China National Nuclear Power Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China National Nuclear Power Bundle

Uncover the core strategies driving China National Nuclear Power’s dominance in the energy sector. This Business Model Canvas illuminates their approach to key partners, value propositions, and revenue streams, offering a clear roadmap for understanding their success. Gain actionable insights for your own strategic planning.

Dive into the intricate workings of China National Nuclear Power’s business model with our comprehensive canvas. Understand their customer relationships, cost structures, and key resources that fuel their growth. Download the full version to benchmark your strategies and identify competitive advantages.

See how China National Nuclear Power builds and delivers value in the complex nuclear energy market. Our detailed Business Model Canvas breaks down their customer segments, channels, and competitive differentiators. Get the full, editable template to fuel your strategic analysis and innovation.

Partnerships

As a state-owned enterprise, China National Nuclear Power (CNNP) operates under the direct guidance of the Chinese government. This partnership is crucial for policy direction, securing project approvals, and accessing substantial financial backing, essential for its large-scale operations and expansion plans.

CNNP's activities are closely aligned with national energy strategies and environmental regulations. Adherence to China's carbon neutrality targets, a key government objective, shapes CNNP's operational framework and future development, particularly in the context of sustainable energy growth.

The government's 14th Five-Year Plan (2021-2025) sets aggressive targets for nuclear power development. This plan necessitates significant state support, directly benefiting CNNP by providing a clear roadmap and the necessary resources for its ambitious growth trajectory in the nuclear energy sector.

China National Nuclear Power (CNNP) actively collaborates with other state-owned nuclear entities, research institutions, and domestic equipment manufacturers. These alliances are vital for advancing technology, ensuring a stable supply chain, and pooling expertise. For instance, CNNP partners with entities like China General Nuclear Power Group (CGN) and research bodies such as the China Institute of Atomic Energy for developing and deploying next-generation reactors.

These partnerships are instrumental in the advancement and implementation of key reactor designs, notably the Hualong One and the smaller Linglong One. In 2023, China continued to make significant strides in its nuclear power program, with several new reactors entering operation, underscoring the importance of these domestic collaborations for national energy security and technological self-reliance.

China National Nuclear Power (CNNP) actively engages with international organizations like the International Atomic Energy Agency (IAEA) to uphold and advance global safety standards in nuclear power. These collaborations are crucial for knowledge sharing and ensuring best practices across its operations.

Partnerships with foreign entities, such as Russian and French nuclear power companies, are fundamental for CNNP's technological advancement and market reach. These alliances facilitate the transfer of cutting-edge nuclear technology and expertise, bolstering CNNP's capabilities in both domestic projects and international ventures.

In 2023, China's nuclear power generation reached approximately 430 billion kilowatt-hours, highlighting the scale of the industry and the importance of international cooperation for continued growth and safety. CNNP's strategic international partnerships are key to maintaining this momentum and expanding its global footprint in nuclear energy exports.

Research and Development Institutions

China National Nuclear Power (CNNP) actively collaborates with leading universities and specialized nuclear research institutes. These partnerships are crucial for driving ongoing innovation in nuclear fission and fusion technologies, bolstering safety protocols, and developing effective waste management strategies. For instance, in 2023, CNNP continued its significant investment in fundamental research, contributing to advancements in areas like Small Modular Reactors (SMRs) and next-generation fuel cycles.

CNNP also plays a pivotal role in national industrial consortia focused on the cutting edge of advanced nuclear fusion technology. These collaborations pool resources and expertise, accelerating the development timeline for future energy solutions. By fostering these strategic alliances, CNNP ensures it remains at the forefront of nuclear science and engineering, translating research breakthroughs into practical applications.

- University Collaborations: Partnerships with institutions like Tsinghua University and Shanghai Jiao Tong University focus on theoretical advancements and specialized training for nuclear engineers.

- Research Institute Ties: CNNP works closely with organizations such as the China Institute of Atomic Energy for applied research in reactor design and safety systems.

- Fusion Technology Leadership: CNNP leads national efforts in fusion research, aiming to contribute to the global ITER project and domestic Tokamak development.

- Safety and Waste Management Focus: Joint projects with research bodies are dedicated to enhancing nuclear plant safety features and exploring innovative waste disposal and recycling methods.

Grid Operators and Power Distribution Companies

China National Nuclear Power (CNNP) maintains a crucial relationship with grid operators and power distribution companies, a vital component of its business model. Close collaboration with entities like the State Grid Corporation of China, the world's largest utility company by revenue, is fundamental. This ensures that nuclear power generated by CNNP can be seamlessly integrated into the national grid, guaranteeing stable transmission of electricity to consumers.

These partnerships are essential for CNNP to effectively participate in China's unified power trading market. By working closely with grid operators, CNNP can optimize the dispatch of its nuclear power output, contributing to grid stability and reliability. This integration is critical for the dependable delivery of electricity, supporting China's vast energy demands.

In 2023, China's installed power generation capacity reached approximately 2,920 gigawatts, with nuclear power playing an increasingly significant role. CNNP's ability to connect its plants to the grid and trade power relies heavily on these established relationships. For instance, the State Grid Corporation of China manages over 90% of China's electricity transmission and distribution, highlighting the indispensable nature of this partnership.

- Grid Integration: CNNP collaborates with national and regional grid operators to ensure the smooth integration of nuclear power into the national electricity network.

- Transmission Stability: Partnerships with companies like State Grid Corporation of China are vital for maintaining stable power transmission from nuclear facilities to end-users.

- Market Participation: These collaborations enable CNNP to actively participate in the unified power trading market, optimizing the sale of its electricity output.

- Reliable Supply: The strong relationships with power distribution companies are critical for the reliable and consistent delivery of nuclear-generated electricity across China.

CNNP's key partnerships extend to domestic equipment manufacturers and engineering firms, ensuring a robust supply chain for components and construction. Collaborations with companies like Shanghai Electric and Dongfang Electric are critical for the localization and advancement of nuclear reactor technologies, including the Hualong One. These alliances are vital for meeting China's ambitious nuclear expansion goals, with new reactors consistently coming online.

| Partner Type | Example Partners | Key Contribution | 2023 Impact/Data |

| Domestic Manufacturers | Shanghai Electric, Dongfang Electric | Supply of critical nuclear island equipment, turbines, and generators | Supported the construction and commissioning of multiple new reactors |

| Engineering & Construction | China Nuclear Engineering Corporation (CNEC) | Turnkey project execution, plant construction, and installation | Essential for achieving China's nuclear capacity growth targets |

| Research & Development | China Institute of Atomic Energy, Universities | Reactor design innovation, safety enhancements, fuel cycle research | Continued investment in advanced reactor concepts and waste management |

What is included in the product

A comprehensive, pre-written business model tailored to China National Nuclear Power's strategy, detailing customer segments, channels, and value propositions.

