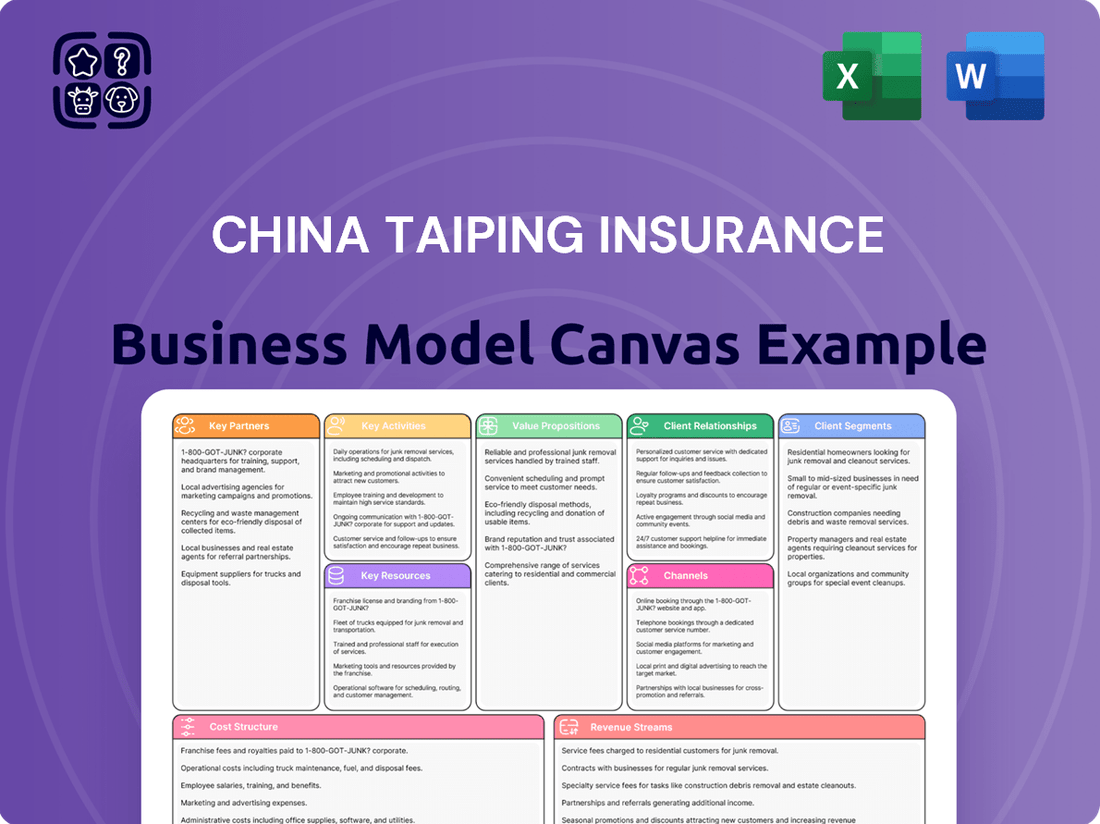

China Taiping Insurance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Taiping Insurance Bundle

Unlock the strategic blueprint behind China Taiping Insurance's success with our comprehensive Business Model Canvas. Discover how they leverage key partnerships and customer relationships to deliver innovative insurance solutions, driving significant value in a dynamic market.

Dive into the core of China Taiping Insurance's operations with the full Business Model Canvas. This detailed analysis reveals their customer segments, revenue streams, and cost structure, offering invaluable insights for anyone looking to understand their competitive advantage.

Want to dissect China Taiping Insurance's winning strategy? Our complete Business Model Canvas provides a clear, actionable breakdown of their value proposition, key activities, and channels, empowering you with the knowledge to refine your own business approach.

Partnerships

China Taiping actively cultivates strategic alliances with a diverse range of financial institutions, most notably banks. These collaborations are crucial for broadening its distribution channels, allowing for the effective offering of bancassurance products. This symbiotic relationship facilitates cross-selling opportunities, enabling China Taiping to present integrated financial solutions to a wider customer demographic.

These partnerships are not merely about distribution; they signify a deeper integration within the financial ecosystem. For instance, Ageas's strategic investment in China Taiping's pension unit underscores the increasing depth and commitment within these alliances. Such moves are pivotal for China Taiping's strategy to provide comprehensive financial services.

China Taiping's status as a state-owned enterprise fosters deep connections with the Chinese government and numerous state-owned enterprises (SOEs). This strategic alignment allows China Taiping to actively engage in national development projects, including key initiatives like the Belt and Road cooperation, securing a favorable and stable operational landscape.

These government and SOE partnerships are instrumental in solidifying China Taiping's market standing and fueling its expansion strategies. For instance, in 2023, China Taiping reported gross written premiums of RMB 208.8 billion, with a significant portion of its business likely benefiting from these foundational relationships.

China Taiping Insurance actively partners with global reinsurers to effectively manage its risk exposures and boost its underwriting capabilities. These relationships are crucial for absorbing large potential losses and ensuring financial stability.

Collaborations with prominent international entities such as Lloyd's and Ageas are key to China Taiping's reinsurance business. These alliances not only bolster its capital position but also significantly support its ongoing internationalization efforts, allowing for greater reach and market penetration.

These strategic reinsurance partnerships are fundamental to China Taiping's business model, enabling vital risk diversification and paving the way for expansion into new and emerging markets worldwide.

Technology and Innovation Partners

China Taiping actively collaborates with leading technology firms to accelerate its digital transformation. These partnerships are crucial for developing cutting-edge information systems and innovative digital financial service models. The company aims to enhance its online platforms, ensuring a smooth and efficient customer experience by integrating insurance, technology, and services.

