China Taiping Insurance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Taiping Insurance Bundle

China Taiping Insurance operates in a dynamic market shaped by intense competition and evolving customer demands. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this landscape. Our analysis reveals how these forces impact China Taiping Insurance's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore China Taiping Insurance’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

China Taiping Insurance, like its peers, depends on reinsurance to handle significant risks and ensure financial stability. The bargaining power of these reinsurance providers can range from moderate to substantial, particularly for niche or catastrophic event coverage where available capacity may be constrained.

In 2024, China Taiping Insurance Group's reinsurance segment demonstrated significant strength, reporting a remarkable 187.5% surge in net profits after tax. This substantial growth highlights a dynamic and potentially advantageous reinsurance market for the group.

The growing reliance on advanced technologies like AI and big data analytics in China's insurance sector significantly boosts the bargaining power of software and technology vendors. As China Taiping Insurance actively pursues digital transformation, including investments in upgrading its information systems and exploring AI applications, its dependence on these specialized suppliers increases, giving them more leverage.

As a major player in investment management, China Taiping Insurance faces potential bargaining power from external asset managers. These providers can wield influence if they offer specialized expertise or exclusive market access that China Taiping cannot easily replicate internally. The group's significant investment activities mean that the terms offered by these external partners can directly impact profitability.

The bargaining power of suppliers in this context is amplified by the need for specialized financial instruments and market insights. If a few select firms dominate niche investment areas or possess proprietary trading strategies, they can command more favorable terms. This is particularly relevant given China Taiping's extensive asset management operations, which necessitate a diverse range of investment vehicles and expertise.

China Taiping's investment sector demonstrated robust performance in 2024, with total investment income surging by 98.2%. This strong rebound suggests that while external suppliers might have some leverage, the group's overall financial health and investment success can also influence negotiation dynamics, potentially mitigating some supplier power.

Healthcare Providers (for Health Insurance)

China Taiping Insurance, when offering health insurance, depends on a network of healthcare providers. The ability of these providers to negotiate terms can be significant, particularly for top-tier or specialized medical institutions, as they directly impact the expenses and standards of claims processed.

The landscape of commercial health insurance in China is undergoing a notable evolution. This transformation is characterized by a strategic pivot, moving away from a primary focus on sheer market size towards an emphasis on the quality of services delivered. This shift means that providers who can offer superior medical care and outcomes are likely to hold greater bargaining power.

- Provider Concentration: The concentration of high-quality healthcare facilities in specific regions or within certain specialties can increase their leverage.

- Specialized Services: Providers offering unique or highly specialized medical treatments or technologies may command higher prices.

- Regulatory Environment: Government policies and regulations concerning healthcare pricing and provider networks can influence bargaining power.

- Demand for Services: High demand for specific medical services can empower providers to negotiate more favorable terms with insurers.

Distribution Channels and Agents

China Taiping Insurance leverages a mix of direct sales, its own branch networks, and a significant reliance on independent agents and brokers. These intermediaries, especially those with established client bases and strong market penetration, can negotiate for higher commission rates and more favorable contract terms, thereby influencing China Taiping’s profitability. For instance, in 2024, the insurance distribution landscape in China continued to see a growing number of independent agencies, some of which represent multiple insurers, increasing their leverage.

The bargaining power of these distribution channels is further amplified by their ability to direct business to competitors if their demands are not met. As the insurance market matures, agents and brokers often become more discerning about the products and compensation they offer, particularly in competitive segments like life and health insurance where China Taiping is a major player. This dynamic means that China Taiping must continually balance the need for broad distribution with the cost of maintaining these relationships.

- Agent Dependency: China Taiping's reliance on agents means these intermediaries hold sway over commission structures.

- Market Reach: Channels with extensive customer reach can command better terms.

- Digital Shift: The rise of online sales platforms introduces new distribution dynamics, potentially reducing the power of traditional agents but creating new platform-based dependencies.

