China Taiping Insurance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Taiping Insurance Bundle

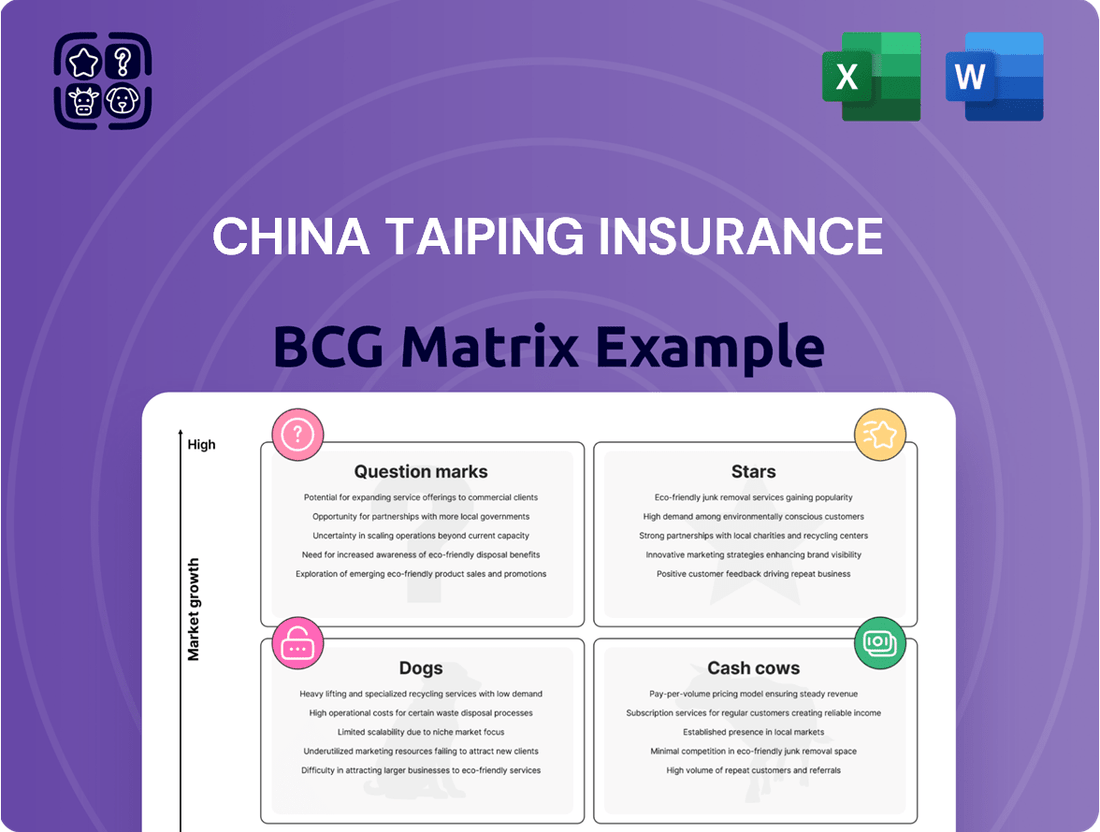

Curious about China Taiping Insurance's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse product portfolio stacks up in terms of market share and growth potential. Understand which segments are driving growth and which might require a closer look.

Unlock the full strategic advantage by purchasing the complete China Taiping Insurance BCG Matrix report. Gain a comprehensive, quadrant-by-quadrant analysis that reveals their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to guide your investment and product development decisions.

Stars

China Taiping Life Insurance (TPL) is a powerhouse within the group, demonstrating impressive momentum. Its new business value surged by a remarkable 83.6% year-on-year in the first half of 2024. This robust performance highlights TPL's strong standing in the dynamic Chinese personal insurance sector.

The growth is fueled by a strategic pivot towards higher-quality products and long-term savings solutions, aligning with evolving consumer demand. This positions TPL favorably to capitalize on the expanding market opportunities and solidify its status as a star performer.

China Taiping's reinsurance business is a star performer within its BCG matrix. In 2024, this segment achieved a remarkable net profit after tax of HK$957.37 million (US$123.05 million), marking a substantial 187.5% increase. This growth underscores its strong market standing and profitability in a dynamic reinsurance landscape.