Reflects real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Simplifies complex nuclear power project financing and risk management, alleviating financial strain for stakeholders.

Provides a clear, structured approach to navigating regulatory hurdles and securing long-term energy contracts, easing operational burdens.

Activities

Key activities for Nuclear Power Plant Investment and Development involve meticulous site selection, comprehensive feasibility studies, and securing substantial financing. This also includes managing the entire project lifecycle, from initial design to the final commissioning of new nuclear facilities.

China's commitment to nuclear power is substantial, with over 50 reactors currently in operation and more than 20 under construction as of early 2024. This rapid expansion underscores the significant investment and development required in this sector.

China National Nuclear Power (CNNP) is deeply involved in the intricate construction and engineering of nuclear facilities. This includes overseeing the building of nuclear reactors, along with all the necessary supporting infrastructure and balance-of-plant systems. They are known for employing advanced domestic technologies, such as the Hualong One design, in these massive undertakings.

CNNP's commitment to construction is evident in its participation in numerous large-scale projects situated primarily along China's eastern and southern coastal provinces. These projects are critical for expanding the nation's nuclear energy capacity. For instance, by the end of 2023, China had 55 nuclear reactors in operation, with CNNP being a major contributor to this operational fleet and its ongoing expansion.

Operation and maintenance of nuclear power plants are the core of China National Nuclear Power's (CNNP) business. This involves ensuring the safe, reliable, and efficient running of all its nuclear units. Key activities include managing nuclear fuel, performing regular maintenance, and conducting planned shutdowns for refueling and essential inspections. These processes are vital for the consistent supply of electricity, a critical component of China's energy grid.

In 2024, China's nuclear power generation continued its upward trend. As of the end of the first half of 2024, China's operational nuclear power capacity reached approximately 55.56 gigawatts, with new units consistently coming online. CNNP's operational fleet is a significant contributor to this, demonstrating the importance of their robust maintenance and operational strategies in achieving high capacity factors and ensuring energy security.

Research and Development in Nuclear Technology

China National Nuclear Power actively invests in pioneering research and development across various advanced nuclear technologies. This includes significant efforts in developing next-generation reactor designs like Small Modular Reactors (SMRs), Fast Neutron Reactors (FNRs), and High-Temperature Gas-Cooled Reactors (HTGRs). These initiatives are crucial for enhancing China's energy security and technological leadership in the global nuclear arena.

The company's R&D also focuses on optimizing the nuclear fuel cycle, aiming for greater efficiency and sustainability in fuel processing and waste management. Furthermore, substantial resources are allocated to nuclear fusion research, positioning China at the forefront of this potentially transformative energy source. In 2024, China's investment in nuclear R&D continued to grow, reflecting a strategic commitment to technological independence and a competitive edge in the international nuclear market.

- Next-Generation Reactor Development: Focus on SMRs, FNRs, and HTGRs to diversify nuclear power capabilities.

- Nuclear Fuel Cycle Advancement: Improving efficiency and sustainability in fuel processing and waste management.

- Nuclear Fusion Research: Investing in the long-term potential of fusion energy.

- Technological Independence: Driving innovation to reduce reliance on foreign nuclear technologies.

Electricity Generation and Grid Integration

China National Nuclear Power (CNNP) is fundamentally involved in generating electricity through nuclear fission, a process that provides a stable and consistent source of power. This generated electricity is then seamlessly integrated into China's national and regional power grids, ensuring it effectively meets the country's ever-growing energy demands.

CNNP’s role is crucial in bolstering China's overall electricity supply, particularly by contributing a significant portion of clean energy. As of the end of 2023, CNNP operated 27 nuclear power units with a total installed capacity of 30,570 MW, representing a substantial contribution to China's clean energy targets and its ongoing transition away from fossil fuels.

- Nuclear Fission Power Generation: CNNP's core activity is harnessing nuclear energy to produce electricity, providing a reliable baseload power source essential for grid stability.

- Grid Integration: The company focuses on efficiently connecting its nuclear power output to the national and regional electricity grids, ensuring a consistent supply to consumers.

- Clean Energy Contribution: CNNP is a key player in China's clean energy initiatives, with its nuclear power generation significantly reducing carbon emissions compared to traditional fossil fuel sources.

- Installed Capacity: By the close of 2023, CNNP's operational nuclear power capacity reached 30,570 MW across 27 units, underscoring its substantial impact on the nation's energy landscape.

China National Nuclear Power's (CNNP) key activities encompass the entire nuclear power lifecycle. This includes the crucial stages of investing in and developing new nuclear facilities, from initial site selection and feasibility studies through to the complex engineering and construction phases. CNNP is also deeply involved in the ongoing operation and maintenance of existing nuclear power plants, ensuring their safe and efficient performance. Furthermore, a significant focus is placed on pioneering research and development into advanced nuclear technologies and the nuclear fuel cycle.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Investment & Development | Site selection, feasibility studies, financing, and project lifecycle management for new nuclear facilities. | China's operational nuclear capacity reached ~55.56 GW by mid-2024, with CNNP contributing significantly to ongoing expansion. |

| Construction & Engineering | Overseeing the building of reactors and supporting infrastructure, utilizing domestic technologies like Hualong One. | CNNP participated in numerous large-scale projects, primarily along China's coast. |

| Operation & Maintenance | Ensuring safe, reliable, and efficient running of nuclear units, including fuel management and regular maintenance. | By end-2023, CNNP operated 27 units with 30,570 MW capacity, contributing to high capacity factors. |

| Research & Development | Developing next-generation reactors (SMRs, FNRs, HTGRs), optimizing fuel cycles, and investing in fusion research. | Continued growth in nuclear R&D investment in 2024, focusing on technological independence. |