The bargaining power of suppliers for China Taiping Insurance is a multifaceted issue, influenced by the concentration of providers, the uniqueness of their offerings, and the overall market demand. In 2024, the insurance sector's digital transformation, driven by AI and big data, has significantly increased the leverage of technology vendors. Similarly, specialized asset managers and high-quality healthcare providers can command more favorable terms due to their unique expertise or service quality.

| Supplier Type | Influence Factor | 2024 Relevance |

|---|---|---|

| Reinsurers | Capacity for niche/catastrophic coverage | Net profits surged 187.5% in the reinsurance segment, indicating a strong market for reinsurers. |

| Technology Vendors | Digital transformation needs (AI, Big Data) | Increased dependence on specialized tech suppliers for system upgrades and AI exploration. |

| Asset Managers | Specialized expertise, exclusive market access | Total investment income surged 98.2%, highlighting the importance of external managers' performance. |

| Healthcare Providers | Quality of service, specialization | Shift towards quality of care in commercial health insurance elevates the power of top-tier medical institutions. |

| Distribution Channels (Agents/Brokers) | Market reach, client base | Growing number of independent agencies in 2024 increased their leverage for commission negotiations. |

What is included in the product

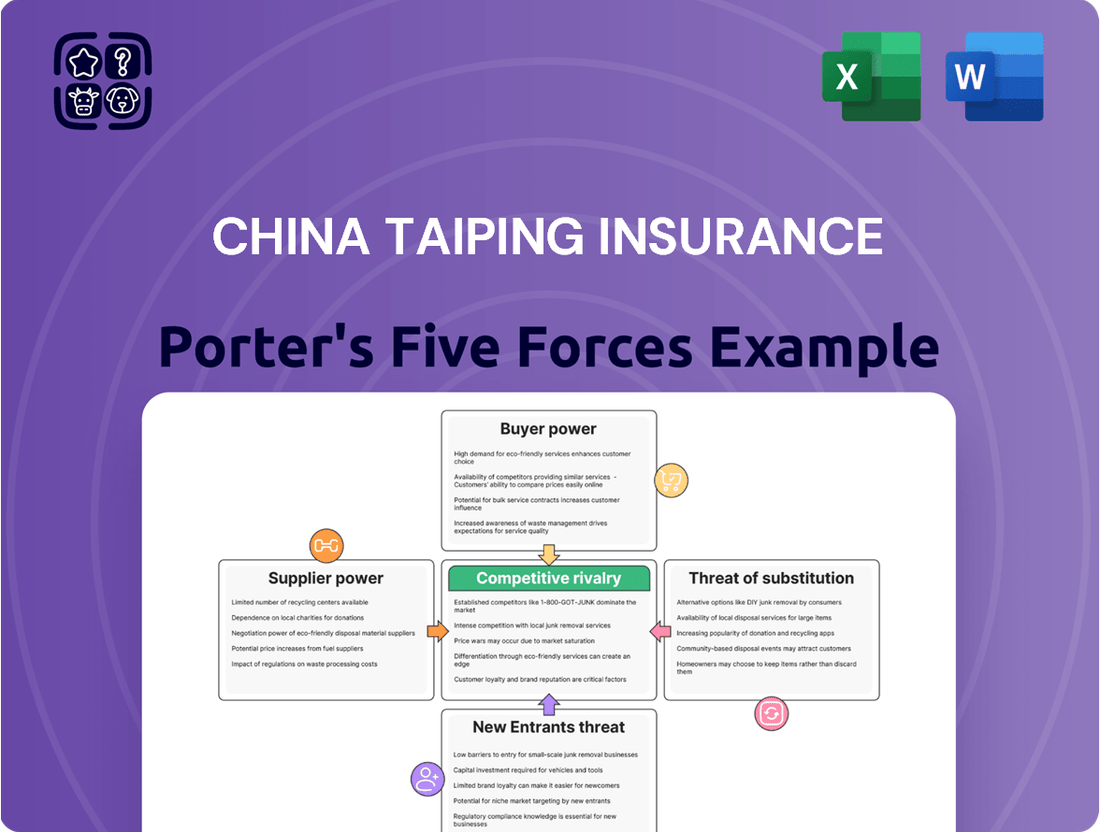

Uncovers key drivers of competition, customer influence, and market entry risks tailored to China Taiping Insurance, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitutes within the Chinese insurance market.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics, allowing for proactive strategy adjustments.

Streamline complex market analysis into an easily digestible format, empowering swift, data-driven decisions to mitigate potential risks.