The Guangdong-Hong Kong-Macau Greater Bay Area (GBA) represents a significant strategic pillar for China Taiping Insurance. In 2024, the Group achieved a substantial HK$60.165 billion in premium income from this dynamic region. This impressive figure underscores the GBA's importance as a key growth engine for the company.

Serving over 7 million individual customers and 150 thousand group customers within the GBA highlights China Taiping's deep penetration and established presence. This extensive customer base is a testament to the trust and value the company delivers in this vital economic zone.

The company's proactive approach in the GBA is further exemplified by initiatives like the launch of cross-border collaborative products, such as 'Infinite Legacy.' This strategic product development aims to cater to the unique needs of customers operating across different jurisdictions within the GBA, solidifying its position as a market leader.

Elder Care Services and Ecosystem

China Taiping is making significant strides in its elder care services and ecosystem, positioning it as a strong contender in a high-growth market. The company's commitment is evident in the official launch of its own elder care communities and the establishment of a broad network that combines self-owned facilities with third-party partnerships across the nation.

This strategic expansion highlights the company's vision for a comprehensive elder care solution. In 2024, China Taiping received an award for its innovative 'China Taiping Solution for Hong Kong Residents Retirement Care in GBA,' underscoring its leadership and forward-thinking approach in catering to the specific needs of this demographic within the Greater Bay Area.

- Ecosystem Development: China Taiping has officially opened self-owned elder care communities, signifying a major step in its ecosystem strategy.

- Nationwide Reach: The company is building a nationwide elder care landscape that integrates both self-owned facilities and collaborations with third-party providers.

- Innovation Recognition: In 2024, China Taiping's specialized retirement care solution for Hong Kong residents in the GBA was recognized with an award, highlighting its innovative market approach.

- Market Potential: These developments signal a high-growth potential for China Taiping within the rapidly expanding elder care sector.

Digital Transformation Initiatives

China Taiping Insurance is heavily invested in digital transformation, viewing it as a cornerstone of its strategic development. This includes ongoing enhancements to its information systems, particularly those supporting new international accounting standards and overseas property and casualty core platforms. The company is also prioritizing risk reduction through these digital initiatives.

These efforts are directly in line with China's national strategy to build a 'Digital China' by 2025. This national focus is expected to fuel significant growth within the insurance sector as digital adoption continues to accelerate across the industry. For China Taiping, this translates to a strong potential for market expansion and operational efficiency gains.

- Digital Investments: China Taiping is channeling resources into upgrading its IT infrastructure to meet evolving regulatory requirements and enhance operational capabilities.

- 'Digital China' Alignment: The company's digital strategy directly supports the national objective of a digitally advanced China, positioning it to benefit from broader ecosystem growth.

- Risk Mitigation: Digital transformation is being leveraged to improve risk assessment and management, a critical aspect for long-term stability in the insurance business.

- Market Potential: The ongoing digitalization of the insurance sector in China presents a fertile ground for companies like China Taiping that are proactively embracing technological advancements.

China Taiping Life Insurance (TPL) and its reinsurance business are clear stars in the BCG matrix. TPL's new business value surged by 83.6% in H1 2024, driven by a focus on quality products. The reinsurance segment saw a remarkable 187.5% net profit increase in 2024, reaching HK$957.37 million. Both demonstrate high growth and market share.

| Business Segment | Growth Rate | Profitability (2024) | Market Position |

|---|---|---|---|

| China Taiping Life Insurance (TPL) | 83.6% (NBV H1 2024) | High (implied by NBV growth) | Star |

| Reinsurance | 187.5% (Net Profit Growth 2024) | HK$957.37 million (Net Profit After Tax) | Star |

What is included in the product

The China Taiping Insurance BCG Matrix provides a tailored analysis of its product portfolio, categorizing units to guide investment decisions.

It highlights which business units to invest in, hold, or divest based on their market share and growth potential.

The China Taiping Insurance BCG Matrix offers a clear, one-page overview, relieving the pain of understanding complex business unit performance.

Its export-ready design for PowerPoint eliminates the hassle of reformatting, easing presentation creation.