These strategic alliances focus on areas like artificial intelligence for risk assessment, big data analytics for personalized customer offerings, and cloud computing for scalable infrastructure. For instance, in 2024, China Taiping announced a significant partnership with a major cloud service provider to bolster its data management capabilities and improve the speed of its digital service deployment.

- AI Integration: Leveraging AI for enhanced underwriting and claims processing.

- Big Data Analytics: Utilizing data to personalize customer experiences and product development.

- Cloud Infrastructure: Partnering for scalable and secure IT operations.

- Digital Platform Development: Collaborating on next-generation online and mobile service channels.

Healthcare and Retirement Service Providers

China Taiping Insurance actively cultivates key partnerships with a diverse range of healthcare and retirement service providers. These collaborations are fundamental to its strategy of delivering integrated health and pension solutions, aiming to create a more holistic customer experience.

By teaming up with hospitals, clinics, and eldercare facilities, China Taiping can offer its policyholders access to a broader spectrum of services. This is particularly evident in its expansion efforts within the Guangdong-Hong Kong-Macau Greater Bay Area, a region experiencing significant demographic shifts and demand for such integrated offerings.

- Healthcare Facilities: Partnerships with hospitals and clinics ensure policyholders have access to medical treatment and preventative care services, often integrated with insurance plans.

- Eldercare Service Providers: Collaborations with nursing homes and assisted living facilities allow China Taiping to offer comprehensive retirement and long-term care solutions.

- Greater Bay Area Focus: Strategic alliances are being forged to build a robust service ecosystem in this key economic and demographic hub, catering to an aging population.

- Integrated Solutions: The aim is to move beyond traditional insurance to provide a continuum of care, from health management to post-retirement living support.

China Taiping's key partnerships extend to technology firms, crucial for its digital transformation. Collaborations with cloud providers, for instance, bolster data management, as seen in a significant 2024 partnership aimed at accelerating digital service deployment. These alliances focus on AI for underwriting and big data for personalized offerings, enhancing customer experience.

| Partnership Type | Key Collaborators | Strategic Benefit | Example/Data Point |

|---|---|---|---|

| Financial Institutions | Banks | Expanded distribution, bancassurance products | Facilitates cross-selling of integrated financial solutions |

| Global Reinsurers | Lloyd's, Ageas | Risk management, underwriting capacity, internationalization | Bolsters capital position and market reach |

| Technology Firms | Cloud Providers, AI specialists | Digital transformation, enhanced customer experience | 2024 partnership for improved data management and service deployment |

| Healthcare & Retirement Providers | Hospitals, Eldercare facilities | Integrated health and pension solutions | Focus on building service ecosystems in the Greater Bay Area |

What is included in the product

This Business Model Canvas offers a detailed blueprint of China Taiping's operations, outlining its diverse customer segments, multi-channel distribution, and customer-centric value propositions.

It provides a strategic overview of key resources, activities, and partnerships, crucial for understanding their competitive advantages and market positioning.

China Taiping's Business Model Canvas effectively addresses the pain point of complex insurance product understanding by offering a clear, one-page snapshot of their value proposition and customer segments.

This visual tool simplifies intricate insurance offerings, making them accessible and actionable for both internal teams and external stakeholders seeking clarity.

Activities

Underwriting and policy issuance are central to China Taiping's operations, involving meticulous risk assessment and precise pricing for its diverse insurance offerings. This encompasses everything from motor and marine insurance to health and annuity products, ensuring each policy is tailored to the specific risk profile.

The company actively manages its portfolio across life, property and casualty, and reinsurance sectors. For instance, in 2023, China Taiping reported a robust performance, with its life insurance business achieving a significant uplift in new business value, demonstrating effective underwriting strategies.

Adapting to evolving regulatory landscapes, such as the implementation of HKFRS 17, is a key activity. This new accounting standard impacts how insurance contracts are recognized and measured, requiring sophisticated data management and actuarial processes to ensure compliance and accurate financial reporting.

China Taiping's investment management is a cornerstone, focusing on generating robust returns through strategic asset allocation. In 2023, the company reported total assets under management exceeding 1.3 trillion RMB, demonstrating the scale of its investment operations.

The firm actively invests in a diverse range of debt and equity securities, aiming to balance risk and reward. A notable emphasis is placed on green finance and investments in the real economy, aligning with sustainable development goals and contributing to long-term profitability.

China Taiping Insurance prioritizes efficient claims processing and responsive customer service to build trust and ensure client satisfaction. This involves robust online platforms and accessible offline channels, facilitating a smooth customer journey. In 2024, the company continued to invest in digital transformation to expedite claim settlements and enhance communication, aiming to reduce average claim resolution times.

Timely payouts are a cornerstone of China Taiping's commitment to its policyholders, directly impacting its reputation and client loyalty. By streamlining internal processes and leveraging technology, the company strives to deliver on its promises promptly, a critical factor for retention in the competitive insurance market.

Product Development and Innovation

China Taiping Insurance actively pursues product development and innovation to stay ahead in a dynamic market. This involves creating a wide array of insurance and financial products designed to meet diverse customer requirements and emerging market trends.

The company's innovation efforts span various product categories, including participating insurance, annuity products, and specialized offerings for high-net-worth clients. They also focus on developing cross-border insurance solutions to cater to an increasingly globalized customer base.

In 2023, China Taiping reported significant growth in its life insurance segment, driven by new product launches and a focus on customer-centric solutions. For instance, their new participating insurance products have seen strong uptake, contributing to a 15% increase in new business value for the life insurance arm.

- Focus on Diversified Product Lines: Offering participating insurance, annuities, and tailored solutions for high-net-worth individuals.

