Cofco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cofco Bundle

Curious about COFCO's product portfolio? This glimpse into their BCG Matrix reveals the strategic positioning of their key offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't settle for a partial view; purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to guide your investment decisions and optimize COFCO's market strategy.

Stars

COFCO International's commitment to deforestation-free soy and corn by 2025, and conversion-free soy by 2030, places it at the forefront of the expanding sustainable agri-commodity sector. This strategic focus, bolstered by substantial investment and collaborations such as the one with Mengniu Group, targets significant market share in a segment experiencing escalating demand.

The company's progress is evident, with 99% of its soy sourced from Brazil verified as deforestation- and conversion-free in 2024. This achievement underscores robust market acceptance and COFCO International's leadership in a high-growth, environmentally conscious market.

COFCO's commitment to advanced agri-food technology and innovation, a core element of its 'new quality productive forces' strategy, positions it for significant growth. This focus on sci-tech innovation aims to revolutionize traditional agricultural practices and boost efficiency throughout the entire food supply chain.

By investing heavily in areas such as digital agriculture and cutting-edge seed development, COFCO is actively seeking to secure a dominant market position in the evolving landscape of agricultural solutions. For instance, in 2023, COFCO's R&D expenditure reached 1.2 billion RMB, a 15% increase year-on-year, underscoring this strategic priority.

COFCO's strategic global supply chain expansion, particularly its investment in a cross-hemisphere agri-food trade corridor, positions it for significant growth. This includes developing modern logistics hubs and ports to enhance efficiency.

The company's commitment to infrastructure development, such as a fleet of bulk grain carriers, underpins its expansion into key markets like Asia-Pacific, Europe, and Africa. This proactive approach aims to capture demand in these high-growth regions.

By ensuring a reliable and efficient global supply chain, COFCO is reinforcing its market leadership in international agricultural trade. For instance, in 2024, COFCO continued to expand its port capacity, handling over 100 million tons of grain through its key terminals.

China's Food Security Mandate

COFCO's position in China's food security mandate is pivotal, directly supporting the nation's drive to stabilize and enhance domestic grain production. This strategic alignment positions COFCO as a key player in a high-growth sector bolstered by substantial government backing and national focus.

The government's commitment to increasing domestic grain supply and curbing import dependency, coupled with ambitious targets like boosting soybean production by 2025, underscores the expanding market share COFCO can capture. This focus on self-sufficiency in critical agricultural areas ensures a foundation for sustained growth.

- National Food Security Focus: COFCO is central to China's strategy to ensure stable domestic food supplies.

- Government Support: Significant government investment and policy backing fuel growth in this sector.

- Import Reduction Drive: Initiatives to increase domestic production, like soybeans, by 2025 are key growth drivers.

- Market Share Expansion: COFCO is well-positioned to capitalize on the expanding market for domestically produced grains.

High-Quality Domestic Food Products

COFCO's focus on high-quality domestic food products aligns with China's national strategy for food security, as highlighted in the 2024-2035 action plan. This initiative aims to bolster the nutritional value and availability of domestically sourced grains, catering to a discerning Chinese consumer base increasingly prioritizing health and quality. This strategic direction positions COFCO to capture a larger share of the premium food market.

By enhancing cereal grains and integrating them more prominently into Chinese diets, COFCO is tapping into a substantial and expanding consumer demand for healthier options. This effort is particularly relevant as China's middle class continues to grow, seeking out superior food products. For instance, the market for premium packaged foods in China is projected to see continued robust growth through 2025.

- Focus on Value-Added Segments: COFCO's investment in processing and manufacturing aims to move beyond basic commodities to higher-margin, value-added food items.

- Growing Health Consciousness: The emphasis on nutritional enhancement addresses a key driver of consumer purchasing decisions in China.

- Domestic Sourcing Advantage: Leveraging China's agricultural output provides COFCO with greater control over its supply chain and quality.