Cash Cows

China Taiping's traditional property and casualty (P&C) insurance operations in mainland China are a prime example of a cash cow. The P&C market in China is vast, and in 2024, motor insurance continued to be a dominant revenue driver, representing a substantial share of the overall P&C sector.

Despite potentially moderate growth rates for the broader P&C market, China Taiping's deep-rooted market position and diverse product portfolio, especially in motor and non-marine insurance segments, are expected to consistently yield high cash flows. This stability allows the company to fund investments in other business areas.

Pension and group life insurance in China are considered cash cows for China Taiping Insurance. This segment benefits from a rapidly aging population and increasing financial awareness, driving consistent demand for retirement and life coverage.

China Taiping's offerings in corporate and personal retirement insurance, alongside group life policies, are well-established. The company holds a significant market share, ensuring a predictable and substantial cash flow that supports other business areas.

In 2023, China Taiping reported a significant portion of its business from its life insurance segment, which includes pension products. While specific cash cow figures aren't always isolated, the segment's consistent growth and profitability underscore its cash-generating capabilities, contributing to the company's overall financial strength.

China Taiping's asset management business is a significant contributor to its financial strength, operating within a mature yet rapidly expanding market in China. This segment manages a diverse range of assets for both individual and institutional clients, capitalizing on the robust growth momentum seen across the nation's insurance asset management sector.

The primary objective for this business unit is to achieve capital growth and generate consistent income, thereby playing a crucial role in bolstering China Taiping's overall cash flow generation. As of the first half of 2024, China Taiping's total assets under management reached approximately RMB 1.9 trillion, demonstrating the scale and importance of this cash cow.

Overseas Property and Casualty Insurance (Hong Kong & Macau)

China Taiping's Overseas Property and Casualty (P&C) insurance operations in Hong Kong and Macau are firmly established as Cash Cows. These subsidiaries have successfully solidified their market standing, particularly in the P&C and reinsurance sectors. This strength in mature international markets translates into consistent profit generation and robust cash flow for the group.

The P&C insurance segment in Hong Kong and Macau has demonstrated significant market penetration. For instance, in 2024, China Taiping maintained a strong presence in these regions, contributing substantially to the company's overall international earnings. The mature nature of these markets means growth may be slower, but the established customer base and competitive advantages ensure reliable cash generation.

- Market Dominance: China Taiping's P&C and reinsurance businesses in Hong Kong and Macau hold a significant market share, reflecting their established positions.

- Stable Cash Flow: These operations consistently generate substantial profits and predictable cash flows due to their maturity and strong market presence.

- Profitability: The focus on consolidating advantages in these international markets has led to sustained profitability, reinforcing their Cash Cow status.

Established Agency Networks

Established agency networks are a cornerstone of China Taiping's insurance business, firmly positioned as Cash Cows within its BCG Matrix. These networks consistently capture the largest share of China's insurance market, particularly in property and casualty segments. For instance, by the end of 2023, agency channels were still the dominant force in insurance sales across China, reflecting their enduring importance.

China Taiping's deep-rooted and expansive agency network serves as a highly dependable and effective sales conduit. This established infrastructure ensures a steady and predictable stream of revenue, making it a reliable generator of cash in a market that has matured significantly in terms of distribution methods. The sheer scale and historical presence of these networks allow for efficient customer acquisition and policy servicing, contributing to their strong cash-generating capabilities.

- Dominant Market Share: Agency networks remain the primary distribution channel for insurance in China, holding a substantial market share.

- Consistent Revenue Generation: China Taiping's extensive agency network provides a reliable and consistent source of income due to its established presence and efficient operations.

- Mature Market Advantage: In a mature distribution landscape, the established nature of these networks offers a competitive edge, ensuring continued cash flow.

- Efficient Sales Channel: The long-standing and widespread reach of these networks facilitates efficient sales processes and customer engagement.

China Taiping's pension and group life insurance segments are solid cash cows. These areas benefit from China's aging population and growing financial literacy, ensuring steady demand for retirement and life coverage products.

The company's established offerings in corporate and personal retirement plans, along with group life policies, hold significant market share. This translates into predictable and substantial cash flows, which are vital for funding other strategic initiatives within the company.