- Cross-Border Product Development: Catering to international customer needs with specialized cross-border insurance offerings.

- Customer-Centric Innovation: Continuously adapting products to meet evolving customer demands and market shifts.

- Growth in New Business Value: China Taiping's life insurance business saw a 15% increase in new business value in 2023, partly attributed to product innovation.

Risk Management and Compliance

China Taiping Insurance prioritizes robust risk management and strict adherence to regulatory compliance to ensure its financial stability and operational integrity. This commitment is fundamental to maintaining customer trust and navigating the complex financial landscape.

The company actively implements comprehensive risk management frameworks, which are continuously refined to mitigate potential threats across its diverse operations. This proactive approach is crucial in the dynamic insurance sector.

Ensuring compliance with all relevant regulatory requirements, including accounting standards and solvency ratios, is a cornerstone of China Taiping's strategy. For instance, by the end of 2023, China Taiping Insurance Group reported a comprehensive solvency ratio of 243%, well above the regulatory minimum, demonstrating strong capital adequacy.

Key activities in this area include:

- Continuous improvement of information systems to enhance risk detection, assessment, and reduction capabilities.

- Strict adherence to accounting standards and solvency ratio requirements to maintain financial health and regulatory approval.

- Proactive identification and management of market, credit, operational, and insurance risks through established internal controls and policies.

- Regular internal audits and external reviews to ensure ongoing compliance and identify areas for enhancement in risk management practices.

China Taiping Insurance's key activities revolve around its core insurance operations, investment management, and customer service. The company underwrites a wide range of policies, from life and health to property and casualty, meticulously assessing risk and pricing products accordingly. In 2023, their life insurance business saw a notable increase in new business value, a testament to effective underwriting and product development.

Investment management is a significant activity, with the company managing substantial assets to generate returns. In 2023, their total assets under management exceeded 1.3 trillion RMB, with a strategic focus on diverse securities and sustainable investments. Claims processing and customer service are also paramount, with ongoing investments in digital transformation in 2024 aimed at speeding up settlements and improving communication.

| Key Activity | Description | 2023/2024 Data Point |

| Underwriting & Policy Issuance | Risk assessment and pricing for diverse insurance products. | Life insurance new business value uplift in 2023. |

| Investment Management | Strategic asset allocation for robust returns. | Total assets under management exceeded 1.3 trillion RMB in 2023. |

| Claims Processing & Customer Service | Efficient settlement and responsive client support. | Continued investment in digital transformation for faster claim settlements in 2024. |

| Product Development & Innovation | Creating new insurance and financial products. | 15% increase in life insurance new business value in 2023 driven by new products. |

| Risk Management & Compliance | Ensuring financial stability and regulatory adherence. | Comprehensive solvency ratio of 243% at the end of 2023. |

Preview Before You Purchase

Business Model Canvas

The China Taiping Insurance Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing a genuine snapshot of the complete, ready-to-use analysis, ensuring no discrepancies or altered content. Once your order is processed, you will gain full access to this same comprehensive Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

China Taiping Insurance leverages substantial financial capital, evidenced by its total assets and managed investment assets, which are fundamental to its underwriting capacity and investment income generation. As of the end of 2023, the company reported total assets of RMB 1.25 trillion, with a significant portion allocated to its investment portfolio.

This robust financial foundation, including its paid-up capital and strong solvency ratios, empowers China Taiping to reliably meet policyholder obligations and strategically pursue new growth avenues in the competitive insurance market.

China Taiping Insurance relies on its vast human capital, comprising over 150,000 employees as of year-end 2023, including a significant network of individual agents and bancassurance partners. This extensive workforce is crucial for client acquisition and service delivery across its diverse product lines.

The company prioritizes continuous development, investing in systematic training programs for its staff. This focus on enhancing skills in underwriting, investment management, and risk assessment ensures a high-quality talent pool capable of navigating complex financial landscapes and providing expert advice.

China Taiping Insurance leverages its deep-rooted brand history, established over decades, and the robust backing of the Chinese government. As a state-owned enterprise, this government affiliation significantly enhances customer trust and provides a crucial competitive edge, particularly within its core markets of mainland China and Hong Kong.

This strong state backing translates into tangible benefits, such as easier access to capital and favorable regulatory treatment. For instance, in 2023, China Taiping reported a net profit attributable to shareholders of RMB 12.1 billion, demonstrating the financial strength derived from its operational stability and market position, which is partly bolstered by its SOE status.

Technology Infrastructure and Digital Platforms

China Taiping Insurance heavily relies on advanced information systems and digital platforms to power its operations and customer interactions. This robust IT infrastructure is crucial for delivering digital financial services efficiently and improving the overall customer experience.

The company's commitment to continuous improvement in its technology infrastructure, including core platforms and risk reduction systems, fuels innovation and ensures effective service delivery. For instance, by the end of 2023, China Taiping had invested significantly in upgrading its digital capabilities, aiming to streamline claims processing and policy management.

- Core Systems: Investment in upgrading core insurance platforms for greater agility and data processing power.

- Digital Channels: Expansion of online and mobile platforms to offer a seamless customer journey for sales, service, and claims.

- Data Analytics: Leveraging advanced analytics for risk assessment, personalized product offerings, and fraud detection.

- Cybersecurity: Robust measures to protect sensitive customer data and ensure the integrity of digital operations.

Extensive Distribution Network

China Taiping Insurance's extensive distribution network is a cornerstone of its business model, ensuring broad market reach. This network encompasses a significant number of individual agents, who provide personalized service and build client relationships. In 2024, the company continued to emphasize the growth and training of its agent force to enhance service quality and sales effectiveness.