- Market Share Expansion: By meeting evolving consumer preferences, COFCO is poised to increase its dominance in key food categories.

COFCO's commitment to sustainability and technological advancement positions its key agri-commodity operations as potential Stars in the BCG Matrix. The company's progress in deforestation-free sourcing, with 99% of its 2024 Brazilian soy verified as such, highlights strong performance in a growing market segment. This focus on environmentally conscious practices, coupled with significant R&D investment, such as 1.2 billion RMB in 2023, signals a forward-looking strategy.

These initiatives are driving market share expansion, particularly in high-growth regions and within the premium food sector. COFCO's strategic global supply chain development and infrastructure investments further solidify its leadership. The company's alignment with China's national food security mandate, including boosting domestic soybean production by 2025, provides a robust foundation for sustained growth and market dominance.

COFCO's strategic emphasis on value-added food products and enhanced cereal grains caters to a growing demand for healthier, higher-quality options. This is supported by China's expanding middle class and a national strategy focused on improving domestic food supplies. The company's proactive approach to market trends and consumer preferences, alongside its substantial investments, indicates a strong potential for these operations to become Stars.

| Operation Area | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Sustainable Soy & Corn Sourcing | High | High | Star |

| Advanced Agri-Food Technology | High | High | Star |

| Premium Domestic Food Products | High | High | Star |

What is included in the product

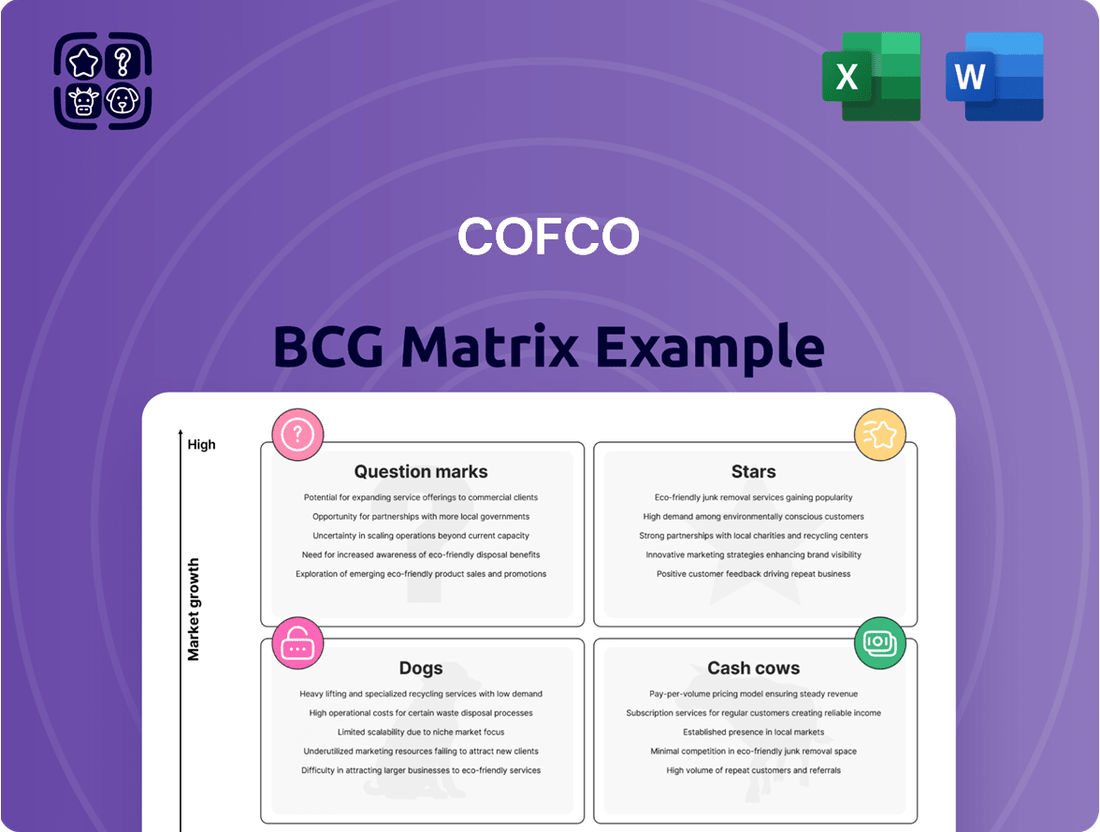

The Cofco BCG Matrix provides a strategic overview of its product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Cofco BCG Matrix offers a clear, visual assessment of business unit performance, alleviating the pain of strategic guesswork.

Cash Cows

COFCO's core domestic grain and oilseed trading and processing operations are undeniable cash cows. They dominate China's market, holding the top spot in grain trading volume and leading in annual processing capacity for key commodities like oilseeds, rice, sugar, and corn. This strong market presence in essential food items translates directly into significant and stable cash flow for the company.

COFCO International, a major player in global agricultural commodity trading, functions as a cash cow within its parent company's portfolio. Despite a reported revenue dip in 2024, attributed to volatile market prices, the company's sheer scale of operations is undeniable.

In 2024, COFCO International managed an impressive 108.4 million metric tons of essential commodities like grains, oilseeds, sugar, coffee, and cotton. This substantial volume underpins its strong market share and consistent revenue generation, providing stable cash flow to support other business units.