Customers Bargaining Power

The bargaining power of individual customers in China's insurance market, particularly for standardized products like basic life or health insurance, is typically low. This is because policies are often uniform, making it difficult for individual consumers to negotiate terms or prices. In 2023, the life and health insurance sector in China saw significant growth, with premiums reaching substantial figures, indicating a strong demand for these standardized products.

However, this power is gradually increasing. A growing number of Chinese consumers are becoming more financially savvy and are actively using online comparison websites and apps to evaluate different insurance offerings. This trend is supported by the projected expansion of China's personal insurance market, which, according to industry forecasts, is anticipated to continue its upward trajectory, with a particular emphasis on more sophisticated and value-added products, giving consumers more choice and leverage.

Large corporate and group customers, like businesses procuring employee insurance or pension plans, wield significant bargaining power. Their substantial purchase volumes and unique demands allow them to negotiate favorable terms, pricing, and bespoke solutions. China Taiping's extensive reach is evident, serving approximately 150,000 group customers within the Greater Bay Area, highlighting the importance of managing these relationships effectively.

The rise of digital platforms has significantly amplified the bargaining power of customers in the insurance sector, particularly for companies like China Taiping Insurance. Younger consumers, in particular, are increasingly comfortable purchasing insurance online. This trend is quite pronounced, with a striking 84% of consumers born after 1995 opting for online insurance purchases in 2024.

This digital savviness allows consumers to effortlessly compare policies, research coverage options, and access detailed product information. Consequently, they are better equipped to demand tailored solutions and more convenient service experiences, directly impacting how insurers price their products and design their offerings.

Customers with Specific Needs (e.g., High-Net-Worth)

High-net-worth individuals and those with specialized insurance requirements, like complex wealth management or unique risk coverage, wield considerable influence. These clients often prioritize customized solutions over mere cost, giving them leverage to negotiate more favorable terms and service packages from insurers like China Taiping.

China Taiping's strategy to offer integrated financial solutions, encompassing insurance, wealth management, and other financial services, directly addresses this segment. By providing a comprehensive suite of products, the company aims to capture and retain these valuable customers, thereby mitigating their bargaining power by becoming an indispensable partner.

- Customer Segmentation: China Taiping identifies high-net-worth individuals as a key segment, recognizing their distinct needs for sophisticated financial planning and specialized insurance.

- Value Proposition: The company offers integrated financial solutions that go beyond basic insurance, aiming to provide a holistic approach to wealth management and risk mitigation for these discerning clients.

- Relationship Management: By focusing on tailored services and personalized attention, China Taiping seeks to build strong, long-term relationships with its high-value customers, reducing their propensity to switch providers based on price alone.

- Market Trends: As of early 2024, the demand for personalized financial advice and specialized insurance products continues to grow among affluent populations globally, including in China, underscoring the importance of this customer segment.

Regulatory and Policyholder Protection

China's robust regulatory framework, particularly its emphasis on policyholder protection and insurer solvency, significantly influences customer bargaining power. This environment ensures that insurance products are transparent and that companies adhere to fair practices, indirectly empowering customers.

The amendment of China's Insurance Law further solidifies this by prioritizing consumer rights. For instance, regulations mandate clear disclosure of policy terms and conditions, reducing information asymmetry and allowing customers to make more informed choices, thereby increasing their leverage.

- Enhanced Transparency: Regulations require insurers to provide clear and understandable policy documents, enabling customers to compare offerings effectively.

- Consumer Protection Focus: Amendments to the Insurance Law in China bolster consumer rights, giving customers more recourse in case of disputes or unfair treatment.

- Solvency Requirements: Strict solvency regulations ensure that insurers can meet their obligations, providing customers with greater confidence and reducing their perceived risk, which can lessen their need to bargain aggressively on price alone.

The bargaining power of customers for China Taiping Insurance is multifaceted, influenced by segmentation and digital adoption. While individual consumers of standardized products have limited leverage, large corporate clients and affluent individuals can negotiate more favorable terms due to their significant purchasing power and demand for tailored solutions. The increasing financial literacy and digital savviness of Chinese consumers, with 84% of those born after 1995 preferring online purchases in 2024, further amplifies their ability to compare offerings and demand customized service.