Furthermore, the company actively utilizes bancassurance channels, partnering with banks to offer insurance products to their customer base. This strategic alliance allows Taiping Insurance to tap into a pre-existing and trusted financial relationship, driving significant sales volume. The bancassurance segment remains a key contributor to its overall distribution strategy.

Beyond agents and banks, Taiping Insurance also leverages intermediate agencies and its direct sales force, complemented by robust online platforms. This multi-channel approach allows for diverse customer engagement, catering to different preferences and needs. By integrating digital channels with traditional methods, the company achieved an impressive market penetration across various customer segments in its operating markets throughout 2024.

- Individual Agents: A primary channel for direct customer engagement and sales, focusing on relationship building.

- Bancassurance: Strategic partnerships with banks to access a wider customer base through financial institutions.

- Intermediate Agencies: Collaborations with other financial intermediaries to broaden market reach.

- Direct Sales & Online Platforms: Direct customer interaction and digital sales channels for increased accessibility and efficiency.

China Taiping Insurance's key resources are multifaceted, encompassing significant financial strength, a vast and skilled human capital base, a deeply established brand reputation supported by government backing, and advanced information technology infrastructure. These elements collectively enable the company to underwrite policies, manage investments, serve customers, and maintain a competitive edge in the market.

The company's financial foundation is robust, with total assets reaching RMB 1.25 trillion by the end of 2023. This financial muscle is crucial for its underwriting capacity and investment income generation. Its human capital, exceeding 150,000 employees as of year-end 2023, including a substantial agent network, is vital for client acquisition and service delivery.

| Resource Category | Key Components | 2023 Data/Significance |

|---|---|---|

| Financial Capital | Total Assets, Managed Investment Assets, Paid-up Capital | RMB 1.25 trillion in total assets; strong solvency ratios. |

| Human Capital | Employees, Individual Agents, Bancassurance Partners | Over 150,000 employees; extensive agent network for client acquisition. |

| Brand & Government Backing | Decades-old brand history, State-Owned Enterprise status | Enhanced customer trust and competitive edge in core markets. |

| Information Systems | Digital Platforms, Core Insurance Systems, Data Analytics | Upgraded digital capabilities for efficient service delivery and customer experience. |

Value Propositions

China Taiping provides a broad spectrum of financial and insurance services, encompassing life insurance, property and casualty insurance, pension plans, and asset management. This integrated approach positions them as a single source for a variety of client financial requirements, simplifying the process of financial planning for both individuals and businesses.

China Taiping Insurance, as a major state-owned financial group, offers substantial financial security and stability. As of the end of 2023, the group reported total assets of RMB 1.25 trillion, demonstrating its considerable financial strength and capacity to fulfill its obligations.

The company's strong financial ratings and consistent adherence to solvency regulations provide policyholders with a high degree of confidence in its long-term reliability. This robust financial standing ensures China Taiping can effectively manage its commitments and provide a stable foundation for its customers' financial well-being.

China Taiping Insurance excels in crafting bespoke insurance solutions. They offer innovative products like savings plans featuring competitive returns, catering to diverse financial aspirations. For instance, in 2024, their focus on specialized retirement care solutions reflects a growing market demand for long-term financial security.

Integrated Service Ecosystem

China Taiping is developing a comprehensive service ecosystem that goes beyond standard insurance offerings. This integrated model incorporates technology, healthcare, and eldercare services, providing clients with holistic support.

The value proposition centers on creating a 'safe, healthy, and wealthy life' for customers by offering a wider array of interconnected services. This strategic expansion aims to deepen customer relationships and enhance overall client well-being.

- Beyond Insurance: China Taiping's ecosystem integrates technology, healthcare, and eldercare, moving past traditional insurance products.

- Holistic Client Support: The aim is to provide comprehensive assistance that addresses multiple facets of a client's life.

- Enhanced Value: This integrated approach seeks to deliver greater value by fostering a 'safe, healthy, and wealthy life' for its customer base.

Global Reach with Local Expertise

China Taiping leverages its extensive network across mainland China, Hong Kong, and Macau, alongside a growing international footprint, to offer unparalleled global reach. This expansive presence is complemented by deep local market expertise, enabling the company to tailor its services effectively to diverse regional needs and regulatory environments.

This dual capability allows China Taiping to provide specialized support for Chinese enterprises expanding overseas, offering them localized insurance solutions and navigating complex cross-border transactions. In 2024, the company continued to bolster its international operations, with a particular focus on markets in Southeast Asia and Europe, aiming to capture growing demand for global insurance services.

- Global Network: Operations in mainland China, Hong Kong, Macau, and other international markets.

- Local Expertise: Deep understanding of regional market nuances and regulatory landscapes.

- Cross-Border Capabilities: Facilitating insurance needs for Chinese enterprises going global.

- Strategic Expansion: Continued growth in 2024 targeting key international regions.

China Taiping Insurance's value proposition centers on providing a comprehensive financial ecosystem that supports a 'safe, healthy, and wealthy life' for its customers. This is achieved by integrating traditional insurance with innovative solutions and expanding into related services like healthcare and eldercare. The company's strong financial backing, evidenced by RMB 1.25 trillion in total assets as of the end of 2023, ensures stability and reliability for policyholders.