COFCO's extensive agri-food processing infrastructure, boasting over 200 facilities in China and Asia's largest integrated grain and oil park, underpins its status as a cash cow. This mature, high-capacity network ensures efficient operations and a dominant market share in numerous processed food categories.

The established market position of these processing assets translates into consistent profit margins and reliable cash flow, necessitating minimal additional promotional investment. For instance, in 2023, COFCO reported significant revenue contributions from its processed food segments, demonstrating the enduring profitability of this infrastructure.

Established Food Manufacturing Brands

Established food manufacturing brands within COFCO, like its significant stake in Mengniu Dairy, represent classic cash cows. These brands enjoy deep penetration in China's massive consumer base, consistently delivering robust profits and predictable cash flows. Their established market presence means less need for heavy marketing spend, allowing them to efficiently generate substantial returns.

For instance, Mengniu Dairy, a key COFCO holding, reported revenue growth of approximately 10% in 2023, demonstrating continued consumer demand. This stability is characteristic of cash cows, where mature market share translates into reliable earnings. The brand equity built over years acts as a significant barrier to entry for competitors, further solidifying their cash-generating ability.

- Mengniu Dairy's Strong Market Position: Holds a dominant share in China's dairy market, a sector experiencing steady, albeit mature, growth.

- Consistent Profitability: Benefits from economies of scale and brand loyalty, leading to high and stable profit margins.

- Low Investment Needs: Mature market presence reduces the requirement for substantial capital expenditure on marketing or expansion.

- Significant Cash Generation: These brands are the primary source of free cash flow for COFCO, funding other strategic initiatives.

Integrated Financial Services Supporting Agri-Food

COFCO Capital, despite a reported Q1 2025 net income decline, remains a cornerstone for COFCO's expansive agri-food operations. Its primary role is to provide essential financial services, including vital supply chain finance and specialized agricultural finance, directly supporting the group's core business activities.

This integrated financial platform is designed to bolster COFCO's substantial industrial footprint. It commands a significant share of the internal financing market, ensuring operational continuity and growth. The financial services generate consistent, reliable returns, even though these profits can experience some year-over-year fluctuations.

- COFCO Capital's Q1 2025 Performance: Net income experienced a decrease, highlighting the dynamic nature of financial services within a large conglomerate.

- Key Services Offered: Supply chain finance and agricultural finance are critical to supporting COFCO's core agri-food businesses.

- Market Position: Holds a high market share in providing internal financing for COFCO's extensive industrial operations.