Delivered as Displayed

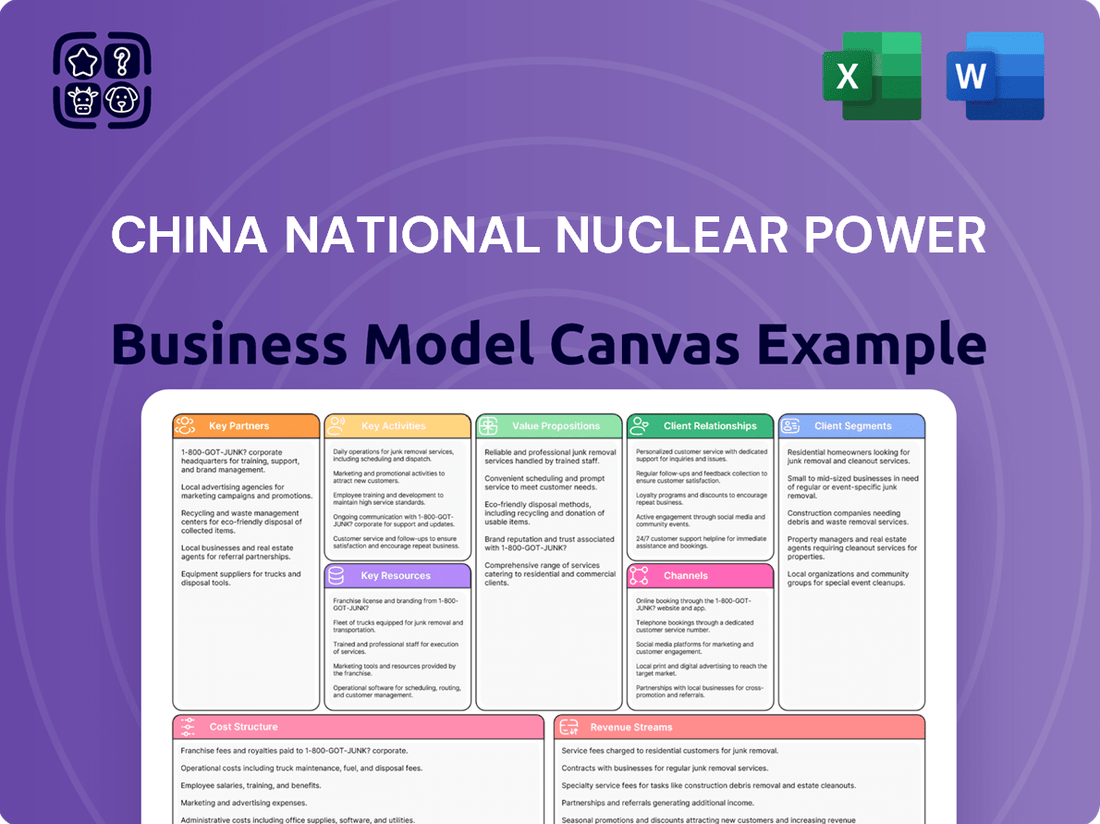

Business Model Canvas

The China National Nuclear Power Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited version, ready for immediate use. You'll get the same structured and detailed canvas, ensuring no surprises and full access to all the information.

Resources

China National Nuclear Power (CNNP) leverages a robust and expanding network of nuclear power plants as its core physical asset. As of early 2024, China boasts the second-largest nuclear power capacity globally, with a significant portion of its reactors operated by CNNP. This includes a growing fleet of operational reactors, with several more under construction, representing substantial ongoing investment in nuclear energy infrastructure.

The key resources extend beyond the reactors themselves to encompass critical supporting infrastructure. This vital network includes advanced cooling systems essential for safe operation, extensive transmission lines to distribute electricity efficiently, and sophisticated safety systems that ensure the highest standards of security. These interconnected components are fundamental to CNNP's ability to generate and deliver reliable nuclear power.

China National Nuclear Power's key resources in advanced nuclear technologies are built upon a foundation of proprietary reactor designs like Hualong One and Linglong One. This intellectual property, coupled with specialized engineering expertise and a growing portfolio of patents in areas such as nuclear fuel and waste management, forms a significant competitive advantage.

The company's commitment to localization is evident, with full domestic production now achieved for essential nuclear plant equipment. This self-sufficiency in manufacturing is a critical resource, reducing reliance on foreign suppliers and enhancing cost control and supply chain resilience.

China National Nuclear Power (CNNP) relies heavily on its highly skilled workforce and technical expertise. This includes a vast reservoir of specialized engineers, nuclear physicists, safety experts, and operational staff crucial for every stage of nuclear facility development, from initial design and construction to ongoing operation and maintenance. This deep pool of human capital forms the bedrock of CNNP's core capabilities and competitive advantage.

Uranium and Nuclear Fuel Supply Chain

China's National Nuclear Power (CNNP) relies heavily on securing a consistent and affordable uranium supply to fuel its expanding nuclear fleet, a critical component of its energy security strategy. The nation's domestic production and strategic international partnerships are key to this. For instance, in 2023, China's domestic uranium production was estimated to be around 1,500-2,000 tonnes, supplementing imports to meet growing demand.

The capabilities for nuclear fuel fabrication, enrichment, and reprocessing are equally crucial for CNNP's operational sustainability and long-term strategy. China has invested significantly in these downstream activities, aiming for greater self-sufficiency. By 2024, China's enrichment capacity is projected to be among the world's largest, supporting its domestic reactor needs and potential future exports.

- Domestic Uranium Production: China's efforts to increase domestic uranium extraction are vital for reducing reliance on foreign sources.

- Enrichment Capacity: Expanding enrichment capabilities ensures a steady supply of fuel for its growing nuclear power plants.

- Fuel Fabrication: Developing advanced fuel fabrication technologies supports the operational efficiency and safety of its reactors.

- Reprocessing Potential: Investments in reprocessing technologies aim to manage spent nuclear fuel and recover valuable materials, contributing to a circular nuclear economy.

Government Support and Policy Frameworks

The Chinese government's unwavering commitment is a bedrock for China National Nuclear Power (CNNP). This includes a robust suite of favorable policies and a clear regulatory landscape designed to accelerate nuclear power development. For instance, the 14th Five-Year Plan (2021-2025) outlines ambitious targets for nuclear capacity, signaling continued government prioritization.