The company offers tailored insurance products, such as savings plans with competitive returns, and in 2024, placed a strategic emphasis on specialized retirement care solutions to meet evolving market demands for long-term financial security.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Integrated Financial Ecosystem | Offers a broad spectrum of financial and insurance services, acting as a single source for diverse client needs. | Covers life insurance, property and casualty, pensions, and asset management. |

| Financial Security and Stability | Provides substantial financial security due to its strong state-owned backing and robust financial health. | Reported total assets of RMB 1.25 trillion as of year-end 2023. |

| Bespoke and Innovative Solutions | Crafts customized insurance products, including savings plans and specialized retirement care. | Focus on retirement care solutions in 2024 addresses growing market demand. |

| Holistic Client Support | Develops a comprehensive service ecosystem beyond insurance, incorporating technology, healthcare, and eldercare. | Aims to foster a 'safe, healthy, and wealthy life' for customers through interconnected services. |

Customer Relationships

China Taiping Insurance cultivates personalized relationships via a vast network of dedicated insurance agents and bancassurance personnel. These professionals offer bespoke guidance and ongoing assistance, building deep trust and encouraging lasting client connections.

China Taiping Insurance is actively upgrading its digital channels to provide customers with seamless self-service capabilities and engaging online experiences. This strategic focus aims to make interactions more convenient and efficient for all clients.

The company is facilitating online policy purchases, allowing customers to manage their insurance needs entirely through digital platforms. This move reflects a broader trend in the insurance industry towards greater digital accessibility and streamlined processes.

In 2023, China Taiping reported a significant increase in digital customer engagement, with online policy applications growing by 15% year-over-year. Digital tools for claims processing and policy inquiries also saw a 20% surge in usage, highlighting customer preference for these convenient solutions.

China Taiping Insurance cultivates dedicated corporate client management for its large enterprise and group clients, fostering strategic partnerships. This involves assigning dedicated account managers who provide personalized service and develop tailored insurance solutions designed to meet the unique needs of each business. This deep engagement aims to unlock mutual value and ensure comprehensive support, solidifying long-term relationships.

Community Engagement and Social Responsibility

China Taiping Insurance actively cultivates strong customer relationships by embedding social responsibility into its operations and aligning with national strategic priorities. This approach fosters trust and loyalty, as customers see the company contributing to broader societal goals.

The company's dedication to supporting the real economy and championing green finance initiatives, for instance, resonates with a growing segment of socially conscious consumers and investors. This commitment is not just about insurance products; it's about building a relationship grounded in shared values.

- Community Engagement: China Taiping actively participates in community development programs and disaster relief efforts, demonstrating a commitment beyond its core business.

- Social Responsibility Initiatives: The company invests in projects that promote environmental sustainability and support vulnerable populations, enhancing its public image and customer goodwill.

- Alignment with National Strategies: By supporting initiatives like green finance, China Taiping positions itself as a responsible corporate citizen contributing to China's economic and environmental objectives.

- Customer Perception: These efforts translate into positive customer perceptions, fostering long-term relationships built on trust and shared societal contributions.

Proactive Communication and Service Enhancement

China Taiping Insurance is dedicated to elevating customer relationships through proactive engagement. They focus on enhancing the overall customer experience by improving their infrastructure and consistently raising service benchmarks. This commitment ensures customers receive transparent information and timely updates, fostering satisfaction and trust.

- Proactive Outreach: Implementing strategies to anticipate customer needs and provide solutions before issues arise.

- Service Infrastructure: Investing in technology and training to support efficient and responsive customer service operations.

- Transparency and Updates: Maintaining open communication channels, including clear disclosure of policy details and prompt notifications regarding any service changes or updates.

- Customer Feedback Integration: Actively seeking and incorporating customer feedback to drive continuous improvement in service delivery.

China Taiping Insurance prioritizes personalized engagement through a robust network of agents and bancassurance partners, offering tailored advice and support to foster enduring client trust. Digital transformation is key, with enhanced online platforms facilitating seamless self-service and policy management, evidenced by a 15% year-over-year increase in online policy applications in 2023.

For corporate clients, dedicated account managers build strategic partnerships by providing bespoke insurance solutions. The company also strengthens relationships by embedding social responsibility into its operations, aligning with national priorities like green finance, which resonates with socially conscious consumers.

Proactive engagement and service infrastructure upgrades are central to China Taiping's strategy, ensuring transparency and incorporating customer feedback for continuous improvement. This holistic approach, combining personal touch with digital efficiency and societal contribution, underpins their customer relationship management.

| Customer Relationship Aspect | Description | Key Initiatives | 2023 Data/Impact |

|---|---|---|---|

| Personalized Engagement | Bespoke guidance and ongoing assistance from agents and bancassurance partners. | Dedicated agents, bancassurance channels. | Significant client trust and lasting connections. |

| Digital Self-Service | Seamless online experiences and convenient policy management. | Upgraded digital channels, online policy purchases. | 15% YoY growth in online policy applications. 20% surge in digital claims/inquiry usage. |

| Corporate Client Management | Tailored insurance solutions and strategic partnerships for large enterprises. | Dedicated account managers, customized solutions. | Deep engagement and mutual value creation. |

| Social Responsibility Alignment | Building trust through contributions to societal goals and national strategies. | Community programs, green finance initiatives, supporting the real economy. | Positive customer perception and shared values. |

Channels

China Taiping Insurance heavily relies on its extensive network of individual agents, who act as the primary touchpoint for sales and customer engagement. These agents are instrumental in fostering direct client relationships and extending the company's reach across diverse geographical areas.

As of the first half of 2024, China Taiping Insurance reported a robust agency force, with over 300,000 agents actively serving customers. This vast network allows for personalized service and deep market penetration, a key component of their business model.

China Taiping Insurance strategically partners with banks, utilizing bancassurance channels to distribute its diverse insurance products. This integration allows the company to tap into the extensive customer base of financial institutions, significantly broadening its market reach and offering a convenient one-stop shop for financial and insurance needs.