- Return Profile: Generates stable, albeit sometimes fluctuating, returns, underscoring its role as a reliable financial enabler.

COFCO's established domestic grain and oilseed trading and processing businesses are prime examples of cash cows. Their leading market share in China for grain trading and processing, handling millions of tons annually, ensures consistent and substantial cash flow. This mature segment requires minimal investment, efficiently generating profits to fuel other ventures.

Similarly, COFCO International, despite market volatility impacting its 2024 revenues, remains a cash cow due to its immense operational scale. Trading over 108 million metric tons of commodities in 2024, its sheer volume guarantees stable revenue streams, acting as a reliable cash generator for the group.

COFCO's extensive agri-food processing infrastructure, featuring over 200 facilities and Asia's largest integrated grain and oil park, solidifies its cash cow status. This mature, high-capacity network consistently delivers strong profit margins and predictable cash flow, as evidenced by significant revenue contributions from processed food segments in 2023.

Mature brands like Mengniu Dairy, in which COFCO holds a significant stake, are quintessential cash cows. With deep consumer penetration and consistent revenue growth, such as Mengniu's approximately 10% revenue increase in 2023, these brands generate substantial, stable cash flow with limited need for further investment.

| Business Segment | Role in BCG Matrix | Key Characteristics | 2024/2023 Data Points |

|---|---|---|---|

| Domestic Grain & Oil Trading/Processing | Cash Cow | Dominant market share, stable cash flow, low investment needs | Top market share in China's grain trading; high processing capacity |

| COFCO International | Cash Cow | High volume of trade, consistent revenue generation | Traded 108.4 million metric tons in 2024 |

| Agri-Food Processing Infrastructure | Cash Cow | Mature, high-capacity network, consistent profit margins | Over 200 facilities; significant revenue from processed foods in 2023 |

| Established Food Brands (e.g., Mengniu Dairy) | Cash Cow | Deep consumer penetration, predictable cash flow, strong brand equity | Mengniu Dairy revenue growth ~10% in 2023 |

What You See Is What You Get

Cofco BCG Matrix

The Cofco BCG Matrix preview you're viewing is the exact, fully formatted document you'll receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered to you without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional, ready-to-implement report you'll acquire, enabling immediate application in your business planning.

Dogs

Underperforming legacy real estate assets within GRANDJOY's portfolio, those not aligned with its primary 'Joy City' or 'Joy Breeze' brands, often reside in mature or slow-growing markets. These properties may struggle to command competitive rents or achieve high occupancy rates, leading to diminished profitability.

These assets can become cash traps, consuming capital for upkeep and modernization without generating sufficient returns to justify the investment. For instance, if such a property saw its net operating income (NOI) decline by 5% in 2024 due to increased vacancy and operational costs, it would highlight the challenge.

Within COFCO's extensive food manufacturing operations, some older or specialized product lines may be facing reduced consumer interest. These products, often characterized by a low market share in mature or shrinking segments, can be classified as dogs. While they might cover their costs, their growth contribution is minimal, reflecting evolving tastes and strong market competition.

Some of COFCO's older processing and storage facilities may not be as efficient as newer ones, leading to higher operating costs. These underperforming assets could tie up capital if they are located in areas with limited growth potential or serve markets that are shrinking.

Divested or Downscaled Grain Assets

COFCO International's divestment of its Chicago grain warehouse facility (B-House) to GROWMARK Inc. in 2024 exemplifies a strategic move within the BCG matrix, likely categorizing these assets as Divested or Downscaled. This action suggests that the B-House facility was perceived as a low-growth or low-market-share component of COFCO's broader portfolio, prompting its sale to optimize resource allocation. Such decisions are common when companies streamline operations to focus on more promising business units.

The sale of grain assets can signal a repositioning towards higher-potential areas. For instance, if COFCO is investing more heavily in bio-agronomy or specialized food processing, older or less profitable grain infrastructure might be offloaded. This aligns with the principle of divesting or downscaling units that do not contribute significantly to overall growth or market leadership.