In 2023, the life insurance segment, which includes pension products, was a major contributor to China Taiping's revenue. While specific cash cow figures aren't always broken out, the segment's consistent profitability and growth highlight its strong cash-generating capacity.

The asset management arm of China Taiping also functions as a cash cow, operating in a mature yet expanding Chinese market. It manages a wide array of assets for both individual and institutional clients, capitalizing on the strong growth in the nation's insurance asset management sector.

| Business Segment | Cash Cow Status | Key Drivers | 2023/2024 Data Points |

|---|---|---|---|

| Property & Casualty (Mainland China) | Cash Cow | Motor insurance dominance, established market position | Motor insurance a significant revenue driver in 2024. |

| Pension & Group Life Insurance | Cash Cow | Aging population, increasing financial awareness | Life insurance segment a major contributor in 2023. |

| Asset Management | Cash Cow | Robust market growth, diverse asset management | Assets under management reached ~RMB 1.9 trillion (H1 2024). |

| Overseas P&C (HK & Macau) | Cash Cow | Mature markets, strong market penetration | Maintained strong presence and international earnings in 2024. |

| Agency Networks | Cash Cow | Dominant distribution channel, established presence | Agency channels remained dominant in insurance sales by end of 2023. |

What You See Is What You Get

China Taiping Insurance BCG Matrix

The China Taiping Insurance BCG Matrix you are currently previewing is the exact, unadulterated report you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, provides a clear strategic roadmap for China Taiping's diverse business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

Rest assured, the preview you see is the final, polished version of the China Taiping Insurance BCG Matrix you will download after completing your purchase. This means no watermarks, no demo content, and no hidden surprises – just a fully formatted, ready-to-use strategic document designed for immediate application in your business planning and decision-making processes.

Dogs

China Taiping's legacy insurance products that haven't kept pace with evolving market needs or new regulations likely fall into the 'Dogs' category. These are products with low market share and diminishing returns, essentially consuming resources without contributing meaningfully to growth or profitability.

For instance, older life insurance policies with less competitive features or higher cost structures compared to newer, more flexible offerings would be prime candidates. These products may struggle to attract new customers and could even see a decline in their existing customer base due to better alternatives available in the market.

In 2024, the insurance industry saw a continued push towards digital transformation and personalized products. Legacy offerings that lack these modern features would inherently be at a disadvantage. For example, if a significant portion of China Taiping's older policies do not support online policy management or offer limited customization options, their market relevance would naturally decline, mirroring the characteristics of 'Dogs' in the BCG matrix.

Certain highly specialized insurance products offered by China Taiping might fall into the dog category if they cater to a very small market and have low premium generation. For instance, if a niche product like specialized cyber insurance for a very specific industry sector sees minimal uptake, it could be classified as a dog. In 2024, China Taiping's overall gross written premiums reached approximately RMB 230 billion, but the performance of these niche segments would need to be isolated to confirm their dog status.

While China Taiping's agency force remains a significant asset, certain legacy distribution channels may be showing signs of wear. These could include older, less digitized sales methods that are struggling to compete with the growing efficiency and reach of online platforms. For instance, if a substantial portion of their sales still relies on physical branch networks in areas with declining foot traffic or high operational costs, these channels might be classified as dogs.

These outdated channels, even if they once contributed significantly, may now represent a drain on resources without commensurate returns. In 2024, the insurance industry globally saw a continued shift towards digital sales, with online channels accounting for an increasing percentage of new business acquisition. If China Taiping maintains a heavy reliance on these less effective, traditional methods, they risk falling behind competitors who have embraced more modern, cost-efficient distribution strategies.

Investments in Stagnant or Declining Industries

China Taiping's 'Other Business' segment might hold investments in industries facing stagnation or decline. These could be classified as 'dogs' in a BCG matrix framework, representing areas with low market share and low growth potential. Such investments can tie up valuable capital that could otherwise be allocated to more promising growth areas within the company's portfolio.

For instance, if China Taiping has significant exposure to traditional print media advertising or certain legacy manufacturing sectors that are experiencing secular decline, these would likely fall into the 'dog' category. In 2024, many mature industries continue to grapple with digital disruption and shifting consumer preferences, leading to reduced revenue streams and profitability.