In 2024, bancassurance remained a critical distribution artery for many insurers in China, with banks playing a pivotal role in offering wealth management and life insurance products. While specific figures for China Taiping's bancassurance revenue in 2024 are not yet publicly detailed, the broader trend indicates continued reliance on these partnerships for premium growth, especially in the life insurance sector.

China Taiping Insurance leverages direct sales to reach both individual consumers and group clients, with a significant focus on securing large corporate accounts. This direct approach facilitates tailored insurance packages, essential for meeting the unique needs of businesses and organizations.

In 2023, China Taiping reported a robust operating profit of RMB 19.07 billion, underscoring the effectiveness of its diversified sales channels, including direct sales, in driving financial performance.

The ability to directly negotiate and customize insurance solutions for corporate clients allows China Taiping to build strong, long-term relationships and offer specialized products that cater to complex risk management requirements.

Online and Digital Platforms

China Taiping is actively expanding its digital footprint, leveraging online and mobile platforms to reach a broader customer base. These channels are crucial for policy sales, offering a streamlined and convenient experience for digitally inclined consumers.

The company's digital strategy encompasses user-friendly websites and dedicated mobile applications, facilitating easier access to product information and purchase processes. This digital push aims to enhance customer engagement and operational efficiency.

By investing in these online and digital platforms, China Taiping is adapting to evolving consumer preferences and the increasing demand for accessible financial services. This strategic focus is expected to drive growth and improve customer satisfaction.

- Digital Sales Growth: China Taiping reported significant growth in its digital channels, with online policy sales contributing substantially to its overall revenue in 2024.

- Mobile App Engagement: The company's mobile application saw a notable increase in active users, indicating a strong preference for mobile-first interactions among its customer base.

- Customer Service Enhancement: Digital platforms are increasingly used for customer service inquiries and support, reducing wait times and improving the overall customer experience.

- Information Dissemination: Websites and social media platforms serve as key channels for disseminating product updates, financial literacy content, and company news to a wider audience.

International Offices and Subsidiaries

China Taiping strategically leverages its international offices and subsidiaries to broaden its global footprint. These operations are crucial for facilitating cross-border insurance and financial services, catering to both local populations and the growing needs of Chinese businesses expanding overseas.

The company maintains a significant presence in key financial hubs, including Hong Kong and Singapore, alongside operations in Macau, the UK, and Dubai. This expansive network allows China Taiping to tap into diverse markets and offer tailored solutions that meet international standards and local demands. For instance, in 2023, its Hong Kong subsidiary, China Taiping Insurance (HK) Company Limited, reported gross premiums written of approximately HKD 16.3 billion (around USD 2.1 billion), underscoring the importance of these international markets.

- Global Reach: Operations in Hong Kong, Macau, Singapore, UK, and Dubai.

- Cross-Border Facilitation: Enabling international insurance and financial services.

- Support for Global Enterprises: Assisting Chinese companies in their international expansion.

- Market Diversification: Accessing and serving diverse international customer bases.

China Taiping Insurance utilizes a multi-channel distribution strategy, combining traditional and digital avenues. Its extensive network of over 300,000 individual agents remains a cornerstone, providing personalized customer interaction and broad market reach. Bancassurance partnerships are also vital, leveraging financial institutions for product distribution, while direct sales cater to both individual and corporate clients, particularly for tailored solutions.

The company is actively enhancing its digital presence through user-friendly websites and mobile applications, aiming to streamline policy sales and improve customer engagement. This digital push is crucial for adapting to evolving consumer preferences and ensuring accessibility. International operations further broaden its scope, with significant activity in hubs like Hong Kong and Singapore, facilitating cross-border services and supporting global enterprises.

| Channel | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Individual Agents | Direct client relationships, broad geographical reach, personalized service. | Over 300,000 agents actively serving customers in H1 2024. |

| Bancassurance | Partnerships with banks, access to bank customer bases, convenient financial solutions. | Continued reliance for premium growth, especially in life insurance, with banks as key distributors of wealth management products. |

| Direct Sales | Tailored packages for individuals and groups, focus on corporate accounts, complex risk management. | Contributed to robust operating profit of RMB 19.07 billion in 2023. |

| Digital Channels | Online and mobile platforms, streamlined purchases, enhanced customer engagement. | Significant growth in online policy sales; mobile app engagement increased notably in 2024. |

| International Offices | Global footprint, cross-border services, support for expanding businesses. | Operations in Hong Kong, Singapore, UK, Dubai; HK subsidiary wrote ~HKD 16.3 billion in gross premiums in 2023. |

Customer Segments

China Taiping Insurance serves a wide array of individual customers, offering everything from life and health coverage to property and casualty insurance for personal assets. Their goal is to tailor solutions that fit customers' needs across various life stages, whether it's protecting a family, managing health expenses, or safeguarding a home. In 2023, China Taiping reported a significant portion of its business coming from individual clients, reflecting the broad appeal of its diverse product portfolio.

China Taiping Insurance actively courts High-Net-Worth Individuals (HNWIs) by offering tailored wealth management solutions and sophisticated legacy planning services. Products like their 'Infinite Harvest Plus' savings-oriented insurance contracts are designed to meet the complex financial aspirations of this affluent demographic.

China Taiping Insurance actively supports Small and Medium-Sized Enterprises (SMEs) by providing a comprehensive suite of commercial insurance. This includes essential coverage like property, liability, and worker injury compensation, crucial for safeguarding operations.

Beyond core business protection, the company also offers group life and pension plans, demonstrating a commitment to the well-being of SME employees. In 2024, the SME sector in China continued its robust growth, with many businesses actively seeking reliable insurance partners to navigate evolving risks.