China Taiping's strategy of providing integrated financial solutions aims to mitigate customer bargaining power by fostering loyalty through comprehensive service offerings. The company's focus on high-net-worth individuals, who prioritize customized solutions, and its extensive network of approximately 150,000 group customers in the Greater Bay Area, underscore the importance of managing these relationships effectively. Regulatory frameworks, including amendments to the Insurance Law, enhance transparency and consumer rights, indirectly empowering customers by ensuring fair practices and clear policy disclosures.

| Customer Segment | Bargaining Power Influence | China Taiping Strategy |

|---|---|---|

| Individual Consumers (Standardized Products) | Low | Focus on broad market reach and product standardization |

| Large Corporate/Group Customers | High | Negotiation of volume-based pricing and bespoke solutions |

| Affluent/High-Net-Worth Individuals | High | Offer integrated financial solutions, personalized service |

| Digitally Savvy Consumers (Post-1995) | Increasing | Leverage online comparison, demand for tailored digital experiences |

Full Version Awaits

China Taiping Insurance Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for China Taiping Insurance, presenting the exact document you will receive immediately after purchase. You can confidently expect the same detailed insights into competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products or services. This professionally formatted analysis is ready for your immediate use, offering a complete and actionable understanding of the market dynamics affecting China Taiping Insurance.

Rivalry Among Competitors

The Chinese insurance landscape is highly competitive, with giants like China Life, Ping An Insurance, and China Pacific Insurance dominating the market. These major domestic insurers fiercely battle for market share across various segments, including life, property, and casualty insurance, as well as asset management. This intense rivalry means companies must constantly innovate and offer compelling value propositions to attract and retain customers.

China Taiping Insurance itself is a significant player, demonstrating its substantial presence with total assets surpassing HK$1.7 trillion in 2024. This growth underscores its competitive standing within an industry characterized by the strong performance and strategic maneuvering of its large domestic counterparts.

While innovation in insurance products does occur, many fundamental offerings, like basic life or health coverage, are readily replicable by competitors. This ease of imitation naturally intensifies price-based competition, forcing companies like China Taiping to vie for market share by emphasizing other factors.

Consequently, insurers are increasingly differentiating themselves through superior service quality, building a strong brand reputation, and ensuring efficient and fair claims processing. For instance, in 2023, the average customer satisfaction score for Chinese insurers saw a slight uptick, reflecting this growing emphasis on non-price factors.

The broader market trend in China, as observed through 2024 data, indicates a discernible shift. Consumers are moving beyond just seeking the lowest price and are instead prioritizing higher-quality insurance products and a greater focus on overall value, including the reliability of the insurer and the comprehensiveness of the coverage.

The competitive landscape for China Taiping Insurance is significantly shaped by the accelerating adoption of digital technologies and the burgeoning Insurtech sector. This digital shift is fueling intense rivalry as companies leverage AI, big data, and online platforms to redefine customer engagement, operational efficiency, and product innovation.

Insurtech startups, unburdened by legacy systems, are agilely introducing novel solutions, forcing traditional players like China Taiping to innovate rapidly. China's internet-based insurance market showed remarkable growth in 2024, with projections indicating online channels will overtake offline sales within the next couple of years, underscoring the urgency for digital transformation.

Geographic and Segment Expansion

Competitive rivalry intensifies as insurers like China Taiping pursue geographic and segment expansion. This includes a strong focus on the Greater Bay Area, a key economic hub. In 2023, China Taiping reported significant premium income from this region, underscoring its strategic importance and the competitive landscape within it.

The drive to diversify into new product segments, such as health and pension insurance, further fuels competition. As more players enter these growth areas, differentiation and innovation become crucial for market share. This expansion strategy directly pits China Taiping against other major insurers vying for dominance in these lucrative markets.

- Geographic Expansion Focus: China Taiping is actively involved in the Greater Bay Area development, a key driver of its regional growth.

- Segment Diversification: The company is expanding into high-growth areas like health and pension insurance, intensifying competition.

- Premium Income Growth: Significant premium income from the Greater Bay Area in 2023 highlights the competitive intensity in this strategic region.

- Rivalry Driver: Expansion into new product lines and geographies directly increases rivalry with other established and emerging insurers.