- Potential 'Dog' Investments: Sectors with declining customer bases or facing intense competition from newer, more innovative alternatives.

- Capital Allocation Challenge: These investments may offer low returns on investment (ROI), potentially dragging down overall portfolio performance.

- Strategic Consideration: Management must evaluate whether to divest these assets, restructure them for efficiency, or maintain them for minimal cash flow generation.

- Impact on Growth: Holding onto 'dogs' can divert resources from high-potential 'stars' or 'question marks' that could drive future growth for China Taiping.

Non-Core, Non-Strategic Business Ventures with Low Market Share

Non-core, non-strategic business ventures with low market share within China Taiping Insurance would be classified as Dogs in the BCG Matrix. These are typically businesses that do not align with the company's core insurance and financial services operations and have minimal impact on overall growth or profitability. For instance, an investment in a niche technology startup with no clear synergy to insurance could fall into this category.

These ventures often consume resources without generating substantial returns. China Taiping, like many large financial institutions, may hold stakes in various entities that have either underperformed or are no longer considered strategic priorities. The key characteristic is their low market share combined with a lack of strategic importance to the main business lines.

- Low Growth Potential: These businesses operate in stagnant or declining markets, offering little prospect for significant future expansion.

- Negligible Market Share: They hold a very small percentage of their respective markets, making it difficult to achieve economies of scale or competitive advantage.

- Resource Drain: Despite poor performance, these ventures may still require capital and management attention, diverting resources from more promising areas.

- Limited Contribution: They contribute minimally to China Taiping's overall revenue and profit, often operating at a loss or break-even point.

Products in China Taiping's 'Dogs' category represent legacy offerings with low market share and diminishing returns, often failing to keep pace with evolving customer needs or digital trends. These products, like older life insurance policies with less competitive features, consume resources without contributing significantly to growth. In 2024, the industry's focus on digital transformation meant that products lacking online management capabilities or personalization options were particularly vulnerable.

Niche, specialized insurance products with minimal uptake, or non-core business ventures with no clear synergy to the main insurance operations, can also be classified as dogs. These segments, even if part of China Taiping's RMB 230 billion gross written premiums in 2024, tie up capital and management attention. Their low market share and lack of strategic importance mean they offer little prospect for future expansion and can divert resources from more promising areas.

Outdated distribution channels, such as those heavily reliant on physical branches with declining foot traffic, also fit the 'Dog' profile. These channels struggle to compete with the efficiency of online platforms, potentially draining resources without commensurate returns. The continued global shift towards digital sales in 2024 highlights the disadvantage faced by companies maintaining a heavy reliance on less effective, traditional methods.

China Taiping's 'Other Business' segment might include investments in stagnant or declining industries, such as traditional print media or legacy manufacturing sectors facing secular decline. These 'dog' investments, characterized by low market share and low growth potential, can tie up valuable capital that could be better allocated to high-potential growth areas within the company's portfolio.

Question Marks

China's insurance sector is experiencing a surge in demand for technology-focused products, with cybersecurity and R&D expense loss insurance leading the charge. These are undeniably high-growth segments, reflecting the nation's rapid digital transformation and innovation drive.

However, China Taiping's market presence in these emerging areas, though growing, might still be relatively small compared to established players or the overall market potential. This positions these products as question marks within the BCG matrix – they have high growth prospects but currently require significant investment to build market share and capture future opportunities.

For instance, the Chinese cybersecurity market alone was estimated to be worth over $10 billion in 2023 and is projected to grow at a compound annual growth rate of over 20% in the coming years. Similarly, the push for technological self-reliance is fueling demand for R&D insurance, a segment that is still in its early stages of development but holds immense promise.

China Taiping Insurance is strategically venturing beyond its established markets, establishing new representative offices in Luxembourg and Dubai. These moves target regions identified with significant growth potential, aligning with a forward-thinking expansion strategy.

While these new international locations offer promising opportunities, they represent nascent markets for China Taiping. Consequently, the company will likely experience a low initial market share in these areas. This necessitates substantial investment to build brand recognition and secure a competitive position.