- Divestment Rationale: COFCO International sold its Chicago grain warehouse facility (B-House) in 2024 to GROWMARK Inc., indicating a strategic decision to exit an asset.

- BCG Matrix Classification: This move suggests the B-House facility was likely classified as a 'Divested' or 'Downscaled' asset due to perceived low growth or market share.

- Strategic Focus: Such sales are typical when a company aims to concentrate resources on core competencies or more profitable business segments.

Struggling Biotechnology Ventures

Struggling biotechnology ventures within COFCO Biotechnology, as indicated by a 1.06% year-on-year decline in operating revenue for 2024, are likely positioned as dogs in the BCG matrix. These ventures may be operating in mature or declining market segments, or facing intense competition that hinders growth and profitability. Without a clear competitive advantage or a significant market share, these businesses consume resources without generating substantial returns.

Consider these factors for struggling biotechnology ventures:

- Low Market Share and Low Growth: Ventures in this category typically possess a small share of a market that is not expanding rapidly. This combination makes it difficult to achieve economies of scale or generate significant cash flow.

- Resource Drain: These businesses often require ongoing investment to maintain their operations or attempt to regain market traction, diverting capital from more promising areas of the portfolio.

- Strategic Review Needed: Companies often consider divesting, liquidating, or significantly restructuring these dog businesses to reallocate resources more effectively.

- Potential for Niche Turnaround: In some rare cases, a struggling venture might be revitalized through a focused strategy targeting a specific niche market or through innovation, though this carries substantial risk.

Within COFCO's diverse operations, certain product lines or business units may exhibit characteristics of "dogs" in the BCG matrix. These are typically businesses with low market share in industries that are not experiencing significant growth. For example, some of COFCO's older or less popular food brands might fall into this category, struggling to gain traction against more innovative competitors.

These "dog" segments often require careful management to avoid becoming significant drains on resources. While they might generate some revenue, their limited growth potential means they are unlikely to contribute substantially to future profits. COFCO's 2024 divestment of its Chicago grain warehouse facility (B-House) to GROWMARK Inc. exemplifies a strategic move away from such assets, signaling a focus on more promising areas of the business.

Question Marks

Early-stage agricultural technology ventures, focusing on sci-tech innovation and digital agriculture, represent question marks within the COFCO BCG Matrix. While these sectors promise high growth, individual ventures typically possess a low current market share. For instance, in 2024, the global agritech market was valued at approximately $22.5 billion, with early-stage companies capturing only a fraction of this.

These ventures demand significant capital for research, development, and scaling, mirroring the characteristics of question marks. The path to market leadership and profitability is often uncertain, requiring substantial investment before a clear competitive advantage emerges. The venture capital funding for agritech globally saw significant activity in 2024, with many early-stage deals being deployed into these innovative areas, indicating investor confidence in future potential despite present market share limitations.

COFCO's new international market entries, particularly in nascent stages across Asia-Pacific, Europe, and Africa, represent their Question Marks. These ventures are in regions with high growth potential, but COFCO's initial market share is likely low as they establish a foothold against entrenched local competitors. For example, in 2024, COFCO's expansion into Southeast Asian agricultural markets, while promising, saw them competing with established regional giants, requiring substantial investment to build brand recognition and distribution networks.

COFCO's exploration into emerging niche food categories like advanced plant-based alternatives and specialized functional ingredients represents a strategic move into high-potential, albeit nascent, markets. These sectors are characterized by rapidly evolving consumer tastes and a demand for innovative products, offering significant growth opportunities.

For instance, the global plant-based food market was valued at over $25 billion in 2023 and is projected to reach $160 billion by 2030, indicating a substantial growth trajectory. COFCO's entry into such a category would likely position it as a 'Question Mark' in the BCG matrix, given its potentially low initial market share and the need for considerable investment in research, development, and marketing to capture a significant portion of this expanding market.