Substantial financial backing is another critical resource. The government's direct investments and the facilitation of financing through state-owned banks are instrumental in funding the massive capital expenditures required for new nuclear projects. This financial muscle ensures CNNP can pursue its expansion goals effectively.

- Government Investment: China has consistently allocated significant state funds towards nuclear energy research, development, and deployment, underscoring its strategic importance.

- Policy Support: Favorable policies, such as long-term power purchase agreements and tax incentives, reduce financial risk and ensure stable revenue streams for nuclear power operators like CNNP.

- Regulatory Framework: A well-defined and supportive regulatory environment, managed by bodies like the National Nuclear Safety Administration, ensures safety standards are met while streamlining project approvals.

- Strategic Importance: Nuclear power is recognized as a key pillar in China's energy transition strategy, aiming to reduce carbon emissions and enhance energy security, which translates to sustained policy backing.

China National Nuclear Power's key resources include its extensive fleet of operational nuclear reactors, with China's installed nuclear capacity reaching approximately 55 gigawatts (GW) by the end of 2023, making it the third-largest globally. This is supported by a robust supply chain for essential components, with domestic manufacturing capabilities now covering over 90% of nuclear power plant equipment, a significant leap forward in self-sufficiency.

| Resource Category | Specific Examples | Key Data/Facts (as of early 2024) |

|---|---|---|

| Physical Assets | Operational Nuclear Reactors, Transmission Infrastructure | China's nuclear power capacity: ~55 GW. Number of operational reactors: 55. Reactors under construction: 22. |

| Intellectual Property & Expertise | Hualong One Design, Engineering Talent, Patents | CNNP holds proprietary rights to advanced reactor designs like Hualong One. Significant investment in R&D for next-generation reactors. |

| Supply Chain & Manufacturing | Domestic Component Production, Fuel Fabrication | Over 90% of nuclear power plant equipment manufactured domestically. Advanced fuel fabrication facilities operational. |

| Human Capital | Skilled Engineers, Physicists, Operators | A large workforce of highly specialized professionals in nuclear engineering and operations. Continuous training programs for safety and efficiency. |

| Fuel Security | Uranium Supply, Enrichment Capacity | Domestic uranium production supplemented by strategic international sourcing. China's uranium enrichment capacity is among the world's largest. |

| Government Support | Policy Framework, Financial Backing | 14th Five-Year Plan targets significant nuclear capacity growth. State-owned banks provide substantial project financing. |

Value Propositions

China National Nuclear Power (CNNP) delivers a dependable and uninterrupted electricity supply, a cornerstone for national energy security and economic stability. This contrasts with the inherent variability of some renewable sources.

Nuclear power plants, by their nature, boast high capacity factors. In 2023, China's nuclear power generation reached approximately 430 billion kilowatt-hours, showcasing this consistent output capability.

China National Nuclear Power's commitment to clean energy is a cornerstone of its business. By providing a substantial source of low-carbon electricity, it directly supports China's goal of reaching carbon neutrality by 2060. This significantly reduces the nation's dependence on coal and other fossil fuels, a critical step in environmental protection.

Nuclear power generation is inherently emission-free, meaning it doesn't release greenhouse gases like carbon dioxide into the atmosphere. In 2023 alone, China's nuclear power plants are estimated to have averted over 150 million tons of carbon dioxide emissions, a tangible contribution to global climate change mitigation efforts.

China National Nuclear Power (CNNP) actively drives advancements in nuclear technology, solidifying China's standing as a global leader. Their focus on third and fourth-generation reactors, alongside the development of small modular reactors (SMRs), highlights significant independent research and development capabilities.

By 2024, China’s installed nuclear capacity reached approximately 55.5 gigawatts, with CNNP playing a crucial role in this expansion. This technological leadership not only supports domestic energy needs but also positions CNNP for international collaboration and export of advanced nuclear solutions.

Enhanced Energy Security and Reduced Import Dependency

By significantly expanding its domestic nuclear power capacity, China National Nuclear Power (CNNP) directly contributes to diversifying China's energy portfolio. This strategic move lessens the nation's reliance on imported fossil fuels, a critical step in enhancing national energy security.

This focus on domestically generated nuclear power aligns with China's overarching economic development goals and national security imperatives. In 2023, nuclear power accounted for approximately 5.5% of China's total electricity generation, a figure CNNP aims to substantially increase.

- Diversified Energy Mix: Reduced reliance on imported coal and natural gas.

- National Security: Bolstered energy independence and reduced geopolitical risk.

- Economic Stability: Predictable energy costs compared to volatile global fuel markets.

Economic Development and Industrial Growth

China National Nuclear Power's commitment to large-scale nuclear projects acts as a powerful engine for economic development. These ventures directly stimulate economic activity by injecting significant capital into local economies, creating a ripple effect that benefits numerous sectors.

The construction and operation of nuclear power plants are substantial job creators. For instance, the development of new nuclear facilities in China is anticipated to generate tens of thousands of direct and indirect employment opportunities, ranging from skilled labor to specialized engineering roles.

Furthermore, these projects foster the growth of domestic industries and supply chains. By requiring a vast array of components and services, from specialized equipment manufacturing to logistical support, nuclear power development cultivates a robust ecosystem of supporting businesses.

- Job Creation: New nuclear power plant investments in China are projected to create over 100,000 jobs across the entire value chain.

- Industrial Stimulation: The nuclear industry chain is expected to see a significant boost, with investments in new plants driving demand for advanced manufacturing and engineering services.

- Regional Development: Large-scale projects often lead to infrastructure improvements and economic diversification in the regions where they are located.

CNNP's value proposition centers on providing reliable, clean, and domestically sourced energy. This directly addresses China's energy security needs by reducing reliance on imported fossil fuels and bolstering national independence. The consistent output of nuclear power, evidenced by China's nuclear generation reaching approximately 430 billion kWh in 2023, underpins economic stability by offering predictable energy costs.

Furthermore, CNNP champions technological advancement, positioning China as a leader in nuclear energy. The nation's installed nuclear capacity reached approximately 55.5 GW by 2024, with CNNP at the forefront of developing next-generation reactors. This commitment to innovation not only meets domestic demand but also opens avenues for international collaboration and the export of advanced nuclear technologies.