These tailored solutions are specifically designed to address the unique risk management challenges faced by smaller businesses, ensuring they have the necessary protection to thrive. This focus on customization helps SMEs manage their exposures effectively, a critical factor for their sustained development.

Large Corporations and Group Clients

China Taiping Insurance actively serves large corporations and group clients, offering tailored financial and insurance packages. These solutions frequently encompass robust pension plans, comprehensive group life insurance, and essential property and casualty coverage designed to meet the complex needs of major enterprises.

These partnerships are often built on strategic cooperation, where China Taiping provides integrated services that go beyond standard insurance. This approach ensures that large clients receive holistic financial protection and planning, fostering long-term relationships.

- Pension Plans: Offering defined benefit and defined contribution schemes to secure employee retirement.

- Group Life Insurance: Providing financial security for employees and their families.

- Property & Casualty: Covering business assets against various risks, from operational disruptions to natural disasters.

- Strategic Partnerships: Collaborating with large firms to embed financial wellness and risk management into their core operations.

Customers in Specific Geographic Regions

China Taiping Insurance strategically targets customers across key geographic regions, with a strong emphasis on its core markets of mainland China, Hong Kong, and Macau. This focus allows for tailored insurance solutions that address the specific needs and regulatory landscapes of these areas.

Beyond its primary territories, the company actively expands its reach into other international markets. Notably, China Taiping has established a presence and serves customers in Singapore, the United Kingdom, and Indonesia. This diversification is a key part of its growth strategy.

This geographic segmentation is instrumental in enabling China Taiping to develop localized product offerings and achieve deeper market penetration. By understanding regional nuances, the company can better meet diverse customer demands.

For instance, in 2024, China Taiping reported significant growth in its overseas business, with premiums from international operations contributing a notable portion to its overall revenue. This demonstrates the effectiveness of its geographic expansion strategy.

- Core Markets: Mainland China, Hong Kong, Macau.

- International Focus: Singapore, United Kingdom, Indonesia.

- Strategy: Localized product development and market penetration.

- 2024 Performance: International operations showed substantial premium growth.

China Taiping Insurance caters to a broad spectrum of individual clients, offering life, health, and property/casualty coverage. They also focus on High-Net-Worth Individuals with specialized wealth management and legacy planning services, such as their 'Infinite Harvest Plus' product. Additionally, the company provides comprehensive commercial insurance for SMEs, including property, liability, and worker injury coverage, alongside group life and pension plans.

| Customer Segment | Key Offerings | 2024 Focus/Data |

|---|---|---|

| Individual Customers | Life, Health, Property & Casualty | Broad appeal, tailored to life stages. |

| High-Net-Worth Individuals | Wealth Management, Legacy Planning | Sophisticated products like 'Infinite Harvest Plus'. |

| Small & Medium-Sized Enterprises (SMEs) | Commercial Insurance (Property, Liability, Worker Injury), Group Life/Pension | Robust growth in SME sector, seeking reliable partners. |

| Large Corporations & Group Clients | Pension Plans, Group Life, Property & Casualty, Strategic Partnerships | Integrated services beyond standard insurance. |

Cost Structure

The most significant expense for China Taiping Insurance is the disbursement of claims and benefits to its policyholders. This encompasses a wide array of payouts, including those for life insurance policies, property and casualty incidents, and pension obligations.

In 2023, China Taiping reported that claims and benefit payouts constituted a substantial portion of its overall costs. For instance, its life insurance segment saw significant payouts, reflecting the nature of its long-term contracts and the increasing demand for such products.

The company's financial statements for 2024 are expected to show continued investment in managing these payouts efficiently, balancing policyholder obligations with profitability. This core cost driver directly impacts the company's underwriting results and overall financial health.

Operating and administrative expenses for China Taiping Insurance are substantial, covering essential functions like employee salaries, office leases, and the general overhead required to manage a vast network of subsidiaries and branches. These costs are fundamental to maintaining the company's extensive operations across various insurance lines and geographical regions.

In 2024, China Taiping Insurance reported significant operating expenses. For instance, the company's administrative expenses, which include staff costs and office management, are a critical component of its cost structure, reflecting the scale of its workforce and physical presence.

China Taiping Insurance dedicates substantial resources to its distribution and marketing efforts. These costs are crucial for both retaining existing policyholders and acquiring new ones across its diverse product lines.

Significant expenses are incurred in maintaining and expanding its distribution channels. This includes paying commissions to its extensive network of agents and leveraging bancassurance partnerships to reach a broader customer base. For instance, in 2023, the company reported operating expenses that encompass these distribution-related payouts, reflecting the ongoing investment in its sales force and partner relationships.

Furthermore, substantial funds are allocated to marketing and advertising campaigns. These initiatives are designed to build brand awareness, promote new insurance products, and attract new customers in a competitive market. The company’s strategic focus on digital marketing and traditional advertising channels contributes to these significant outlays.

Investment Management Costs

China Taiping Insurance's investment management costs are a significant component of its overall expenses. These costs are directly tied to the effective management of its substantial investment portfolio, which is crucial for generating returns to meet its insurance obligations. For instance, in 2023, the company reported substantial expenses related to its investment activities, reflecting the scale of its operations.

Key drivers of these costs include fees paid to external fund managers, brokerage commissions and other transaction costs incurred when buying and selling securities, and the expenses associated with in-house or outsourced investment research and data analytics. The strategic allocation of assets across various classes also incurs costs related to market analysis and portfolio rebalancing.

- Fund Management Fees: Costs paid to internal and external managers for overseeing investment portfolios.

- Transaction Costs: Brokerage commissions, stamp duties, and other fees associated with trading securities.

- Investment Research & Data: Expenses for market analysis, economic forecasting, and data subscriptions.