Specific New Commodity Trading Expansions

COFCO International's ventures into nascent commodity markets or the establishment of new trading routes would typically be categorized as 'Question Marks' in the BCG Matrix. These initiatives, while holding potential for high growth, currently represent a small market share for COFCO. For instance, exploring trading in emerging bio-based commodities or developing new logistical pathways for specialty agricultural products in regions like Southeast Asia would fit this profile. These segments require significant investment in infrastructure, market research, and relationship building to gain traction.

The financial commitment for these 'Question Marks' is substantial, as COFCO International invests in building capacity and securing market access. For example, establishing new grain handling facilities in a developing African market or investing in the supply chain for novel protein sources would necessitate considerable capital expenditure. The objective is to nurture these nascent operations into future 'Stars' or strong 'Cash Cows' by capturing market share in high-growth sectors.

- Emerging Markets Focus: COFCO International's expansion into less-established commodity trading, such as niche bio-fuels or advanced agricultural inputs in regions with developing infrastructure, would be considered Question Marks. These areas present high growth potential but currently hold a low market share for the company.

- Investment Needs: Significant capital is deployed to penetrate these new markets, covering logistics, storage solutions, and building local distribution networks. For example, investments in port facilities or specialized transportation for new product lines are crucial.

- Strategic Rationale: The strategy behind these Question Marks is to cultivate future revenue streams by gaining an early foothold in potentially lucrative, high-growth segments of the global commodity market.

Pilot Sustainable Farming Initiatives

COFCO's pilot sustainable farming initiatives, like supporting farmers in Brazil's Cerrado to adopt eco-friendly soy, tap into a high-growth market driven by global demand for sustainability. These programs represent a significant investment in future market share.

While the demand is strong, the initial adoption rates for these pilot programs or new sustainability standards can be low. This means they might currently be in a low-market share phase within the BCG matrix, requiring substantial capital to scale up and realize their full market potential.

- High Growth Potential: Global demand for sustainably sourced agricultural products is projected to continue its upward trajectory, creating a fertile ground for COFCO's initiatives.

- Initial Investment Needs: Expanding these pilot programs to achieve broader market impact will necessitate considerable financial resources for farmer training, infrastructure development, and certification processes.

- Market Share Development: As adoption rates increase and these initiatives mature, they are expected to capture a larger share of the growing sustainable agriculture market.

Question Marks in COFCO's BCG Matrix represent ventures with high growth potential but currently low market share, demanding significant investment. These are often new product lines or market entries where COFCO is still establishing its presence. For example, COFCO's foray into novel protein sources, like insect-based ingredients, aligns with this category. The global alternative protein market, including novel sources, was valued at around $18.5 billion in 2024 and is expected to grow substantially, yet COFCO's share in this nascent segment is minimal.

These ventures require substantial capital for research, development, and market penetration to convert their potential into market leadership. The success of these 'Question Marks' hinges on COFCO's ability to effectively invest and navigate competitive landscapes. For instance, developing the necessary processing technology and consumer acceptance for insect-based proteins in 2024 involved significant R&D expenditure by companies in the sector.

COFCO's strategic investments in advanced agricultural technologies, such as precision farming solutions and AI-driven crop management systems, are prime examples of Question Marks. While the agritech sector offers high growth, these specific technologies are still gaining widespread adoption, meaning COFCO's current market share in providing these solutions is relatively small. The global precision agriculture market was estimated to be worth over $9 billion in 2024, with a strong growth outlook.

| Venture Type | Market Growth | Current Market Share | Investment Needs | Strategic Goal |

| Novel Protein Sources | High | Low | High | Market Leadership |

| Advanced Agritech Solutions | High | Low | High | Market Penetration |

| Emerging Commodity Trading | High | Low | High | Establish Foothold |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial data, comprehensive market research reports, and publicly available company disclosures to provide a robust strategic overview.