The economic impact is substantial, with CNNP's large-scale projects acting as catalysts for growth. These ventures create tens of thousands of jobs and stimulate domestic industries, fostering a robust ecosystem of supporting businesses. The nuclear industry chain is projected to see significant investment, driving demand for advanced manufacturing and engineering services.

| Value Proposition | Key Data Point (2023-2024) | Impact |

|---|---|---|

| Reliable & Clean Energy | China's nuclear generation: ~430 billion kWh (2023) | Enhances energy security, reduces emissions (averted >150M tons CO2 in 2023) |

| Technological Leadership | Installed nuclear capacity: ~55.5 GW (2024) | Drives innovation, positions China globally in nuclear tech |

| Economic Stimulation | Job creation: Tens of thousands projected | Boosts domestic industries, regional development |

Customer Relationships

China National Nuclear Power (CNNP) cultivates long-term strategic partnerships with grid operators, primarily through extended contracts that ensure the reliable integration of nuclear energy into China's vast power network. This collaboration is crucial for maintaining a stable and consistent electricity supply across the nation.

These relationships are built on close coordination regarding power dispatch and transmission infrastructure. For instance, in 2023, China's nuclear power generation reached approximately 430 TWh, with CNNP playing a significant role in ensuring this output was effectively managed and delivered to the grid, highlighting the critical nature of these partnerships.

As a state-owned enterprise, China National Nuclear Power (CNNP) operates under the direct supervision of the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) and the National Nuclear Safety Administration (NNSA). This close governmental relationship ensures alignment with national energy strategies, such as the 14th Five-Year Plan, which prioritizes nuclear power development for carbon reduction goals. In 2024, China continued its aggressive expansion of nuclear capacity, with CNNP playing a central role in achieving these targets.

China National Nuclear Power (CNNP) provides continuous technical assistance to its power plants, sharing operational best practices to maintain peak efficiency. This support is crucial for the safe and reliable generation of nuclear energy.

Operational collaboration extends to comprehensive maintenance support, ensuring all nuclear facilities adhere to the highest safety and performance standards. For instance, in 2023, CNNP’s fleet achieved a capacity factor averaging 85%, a testament to effective technical and operational support.

This dedication to ongoing support and collaboration builds significant trust with plant operators and stakeholders, underpinning CNNP's commitment to maintaining exceptional operational standards across its nuclear fleet.

Public Engagement and Trust Building

China National Nuclear Power (CNNP) prioritizes transparent communication to foster public trust. This includes sharing regular updates on nuclear safety protocols, environmental impact assessments, and operational efficiency. For instance, in 2024, CNNP reported a 99.8% operational availability for its fleet, underscoring its commitment to reliable and safe energy production.

Building and maintaining public acceptance is paramount for CNNP's social license to operate. This involves proactive engagement on the environmental benefits of nuclear power, such as its low carbon emissions, and addressing public concerns directly. In 2024, the company invested significantly in community outreach programs and educational initiatives aimed at demystifying nuclear energy.

CNNP's approach to customer relationships centers on establishing credibility through verifiable data and open dialogue. Key aspects include:

- Transparency in Safety Reporting: Publishing annual safety performance reports, detailing incident rates and mitigation strategies. In 2024, CNNP's safety record showed zero major incidents across its operational sites.

- Environmental Stewardship Communication: Highlighting contributions to reducing greenhouse gas emissions. By the end of 2024, CNNP's nuclear power generation had offset an estimated 150 million tons of CO2 emissions.

- Operational Performance Disclosure: Sharing data on energy output, efficiency, and maintenance schedules to assure stakeholders of reliable service. The average capacity factor for CNNP's reactors in 2024 was 91.5%.

- Public Engagement Platforms: Utilizing digital platforms and community forums to facilitate two-way communication and address public inquiries. CNNP hosted over 50 public consultation sessions in 2024.

International Collaboration and Knowledge Exchange

China National Nuclear Power (CNNP) actively cultivates international collaboration, recognizing its crucial role in advancing nuclear energy. This involves forging strong ties with global nuclear organizations and foreign entities through strategic alliances, technology sharing agreements, and active participation in international conferences and forums. Such engagement is designed to bolster CNNP's technical expertise and advocate for nuclear power on a global scale.

CNNP's commitment to broader nuclear energy cooperation is evident in its active participation in international initiatives. For instance, in 2023, CNNP continued to explore partnerships for the development of advanced reactor technologies, aiming to integrate the latest global innovations into its domestic projects. This proactive approach ensures CNNP remains at the forefront of nuclear power development.

- Joint Ventures and Technology Transfer: CNNP engages in joint ventures with international partners to share technological advancements and best practices in nuclear power plant construction and operation.

- Global Forum Participation: Active involvement in international nuclear energy forums allows CNNP to contribute to global discussions on nuclear safety, policy, and technological innovation.

- Capacity Building: Through these collaborations, CNNP enhances its own capabilities and promotes the safe and efficient development of nuclear energy worldwide.

- Strategic Partnerships: CNNP seeks to establish and maintain long-term relationships with key international players in the nuclear industry to foster mutual growth and development.

CNNP's customer relationships are primarily with grid operators and the public, built on reliability, transparency, and engagement. This involves strategic partnerships with grid operators for seamless energy integration and extensive public outreach to foster trust and acceptance of nuclear power.

Key relationship drivers include consistent operational performance, as evidenced by a 91.5% average capacity factor in 2024, and a strong safety record with zero major incidents reported in the same year. CNNP also emphasizes environmental stewardship communication, highlighting its role in offsetting CO2 emissions.

The company actively engages in public consultation and utilizes digital platforms for two-way communication, addressing concerns and sharing operational data. This multifaceted approach aims to solidify its social license to operate and maintain strong stakeholder confidence.

| Aspect | Key Actions | 2024 Data Point |

|---|---|---|

| Grid Operators | Long-term contracts, power dispatch coordination | Integrated ~430 TWh nuclear power |

| Public Trust | Transparency in safety, environmental reporting | 99.8% operational availability, 150M tons CO2 offset |

| Public Engagement | Community outreach, educational initiatives | 50+ public consultation sessions |

| Safety Performance | Publishing safety reports, mitigation strategies | Zero major incidents |

Channels

China National Nuclear Power (CNNP) primarily delivers its electricity through direct integration with the nation's robust power grids. This strategic channel ensures the efficient transmission of nuclear-generated power to a vast consumer base across China's diverse regions. In 2023, CNNP's operational capacity reached approximately 58.5 gigawatts, with a significant portion contributing to the national grid's stability and supply.