Talent Acquisition and Retention

The insurance sector, including China Taiping, faces intense competition for skilled professionals. This is particularly true in areas like underwriting, actuarial science, and increasingly, technology and data analytics. Companies actively seek experienced individuals to drive innovation and maintain service quality.

The demand for specialized talent means that companies must offer competitive compensation and benefits to attract and retain top performers. This talent acquisition and retention dynamic directly impacts a company's ability to develop cutting-edge products and deliver superior customer service, thereby influencing its competitive position.

- High demand for actuaries and underwriters: These roles require specialized knowledge and certifications, making qualified candidates scarce.

- Technology and digital skills are crucial: Insurers need professionals proficient in AI, big data, and cybersecurity to remain competitive.

- Sales talent is vital: A strong sales force is essential for market penetration and revenue growth in the insurance industry.

- Retention is key: High turnover rates can disrupt operations and increase recruitment costs, impacting profitability.

China Taiping operates in a fiercely competitive domestic insurance market, facing off against giants like China Life and Ping An. This intense rivalry forces companies to innovate beyond price, focusing on service and brand reputation. The market's shift towards valuing quality over cost, evident in 2024 consumer trends, further heightens this competition.

The rise of Insurtech and digital transformation are major competitive drivers, with online channels projected to surpass offline sales in China soon. China Taiping's expansion into key regions like the Greater Bay Area, and into growth segments such as health and pension insurance, directly intensifies its rivalry with other major players. For instance, China Taiping's total assets exceeded HK$1.7 trillion in 2024, reflecting its scale amidst this competitive pressure.

| Competitor | Key Business Areas | 2024 Asset Estimate (Approx.) |

|---|---|---|

| China Life Insurance | Life, Health, Property & Casualty | > HK$5 Trillion |

| Ping An Insurance | Life, Health, P&C, Banking, Tech | > HK$10 Trillion |

| China Pacific Insurance | Life, Health, P&C | > HK$2 Trillion |

| China Taiping Insurance | Life, Health, P&C, Asset Management | > HK$1.7 Trillion |

SSubstitutes Threaten

Large corporations increasingly leverage self-insurance or risk retention strategies, setting aside internal funds to cover predictable losses. This approach directly substitutes traditional insurance for risks like operational disruptions or employee benefits, thereby diminishing the need for external providers. For instance, many Fortune 500 companies maintain significant captive insurance subsidiaries to manage their own risks more cost-effectively.

Alternative risk transfer (ART) mechanisms, like catastrophe bonds and insurance-linked securities (ILS), present a significant threat by offering substitutes for traditional reinsurance. These instruments allow risks to be transferred to capital markets, bypassing conventional insurance channels. The Hong Kong and Chinese governments actively support the growth of the catastrophe bond market, indicating a strategic push towards diversifying risk management solutions.

Government social security programs, particularly in China, present a significant threat of substitutes for private insurance providers like China Taiping. These state-sponsored schemes offer basic healthcare, retirement income, and unemployment benefits, which can fulfill essential needs for a portion of the population, thereby diminishing the demand for comparable private insurance products, especially for fundamental coverage.

Despite this, the Chinese personal insurance market is experiencing robust growth, projected to expand significantly in the coming years. Favorable government policies, including tax incentives for commercial health and pension insurance, are actively encouraging citizens to supplement state provisions with private plans, creating a dual landscape where both public and private sectors cater to evolving financial security needs.

Financial Products and Savings

For life insurance and pension products, individuals have a range of substitutes to consider for wealth accumulation and security. These include traditional bank deposits, which offer safety but lower returns, and various investment vehicles like mutual funds and direct stock market investments, which can provide higher growth potential but also carry greater risk. In 2024, the average interest rate on savings accounts in China remained relatively low, often below inflation, making these less attractive for long-term wealth building compared to potentially higher-yielding insurance-linked savings products or market investments.

The availability and attractiveness of these substitutes directly impact China Taiping Insurance's ability to retain and attract customers for its savings-oriented products. For instance, a strong performance in the equity markets in 2023, with the Shanghai Composite Index seeing fluctuations but overall growth in certain sectors, could draw capital away from insurance savings plans towards direct investments.

- Bank Deposits: Offer principal safety but typically yield returns below inflation, making them a less attractive substitute for long-term savings goals.

