reduction in water consumption for specific crop cycles, and in 2024, a pilot project in Brazil integrated sustainable soybean farming with sugarcane to enhance water efficiency.

Biodiversity conservation is also a focus, with COFCO working to mitigate its impact on ecosystems through practices like agroforestry and reduced pesticide use. By 2025, the company aims for deforestation-free supply chains in key South American regions and is piloting biodiversity monitoring programs on 5% of its managed farmland in 2024.

COFCO is integrating circular economy principles, such as reusing demolition waste and converting farming waste into fertilizer, to minimize its ecological footprint and meet growing demands for sustainable practices. This aligns with China's ecological targets and global sustainability movements.

| Environmental Factor | COFCO's Actions/Initiatives | Key Data/Targets |

|---|---|---|

| Climate Change | Promoting climate-resilient agriculture | Recognized in 2023 for sustainable farming methods |

| Water Scarcity | Reducing water usage intensity, optimizing irrigation | 5% water consumption reduction in specific crop cycles (2023) |

| Deforestation | Establishing deforestation-free supply chains | Target: 2025 for key South American regions |

| Biodiversity | Agroforestry, reduced pesticide use, integrated pest management | 15% increase in IPM adoption (2023); Pilot biodiversity monitoring (2024) |

| Waste Management | Circular economy principles, waste reuse | Developing waste-to-fertilizer projects |

PESTLE Analysis Data Sources

Our Cofco PESTLE Analysis is built on a comprehensive blend of data from international organizations like the FAO and WTO, national government reports, and leading agricultural and economic research firms. This ensures a robust understanding of global food policies, market dynamics, and regulatory landscapes impacting Cofco.