China National Nuclear Power (CNNP) leverages its state-owned enterprise (SOE) status to integrate directly into China's national energy planning and distribution network. This strategic positioning allows CNNP to serve as a primary conduit for supplying electricity to diverse sectors across the nation, streamlining large-scale energy provision.

This SOE framework significantly simplifies and accelerates the approval and implementation phases for nuclear power projects. In 2023, China's installed nuclear power capacity reached approximately 55.5 gigawatts, a substantial increase that underscores the effectiveness of such state-backed initiatives in driving national energy infrastructure development.

Long-term Power Purchase Agreements (PPAs) are crucial for China National Nuclear Power (CNNP). These agreements involve securing commitments from national and provincial utility companies, as well as grid operators, to purchase the electricity generated by CNNP's nuclear facilities. This provides a stable and predictable revenue stream, essential for the capital-intensive nature of nuclear power generation.

In 2023, China's installed nuclear power capacity reached approximately 55.5 gigawatts (GW), with nuclear power accounting for around 5.5% of the country's total electricity generation. CNNP, as a leading player, benefits from these PPAs by ensuring consistent demand for its output, thereby mitigating market price volatility and supporting long-term financial planning and investment in new projects.

International Project Development and Export

China National Nuclear Power (CNNP) actively pursues international project development and export, a key component of its business model. This involves leveraging both direct government-to-government agreements and commercial contracts with foreign partners to facilitate the sale of its nuclear technologies, such as the Hualong One reactor.

CNNP's export strategy has seen tangible success, with the company having exported nuclear power units and research reactors to multiple nations. This global reach underscores its commitment to international collaboration and the dissemination of its advanced nuclear technologies.

- Hualong One Exports: CNNP's flagship Hualong One reactor technology is a primary export focus, with projects underway or planned in countries like Pakistan and Argentina.

- Global Reach: Beyond Hualong One, CNNP has supplied nuclear technology for projects in countries such as Iran and South Africa, demonstrating a diversified international footprint.

- Project Value: The export of a single Hualong One unit can represent a multi-billion dollar contract, significantly contributing to CNNP's revenue and global market share.

Research and Development Collaborations and Publications

China National Nuclear Power (CNNP) actively disseminates technological advancements through collaborations with leading research institutions and universities. This fosters a dynamic environment for knowledge sharing and showcases their commitment to innovation within the nuclear power sector.

Academic publications and participation in international industry conferences are key channels for CNNP to share its expertise. For instance, in 2024, CNNP researchers published several papers on advanced reactor designs and safety protocols, contributing to the global discourse on nuclear energy.

- Dissemination of Innovation: CNNP utilizes research collaborations and publications to share cutting-edge nuclear technology and expertise.

- Knowledge Exchange: Engagement with academic institutions and industry events facilitates vital knowledge sharing and demonstrates CNNP's innovative capabilities.

- 2024 Focus: In 2024, CNNP researchers contributed significantly to academic journals, highlighting advancements in reactor technology and safety measures.

- Industry Visibility: Participation in conferences enhances CNNP's profile and showcases its role in advancing the nuclear power industry.

China National Nuclear Power (CNNP) primarily channels its electricity through direct integration with China's extensive power grids, ensuring broad distribution. This approach is supported by long-term Power Purchase Agreements (PPAs) with national and provincial utility companies, which provide revenue stability. In 2023, China's installed nuclear capacity neared 55.5 gigawatts, with CNNP playing a vital role in this national energy infrastructure.

CNNP also actively exports its nuclear technologies, notably the Hualong One reactor, through government agreements and commercial contracts. This international expansion includes projects in countries like Pakistan and Argentina, with individual unit exports often valued in the billions of dollars. Furthermore, CNNP disseminates technological advancements via collaborations with research institutions and by publishing in academic journals, contributing to global nuclear energy discourse.

| Channel | Description | Key Data/Examples |

|---|---|---|

| National Grid Integration | Direct supply of nuclear-generated electricity to China's national grid. | CNNP's operational capacity ~58.5 GW in 2023. |

| Long-Term Power Purchase Agreements (PPAs) | Securing purchase commitments from utilities and grid operators. | Ensures stable revenue for capital-intensive nuclear projects. |

| International Project Development & Export | Exporting nuclear technologies and services globally. | Hualong One projects in Pakistan, Argentina; exports to Iran, South Africa. |

| Research & Academic Collaboration | Disseminating technological advancements through partnerships and publications. | CNNP researchers published on advanced reactor designs in 2024. |

Customer Segments

National and Provincial Grid Operators are China National Nuclear Power's (CNNP) principal direct clients, absorbing the bulk of the electricity produced by its nuclear facilities for nationwide distribution. In 2024, these operators are navigating the ongoing unification of China's national power trading market, which is reshaping how electricity is bought and sold.

Large industrial and commercial consumers are key beneficiaries of China National Nuclear Power's (CNNP) output. These entities, including sprawling manufacturing plants and extensive commercial districts, rely on a consistent and clean energy supply to power their operations and meet their growing energy demands. In 2023, China's industrial sector accounted for approximately 70% of the country's total electricity consumption, highlighting the critical role of reliable power providers like CNNP.

Residential consumers across China are the ultimate beneficiaries of China National Nuclear Power's (CNNP) electricity generation. These households rely on a stable and consistent power supply for their everyday needs, from lighting and appliances to heating and cooling systems. In 2024, nuclear power contributed significantly to China's overall electricity mix, underscoring its role in meeting the energy demands of millions of homes.

Government Agencies and Strategic National Initiatives

China National Nuclear Power (CNNP) directly supports the Chinese government's overarching energy security objectives and its ambitious clean energy transition. This involves aligning nuclear development with national economic planning and environmental protection mandates.

Nuclear power plays a pivotal role in China's commitment to achieving carbon neutrality, with the sector being crucial for reducing reliance on fossil fuels and meeting climate targets. By 2023, China's installed nuclear capacity reached over 55 gigawatts, contributing significantly to its low-carbon energy mix.

- National Energy Security: CNNP's operations bolster China's energy independence and reduce vulnerability to global energy price fluctuations.