- Mutual Funds: Provide diversification and professional management, but their performance is tied to market volatility, presenting a different risk-reward profile than insurance products.

- Direct Investments (Stocks/Bonds): Allow for higher potential returns but require greater investor knowledge and tolerance for risk, acting as a significant substitute for those seeking aggressive growth.

- Real Estate: Historically a popular savings vehicle in China, direct property investment can also serve as a substitute, though market conditions and regulatory changes in 2024 influenced its attractiveness.

Preventative Measures and Risk Mitigation Services

The threat of substitutes for China Taiping Insurance is amplified as individuals and businesses increasingly invest in preventative measures and risk mitigation services. For instance, instead of relying solely on insurance for cybersecurity breaches, companies are allocating significant budgets to advanced security software and expert consultation. In 2024, global spending on cybersecurity solutions was projected to reach over $200 billion, a clear indication of this trend.

This shift directly impacts the demand for traditional insurance products. Consider health insurance: a growing emphasis on wellness programs, preventative screenings, and healthy lifestyle choices can reduce the frequency and severity of claims, making some health insurance policies less attractive. In 2024, corporate spending on employee wellness programs saw a notable increase, with many companies reporting a reduction in healthcare costs as a direct result.

The availability of these alternatives means that China Taiping Insurance must adapt its offerings. This could involve developing new products that complement preventative services or focusing on niche risks that are harder to mitigate through internal measures. The market for risk mitigation services is dynamic, with new technologies and approaches emerging constantly, presenting a continuous challenge to insurers.

- Cybersecurity Investment: Global cybersecurity spending was expected to exceed $200 billion in 2024, diverting funds from potential cyber insurance premiums.

- Wellness Program Impact: Increased corporate investment in employee wellness programs in 2024 led to a reported decrease in healthcare claims for many organizations.

- Alternative Risk Management: The rise of specialized risk mitigation services offers alternatives to traditional insurance coverage for various business and personal risks.

- Product Adaptation: Insurers like China Taiping may need to innovate by offering policies that integrate with or enhance preventative risk management strategies.

The threat of substitutes for China Taiping Insurance is significant, as individuals and businesses explore alternatives to traditional insurance. Self-insurance, alternative risk transfer mechanisms like catastrophe bonds, and government social security programs all serve as direct substitutes for certain insurance needs. Furthermore, investment vehicles such as bank deposits, mutual funds, and direct stock market investments compete for capital that might otherwise be allocated to savings-oriented insurance products. In 2024, low interest rates on savings accounts made these less appealing, pushing individuals towards higher-growth alternatives.

| Substitute Category | Examples | 2024 Relevance/Data |

|---|---|---|

| Self-Insurance/Risk Retention | Captive insurance subsidiaries | Used by large corporations to manage predictable losses cost-effectively. |

| Alternative Risk Transfer | Catastrophe bonds, Insurance-Linked Securities (ILS) | Governments in regions like Hong Kong and China support growth, diversifying risk management. |

| Government Programs | Social security, basic healthcare, retirement income | Fulfills essential needs, reducing demand for fundamental private coverage. |

| Investment Vehicles | Bank deposits, mutual funds, stocks, bonds, real estate | Bank deposit rates in China were low in 2024, often below inflation, making them less attractive for long-term wealth. Equity market performance in 2023 influenced capital allocation. |

| Preventative Measures | Cybersecurity software, wellness programs | Global cybersecurity spending projected over $200 billion in 2024; corporate wellness programs increased, reducing healthcare claims. |

Entrants Threaten

The insurance sector in China operates under a stringent regulatory regime, demanding substantial capital investment, obtaining specific licenses, and navigating intricate compliance procedures. For instance, the minimum registered capital for an insurance company in China stands at RMB 200 million, a significant hurdle for potential new players. This robust framework effectively erects considerable barriers to entry, safeguarding established entities like China Taiping Insurance.

Newcomers to the insurance sector, especially those aiming to rival giants like China Taiping, face a formidable hurdle in capital requirements. Building a robust insurance operation that can offer a diverse range of products and serve a broad customer base demands significant upfront investment. This financial barrier is a key deterrent for potential entrants.