China Taiping's exploration of 'AI Plus' applications in insurance, such as AI-powered claims processing or personalized policy recommendations, aligns with China's broader 2025 Digital China initiative. These innovative solutions, while promising high future growth potential within the rapidly digitizing insurance market, may currently represent a nascent market share for the company.

Specific Cross-Border Product Innovations Beyond GBA

China Taiping's exploration of cross-border insurance products outside the Greater Bay Area (GBA) represents a strategic move into potentially lucrative but nascent markets. While the GBA remains a stronghold, these new ventures are classified as question marks because they are entering less familiar territories with established competition. For instance, targeting emerging markets in Southeast Asia or Europe requires significant investment in understanding local regulations and consumer needs, which could dilute resources from core GBA operations.

These initiatives are designed to capitalize on growing international demand for specialized insurance solutions, such as global health coverage or international property insurance. However, building market share from a low base in these new regions presents a considerable challenge. For example, in 2023, the global cross-border health insurance market was valued at approximately $10 billion, with significant growth potential, yet China Taiping would be entering this space with limited brand recognition compared to established global players.

- Targeting new international markets requires substantial upfront investment in market research and product development.

- Building brand awareness and trust in regions outside the GBA will be a gradual and resource-intensive process.

- Success hinges on adapting product offerings to diverse regulatory environments and consumer preferences in these new territories.

- The potential for significant returns exists, but the path to market penetration is uncertain, characteristic of a question mark in the BCG matrix.

Targeted Offerings for China's New Childcare Subsidy Policy

China's new national childcare subsidy policy, set to launch in 2025, is designed to boost spending on early childhood development. This policy creates a fertile ground for China Taiping Insurance to introduce innovative products and services catering to childcare needs.

The company can leverage this government initiative to develop offerings that address parental concerns about early education, health, and safety. For instance, specialized savings plans for education, comprehensive health insurance for young children, or even accident insurance for daycare facilities could be introduced.

- Child Education Savings Plans: Tailored plans to cover preschool and early learning expenses, potentially offering tax advantages.

- Pediatric Health Insurance: Enhanced coverage for routine check-ups, vaccinations, and common childhood illnesses.

- Daycare Liability Insurance: Policies for childcare providers to cover accidents and ensure a safe environment.

- Parental Leave Support Insurance: Products that offer income replacement or support during parental leave periods.

These new offerings would tap into a high-growth market, directly stimulated by government policy. However, their initial market share is expected to be low as China Taiping establishes its presence and builds customer trust in these specialized areas.

China Taiping's ventures into new technology-driven insurance segments, such as cybersecurity and R&D expense loss, represent promising growth areas but currently hold low market share. Similarly, their expansion into new international markets outside the Greater Bay Area, while strategically important, also begins with a limited presence. The company's development of new products aligned with China's 2025 Digital China initiative and the upcoming national childcare subsidy policy also fall into this category, requiring significant investment to build traction.

These initiatives are classified as question marks because they possess high potential for future growth but require substantial investment to achieve significant market share. For example, the cybersecurity market in China was projected to reach over $10 billion in 2023, with a projected growth rate exceeding 20% annually, indicating the vast opportunity. However, China Taiping's current penetration in these emerging areas is likely minimal, necessitating a focused strategy to capture this potential.

The company's strategic establishment of new representative offices in Luxembourg and Dubai, targeting regions with significant growth potential, also exemplifies this question mark status. While these markets offer future promise, China Taiping's initial market share is expected to be low, demanding considerable investment to build brand recognition and competitive positioning. This is akin to their exploration of cross-border insurance products outside the GBA, where entering less familiar territories with established competition requires careful resource allocation.

The potential for significant returns exists in these nascent markets, but the path to market penetration is uncertain, characteristic of a question mark in the BCG matrix. Success hinges on adapting product offerings to diverse regulatory environments and consumer preferences, a gradual and resource-intensive process. For instance, in 2023, the global cross-border health insurance market was valued at approximately $10 billion, a segment where China Taiping would enter with limited brand recognition compared to established global players.

BCG Matrix Data Sources

Our China Taiping Insurance BCG Matrix leverages official company filings, industry growth forecasts, and market share data to accurately position each business unit.