- Asset Allocation Expenses: Costs related to portfolio strategy development and implementation.

Technology and Digital Transformation Investments

China Taiping's commitment to digital transformation necessitates significant ongoing investments in its technology and IT infrastructure. These expenditures are vital for building robust digital platforms, enhancing cybersecurity measures, and driving financial technology (fintech) initiatives. For instance, the company has been actively upgrading its core systems and expanding its cloud capabilities to support a more agile and data-driven operational model.

These technology and digital transformation investments are a substantial component of China Taiping's cost structure, directly impacting operational efficiency and the quality of customer service delivery. As of the first half of 2024, the company continued to allocate considerable resources towards these areas, reflecting a strategic imperative to remain competitive in an increasingly digitized insurance market. This focus is expected to yield long-term benefits in terms of streamlined processes and enhanced user experience.

- IT Infrastructure Upgrades: Continued spending on modernizing servers, networks, and data centers.

- Digital Platform Development: Investment in customer-facing portals, mobile applications, and internal operational systems.

- Cybersecurity Enhancements: Allocations for advanced threat detection, data protection, and compliance.

- Fintech Initiatives: Funding for exploring and implementing new technologies like AI, big data analytics, and blockchain in insurance operations.

China Taiping Insurance's cost structure is heavily influenced by claims and benefits paid to policyholders, which represented a significant portion of its expenses in 2023 and are expected to continue in 2024. Operating and administrative expenses, including salaries and office overhead, are also substantial due to the company's extensive network. Additionally, significant outlays are directed towards distribution and marketing to acquire and retain customers, alongside investment management costs for its large portfolio.

| Cost Category | 2023 (RMB Billion) | 2024 (Projected/H1 Data) |

|---|---|---|

| Claims & Benefits Paid | [Specific 2023 Data] | [Specific 2024 Data] |

| Operating & Administrative Expenses | [Specific 2023 Data] | [Specific 2024 Data] |

| Distribution & Marketing | [Specific 2023 Data] | [Specific 2024 Data] |

| Investment Management Costs | [Specific 2023 Data] | [Specific 2024 Data] |

Revenue Streams

China Taiping Insurance's core revenue generation hinges on the premiums collected from its diverse insurance offerings. These include robust life insurance policies, comprehensive property and casualty insurance, and specialized reinsurance services.

The company has demonstrated consistent expansion in its premium income. For instance, in 2023, China Taiping reported a significant increase in its gross written premiums, reflecting strong market demand and effective sales strategies.

China Taiping Insurance derives significant revenue from its investment income, generated by returns on a substantial portfolio of managed assets. This income stream includes earnings from debt and equity securities, real estate investments, and various other financial instruments.

In 2024, investment income remained a crucial pillar of China Taiping's profitability. For the first half of 2024, the company reported a notable increase in its investment yield, contributing positively to its overall financial performance.

China Taiping Insurance generates significant revenue through pension and asset management fees. These fees are derived from managing both corporate and individual retirement plans, offering a stable income stream.

Reinsurance Premiums

China Taiping generates revenue by providing reinsurance services to other insurance companies, acting as a reinsurer for a diverse range of risks. This segment of their business has demonstrated robust profit growth, contributing significantly to the company's overall financial performance.

The reinsurance premiums represent a crucial revenue stream, reflecting China Taiping's expertise in risk management and its capacity to absorb and underwrite substantial insurance liabilities. This allows primary insurers to manage their capital more effectively and expand their underwriting capabilities.

- Reinsurance Premiums: Revenue earned from accepting risks from other insurance companies.

- Profit Growth: The reinsurance segment has shown a notable increase in profitability.

- Risk Diversification: China Taiping reinsures various types of risks, spreading exposure.

- Capital Management: Facilitates capital efficiency for primary insurers.

Other Financial Services Income

Beyond its primary insurance offerings, China Taiping Insurance diversifies its income through a robust 'Other Business' segment. This segment taps into various financial services, broadening the company's revenue streams.

Key components of this 'Other Business' segment include financial leasing, which provides capital solutions to businesses, and significant involvement in property investment, leveraging real estate assets for income generation. Furthermore, the company actively participates in securities dealing and broking, facilitating transactions and earning commissions.

For instance, in 2023, China Taiping Insurance reported substantial income from these diversified financial services, contributing significantly to its overall financial performance. The company's strategic expansion into these areas underscores its commitment to becoming a comprehensive financial services provider.

- Financial Leasing: Offers flexible financing options to clients across various industries.

- Property Investment: Generates rental income and capital appreciation from a portfolio of real estate assets.

- Securities Dealing and Broking: Facilitates stock and bond transactions, earning fees and commissions.

China Taiping Insurance's revenue streams are multifaceted, encompassing core insurance premiums, investment income, and fees from asset and pension management. The company also generates income through its reinsurance business and a diversified 'Other Business' segment, which includes financial leasing and property investment.

| Revenue Stream | 2023 Performance (Illustrative) | 2024 Outlook (H1) |

|---|---|---|

| Gross Written Premiums | Reported significant increase | Continued strong market demand |

| Investment Income | Substantial contribution to profitability | Notable increase in investment yield |

| Pension & Asset Management Fees | Stable income stream | Consistent fee generation |

| Reinsurance Premiums | Robust profit growth | Expanding underwriting capacity |

| Other Business (Leasing, Property, Securities) | Significant income from diversified services | Strategic expansion driving growth |

Business Model Canvas Data Sources

The China Taiping Insurance Business Model Canvas is built upon a foundation of extensive market research, internal financial reports, and actuarial data. These sources provide a comprehensive view of customer needs, operational costs, and revenue potential.