China Taiping, for instance, boasts total assets surpassing HK$1.7 trillion, a scale that new entrants would struggle to match quickly. Achieving similar economies of scale is crucial for competitive pricing and operational efficiency, making it incredibly difficult for smaller, newly formed companies to gain traction against such an established financial powerhouse.

Brand recognition and trust are paramount in the insurance sector, a reality that significantly deters new entrants. Established companies like China Taiping have cultivated deep-rooted brand loyalty and customer trust over decades, a formidable barrier for newcomers aiming to penetrate the market. China Taiping, for instance, marked its 95th anniversary in 2024, underscoring its long-standing presence and the accumulated goodwill it enjoys among consumers.

Distribution Network Development

Building an extensive distribution network is a formidable barrier for new entrants in China's insurance market. Incumbents like China Taiping have established vast agent forces and bancassurance partnerships over years, requiring substantial capital investment to replicate.

New players face the challenge of matching the reach and customer penetration of established insurers. This includes developing both traditional agent networks and robust digital platforms.

The landscape is shifting, with online insurance penetration expected to exceed offline channels within the next two years. This presents an opportunity for digital-first entrants but still requires significant investment in technology and customer acquisition.

- Distribution Network Investment: New entrants need to invest heavily to build agent networks and digital platforms comparable to incumbents.

- Reach and Penetration: Replicating the market reach of established players like China Taiping is a significant hurdle.

- Digital Shift: The projected rise in online insurance penetration (surpassing offline within two years) necessitates substantial investment in digital capabilities.

Technological Investment and Expertise

The threat of new entrants into China Taiping Insurance's market, particularly concerning technological investment and expertise, is moderated by the significant capital and specialized knowledge required. While Insurtech presents avenues for innovation, establishing a competitive presence necessitates substantial outlays in advanced technologies such as artificial intelligence, big data analytics, and robust cloud infrastructure. For instance, developing proprietary AI-driven underwriting platforms or sophisticated customer relationship management systems demands millions in upfront investment and ongoing R&D. Furthermore, attracting and retaining talent with expertise in data science, cybersecurity, and AI development is a crucial barrier, as these skills are in high demand across industries.

The steep learning curve and operational complexities associated with integrating cutting-edge Insurtech solutions also deter nascent competitors. New players must not only acquire the technology but also master its application to achieve efficiency gains and offer compelling value propositions. This often involves a lengthy and costly process of system development, testing, and deployment. For example, building a blockchain-based claims processing system requires deep understanding of distributed ledger technology and its integration with existing insurance workflows. The need for significant financial resources and specialized human capital thus creates a considerable hurdle for potential entrants aiming to disrupt the established insurance landscape.

In 2023, global Insurtech funding reached approximately $7.5 billion, indicating continued investor interest but also highlighting the substantial capital needed to launch and scale new ventures. This investment landscape underscores the financial commitment required to compete effectively. The challenge is compounded by the need for regulatory compliance and data privacy adherence, adding further layers of complexity and cost for any new entrant aiming to operate within China's financial services sector.

The threat of new entrants in China's insurance market remains low due to substantial capital requirements, stringent regulatory oversight, and the need for extensive distribution networks. China Taiping's established brand trust, cultivated over 95 years, further solidifies its market position.

Newcomers must overcome significant hurdles, including the RMB 200 million minimum registered capital and the challenge of matching China Taiping's HK$1.7 trillion in total assets to achieve economies of scale. The projected shift towards online insurance, expected to surpass offline channels within two years, necessitates considerable investment in digital capabilities, adding another layer of complexity for potential entrants.

| Barrier | Requirement/Challenge | Impact on New Entrants |

|---|---|---|

| Capital Requirements | RMB 200 million minimum registered capital | High financial barrier to entry |

| Brand & Trust | 95 years of operation for China Taiping | Difficult to replicate established customer loyalty |

| Distribution Network | Vast agent forces and bancassurance partnerships | Requires significant investment to build comparable reach |

| Technological Investment | AI, big data, cloud infrastructure, Insurtech integration | Demands substantial capital and specialized expertise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Taiping Insurance is built upon a robust foundation of data, including the company's annual reports, official regulatory filings, and reputable industry research from sources like Statista and IBISWorld. This blend ensures a comprehensive understanding of the competitive landscape.