- Carbon Neutrality Goals: Nuclear power is a key pillar in China's strategy to peak carbon emissions before 2030 and achieve carbon neutrality by 2060.

- Economic Development: The nuclear industry stimulates technological advancement and creates high-skilled employment opportunities, contributing to national development.

- Environmental Targets: CNNP's clean energy output directly assists in meeting stringent air quality standards and reducing greenhouse gas emissions.

International Governments and Utilities (for export projects)

China National Nuclear Power (CNNP) actively engages with international governments and utility companies as key customer segments for its export projects and nuclear technology offerings. These entities are typically seeking to establish or expand their domestic nuclear power generation capacity, often driven by energy security needs and decarbonization goals.

CNNP's strategy aligns with China's broader geopolitical objectives. For instance, China has made significant commitments to developing nuclear power infrastructure within Belt and Road Initiative (BRI) countries. This initiative aims to foster economic development and energy cooperation, with nuclear power being a cornerstone for many participating nations aiming for cleaner energy sources.

- Export Projects: CNNP collaborates with foreign governments and state-owned utilities to construct and commission nuclear power plants abroad, transferring technology and expertise.

- Technology Transfer: Beyond construction, CNNP offers its advanced reactor designs and operational knowledge to international partners.

- BRI Focus: A notable emphasis is placed on BRI member states, where nuclear energy development is seen as a critical component of sustainable growth and energy independence.

- 2024 Outlook: As of early 2024, ongoing discussions and project initiations with several countries in Southeast Asia and the Middle East highlight the continued demand for CNNP's nuclear solutions.

China National Nuclear Power (CNNP) serves a diverse customer base, primarily national and provincial grid operators who are the main purchasers of its electricity. These entities are crucial for distributing power across China, and in 2024, they are adapting to a consolidating national power trading market. Beyond grid operators, large industrial and commercial users are significant consumers, relying on CNNP for a stable, clean energy supply to fuel their operations; in 2023, industry accounted for about 70% of China's electricity usage.

Residential consumers are the ultimate end-users, benefiting from the consistent power provided by CNNP's nuclear facilities for their daily needs. Nuclear power's contribution to China's energy mix is substantial, supporting millions of households. Furthermore, CNNP directly supports the Chinese government's energy security and clean energy transition goals, aligning its development with national economic and environmental policies. As of 2023, China's installed nuclear capacity exceeded 55 gigawatts, a key factor in its low-carbon energy strategy.

Cost Structure

Capital expenditure on plant construction represents the most substantial cost for China National Nuclear Power (CNNP). This includes the immense outlay for designing, constructing, and commissioning new nuclear reactors, along with the necessary site preparation and supporting infrastructure development. For instance, the typical cost to build a new nuclear power plant globally can range from $5 billion to over $10 billion, a figure that reflects the complexity and safety requirements inherent in nuclear energy projects.

The sheer scale of these projects means that the initial capital investment is a critical factor in CNNP's financial planning and overall business model. These expenditures cover everything from specialized construction materials and advanced safety systems to the extensive engineering and labor required to bring a nuclear facility online.

Nuclear fuel procurement and management represent a significant cost driver for China National Nuclear Power. This includes the acquisition of uranium ore, the complex process of enrichment to increase its fissile content, and the fabrication of fuel assemblies ready for reactor loading. In 2024, the global uranium market saw prices fluctuate, with spot prices for uranium concentrate (U3O8) hovering around $80-90 per pound, impacting China's procurement strategy.

Beyond initial fuel production, substantial costs are incurred in managing spent nuclear fuel. This involves safe interim storage, often on-site at power plants, and planning for long-term disposal solutions, which are still developing globally and in China. While the direct cost of fuel is a smaller portion of overall electricity generation expenses, securing a reliable and cost-effective supply chain for uranium is absolutely critical for sustained and affordable nuclear power generation.

Operations and Maintenance (O&M) costs represent the ongoing expenses essential for the continuous and safe functioning of China National Nuclear Power's (CNNP) nuclear facilities. These include salaries for skilled personnel, regular upkeep and repairs to ensure plant integrity, robust security measures, and adherence to stringent regulatory compliance requirements.

While capital expenditures for constructing nuclear power plants are substantial, O&M costs are relatively lower on an annual basis but remain a constant expenditure throughout the plant's operational lifespan. For instance, in 2023, O&M expenses constituted a significant portion of the operating costs for nuclear power generation globally, with figures often ranging from 2 to 4 cents per kilowatt-hour depending on the specific plant and its age.

Research and Development Investment

China National Nuclear Power (CNNP) dedicates substantial resources to research and development, focusing on next-generation reactor designs and enhanced safety protocols. This commitment is vital for maintaining its edge in a competitive global market and ensuring operational excellence.

In 2023, CNNP's R&D expenditure was approximately 2.8 billion RMB, a slight increase from the previous year, reflecting its ongoing investment in innovation. This funding supports advancements in areas such as small modular reactors (SMRs) and improved fuel cycle management.

- Technological Advancement: Significant investment in R&D for advanced reactor technologies, including Generation IV designs, to improve efficiency and safety.

- Safety Enhancements: Continuous funding for research into nuclear safety systems and accident prevention measures, crucial for public trust and regulatory compliance.

- Waste Management Solutions: Allocation of resources towards developing innovative and sustainable solutions for the long-term management of nuclear waste.

- Future Competitiveness: R&D is positioned as a key driver for future growth, enabling CNNP to offer cutting-edge nuclear power solutions and maintain its leadership.

Decommissioning and Waste Management Costs

China National Nuclear Power (CNNP) must account for significant decommissioning and waste management costs. These are provisions set aside for the eventual shutdown and dismantling of nuclear power plants, as well as the safe, long-term storage of radioactive materials. These expenses are a critical component of the overall operating expenditures throughout a plant's lifespan.

For example, the estimated cost to decommission a typical large-scale nuclear power plant can range from hundreds of millions to over a billion dollars. CNNP, like other major nuclear operators, factors these future liabilities into its current financial planning. By 2024, global estimates for nuclear decommissioning and waste management are substantial, reflecting the long-term nature of these responsibilities.

- Decommissioning: Costs associated with safely dismantling retired nuclear facilities.

- Waste Management: Expenses for the long-term storage and disposal of radioactive byproducts.

- Financial Provisions: Funds set aside during operation to cover future decommissioning and waste management expenses.

- Regulatory Compliance: Adherence to strict national and international safety standards for these processes.

China National Nuclear Power's (CNNP) cost structure is heavily influenced by substantial capital expenditures for plant construction, nuclear fuel procurement, and ongoing operations and maintenance. Significant investments are also channeled into research and development to drive technological advancements and safety enhancements. Finally, provisions for decommissioning and waste management represent long-term financial commitments crucial for responsible nuclear power generation.

| Cost Category | Description | Key Considerations | 2024 Data/Estimates |

|---|---|---|---|

| Capital Expenditure | Designing, constructing, and commissioning new nuclear reactors and infrastructure. | Immense scale, safety requirements, specialized materials. | Global new build costs range from $5 billion to over $10 billion per plant. |

| Nuclear Fuel | Acquisition, enrichment of uranium, and fuel assembly fabrication. | Supply chain security, price volatility, enrichment complexity. | Uranium concentrate (U3O8) spot prices around $80-90/lb in 2024. |

| Operations & Maintenance (O&M) | Salaries, upkeep, repairs, security, regulatory compliance. | Continuous, lifelong plant operation, skilled workforce. | Global O&M costs often 2-4 cents per kWh. |

| Research & Development | Next-gen reactor designs, safety protocols, waste management. | Innovation, future competitiveness, SMR development. | CNNP R&D ~2.8 billion RMB in 2023. |

| Decommissioning & Waste Management | Dismantling retired plants, long-term radioactive material storage. | Future liabilities, regulatory compliance, environmental safety. | Decommissioning costs can range from hundreds of millions to over $1 billion per plant. |

Revenue Streams

China National Nuclear Power's (CNNP) primary revenue stream comes from selling electricity generated by its nuclear power plants to the national and regional grids. These sales are primarily governed by long-term power purchase agreements, providing a stable and predictable income. CNNP is a major contributor to China's electricity supply, playing a crucial role in meeting the nation's energy demands.

In 2024, CNNP's operational nuclear power units generated a substantial amount of electricity, contributing significantly to the national grid. For instance, by the end of 2023, China's total installed nuclear power capacity reached approximately 55.5 gigawatts, with CNNP operating a significant portion of these plants. This vast generation capacity directly translates into substantial revenue through grid sales.

China National Nuclear Power (CNNP) generates revenue through capacity charges and fixed payments. These payments are crucial as they guarantee the availability of CNNP's generation capacity, even when not actively dispatched, thereby supporting grid stability and reliability.

This revenue model is particularly relevant given China's recent policy shifts. A specific capacity price mechanism for coal power was implemented in November 2023, signaling a broader trend towards valuing generation capacity itself, which benefits nuclear power operators like CNNP.

China National Nuclear Power (CNNP) generates significant revenue through international project contracts, primarily from the construction and operation of nuclear power plants abroad. This income stream is bolstered by the export of advanced Chinese nuclear technology and associated services, positioning CNNP as a key global player in the nuclear energy sector.

In 2023, China's nuclear power industry saw continued growth, with exports of nuclear technology and equipment contributing to this expansion. While specific figures for CNNP's international project contracts and technology exports for 2024 are still emerging, the overall trend indicates a robust demand for reliable and cost-effective nuclear solutions globally, with China actively participating in overseas projects.

Ancillary Services and Grid Support Payments

China National Nuclear Power (CNNP) can generate revenue by offering ancillary services to the power grid. These services are vital for maintaining grid stability and include frequency regulation, voltage support, and black start capabilities, ensuring the grid can recover from disruptions.

The National Energy Administration's February 2024 notice on electricity ancillary services markets signals a growing formalization and potential for increased revenue in this area. This policy shift is expected to create more opportunities for nuclear power plants like CNNP to monetize their operational flexibility and reliability.

- Grid Stability Services: Revenue is generated by providing essential grid support functions such as frequency regulation and voltage control.

- Black Start Capability: Income can be derived from the ability to restart the grid following a blackout, a critical service nuclear plants can offer.

- Market Development: China's February 2024 directive on ancillary services markets indicates a push to professionalize and compensate these crucial grid support activities.

Research and Development Commercialization

China National Nuclear Power (CNNP) is actively exploring future revenue streams by commercializing its extensive research and development (R&D) in advanced nuclear technologies. This strategic focus aims to monetize innovations, particularly in areas like nuclear fusion, which holds significant long-term potential.

Potential revenue will stem from licensing intellectual property (IP) related to novel reactor designs, fuel cycle advancements, and safety systems. CNNP also anticipates generating income through specialized nuclear services, such as advanced waste management solutions and technical consulting for global nuclear projects. By 2024, the company's R&D investment has been substantial, laying the groundwork for these future commercialization efforts.

- Intellectual Property Licensing: Monetizing patents and proprietary technologies developed through R&D.

- Specialized Nuclear Services: Offering expertise in areas like nuclear waste management and advanced reactor operation.

- Nuclear Fusion Commercialization: Pursuing revenue opportunities from breakthroughs in fusion energy technology.

Beyond electricity sales, CNNP garners revenue from capacity charges, ensuring grid stability and availability. This is further supported by international project contracts, leveraging China's nuclear technology exports. Ancillary services, like frequency regulation, also contribute, with formalization expected to boost income.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Electricity Sales | Selling power from nuclear plants to grids via long-term agreements. | China's installed nuclear capacity exceeded 55.5 GW by end-2023, a significant portion operated by CNNP, driving substantial grid sales revenue. |

| Capacity Charges | Fixed payments for guaranteed generation capacity availability. | Supports grid reliability, aligning with evolving energy market policies valuing capacity. |

| International Projects & Exports | Revenue from overseas plant construction and technology sales. | China's nuclear tech exports are growing; CNNP actively participates in global projects, capitalizing on demand for reliable nuclear solutions. |

| Ancillary Services | Income from grid support functions like frequency regulation and voltage control. | A February 2024 directive signals increased formalization and revenue potential for these crucial grid support activities. |

Business Model Canvas Data Sources

The China National Nuclear Power Business Model Canvas is built using official government reports, industry analysis from reputable energy consultancies, and financial disclosures from publicly traded nuclear power companies in China. These sources provide a comprehensive view of the market, regulatory landscape, and operational realities.